To combat climate change in Africa effectively, investors, governments, and companies must collaboratively develop and finance sustainability-driven ventures that can grow rapidly across the continent’s business ecosystem.

Africa has reached a critical point in terms of sustainability . As the 54 countries on the continent struggle to contain the pandemic-induced recession of the past 30 months—the worst in the past five decades—as well as recent stagflation, which has sent fuel and food prices surging, they also find themselves confronted by a foundational and fast-growing challenge in the form of the climate crisis.

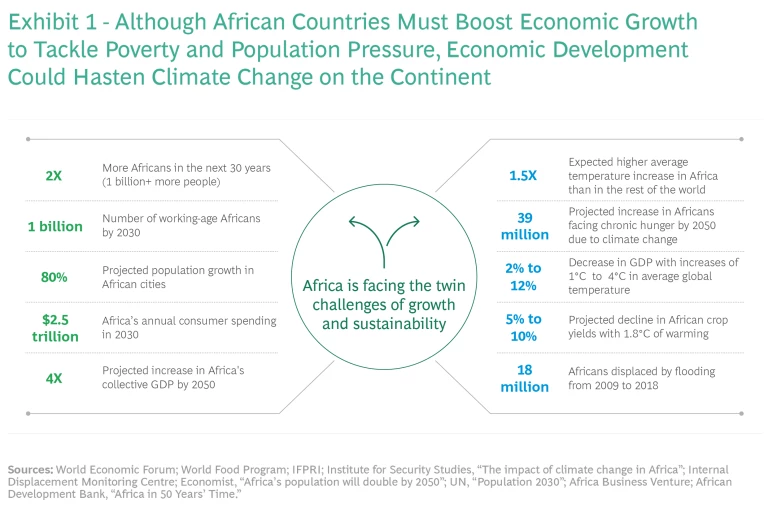

Economic development remains a priority for every African government, with the continent’s population growth amplifying the need for rapid economic growth and job creation. The number of Africans on the continent is expected to double between 2020 and 2050. At the same time, Africa must deal with the consequences of climatic disruption. Its impacts in the form of soaring temperatures, longer droughts, more frequent crop failures, more severe tropical storms, and increased coastal flooding, could plunge more Africans into poverty if something isn’t done quickly. (See Exhibit 1.)

Indeed, Africa’s climate emergency has brought into sharp relief the paradox of prosperity that confronts the continent: as the next generation’s consumption—though still only a fraction of the developed world’s—increases, so do the environmental consequences. Thankfully, African business can respond to this dilemma by developing and deploying green technologies and sustainable business models that create jobs and boost economic growth. In fact, there’s no dearth of green ventures—companies that minimize their impact on the environment and contribute to climate mitigation, climate adaptation, and environmental protection—on the continent.

Unfortunately, most of Africa’s green ventures face a crippling challenge in that they haven’t been able to scale—yet. They need to grow rapidly to drive economic development on the continent in a sustainable fashion. That task requires fresh thinking and collaborative action by the key players in Africa’s business ecosystem , as this article will detail. Investors must fund the continent’s green ventures adequately, with well-structured equity, debt, and concessional finance. Governments must treat green ventures as a priority, designing subsidies and policies so they can get big quickly. And Africa’s green ventures must develop management capabilities to sustain faster growth in the future. If they learn to grow rapidly, Africa’s green ventures could well become role models for the continent and the world.

The Problems of Poverty and Plenty

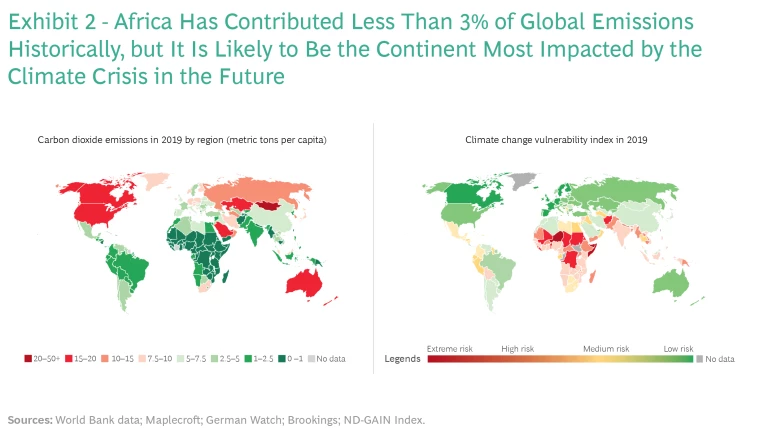

Of the inhabited continents, Africa has contributed the least to climate change , accounting for only 2.7% of global carbon emissions from 1751 to 2017. Even in 2020, while China generated 23% of the world’s greenhouse gases, the US 19%, and the EU 13%, Africa produced just 3.8%, and five nations—South Africa, Egypt, Algeria, Nigeria, and Morocco—accounted for 75% of those. Even so, a fast-warming planet will hurt Africa the most. The continent is expected to heat up 1.5 times faster than the rest of the world, with 35 of the 50 countries in the world that are most vulnerable to climate change located there. (See Exhibit 2.)

Global warming has increased the risk of both floods and droughts in Africa, where most people depend on agriculture for food, employment, and incomes. Rising temperatures are reducing food productio n and sending prices soaring, but they’re also straining water resources and forcing Africans to migrate to cities. According to one estimate, a 40 C increase in global warming could halve wheat and maize (corn) yields in Africa, which would lead to political, social, and economic disarray.

As in any developing region, the industrialization, employment, and income growth necessary for Africans’ prosperity carries the risk of turning the continent into a significant source of greenhouse gas emissions in the future. Africa needs to be more strategic about driving growth, especially since the developed world could impose carbon taxes on its exports even as multilateral donors factor emissions into their lending. Such policies could weaken trade and investment inflows, and undermine Africa’s growth.

If Africa’s countries are to grow sustainably, they must develop and deploy novel strategies, not simply copy those adopted by other nations, even developing ones. The developed world should help fund Africa’s transition to a green future. Meeting African countries’ nationally determined contributions—which embody their stated efforts to reduce emissions according to the Paris Agreement—will require more than $2.4 trillion in additional climate financing by 2030. Much of this capital needs to come from overseas, but African nations have to develop in a sustainable way, so they can ensure economic growth and job creation even as they withstand the impacts of climate change.

The Green Scaling Challenge

African business has a lucrative opportunity to create sustainable industries by leapfrogging technologies known to be harmful to the environment, and developing and using novel ones instead. Over the past 15 years, many hundreds of startups have sprung up to offer climate-smart products and solutions to African consumers. This year, when BCG’s Green Ventures team analyzed the investment portfolios of 90 large investors in Africa, we identified over 500 companies operating in green industries such as agriculture , clean energy, sustainable materials, e-mobility and transportation, and nature-based solutions. That number has grown exponentially, with a 300% increase in the number of green ventures across the continent in the past 15 years.

Africa’s green industries embody enormous growth potential. For instance, there are around 150 off-grid clean-energy companies at the startup or growth stage in sub-Saharan Africa’s power sector Over the past decade, these companies have provided 370 million Africans and businesses with access to energy , and often they represent the lowest-cost electrification solution, according to the World Bank. These clean-energy generation, distribution, and financing companies will continue to play a major role in the future, and their share is likely to rise from 30% of new energy connections in 2022 to over 50% by 2050.

Climate change has also catalyzed the birth of new industries on the continent such as carbon sequestration. In these businesses, thanks to their access to large forest and soil ecosystems for carbon sequestration, African ventures enjoy an edge over global rivals. Businesses such as NetZero, a biochar company that originated in Cameroon, are poised to lead this emergent industry. The venture removes carbon from the atmosphere by extracting and stabilizing the carbon that plants capture during photosynthesis by heating organic matter without oxygen, a process called pyrolysis. NetZero sells the resulting biochar, which is solid carbon, to farmers who use it to improve soil health and increase yields while keeping the carbon out of the atmosphere for centuries. According to experts, biochar has a sequestration potential of 2 billion to 5 billion metric tons of carbon dioxide per year by 2050, with a cumulative potential of 1 gigaton by the end of the century.

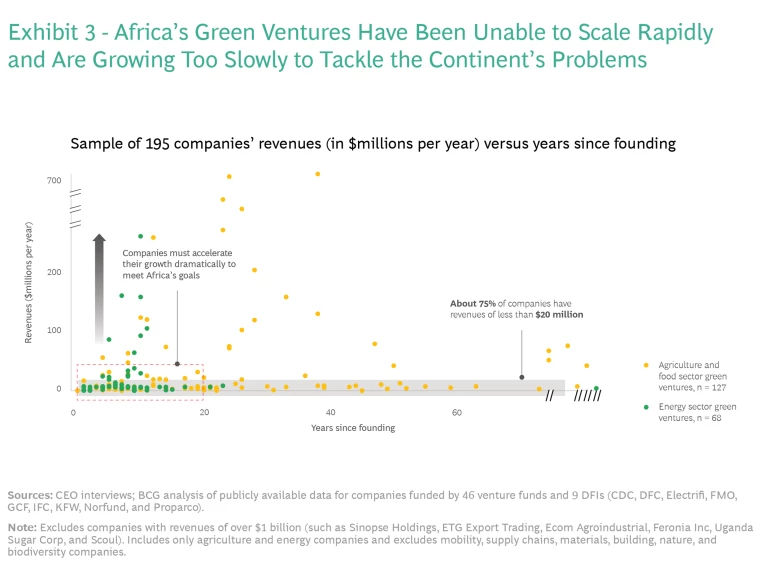

Yet the goal of transforming Africa into the epicenter of the world’s low-carbon industry has not been easy to achieve. That’s because the continent’s green ventures haven’t been able to scale successfully. Most have remained small, relative to the size of the opportunity, and have taken too long to grow. A 2022 BCG analysis of 300 green ventures in Africa found that over 75% of them were generating less than $20 million in annual revenues each, despite having been in business for at least a decade. (See Exhibit 3.)

Africa’s green ventures face challenges above and beyond the barriers that all companies on the continent must contend with, such as low individual purchasing power, fragmented markets, and the scarcity of trained, highly specialized, and seasoned employees. In particular, three major barriers impede progress on the green ventures’ growth path: capital, policy, and industry structure.

First, because green ventures must deploy additional infrastructure and develop novel hardware, they need large sums of long-term financing and working capital, both of which are scarce and expensive in Africa. Second, green companies tend to be subject to special regulations, require licenses to operate, and are more vulnerable to import duties than are traditional players. Moreover, many of these companies offer public goods that government agencies or contractors in industrialized countries would usually provide or fund, and they should be subsidized. Third, green ventures need to develop more sophisticated technological and management capabilities as well as skilled talent in order to successfully scale their operations across the continent.

If Africa’s green companies can scale to global levels, they will not only deliver sustainable products and solutions to enterprises and consumers, but also drive employment and incomes on the continent. The climate crisis demands fast action, and the quickest solutions are likely to come from scaling what's already working. Consequently, fostering green ventures offers opportunities for growth on a sustainable basis. The question is, who needs to do what to help Africa’s green ventures grow?

We’ve been studying Africa’s green ventures, as well as the global business ecosystem in which they operate, and believe that a shift in focus is essential. The three critical stakeholders in the effort—investors, governments, and companies—must work in a coordinated way to unlock the full potential of green ventures. Moreover, the focus on scaling requires the actors to play different roles and tackle new priorities.

Scale—with Investments

Private investors, foreign governments, multilateral development banks, and development finance institutions—such as the US International Development Finance Corporation (DFC), the UK’s British International Investment (BII), and the Netherlands’ Entrepreneurial Development Bank (FMO)—invest in Africa’s startups. In 2021, global financial institutions invested as much as $7.4 billion in the equity of African companies, large and small.

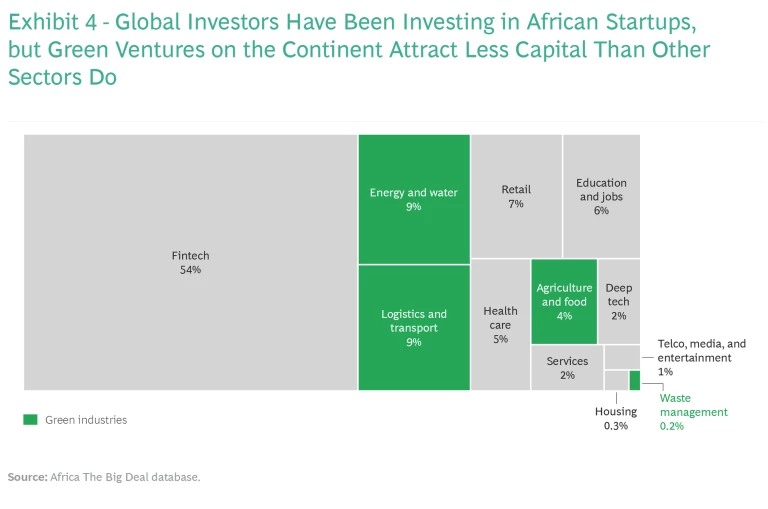

As is evident from the inability of many of Africa’s green ventures to achieve vigorous growth, however, investors are missing something: they aren’t providing enough funding, and their funding isn’t structured to enable green ventures to scale easily and quickly. In 2021, only 11% of venture capital deals in Africa exceeded $10 million, and fewer than 5% were for later-round Series C and D financing, according to BCG analyses. Startups in sectors such as nonconventional energy, water, logistics , agriculture and food, and waste management—only some of which were green—attracted just 22% of the money that Africa’s venture capitalists invested last year. (See Exhibit 4.) By comparison, Africa’s fintech platforms drew as much as 54% of the investments.

The lack of debt compounds the challenge. For various reasons, African startups use equity, rather than debt, to fund their infrastructure and working capital requirements. The paucity of debt capital creates working capital shortages, and green ventures can’t access capital to fund large expansions, diversifications, or M&A. Green ventures clearly require different funding structures, so institutional investors should rethink their evaluation criteria and refine the decision-making mechanisms they use.

BIG IDEA

A massive influx of capital into Africa’s green companies is essential today, and it must be appropriately structured. Many investors say they’re keen to increase their green investments, but they need to go beyond the usual to do so. Investors, our calculations suggest, should create $200 billion in blended capital facilities by 2023 dedicated to financing Africa’s green ventures.

Investors should invest in the equity of enterprises at different stages of maturity, addressing, in particular, the current gap in $20 million to $50 million investment rounds and late-stage investments. They should also provide reasonably priced debt in local currency for long-term infrastructure financing and short-term working capital. Some of the funds’ loans should consist of concessional financing. Money must be channeled into third-party credit enhancement schemes to improve green ventures’ credit profiles so that they can obtain debt on better terms from local financial institutions. The funds should include new carbon-financing vehicles, design results-based financing schemes to increase consumer access, and offer managerial and technical assistance to ensure that green ventures develop the organizational capabilities they need in order to grow rapidly.

Each kind of investor—whether a debt provider, an equity investor, or a capability creator—faces different imperatives. (See Exhibit 5.)

Debt Providers

Many African green ventures need three to five times as much debt capital as equity, according to BCG studies, because of the infrastructure they must create and the hardware they must develop. But debt is scarce and difficult to obtain, and Africa’s green ventures have few options open to them. Local banks worry about the risks that new ventures embody and resist offering much debt to green ventures.

When green ventures do borrow from commercial banks, they must accept interest rates of over 20% in the case of local currency debt and, often, over 12% for hard-currency loans, with the borrower carrying the foreign-exchange risk. While top-performing ventures may be able to secure less expensive debt, the amounts they can access are limited. Both bond and commercial paper markets in Africa are relatively underdeveloped, so green ventures have no choice but to explore new sources of financing or use equity to fund operations.

African companies operating in infrastructure businesses have a lower default rate than their counterparts in the US and Europe, according to EDHECinfra data. Nevertheless, the cost of infrastructure financing on the continent is much too high: the five-year average cost is 10.2% compared with 4.7% globally. Unless development finance institutions step up to provide more credit and offer commercial banks better risk-mitigation products, the latter will not be willing to increase their exposure to green ventures.

Lenders must offer green startups financing that weighs the risks of climate inaction against company risk, as some are starting to do. The $10 billion Global Climate Fund, for instance, is an investor in Climate Fund Managers (CFM), which today manages a portfolio of over $2 billion. CFM offers lines of blended finance in sectors such as renewable energy, water, and sanitation, addressing investee needs across the life cycle of project financing, development capital, project equity, and patient project finance. If Africa’s green ventures are to tap structured debt for operations, as companies everywhere else do, more funds like CFM need to be floated.

Africa’s green ventures must also learn to tap novel carbon-financing opportunities and monetize carbon sequestration. Carbon offset demand is set to grow by between 6 and 16 times by 2030, and offset prices could rise to $50 to $80 per ton of carbon dioxide equivalent by 2030, compared with $5 per ton in 2019. In fact, carbon monetization could become a $1 trillion market by 2030, based on today’s emission levels.

Africa’s ventures in agriculture, alternative energy—particularly in applications related to clean heating, cooking, and fuel substitution—and nature-based solutions can take advantage of these revenue streams. They can structure their future revenues in such a way that they receive cash upfront to fund the expansion of their manufacturing and distribution. A BCG analysis of VERRA, the world’s largest voluntary carbon credit market, suggests that conservatively Africa could grow its carbon revenues from less than $1 billion in 2021 to around $9 billion by 2030.

Consider Sanergy, a Kenyan company that manufactures insect-based proteins for animal feeds and fertilizers. Sanergy has grown a colony of black soldier fly larvae that consume organic waste; the company then converts the larvae into nutrient-rich inputs for animal feeds. To produce fertilizers, Sanergy co-composts the frass residue from the process with carbon-rich plant waste, yielding an organic fertilizer that nourishes the soil and improves crop yields. Sanergy also produces biomass briquettes, an industrial eco-fuel.

The company avoids and removes carbon emissions throughout its production process. Its operations remove city waste that would otherwise emit greenhouse gases, its insect-based animal protein substitutes for emissions-intensive fishmeal and soy, its composted fertilizer supplants high-emission synthetic fertilizers, and its biomass briquettes reduce deforestation by replacing firewood. Sanergy has already started monetizing its carbon avoidance benefits and is using the revenues to finance its expansion plans.

Equity Investors

Global investors’ commitments to green businesses have substantially increased in recent years, and a number of climate-specific funds having been floated. Most of them, however, overlook opportunities in Africa. Of the most impactful private equity funds, the Impact 30, only five have investments of any significance in African ventures.

New climate-focused funds—such as Generation Investment Management’s Just Climate, a fund that invests only in climate-related ventures, and TPG’s $7 billion Rise Climate Fund, which invests in companies that can quantifiably demonstrate carbon avoidance—look for late-stage ventures, of which there are only a few in Africa. That creates a chicken-and-egg situation. The two funds invest only in ventures that can absorb $50 million and $200 million, respectively, at a time—investment levels that are beyond the capacity of all but a handful of Africa’s green growth companies to absorb. Moreover, few ventures will ever reach that stage unless they can raise more equity capital and grow.

Africa’s green ventures find themselves endlessly engaged in money-raising mode, mounting round after round of bridge financing to escape cash crunches. They need specialized investors that are willing to lead funding rounds. Investors must be able to better match business models with asset classes and ensure that Africa’s startups don’t have to part with equity in order to finance infrastructure development. If investors could arrive at quicker decisions and make larger commitments, Africa’s green business leaders could focus on growing their businesses instead of constantly worrying about fund raising.

Some encouraging signs are visible, with specialized funds such as the Acumen Resilient Agriculture Fund, KawiSafi Ventures, E3 (formerly Energy Access Ventures), AllOn, and Lion's Head Global Partners emerging in the past five years. It’s also reassuring to see the emergence of later-stage funds. For example, the African private equity investor Helios Investment Partners has just launched a Climate, Energy Access, and Resilience fund that plans to raise over $350 million for investments in later-stage ventures. By using experts who have a firm understanding of Africa’s green industries, such funds have successfully invested in ventures that have sound business models. By spotting promising candidates before they came into the limelight, the funds were also able to invest at lower valuations.

Capability Creators

Many investors say that they can’t find enough investment-ready companies to invest in. That’s a call to action for development finance institutions, impact investors, and others to provide more support to ventures to improve their operations and enable them to absorb investments, as IFC’s Upstream Program plans to do.

Global investors must work closely with the top management teams of Africa’s green ventures, helping them recognize early on that their organizations will look dramatically different when they’re bigger. After all, they will face different challenges at each stage of their ventures’ lives. As companies become larger, they will need to focus their strategies and operations on balancing sales with profits.

Investors can help founders develop management systems, catalyze investments in digital technologies to increase efficiency, re-evaluate operating and partnership models, and recruit talent to fuel growth. Such efforts will likely require greater subsidies and targeted grants from development finance institutions to bring best practices to these businesses. Investors should appoint seasoned local and global executives, not just finance people, to boards, so they can help Africa’s green ventures cope with the management challenges growth. Large investors must also catalyze structural changes in industries to help the green ventures improve margins.

Scale—with Policy

Recognizing that Africa’s green growth ventures are often public service providers, governments and public sector institutions on the continent must create a more supportive environment. As a first step, they must acknowledge the major role that Africa’s green companies will play in the industrialization of the region’s economies, and formulate policies to accelerate their growth.

BIG IDEA

Countries that want to grow their green industries to scale and compete in the global economy should ensure that the highest levels of government treat this objective as a priority. They should create a government department, headed by a cabinet minister, that is dedicated to driving the process.

This department should be responsible for reducing tariff barriers, increasing subsidies, boosting procurement from green enterprises, and harmonizing regional standards. Depending on the country, the department might fall within the ministry of industry, trade and investment, or finance. To succeed, the department must possess a meaningful budget, a fair degree of autonomy, and the freedom to act.

A government department of this kind would tackle the main levers such as reducing fiscal barriers, deploying subsidies, and harmonizing regional standards. (See Exhibit 6.)

Reduce Fiscal Barriers

African governments have an opportunity to unlock growth by waiving import duties and taxes on sustainable industries such as renewable energy, electric mobility, and agricultural inputs. Many governments won’t find it easy to do so in the face of limited financial resources and rising debt-servicing levels, but they must factor in the many benefits of supporting green industries. For instance, in 2013, when several East African countries waived import duties and value-added taxes on solar power systems, the new policies kickstarted the industry’s development, according to the Global Off-Grid Lighting Association. The tax concessions enabled startups to slash electricity prices for rural consumers by from 10% to 24%, which in turn boosted the startups’ revenues by as much as 25% a year.

Deploy Subsidies

Recognizing that many green ventures provide public goods and services, governments must try to offer incentives such as concessionary loans, tax breaks, tax credits, and direct and indirect subsidies. Because African governments face serious financial constraints, they may not be able to afford to provide these incentives themselves, in which case development finance institutions and foundations must rise to the challenge.

Multilateral institutions can develop financial instruments such as social bonds and results-based financing schemes that will reward companies for delivering results. For instance, African farmers irrigate only 5% of the continent’s arable land, compared to 50% in India, and more than 80% of African farmers are smallholders who can’t afford to buy equipment for water pumping and irrigation. That’s where green ventures, such as SunCulture , can make a difference. SunCulture designs, distributes, services, and finances small solar-powered irrigation systems; however, despite the inroads that it has made, the costs of hardware are still too high to permit mass adoption.

A BCG cost analysis conducted in 2022 found that companies like SunCulture could reach a mass adoption price point if they received suitable results-based financing. Our calculations suggest that subsidies of from $50 million to $100 million would unlock demand at scale and provide a bridge to low-cost price points. Similar analyses in other industries would enable governments to deploy subsidies with precision, thereby boosting African consumers’ demand for green offerings.

Harmonize Regional Standards

Until the African Continental Free Trade Area (AfCFTA) realizes its potential, regional trading groups such as the Economic Community of West African States (ECOWAS) and the East African Community (EAC) must take the lead in developing policies for green ventures. They must harmonize nascent standards for green products and services, as well as tariffs, so that green ventures can expand more efficiently across borders in each region.

The opportunity is exemplified by the aquaculture industry in East Africa. Tilapia, a freshwater fish, is the most affordable and sustainable source of animal-based proteins for East African households in Rwanda, Kenya, Tanzania, and Uganda. The fish has a feed conversion ratio—a measure of the efficiency with which it converts feed into meat—that is 16% better and a carbon footprint that is 72% lower than the corresponding ratios for chicken, the most efficient land-based protein.

Fish has become an increasingly popular source of protein in East Africa, but availability and price limit its consumption. According to a BCG analysis based on demographics, consumer preferences, and prices, fish consumption in the EAC is likely to grow at 7% to 8% per year, resulting in a $8 billion to $10 billion market by 2030 in East Africa, which is currently a net importer of tilapia even though the fish is native to African lakes and waterways. The EAC could even become a tilapia export hub by adopting climate-smart fish farming and fish production processes.

Several companies—among them, Yalelo, which has operations in Zambia and Uganda, and Victory Farms, which operates in Kenya and Rwanda—are building sustainable aquaculture businesses. Victory Farms, which is East Africa’s largest sustainable fish producer, has a production capacity of 10,000 metric tons and sells through a network of over 15,000 primarily woman-run businesses. It hopes to expand revenues tenfold over the next five years, despite operating with little or no government support.

Victory Farms deals with different standards regarding fish feeds, farming and harvesting processes, and fish preservation in each of the three Lake Victoria countries in which it operates. By agreeing on common standards, Kenya, Uganda, and Tanzania could greatly facilitate the tilapia trade, enabling companies like Victory Farms to scale operations, provide affordable protein, boost employment, and generate much-needed foreign exchange through exports.

Scale—with Business

If Africa’s green ventures are to scale rapidly, they must develop the management and operational abilities necessary to sustain faster revenue growth. In addition to identifying essential skills and competencies for coping with growth, these ventures must design integrated systems, create processes, and build teams. Above all, green ventures need to figure out how to perform optimally when they grow to many times their current size.

BIG IDEA

Successful scaling is unlikely to happen unless investors, foundations, development finance institutions, and governments channel management support and offer subsides to startups so they can deploy cutting-edge management practices. Many development finance institutions have set up small funds that offer discretionary grants of from $20,000 to $50,000 for technical assistance. Given the headwinds that green ventures face, however, bigger visions and greater ambitions will be necessary to enable them to scale.

If such ventures are to grow ten times bigger in, say, three years’ time, stakeholders must provide investment support to help them build capabilities to accomplish three strategies: strike partnerships, spur consolidation, and forge foreign alliances. (See Exhibit 7.)

Strike Partnerships

Many green ventures on the continent are vertically integrated or operate many complex business models under the same roof. For an African startup, that’s often a necessity to ensure quality and delivery, but it slows their agility as they grow, and it creates operational complexity in already-challenging markets. Vertical integration also adds to companies’ cost structures and lowers their profit margins.

To scale, green growth ventures must forge cross-sector partnerships with peers, incumbents, and multinational companies, although making such alliances work isn’t easy. It’s crucial to crack the code of partnership so that each venture can focus on its core competency and grow. In the off-grid energy sector, for instance, every startup initially set up its own end-to-end product design, manufacturing, distribution, and product financing operations. But the trend has changed over the last decade, with more specialization emerging in the industry.

Companies in other industries are learning the value of such partnerships. For instance, ROAM, which manufactures electric motorcycles in East Africa, has partnered with M-KOPA, an asset finance company that formerly specialized in solar home systems, for consumer financing. While ROAM focuses on designing and manufacturing two-wheelers, M-KOPA draws on its expertise in IoT devices and pay-go asset financing to boost sales. Together, the two ventures help customers, mainly motorcycle taxi and delivery entrepreneurs, lower their operational costs by over 70%, increasing their daily incomes by as much as 50%.

Spur Consolidation

Many green ventures have built dedicated supply chain and delivery systems, so the business case for consolidation on the continent is obvious. Otherwise, investments will continue to be spread thin over many duplicated models rather than focusing on making bigger bets.

There are many opportunities for M&A in Africa, but to grasp them, top management teams must think holistically. Moreover, investors must be willing to provide post-merger integration capabilities. Mergers and acquisitions are challenging in Africa, which is why they have been rare, currently accounting for just 2% of global M&A.

Forge Foreign Alliances

Africa’s green ventures must attract multinational companies to make investments, transfer the next generation of technologies, and enter into relationships that will give them access to resources, know-how, and export markets. In the past five years, several global companies have started working with African ventures: Bayer with Apollo, EDF with SunCulture and BBOXX, Dow Chemicals with Mr. Green Africa, ENGIE with Fenix and Mobisol, and Sumitomo with M-KOPA and PowerGen, for instance.

Nevertheless, many multinationals have made only minority investments, so Africa’s green ventures need to find ways to take these fledgling alliances to the next level. Doing so will involve making the business case—supported by analytics and an understanding of multinationals’ current growth priorities—for global companies to invest more in Africa.

Next Practices in Growing Africa’s Green Ventures

If the players in Africa’s green ecosystem—investors, governments, and companies—were to act in concert to scale its ventures, the results could be exceptional. Consider the electric two-wheeler (E2W) industry, which has unexpectedly risen to prominence in sub-Saharan Africa.

Two-wheelers, mainly motorcycles, have long been a common form of transportation in African cities, often serving as passenger taxis and goods delivery vehicles. Over the next five years, according to BCG analysis, sales of two-wheelers are poised to grow by around 9% per year across the continent, with double-digit growth in some countries. Many of these two-wheelers are likely to be electric vehicles.

Africa’s E2Ws have reinforced suspensions, a range of around 100 kilometers, USB ports for cellphone charging, and new batteries imported mainly from China. The two-wheelers are durable, maneuverable in urban traffic, and stable on low-quality roads; and they emit fewer fumes, vibrations, and noise. The E2Ws perform on a par with traditional motorcycles but have a lower total cost of ownership when fuel and maintenance costs are factored in. Some three dozen companies in Africa have sprung up to make, distribute, and finance E2Ws in recent times.

These ventures face several challenges, however, ranging from unstable electricity supplies in cities to the large investments required to finance E2W purchases, create charging infrastructure, and facilitate battery swapping. Even so, several African governments are eager to expand production of electric two-wheelers to create jobs, reduce fuel subsidies, and lower pollution. As E2W ventures confront the familiar challenge of scale, how should Africa’s green ecosystem nurture this industry so that it scales profitably and goes global?

With the aid of an in-depth study that BCG recently conducted, we’ve identified the first steps that different stakeholders could take:

- Investors should expand the equity bases of the most promising E2W ventures to ensure their rapid growth. They should invest in synergistic ventures to open up the possibility of expansion through consolidation down the road. The world’s development finance institutions should fund the green ventures’ R&D for new vehicle designs, battery technologies, and charging solutions, but they should also create a $500 million local currency debt fund for financing two-wheeler purchases.

- Policymakers should consider reducing duties on imports of electric two-wheeler and three-wheeler components, and offer incentives for local vehicle and battery assembly. At some stage, they should invest in charging infrastructure, particularly in urban areas, or incentivize the private sector to build such infrastructure. Governments could subsidize the electricity used for charging motorcycles, or they could reduce existing subsidies for gasoline and diesel, which hinder green ventures’ competitiveness. They could also share the costs of creating the needed infrastructure with energy utilities that will earn more revenues from the E2W charging industry.

- Green ventures, in addition to investing in growth, should pursue partnerships, rather than vertical integration, as a strategy from their inception. They should also learn to consolidate—rather than duplicate—business models and professionalize their management.

If the players in Africa’s green venture ecosystem were to synchronize their efforts, the continent’s E2W business could grow into a $1.5 billion industry by 2027. Almost a third of the new two-wheeler purchases on the continent could be clean and green, which would ensure that Africa overtakes the rest of the world in electric mobility.

The quest for economic development over the two-and-a-half centuries since the dawn of the Industrial Revolution has led to climate chaos on a planetary scale. The industrialized nations of the world should defray much of the cost of Africa’s adaptation to climate change as well as of losses and damage from it. While that negotiation plays out on the world stage, the continent must—and is trying to—pursue its own path of innovation. It’s no accident that the continent has seen the birth of many sustainability-driven ventures, many of which are being held back only by the challenges of scaling.

The players in Africa’s business ecosystem, especially investors and governments, must come together to help green ventures on the continent scale successfully so that they become lighthouses of a sustainable and prosperous planet. When these green ventures grow, they will trigger a virtuous cycle that helps them continue to grow bigger and faster. What might appear to be a paradoxical challenge of boosting economic growth in Africa today while reducing emissions tomorrow can thus be resolved by a single—and single-minded—focus on scaling Africa’s green ventures.