It’s no longer as simple as “bigger is better.” Retailers need to build local ecosystems to reach customers where they live and work.

The old rules of retail are gone.

Historically, retailers have followed a strategy of building scale through store expansion and geographic reach. More brick-and-mortar stores meant greater economies of scale, lower operational costs , and the buying power to reduce the cost of goods sold. Retailers would then reinvest these savings to improve the customer experience and to lower prices, attract new customers, and fund the opening of even more stores. Continuing this cycle of “winning through scale” was the key to retail success.

But all of that is changing. We’re currently in a period of fast evolution in retail, with several trends combining to overturn the traditional strategic approach:

- Spending has quickly moved online across categories and geographies, with online spending in the US growing from 8.2% to 14.5% between 2016 and 2021 and nearly doubling in China in that same period, growing from 12.6% to

24.5%.1 1 US Census Bureau; National Bureau of Statistics of China. COVID lockdowns accelerated adoption, with consumers confidently purchasing everything from toilet paper to TVs online. While physical stores continue to have importance and value to consumers, their role in the customer journey has fundamentally changed. - Competition has intensified, as new entrants and digital-first players such as food delivery companies steal share from incumbents such as grocery retailers; others are taking a cut of logistics value in the traditional value chain.

- Platform and marketplace players are taking increasingly larger shares of consumers’ digital spending as companies expand product offerings and sweeten loyalty perks. Digital ecosystems such as Amazon and Alibaba offer a much broader array of products and services, covering everything from health to entertainment. Amazon is estimated to account for 44% of all e-commerce sales, according to Forrester, with Walmart taking the next-largest share at just 10%—making it difficult for even large retail players to get a foothold.

- Customers are shopping differently, with 71% of them shopping in micromoments—in other words, when they are doing something else. Consumers now have heightened demands and expectations; they’re seeking more personalized offers, convenience, differentiated experiences, and better service than ever before, which is leading to closures of legacy store formats.

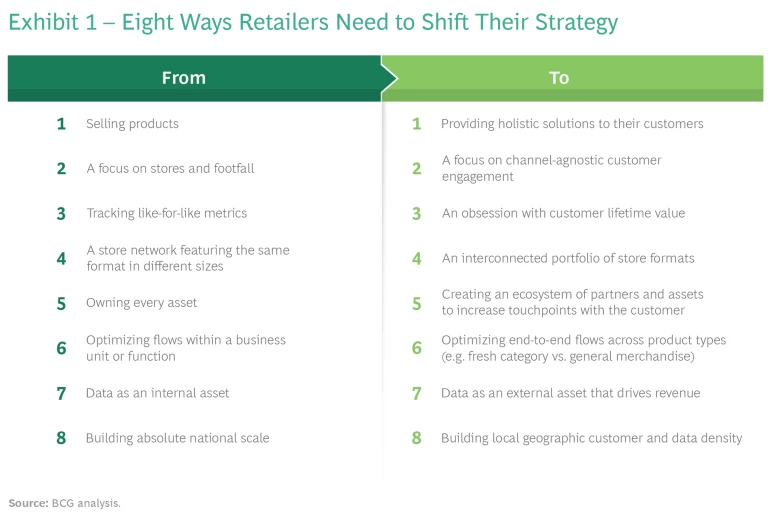

In the face of these market forces, retailers must completely rethink the customer proposition they offer and the operating and economic models they use. A one-size-fits-all value proposition is no longer a viable approach. Instead of trying to grow by implementing the same model everywhere, retailers must compete for customers at the local level with an approach that emphasizes customer density. This means creating a winning network, localizing through a deep understanding of the customer, and building a customer journey across multiple touchpoints. To do this, retailers must make several bold shifts in their strategy. (See Exhibit 1.)

We call this new approach to retail strategy “Win the Town.” To explain how this approach works in practice, let’s take a closer look at these eight strategic shifts—along with some examples of retailers that are moving toward this future retail model.

From selling products to providing holistic solutions, capturing more consumption occasions. This requires a deep understanding of customers—looking beyond when, where, and how they want to shop to answer why they’re shopping and what they’re shopping for.

For example, a grocery retailer could move from merely selling food to being a “feeding the family” solution provider as well as a “throwing a dinner party” and “staying healthy” solution provider. This shift to solutions adds value for shoppers while creating opportunities for retailer growth.

Just recently, home-improvement retailer Lowe’s announced a partnership with Petco to create store-in-store concepts for the latter’s pet products at 15 Lowe’s locations. This pilot program expands the “total home” solutions strategy of Lowe’s while bringing Petco’s brand into a new customer shopping occasion.

Dollar General also recently updated its offering, shifting from “discount general merchandise” to more of a family-needs solution by introducing fresh produce. Some 75% of the US population lives within five miles of a Dollar General store, making it the closest food retailer for many small towns and rural areas of the country. The company is growing quickly, with plans to execute 2,980 real estate projects in 2022, including 1,110 new store openings and 1,750 remodels—thus meeting a broader set of customers and missions.

From focusing on stores and footfall to channel-agnostic customer engagement. As the line between online and offline continues to fade for customers, so will the difference between a “local convenience” concept and a traditional format; consumers just see the brand and how it’s fulfilling their needs. For retailers, attributing sales to a specific channel—in store or online—also becomes challenging and counterproductive. As retailers open specialty locations focused on service or brand building—which in turn can drive sales online or to a larger-format location while building overall brand loyalty—traditional KPIs can actually drive conflict within operating teams rather than encouraging growth.

From tracking like-for-like metrics to an obsession with customer lifetime value. To win the town, retailers need to move from assessing the value of each store as an individual silo to measuring the total value of each customer and how those customers are being served across a network of assets. This shift in thinking has led to new formats focused on services and omnichannel capabilities, allowing retailers to rethink their offerings in the context of the future market and outside of the confines of traditional reporting metrics.

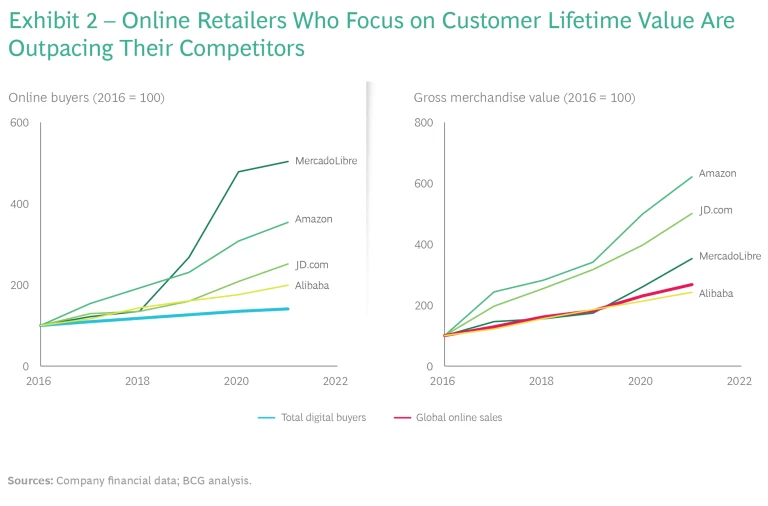

Many of the world’s most successful digital-first retailers are known for their relentless focus on building customer lifetime value (CLV), rewarding loyalty with benefits and added service options such as fast shipping and media streaming—knowing that, in return, these customers will spend more over the duration of their membership. (See Exhibit 2.)

By expanding beyond traditional KPIs for success, these retailers have been able to meet their customers’ needs and build value for their companies.

From a store network featuring the same format in different sizes to an interconnected portfolio of store formats. To play a role in these new consumption occasions—and meet the needs of shoppers most seamlessly and efficiently across channels—retailers must rethink their assets and how they can most effectively operate as a unified portfolio of customer touchpoints and a unified fulfillment network.

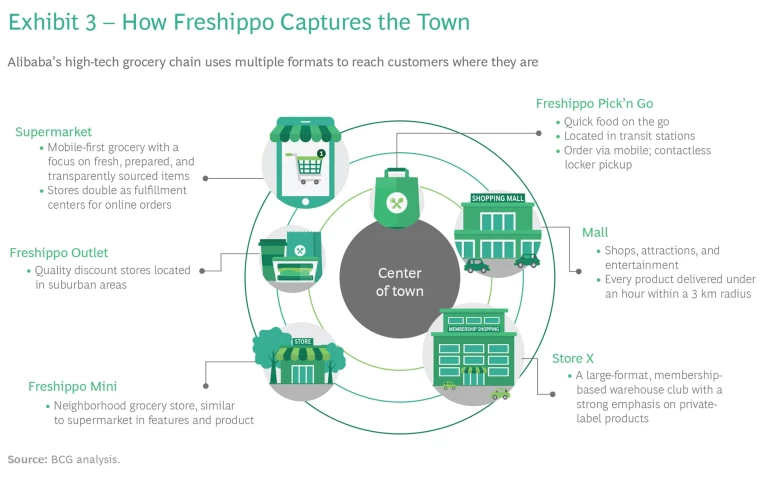

For its high-tech grocery chain, Freshippo, Alibaba has built a network spanning digital and physical touchpoints with their customers within major cities in China. They’ve built local scale through a brand of physical storefronts, delivering tailored offerings based on location: convenience shops near train stations, grab-and-go prepared-foods stops in business corridors, and neighborhood grocery stores in local communities. These formats are in addition to online shopping via Alibaba’s marketplace and fulfillment by stores that also can deliver directly to customers’ homes. Alibaba is expanding the number of customer touchpoints well beyond conventional in-person shopping, all while fulfilling multiple missions and becoming the go-to for all its customers’ food needs. (See Exhibit 3.)

From owning every asset to building an ecosystem of partners and assets that provide touchpoints with the customer. Traditionally, retailers stayed within their own company structure, operating as independent entities and building capabilities in house. But given the speed of innovation within the industry—and the growing reach of tech giants—all retailers must look to their broader ecosystem of alliances and partners to economically grow touchpoints and density with customers within a geographic area.

We’ve recently seen retailers form technological and operational alliances and partnerships—for example, partnering on voice technology capabilities or delivery services. On their own, these initiatives would be costly and would carry a high risk for failure, but by working together these retailers have greater power and chance for success. Customers see this play out most prominently in shop-in-shops or product partnerships, such as Sephora and Kohl’s in the US or Suning and Carrefour in China. These arrangements bring category expertise to the “host” retailer while adding additional customer touchpoints for the partner retailer.

From optimizing flows within a business-unit function to optimizing end-to-end flows across product types. With a diversity of touchpoints and assets in the same geographic area, retailers can reconfigure operations to operate as a whole rather than within individual business units. In this model, physical stores are no longer just customer interfaces, they are critical components of a distribution network. For example, larger stores can become distributing centers for smaller stores, while neighborhood stores can support last-mile delivery for grocery delivery—a smaller, nimbler operation closer to the customer’s doorstep.

As channels grow—for example, on-demand or third-party fulfillment—retailers need to reconsider how they optimize end-to-end flows by product archetype to meet customer needs. On-demand delivery of short-life vegetables requires different handling than long-life vegetables in store. Designing a supply chain to meet these varying needs requires a more nuanced thinking of flows—whether to cross-dock at a larger store or deliver direct-to-store, for instance—and greater intelligence (through AI, for example) to operate on a day-to-day basis.

From data as an internal asset to data as an external asset that is monetizable. Over time, retailers can also use data as a springboard for new business ventures and revenue streams. Forrester recently predicted that global revenue from the retail media category will reach $50 billion in 2022. And with retailers around the world launching platforms, advertisers have increasing options for targeting shoppers—while retailers have new opportunities to build an adjacent business.

For example, The Home Depot’s retail media business—powered by the retailer’s trove of customer data and combined with agile data-science and AI systems—personalizes the digital experience for customers on HomeDepot.com while also supporting the company’s broader marketplace vendors. Home Depot has monetized its data by creating an advertising platform which connects the right vendors to the right customers at the right time. And it’s not only Home Depot seeing success with data monetization: Walmart, Kroger, Woolworths, and many others are quickly growing their media businesses.

From building absolute national scale to building local geographic customer and data density. Retailers will need to know what matters most to customers at the local level, utilizing AI-powered forecasts to anticipate demand, manage inventory, and effectively allocate space and labor across physical locations.

In winning the town, a retailer will not just offer the best price or a mass promotion. It will build a deeper understanding of the local customer and become a significant piece of the customer’s day-to-day experience. To do this, retailers will need to understand the nuances of customer behavior and what drives choice for different shopping occasions—which, in turn, will inform the retailer which occasions and needs to solve for, how to expand touchpoints in the retail network, and which partnerships to pursue. This allows retailers to deliver a better overall value proposition for each customer (across product, price, service, and experience) with an efficient delivery system.

It’s possible for any retailer, regardless of size or product focus, to deploy a strategy of winning the town—building a winning position in each town it serves and driving increased consumer engagement, a larger share of sales, and lower operating costs. Applying this framework takes a willingness to rethink the customer relationship, the channels in which a company plays, and operational capabilities, as well as the overall business model and economics. (See Exhibit 4.)

Given the speed of change in retail, moving too slowly likely will have significant consequences. While many retailers are developing new AI , user experience, and other data-driven digital capabilities that will allow them to move in this direction, few are doing so at scale. In the last decade we’ve watched many retail giants fall after digging their heels in on strategies that are no longer competitive—strategies that are reliant on stores, unresponsive to consumer demands, and inflexible to advancements in digital capabilities.

Now is the time to recognize the opportunities—and threats—inherent in this growing ecosystem of digital capabilities. The winners of the next decade will be those retailers that can reimagine their fundamental business model while simultaneously managing near-term growth targets.