Dynamic, innovation-led economies require lots of digital technology experts. Here are measures policymakers can take to attract both digital talent and companies needing their services.

The Digital Revolution is creating enormous opportunities for cities and nations to unleash new sources of innovation-led growth. To drive the digital transformation of their economies, aspiring tech hubs around the world are striving to become magnets for leading-edge companies, R&D investments, and startups.

BCG studied 11 tech hubs around the world that continue to thrive by attracting digital talent from beyond their borders .

But successful digital hubs need lots of digital talent—an increasingly scarce commodity. Korn Ferry forecasts that the global shortage of technology workers will reach 4.3 million by 2030. And that was before the onset of the COVID-19 pandemic, which heightened demand for digital services.

To win the digital talent challenge, policymakers need a clear vision of their hub’s current strengths, the key industrial sectors they aim to develop, and the type of workforce they need. Attracting digital talent also requires insight into the factors that motivate skilled tech workers to move to new locations. Armed with this knowledge, policymakers can work with stakeholders in the local digital ecosystem to develop and execute strategies to build and nurture dynamic, resilient tech hubs that can spur innovation and economic growth for decades to come.

As part of our work in decoding global talent , BCG studied 11 tech hubs around the world that continue to thrive by attracting digital talent from beyond their borders: Amsterdam, Bangalore, Berlin, Dubai, Dublin, London, São Paulo, Seattle, Shanghai, Singapore, and Tel Aviv. We asked more than 1,000 digital tech workers who had relocated to these hubs about the most important factors in their decision, as well as what would most influence whether they decided to stay for the long term. We also analyzed the strategies and mix of policies these tech hubs have deployed to attract talent.

Our conclusion: with the right mix of policies that leverage existing strengths and enhance their appeal to digital talent and leading tech companies, cities and nations can nurture dynamic tech hubs that will become vibrant centers of

international business.

Understanding the Needs of Global Digital Talent

To develop a strategy for attracting digital talent, we started by taking a close look at the characteristics and preferences of individuals in the available digital labor pool who are “tech migrants.” That is, people who move to other cities, and even countries, to advance their careers.

The hottest fields for relocators? Big data and analytics as well as artificial intelligence, followed by cybersecurity and fintech.

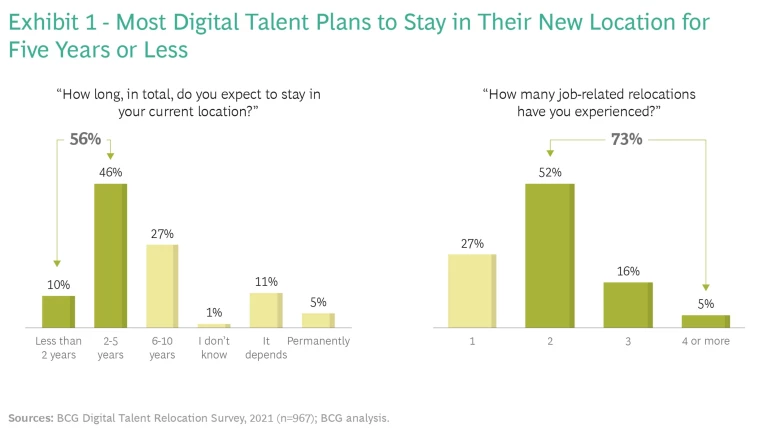

Around three-quarters of tech migrants we surveyed are married, and 70% are male. More than half are either engineers or programmers. They are generally young and mobile: 75% report they have less than seven years of experience in their professions; just 1% have at least 14 years. Nearly three-quarters have switched locations at least once before. More than half intend to remain in their new locations for five years or less. Only 5% say they plan to stay permanently where they currently live. (See Exhibit 1.)

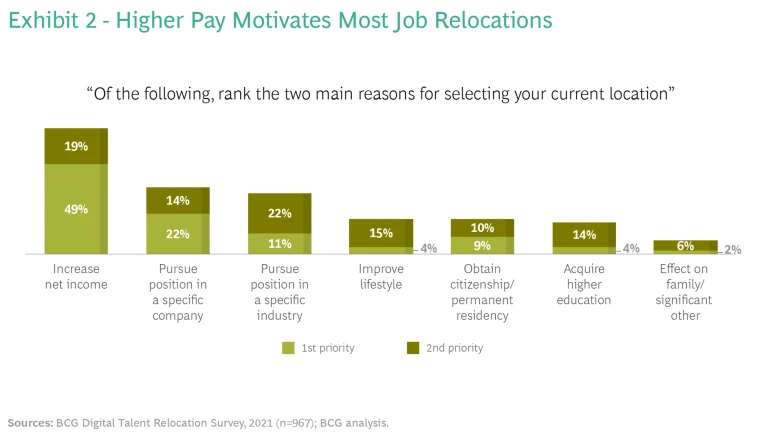

We asked each tech worker to rank the two main reasons for selecting their current location. Perhaps not surprisingly, the desire for substantially higher pay was overwhelmingly the most powerful motive in every digital hub we studied. The portion of respondents citing higher pay ranged from 59% in Dublin and Seattle to 78% in Shanghai. Three-quarters of the tech workers we surveyed boosted their salaries by at least 50%; many were able to double or triple their incomes.

A range of other factors also played significant roles in the decisions around job location. Landing a position in a specific company or industry were cited by around one-third of respondents globally. (See Exhibit 2.) By far the most migrants flocked to midsize and large companies, those with between 100 and 10,000 employees. The hottest fields for relocators? Big data and analytics as well as artificial intelligence, followed by cybersecurity and fintech.

Nonwork considerations also come into play. Around 60% of mobile digital tech professionals said they were looking for a better standard of living in their new location. Many relocated individuals also expressed a desire for better work-life balance, safety, and community values that are similar to their own. Lifestyle and family concerns grow stronger over time, our research found.

Some Common Features of Top Tech Hubs

To understand the keys to attracting digital talent, we studied a range of tech hubs. They include cities such as Bangalore and Shanghai that are technology centers for their national economies. Others, such as São Paulo, are hubs for neighboring countries as well. Yet others, including Singapore and London, are global hubs.

Each of the 11 cities in our study are able to attract talent from beyond their borders. Between 40% and 50% of the tech experts in Bangalore, for example, moved there from elsewhere in India. Fifty-four percent of London’s tech industry employees—and half of its founders of tech startups—are immigrants.

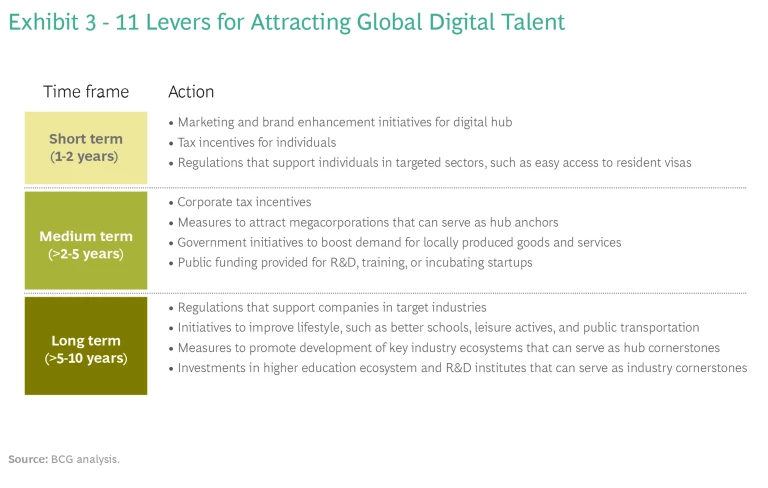

Another common feature of successful hubs: they adeptly use a range of policy tools to increase both the local supply of digital talent and demand for their services by attracting tech companies. We have identified 11 such levers that target short-, medium-, and long-term goals for expanding both the supply and demand for digital talent. (See Exhibit 3.)

Branding campaigns and tax incentives for individuals can be implemented quickly, for example. But immediate incentives aren’t enough. It’s also important to take actions that take longer to bring results and can sustain progress. Governments should consider offering corporate tax incentives, providing access to funding, supporting large corporations that serve as cornerstones, and seeking ways to boost demand for locally produced goods and services, such as through government procurement. Longer-term actions include supportive regulations, investments in research institutes and universities, support for targeted industries, and initiatives that enhance lifestyle and work-life balance, such as improved schools, leisure activities, and public transportation.

Lessons from Successful Hubs

We identified the following four lessons that other cities and nations can learn from the leading tech hubs we studied.

Lesson 1: Develop and execute a strategic plan. Hubs that do the best job attracting and retaining digital talent have studied and learned from the experiences of others. They then create a structured strategic plan and execute it well.

Singapore, which ranks highest in INSEAD’s 2020 Global Talent Competitiveness Index for its ability to attract talent, developed its strategic plan more than a decade ago. Government agencies collaborated with relevant companies to create a vision for targeted industries. The plan addresses industrial supply chains, identifies skills needs, and specifies government actions and regulations necessary for success. Singapore then developed a multiagency approach to making decisions and implementing them across the government.

Hubs that do the best job attracting and retaining digital talent have studied and learned from the experiences of others.

To build a strong base of anchor employers and tech industry clusters, Singapore offered generous tax incentives and developed campuses with office space, laboratories, and research programs for such targeted industries as digital media and biotechnology. Among its methods of developing talent pools are programs that provide students with scholarships paid by companies that eventually employ them. It offers support staff, such as nannies, for professionals who relocate to Singapore.

Lesson 2: Build on existing strengths. One of the best ways to develop a successful hub is to build on a location’s existing strengths. These strengths might include anything from established, globally competitive industries or strong universities to world-class hospitals, an abundance of certain natural resources, or a great climate.

To boost its talent supply, São Paulo offers one of the region’s strongest science, technology, engineering, and mathematics education systems.

London, which ranks second in talent attraction, leverages its position as a global financial center. The abundance of investment capital—London ranks eighth worldwide in venture funding—draws numerous companies and entrepreneurs. From 2015 through 2019, around 2,700 technology companies were founded in London—twice the number as in Paris, the leader in the EU. In 2011, London amplified its advantages by introducing the Seed Enterprise Investment Scheme, which offers tax relief to investors in startups.

London also leverages its excellent higher-education system, which includes University College London, the London School of Economics, King’s College London, and nearby institutions such as Oxford and Cambridge. Moreover, the UK offers generous scholarships that also help London attract and retain international talent–and visas to entrepreneurs who want to start up innovative businesses.

São Paulo likewise capitalizes on its role as the most important financial and economic center in Brazil and the rest of Latin America. All major multinationals operating in Latin America have local headquarters in the city, and around two-thirds of the region’s venture-capital funds have a presence. To boost its talent supply, São Paulo offers one of the region’s strongest science, technology, engineering, and mathematics education systems. It also promotes its high quality of life and openness to nonnatives.

In Israel, a key to the country’s emergence as a digital technology hub is its ability to build on its expertise in fields such as cybersecurity and agricultural technology. These stem from Israel’s strength in defense industries and the necessity of feeding its population in an arid environment. Israel also leverages its strong appeal to the educated Jewish diaspora. After higher pay, the ability to obtain Israeli citizenship was cited most often by respondents as a reason for moving to Tel Aviv. Potential citizenship was the most important consideration among those who decided to stay, cited by 48% of respondents.

The Israeli government boosts demand for tech talent through financial incentives and public investment in key industries. Among its many measures to improve the supply of digital talent are programs offering access to Jewish education and communal facilities. Tel Aviv promotes its openness to the LGBTQ+ community and invests in the young Jewish diaspora through programs such as Taglit Excel, which finances and facilitates visits to Israel for young Jewish adults living abroad.

Lesson 3: Leverage anchor companies to build broader hubs. The presence of large, stable employers is a key attraction for digital talent. Forty-five percent of respondents said they relocated to London and Bangalore, for example, to pursue jobs at specific companies. In Seattle, that response reached 55%.

Large anchor tech companies and the spinoffs they generate have helped make the Seattle area second in the US only to Silicon Valley as a talent market. Over the past five years, Seattle’s population of tech workers has grown by around 23%, to 155,000—with an estimated 12,000 of those workers relocating from other places.

The Seattle area has been home to Boeing since 1916, Microsoft since 1986, and Amazon since 2010. The area is an engineering hub for technology giants such as Google, Facebook, Twitter, and Salesforce. What’s more, Seattle’s networks of past and present employees of major companies have become solid foundations for building broader hubs.

Over the past five years, Seattle’s population of tech workers has grown by around 23%, to 155,000—with an estimated 12,000 of those workers relocating from other places.

Among the local startups launched by Amazon veterans alone are the supply-chain platform Shipium, digital freight network Convoy, and Pandion, a developer of software for managing small-parcel delivery. Incubators and accelerators such as Pioneer Square Labs, a “startup studio” backed by leading venture capitalists, help launch new companies. The region’s strong universities and attractive lifestyle also enable it to draw and retain tech talent.

Bangalore has also leveraged large anchor employers into a broader innovation ecosystem that has made it a talent magnet. The city started attracting big domestic and international technology companies into “export zones” in the 1980s with tax incentives and low, government-subsidized rent for office space. City leaders have been aware, however, that there must also be enough jobs to keep top talent from migrating to other cities—which in turn could eventually prompt companies to relocate as well. Bangalore sustained and expanded its position as India’s leading digital hub in part by investing in higher education, startup incubators, and other local development platforms to help innovators and entrepreneurs create new local tech companies. The city is now home to 48% of India’s R&D workforce.

Lesson 4: Combine short- and long-term levers. Aspiring tech hubs must enact measures that both create traction quickly and that sustain growth and development in the future.

The United Arab Emirates—96% of whose tech workforce is composed of immigrants—exemplifies the benefits of a well-planned, comprehensive strategy for developing a tech hub that deploys both short- and long-term levers.

The UAE tackled the challenge in three waves. First, it successfully attracted leading technology companies by cutting its corporate tax rate to zero. Smaller tech companies followed with UAE operations. Second, it launched an initiative to attract talent with the skills needed by industries targeted by the government, such as agriculture technology. For the longer term, the government encouraged leading international universities to establish local campuses to attract top students and encourage the children of the current workers to remain in the UAE for their higher education.

The United Arab Emirates—96% of whose tech workforce is composed of immigrants—exemplifies the benefits of a well-planned, comprehensive strategy.

Third, the UAE attracted tech entrepreneurs. Among other initiatives, it established incubators such as Dubai’s Area 2071 and recruited venture capital firms from around the world to establish local offices. To address the problem of high living costs, the UAE offers select startups office space with two years of free rent, and it provides health insurance for employees. It also has made it easier for incoming talent to attain work visas.

Yes, the competition for global digital talent is intensifying. But even cities and regions that are relatively new to the game can develop dynamic technology hubs. What’s required is a sound strategic plan that builds on local strengths, leverages anchor companies, deploys the right combination of policy tools, and maintains a healthy balance between the demand for skills and supply. Communities that execute the playbook we’ve just outlined can nurture hubs that will, in time, become magnets of talent, investment, and enterprises that promise to drive innovation-led growth.