The yearly global margin pool could surpass $100 billion in the coming decade—if market players secure more feedstock supplies, improve process economics, and address pricing issues.

The day is coming when more airplanes will fly on fuel made from used cooking oil and tractor-trailers will roll down the highway on a mix of animal fat and forest residue.

Aviation and heavy transportation industries worldwide have pledged to increase their use of renewable fuels made from bio-based and synthetic materials to reduce the carbon emissions that contribute to climate change . They’re following the lead of countries that have set ambitious goals for renewable fuels to make up 10% or more of their total fuel consumption by the end of the decade, an exponential leap from the amounts they use today. In addition, an underinvestment in oil during the COVID-19 pandemic is helping to intensify the demand for renewable fuels, as are ongoing geopolitical events that have set the stage for higher prices for fossil-based fuels that could last several years.

By our estimates, the demand for renewable fuels could push the industry’s cumulative global margin pool—the total worldwide profits from each stage of the value chain—into the range of $100 billion to $160 billion annually in the coming decade.

For that kind of growth to happen, though, the market must overcome several major challenges, including the limitations of existing renewable-fuel feedstock sources, current process economics that favor refining some renewable fuels over others, and, in some regions, higher prices for new fuel types.

Moreover, all parties with a vested interest in creating a successful global renewable-fuels market—including producers, feedstock suppliers, aviation and heavy transportation users, and policymakers—need to work together to help it grow.

The Push for Renewable Fuels

The aviation and heavy transportation industries are under intensifying pressure from customers, employees, shareholders, and policymakers to decarbonize. Doing nothing is not an option. Without taking corrective action, the portion of total global emissions that is attributable to the aviation industry could grow from 2% to 3% to as much as 20% by 2050 . Emissions from heavy transportation account for about 8% of the global total. Without corrective action, that percentage could continue to grow about 2% a year. At the same time, passenger vehicle emissions will decline as more electric vehicles hit the road, resulting in heavy transportation’s share of overall global emissions rising to more than 12%.

The two industries have limited options for decarbonizing. For aviation, the most viable one is using sustainable aviation fuel (SAF), a cleaner substitute for fossil-based jet fuel. The most viable options for the heavy transportation industry are using renewable diesel fuel, an alternative to fossil-based diesel fuel, or electric or hydrogen-powered vehicles. However, renewable diesel—like SAF—does not require modifying existing engines or making a significant investment in modifying the supply chain infrastructure, both of which are needed for electric and hydrogen-powered vehicles. And the costs, even though expensive, are more competitive with those of traditional fuels.

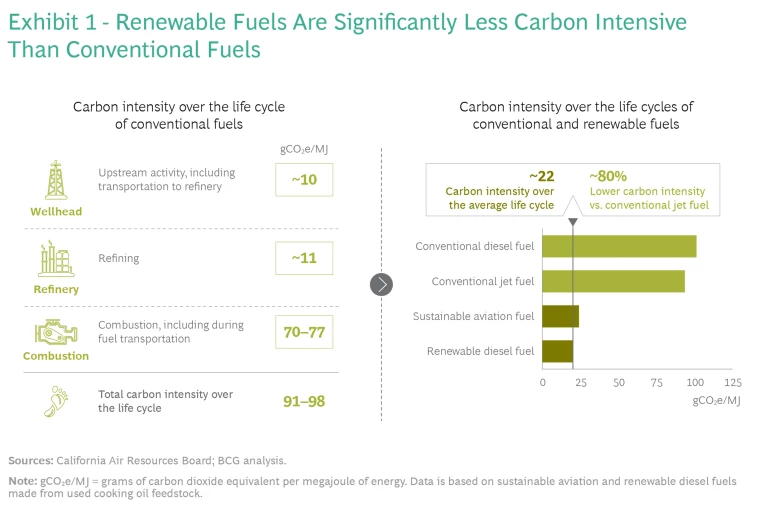

Renewable fuels are also attractive because of their lower carbon intensity, a calculation of total life cycle emissions per unit of energy. (See Exhibit 1.) SAF that is made from used cooking oil, for example, has a carbon intensity of approximately 24 grams of carbon dioxide equivalent per megajoule of energy created, compared with 94 gCO2e/MJ for traditional jet fuel. Renewable diesel’s carbon intensity is even lower, at about 22 gCO2e/MJ, or roughly 80% less than that of conventional diesel fuel.

Despite the advantages of renewable fuels, their use is still in its infancy. In the US and European Union (EU), these fuels make up less than 5% of the total transportation fuel consumed in a year. Both regions have ambitious goals to change that. In the US, the Biden administration has made it a goal to boost annual SAF use to 3 billion gallons by 2030, the equivalent of 10% of total US jet fuel consumption. The EU has a target of increasing transportation’s use of renewable fuels to 14% of fuel consumption by 2030. In 2021, the European Commission proposed an additional greenhouse gas-reduction target for the transportation sector. If passed, it would increase minimum SAF use to 20% by 2035 and to 63% by 2050.

Aviation and heavy transportation companies have set similar targets. Carriers such as Alaska Airlines, Cathay Pacific, and Virgin Atlantic have announced plans to increase SAF use to 10% of their total annual fuel consumption by 2030. Air freight carriers are even more ambitious. DHL and FedEx have pledged to use 30% of SAF in their air freight operations by 2030, and UPS has committed to do likewise by 2035. In September 2021, 60 airlines, airports, fuel suppliers, and global companies joined a World Economic Forum initiative to increase the use of SAF to 10% of the global jet aviation fuel supply by 2030. They and dozens of other aviation industry players have further announced their intentions to reach net-zero emissions by 2050.

Trucking companies and other freight haulers, as well as companies with truck fleets, have made similar pledges. For example, US Foods, an American food-service distributor, expects to convert to using renewable diesel for trucks based in its California distribution centers by mid-2022.

If all these pledges pan out, we estimate that it could help the cumulative global margin pool for renewable diesel and SAF to climb above $100 billion annually within the next decade. That estimate includes margins for feedstock, feedstock processing, fuel manufacturing, and retail fuel.

Three Ways to Expand the Global Renewable Fuels Market

Building out a global renewable fuels market that can meet the predicted demand will require surmounting multiple challenges, beginning with coming up with more supplies of fuel feedstocks. It also means making environmentally friendly fuel less costly to manufacture so that more producers make it and customers buy it. The final obstacle is overcoming existing high prices for end users.

Secure additional feedstock supplies. Renewable fuel producers need additional supplies of low-cost, low carbon-intensity feedstocks—above and beyond what’s available—to meet increasing demand, fulfill their customers’ goals for using fuels with lower carbon-intensity levels, and counter rising costs for existing raw materials.

Currently, a large portion of renewable fuels are processed with hydroprocessed esters and fatty acids (HEFA) technology that uses feedstocks based on soybean and other vegetable oil. Food and animal waste are also popular feedstocks because of their low carbon intensity and because of the incentives that countries, including the US, offer producers to use them.

However, increasing demand is expected to vastly outstrip the supply of these feedstock types. The US is expected to generate 33 billion pounds of HEFA feedstocks by 2030, but we estimate that will be about 27 billion pounds short of what’s needed to meet demand. Likewise, the EU is expected to produce 13 billion pounds of HEFA feedstocks by 2030, shy of the 22 billion pounds required.

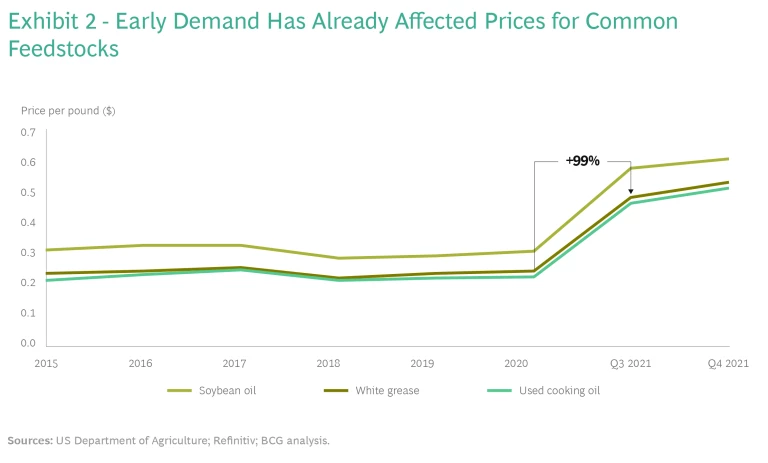

Producers need to find new feedstock sources in order to increase the overall supply—and not only because of increasing demand. Higher prices for both vegetable oils and waste-based feedstocks are cutting into margins. After years of relatively minor increases, prices for various feedstocks spiked from 2020 through 2021. (See Exhibit 2.)

Prices for white grease, for example, jumped 99% from the end of 2020 to the third quarter of 2021. In addition, increasing geopolitical volatility could shut off access to some existing sources of feedstock supply. Ongoing debates over the ethics of diverting food-based feedstocks, such as cooking oil, away from the global food supply in order to make fuel are adding to the pressure, and the EU has capped food-based biofuel production as a result.

Producers can circumvent higher prices by importing feedstocks from Asia and South America, where the raw materials are more plentiful and less expensive. However, those regions are scaling up their own renewable-fuel production capacity, which could eventually cut into the supplies of raw materials available for export.

A more promising option is adopting new technology pathways that use alternative feedstocks from readily available materials, many of which emit even less carbon than existing options, and none of which are food based. These technology pathways include:

- Gasification Fischer-Tropsch (GFT), a process that turns forest residues and municipal solid waste into renewable fuels

- Alcohol to jet fuel (ATJ), a process that converts ethanol derived from sugarcane or corn into SAF

- Power-to-liquid (PtL), a process that uses carbon dioxide and water as feedstock to produce synthetic fuel

- Hydrothermal liquefaction, a process that uses woody biomass or municipal waste to make biocrude, which can be coprocessed in refineries that produce conventional fuels

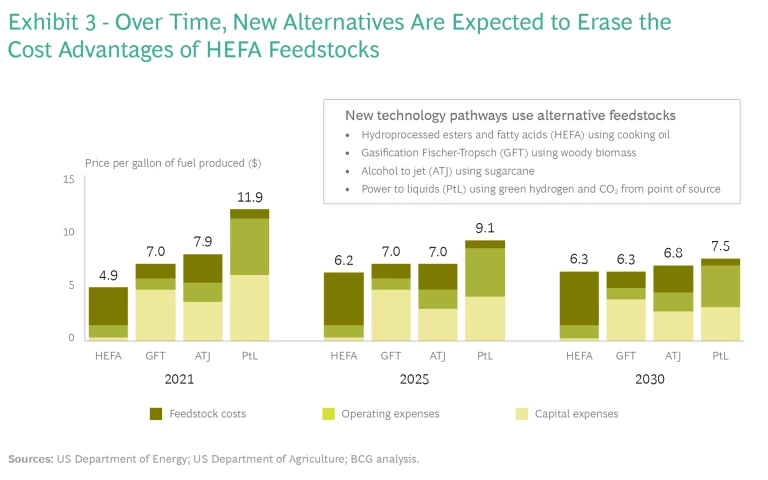

Newer technologies, such as GFT and ATJ, use feedstocks that cost less and have lower carbon intensity. But setting them up requires substantial upfront capital, and operating expenses are higher. A PtL refinery, for example, requires investing in green hydrogen production and related technology. However, we expect related capital expenses and operating expenses to decline over time. In addition, feedstock costs for newer processes are expected to hold steady, while costs for HEFA feedstocks are expected to continue to rise. (See Exhibit 3.) As a result, newer feedstocks may eventually become more economically viable options.

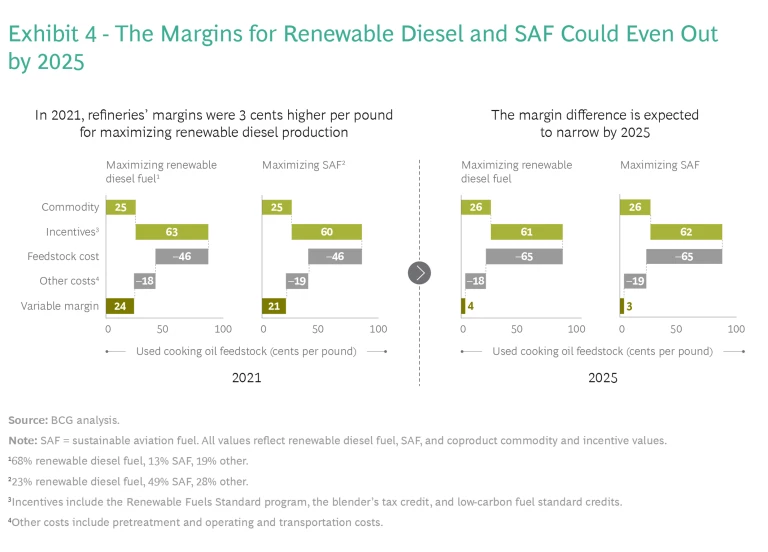

Improve production-process economics. Like other types of refineries, renewable fuel producers maximize finite manufacturing capacity by devoting more of that capacity to making products with higher margins, considering a product’s refining costs and anticipated market price. And since producing renewable diesel is more profitable than SAF, most producers make more of it. That’s fast becoming a problem as demand for SAF increases.

Current government incentives are structured in such a way that they encourage producers to refine more renewable diesel than SAF. In the US, a federal renewable fuel program and state-level low-carbon fuel programs pay producers incentives of 25 cents more per gallon to make renewable diesel than to make SAF, leading to higher profit margins for the former. A provision in the Build Back Better Act would have revised an existing biodiesel tax credit to pay $1.25 to $1.75 per gallon for SAF that reduces life cycle emissions by at least 50%. The increase would have brought the economics of producing SAF on par with making renewable diesel by 2025, and ultimately lead it to account for a higher share of total renewable fuel production. (See Exhibit 4.) Although that bill stalled in Congress, higher tax credits for SAF are included in other pending legislation. The Sustainable Skies Act, a joint Congressional bill introduced in 2021, would offer a tax credit of $1.50 per gallon or more for SAF that reduces life cycle emissions by at least 50%.

One way that producers can respond to increasing demand is to add capacity, either by converting existing refineries so that they can make renewable fuels or by opening more plants. Some fuel producers are already doing the former. Phillips 66 is retrofitting an existing refinery that it operates in California to produce 800 million gallons of renewable fuels a year, including SAF.

Make accommodations for higher renewable fuel prices. Making renewable fuel feedstocks more abundant and improving the process economics of manufacturing them are two options for expanding the market. The third is addressing end user prices that, depending on the region, could be higher than what trucking fleets and airlines pay for fossil-based diesel and jet fuels, giving them little reason to make the switch.

Prices for renewable fuels vary by region. In the US, federal and state programs provide monetary incentives to renewable fuel producers and distributors that have brought prices closer to those of fossil fuels. In California, for example, incentives bridge the gap between the cost to produce renewable fuels and the market price for fossil fuels.

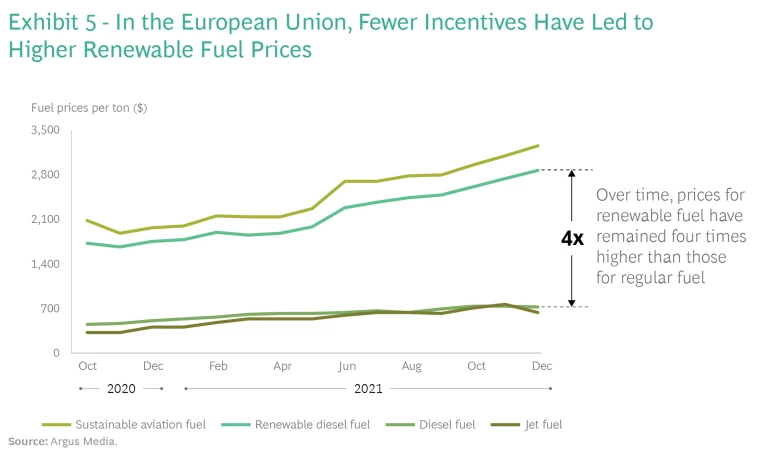

In the EU, renewable fuel feedstock and production costs are higher than they are in the US, and governments do not offer producers subsidies or incentives. As a result, wholesale prices for renewable diesel and SAF can be up to four times more expensive than their petroleum-based equivalents. (See Exhibit 5.)

Because EU producers pass the higher production costs onto customers, the prices for airline tickets as well as air freight and truck transportation have increased. Air France KLM, for example, has added a ticket surcharge on all flights departing from France to fund the extra cost the company will incur meeting the country’s mandate for airlines to increase the use of SAF to 1% of total fuel consumption this year. As feedstock prices in the EU continue to climb, end user prices for renewables could increase even more.

One way that producers could address high prices is by marketing renewable diesel to make it more attractive to customers, emphasizing such benefits as lower carbon emissions and the lack of an odor. End users can also take actions to address high prices.

Some airlines and freight carriers have begun to counterbalance higher prices by sourcing SAF for corporate customers that are seeking to operate more sustainably. In such partnerships, a company pays a so-called green premium to an airline or freight carrier for the portion of the fuel consumption linked to their business travel. The airline or freight carrier then uses the revenue to cover a portion of the higher prices that they pay for SAF, and the company records a reduction in emissions, although the exact accounting rules for that are still being developed. In the past few years, some carriers, including Alaska Airlines, American, Delta, and United, have struck SAF deals with corporate customers.

In addition, companies have struck deals to buy SAF from renewable fuel producers either directly or through three-way deals with airlines. In one such agreement, Nike buys SAF for corporate business travel that is supplied by Finnish renewable jet-fuel producer Neste through an agreement with Delta.

What Key Participants Can Do to Get Started

Ready or not, the renewable fuels market is evolving. Key market players need to understand what they need to do to capitalize on the trends and secure their position.

Feedstock suppliers need to create a raw-materials strategy. Feedstock suppliers should map out a strategy to ensure that they have access to adequate sources of raw materials at the best possible prices. They need to track technology developments to ensure that they can change course should it become more economical to use new technologies, such as ATJ or PtL. They should also expand their network of raw-materials suppliers, and if possible, lock in contracts in order to ensure that they have adequate supplies.

Suppliers of waste products should monitor trends. Suppliers of waste products—including restaurants and other businesses that produce used cooking oil or byproducts that feedstock suppliers purchase—should keep up with the effects of increased demand for renewable fuels. Market changes can increase or decrease the demand for different types of waste products, which can affect their prices. Suppliers must also educate themselves on how to assess the value of contracts since more fuel producers will be looking to lock in feedstock supplies.

Producers have to act. Refineries that currently focus on renewable diesel need to monitor demand so they can determine when to shift production to the mix of renewable diesel and SAF that maximizes their profits. They can add capacity by converting traditional refineries, a step some companies have already taken because they can earn a higher return on investment by producing renewables. Producers can also add capacity through acquisitions. Chevron recently acquired Renewable Energy Group, which produces renewable diesel and operates 12 biorefineries and a feedstock processing facility. Or, producers can invest in renewable fuel companies. In early 2022, ExxonMobil took a stake in Global Clean Energy Holdings, a California-based energy company that refines nonfood oilseed plant feedstock into renewable diesel.

Refineries need to monitor demand so they know when to shift production to a mix of renewable diesel and SAF that maximizes profits.

Producers also need to work on deals to secure feedstock sources now before competition heats up. US producers can take advantage of arbitrage opportunities to sell renewable fuel to EU markets, where fuel prices are higher.

Trading renewable fuels is expected to become a multibillion-dollar market by 2030. Producers could use their familiarity with renewable fuels, feedstocks, and market volatility to their advantage should they want to participate in trading activity.

Renewable fuel customers have to secure adequate supply. Airlines, freight carriers, trucking companies, and other industrial customers have to follow through on commitments to decarbonize by securing supplies of renewable fuels and do it in a way that minimizes the impact on their operating costs. One way is by investing in renewable diesel and SAF projects to lock in competitive prices. Some air carriers have already taken this step. KLM teamed up with SkyNRG and SHV Energy to invest in a SAF project in the Netherlands, ensuring it of a steady supply of renewable fuel.

Original equipment manufacturers can begin modifying aircraft. If they have not started already, OEMs could begin to adapt engines and fuel tanks to accommodate using higher quantities of SAF, and they could begin to be certified accordingly, a process that we estimate should take no more than two years. Although the adjustments are not technically complex and should not represent manufacturing bottlenecks, they are another step on the path that OEMs must take to prepare for the future. Making accommodations for SAF could also be a way to differentiate themselves from other manufacturers.

Policymakers should monitor and support the market. Government agencies should work closely with industry players to update regulations and policies to ensure that target renewable-fuel production rates become a reality. Agencies also need to support airlines, which operate on relatively thin margins, so that they are not penalized financially for adopting more environmentally friendly fuel targets. And agencies need to monitor the market and avoid distortion to the margins and operations of airlines, fleets, and other customers.

Renewable fuels will be integral to decarbonization. The renewable fuels market is promising and evolving fast. Key stakeholders must act now to make the most of economic and sustainability investment decisions, while taking into consideration factors such as carbon intensity, fuel price, technology maturity, and the impact of their actions on the food supply and the environment.

The authors would like to thank Daniel Fernandez, Maurice Jansen, Pelayo Losada, Valentin Markov, and Antoine Poulallion for their invaluable contributions to the research and analysis for this article.