It may be a phenomenon without a commonly accepted appellation, but synthetic biology—or syn-bio, as we call it—has become a disruptive force that is birthing the Bio Economy. Biology is usually defined as the study of living things and life itself, but syn-bio has turned the science into the manufacturing paradigm of the future. Microorganisms can, in theory, make many of the things that industrial processes currently manufacture, so syn-bio—the design and engineering of biological systems to create and improve processes and products—offers new ways of producing almost everything that human beings consume, from flavors and fabrics to foods and fuels.

Supply might no longer be constrained by the availability of raw materials. Companies can engineer and manufacture an infinite quantity of things, cell by cell, from scratch. Half a gram of cattle muscle could create as much as 4.4 billion pounds of beef—more than Mexico consumes in a year. Already, syn-bio has spawned an industry of science-based start-ups that are trying to alter conventional products and processes, transforming the material world as we know it.

By the end of the decade, syn-bio could be used extensively in manufacturing industries that account for more than a third of global output—a shade under $30 trillion in terms of value.

Just as arranging zeroes and ones enabled all types of information to be communicated digitally, changing the genetic code—A, T, C, and G, which stand for adenine, thymine, cytosine, and guanine, the four nucleotides that form DNA—alters biological systems. New genome-editing technologies, such as CRISPR-Cas9, are helping the creation of novel DNA combinations, reducing the costs of editing DNA, and increasing the length of DNA strands that can be replicated without error. The viability of cell-free biology has improved, allowing companies to use metabolic cell processes that don’t need live cells and make testing faster by using biosensors. Like data and cloud computing, DNA and DNA editing are fueling the creation of a new production frontier.

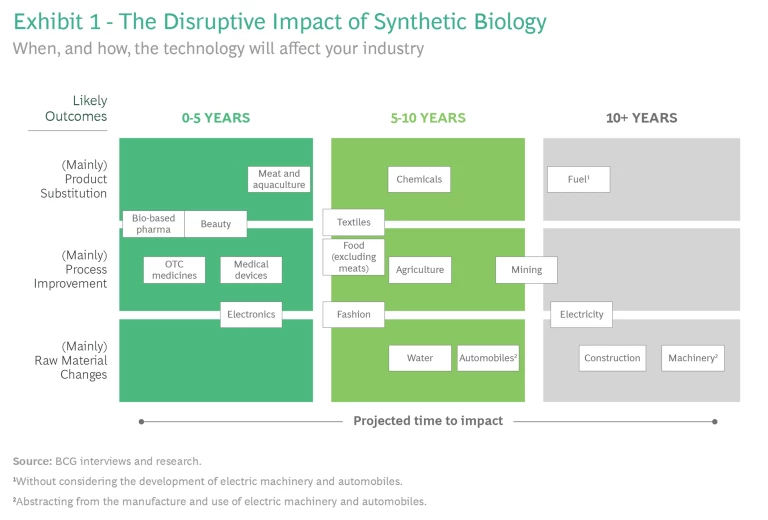

By the end of the decade, syn-bio could be used extensively in manufacturing industries that account for more than a third of global output—a shade under $30 trillion in terms of value—according to a new BHI study. To be sure, because of real-time data collection, automation, and AI , some industries are closer to feeling the impact than others. According to our projections, incumbents in sectors such as health and beauty, medical devices, and electronics will be challenged by syn-bio rivals—as the pharmaceutical and food industries already have been—in the next five years. Other industries, such as chemicals, textiles, fashion, and water, which many start-ups are already targeting, will face cost-based competition from syn-bio alternatives in the medium run, followed in the long term by sectors such as mining, electricity, and even construction.

Syn-bio’s frontiers will continue to expand as the world’s knowledge of biology rises, the cost of DNA writing and editing falls, and synthesizing tools become even easier to use. New products and processes will be created that sound like the stuff of science fiction but are ripe to go mainstream. Moreover, the syn-bio start-ups are engineering more sustainable products that consume fewer resources, such as land and water, and don’t use fossil fuels and their derivatives. These products are also more durable, generate less waste after use, and are healthier for humans in most cases.

Just as synthesis changed chemistry and chip design altered computing in the last century, biologists have built on advances in molecular, cell, and systems biology to transform the science from an analytical to an engineering discipline.

CEOs the world over must come to grips with this fascinating technology right away, especially since business and science have tended to operate in separate spheres until now. If companies hope to survive, they must learn to use syn-bio to gain a competitive advantage that is, in every sense of the term, sustainable.

Syn-Bio Is Transforming Products and Processes

Just as synthesis changed chemistry and chip design altered computing in the last century, biologists have built on advances in molecular, cell, and systems biology to transform the science from an analytical to an engineering discipline. While hardware engineers design new integrated circuits and microprocessors based on materials’ physical properties, biologists can build syn-bio systems that will help companies change products, processes, or both. Thus, the syn-bio pioneers are using the science to attain five different objectives:

1. Create innovative products and novel processes. Many syn-bio start-ups have designed all-new products that require fewer natural resources to make than those they replace. The challengers can sell them at premium prices because the products are more sustainable and are customized to each application or user.

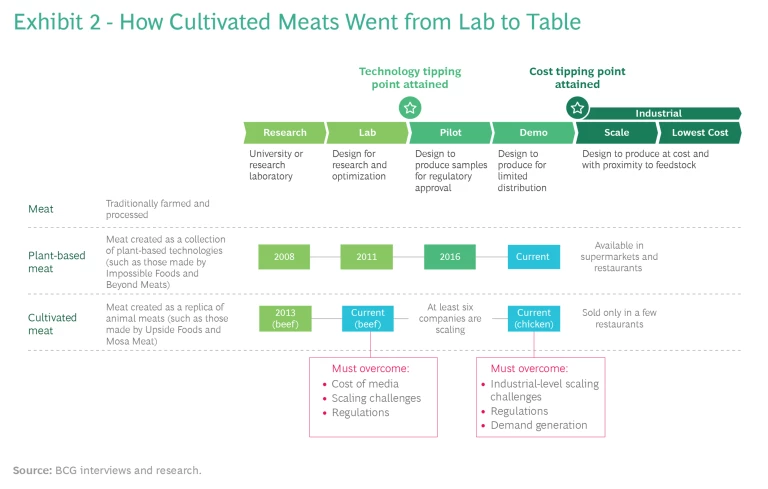

Consider, for example, the synthetic meat industry, where more than 70 start-ups with idealistic names—such as Impossible Foods, Beyond Meat, Innocent Meat, New Age Meats, Change Foods, Eat Just, Good Chicken, and Upside Foods—are growing like wildfire.

Upside Foods was founded seven years ago in Berkeley, CA, by cardiologist Uma Valeti, oncologist Nicholas Genovese and Will Clem, who has a doctorate in biomedical engineering, to create syn-bio meats at scale. The start-up takes stem cells from several breeds of chicken and eggs, feeds them nutrients such as amino acids, carbohydrates, minerals, fats, and vitamins, and speeds the growth of the feasting cells using a bioreactor. This not only mitigates the environmental impact of raising animals for human consumption, but also limits the risk of contamination because of the sterile conditions in which the proteins are manufactured. Upside Foods has grown chicken, beef, and duck in its bioreactors, and like Eat Just, which launched cell-culture chicken in Singapore’s restaurants last year, it plans to sell lab-grown chicken meat all over the US in the near future.

Syn-bio’s innovations extend to processes as well. Boston-based syn-bio company Ginkgo Bioworks uses genetic engineering to produce bacteria that can be used in industrial processes. Ginkgo is reprogramming the science to disrupt a range of industries and has created a conglomerate business model that it calls “Berkshire (Hathaway) for biotech.”

Many syn-bio firms are redesigning traditional processes, developing new ways of manufacturing familiar things that are more environmentally sustainable than existing ones.

Five years ago, Ginkgo Bioworks set up a joint venture with Bayer, the German manufacturer of pharmaceuticals, healthcare products, agricultural chemicals, and seeds. Called Joyn Bio, the new venture synthesizes microbes that will allow crops such as corn, wheat, and rice to use fertilizers more efficiently, thus reducing the quantity needed. Plants require nitrogen for growth and photosynthesis, but they can’t access it directly from the air. They must rely on the soil as well as bacteria and archaea on their roots, which convert molecular nitrogen from the air to ammonia.

However, many cereal crops can’t access enough bacteria, so farmers must use nitrogenous fertilizers to ensure that plants grow. Joyn Bio is hoping to change that by engineering microbial products that, when introduced to the soil, will help corn, wheat, and rice plants convert nitrogen into forms they can use. And as a bonus, the microbes will also protect plants from pests and diseases.

2. Improve the performance of existing products or processes. Many syn-bio firms are redesigning traditional processes, developing new ways of manufacturing familiar things that are more environmentally sustainable than existing ones, which tend to rely on petrochemicals, their derivatives, or other ecologically hazardous chemicals. Cell-based processes also often boost output, since scientists can engineer those strains of microorganisms that will deliver the maximum yields.

The mining industry, for example, uses heap leaching on site to extract metals such as copper, uranium, and gold from mined ores. The process uses chemicals to extract metals from underground deposits, triggering a series of reactions to absorb specific minerals and later, re-separating them from other materials. Trouble is, mining companies traditionally have used alkaline cyanide to treat crushed ores, which generates toxins. It also produces a lot of waste. Extracting the gold needed to fashion one wedding ring, for instance, can generate up to 20 tons of waste.

Instead, several mining companies—such as Rio Tinto in Spain, BHP Cerro Colorado in Chile, and Cananea in Mexico—are experimenting with bio-leaching and bio-oxidization. These syn-bio processes extract metals such as copper, zinc, lead, arsenic, antimony, nickel, molybdenum, gold, silver, and cobalt from sulfide concentrates using materials such as water, air, and, crucially, living microorganisms. The microorganisms catalyze the oxidation of iron sulfides to create ferric sulfate and sulfuric acid. The former oxidizes the copper sulfide, and the copper is leached by the sulfuric acid that forms.

Bio-leaching is cheaper than traditional processes because fewer engineers are needed to manage the process. It can be used to replace some of the crushing and grinding, reducing costs and energy consumption in mining. Even low ore-concentration levels don’t pose a challenge; bacteria usually ignore the waste that surrounds the metal, and ensure extraction yields of more than 90%. The process is more environmentally friendly than traditional ore extraction, causing less landscape damage. Moreover, the bacteria breed inside mines, so they can be recycled with safeguards in place to prevent spillage. That creates a circular economy, where byproducts or waste are used as inputs for the same or other processes.

Despite the rising appetite for all things natural, the global output of natural vanilla is small and falling. Of the 18,000 metric tons of vanilla flavoring produced annually, less than 1% now comes from beans.

3. Reduce the costs or increase the availability of scarce raw materials. It has become commonplace for syn-bio companies to manufacture products by fermenting plant-based feedstock—just as brewers and pharmaceutical manufacturers use vats of yeast to make beer and insulin. The process doesn’t need special raw materials, and when manufactured at scale, some plant-based feedstocks are also less expensive.

As syn-bio companies go up the learning curve, they have started making simple raw materials such as squalene, a chemical found in aquatic wildlife that is used in pharmaceuticals, as well as complex ones such as leather and vanillin. Consider, for instance, vanilla, a popular flavoring agent since the early 1900s. Despite the rising appetite for all things natural, the global output of natural vanilla is small and falling. Less than 1% of vanilla flavoring now comes from beans. Of the 18,000 metric tons of vanilla flavoring produced annually, manufacturers chemically synthesize about 85% from guaiacol, an organic compound derived from the guaiacum plant, and 15% from lignin.

Food companies that want to be all-natural are facing rising costs, complicated labeling laws, and consumer challenges about what is, and isn’t, natural vanilla. One option that syn-bio has pioneered is natural vanillin made from sources other than vanilla beans. For example, since 2011, Evolva, a Swiss biotech company, has been working with the global leader, International Flavors and Fragrances (IFF), to develop vanillin in labs. Evolva has invested in developing the ingredients, optimizing their use, and shortening the time needed to scale production while IFF will help scale output and boost commercialization.

At the other end of the spectrum, several syn-bio firms are trying to bio-fabricate luxury materials such as leather. Making leather is a costly and labor-intensive process, and it has major environmental downsides. New Jersey-based Modern Meadow has started growing a strain of yeast that it engineers to produce collagen, the protein that gives leather its strength and stretch. Once it is purified, pressed into sheets, and tanned, the vat-grown collagen becomes almost like leather. The process does not depend on dead cattle or any of the petrochemicals required to make pleather or vegan leather.

Because yeasts don’t produce collagen that can automatically assemble itself into sheets of leather, Modern Meadow has added two genes to generate enzymes that help modify the collagen’s molecular structure. Using another process, it forms the material into sheets of rawhide. The company can tan the hides as it would cowhides, and it also can modify the collagen to make the engineered leather more tear-resistant, impossibly thin, or optimize it for specific requirements.

Similarly, California-based start-up MycoWorks is developing leather from mycelium. Better known as the root structure of mushrooms, mycelium displays the strength and durability of leather when lab-grown spores are used to bond the material into a pliable membrane. MycoWorks recently began a collaboration with Hermès to develop bio-leather with a patented technology that enhances mycelium as it grows. Called Sylvania, the bio-leather will be tanned, finished, and shaped by Hermès tanners and craftspeople—a rare distinction. The first Hermès bag made from Sylvania leather will be the all-new Victoria Voyage, to be launched at a price of around $4,000 in 2022.

4. Create products or raw materials that are more environmentally friendly. If synthetic biology delivers even partly on its original promise of making business more sustainable, it will have more than justified its existence. Sustainability usually results when companies develop new products and processes, but many are also substituting for environmentally hazardous products.

Take, for instance, San Diego-based Genomatica, which develops ecologically safer processes for making intermediate chemicals and basic chemicals. Eight decades ago, DuPont created and commercialized Nylon 6, which companies now use to make nylon carpets, clothing, car interiors, engineered plastics, and food packaging. Last year, Genomatica succeeded in developing a microorganism-based production process that ferments the sugars in plants, instead of petroleum, to make a key intermediate for the making of Nylon 6. And France’s Aquafil converts the renewably sourced ingredient into Nylon 6 polymer chips and yarns at one of its plants in Slovenia. It plans to increase its bio-nylon production capabilities by 50 times in the next 10 years, primarily because switching to syn-bio-based nylon will reduce greenhouse gas emissions by as much as 60 million tons every year.

Some organic wastes may acquire value as syn-bio develops novel methods to use them. For instance, lignin, the natural polymer found in plant cell walls, can be reused as a carbon source to fuel the growth of microorganisms.

5. Catalyze resilient supply chains. Syn-bio manufacturing facilities are usually co-located with feedstock sources such as agricultural and city waste, reducing costs, making them more resilient, and shrinking their carbon footprints. These raw material sources are abundant and perennial, so supplies for syn-bio processes are likely to be immune to the shocks that plague today’s global supply chains. Co-location also will insulate companies from fluctuations in commodity prices, foreign exchange rates, and geo-political tensions.

Some organic wastes may acquire value as syn-bio develops novel methods to use them. For instance, lignin, the natural polymer found in plant cell walls, can be reused as a carbon source to fuel the growth of microorganisms. Similarly, the biosynthesis of chitosan from chitin—the second most abundant natural biopolymer, which is found in the exoskeleton of arthropods—can be used to make several products, from plastic substitutes to food preservatives.

Syn-bio processes will help tackle demand fluctuations better. The microbial feedstocks for syn-bio fermentation plants can be used to make a variety of products, so companies can diversify once they’ve chosen a microbe. They can use their modular technology platforms to engineer the microbe and switch from making one product to another.

Featured Insights: BCG’s most inspiring thought leadership on issues shaping the future of business and society

Syn-Bio Might Disrupt Your Industry Soon

Syn-bio will soon affect many industries, although the timing of the impact on each of them will differ. Our studies show that some industries, such as health and beauty, medical devices, and electronics, will be affected immediately, while other sectors including chemicals, textiles, and water management will face cost-based competition over the next 10 years, followed by industries such as mining, electricity, and construction, as we mentioned earlier. (See Exhibit 1.)

Two factors determine when syn-bio will disrupt an industry:

1. Time to maturity. Much will depend on the time that syn-bio technologies take to evolve from scientific theories to commercial technologies. It isn’t easy to forecast how soon that will happen. These complex technologies don’t scale in a linear fashion because, in addition to the known challenges, unknown factors creep in at each stage of technological development. Just as every technology has a tipping point when it ceases to be an experiment and is ready for commercialization, syn-bio technologies must cross two milestones in their journey to market.

- Scale. This milestone is crossed when scientists can prove that the technology works first in a lab and then at industrial scale in a bioreactor. Although they could be promising at the lab stage, more than 90% of syn-bio technologies fail because they can’t be scaled. Scale means different things for different cell types. Manufacturing yeast in bioreactors requires a scale of at least 600 kiloliters a year, while making animals cells attains scale at just 45 kiloliters. Either way, scaling takes time and effort. The industry practice is to execute 1,000 run-time hours for any change to a process.

- Cost. The organization hits this mark when it can lower the cost of making the product or using the process to a level cheaper than its traditional counterparts. Moving to a cost-effective facility usually involves increasing its proximity to feedstock sources.

2. Diffusion. This factor, which captures how a technology gains acceptance, is a function of government regulations, industry concentration, investments, the nature of the product, the extent of its scarcity, and so on. The rate of diffusion also depends on the maturity of the supporting ecosystem, especially the availability of scientific talent, academic partners, and supply chains.

Implicit in our discussion of the impact of syn-bio technologies is their acceptance by society and consumers, which we don’t address in this article. They could be uncontroversial—as the use of cultivated leather has been—or controversial, as with genetically modified foods. (Syn-bio techniques involve programming cells to produce unique chemicals or products, while genetic engineering focuses on modifying specific parts of existing organisms.) Which way the winds of social acceptance will blow around the syn-bio industry in the future is impossible to predict at this stage, which is why the early adopters must shape the narrative and regulations so they’re conducive to the syn-bio industry.

Given the kind of technology that will disrupt an industry—microbes or whole cell, for instance—and industry margins, some companies are likely to feel the changes sooner than others. For instance, given their scale, scarcity, and margins, the chemicals used to manufacture beauty products are more likely to face competition from syn-bio products than those needed to make textiles. In the next section, we will apply the framework we have just described to forecast when a sample of industries likely will be affected by syn-bio.

Syn-Bio Threatens Three Disruptions Today

Apart from the differences in the timing of their impact, syn-bio technologies are likely to have diverse impacts on industries and incumbents. One, or more, of three types of fallout are expected:

- Industry incumbents could face competition from new syn-bio engineered products, which will reduce and, over time, eliminate, demand for existing products by offering better features and a smaller environmental footprint.

- Incumbents could shift to the new, more sustainable processes that syn-bio firms develop.

- Incumbents could switch to new kinds of raw materials that syn-bio firms engineer to produce existing products.

Let’s consider each of these consequences by turn, focusing on the industries that are most likely to be affected in the short run.

Product Substitution. In some industries, companies will soon have to compete directly or indirectly with syn-bio engineered substitutes. They can do so by developing their own syn-bio offerings, using their traditional offerings to go head-to-head with syn-bio start-ups, or focusing on the most lucrative niches for their existing products. These industries, our studies suggest, range from industrial (B2B) to consumer (B2C) businesses.

At the industrial end of the spectrum, several syn-bio firms have started producing bulk chemicals and specialty chemicals by engineering microbes and scaling them through fermentation. Consider, for instance, BDO (1,4-Butanediol), an intermediary chemical that is a primary alcohol and one of the four stable isomers of butanediol. It’s used as a solvent in the manufacture of plastics, elastic fibers such as spandex, and polyurethanes. The leading BDO manufacturers—BASF, Dairen Chemical, Sinopec, Xinjiang Tianye, and Xinjiang Guotai—together produce over 1 million metric tons a year, which is used to make 2.5 million tons of polymers annually. In 2020, BDO was a $5 billion industry, with about 30 manufacturing plants using hydrocarbon feedstocks to produce BDO.

If all the world’s BDO manufacturers switch to making bio-BDO, it will stop the emission of more than 15 million tons of carbon dioxide a year, nearly the annual carbon emissions of a million Americans, 2 million Chinese, or 3 million Europeans.

Several syn-bio firms have been trying to produce bio-BDO from sustainable sources on a commercial basis. Genomatica, for instance, uses renewable feedstocks such as sugarcane, sugar beets, and other sources of carbohydrates, such as corn, instead of petrochemicals to do so. It uses fermentation to make bio-BDO, which is chemically identical to its conventional rival but lowers greenhouse gas emissions and creates sustainable supply chains. In addition to scaling output from a first-generation industrial-scale plant, the firm is building a second one in the US.

Genomatica has also licensed its biomanufacturing process technology to a joint venture between Cargill, the global seed and meat company, and HELM, a family-owned chemical marketing and distribution company, which will invest $300 million to build the new plant. Slated for completion in 2024, the new facility will produce more than 65,000 tons a year, tripling the world’s bio-BDO manufacturing capacity. At capacity, it will emit 93% less greenhouse emissions than a conventional BDO plant. Incidentally, if all the BDO manufacturers in the world switch to making bio-BDO, it will stop the emission of more than 15 million tons of carbon dioxide a year. That’s almost equal to the annual carbon emissions of a million Americans, 2 million Chinese, or 3 million Europeans.

In the rubber industry, several companies are trying to manufacture syn-bio monomers that can be used to manufacture synthetic rubber (polyisoprene), a common alternative to natural rubber. Used in the production of surgical gloves, golf balls, adhesives, and tires, synthetic rubber is usually made from petroleum-derived materials. To change that using syn-bio technologies, companies such as Goodyear teamed up with DuPont Industrial Biosciences in 2007, GlycosBio has been working with Malaysia’s Bio X Cell since 2010, and Bridgestone announced a joint venture with Japan’s Ajinomoto in 2012.

These giants are trying to cost-effectively manufacture isoprene (2-methyl-1, 3-butadiene), a key chemical in the production of synthetic rubber, using a fermentation-based process. Called bio-isoprene or Biolsoprene, the new syn-bio monomer can be made from microbes engineered from renewable carbohydrate raw materials. Switching to it will shake up the $3 billion isoprene market and reduce the rubber industry’s dependence on petrochemical-based raw materials.

Meanwhile, the popularity of bio-engineered flavors and fragrances, which lie midway on the industrial-to-consumer spectrum, are gaining ground. Sales of flavors and fragrances top $40 billion annually and are growing 3.5% a year. The majors have been partnering with syn-bio firms for more than two decades, with companies such as BASF, Firmenich, Givaudan, and Takasago making acquisitions and in-house investments, and syn-bio entrants such as Conagen and Manus Bio expanding the number of available molecules. Meanwhile, Ginkgo Bioworks has started producing a range of aromas in collaboration with Robertet, the French fragrance and flavor house based in Grasse.

Many food companies use synthetic vanillin—the main flavor component of cured vanilla beans—which can be synthesized from guaiacol and lignin, as we described earlier. Because of consumer pressure, companies are desperate to replace synthetic vanillin with natural vanillin produced from sources other than vanilla beans, which are expensive. For example, Solvay makes natural vanillin by fermenting ferulic acid, a by-product of rice bran oil, using a proprietary strain of yeast, while the French flavor company Mane uses eugenol from clove oil to do so. This is altering the dynamics of the $300 million global vanilla market.

Making one Impossible Foods beef burger patty, whose ingredients include a lab-engineered non-meat-based heme molecule, requires 96% less land and 87% less water than one beef patty, and it emits 89% less carbon into the atmosphere.

In the fertilizer industry, start-ups such as Joyn Bio and Pivot Bio are trying to create microorganisms that will help cereal crops improve their nitrogen intake from the soil, as we described earlier. By offering cheaper solutions and reducing the amount of nitrogenous fertilizers that farmers will need to use, they could disrupt the $250 billion nitrogenous fertilizer industry. The latter contributes 3% of the world’s greenhouse emissions, which would be halved if the syn-bio start-ups succeed.

At the consumer end of business, the meat industry is facing competition from companies such as Impossible Foods and Beyond Meat. Impossible Foods makes its beef burger patties from wheat and potato protein, sunflower and coconut oils, methylcellulose, food starch, and—crucially—a lab-engineered non-meat-based heme molecule. It has figured out that heme, which gives ground beef its reddish-brown color, makes the patty bleed, sizzle, and taste like animal meat. According to an environmental lifecycle analysis of its burger produced by independent auditor Quantis, making one Impossible patty requires 96% less land and 87% less water than one beef patty, and it emits 89% less carbon into the atmosphere. (See Exhibit 2.)

The syn-bio meat companies are using new techniques to improve yield, increase scalability, and lower costs. Impossible Foods’ products are used by fast-food chains such as Umami Burger, Bare Burger, White Castle, and Burger King as well as supermarkets such as Walmart and Kroger, while its archrival, Beyond Meat, sells its synthetic burgers at Carl’s Jr., Subway, Denny’s, TGI Fridays, A&W, Hardee’s, Del Taco, and Dunkin’. If current trends continue, conventional meat consumption in the US could drop 33% by 2040.

Process Improvements. In many industries, syn-bio processes could substitute for today’s processes, forcing the incumbents to develop better inputs or to improve them by switching to syn-bio-based sourcing. They also could use the syn-bio-based processes to improve yields and, at the same time, reduce their environmental impact.

Syn-bio technologies likely will affect different sections of the value chain differently. For instance, the textile industry is in the throes of change because of bio-engineered dyes and processing chemicals. The production of one ton of dyestuffs requires the use of 1,000 cubic meters of water, 100 tons of heavy petroleum compounds, 10 tons of toxic and corrosive chemicals, and at least 200 MJ/ton of energy. That’s why start-ups such as PILI are trying to eliminate the use of petrochemicals, such as benzene and formaldehyde, as well as reducing the amount of water, energy, and chemicals needed to make dyes.

PILI uses enzymes to convert carbon from renewable sources into molecules that can be used to produce textile dyes, reducing waste and byproducts. It creates microorganisms with DNA encoding for an enzyme or a series of enzymes that can convert carbon into a dye or a pigment, which is then extracted and purified. A variety of colors can be produced by swapping enzymes and optimizing the metabolic engineering process. Since textile makers can use syn-bio dyes without changing their production systems, organic dyes are poised to take over the $33 billion market in the next five years.

Companies should approach syn-bio as they would any other disruptive technology, focusing on forecasting its immediate development and long-term evolution. They must act immediately based on the outcomes they can predict.

New Inputs. In some industries, syn-bio will change only the raw materials that companies use without affecting processes. Incumbents can reduce their costs or improve the consumer proposition by using syn-bio inputs. For instance, many aspects of an automobile’s interior can be replaced by syn-bio alternatives such as biological sensors, syn-bio plastics, and mycelium-based leather upholstery. However, these materials are unlikely to change the way companies manufacture automobiles in factories.

Business Must Prepare for Syn-Bio Now

The innumerable possibilities that syn-bio offers business today are matched only by the multi-dimensional challenges that the technology presents. Just like digital technologies, syn-bio technologies soon will force companies to rethink their business models. Many will have to make large investments in syn-bio R&D, the payoffs from which are uncertain and will accrue in the long run even as companies figure out how to forge complex partnerships and joint ventures with start-ups. As in the case of AI, using syn-bio technologies will force business to deal with societies that are uncomfortable with the idea of re-engineering life in any form.

Companies should approach syn-bio as they would any other disruptive technology, focusing on forecasting its immediate development and long-term evolution. They must act immediately based on the outcomes they can predict, altering how closely they monitor technologies according to the projected impact on their industries. Given the growing speed at which syn-bio technologies are changing, as well as the way the industry is maturing, some sectors will need to react and respond sooner than others. CEOs in every industry would do well to take the following first steps right away:

- Get familiar with the science and the technology. Because syn-bio is different from other technologies, business will face a steep learning curve. To strategize successfully, and to identify winning technologies and promising start-ups, corporations must find the time to learn. The pioneers, we find, are arranging study tours, inviting guest speakers, and organizing syn-bio learning days for their top management, strategy, and R&D teams.

- Test promising opportunities. Using the shared knowledge and understanding gained across teams, business must hold workshops to explore the art of the possible, identify the most promising technologies, and pick a few to explore in depth. To validate the most promising concepts, executives must seek critical feedback from stakeholders and scientists. They can validate key hypotheses through iterative sprints and rank opportunities by the rewards they promise as well as the possible risks. Doing so will allow executives to identify quick wins and set up trials and experiments. For instance, the Swedish furniture company IKEA, as well as the US computer-manufacturer Dell, are trying to replace polystyrene and Styrofoam with Ecovative Design’s plant-based mycelium packaging, which decomposes within a month of composting.

- Scout for successful pioneers. For every opportunity they identify, companies must scout for the start-ups and giants that are trying to develop the technologies, products, and processes to realize them. It’s best to pay attention to start-ups that have scaled technologies beyond the lab—an indicator of their ability to survive.

- Identify the manufacturing and supply challenges upfront. Many syn-bio applications face challenges in scaling, standardization, quality consistency, transportation, and biosafety compliance. Companies must identify all the potential techno-commercial challenges before choosing the paths to follow. For instance, unlike the other COVID-19 vaccine manufacturers, Moderna uses a lipid nanoparticle coating on its vaccine. It prevents mRNA degradation at temperatures as high as those of a regular freezer, eliminating the need for ultra-cold conditions to transport its vaccines.

- Partner selectively. In industries that face the threat of immediate disruption from syn-bio technologies, companies have no choice but to focus on the transformative capabilities of the technology and try to get ahead of the curve. They should partner with start-ups and university incubators so they can learn quickly. As we said earlier, the German chemicals giant Bayer has set up a joint venture with Boston-based Ginkgo Bioworks, Joyn Bio, which is using syn-bio to fight plant disease and improve nutrition. Bayer’s investment came from its Lifesciences Center, the company’s innovation unit that searches for breakthrough technologies complementing Bayer’s offerings. It has joined with Versant Ventures to launch stem cell therapeutics company BlueRock Therapeutics and has teamed up with CRISPR Therapeutics to form joint venture Casebia Therapeutics, which uses gene-editing technology to develop treatments for blood disorders, blindness, and congenital heart disease.

- Drive syn-bio within your business portfolio. Corporations must quickly add syn-bio products to their portfolios by making greenfield investments as well as planning acquisitions. For instance, Cargill in 2018 launched its zero-calorie sweetener EverSweet, which is made through yeast fermentation. One of the world’s largest meat producers, it has invested in several cultivated meat start-ups such as Just Foods and Aleph Farms as well as PURIS, a leading provider of pea protein, which is used in vegan meat and dairy products.

Companies with a history of R&D can explore the creation of syn-bio platforms. A platform play will enable an organization to develop and sell several syn-bio applications. This will provide it an opportunity to shape rules and standards. Managers must understand that platform development is an R&D-intensive, multi-year journey that requires the unwavering commitment of top management.

Curiously, syn-bio was lauded at first as an environment-saving technology, but it didn’t quite live up to that narrow promise. As a popular magazine sarcastically tweeted some years ago: “Synthetic biology was going to save the world. Now it’s being used to make vanilla flavoring.” In retrospect, though, the commercial production of vanillin in a bioreactor did mark a watershed moment because it demonstrated the enormous commercial potential of syn-bio. It has taken time for syn-bio to reach a tipping point, but that moment has finally come. The timing couldn’t be better. Using syn-bio at scale is the only way business will be able to grow sustainably in the future, helping to save the planet and redeeming its checkered reputation as well.