Companies in virtually all industries face ever-increasing pressure to reduce their environmental footprint, including CO2 emissions, waste, and pollution. In many cases, a successful response entails transforming a company’s operations and way of doing business.

Companies can use M&A to accelerate an environmental transformation if the right acquisition targets are available. Minority stakes, joint ventures , and other alternative deal structures are useful when circumstances, such as uncertainty surrounding a new technology, make outright acquisitions difficult or excessively risky. As a complement to organic capability building, green deals often create significant value .

Applying lessons learned in helping companies solve climate- and sustainability-related challenges, we have identified four archetypes of environmental transformations in which M&A and alternative deal structures are especially effective. An assessment of success stories across these archetypes reveals a set of winning moves for green dealmaking.

Four Types of Green Transformation Drive Dealmaking

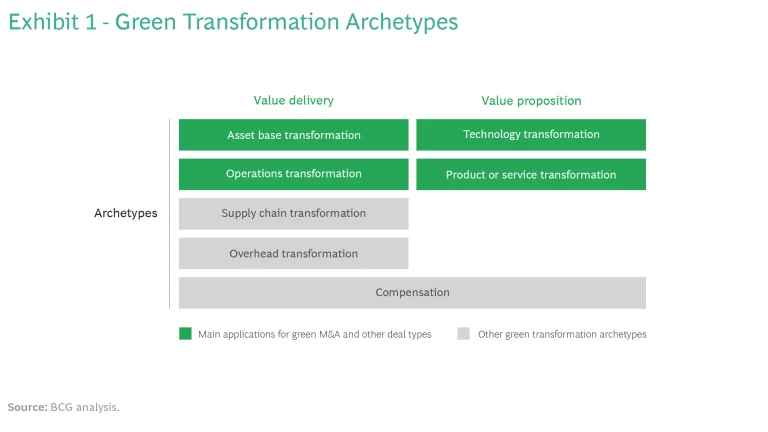

Four environmental transformation archetypes—relating to a company’s asset base, operations, technology, and products and services—are addressable by green M&A or alternative deal structures. Transforming the asset base or operations primarily affects how a company delivers value, whereas transforming technology or products and services alters its value proposition to customers. (See Exhibit 1.)

There are additional approaches to avoiding or effecting environmental transformation, but dealmaking is not relevant to them. (See “Dealmaking Isn’t Applicable to Several Impact-Reduction Approaches.”)

Dealmaking Isn’t Applicable to Several Impact-Reduction Approaches

Offsetting emissions and impacts from a company’s value chain by purchasing compensatory credits is the most basic way to reduce a company’s environmental impact. This approach is an alternative to direct action and lies at the heart of emissions trading schemes. Compensatory credits are important mechanisms for setting economic incentives and promoting an energy transition, and they arguably have a net positive environmental impact. They are not, however, a form of dealmaking, and in any case credits are just a transitional tool until other, more viable approaches become available.

Companies also need to improve the environmental footprint of their overhead, such as by optimizing the heating profiles of their office buildings or by reducing IT-related energy consumption. Emissions and other environmental impacts in a company’s external supply chain are increasingly coming into focus as well. Nevertheless, it would be highly unusual for a company to use M&A to address either of these issues, except perhaps in the form of vertical integration by purchasing suppliers to perform the environmental transformation in-house.

Success stories illustrate the sorts of opportunities that may arise for using M&A and other deal structures to support the four archetypes.

Transforming the Entire Asset Base

Acquirers typically use green M&A to transform their entire asset base, including critical processes. An acquisition can significantly accelerate an environmental transformation that would require sustained innovation and investment over a period of years or even decades to accomplish organically.

In the energy and utilities industry , many players are using a combination of organic investments and M&A to shift their asset base to emissions-free technologies—such as by transitioning from coal- or gas-based power generation to solar or wind energy. Deals in this area are often relatively small and piecemeal, typically involving purchases of individual sets of assets (for example, wind parks with turbines numbering from a handful to a few dozen). But companies also purchase larger rivals that focus on alternative energy sources. For example, in 2021, Eneos, Japan’s largest oil refiner, acquired Japan Renewable Energy for $1.8 billion (at a premium of greater than 100% in terms of enterprise-value-to-revenue multiple, compared with the sector average) from Goldman Sachs and Singaporean sovereign wealth fund GIC.

A leading example of environmental transformation in the energy and utilities industry is Ørsted, a Danish energy company with revenues of $11.7 billion in 2021. The company transitioned from deriving 85% of its revenues from nonrenewable sources in 2009 to generating 90% of them from renewable sources in 2021. It aims to deliver fully climate-neutral power generation by 2025.

Ørsted relied heavily on M&A to shift to wind and solar power generation. It divested some of its existing assets and converted the remainder to sustainable fuels, such as from biomass. It also acquired a significant number of assets and companies—mainly in offshore and onshore wind power, and to a lesser extent in solar power. The company’s asset purchases included a 50% stake in Elektrownia Wiatrowa Baltica 2 and 3, a Poland-based offshore wind park, for $147 million in 2021. Its buyouts included the 2018 acquisition of Lincoln Clean Energy LLC, a US-based developer, owner, and operator of wind and solar projects.

To stabilize its transition, Ørsted has invested in companies at different stages of the value chain, such as wind turbine installation providers. It has also used significant traditional capex—supported, for example, by forming partnerships with original equipment manufacturers (OEMs) such as Siemens—to grow its wind energy business organically. Today, Ørsted is the top-ranked energy company in Corporate Knights' 2022 index of the world’s 100 most sustainable corporations, and it is considered the global market leader in offshore wind energy. The company’s environmental transformation has created substantial shareholder value, with a relative total shareholder return (rTSR) of 1.9% per year from 2017 through 2021.

Upgrading Specific Aspects of Operations

As an alternative to transforming an entire asset base, companies in many industries can use green M&A to upgrade select elements of their operational value chain, from production to logistics. These deals can help a company minimize or eliminate emissions and waste or otherwise make value generation more environmentally friendly. Companies in industries as diverse as steel production and retailing have used green M&A for this purpose.

Steel production is a major CO2 emitter for various reasons, one of which is that several stages of the process of converting iron ore to steel generate the gas. Some steel players are transitioning to a steelmaking technology that reduces CO2 emissions by using scrap metal rather than iron ore as the feedstock. They have complemented their organic capability expansion with targeted green M&A to achieve environmentally friendly growth.

US steelmakers offer some prominent recent examples. Steel Dynamics, an Indiana-based midsize steelmaker, was an early leader in integrating recycled scrap into its production process. In 2007, it purchased OmniSource, a scrap processor, for $1 billion. It has also used M&A to continually expand its in-house scrap recycling capacity, most recently acquiring Mexico-based Zimmer in 2021. U.S. Steel, which traditionally focused on blast-furnace-based steelmaking, needed access not only to scrap but also to the production technology for using it. To acquire the technology, it bought Big River Steel, a competitor that operated a scrap-using mini mill. The acquisition occurred in two transactions—in 2019 and 2021, respectively—with U.S. Steel paying a total of $1.4 billion for the target’s equity.

Retailing offers a perhaps more surprising example of using green M&A to transform operations. Germany-based Schwarz Group, a privately held company, is the world’s fourth-largest grocery and retail player by revenue. It has taken a holistic approach toward sustainability in its supply chain since 2009, when it established a waste disposal logistics division at its main grocery chain, Lidl. Since then, the company has implemented various measures for recycling and reducing resource usage throughout its operations. It has supplemented this organic approach with a series of green M&A deals.

In the past three years, Schwarz Group completed six acquisitions of waste management and recycling companies across Europe. Most prominently, it acquired Ferrovial’s waste disposal and recycling business in Spain and Portugal for €1.1 billion in 2021, adding that business to its own environmental services division Prezero. This deal demonstrates that green M&A need not solely be a means to an end—in this case, making a supply chain greener by adding recycling capabilities. It can also be a viable way to build a new strategic leg to complement a company’s existing business.

Adopting New Technology

In many instances, companies can mitigate the environmental effects of their products and services by transforming the underlying technology, without fundamentally altering the products or services they offer.

Examples include plastics producers that have weaned themselves off fossil-fuel-based feedstocks and transitioned to organically derived and biodegradable materials, and consumer goods companies that have eliminated microplastics and other environmentally harmful ingredients from their products. But arguably the most prominent technology transformation involves replacing the internal combustion engine—which still powers most vehicles of all types and sizes—with electric motors and other greener propulsion systems.

Passenger cars lie at the heart of this transformation. They account for approximately 45% of global CO2 emissions from transport, according to IEA data . Most passenger car OEMs have embarked on this transformation and are introducing new electric vehicles at a rapid clip. To do so, they must build significant expertise and capabilities across a range of technologies, from batteries and electric motors to software systems capable of managing the complex interplay of components in an electric powertrain. Such capabilities are far removed from those necessary for building traditional gas or diesel engines. To achieve this transformation, OEMs and their suppliers have committed to making significant investments over the next five to ten years.

For example, in 2021, General Motors announced that its total investments in electric and autonomous vehicles from 2020 through 2025 would reach $35 billion, a 75% increase from its initial commitment, made prior to the COVID-19 pandemic. So far, GM is focusing its investments on developing capabilities organically, including building new battery cell plants. Other OEMs are also pursuing external investments to accelerate their transformation.

Most commonly, companies use a mix of green M&A and other deal structures— including participating in funding rounds for startups (that is, corporate venturing) and purchasing minority stakes in strategic alliances—to maximize the impact of their investments.

For example, Ford has made several investments along the electric vehicle value chain in recent years. Typically, these deals have consisted of smaller equity stakes in startups bought in private placements, not majority acquisitions. For instance, Ford invested in battery cell developer Solid Power in 2018 and 2021, and in battery circuits player CelLink in 2019. It has also participated in funding rounds for Rivian, a producer of electric pickup trucks and SUVs, and it acquired an equity share in Ionity, a German operator of electric vehicle charging stations.

The picture is similar for Volkswagen Group. The German OEM has mainly used minority stakes and strategic partnerships with startups, rather than takeovers, to supplement its own substantial investments in electric vehicle and battery technology and production. Recent deals have included equity participation in battery manufacturers such as US-based QuantumScape and 24M Technologies (in 2018 and 2021 to 2022, respectively) and Sweden-based Northvolt (in 2021).

The emphasis on corporate venturing, strategic partnerships, and other alternative deal types, rather than on major M&A moves, is not surprising. Few mature targets are available for acquisition, given that electric vehicles and their powertrain components, especially batteries, are still at an early stage of development. OEMs are hedging their bets by spreading their investments and occasionally using partnerships and minority stakes to accelerate their own R&D, instead of buying specific technologies outright. In contrast, companies in the energy and utilities industry have access to mature technology (for solar and wind power generation) and a plethora of targets, large and small. This makes M&A the preferred choice for that industry’s dealmakers.

Transitioning to Green Products and Services

The final green transformation archetype involves a partial or full transition of a company’s products or services to green offerings and solutions. This can take different forms, ranging from expanding into new segments near the existing portfolio to fundamentally transforming existing products.

The industrial services sector offers an example of expanding into new segments. US-based Harsco was initially a producer of rail cars and steel coils, but it later shifted its focus to services for steel production, among other industries. These services include recovering and refining metallic and nonmetallic byproducts of steelmaking for use in agriculture, cement production, construction, and other operations.

Building on this core of environmentally related services, Harsco began a significant transformation. In 2018, for $52 million, it acquired ALTEK Group, a UK business that helps aluminum producers extract value from aluminum scrap. It followed this with two much larger acquisitions that rapidly accelerated its shift toward waste and recycling services. In 2019, it paid $625 million to acquire Clean Earth, a provider of treatment and recycling services for specialty waste streams. And in 2020, for $463 million, it acquired Stericycle Environmental Solutions, a provider of hazardous waste transportation and processing solutions. Analysts reacted positively to both acquisitions, which yielded cumulative abnormal returns of 14.4% and 4.5%, respectively.

Although Harsco faces some headwinds in the current inflationary environment, the company is well on its way toward completing its transition to environmental services. Two divisions, Clean Earth and Harsco Environmental, are fully dedicated to these services.

An example of a company that fundamentally changed its existing products is Neste, formerly Finland’s national oil company. It is a leading oil refining and marketing company in the Nordics, with revenue of approximately €15 billion in 2021. Its transformation started in 2007 when it began producing renewable diesel derived from fats, using a proprietary process developed in the 1990s. In the years that followed, Neste opened production plants in Singapore and Rotterdam and used green M&A to expand its raw materials access. Since 2018, Neste has acquired fat and oil traders, recyclers, and refiners in the Netherlands (IH Demeter and Count Terminal Rotterdam) and the US (Mahoney Environmental and Agri Trading). These acquisitions have helped ensure a continuous supply of raw materials for its refineries.

Today, 15 years into its transformation, Neste is the global leader in producing renewable diesel and renewable aviation fuel. It also ranks first among its peers in refining, petrochemicals, and basic organic chemicals for sustainability in the Corporate Knights 2022 Global 100 Index, and it has appeared in the index longer than any other energy company. This success story is reflected in Neste’s share price performance, which rose tenfold, from approximately €4 per share in early 2011 to approximately €44 toward the end of 2021, generating an rTSR of 3.3% per year during that period.

Five Winning Moves

The success stories across the archetypes point to a set of winning moves that companies can make. (See Exhibit 2.)

These include the following:

- Define a clear strategy. Pursue green M&A on the basis of an overarching plan informed by a well-considered strategy and thorough portfolio review. Don’t view green M&A as a short-term tactic to greenwash your operations or provide a temporary bump in share price.

- Build on your strengths. Anchor your green transformation and related M&A activities to existing core competencies—whether production processes, products, or end-application expertise. Building on your strengths makes these activities credible to investors and eases integration and synergy realization.

- Use the right deal approach. When you are seeking access to new technologies that involve high levels of uncertainty and risk, alternative deal structures are often a more suitable option than traditional M&A. Reserve outright acquisitions for stable technological environments. Focusing on small to midsize deals rather than transformative transactions can mitigate the risk. Ørsted, for example, used small to midsize deals to acquire capabilities in its core business and at supporting stages in its value chain.

- Complement deals with organic investments. M&A and other deal structures are not silver bullets. In all of the success stories discussed above, companies made substantial investments to build their R&D capabilities, physical assets, and talent. Volkswagen, for example, has committed to investing $59 billion in e-mobility across its brand portfolio by 2026.

- Follow through on execution. As is true for every deal, thorough preparation, due diligence, and postmerger integration—ideally in a seamless process—are crucial for success.

Green M&A and other deal structures can play a key role in helping companies transform their business toward a greener and more sustainable model. Our analyses show that green deals are cost-effective ways to drive environmental transformation and that they create shareholder value over the short and long terms. By applying the lessons learned from success stories, companies across industries can use green dealmaking to accelerate their environmental transformations.

The authors are grateful to Miriam Benedi, Elena Corrales, Hendrik Froelian, and Yiran Wang for their valuable insights and support in the preparation of this article.