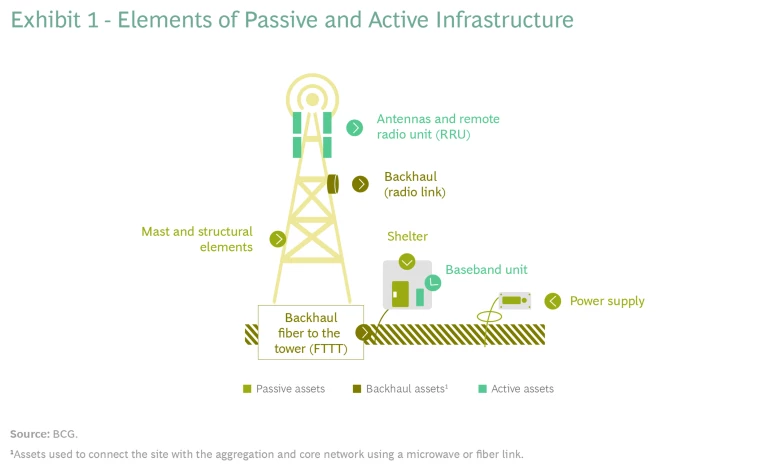

The rapid consolidation of the European tower company (TowerCo) market over the past five years will soon plateau as the number of available targets decreases. This will prompt TowerCos, which traditionally manage passive assets such as structures and shelters, to look for new sources of growth. We believe the most likely source of significant new revenue will come from expanding into active assets; more specifically, into the ownership and management of active radio access network (RAN) equipment (see Exhibit 1).

Today, mobile network operators (MNOs) own this equipment but are increasingly looking to outsource RAN to focus their operations on greater value opportunities and fund 5G network expansion. By investing in RAN, TowerCos have a unique opportunity to become more integral partners with MNOs. Furthermore, by structuring these partnerships similarly to those involving their passive assets, TowerCos can reduce commercial risk and ensure that their investment returns in active assets are stable and long-term. Some TowerCos and MNOs are better positioned to make this move than others, but with 5G rollouts imminent or already underway, now is the time to evaluate and seize this opportunity.

MNOs Are Carving Out Infrastructure Assets

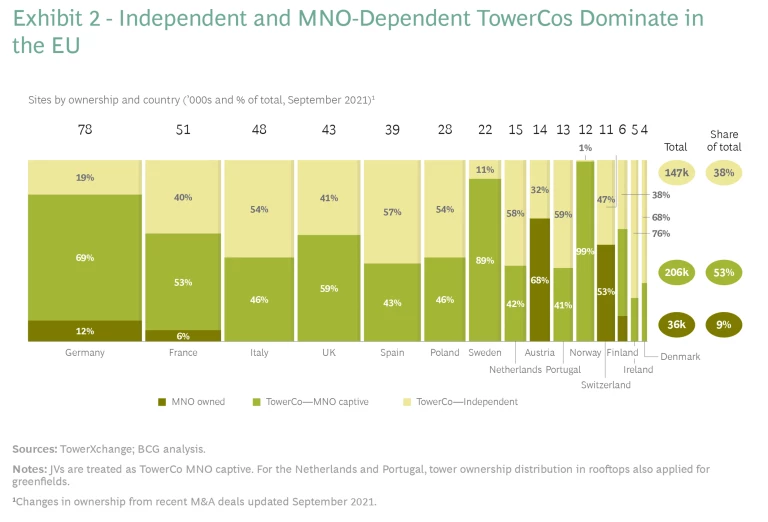

In recent years, many MNOs have carved out their passive infrastructure into dedicated TowerCos with different levels of ownership (from a complete sale to maintaining a majority share or even full ownership) for various strategic reasons. Some MNOs have done so because TowerCos are trading at historical high multiples, creating arbitrage opportunities for an asset sale, as opposed to holding the assets. MNOs have also carved out passive infrastructure to shrink their balance sheets and free up capital to fund 4G and 5G rollouts.

As mobile network operators carve out their passive infrastructure, independent or quasi-independent TowerCos can pursue commercial deals with other MNOs.

As autonomous players, many TowerCos have improved margins and extracted more value from core operations by optimizing ground leases, digitizing operational processes, using advanced pricing models , and driving synergies in portfolio support functions, operations, and procurement . But the most value from these carve-outs has come from TowerCos’ ability—as independent or quasi-independent entities—to pursue commercial deals with other MNOs and foster infrastructure sharing.

With their more autonomous structure, TowerCos have consolidated sites more easily through proactive sales, swapping, acquisitions , and increasing tenancy ratios. From 2019 to 2020, the value of M&A activity in Europe, the region where consolidation has been most intense, leaped from about $3 billion to $21.5 billion; by July of 2021, activity had already topped $22 billion for the year. As a result, 90% of the sites in Europe are now owned by MNO-dependent or -independent players compared with 70% in 2018 (see Exhibit 2).

With available acquisition targets dwindling, some TowerCos are now considering moving into adjacent products, mainly capitalizing on opportunities such as small cells (a small cell network consists of a series of small low-powered antennas—sometimes called nodes—that provide coverage and capacity comparable to a macrosite), and edge data centers (smaller facilities located close to the populations they serve that deliver cloud computing resources and cached content to end users). But for most TowerCos, these moves offer only short-term, incremental benefits. The much greater, long-term opportunity lies in active assets.

MNOs May Now Want to Divest Active Assets

The key to understanding this opportunity is recognizing the mounting challenges that MNOs face. For starters, MNOs are finding it increasingly difficult to differentiate their products and services based on infrastructure and connectivity alone; these are now regarded as table stakes in most markets. For the most part, their focus is now on creating a more consumer-centric, service-based value proposition to compete better and counter the decline in average revenue per user rather than trying to create a differentiated value proposition largely based on infrastructure assets.

MNOs are also on the hook for substantial capital expenditures and face intense cost pressure related to 5G license fees, network rollout obligations, fiber deployments, and other expenses necessary to take full advantage of 5G. Divesting active assets is a way to free up capital to fund these 5G expenditures. Complicating the investment decisions for MNOs is that, according to BCG research, connectivity is expected to contribute just 12% to 18% to total 5G market value. Companies will build most of their future value around storage, platform apps, security, system integration, and data analytics, with connectivity simply an enabler.

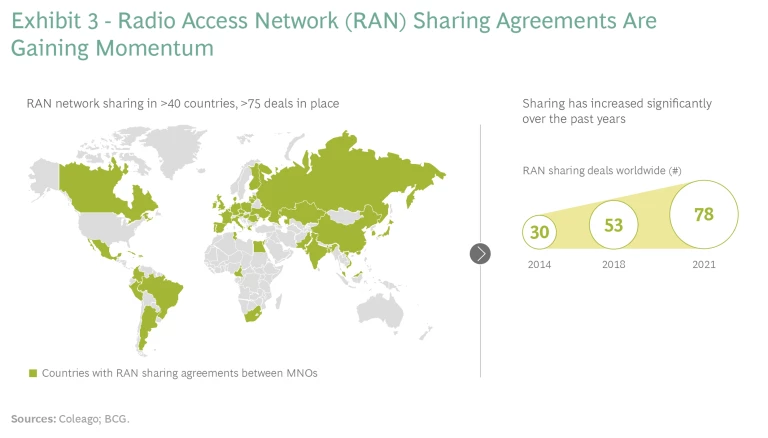

To manage these cost pressures and deliver dependable network performance, MNOs face some urgency to act. They are, for example, increasingly exploring RAN sharing agreements, especially for 5G (see Exhibit 3). Over time, as MNOs become accustomed to these arrangements, they may become more comfortable divesting equipment completely to a joint venture (JV) or to a TowerCo. This also might trigger a domino effect. In markets where one or more MNOs have cut costs through JVs or sharing agreements, those MNOs still operating standalone networks may find themselves at a competitive disadvantage. This could prompt them to strike their own agreements or divest.

In addition, the recent trend toward network virtualization and Open RAN, which standardizes the interfaces between RAN’s building blocks (radios, hardware, and software), might facilitate sharing and lower the complexity of active asset management. As MNOs begin adopting these more accessible and flexible technologies, the business case for divesting active infrastructure to a neutral host will become even more compelling.

In this context, TowerCos are uniquely positioned to unlock industrial value from the active assets (e.g., synergies with passive assets, operational efficiencies), while the network experience is managed by the MNO. Indeed, many TowerCos and infrastructure funds that own them are seeking such deals. MNOs that negotiate these deals first will enjoy a first-mover advantage.

So far, these trends have manifested most strongly in Europe but are gathering momentum in the Americas, Africa, and Asia.

TowerCos Could Adopt Various Business Models

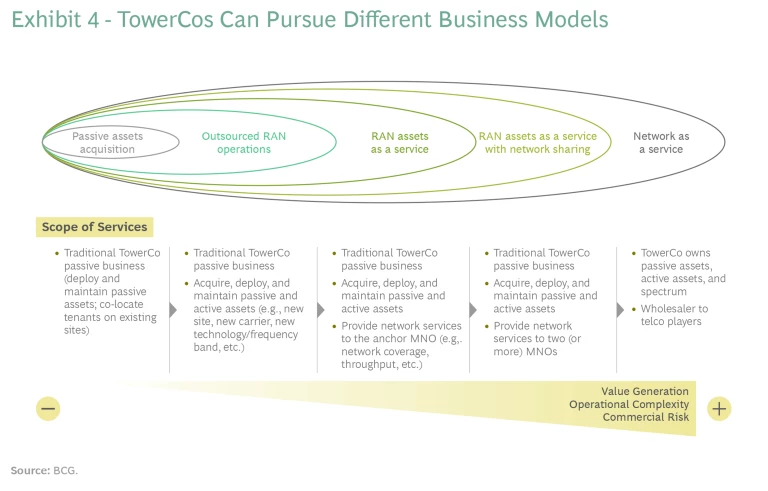

Sharing agreements and divestitures of active assets might make sense for MNOs, but do they make sense for the TowerCos? Given the size of the market, such arrangements are certainly enticing. In Europe alone, active RAN investments are expected to reach €4.5 to €5.5 billion annually through 2024 based on planned 5G investments. Globally, the amount of investment needed would far exceed that number.

By acquiring, deploying, and maintaining these active assets, TowerCos could help to finance this 5G rollout. MNOs would outsource their RAN operations to the TowerCos similarly to how they now outsource the passive infrastructure. This offering is a natural extension of the existing TowerCo-MNO relationship built around passive assets and could create even stronger and longer partnerships.

With the active assets under their control, TowerCos could pursue several different operating models with various degrees of operational complexity, commercial risk, and value-creation potential—from outsourcing RAN operations, to offering RAN assets as a service with or without network sharing, to offering network as a service. With these models, TowerCos can unlock additional value from realizing synergies with existing assets, from gaining a better understanding of build-to-suit opportunities, and from network sharing (see Exhibit 4).

One big attraction of these models for TowerCos is that MNO customers would be unlikely to switch providers due to the complexity involved. This barrier to switching would not only protect a TowerCo’s active investments but also its passive investments by bundling them together.

Indeed, over time the return on passive investments might improve as MNO customers continue to refine their models to fully utilize the infrastructure. For instance, TowerCos could take back assets currently located on third-party sites (e.g., antennas). By consolidating and managing these assets—and no longer paying a third party—the TowerCos could provide a more holistic service and gain additional revenue. Furthermore, by building their skills in managing active assets and working more closely with MNOs, TowerCos could gain strategic insights for expanding into adjacencies that so far have usually been of limited value (e.g., small cells and distributed antenna systems (DAS)).

TowerCos Can Structure Active Assets for the Long Term

In the past, TowerCos have shied away from active investments. They prefer secure, very stable returns over the long term, and active assets look more volatile than passive infrastructure because they carry commercial risk that passive investments do not. More specifically, traffic might fluctuate over time. But based on our experience working with clients, it is possible to structure active asset agreements in ways that make them resemble passive infrastructure, with predictable returns for decades.

There are several common elements in passive infrastructure agreements that TowerCos and MNOs could adopt for active asset agreements:

- Use volume estimates to make long-term commitments.

- Agree to new activities and development over time.

- Develop pricing models that satisfy both parties for both existing and new assets.

- Incentivize both parties to pursue efficiency initiatives.

- Balance agility with good governance and clear requirements for approval on key decisions.

- Reduce operational risk for both parties by clearly defining the commercial terms, provider obligations, relocations and decommissioning, and the capital plan.

Subscribe to receive the latest insights on Technology, Media, and Telecommunications.

Some TowerCos Have an Advantage

Passive infrastructure operations are generally low complexity and often have relatively lean staffs, while active assets demand a wider range of capabilities due to the scope, tasks, and organizational requirements. Thus, expanding from managing a traditional TowerCo to becoming an integrated (passive and active) service provider to MNOs poses significant challenges—and some TowerCos and MNOs are better positioned than others to tackle these challenges, which include:

- Asset Scope. In addition to the passive elements (e.g., structural and technical facilities, storage surfaces, lease contracts with landlords and tenants), active assets involve managing the operations support systems, monitoring the network operating center, managing the equipment vendors, and fulfilling operational KPIs and service level agreements (SLAs).

- Tasks. In addition to passive infrastructure tasks (e.g., construction, maintenance and collections), TowerCos need to coordinate with the MNO team to drive network planning and rollout, active operations and maintenance, the network operating center, as well as the integration with the MNO network team (e.g., on traffic forecasts to determine network requirements).

- Organizational Requirements. Given the new range and complexity of tasks, management needs to beef up staffing, including a full network team (internal and third-party).

When taking all these requirements into account, the TowerCos in the best position to take advantage of the emerging opportunity are probably carve-outs that are still MNO dependent. The parent MNO could provide the TowerCo with the expertise necessary to make the move. MNOs that still operate their own infrastructures are also well positioned. They could initiate a carve-out of both their passive and active operations, thus ensuring continuity of expertise and functional ability. Additionally, a few of the largest independent TowerCos with experience in managing active assets (for instance, in DAS, small cells, and private networks) may have many of the capabilities necessary to manage active assets as a service.

Conversely, most independent TowerCos lack experience managing active assets and so face the greatest challenges. If they don’t move quickly to acquire expertise and win the right to take over these MNOs’ operations, others will block their path. At the same time, MNOs need to decide soon what their role will be in this space given the pressure from 5G rollouts and the opportunities to unlock substantial value.