Yet we also see a window of opportunity for those that move quickly to implement fundamental process changes and begin the transition to carbon neutrality.

As regulatory, investor, and consumer pressures amplify the urgency for industrial decarbonization, the steel industry faces increasing demands for real plans to reduce emissions. That’s not an easy task. To meet significant CO2 reduction targets, the industry will have to make fundamental changes to its production processes. Two possible solutions immediately come to mind: capturing the CO2 produced by traditional steel plants and repurposing it or storing it underground, or closing existing plants and building new ones that operate initially on natural gas and eventually on green hydrogen.

The industry has considered such changes for years, and a few companies are piloting production of low-carbon, hydrogen-based steel in small volumes. Beyond that, however, little progress has been made, primarily because the two possible solutions are enormously expensive and would hike the price of steel by as much as 50%.

That may seem unpalatable in a commodity industry with extremely low margins to begin with. But the alternative will be increasingly costly as well. Approved or anticipated global regulatory changes aimed at reaching carbon neutrality in the next 30 to 40 years will translate into ever-mounting carbon costs for steel companies that continue to use traditional processes.

Europe is leading the way in regulatory reform, targeting a 55% reduction in carbon by 2030 and carbon neutrality by 2050, primarily through so-called market-based measures, which require steel producers to pay for each metric ton of CO2 emitted. In addition, the EU will soon introduce the innovative Carbon Border Adjustment Mechanism (CBAM), essentially a tariff on steel imports based on the amount of carbon embedded in them.

Simultaneously, China—by far the largest steel-producing country—is seeking carbon neutrality by 2060 and is also in the process of introducing a national carbon-pricing system. The first emissions trading started in 2021 in the power sector and is expected to expand to include the steel sector in the coming years. Given the sheer size of Chinese steel output, even a small percentage shift toward green-steel production would bring large quantities to the market. This could alter trade balances significantly because a lot of this Chinese steel would serve to meet the increasing demand for green products in Europe.

Weighing all of the decarbonization trends roiling the steel industry, it is apparent that steel manufacturers must move quickly to revamp their operations and cut their carbon emissions if they are to remain competitive. We believe that steel companies could achieve this—and gain advantage—with a three-step strategy: help shape both the overall regulatory discussion and the definition of green steel, support market development, and work hard to implement large investment projects on time and on budget.

There is no doubt that this is a difficult-to-abate industry under intense regulatory pressure. Yet we also see a window of opportunity: first movers will be positioned to define new market mechanisms, compete in the nascent green-steel market, and prosper from the transition to carbon neutrality.

A Closer Look at Ambitious New Regulations

The steel industry is responsible for about 7% of all manmade carbon emissions, which puts it in the cross hairs of new regulatory restrictions emerging in part from commitments made at the COP26 global climate change summit in December 2021. At that meeting, most developed economies set targets for net-zero carbon by 2050, and many also pledged ambitious 2030 emissions reduction goals.

Like other parts of the world, the EU hopes to achieve these goals by significantly strengthening climate regulations in the next two to three years, which will impact both domestic and international steel producers. For instance, the EU’s main market-based measure—the Emissions Trading Scheme (ETS)—is already being tightened by annual reductions in the overall number of carbon emissions permits available. And the CBAM’s emission-reporting requirements will be introduced perhaps as early as 2023 to protect against carbon leakage (the movement of production offshore to avoid EU climate costs and the replacement of EU products with more carbon-intensive imports).

When the CBAM is fully implemented, later in this decade (approximately 2026), steel importers will have to pay the same carbon price as EU producers for each metric ton of embedded CO2 they sell in the EU market. Over time, this tariff will eliminate the free ETS allowances that the steel industry has enjoyed for most of its production volumes. With CBAM, these free allocations, which steel companies could sell if they reduced their carbon emissions, would decline by 10% from 2026 onward before being completely removed in 2035.

The implementation dates of these regulatory changes are still under negotiation, and some stakeholders are pushing for aggressive action. The European Parliament’s environment committee, for example, said in late 2021 that the CBAM should be introduced more quickly than originally proposed and should cover a wider range of products and ETS free allowances should be phased out by 2028 rather than 2035. For their part, energy-intensive industries in the EU have argued that the CBAM alone is insufficient to protect against carbon leakage, and they should receive a rebate on climate costs for exports outside the bloc. In January 2022, the European Commission rejected such a proposition, saying it would be incompatible with the EU’s obligations to the World Trade Organization.

The EU envisages the CBAM acting as an incentive for other parts of the world to ramp up their own carbon-pricing regimes. If they do so, they will be able to negotiate a CBAM exemption or rebate with the EU, covering all or part of their energy-intensive trade. Over time, this is likely to lead to the formation of a “carbon club” of nations that have tough climate regulations and that allow CBAM-free trade between them. Imports into the club from the rest of the world would still pay a border charge.

The US is taking a different approach. While it has rejoined the Paris Agreement and is aiming for net zero by 2050, federal carbon pricing is not in the offing. While some regional carbon-pricing systems exist in the US, national action will primarily focus on regulating emissions and product standards, green procurement, and tax incentives. It remains unclear whether this package will be sufficient for the EU to give US exports an exemption from the CBAM.

Why the Technological Solutions Have Languished

To meet the emissions reduction targets under discussion among regulators around the world, the steel industry would have to undertake a large-scale technological transformation that would affect the entire steel ecosystem. As noted earlier, companies have by and large avoided these approaches, which are not yet perfected, seem very disruptive, and could negatively impact growth and profits.

For example, carbon capture, utilization, and storage (CCUS) technology ostensibly offers a way to produce low-carbon steel in existing blast furnace or basic oxygen furnace (BF–BOF) plants via carbon capture. But the technology is still immature. The storage option is expected to be more viable more quickly than the utilization option, but even that will be difficult to sort out because it requires specific geological formations that allow CO2 to be pumped and retained underground as well as an extensive network of carbon transportation and storage infrastructure. Even when these geological footprints are identified, gaining access to them can be difficult, in part because area residents often refuse to allow the operations near their homes (“not in my backyard”).

The other carbon reduction concept involves entirely replacing the upstream facilities of a steel plant with direct-reduced iron plant–electric arc furnaces (DRI–EAFs). These furnaces run on natural gas and will eventually use green hydrogen (H2), dramatically reducing the plant’s carbon emissions. To succeed, however, this pathway requires access to significant volumes of green H2—an element that is created using renewable energy rather than fossil fuels and is currently generated only in small-scale pilots and demonstration plants; it cannot yet be economically produced at scale.

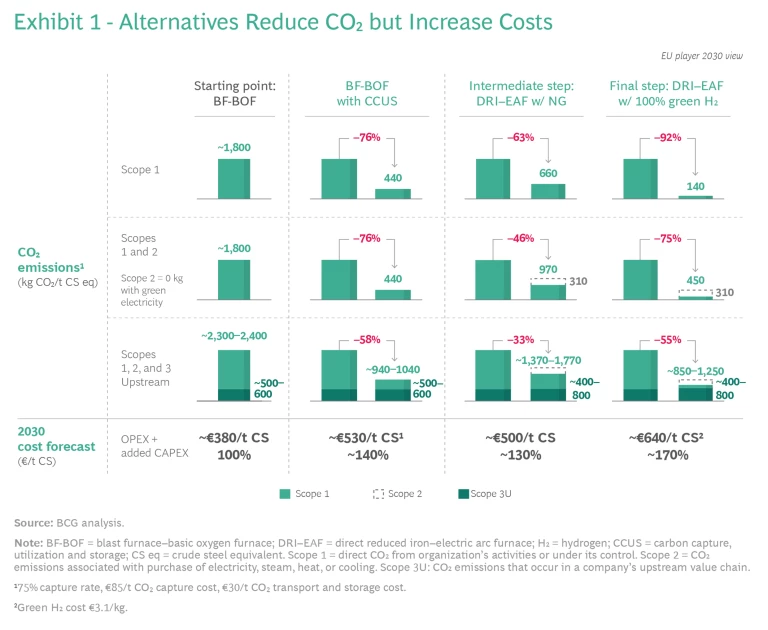

Our models predict that implementing the carbon capture concept in Europe and the UK would reduce CO 2 emissions from approximately 1.8 metric tons per metric ton of steel today to about 0.4 metric tons per metric ton of steel in 2030 (scope 1 and 2 emissions only). Plant operating costs and CAPEX combined would increase by 40%, or €150 per metric ton of steel. In contrast, the DRI–EAF pathway with green H2 would reduce CO2 in Europe to about 0.1 metric tons per metric ton of steel in 2030, while costs would increase by 70%, or €260 per metric ton of steel. These numbers could change, depending on the CBAM or ETS free CO2 allocation policies. (See Exhibit 1.)

Take Three Steps to Begin

Considering the realities of regulations and technological limitations—and the potential added costs weighing on the industry—steel companies may feel boxed in. But to navigate these issues successfully and transform their processes in a sustainable way (for them and the climate), steel manufacturers should follow a three-step strategy.

Help shape both the overall regulatory discussion and the definition of green steel. As regulations evolve and governments consider imposing new restrictions, steel manufacturers should develop clear rationales and fact-based perspectives to argue their positions in this debate. Then, they should join the larger conversation as quickly as possible.

The new CBAM regulations in Europe, for example, will have significant cost implications for steel importers as well as domestic producers. We are concerned that the industry will take the stance in CBAM negotiations that steel companies should be allowed to retain their ETS allowances or be awarded WTO-incompatible export rebates. This position is not realistic, in our view, given that both measures—the allowances and the CBAM—were created to protect the European steel industry from carbon leakage; further, under WTO treaties, governments cannot subsidize twice for the same purpose. We recommend that instead of trying to hold on to their allowances, effectively short-circuiting the discussion, steel companies should focus on quantifiable, fact-based arguments about the carbon leakage risk remaining after the CBAM is applied and how this should affect the allowances.

The introduction of the CBAM is also reinforcing ongoing discussions about a common definition of green steel or different green-steel categories. A common definition is a prerequisite for any regulation—and, in this case, for generating an effective green-steel market. If this definition is to gain the trust of both customers and consumers, it must be followed industrywide and be easy to understand. The reasoning behind it must be transparent and must conform to greenhouse gas calculation protocols. However, a joint industry consensus is a challenge for these reasons:

- The definition must balance the requirements of long-, flat-, and stainless-steel players, considering that these products are made in different ways, with different levels of carbon emissions.

- It must support circularity goals while balancing those goals with the need to build new capacity. Scrap-based recycling to produce steel would generate much less CO2, but recycling can supply neither all grades of steel nor the quantities needed to meet global demand.

- It must recognize historical investments in emissions reduction rather than solely creating incentives for large new investments.

If companies focus strictly on optimizing the definition for their own needs, they risk getting lost in battles with each other. Compromises about the precise meaning of green steel are therefore a high priority if the industry is to retain its credibility with consumers and the public and avoid having third parties, such as regulators, determine what the definition is.

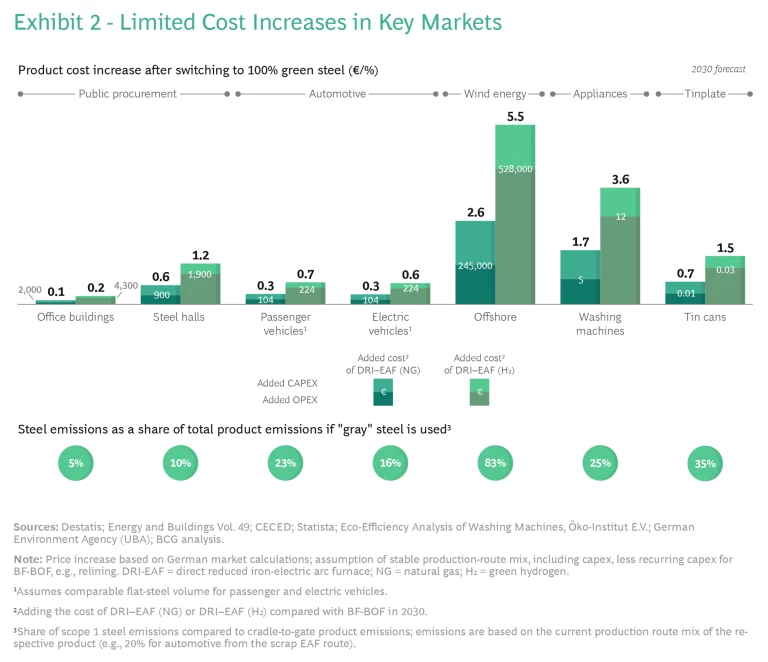

Develop the market. While green-steel technologies, such as green-hydrogen DRI–EAF, will greatly increase production costs per metric ton of steel, in many consumer industries the resulting steel price increases translate into relatively limited price increases for the end customer. (See Exhibit 2.)

For example, in auto manufacturing the steel in a combustion engine vehicle is responsible for approximately 23% of the related carbon emissions and the conversion to 100% green steel would increase the vehicle price by only about 0.3% to 0.7%, or less than €250 for a midsize vehicle.

In appliances, steel is responsible for approximately 25% of the carbon emissions related to the production of a washing machine; the conversion to 100% green steel would increase the machine’s price by only some 2% to 4%, or less than €12.

Although demand for green steel is difficult to calculate, we estimate that European OEMs, appliance manufacturers, and others facing the need to reduce carbon emissions will purchase 20 million to 40 million metric tons of green steel by 2030. Moreover, this demand will continue to grow, especially among consumer-facing industries with ambitious climate goals that include reducing scope 3 upstream emissions, such as the automotive industry.

Steel players can proactively target these potential markets for green steel with a sound value proposition, persuading companies to pay a premium for green steel as demand for it grows, and therefore contribute indirectly to financing the wholesale transformation to the new product.

From our perspective, this implies a potential shift among steel companies from a cost-plus mindset to a value-added pricing paradigm. Furthermore, the long-standing practice of producing iron onsite at steel-manufacturing facilities is likely to become less common following the move toward DRI, a significant change to traditional supply chain models. Hence, success for steel companies in a green-steel environment will depend on having the right partnerships and superior supply chain management skills.

Implement large-investment projects on time and on budget. New manufacturing technologies will require billion-dollar investments by steel manufacturers, much larger than most steel production CAPEX programs. In an industry that has not earned back its cost of capital since the global financial crisis of 2008 and 2009, it will be critical that steel companies protect their investments by planning these projects diligently and executing them professionally, ensuring that they are on time and on budget.

Additionally, to be certain that these new reduced-emissions facilities operate at full capacity and buoy sales and profits, steel producers need to secure access to three critical resources:

- Increased scrap metal to reduce the CO₂ footprint by increasing circularity

- High-quality iron ore pellets for use in DRI–EAF plants

- Green hydrogen and the required renewable electricity for DRI–EAF plants

We expect those resources to become even more scarce as the green transformation progresses. Steel producers should seek long-term contracts and partnerships to maintain a steady flow of these materials.

Immediate Action Required

Facing a rapidly shifting carbon emissions landscape, steel producers must take the initiative to be proactive and play a key role in advancing changing market and operating conditions. They need to understand the implications for their business of all regulatory proposals , helping to shape the discussion even while preparing to compromise. Simultaneously, they must build new sales expertise and develop a sound value proposition for early green-steel customers. And they have to enhance their expertise in managing large-investment projects—something they will need sooner rather than later. Dialogue and meaningful action across all of these areas will go a long way to helping steel companies surmount one of the most difficult challenges and disruptive periods of their long history.