Startups typically chase sales at any cost. But those that thrive long term know when to strike a balance between generating sales and making profits.

“The race is not always to the swift,” concluded Aesop in his tale about the tortoise and the hare. If the Greek fabulist was writing in the Digital Age, the moral of the story would have a binary spin: there’s a time to be a hare—and a time not to be one.

Nowhere is that more evident than in the $700 billion enterprise software industry. Although some entrepreneurs seemingly operate as if software companies are free from performance imperatives and challenges at each stage of their growth, the reality is the opposite. Growth at all costs may be the right mindset when starting up, but it isn’t a viable long-term strategy. In fact, becoming obsessed with growth can hurt a firm’s ability to scale and drive value creation on a sustained basis. As software firms become bigger, they must refocus their strategies and operations on balancing sales with that dreaded imperative: making profits.

Moreover, it’s critical for software companies to develop the operational capabilities that they need to sustain growth at the right time: not so early that a firm misses out on growth and not so late that it jeopardizes its future. Most market leaders, our studies show, developed many of their foundational capabilities before their initial growth surge tapered off, enabling them to survive and thrive. In this article, we describe the four stages of growth that every software company goes through and the five rules that winners follow in order to grow profitably.

Back to Basics

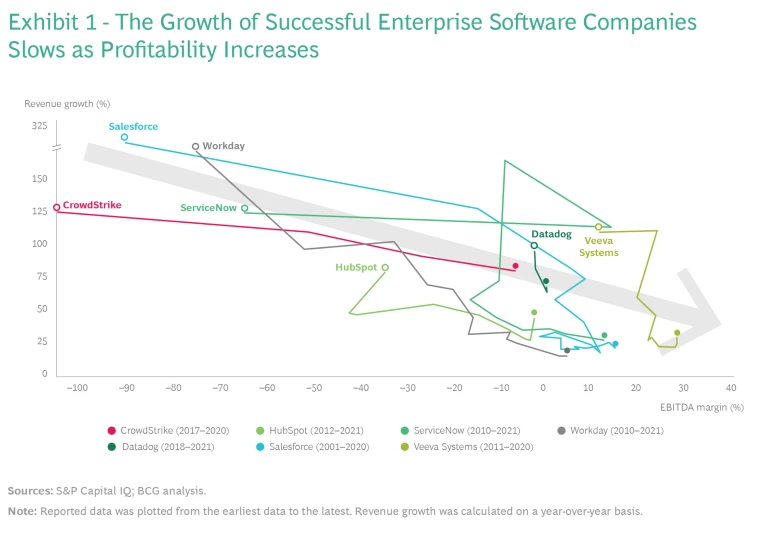

Striking a balance between growth and profitability appears to be as difficult to achieve as understanding its importance. Successful enterprise-software companies embark on a journey that starts out with rapid growth and negative profitability, and they learn to manage declining growth and boost profitability along the way. (See Exhibit 1.) That brings into focus the key question: How do software companies optimize the growth-profitability equation over time?

Although software companies use a variety of methods to measure success, most find it tough to achieve the right balance between growth and profitability. Some firms evaluate their performance, particularly as they move beyond the early product development stage, by focusing on metrics, such as the ratio of the lifetime value (LTV) of a customer to the customer acquisition cost (CAC). The prevailing wisdom is that a firm with an LTV-to-CAC ratio greater than three is doing well, but LTV is based on difficult-to-predict assumptions about market risk and customers’ future behavior.

Other companies, and investors, use parameters such as the popular Rule of 40—the idea that a software firm’s growth rate and profit margin should together be greater than 40%—to monitor how they’re faring. Despite its simplicity, the rule is arbitrary, and it doesn’t take into account the fact that baseline growth rates in different segments of the market vary. Furthermore, the Rule of 40 shouldn’t be applied uniformly to companies young and old; early-stage companies often enjoy astronomical growth rates that hide immature and inefficient operating models; older firms don’t have the excuse of immaturity to hide what might be fundamental flaws in their business.

The critical issue isn’t the metric that software companies use to measure performance but when they make tradeoffs between revenues and profits.

In any case, the critical issue isn’t the metric that software companies use to measure performance but when they make tradeoffs between revenues and profits. Fast-growth companies, which need to invest in building products and routes to market, could get the timing wrong by focusing on profitability too early. They could also err by waiting too long, which could diminish their potential to create value in the long run. There’s an ideal time—a Goldilocks zone, so to speak—in every software firm’s journey during which the organization needs to shift its operational mindset from growth at all costs to optimize and improve if it wants to drive long-term value creation.

At no time has recognizing that been more important than at present. The global macroeconomic environment has become volatile, with rising inflation in the US that has caused interest rates to rise. In just 25 days, from January 1, 2022, through January 25, 2022, the valuation of the top 30 software companies in the US fell by $2.7 trillion, leading to an 18% decline in their revenue multiples. Tellingly, BCG’s research shows that the more profitable companies experienced a smaller decline in value, compared with that of the fastest-growing ones, underscoring the importance of profitability. Unless a software firm has developed the capabilities to manage the four stages of growth, it’s unlikely to survive.

The Four Stages of Growth

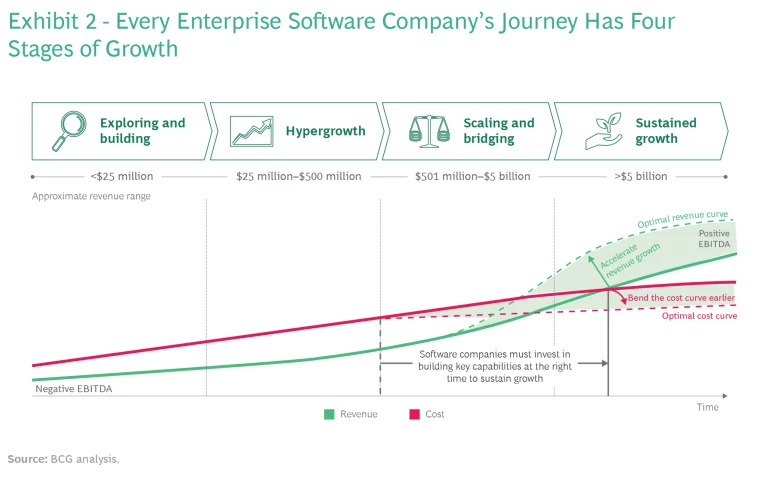

Every software company goes through four phases, from birth to maturity. (See Exhibit 2.) The length of each stage depends on the market and the organization, but every firm’s existence hinges on two factors: its focus on operational imperatives and its ability to develop the capabilities to manage them. Both differ at each growth stage.

Exploring and Building. Startups’ revenues at this stage vary, depending on the traction that their products and services have gained in the marketplace, but these companies’ revenues are usually less than $25 million. During this phase, every company must establish its product-market fit and try to get target customers to buy, use, and tell others about its products in numbers large enough to drive growth. Getting the product right unlocks multiple sources of value, especially the ability to retain customers.

As a company builds software products and go-to-market capabilities , it must develop repeatable go-to-market actions and support them by tapping resources both inside and outside the organization. Operating expenses, particularly R&D and sales and marketing expenditures, will likely exceed revenues, so companies are financed by venture capital or angel equity funding. Even meeting the Rule of 40 will hinge on the firm’s ability to compensate for negative operating margins with high revenue growth rates. But off a small base, even small absolute revenue gains post massive rates of growth.

Hypergrowth. This phase is, arguably, the most exciting, with software companies doubling or tripling revenues every year. When firms are experiencing hypergrowth, their revenues can quickly soar from $25 million to $500 million. The fastest-growing software companies triple revenue for two years and then double it for three years, which is the T2D3 rule. By following this route, a software company can grow from $1 million to $2 million in revenue to more than $100 million in just five years’ time—and, in the process, earn a $1 billion valuation as a unicorn.

Hiring is usually the most critical operational bottleneck at this stage. Software companies have to expand their hiring across the product, go-to-market, customer success, and support organizations, as well as increase their regional coverage to sustain their momentum. Companies must also invest in developing the next generation of product and service innovations and expand their portfolios to create competitive moats in their target segments.

Scaling and Bridging. This phase tends to be the biggest stumbling block in the path of most software companies, and it comes just as they’re trying to grow revenues from about $500 million to $5 billion. As revenues increase, growth starts to slow a little because of operational and market realities. However, with revenues still growing from 40% to 100% a year in many cases, organizations have to develop new capabilities to cope with their increasing size.

Two factors make the challenge tougher. One is the inertia of hypergrowth. The success of the growth-at-all-costs mentality during the previous stage often prevents companies from stepping back and developing a more strategic approach to scaling. Externally, software companies need to refine their pricing strategy and build alliances and partnerships to improve their positioning, reach, and value propositions. Internally, companies have to redesign their operating models across the product and go-to-market organizations. They must also make investments in operational IT, systems, and tools, and they must build cross-functional processes to manage the customer experience.

The success of the growth-at-all-costs mentality often prevents companies from developing a more strategic approach to scaling.

The second factor, as mentioned earlier, is getting the timing right. It isn’t easy. A premature focus on operational efficiency can result in compromising growth, while waiting too long can mean accumulating operational debt, which can be expensive to unwind. These struggles often result in missteps in the product strategy and portfolio that increase unit costs and lower gross margins.

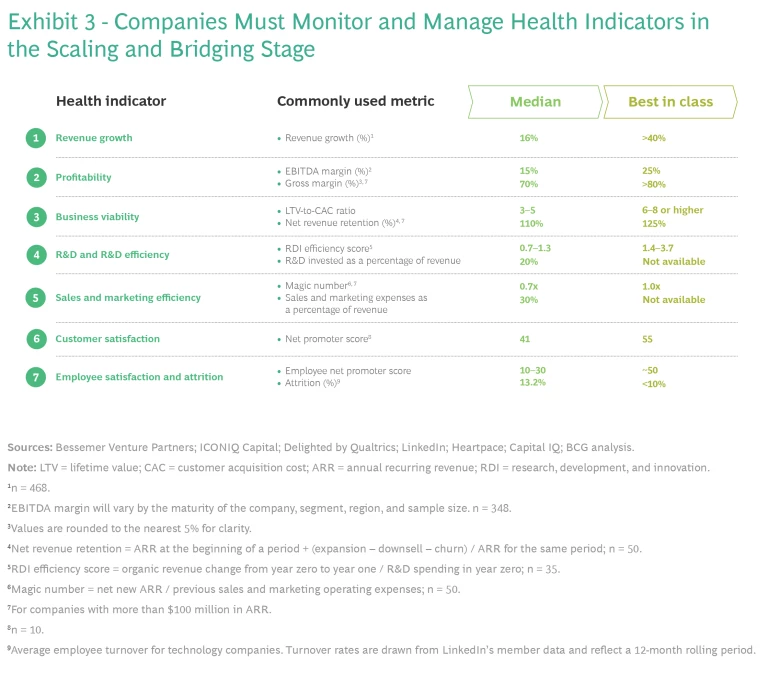

Profitable scaling doesn’t happen by chance; it requires CEOs to be deliberate. For starters, CEOs must ensure the company’s health by having their firm monitor and manage seven indicators. (See Exhibit 3.) A decline in any or all of the metrics may require management teams to rethink their strategies for sustainable growth. CEOs also must follow five rules for profitable growth, which we discuss later.

Sustained Growth. After a software company’s revenues exceed $5 billion, its growth rate asymptotically approaches the market’s average rate, which means that, in most cases, growth slows to less than 40%. That makes profitability more important than before. By this stage, a company’s investor mix is also likely to have changed and include investors that see both growth and profitability as key performance drivers.

After a software company has navigated the scaling and bridging phase, it must focus on developing new revenue streams, either organically or inorganically. It must also improve and scale internal processes, and it must maximize efficiencies and synergies to improve the time to market and margins. Doing so usually involves four actions: improving sales effectiveness and R&D efficiency, increasing long-term value for customers, establishing M&A and portfolio management capabilities, and driving organization-wide cost-optimization efforts. Investments should be aimed at balancing growth and profits, and companies must put in place the metrics that enable them to do just that.

Five Rules for Profitable Growth

Every enterprise software company charts its own path, but the successful ones follow five rules in order to grow sustainably.

Winners design a robust strategy and continually adapt to the market. In the software industry, growth depends on being in the right market segments and developing the right strategy. No amount of operational efficiency can overcome structural inadequacies or a poor product-market fit.

There isn’t one winning strategy in the industry; every firm carves out a unique path. But there are patterns: our research suggests that there are at least six growth models. Companies including Zoom and Twillio (a provider of communications tools) have focused on product-led growth, while Adobe and Coupa Software (a cloud-based procurement, payments, and supply chain management platform) have grown by reinventing traditional categories, creating a broad portfolio, and cross-selling and upselling. Veeva Systems (which develops software as a service for pharmaceutical and life science companies) and nCino (which develops operational software for financial institutions) have specialized to dominate a vertical segment. Zscaler (a cloud-based security company) and Workday (a provider of finance, human resources, and planning solutions) have generated early disruptor advantages, while Microsoft has used customer access and scale to come from behind and win with products such as Azure and Microsoft Teams. And Salesforce and ServiceNow have focused on ecosystems as a way to drive growth.

In the fast-moving tech world, it’s critical for CEOs to develop a winning strategy—and many use a mix of growth models—in order to continually adapt to customers’ needs, market trends, and rivals’ moves. However, developing a strategy alone is insufficient; firms must follow four additional rules to succeed.

Winners focus on the basics and continually improve their operating models. Software companies face several growing pains simultaneously, including the inability to scale products or support them, especially as customers become bigger; uncoordinated go-to-market strategies; and a lack of experience in systematic pricing and discount management. Companies that succeed recognize the importance of getting the basics right.

Although software companies may be aware of the challenges they face, tackling them is essential. In the case of product development, for instance, executives must build rigorous product-management and agile-development processes, investing in platform modernization and best-in-class development, security, and operations capabilities. Similarly, in terms of go-to-market strategies, software companies must tackle three challenges. First, firms should articulate a pricing and packaging strategy that drives growth in the short run and maximizes the amount of customer value that is captured over time. Second, they must build a land-adopt-expand-and-renew sales process with the right coverage model and incentives. Third, software companies must develop a data-driven customer success function.

Software companies often remain unaware of their challenges, or they put off tackling them for too long.

The importance of having these capabilities may seem obvious, but software companies often make one of two mistakes: they either remain unaware of these challenges, or they put off tackling them for too long, both of which can prove to be costly. By comparison, market leaders are highly focused on making operating model improvements. In addition, they recognize that companies, particularly those that are growing quickly, can’t digest Big Bang transformations, so they bring about change in smaller, more digestible doses. Doing so proactively and continually pays off.

Winners invest in new systems, automate functions, and integrate data across the organization. As software companies grow, they run into two problems related to technology and systems. The first is that some functions have had to operate for a long time without the organization investing even minimally in tools or data or in the automation of various functions, such as marketing and sales , customer success and support, subscription billing, and operations. This issue is relatively easy to tackle; most companies can proactively or reactively put new technology and systems in place and start optimizing and automating these functions.

The second problem is that operational data and customer data are fragmented across systems that aren’t connected. For instance, customer data from front-office systems (such as customer relationship management solutions) and marketing, data from back-office systems (such as enterprise resource planning and subscription billing solutions), and product data are often not integrated but stored in silos.

Integrating data silos is a challenge, but doing so can unlock significant value. For example, a company can develop a 360-degree view of the customer by integrating data flows. That view enables the company to personalize the customer experience; set up targeted, data-driven marketing and sales efforts with pricing that improves conversion; use predictive models to stay ahead of renewals and retain customers; and, ultimately, boost customer loyalty. The best software firms recognize the importance of integrating data and building an automation backbone to drive operational excellence.

Winners create processes to improve cross-functional teamwork. Success in the software business depends on the ability to pivot quickly. While fast-growing companies stay nimble by avoiding too much structure, the lack of systems and processes hinder execution as they become bigger. Companies would do well to create cross-functional processes that enable them to work systemically and deliver results. Three cross-functional processes, in particular, are critical for sustaining growth:

- Integrated Business Planning. Successful software companies elevate the role of planning and bring together strategy, finance, product management, and sales in a joint planning process. Such a process not only ensures operational alignment among the development, sales, marketing, and customer success teams but also helps in driving better prioritization and focus. Designed properly, an integrated planning process can help drive growth in many ways, including by outlining hiring priorities, creating a framework for end-to-end performance management, and driving business reviews.

- Holistic Product Life Cycle Management. Every aspect of a firm’s product-related activities—be it developing, marketing, pricing, or sunsetting products—demands cross-functional coordination and orchestration among the product, marketing, pricing, sales, legal, and support teams. Well-run companies, therefore, think about the product life cycle in the context of the entire organization and not just in terms of each product team. An integrated product life cycle management process serves as the foundation of customer-centric innovation and the basis on which teams work together.

- End-to-End Customer Experience Management. Contrary to popular belief, providing an outstanding customer experience isn’t just a sales and support priority; it’s an organizational responsibility because customer touch points extend to almost every function. Business leaders must promote interconnected customer-experience metrics, such as customer delight, customer loyalty, and net promoter scores; streamline customer touch points; and enable seamless handoffs between teams in the organization. In addition, market leaders extend the scope of the customer experience to what partners do for their users.

Winners treat profitable growth as a C-level priority, and they build roles and teams to drive scale. As software companies develop new products and scale their go-to-market strategy, they face fresh challenges, such as the need to allocate scarce resources across a growing product portfolio, to organize sales processes in several segments, and to put out fires. Companies, therefore, need to re-evaluate their structures to ensure that the organization doesn’t miss a beat.

Several changes need to take place at two levels. First, companies need to create new functions and capabilities at the level of product and go-to-market teams. For example:

- Tactical teams, such as a deal desk and a sales operations team, are often needed to professionalize sales planning, execution, and management.

- Strategic teams, such as a revenue operations team, are needed to integrate operations across the marketing, sales, and customer success functions.

Similarly, executives need to build capabilities in product management, creating a portfolio management function to prioritize and track investments; in program management to coordinate large cross-company initiatives; and in developer productivity engineering to optimize engineering and development processes. These teams and capabilities have to be built at the right time.

Second, balancing growth and profits must become a C-suite responsibility. Companies need to either bring in a full-time chief operating officer or change the compensation of their leadership teams and each person’s individual mandate to ensure that the focus is on the important even while dealing with the urgent. Crucially, senior management teams have to ensure an organizational culture and an employee mindset of continuous improvement. That alone can ensure that changes are brought about incrementally, so that the company can absorb them without losing momentum.

In the software industry, more than in any other sector, companies have traditionally believed that success comes from chasing sales and getting big fast—whatever the cost. Even if that may have been valid once, it isn’t true in today’s uncertain world. Sales growth alone won’t attract buyers or investors.

Companies must monitor their growth and strive to become profitable at the right time. It is imperative in order to face the challenges ahead. As technology continues to evolve and next-generation platforms emerge, companies will be forced to innovate faster to keep pace. Investors will still provide capital, but the competition for funding will increase. And with more investment options amid an uncertain macroeconomic environment, investors will weigh companies’ business models and unit economics more carefully. Companies are likely to find that they must innovate more, with less.

Adapting to this new industry order—and fast—is critical. To do so, companies must be able to draw on their own resources and proactively invest in teams, cross-functional processes, and automation and data. They also must overcome their biases and recognize that growth at all costs is a strategy best used during the early stages. The winners will be those that understand the race is a marathon, and to sustain growth and deliver value, they must evolve their strategy, advance their operating model, and become profitable.