To get beyond the starting line, CEOs need to approach the challenges of sustainability from a strategic and value-creation perspective in terms of both the questions they ask and the answers they seek.

Rarely in business history have CEOs had more significant opportunities to capture advantages, reset industries, and anchor their legacies than at this moment in the global race to sustainability. These opportunities span industries and regions, and they extend beyond current net-zero ambitions and environmental, social, and governance (ESG) targets. CEOs should formulate strategies that create and capture long-term competitive advantage from the transition to net zero and sustainability.

This is a race—one that has already begun and is quickly accelerating. Capital markets have seen tremendous growth in ESG-related assets under management, and they are projected to rise from $35 trillion in 2021 to $50 trillion globally by 2025. Sustainability-linked loans and financing exceeded $1.6 trillion in 2021, up by a factor of three since

And yet, most companies are still making their way to the starting line of the race to sustainability and have not addressed it in a strategic manner. This isn’t surprising: when confronted with long-term endeavors, many CEOs struggle to balance the imperative of meeting quarterly expectations with the need to grapple with the many uncertainties of transforming their businesses. When it comes to sustainability, more than a few CEOs are attempting to walk this line by pointing to ambitious net-zero statements and ESG targets as evidence that their companies are front-runners in the race to sustainability. These are good moves, but they are quickly becoming de rigueur for well-managed companies, and they are insufficient to seize competitive advantage.

If public commitments and ESG targets are no longer considered evidence of being a front-runner, what is?

The Leaders in Sustainability Strategy

Assessing the relative scope, scale, and speed of a company’s business transformation can reveal whether it is a leader in sustainability strategy. Specifically, a company should have some degree of scale in all the following indicators:

- A morphing corporate portfolio, business boundary, and asset base that enable sustainability transformations in a company’s operations, its customers’ operations, and industry infrastructure

- An evolving product portfolio with a growing share of revenues and higher margins from the sustainability segments in the company’s markets

- Restructured supply chains that are designed to improve business resilience and lower emissions via more sustainable suppliers, capabilities, and content

- An innovation portfolio and supporting ecosystems that accelerate investment in sustainability technologies, infrastructure, products, and services

- New customer value propositions that are differentiated and priced according to their sustainability benefits

- A portfolio of commercial arrangements, investments, and ventures that mitigate and exploit sustainability scarcities in the value chain

- The creation of new business ecosystems that enable sustainability solutions and markets

- Strategies aimed at resetting the basis of advantage for the industry that prompt commensurate competitor reactions and industry disruption

We examined more than 500 sustainability initiatives from companies around the world, and we found that only 1 in 5 initiatives showed any meaningful connection to drivers of business value and advantage, and only 1 in 15 was changing the basis of industry competition and the boundaries of the company’s business model.

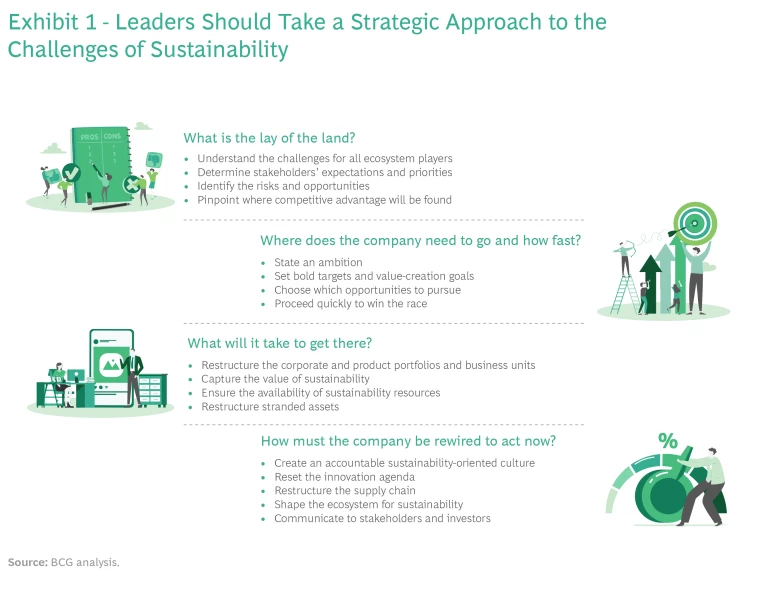

To get beyond the starting line of this race, CEOs need to approach the challenges of sustainability from a strategic and value-creation perspective in terms of both the questions they ask and the answers they seek. This approach will not only ensure that their company will act on sustainability imperatives in an aligned and rigorous way but also assure their boards, investors, and other stakeholders that the company is properly prepared to enter the race to sustainability. Developing a strategic perspective involves answering four questions. (See Exhibit 1.)

- What is the lay of the land?

- Where does the company need to go and how fast?

- What will it take to get there?

- How must the company be rewired to act now?

What Is the Lay of the Land?

Leaders typically begin a strategy-making exercise by understanding the near- and long-term challenges facing their company, customers, competitors, stakeholders, and value chains—and identifying the opportunities embedded in those challenges. Leaders should do the same to create advantage in an era of sustainability. In many companies, this will require adjusting the aperture through which the leadership team views sustainability and the team’s strategic time horizon.

Too often, we see leaders viewing sustainability through the narrow aperture of operations. They tackle scope 1 or 2 emissions as an end in itself, for example, rather than using the effort to drive business growth. Reducing emissions is not inconsequential, but neither is it strategic in nature unless engineered to be so. At a time when the context for business is forcing leaders to deal with climate and sustainability challenges that extend far beyond the company’s borders and planning horizons, leaders should become adept at viewing the challenges and opportunities in their company, industry, and business ecosystems through this wider strategic lens.

Once a wider aperture is set, companies can bring deep stakeholder discovery and rigorous scenario assessment to bear on sustainability. Stakeholder discovery is aimed at thoroughly understanding material stakeholders, their current expectations and priorities, and how they are likely to change. Shifts in consumer behaviors, procurement priorities, supply chain capacities, regulations, investment flows, new climate abatement technologies, and climate impacts on business resilience are just a few of the changes that could affect a strategic direction.

Scenario assessments explore the changing stakeholder expectations by region (including regulations) and what they may mean to the future performance of the business. Such assessments enable leaders to test how robust the business is likely to be given changing environments, stakeholder dynamics, and various constraints. For instance: How will the business perform under different carbon tax regimes? If the business is manufacturing, how will it fare when faced with regulations that extend the company’s responsibilities for the social costs of its products? If the business sells consumer goods, how will it perform if behaviors shift and consumers expect and reward higher levels of proven sustainability in the content of products?

The goal of all this work is for leaders to come away with a conviction about where the competitive advantages associated with sustainability lie.

Understanding the lay of the land also includes identifying other potential risks and opportunities. These could emerge from shortages in resources (such as key materials needed to manufacture a more sustainable product). They could come from productive assets that become unsustainable (such as high-emission production equipment, data centers in water-scarce regions, or significantly diminished farmland owing to soil degradation). And risks and opportunities could result from changing labor demographics or norms and regulations that demand a living wage throughout a company’s supply base. In essence, understanding the lay of the land entails identifying new risks and new spaces for growth that might arise from the push for sustainability.

All risks and opportunities need to be explored over short-term and midterm timelines. Already, evidence suggests that the prevailing forecasts for the adoption and penetration of electric vehicles and various devices powered by renewable energy have consistently missed the mark, with change happening faster than predicted. Leaders need to anticipate these and other possibilities if they are going to win the race to sustainability.

The goal of all this work is for leaders to come away with a conviction about where the competitive advantages associated with sustainability lie, how they may shift, and what the company can do to capture them.

To understand how sustainability trends could impact its P&L, Brussels-based Solvay, a global chemical company founded in 1863, uses a sustainable portfolio management (SPM) tool that informs capital allocation across all research and innovation projects, all capital expenditure decisions that exceed $10 million, and all M&A deals. The SPM tool provides management with a fact-based dashboard that helps steer decisions in two ways: It assesses the company’s products’ environmental manufacturing footprint and operational vulnerabilities (across 19 sustainability indicators). It also provides a forward-looking view of market signals driven by sustainability benefits and challenges (qualitatively assessed by asking 60 questions). For example, for Paramove, a product that controls parasitic diseases in farmed salmon and enhances yields, the SPM tool revealed a very low operations risk when comparing the potential costs of externalities to revenue potential, and it uncovered no environmental risk (the product breaks down to water and oxygen). This assessment, combined with a potential growth in annual sales in excess of 10% annually, helped Paramove earn a star rating in Solvay’s portfolio.

Solvay reports that the SPM tool has been applied to 80% of its product portfolio. In 2020, the company expected 77% of its research and innovation revenues and 52% of its global revenues to derive from sustainability solutions on the basis of its SPM assessments.

Where Does the Company Need to Go and How Fast?

Once leaders understand sustainability’s risks and opportunities, they can state an ambition, set bold targets, and choose which opportunities to pursue. Selecting opportunities requires knowing how they will reinforce the company’s advantage, differentiate its brands, and drive profitable growth. Leaders need to be able to win support for their decisions from the board of directors, employees, and investors—whose help will be required to deliver results, especially when broad business transformations are required.

CEOs also need to set bold value-creation goals to win the race to sustainability, to catalyze innovation, and to guide business model transformation. These goals should be connected to its core business and make a material contribution to its long-term performance. Companies on the leading edge of sustainability pursue it in a manner that leads to growth and enhanced business resilience, thereby leading to a virtuous cycle of greater sustainability and enhanced performance.

How quickly a company needs to act depends on its understanding of the competitive opportunity and risks. We find too many companies fail to analyze the risk of not acting. They compare investments in sustainability transitions to the current performance baseline of their business and do not recognize or consider the growing risks and disruption potential inherent to the current business model. Furthermore, as their competitors begin sustainability transitions, certain resources and infrastructure necessary to transition will become scarce and more expensive. Moving with the pack risks being competitively disadvantaged.

The pace at which green technologies are evolving and the rate at which their associated costs are falling have been consistently underestimated. For example, according to the World Economic Forum, projections of solar photovoltaic capacity in 2030 increased by a factor of 36 from 2002 through 2020, while projected unit costs dropped by a factor of three. And forecasts have underestimated the pace of societal change. The adoption of electric vehicles (EVs) is a good example: from 2016 through 2018, Exxon Mobil updated its estimate of the number of EVs on the road by 2040 three times, increasing it by more than

Hitachi, the Japanese conglomerate whose business segments include heavy construction equipment, electronics, mobility, and technology, has put up the table stakes of sustainability. The company has made a public commitment to achieve carbon neutrality (scopes 1 and 2) by 2030 and to reach neutrality across its value chain by 2050. Hitachi substantiated its commitment with detailed near- to mid-term milestones and underpinned it with a robust decarbonization plan. But the company also has reframed its strategic vision around sustainability, and it launched a social innovation business unit that seeks to create social, environmental, and economic value across a number of realms, including manufacturing, energy, transportation, and urban development.

Too many companies fail to analyze the risk of not acting.

Hitachi’s Lumada is a digital ecosystem platform that provides the underlying data infrastructure needed to work with clients and ecosystem alliance partners to cocreate sustainability solutions and define new value pools that leverage clients’ assets and data. Working with Kashiwa-no-ha Smart City, for instance, Hitachi used Lumada to develop an area energy management system. The AEMS connects offices, shopping centers, residences, and public facilities with energy sources, such as solar power and batteries, through independent transmission lines and information networks. It also includes one of Japan’s largest industrial lithium-ion storage battery systems and peak shift-and-cut controls to minimize the need for high-emission energy sources across regional borders in real time.

Hitachi’s ambition is to grow group operating income to 1 trillion yen ($8.7 billion) by FY 2025 (up from 495 billion yen in FY 2020), with 50% of the gain derived from Lumada. In FY 2021, Hitachi businesses using the Lumada platform were expected to reach 1.6 trillion yen in sales.

What Will It Take to Get There?

Once leaders understand where they can generate significant value from sustainability, they can begin the work of reshaping the company. For most companies, this will be a necessity, because it is unlikely that the current strategy, business models, and corporate and product portfolios were designed with sustainability in mind.

As leaders begin their work, they should address four challenges: restructuring the corporate and product portfolios and business units—a necessary task to achieve a sustainability advantage; capturing the value of sustainability, including its impact on the cost of capital; ensuring the availability of sustainable resources needed to execute the strategy; and restructuring stranded assets.

Restructuring the Corporate and Product Portfolios and Business Units. Companies seeking a long-lasting competitive advantage from sustainability will need customer offerings that deliver a step change in sustainability performance that can be differentiated in the market. Identifying such offerings usually requires the assembly of a new portfolio of sustainable businesses and products, with all the implications for the corporate development agenda and business boundaries that infers. Bolting sustainability onto existing businesses probably won’t be enough: a few green product lines may offer incremental sustainability enhancements and buy some time, but they will not create lasting competitive advantage.

Bolting sustainability onto existing businesses won’t be enough to create lasting competitive advantage.

Paris-based Saint-Gobain, a manufacturer of construction and other high-performance materials, re-envisioned and reshaped its portfolio as a one-stop shop for sustainability solutions. The company assembled a unique combination of 117 brands that offer customers holistic sustainability solutions. For example, it has 33 products and services that when used together can improve the energy efficiency of a home by 70%. The new portfolio supports the company’s mission to become the worldwide leader in light and sustainable construction, and in 2021, that portfolio was responsible for producing 72% of the company’s sales.

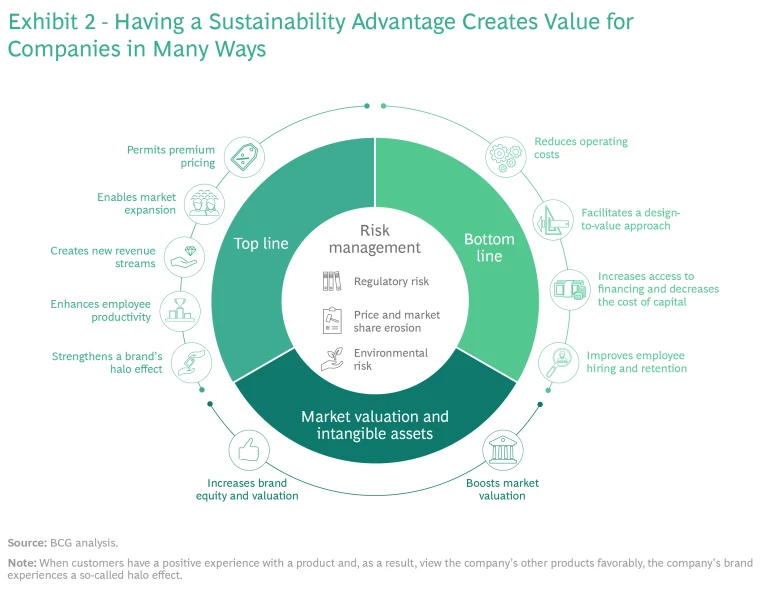

Capturing the Value of Sustainability. Leaders need to develop a comprehensive understanding of how their company will create market value from their sustainability advantage. (See Exhibit 2.) Knowing where value can be captured requires deeply understanding the best mix and sequencing of abatement technologies, the trajectory of customers’ sustainability needs, which market segments will evolve faster and offer a green premium, and the ESG dimensions that capital providers consider most material for preferred financing.

Swedish steel manufacturer SSAB, which is operating in one of the hardest-to-abate sectors, aspires to bring fossil-free steel to the market across its product portfolio, a critical enabler of its ambition to reach net-zero by 2030. SSAB sees fossil-free steel as an opportunity to expand its premium-products segment and capture value through a pricing premium in a less competitive space, while seeing operational improvements that provide greater volume flexibility and lower maintenance costs and capital expenditures. In 2021, SSAB delivered its first fossil-free steel to Volvo, and the company is already seeing a strong appetite for the product among its customers. It is working with Faurecia (a tier one supplier of automotive technology), Mercedes-Benz, and Volvo to create prototypes of components.

Some investors are willing to trade earnings today for reduced emissions and improved sustainability tomorrow.

Investors are another important source of sustainability value. They are awarding higher values to companies that are well positioned to meet sustainability challenges, resulting in lower costs of capital. In addition, we have found evidence that some investors are willing to trade earnings today for reduced emissions and improved sustainability tomorrow. For example, a BCG analysis found that market valuations in the materials sector indicated that investors valued the elimination of a ton of recurring carbon at $45 in current earnings. In essence, it was a no-regret move for a company in that sector to pursue abatement investments up to $45 per ton. When companies understand where investors’ marginal indifference point is positioned—what percentage of earnings they can invest today to reduce emissions tomorrow—companies can invest more aggressively in business transitions and gain the advantage over their peers.

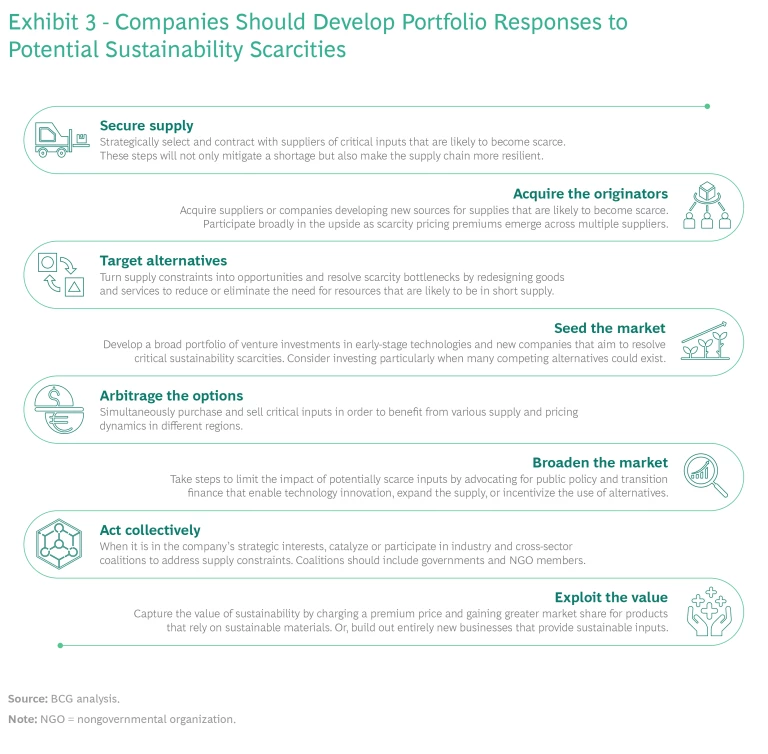

Ensuring the Availability of Sustainability Resources. As more and more of the world’s largest businesses develop new products and processes and redesign existing ones to reach sustainability targets, bottlenecks and scarcities are highly likely to emerge for critical inputs. To avoid being locked out, leaders need to identify where sustainability scarcities may emerge in their ecosystems and develop a robust set of portfolio responses to mitigate them. (See Exhibit 3.)

When Belgian recycler Umicore recognized that there were likely to be scarcities in key metals (including lithium and cobalt) as the global energy transition progressed, it created a closed-looped business model that aims to turn waste into feedstock for its customers and its own clean mobility production. The company also signed long-term contracts to obtain sustainable lithium supplies from two vendors to further secure inputs for its battery cathode products.

Restructuring Stranded Assets. As leaders transform a business in pursuit of the sustainability advantage, parts of its asset base will no longer be fit for purpose. This is especially true in high-emitting industries with long-life capital assets. In the oil and gas sector alone, the associated risks of stranded assets are estimated to reach $1.4 trillion of cumulative net present value by

Identifying at-risk assets necessitates that leaders evaluate the company’s assets against a sustainability scenarios matrix and then segment the assets by the actions required for disposal and the timing. In many cases, the investment demands for achieving the sustainability advantage in existing assets will rise above historical levels, sometimes by multiples. To meet this demand, leaders should encourage innovation across corporate structures, financial engineering, and capital mix. For instance, companies may need to tap new transition-financing instruments, sustainability-linked bonds, or public-private financing, or all three.

In 2008, when Dong Energy embarked on the black-to-green transformation that would eventually lead to its 2016 IPO as Ørsted, it was producing 85% of its heat and power from fossil fuels, and it was responsible for one-third of Denmark’s carbon

How Must the Company Be Rewired to Act Now?

Most companies will need to reshape their organization structure and culture to capture the sustainability advantage. Often, reshaping will require refreshed incentive and decision-making frameworks that can drive an accountable, sustainability-oriented culture. It will also require a reorientation of a company’s innovation agenda, supply chain, and ecosystem to support the quest to capture new value streams. And, as always, reshaping will require a compelling, integrated investor narrative that articulates a differentiated approach to sustainability that is aligned with the corporate purpose and anchored in competitive advantage.

Create an accountable sustainability-oriented culture. To drive the growth of a company, sustainability needs to be explicitly embedded in leadership and decision-making frameworks, capital allocation and governance practices, and incentives. Otherwise, the ability to practice sustainability as an advantage can run into resistance as it confronts mindsets and corporate DNA that have been developed and reinforced by decades of functional and operational optimization focused on shareholder value and quarterly earnings.

The race for sustainability requires new muscles and the courage to run off-trail. Thus, it isn’t entirely surprising that our analysis of corporate sustainability initiatives found that more than 90% of the initiatives that created the most robust and resilient business models with the most significant environmental and societal benefits featured an internal vision and purpose that helped to energize an accountable sustainability culture. In this regard, CEOs must be convincing and clear and continuously assure stakeholders that this race will be worth running—and that it will be run.

Tying the compensation, retention, and promotion of individual leaders to sustainability is essential, of course, but it takes more to activate a culture and an organizational mindset that embeds sustainability into every facet of the business and applies it as the lens through which decisions are made. It requires rethinking capital allocation tools (for example, new discount rates and payback periods), finding mechanisms that internalize the costs of externalities (such as carbon, water, and waste), creating governance structures (for example, carbon budgets), and re-equipping leaders, functions, and businesses with the necessary skills (such as those required for systems dynamic mapping).

An internal vision and purpose helped to energize an accountable sustainability culture.

Most industrial companies have analogous experience in embedding a safety-first culture. They have reset employees’ safety mindset by continuously making changes on the shop floor, integrating indicators on dashboards, reworking capital investment templates, and including performance measures in senior executives’ compensation. Years later in such companies, many employees say, “Safety is just how we do things.” We expect sustainability to follow a similar journey.

Reset the innovation agenda. Winning a sustainability advantage requires the creation of new technologies, business models, ecosystems, and markets. Accordingly, R&D and innovation investments need to be redirected.

An innovation agenda aimed at a sustainability advantage should be anchored by the company’s R&D portfolio, enlist external strategic partners, and reflect emerging technologies in the rapidly expanding startup space. In addition, senior leaders need to be clear as to how that agenda will deliver on the company’s strategic priorities and bolster its product and business portfolios.

Dow, a US-based chemicals and plastics manufacturer, redirected its innovation agenda toward sustainability by identifying and focusing its investments on three priority areas: climate protection, the circular economy, and safer materials. In 2020, the company invested approximately $770 million in R&D, with 80% of its R&D projects focused on those areas. Dow also linked its Sustainable Chemistry Index, a tool which assesses the sustainability attributes of its businesses and products, to its innovation agenda.

Restructure the supply chain. Fully implementing sustainability innovations at scale will require fundamental rewiring of a company’s supply chain. Many innovations will be able to deliver their full sustainability and business potential only if the underlying supply chain is shifted to ensure that sustainability is measured and optimized at each step of the production process.

There are five actions that companies can take across their value chain to bolster sustainability and resiliency. They can improve the sustainability of inputs, redesign products and packaging, increase resources within the chain for resilience, optimize the networks considering both efficiency and resilience, and pursue circularity.

We see examples of companies taking some of these actions, but few are doing all five in a way that will fully transform the supply chain. Consider McCormick & Company. Its sustainable sourcing standard “Grown for Good” focuses on safe and ethical supply chains, regenerative production systems, and resilient communities. The standard is certified by third-party verification and goes beyond industry standards by including criteria for women’s empowerment and farmer resilience. It has been a driving force for reshaping the company’s supply chains for sustainability beyond carbon, and it is the first standard to cover spices and herbs specifically.

Shape the ecosystem for sustainability. Sustainable companies need a sustainable ecosystem, and they should shape it in ways that benefit their strategic goals through bilateral partnerships, sustainability business ecosystems, and corporate-led sustainability alliance. For example, a beverage manufacturer may aspire to have sustainable packaging but be limited by the recycling capacity in key markets. The manufacturer should pinpoint the short-term and long-term recycling constraints and then determine when and where to collaborate with others to overcome those constraints.

An ecosystem for sustainability can encompass supply partnerships, solution partnerships, or alliances aimed at shaping standards and influencing public policy. For instance, in 2021, Texas-based Hyliion, a maker of low-carbon, electrified powertrain solutions for the heavy transportation market, formed an ecosystem named the Hypertruck Innovation Council to advance electrification solutions for commercial transportation. The council is a group of leading companies focused on removing barriers to sustainability, while creating unique sources of advantage. The companies—including Agility Logistics, American Natural Gas, NFI Industries, and Ryder System—collectively represent 100,000 Class 8 commercial trucks globally and represent some of the world’s largest private fleets. Hyllion is working with the innovation council to pilot Hypertruck ERX, a net-carbon-negative commercial transport.

Communicate to stakeholders and investors. Capturing the competitive advantage of sustainability requires engaging stakeholders and investors in the company’s sustainability ambition and initiatives. The table stakes here include reporting ESG performance (compared with the converging standards), applying better disciplines in target setting (such as using science-based emissions-reduction targets), and being transparent about material ESG issues. But standing out means, at a minimum, clearly demonstrating, particularly to investors, the links between the company’s sustainability agenda and the quality, competitiveness, purpose, and resiliency of the business.

This higher standard means infusing the company’s sustainability ambition into brand and corporate narratives. The goal is to activate employees and strengthen their affinity because they know they are part of a company that is changing the world for the better. It also means strengthening the loyalty of customers and suppliers because they benefit from the value that the company brings to their journey to sustainability.

A decade ago, the luxury fashion retailer Kering started to develop an interactive tool that presents the environmental impact of its activities in order to demonstrate transparency to its stakeholders. Its online environmental profit-and-loss statement deconstructs the monetary impact of the company’s environmental externalities across business units, processes, value chain players, and raw material inputs. This approach enables Kering to report its environmental performance in each area, maintain a running tally on its progress, and communicate clear targets for the overall environmental impact of the business.

A Call to Action

We are on the cusp of a remarkably broad and deep business transformation propelled by corporate and infrastructure investments estimated at more than $3.5 trillion per year through 2050. This transformation offers enormous growth opportunities for the companies that understand how to pursue sustainability for advantage. Investors wielding trillions of dollars are on the hunt for companies that can deliver this sustainability advantage, and they are increasingly willing to penalize the laggards. Emboldened by hardening public opinion, governments are putting in place increasingly ambitious sustainability targets and backing them up with spending. But most companies are not moving with the bold foresight, ambition, and speed needed to secure sustainability as competitive advantage and reset the basis of competition. Companies must up their game to win what may well turn out to be the most important race of this business era.