Marketers know that bold and consistent investment plays a direct role in shaping consumer perceptions and driving market-share growth. However, most organizations struggle to track the impact of their investments until months or quarters have passed, making it hard to gauge whether a campaign is working or if a pivot is needed.

Backward-looking and delayed measurement also puts brand investment at risk. Without credible evidence of return on investment (ROI), marketing budgets can land on the chopping block during periods of economic uncertainty, which can cause negative, long-term consequences. As BCG research has shown, recovering lost brand momentum can cost $1.80 for every dollar saved .

Marketers need timely insights into a consumer’s expected purchasing, engagement, and loyalty behaviors.

To avoid these risks, marketers need timely insights into a consumer’s expected purchasing, engagement, and loyalty behaviors. They need to know, for instance, if theirs is the first product that comes to mind when a consumer is thinking about a healthy breakfast cereal for their kids or which tires would be suitable for a winter road trip. Getting into that consideration set drives sales growth, but it requires a precision-branding metric capable of tracking a consumer’s unconscious decision-making habits.

One such metric is First-Fast Response (FFR), BCG’s new indicator of “mind share.” It measures a consumer’s likelihood of choosing a brand in specific needs-based contexts, known as demand spaces . Testing shows that FFR is highly sensitive to picking up perceptual shifts within these specific buying contexts—often doing so in a matter of weeks after exposure to marketing campaigns. By integrating this new precision metric into their planning, marketers can optimize in-year brand investment and credibly demonstrate the impact of such investments on future share.

A Different Kind of Metric

To boost return on investment, brand campaigns must be tailored to specific demand spaces. Products such as bleach, for example, are used to remove laundry stains in some cases and disinfect surfaces in others. These are two different problems to solve in the minds of consumers, and they expose brands to different competitive sets, each with their own share of voice (SoV) and share of market (SoM) characteristics.

The stronger the brand association in a given demand space, the more likely a customer is to choose that brand over alternatives.

Tailoring messaging to demand spaces can yield powerful results. Our research found that when marketers align campaigns with specific needs-based contexts, they can influence consumers’ unconscious brand associations more effectively than when they use catch-all campaigns. The research also found that brand mind share is highly predictive of purchasing intent. The stronger the brand association in a given demand space, the more likely a customer is to choose that brand over alternatives.

To design and manage these campaigns, marketers need a metric that can track the unconscious associations that drive purchasing behavior. And that metric needs to be quick at sensing when consumer perceptions change.

Traditional brand metrics aren’t cut out for this task. While awareness and consideration metrics can be helpful early in a brand’s life cycle, these indicators tend to be remarkably stable for established brands and rarely capture nuances in sentiment across audiences. As such, they are not reliable at sensing “good” marketing campaigns or predicting future purchasing intent, which makes them poorly suited for econometric modeling.

The Benefits of First-Fast Response

In unconscious decision-making moments, the first brand that consumers think of is often the one they go on to buy. To measure this, BCG developed FFR. The metric tracks how easily and quickly a brand comes to a consumer’s mind in specific demand spaces and, over time, compares that initial response to subsequent purchasing outcomes, using data from consumer surveys. Our research shows that FFR has considerable benefits.

Methodology

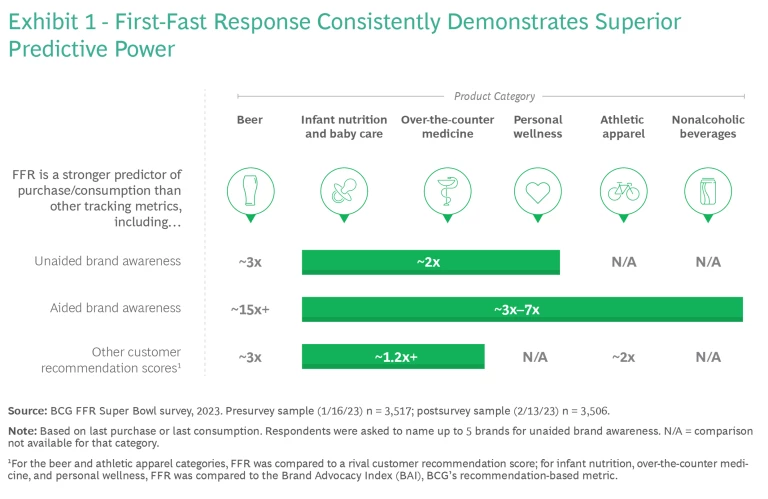

In tests run across six product categories, consumers were more likely to buy FFR brands than those they were simply aware of or that scored well in other popular consumer recommendation scores—making FFR a much stronger predictor of purchasing intent. (See Exhibit 1.) Greater increases for FFR can also provide benefits for econometric modeling.

In our most extensive in-market test, we used FFR to test the impact of brand marketing for beer companies that advertised in the 2023 Super Bowl. Across multiple waves of survey testing, the results confirmed FFR to be superior to other brand metrics both in its responsiveness to marketing activity and its predictive capacity.

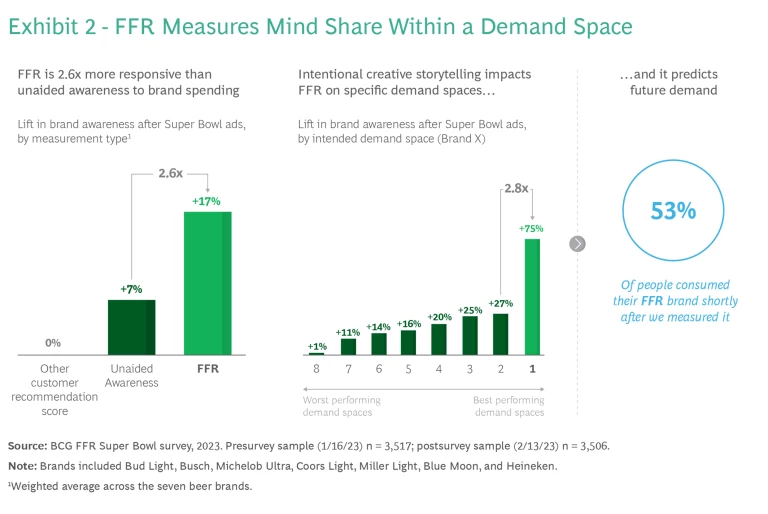

All seven brands that advertised during the Super Bowl improved their core brand health metrics. Compared to unaided awareness, however, FFR was 3.8 times more predictive of purchasing outcomes. In the month after our survey ran, consumers purchased 53% of the brands they had earlier listed as the first ones to come to mind versus 14% of brands noted in unaided awareness.

FFR also captured the greatest variation in consumer response to ads shown during the Super Bowl. Compared to unaided awareness, FFR was 2.6 times more responsive at picking up a change in brand association after the campaign ran. Aided awareness rose only slightly, and scores in another customer recommendation score stayed flat. In addition, FFR was effective at deaveraging how the ad campaign performed across different demand spaces, unlike other traditional metrics that only take a category lens. (See Exhibit 2.)

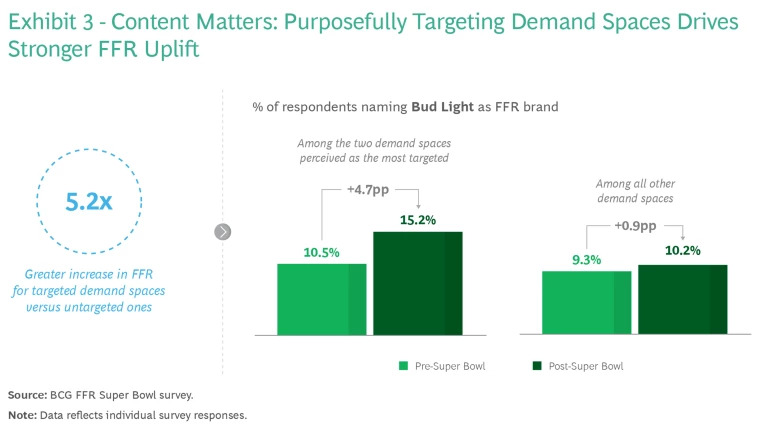

Testing that focused on Bud Light’s advertising, for example, showed that purposeful brand messaging drove the most impact during the Super Bowl. Consumers were 5.2 times more likely to include Bud Light in their FFR set when marketing was targeted at a specific demand space than when campaigns were generic. This heightened response underscores the effectiveness of needs-based messaging in precision marketing and activation strategies. (See Exhibit 3.)

Bringing FFR to Life in an Integrated Marketing Plan

FFR and mind-share measurements can be powerful complements to performance-oriented (or lower-funnel) KPIs and should be used as part of a holistic precision-branding approach. But the tool works best for companies that already have strong market awareness. Smaller brands that haven’t yet achieved broad awareness should focus first on building recognition among consumers.

Using FFR in tandem with conventional metrics can give marketers a more precise understanding of near-term brand impact within targeted spaces. As marketers launch campaigns, they can use FFR to gain early insight into how their outreach is performing, refine those campaigns as needed, and test again.

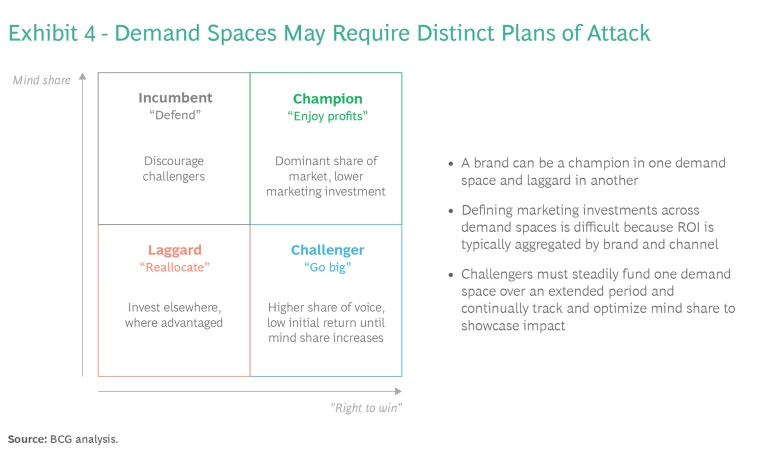

Brands will need a unique strategy for each demand space based on their SoV and SoM. (See Exhibit 4.) The bleach brand mentioned earlier, for instance, might have a high mind share in the stain-removal demand space but much lower mind share in the “sanitize my home for kids” demand space.

When a brand has the ability to outpace peers in a demand space—known as “right to win”—but low current mind share, it may require a substantial, multiyear investment to challenge the current market leader, and that investment may deliver relatively low returns until mind share hits a critical mass. A brand with high mind share and right to win, on the other hand, may be able to substantially reduce overall investment and enjoy higher profitability.

Brands will need to measure “right to win” on an ongoing basis. Doing so requires a multifaceted approach that looks at direct and indirect brand and product exposures and compares FFR to that of competing brand offerings. The ability to sense consumer responsiveness in these ways can drive higher marketing ROI, allowing teams to channel spend most effectively.

Marketers know better than anyone that consumer perceptions can change on a dime. So, too, can intent to purchase. But until recently, most marketers haven’t been able to track if their campaigns are influencing customer perception until months have passed. BCG’s precision-branding metric, FFR, seeks to fill this gap. And tests show that it can provide the early and predictive insights marketing teams need.

Acknowledgements

The authors thank Saurabh Chaddha, Harshit Agarwal, Tanvi Sangwan, and Karunya Deepika Koganti for their support of the field work, data processing, and analytics in our beer survey, and the team at Dynata for their partnership in programming and sampling this research.