By applying digital tools and promoting functional excellence, operators can reduce maintenance time, enhance train availability, and cut costs.

There’s nothing trivial about spare parts for freight and passenger rail operators. Having the required parts in the right place at the right time is essential for smooth operations. And improving maintenance efficiency is crucial for rail operators seeking to unlock growth opportunities and fulfill their potential in the fight against climate change.

To achieve these goals, rail operators need to transform their spare-parts

supply chain organization

. By combining digital tools with functional excellence, operators can fully exploit capabilities that already exist in their organizations. A transformative approach involves reimagining every part of the supply chain, from rolling stock procurement and demand planning to parts delivery and maintenance. The challenges are significant, but the opportunities are immense.

The Challenges of Legacy Operations

Most large rail operators have a long and proud history. But this legacy has a downside for supply chains: many operators use processes and tools established in the distant past, updating them periodically but never entirely replacing them. This has created the following challenges for rail operators around the world.

Poor Demand Planning. Most operators base their spare-parts demand planning on human experience and historical order quantities. This approach often results in parts supplies that are higher or lower than actual demand by more than 30%. Poor planning can lead to insufficient availability of parts in maintenance shops; indeed, major rail operators own larger fleets than needed for their daily operations to account for long maintenance downtimes. If operators need to place short-term orders to get necessary parts, they incur surcharges and higher logistics costs.

High Inventories. Excessively high inventory levels are another outcome of poor planning. In some cases, more than 30% of total stock is composed of rarely used parts that have been held in storage for more than three years. A lack of transparency into stocks is also an issue—some railway warehouses even store spare parts for trains models that are no longer in service.

Insufficient Supplier Management. Rail operators often must source parts from monopoly suppliers because stringent regulatory requirements limit the attractiveness of the rail supply market. Operators also frequently have a large number of suppliers that each sell only a few parts. This makes supplier management inherently challenging. We have seen delivery reliability as low as 70% when buyers do not apply penalties for late deliveries, for example, or when they negotiate contracts without involving functions that understand demand needs or the practical problems that could occur. We have also seen high shares of spot-buys outside capacity contracts.

Incomplete or Incorrect Master Data. The foundation of many supply-chain processes is transparency. This includes full transparency on inventory levels, train operations, and inbound deliveries, as well as having complete bills of material. Full transparency requires comprehensive and accurate master data. Unfortunately, the shortcomings of legacy IT systems and unclear responsibilities for collecting and cleaning data have left many rail operators with incomplete or incorrect data—missing bills of materials for train models, for example, or a lack of fully documented material attributes, such as delivery times or storage requirements. This often makes it impossible to implement data-driven planning and management.

Working in Silos. Reflecting a common challenge across industries, supply chain efficiency is impeded by functional silos. Spare-parts supply chain organizations typically operate separately from maintenance shops and their responsibility and visibility end at the transfer point between the warehouse and maintenance center. This leads to friction, delays, and untraced spare-parts inventory stocks in maintenance shops. In addition to the organizational challenges, the IT systems of the different functions often are not connected and seamlessly integrated.

A New Vision for End-to-End Processes

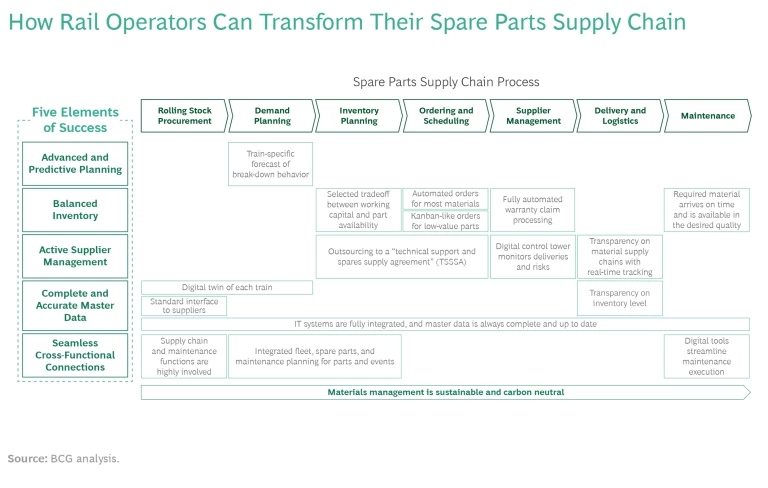

To address these challenges, a state-of-the-art organization for spare parts supply chains should include five elements:

- Advanced and Predictive Planning. Use analytics and a digital twin of each train to plan for spare parts demand on the basis of predicted defects and parts replacements.

- Balanced Inventory. Define inventory levels by balancing efficiency (lower net working capital) and resilience (availability of parts).

- Active Supplier Management. Work with suppliers to ensure on-time delivery and required quality. Set up systematic tracking and quality control.

- Complete and Accurate Master Data. Ensure that all required data (such as bills of materials and replacement cycle times) is available and correct.

- Seamless Cross-Functional Connections. Promote collaboration between relevant departments (such as procurement, maintenance, and supply chain) and connect systems to achieve aligned targets.

Each of these elements applies to one or more of the processes in the spare parts supply chain. (See Exhibit 1.)

Here is an overview of how operators can reimagine these processes:

Rolling Stock Procurement. Procurement teams should consider the requirements of the spare parts supply chain when ordering new train cars. To facilitate spare parts planning, the organization needs a digital twin of each train car. This virtual representation contains all information about the train’s condition as well as standard parts lists, such as the bill of materials for the entire car and each planned maintenance event. To enable the rail operator to create a digital twin, rolling-stock suppliers must provide the relevant data in the right format. Building a standard interface to suppliers can simplify this process and ensure that up-to-date information is available. Teams from the supply chain and maintenance functions should be highly involved in the procurement process.

Demand Planning. The digital twin provides the fact base for advanced and predictive planning, which is a fundamental shift in mindset for most organizations. Instead of basing the demand forecast entirely on historical orders and experience, planners consider the train’s condition and mileage.

The idea is very simple. Imagine having only one train. To create an accurate forecast for spare-parts demand, you would take three steps:

- Determine planned mileage and when the next planned maintenance event is scheduled. For each event, create a bill of materials, including all parts that need to be changed periodically for regulatory or warranty reasons.

- Create a list of damages that have been observed by the train crew or service personnel.

- Apply historical experience to build appropriate safety stocks to prepare for unplanned breakdowns.

With the forecast in hand, you would check which maintenance center is available and send the parts directly there so that they are waiting when the train arrives.

Inventory Planning and Ordering and Scheduling. The planning you can do for one train, you can also do for thousands—thanks to digitization. Digital tools, accurate master data, and active condition monitoring make it possible. To capture the opportunities, it is critical to seamlessly connect or even integrate the planning department into fleet operations and maintenance. Teams can use artificial intelligence to assist in forecasting safety stock requirements, thereby reducing inventory levels.

Effective planning also requires a clustering of parts to differentiate mission-critical parts that require higher stocks from low-value parts and consumables. An accurate classification of parts is essential to avoid higher costs or service delays. Ultimately, inventory levels should reflect the operator’s selected tradeoff between working capital and part availability.

Accurate planning enables supply chain organizations to set up automatic spare-parts orders with suppliers. For consumables, organizations should consider using a Kanban-like process in which parts are automatically reordered when supplies drop to a specified level. Other options for consumables include using vendor-managed inventory or storing parts in the maintenance shop.

Some rail operators are testing the use of a “technical support and spares supply agreement” (TSSSA) with train manufacturers. The operator outsources spare-parts handling to the manufacturer, which agrees to supply the necessary parts within a specified time frame that varies based on a part’s criticality. A TSSSA’s success depends on the manufacturer’s ability to meet its service-level commitment.

Supplier Management and Delivery and Logistics. A digital supply chain control tower should monitor deliveries closely. This allows teams to systematically track supplier performance and trace material supply chains in real time. The control tower should also analyze and mitigate risks. Risk mitigation includes establishing secondary sources for most critical parts and using fully automated warranty claims in response to delays and defects. To reduce complexity and increase negotiating leverage, organizations should consider obtaining quotes for part bundles rather than individual parts. To actively manage suppliers and plan inventories, an operator needs full transparency on inventory levels.

Maintenance. The maintenance department should use digital tools to support cross-functional planning efforts, so that required materials are available on time and in the desired quality. Maintenance staff can also use digital tools to access up-to-date information, such as for scheduling and parts availability. In addition, it’s possible to use documentation that multiple parties can update in real time, such as for recording defects and status assessments.

Implementing the Transformation

To lead the transformation of the spare-parts supply chain organization, rail operators need a dedicated team that includes representatives of relevant departments and business divisions. The team should conduct a rapid assessment to analyze pain points and performance gaps; it can then develop an ambitious target picture for the organization five years in the future. These steps provide the basis for designing initiatives to transition from the current state to the target picture. Each initiative needs a clear roadmap and accountabilities.

To enable the transformation, the organization needs to break down silos .

Prioritizing the initiatives is essential for successful implementation. Some no-regret moves, such as master data cleaning, can start right away. There may also be quick wins, such as reducing inventories and optimizing procurement (for example, parts bundling), that can fund the journey. Next, the organization can begin the main transformation program by introducing a new planning process and taking supporting actions, such as establishing a digital supply chain control tower.

To enable the transformation, the organization needs to break down silos so that maintenance, planning, procurement, logistics, and fleet operations can work hand in hand. Each function has an important role in the integrated effort. Maintenance workers need to create documentation that specifies each part they mount onto a train, thereby establishing feedback loops between actual demand and planning. Procurement can use advanced planning to obtain lower prices through fixed order quantities—but it must give planners accurate data, such as a digital bill of materials.

Logistics should provide maintenance operators with appropriately packed material kits for each maintenance event and should even premount some parts in the warehouse. Fleet operations should ensure the accuracy of digital twins and provide planning teams with updated information to reflect significant mileage changes; such efforts will be rewarded with much more reliable maintenance times.

Along with being efficient and effective, the spare parts supply chain also needs to be sustainable to realize the promise of climate-friendly rail transportation. This includes obtaining CO2-neutrality certifications from suppliers, optimizing logistics, and reducing waste through optimized inventories.

A state-of-the-art supply chain for spare parts allows rail operators to tap into the hidden potential of their fleet by reducing maintenance time, enhancing train availability, and cutting costs. Success requires using advanced analytics for demand planning, balancing efficiency and resilience in inventories, improving supplier management, ensuring accurate and complete master data, and establishing cross-functional connections. Such a transformation might seem like a huge undertaking—but it is essential to meet public expectations for a rail sector that is both cost-effective and sustainable.