Two trends broadly affecting the

semiconductor industry

threaten to significantly increase its carbon emissions from around 0.3% of total global emissions today.

First, demand for chips is accelerating. Virtually every modern industrial and consumer device—from children’s toys to rocket ships, and from the smallest appliance to the biggest automobiles—as well as most daily activities, such as sending an email, ultimately run on semiconductors.

Second, as chips increase in processing power, semiconductor production almost inevitably becomes more carbon intensive. Manufacturing more advanced semiconductors requires ever more complex processes, which consume more electricity and process gases.

If the current growth path were to continue unchecked, carbon emissions from semiconductor production would rise by about 8% annually in coming years and not peak until about 2045.

Springboard to Action

The need to combat climate change grows more urgent as the Paris Agreement’s goal of limiting the increase in global average temperatures to 1.5°C above preindustrial levels slips away. To do its part, the semiconductor industry must develop a decarbonization plan to reach net zero.

But without a clear picture of semiconductor emissions levels at every stage of chip manufacture and usage, there can be no path to net zero. With that in mind, BCG, SEMI, and the Semiconductor Climate Consortium (SCC) have published Transparency, Ambition, and Collaboration: Advancing the Climate Agenda of the Semiconductor Value Chain , a report that offers the most complete analysis of semiconductor-related greenhouse gas (GHG) emissions to date, as well as a detailed analysis of current and future emissions across the semiconductor value chain to facilitate targeted development of abatement solutions.

The research is especially notable for its ambitious range. Not only did we calculate Scope 1 and Scope 2 emissions—essentially, emissions that directly result from semiconductor design and manufacturing activities and from the energy consumed during those operations, respectively—but we also examined Scope 3 emissions. These are upstream CO2 emissions from suppliers’ production and materials sourcing activities as well as downstream emissions from the use of chips by customers in daily applications.

What We Learned

Our research yielded five key findings:

- Semiconductor devices manufactured in 2021 will have a lifetime CO2e footprint of nearly 500 megatonnes (Mt)—15% from materials and equipment (Scope 3 upstream), 20% from device design and manufacturing (Scopes 1 and 2), and 65% from device processing, use, and disposal (Scope 3 downstream). Up to 99% of the Scope 3 downstream emissions arise from the use of devices by consumers, companies, and governments, and are not under the direct control of the semiconductor industry. Increasingly, chip industry partnerships such as the SCC are addressing this issue, attempting to design new ways to reduce the energy consumption of devices over time—including, for instance, equipment in data centers, which are massive consumers of semiconductors.

- More than 80% of semiconductor industry emissions come from consumption of electricity (mostly Scope 2), typically generated by a third party and primarily used for manufacturing and to power semiconductors over their lifetime. Accelerating replacement of fossil fuel energy sources with low-carbon sources is a viable and increasingly attractive option for addressing this outsized source of greenhouse gases.

- The remaining 15% or so of emissions—primarily from supply chain and chip manufacturing activities—are difficult to reduce with today’s technologies and will require considerable R&D investment to alter current practices. Process gases used during manufacturing steps such as etching and lithography are significant contributors. Limiting emissions from these gases will require reimagining highly complex production methodologies through the use of different chemicals and advanced abatement technologies. Some progress has already been made to reduce emissions intensity during manufacturing, and newly adopted or implemented government regulations should accelerate this trend. Another difficult area to address involves supply chain emissions that arise from extracting and processing various materials and chemicals that are used for semiconductor manufacturing or for making factory equipment and intermediate products. These processes generally lie outside the direct control of semiconductor manufacturers, but chipmakers can influence their suppliers’ sustainability strategies by adopting appropriate procurement policies.

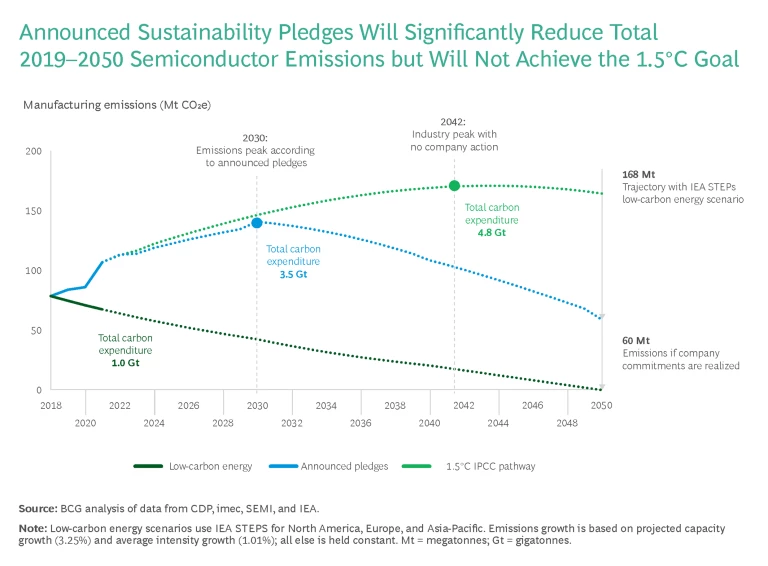

- Commitments to minimize manufacturing emissions are as yet insufficient to reach net zero in the semiconductor industry by 2050. Semiconductor emissions are forecasted to overshoot the carbon budget for the 1.5°C pathway by 3.5 times, based on the current trajectory and existing commitments, and to fall short of net zero in 2050. Actions taken by companies and society have substantially improved the outlook for carbon emissions, but there is still a long way to go.

- Semiconductors are essential to power critical climate change solutions, such as smart grids, renewable energy storage, and electric vehicles. Moreover, consumers, policymakers, and companies are seeking greater semiconductor performance in part to reduce their own greenhouse gas emissions. The semiconductor industry must continue to build capacity for such essential applications—but added manufacturing capacity, in turn, increases the industry’s own carbon footprint.

Greenhouse Gas Emissions Forecasts

The full report develops and analyzes a series of scenarios for GHG emissions in manufacturing through 2050, charting possible semiconductor industry outcomes against an overall goal of adhering to the 1.5°C pathway. (See the exhibit.) Because data on supply chain and device usage is still difficult to measure and assess, we do not include these activities in our forecasts.

The “ low-carbon energy ” scenario anticipates that the semiconductor industry can curb over half of benchmark 2050 emissions—the level of carbon output in the absence of any viable action to reduce it—by supporting the realization of the International Energy Agency’s Stated Energy Policies Scenario (STEPS). STEPS reflects the impact of existing government policy frameworks and announced plans. However, this outcome leaves chip manufacturing emissions at 168 Mt per year in 2050 and nearly 5 Gt total, significantly above net zero and 1.5°C targets.

Our other scenario incorporates company commitments by the 40 highest emitters in semiconductor manufacturing, as currently reported, representing a substantial majority of all emissions. This scenario promises material progress toward a collective net zero goal. Even so, its results fall short of net zero by 2050—and of meeting the 1.5°C objective, by a factor of 3.5x.

As the report shows, achieving the 1.5°C carbon expenditure goal will not be easy for semiconductor companies. Indeed, even the significant efforts already pledged and taken will not reduce the industry’s carbon footprint to net zero. Overcoming this gap will require deeper collaboration across the industry, which we strongly encourage and the SCC has begun to foster.

Click here to read the full report .