The transportation sector needs to adapt to climate and sustainability targets, and electric vehicles can’t solve the problem alone. Are low-carbon fuels the answer?

Electrification is transforming transportation , turning gas-guzzling automobiles and light trucks into a clean mode of getting from point A to B. But electric-powered vehicles are only part of the answer if the transport sector is to achieve net-zero emissions by 2050. For areas where electrification isn’t a realistic option—especially hard-to-abate sectors such as aviation and shipping—low-carbon fuels will be essential.

Between biofuels, power-to-X fuels that depend on

green hydrogen

, and fuels that rely on blue hydrogen made from natural gas, we expect a $40 to $50 billion global market in low-carbon fuels to materialize by 2030, driven by early adopters willing to pay a premium to meet decarbonization pressures and benefit from regulatory incentives.

A Sector Searching for Solutions

Transportation accounts for about 16% of global CO2 equivalent emissions, with only industry and power generation being bigger polluters. Curbing these emissions is a huge challenge; since 1990, transportation emissions in the European Union have worsened even as the performance of other economic sectors has improved. And despite increasing efforts from regulators to promote them, fossil-fuel alternatives currently make up just 4% to 5% of transport fuel consumption worldwide.

Several factors are behind transportation’s poor emissions record. Aircraft and maritime vessels require fuels with a high energy density—fuels that produce a large amount of energy per unit volume—which for most applications has ruled out the use of electric power in favor of fossil fuels. And in heavy road transportation, the cost of new charging infrastructure, limits on vehicle range, and excessive charging time have been major sticking points for electric vehicles.

Low-carbon fuels—in particular, biofuels and fuels based on blue and green hydrogen—offer a variety of potential solutions to these challenges. (See “Facts on Fuels.”) Hydrogen can be used as a fuel on its own, but fuels formed by combining it with other molecules have a higher energy density and can be more easily transported and stored. Additionally, some of these variants are interchangeable with fossil fuels; as a result, they can be blended with fossil fuels to reduce overall emissions or they can replace fossil fuels entirely, without requiring expensive changes to existing internal combustion engines, vehicle fuel systems, or fuel distribution networks.

Facts on Fuels

Power-to-X fuels. The primary constituent of power-to-X fuels—also called e-fuels—is green hydrogen, which is produced by using renewable energy to power electrolyzers that split water into hydrogen and oxygen. Green hydrogen makes up between 60% to 90% of the production costs for e-ammonia, e-methanol, and e-kerosene. Hydrogen also plays an important role in its own right, especially for industrial applications like steel production and several chemical processes. As a result, hydrogen is pivotal in the energy transition and is expected to account for 15% to 20% of the total global energy supply in a net-zero environment.

Power-to-x fuels include:

- E-ammonia, which is made by combining green hydrogen with nitrogen using a high-temperature chemical synthesis process. It has a higher energy density than hydrogen, which means it can be more easily transported and traded internationally. E-ammonia has a limited drop-in capability, however, which reduces its usefulness with the current installed base of transportation engines.

- E-methanol, which is made by combining green hydrogen with sustainable CO2 in a chemical synthesis process. It has a strong drop-in capability, which makes it especially suitable for fuel blending. But its cost competitiveness depends on the ability to source sustainable CO2 cheaply.

- E-hydrocarbons such as e-gasoline and e-kerosene, which offer significant benefits because of their full drop-in capability across all existing fossil fuels. Several processes can be used to manufacture them. For e-kerosene, the dominant one is the Fischer–Tropsch process, which comprises multiple chemical reactions that convert a mixture of carbon monoxide and hydrogen into liquid hydrocarbons. E-gasoline can be made using low-carbon methanol, which is converted into liquid fuel and a small stream of liquefied petroleum gas. To make e-hydrocarbons a commercial reality, costs must be brought down to a level similar to fossil fuels and carbon-free alternatives.

Biofuels. Biofuels will also play an important decarbonization role in hard-to-abate areas such as aviation. Demand for second-generation biofuels produced from non-food biomass will be driven by increased regulation. However, feedstock shortages will make it difficult to source sufficient economically viable volumes to meet the growing demand. Oil and gas companies are already competing for feedstock to produce green jet fuel and similar products.

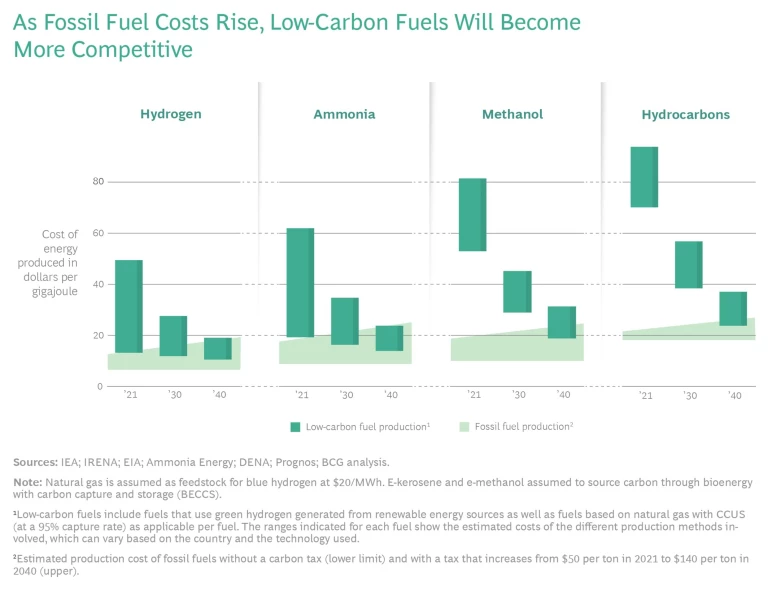

With these advantages come some limitations. Low-carbon fuels today are more expensive than fossil fuels and far less energy efficient than direct battery-based electrification, factors which will determine how they are used in the coming years. (See “A Patchwork of Future Applications.”) Lower production costs driven by efficiency improvements, scale, and favorable policies and incentives—including a carbon tax—are a prerequisite if low-carbon options are to compete against incumbent fossil fuels. Still, we believe the renewable energy boom combined with regulatory incentives (which together can help players derisk and scale fuel technologies) will drive down the cost of hydrogen production and make these fuels competitive early in the next decade.

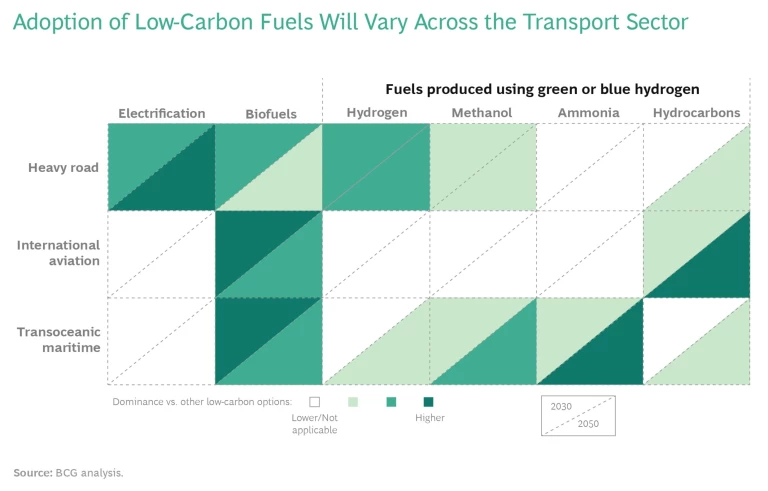

A Patchwork of Future Applications

Heavy Road Transport. For heavy road segments, the race between battery and hydrogen power is difficult to call. But adoption of battery electric trucks will depend on government subsidies meeting the cost of building charging infrastructure across wide areas and on advances in batteries that will allow commercial vehicles to travel farther on a single charge. Given these challenges, we expect green and blue hydrogen—as well as biofuels such as biodiesel—to gain significant market share by 2030.

Aviation. Biofuels and e-kerosene are the only alternatives to traditional jet fuel that have the energy density required to power commercial aircraft. (Electric batteries could be used for lighter planes, which are generally intended for shorter distances.) We expect biofuels to be an important near-term solution and to become one of the dominant technologies in the coming decades. However, e-kerosene should emerge as a viable alternative as the cost of sustainable CO2 declines and as biofuels begin to face feedstock availability constraints. Both biofuels and e-kerosene can use the existing fossil fuel infrastructure.

Maritime. Like aircraft, ships also need their fuels to have a high energy density—making biofuels and low-carbon ammonia and methanol clear favorites as both near-term and longer-term solutions. Natural gas and liquefied natural gas, which emit less CO2 than other fossil fuels, will also be near-term solutions. Maritime vessels powered by e-methanol will go into service in the next few years; the fuel’s “drop in” qualities and compatibility with existing distribution networks make it an attractive alternative to fossil fuels. In the longer term, however, low-carbon ammonia is likely to become one of the dominant fuels because its production does not require abundant and expensive sustainable CO2. Growth in low-carbon ammonia volumes will be driven by the pace at which new engine technologies are implemented across commercial fleets.

How to Build a Low-Carbon Future

As the appetite for low-carbon fuels grows, global production hubs will emerge in countries with abundant solar or wind energy, such as Australia, Chile, and the Middle East, and in regions with access to cheap natural gas, such as the Middle East and Russia. We are already seeing power-to-X projects with a generating capacity of 10 gigawatts and above in several of these regions.

For complex fuels like methanol and hydrocarbons, cost competitiveness will depend on producers’ ability to source sustainable CO2 from biogenic sources (for example, using carbon-capture technologies with biomass combustion plants) or directly from the air through emerging direct-air capture (DAC) technologies. Sufficient biogenic feedstock is available in the short term, but shortages will likely emerge as demand grows. As a result, in the longer term we expect sustainable CO2 will mainly need to be sourced using DAC. The costs of the technology will have to come down first, however.

Today, blue hydrogen and fuels that are made out of it are becoming increasingly cost competitive with fossil alternatives, driven by the low cost of natural gas and emerging carbon pricing mechanisms. However, because of hydrogen’s significant transportation costs, low-cost producers are converting hydrogen into low-carbon ammonia, addressing 15% to 25% of global applications and demand in the short term. (See the exhibit.)

Two other factors are key to the creation of a significant global low-carbon fuels market by 2030—customer choice and regulation. Here’s how they are currently playing out:

- Customer Choice. Some fuel users are already early adopters of low-carbon fuels. For example, Danish shipping group Maersk plans to operate eight methanol-fueled vessels starting in the first quarter of 2024. This can be interpreted as a strategic move to ensure an early position in the value chain by testing different pathways for decarbonizing its own fuel consumption. But the move also has value from a marketing standpoint, as it may benefit the company’s positioning with customers and employee relations.

- Regulation. Policymakers worldwide are accelerating actions to curb greenhouse gas emissions. In the European Union, the proposed Renewable Energy Directive III will target a 13% reduction in the emissions intensity of transportation fuels by 2030 and set specific targets for biofuel and power-to-X fuel usage. This will increase the pressure on European companies to transition from fossil fuels to cleaner alternatives. In the US, policymakers are increasingly implementing credit systems and funding pilot projects to reduce scaling risks. Over 40 countries have developed a hydrogen roadmap, creating the foundations for specific regulations and subsidies.

What Should Market Participants Do Now?

To play in the low-carbon fuels market, companies first need to weigh the risks and benefits ahead. They will need to take a view on how the new landscape is likely to develop in the coming decades and decide what impact emerging fuels will have on their core businesses. Some players may opt to wait for greater penetration of large-scale renewables or for more efficient generating and electrolyzer technologies to drive down fuel production costs.

Companies that choose to seize the opportunities available today will need to take different steps depending on their position in the value chain and target market.

Power producers. A growing number of utilities and independent power producers are creating partnerships with technology providers and customers to share the risk of developing power-to-x fuels. Before choosing when and how to play, they should do the following:

- Decide on the speed of decarbonization of their own power production assets and associated low-carbon technology bets.

- Secure competitive access to cheap renewables, thereby avoiding a value chain squeeze from other players.

- Evaluate their own geographical footprint in order to maximize power generation from regions with low-cost renewables, such as the Middle East and Australia.

- Consider how to use low-carbon fuels to hedge the risk of greater electricity price fluctuations across their own assets and products.

Integrated oil and gas producers. As with power producers, oil and gas players are assessing their positioning in low-carbon fuels and creating ecosystems that support supply chain development. There are several considerations impacting when and how to play. Oil and gas producers should:

- Decide on the speed of decarbonization of their own production assets and the deployment of low-carbon technology bets.

- Consider securing competitive access to natural gas and renewable resources (such as land with favorable solar or wind conditions), sustainable CO2, and CO2 storage capacity; these will provide key advantages as the market develops.

- Secure early offtake to their low-carbon production, leveraging their current customer base.

Refineries. As low-carbon fuel consumption grows, refineries will face reduced demand for fossil fuels. This will likely cause them to place bigger bets in other areas, such as petrochemicals, or to switch to using renewable feedstock such as animal fats, plant oils, and used cooking oil for refined low-carbon fuels—provided they can secure volumes at a reasonable price. Refineries therefore need to:

- Decide on the best use for each of their sites to avoid stranded assets.

- Secure early offtake to their low-carbon production, leveraging their current customer base.

- Exploit their stronger value chain position, relative to other players, in producing low-carbon liquid fuels while harvesting synergies from their asset base (through heat recovery and increased steam methane reforming capacity) and distribution network.

Fuel production OEMs. For providers of production technologies, the ability to act as system integrators, using strong digital and asset rightsizing skills, will provide a key competitive advantage. These capabilities will enable players to participate in leading electrolyzer and fuel synthesis projects. Production OEMs should therefore:

- Create market projections for centralized and decentralized low-carbon fuel production and adjust their R&D and go-to-market plans in line with these forecasts.

- Build access to best-in-class technology platforms; for example, by competitively taking technical risks on technology projects.

- Establish a focus on operations and maintenance, since future low-carbon plant owners, such as utilities, will lack skills in complex synthesis-based processes and yield optimization.

Engine and fuel-cell OEMs. Companies developing fuel cells and engines that use low-carbon fuels will need to closely monitor the trajectory of electric battery technology, as this will have a huge bearing on their success. These OEMs need to:

- Select bets on low-carbon fuel applications based on the current outlook for battery and dual-fuel engine technologies, but be prepared to hedge their R&D and product plans by pursuing various options.

- Form a clear view about evolving regulation in areas such as fuel blending and revise their plans accordingly.

- Develop business models that reduce the engine and fuel cell risks for fleet owners in retrofitted and new vehicles.

Fleet owners and operators. Fleet owners and operators play a vital role in reducing risks arising from maturing and scaling the supply of low-carbon fuels through off-take agreements and partnerships. Fleet owners therefore need to:

- Decide on the speed of their fleet transformation plans, given potential changes to technologies and regulations impacting the availability and cost competitiveness of fossil fuels, low-carbon fuels, and electric options.

- Consider expanding their position in the value chain, via backward integration, to secure competitively priced low-carbon fuel volumes.

- Select a balance of short-duration versus long-duration offtake commitments based on likely future changes in fuel prices and subsidies.

While low-carbon fuel technology is still largely nascent, we expect a sizeable market in transportation fuels to emerge this decade—faster than many observers are counting on. Over time, the landscape will change, with some fuels playing an important short-term role and others becoming the dominant long-term option depending on the transportation sector. However, players that want to secure an attractive and competitive position in the low-carbon fuels value chain cannot afford to wait. They need to look ahead and make strategic decisions today about when and how to participate.