Chemical companies are shifting to a new, multifunctional, more collaborative form of R&D, where growth depends on their ability to engage with the outside world.

A producer of specialty chemicals announces a crowdsourcing competition, inviting outsiders to submit ideas for new products and services—and then it collaborates with the winners to develop them. An agrochemical company develops data-driven guidance on crop cultivation, coinventing their application methods with their farming customers. A multispecialty company shares its research staff and laboratory facilities with universities in Europe and China. And several chemical companies run venture capital units, funding startups with joint research projects in multiple fields, such as food and personal care additives, electronic chemicals, and others.

These are not isolated cases. They are part of an accelerating trend—a shift to a new, multifunctional, more collaborative form of innovation—that we have observed in our ongoing work with leading chemical companies worldwide and in our surveys of industry leaders.

These cases are part of an accelerating trend—a shift to a new, multifunctional, more collaborative form of innovation.

Innovation is as strong as ever in the chemical industry. Our study of publicly listed companies found that they spent, on average, 2.4% of their annual revenues on R&D in 2021, with a few spending more than 6%. This represents a significant investment.

But the style of innovation has changed dramatically. In the past, chemical company research was conducted by in-house chemists focused on developing and commercializing their own company’s breakthrough molecules, differentiated formulations, and novel processes. Outsiders were viewed as competitors and opponents. Today, a typical R&D effort involves multiple disciplines beyond chemistry, including

artificial intelligence

and

analytics

. Labs routinely engage with external parties, including customers, academics, and startups. Revenue streams go beyond selling molecules to include problem-solving services that incorporate sophisticated analytics, tailoring new offerings to serve specific applications. All of this is done with an eye toward addressing customer problems as they arise. Accordingly, the role of corporate innovation teams needs to be revisited.

Growth Through Collaboration

Several factors have accelerated the shift toward more collaborative innovation in the chemical industry. They are:

- The growing use of business models that are closer to the end application and thus involve more interplay with downstream manufacturers and customers

- Increasingly powerful digital technology, which crosses intercompany boundaries more easily and requires new capabilities (often outsourced)

- Sustainability imperatives from regulators, investors, and customers, requiring manufacturers of materials and additives to work together to deliver environmentally oriented solutions

- Advancing commoditization, which has spurred the use of novel technologies and capabilities, such as advanced analytics, to optimize efficiency and costs

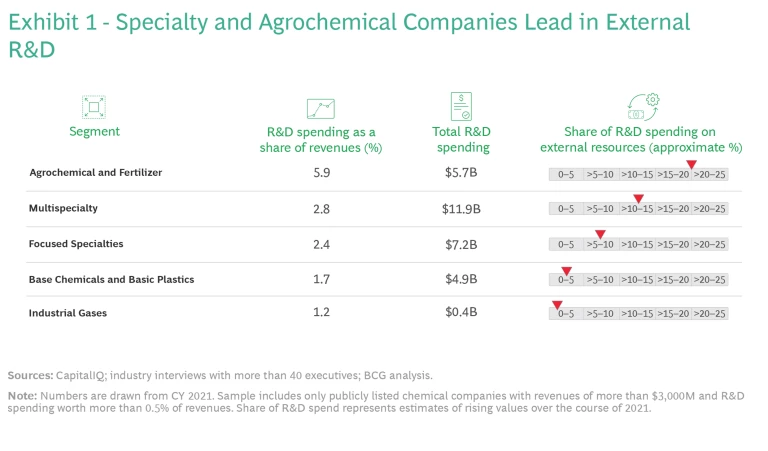

Different subsectors in the industry have responded to these factors in different ways. Based on interviews with experts across the industry, we have identified agrochemicals as the segment with the highest share of external resources in its innovation spending. (See Exhibit 1.) This is because of the complexity of agrochemical innovation, which incorporates molecular research and regulatory trials, as well as digital technology used in precision farming and dispensing. On the other end of the spectrum are base chemicals and basic plastics. Driven by the commodity nature of their businesses, these sectors leverage external partners more sporadically to gain access to particular capabilities.

Chemical companies employ a variety of new or rethought strategies to source and manage external inputs. They partner with academia and digital tech companies. They crowdsource R&D activity through competitions and prizes. They cocreate offerings with their customers, and they establish corporate venture capital funds and incubators to gain access to the ideas and capabilities associated with startups. Best practices are emerging: for the strategies, their implementation, and the organizational structures that support them.

Best Practices for Collaborative Strategies

BCG’s list of successful innovation strategies is based on our work with chemical companies and on industry interviews conducted in 2021 and 2022. At first glance, these may seem like familiar approaches, but they incorporate significant shifts in R&D management. They are resilient and oriented toward excellence in execution. Most important, they are collaborative in nature. Tailored to generating the most value from external relationships, these approaches are aimed at accessing capabilities from other enterprises.

The five strategies that follow include examples of best practices and represent good starting points that any company can adapt to its own culture and context.

- Outsourcing and vendor management: share data with external suppliers. Most conventional outsourcing arrangements keep vendors at arm’s length and overlook the potential for collaborative innovation. Set up standards for data integration with vendors, pooling efforts and achieving better results faster. Leading agrochemical companies are exchanging data in real time with suppliers in fields such as mass spectrometry, nuclear magnetic resonance, and high-performance liquid chromatography. Those companies can now identify contaminations and performance drivers more easily, and they’ve reduced some product launch times by several weeks.

- Fast and efficient partnership models: streamline joint ventures and joint development agreements. Many business leaders regard formalized partnerships with externals as slow, difficult to set up, and cumbersome to operate. Best-in-class companies have a different perspective. They structure partnerships for speed, flexibility, and freedom from bureaucratic overhead. Standardized, fast-to-implement agreements provide clearly defined legal frameworks, steering mechanisms, and guidelines for sharing knowledge and intellectual property. This approach allows for efficient collaboration and governance of the partnerships, particularly with smaller partners. At the same time, it allows the joint venture to act independently from corporate processes that might not be suitable for a small, agile business.

- Partnerships with academia and innovation hubs: create real value. The greatest benefit often comes from mutual projects, with industry professionals and academics on a single innovation team. Benefits include cross-fertilization (casual conversations among peers), talent-spotting and development, intellectual property rights shared between the company and the university, research productivity, and more advanced work on issues such as reducing ecological harm. At best, there is a constant flow of innovation and insight from cross-boundary collaboration that wouldn’t otherwise emerge. In this vein, the French chemical company Solvay and the University of Bordeaux have built a facility, The Laboratory of the Future. It is known for its development of gels and colloids, some of which have been converted to consumer products.

- Venture capital investments: develop your own fund. Use it to invest in strategically aligned startups. The European firms Bayer and DSM are among the companies that have done this successfully, and best practices are emerging. The fund needs enough investment to support a portfolio of multiple companies. Only a few investments may succeed, but they will justify the entire effort. As in traditional venture capital funds, a significantly sized portfolio is required. The portfolio should be aligned with the chemical company’s strategy, but it should not be micromanaged. Run it as a financial vehicle, with finance professionals overseeing it, and ideally locate the fund’s offices near innovation hotspots.

- Competitions and crowdsourcing: gain access to early-stage activity. Chemical companies increasingly use open-access platforms and competitions to gain expertise that otherwise would be difficult or expensive to acquire. This strategy not only brands companies as a source of innovation, but it also allows them access to early-stage ideas and offerings. The platforms are typically online spaces where researchers have incentives to share information related to advanced areas like biotech or synthetic chemicals. Competitions are modeled after Silicon Valley’s “hackathons,” where the host companies engage with teams of external programmers. Sometimes those interactions lead to an ongoing relationship with a startup.

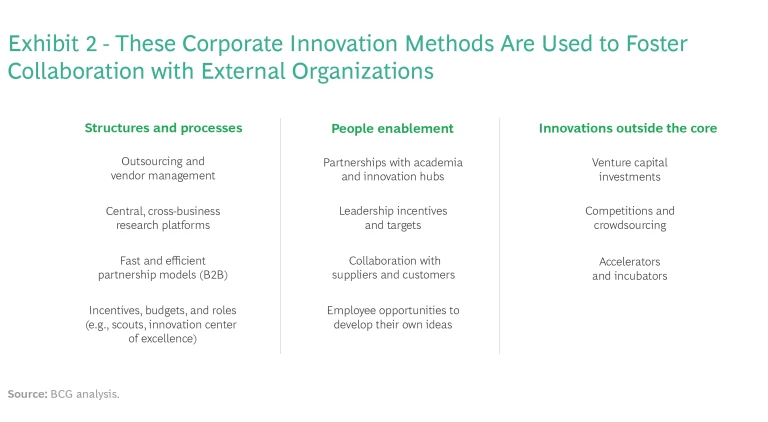

Exhibit 2 presents these methods and strategies, along with other actions that can help build the necessary capabilities and business infrastructure over time. All of these are being deployed by leading chemical companies to involve external entities in the innovation process and to capture the highest value from those engagements. Together, these methods can help a company raise its level of innovation readiness. ( Innovation readiness is the capability of realizing value from R&D investment.) There may be less emphasis on traditional innovation tools, such as R&D projects based only in in-house laboratories.

The Changing Role of Corporate Innovation

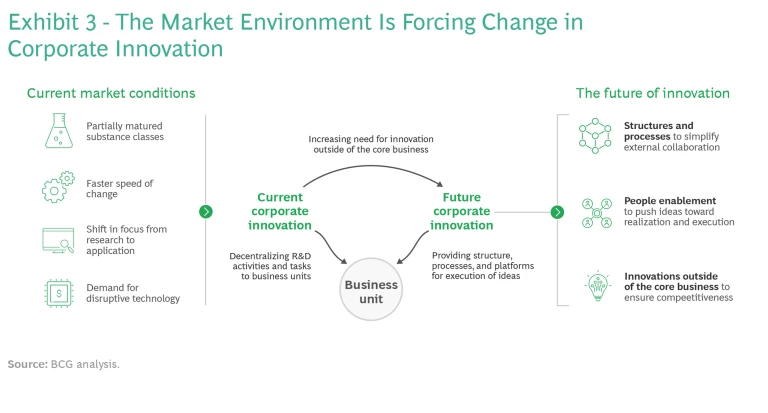

As a chemical company moves into more collaborative types of R&D, the role of the corporate innovation function must change with it. In more and more companies, large parts of R&D activities related to process and product are performed by the business, thus ensuring the closest possible link to customer requirements.

The role of corporate innovation becomes one of facilitation, with a concurrent, remaining focus on such critical areas as high-performance analytics and computing or platform technologies. These are areas with cross-business relevance where deep expertise is needed. In its role as the central innovation hub, this corporate function will need to facilitate agile management, reduce barriers to collaboration, and develop the necessary skills and digital platforms while maintaining a customer-centric focus. Companies that fully engage in such innovative strategies will lead the industry during the next few years and probably beyond.

As a chemical company moves into more collaborative types of R&D, the role of the corporate innovation function must change with it.

Accordingly, these new practices may require a change in the culture of the enterprise. Simplify some of the more elaborate R&D processes of the past, especially if they involved multiple layers of approval before a product could be released—or waterfall-style systems in which different teams took charge of the new offering at different stages of development. Instead, adopt a minimum-viable-product approach. Release new offerings in the beta stage, test them in the field, and then revise them as needed.

The new approaches also require better working relationships with external partners, even long-standing suppliers or customers. You will have to provide guidance, maintain standards for quality and collaboration, and develop a framework for multidisciplinary innovation. As budgets are dedicated to crowdsourcing platforms, shared innovation centers, venture funds or joint ventures, and other projects may lose funding. Therefore, existing staff must fully understand the benefits to be gained. As shown in Exhibit 3, the shifting market environment will provide a rationale and sense of urgency for making the needed changes.

Developing a highly capable innovation function will enable you to coordinate activities far more effectively in real time. It will also lay the groundwork for future innovation. With the advent of quantum computing, theoretical research and analysis may take a major leap forward during the next few years. This could have profound implications for materials and biochemistry. Having a central innovation function, well-versed in how to collaborate with outsiders, will give companies a head start in participating in this research and help apply and deploy the resulting breakthroughs.

A Call to Action

The corporate innovation function is typically responsible for coordinating all innovation activity. Coordination alone, however, will not be enough to lead the change effort across the company. Start by establishing your goal of enabling your company to innovate successfully in a highly collaborative environment. Then pursue the following steps:

- Define a value proposition. This is a shared concept of how more collaborative innovation will allow your particular mix of products and services to be successful. Such a proposition helps you set the right incentives, put the best leadership in place, and identify other companies and academic institutions with whom you want to build working relationships.

- Focus your investment on collaboration priorities. Look at all spending across the business and then assign more of the budget to local efforts, closer to the customer. Rethink traditional spending schemes and offer incentives for collaboration with external partners.

- Set up lighthouse pilots for collaboration. Lighthouse pilots are focused on new offerings that meet a current customer demand. Design these pilots with external participation in critical innovation areas that ensure high visibility and serve as good precedents. Track their impact. Learn from your own efforts.

- Establish relevant key performance indicators. Set a direction for future innovation by realizing value with new product releases, migrating customers to new solution-related services, and operational efficiency.

- Adopt an agile, multidisciplinary projects model. Enhance agility in R&D by creating a mix of both application-driven project teams and functional specialist teams. Build cross-functional teams, involving data analysts and methodological experts who understand how to work with external partners.

- Explicitly work to reduce cultural and other barriers. These make it difficult to collaborate with outsiders and might include a reluctance to engage because of a past negative experience or the tacit view that one’s own company is the best innovator. There may also be legal barriers or budget limits that constrain joint ventures, incubators, or investment funds. You will not remove all barriers overnight. But you can generate a few projects, invest in them wholeheartedly to give them a good chance of success, and promote the results.

You will know when you have made sufficient progress because your revenues will shift to services and tailored products. The structure of the innovation function will also change. And you may have a new appetite for anticipating future trends. The current momentum is undeniable. Your strategy now, and especially the way you marshal your innovation resources and the integration of external capabilities, will determine much of your company’s performance over the next ten years.