Sustainability has become inseparable from financial success, making finance leaders key players. Only they can hardwire this new priority into steering and performance management.

There’s a success factor for climate and sustainability agendas that most companies have overlooked: CFO leadership. The finance function leads this agenda at 20% of companies, according to BCG’s CFO Excellence Index. These companies scored, on average, 9 points higher in the index’s climate and sustainability performance benchmarking than companies that have other functions lead the agenda.

CFOs’ leadership role in sustainability falls within their growing responsibilities as the custodians of corporate performance. Indeed, sustainability performance has become inseparable from financial performance, making companies’ ability to act on sustainability-related issues a key differentiator in achieving corporate success. Moreover, many individuals and organizations now expect companies to have a strong reputation for sustainability before engaging with them as investors, customers, employees, or business partners.

To meet the sustainability imperative, finance functions must apply their core capabilities for driving performance through target setting and transparency. Our benchmarking found that the best finance functions apply these capabilities to excel in four types of actions: measuring and disclosing their company’s carbon footprint, managing emissions across the value chain, forging strong relationships with stakeholders, and embedding sustainability in capital and investment decisions. Across these activities, finance functions’ enterprise-wide view of company operations gives them a more objective perspective than other functions have and helps to ensure cross-functional alignment. (See “About BCG’s Finance Sustainability Benchmarking.”)

About BCG’s Finance Sustainability Benchmarking

About BCG’s Finance Sustainability Benchmarking

Pressures Demand Finance-Led Climate Action

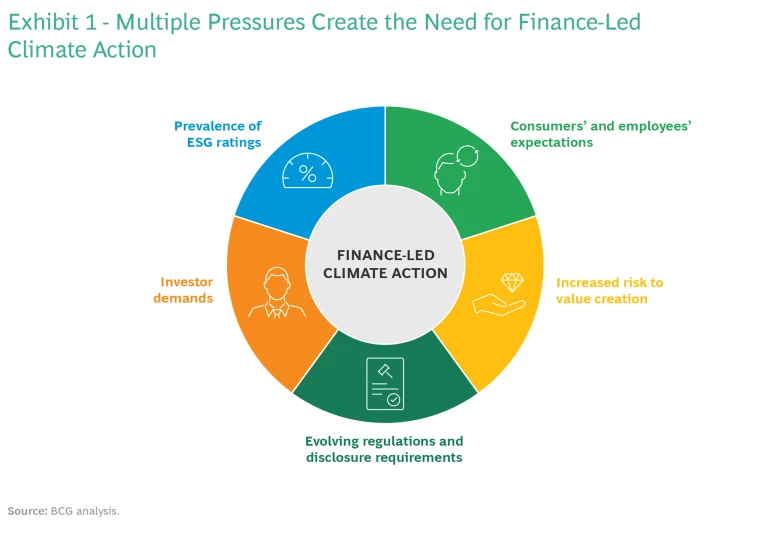

Several developments highlight the inseparability of sustainability and financial performance, pointing to the imperative for the finance function to lead climate action. (See Exhibit 1.)

- Consumers’ and Employees’ Expectations. Sustainability has become a key consideration for consumers as they seek more environmentally friendly products and services. Similarly, many current and prospective employees want to work for climate-conscious organizations, making a strong reputation for climate action essential to compete in the war for talent.

- Increased Risk to Value Creation. Ineffective climate action poses risks to value creation, particularly for companies transitioning to a new business model or for those with extensive and complex supply chains. According to the World Economic Forum’s Global Risks Report 2022, experts and business leaders ranked several environmental concerns—including failure to take climate action, extreme weather, and the loss of biodiversity—among the most significant risks to businesses globally.

- Evolving Regulations and Disclosure Requirements. Sustainability reporting is becoming an integral part of financial accounting and reporting. For example, the IFRS Foundation’s International Sustainability Standards Board has proposed new disclosure requirements for sustainability-related financial information, which would go into effect starting with the 2024 reporting period.

- Investor Demands. Activist investors are emphasizing climate concerns as they seek to minimize risks while maximizing shareholder returns. For example, Engine No. 1, a small climate-focused hedge fund, succeeded in electing three members to the board of directors of ExxonMobil. To inform investment decisions, Engine No. 1’s total value framework links environmental, social, and governance (ESG) data directly to financial value creation.

- Prevalence of ESG Ratings. ESG performance ratings are being considered more widely in capital markets as investors and fund managers seek to make better-informed longer-term investment decisions.

Finance Capabilities are Essential for Achieving ESG Objectives

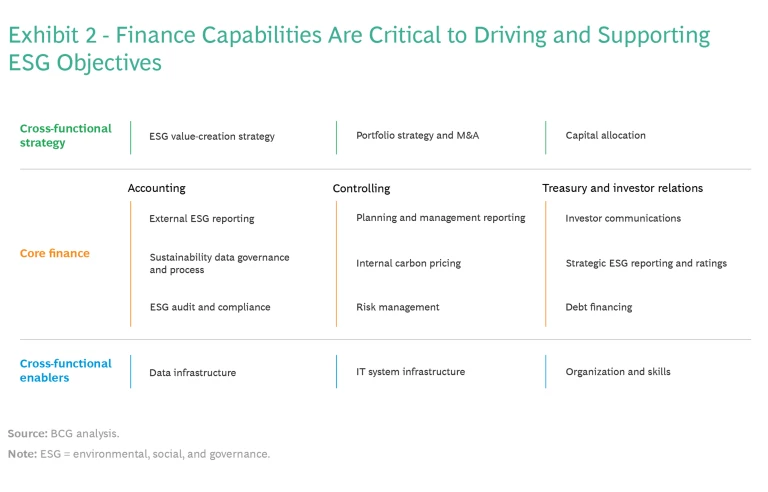

The growing importance of climate action has expanded the scope of companies’ ESG transformation initiatives. To manage these effectively, CFOs need to apply finance capabilities to key topics in three broad categories. (See Exhibit 2.)

- Cross-Functional Strategy. Companies need a comprehensive ESG strategy that cuts across functions to guide portfolio optimization and M&A. The strategy also guides capital allocation to promote ESG goals while maximizing shareholder return.

- Core Finance. Measuring ESG performance and externally reporting it promotes regulatory compliance and stakeholder support. To realize their sustainability ambitions, companies must integrate core finance and metrics into controlling and performance management. And they need to efficiently communicate ESG performance to shareholders and debt holders.

- Cross-Functional Enablers. To execute their ESG strategy and create value, companies must optimize their data infrastructure and IT systems to effectively measure and distribute information on ESG performance. Additionally, they must implement new ESG-focused roles and enhance skills for existing roles.

The Finance Function’s ESG Capabilities in Action

A global chemical company’s approach to core finance topics illustrates the great extent to which finance capabilities are essential to delivering a transformation.

- External ESG Reporting. The company defined carbon accounting and reporting standards to ensure objective, transparent climate disclosure. To implement the required policy and process changes, it defined a clear set of actions. These included initiating reporting that follows the SASB Standards, automating data collection and reporting, and setting up processes to monitor changes to regulatory guidance and global and local reporting standards.

- Internal Carbon Pricing. The company established a policy for internal carbon pricing. It adopted a carbon fee—an internal tax on each operating asset’s emissions—to incentivize decarbonization and generate funds for abatement initiatives. To inform business planning and investment decisions, it introduced shadow pricing—a way to reflect the costs of future projects given various carbon scenarios. This approach enhances the economics of low-emissions projects while penalizing those of high-emissions projects.

- Debt Financing. The company set policies to advantageously use two types of sustainable financing options. Green financing relates to financial instruments (such as loans and bonds) that are earmarked to fund environmentally beneficial projects (for example, renewable energy). Sustainability-linked financing relates to instruments intended to fund the achievement of broader ESG objectives, such as enabling a climate change strategy.

What Differentiates the Top Performers?

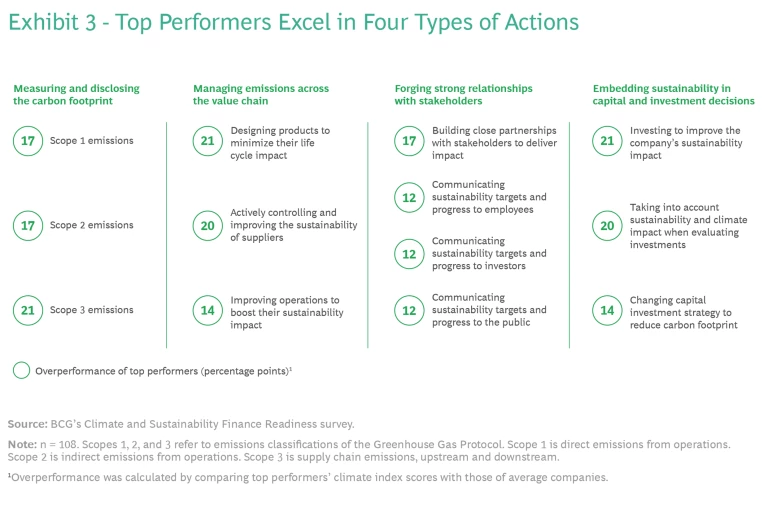

The benchmarking of finance functions identified four types of actions in which the top climate performers stand out as they pursue their climate agendas. (See Exhibit 3.)

Measuring and Disclosing the Carbon Footprint. Measuring and disclosing the company’s carbon footprint supports efficient performance management and enables regulatory compliance. The top performers publicly disclose their carbon footprint—across scope 1 (direct emissions from operations), scope 2 (indirect emissions from operations), and scope 3 (supply chain emissions). Scope 3 disclosures are the most onerous because they concern operations outside the company’s control. Initiating and maintaining an infrastructure to measure and disclose Scope 3 emissions requires significant effort and resources. Success requires setting up effective teams, processes, and systems and then continuously monitoring progress against targets. Companies that master the challenges at the initial stages will be able to make course corrections to achieve their net-zero goals.

Managing Emissions Across the Value Chain. Leading companies actively manage their organization’s carbon footprint throughout their value chain, including, for example, the emissions generated by their suppliers and by the disposal and treatment of products at the end of their life cycle. Taking this action allows companies to improve their bottom line by tapping into value pools created by, for example, recycling, sustainable packaging, and renewable energy.

Forging Strong Relationships with Stakeholders. Close relationships with regulators, investors, suppliers, the public, and other stakeholders enable companies to communicate their progress, gain valuable insights into expectations, and tap into larger sources of capital. These relationships also support efforts to actively track and manage climate impact across the value chain (including for suppliers). Successful companies use their strong relationships to improve their public image, thereby attracting better talent and more customers.

Embedding Sustainability into Capital and Investment Decisions. Including sustainability considerations in capital and investment decisions makes the company’s strategy and long-term vision future-proof by preparing it for any uncertainty that might arise from regulations, compliance requirements, and higher costs. The top performers redefine investment policies to promote sustainable investments and rebalance existing portfolios.

It should come as no surprise that when the finance function oversees climate performance, companies significantly outperform their peers. For companies that are truly committed to achieving their ESG objectives, the CFO’s leadership is essential for hardwiring these new priorities into steering and performance management. Moreover, as new ESG regulations come into effect, finance functions have the right competencies to translate the requirements into internal policies and systems. Simply put, corporate success depends on having strong climate performance—and CFOs are the right people to make it happen.

The authors thank Hady Farag, Udit Mehra, and Juhi Mittal for their contributions to this article.