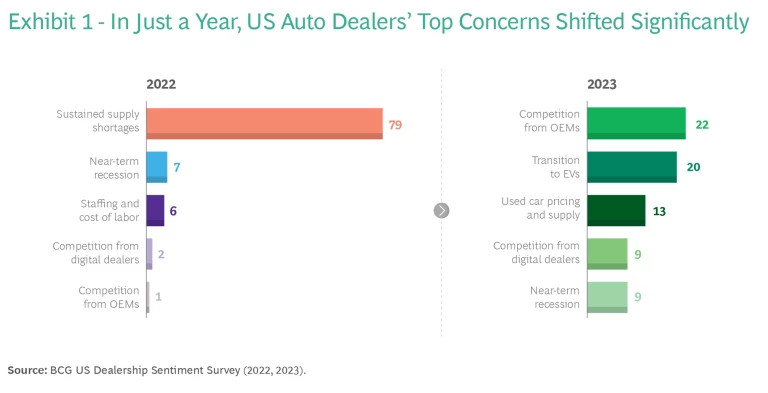

In 2023, the biggest concern for US auto retailers is the competitive dynamic with OEMs, whether traditional OEMs looking to evolve their franchise distribution models or new OEMs focused on electric vehicles (EVs); new EV OEMs are changing the landscape with direct-to-consumer (DTC) or agency retail models. The rise of EVs themselves brings other key concerns for US retailers—required investments in charging infrastructure and staff training, for example—especially given the accelerated pace of the transition to battery-electric vehicles.

This is a striking shift in sentiment for auto retailers in just a year, revealed by BCG’s second annual survey of the auto retail industry. (See Exhibit 1.) Last year’s survey found auto dealers largely focused on when—and whether—the next delivery of new cars was going to arrive. Because demand far exceeded supply, customers were willing to pay premium prices, and dealers realized some of the best profit margins in recent memory. Future supply security was the single biggest concern on dealers’ minds last year.

For US auto retailers, three key themes are now playing out in parallel: the rise of EVs, the evolution of the franchise dealer model, and the shift toward a truly omnichannel customer experience, blending digital and in-person elements.

EVs Are Coming

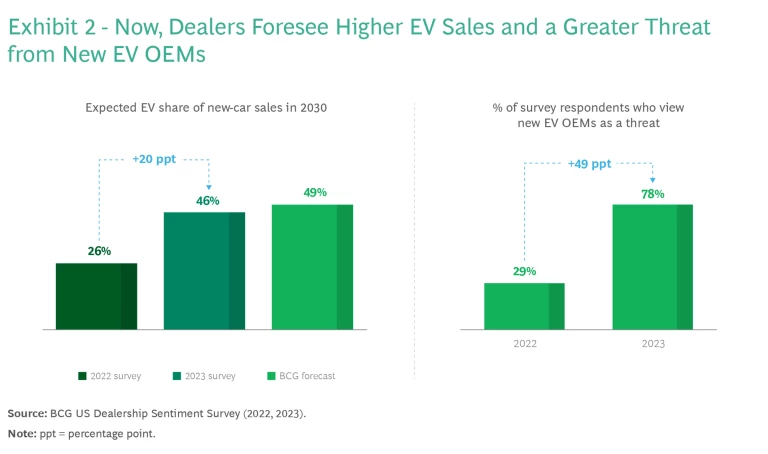

For the last five years, BCG has published an annual powertrain forecast , and we deliberately and thoughtfully raised EVs’ share of the sales mix on an annual basis through 2022. That trajectory was right: OEMs have invested in production capacity and accelerated product development; battery cost is coming down the scale curve quicker than expected; and the federal government has bolstered customer demand through purchase incentives.

Our latest forecast has EV penetration of new car sales in the US at nearly 50% in 2030. Last year, dealer expectations regarding 2030 EV sales lagged that forecast significantly at only 26%. In this year’s survey, however, dealers came in 20 percentage points higher, bringing their expectations close to ours—a sizeable shift from bearish to bullish in just one year, likely fueled by the passing of the Inflation Reduction Act and its associated purchase incentives of up to $7,500 per EV. At the same time, the share of surveyed dealers who consider new EV OEMs (the likes of Tesla, Rivian, Polestar, and Lucid) to be a real threat to their own business has jumped by 50 percentage points. (See Exhibit 2.)

A key part of the perceived threat from new EV OEMs is the continued volume growth of Tesla, combined with the presence of additional brands that are scaling up production and capturing market share from established brands. The picture still varies by segment, with most brands choosing to start upmarket (for example, Lucid’s Air and Rivian’s R1T and R1S), but ambitions to move downmarket into volume segments are clear. Perhaps the most explicit signal comes from Rivian, which announced plans to make its next two models at a new plant in Georgia with capacity of up to 400,000 vehicles per year.

The other part of the perceived threat is how the new EV brands are changing the rules of the retail game. With the exception of Polestar, which established the first (and currently only agency distribution model in the US, all new brands are deploying a DTC sales model.

This comes with its own customer experience challenges related to delivering cars to their buyers. But it has also raised the bar for the earlier purchase funnel experience. Aided by a much less complex option structure (a few hundred possible vehicle configurations versus tens of thousands), the new EV OEM websites have become shopping portals where customers can not only configure their next car but also place orders, qualify for financing, and manage their account.

This direct engagement enables the EV OEMs to build relationships with car buyers over a vehicle’s life cycle in a way that most legacy OEMs would like to replicate. This model also allows OEMs to be much more dynamic in their vehicle pricing in that they own the vehicle transaction—as opposed to merely setting a manufacturer’s suggested retail price while the franchise dealer owns the actual transaction and thus the actual retail price.

Lastly, the DTC model is cheaper to operate for OEMs than a traditional franchise dealer network (at least on the sales side, without taking aftersales and service into account), which creates pressure on established OEMs and their dealer partners.

It's important to recognize that in the US, the dealer franchise model is here to stay. Unless OEMs create an entirely new brand (as Volvo did with Polestar), they are bound to their dealer franchise agreements for the distribution of future products, regardless of powertrain. However, OEMs seek to use the advent of EVs as an inflection point to redefine the shape of and engagement with their dealer networks. For example:

- General Motors has gone on record that it is willing to buy out Buick and Cadillac dealers that are unwilling to invest for an EV future.

- Ford, on the other hand, has defined a tiered system for its dealers in which the level of commitment and investment corresponds to the volume of future EV products allocated for sale.

Both OEMs have publicized their intent to reduce retail price variation and take a more central role in setting transaction prices. It remains to be seen how that goal can be implemented and enforced within a franchise dealer paradigm.

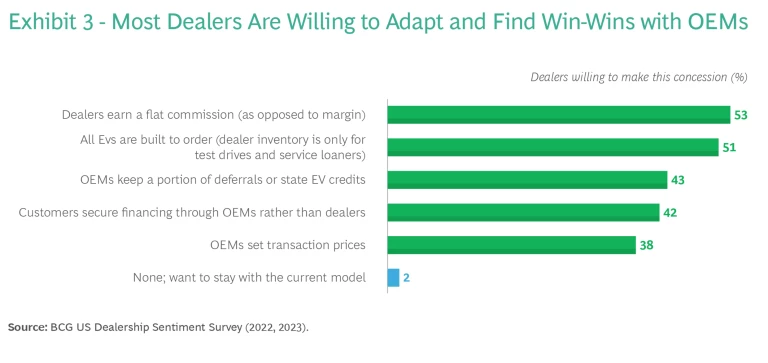

US franchise dealers feel this pressure, and several have pursued legal action to push back against the OEM changes. But our survey found that a vast majority of dealers (98%) are willing to make at least some concessions to OEMs in an attempt to find win-win scenarios and jointly define a new normal in the relationship. There is not a lot of consensus (yet) as to what the right terms of engagement shall be going forward, with none of the surveyed options eliciting more than 53% of dealer acceptance. (See Exhibit 3.) In return for such concessions, however, dealers expect to receive uncapped access to OEMs’ full product portfolio as well as greater support on the capital-intensive charging infrastructure and staff training that they need to sell EVs.

The Dealer Business Model Is Evolving

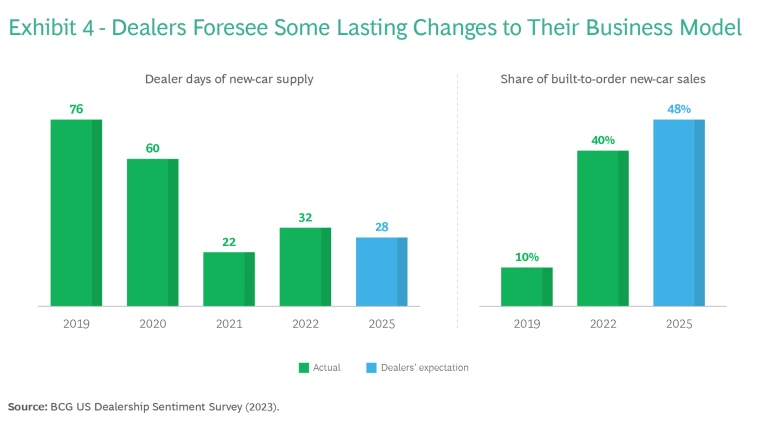

Even before the rise of EVs, the last few years were unusual for US dealers. The pandemic and supply chain disruptions led to a scenario where dealers held much lower inventory levels (20 to 30 days of supply as opposed to 60 to 76) and sold much deeper into the production pipeline: the build-to-order (BTO) share jumped from just 10% in 2019 to about 40% in 2022, according to dealer estimates in our survey.

We asked dealers what they expect going forward: Will these trends have a lasting impact, or will the metrics revert to 2019 levels? There was strong consensus that the shifts will stick. Dealers expect a roughly 30-day supply as the new normal and a BTO share of about half of vehicles sold. (See Exhibit 4.)

Will the shifts materialize as expected across the board? It remains to be seen. Recent inventory data shows a wide variation across brands in terms of inventory on hand. For several brands with high inventories, the incentive spigots have been opened again after three or so years of minimal incentive spending.

With all this change happening on the sales side, combined with the shift toward more digital retail and an omnichannel buying experience, dealers now do expect the role of brick-and-mortar dealerships to evolve. Only a third of surveyed dealers thought so in last year’s survey, but this year, 85% do—up more than 50 percentage points.

Dealers are also very cognizant of the longer-term impact of EVs on the service side. It will take time for EVs to penetrate the car parc (or vehicles in operation), given that the average vehicle age in the US is 11 to 12 years, but service revenue will eventually decline given EVs’ fewer parts as well as other shifts that will reduce the frequency of dealer service visits, like over-the-air software updates and the lack of oil changes. BCG estimates the annual parts revenue per EV to be about 20% lower than for a comparable ICE vehicle, before any labor effects.

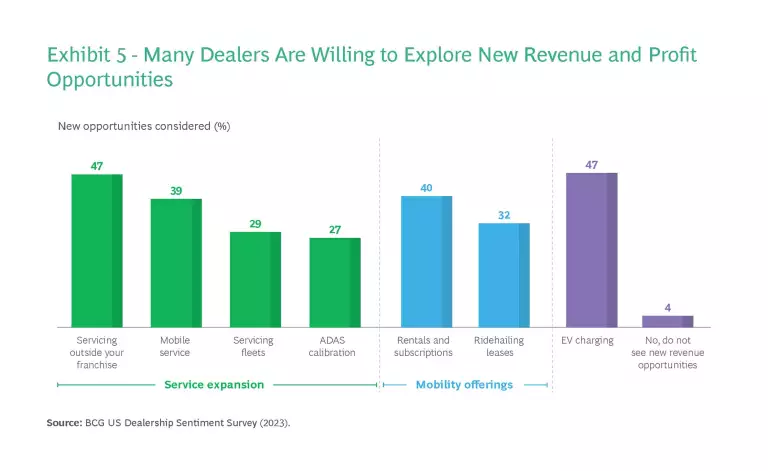

Dealers are looking at the potential to make up for lower service revenue streams in several ways. (See Exhibit 5.) Nearly half plan to actively push servicing other makes beyond their franchise brand. Close to 40% of dealers are looking to monetize a mobile service offering, and just under 30% are banking on incremental business from servicing fleets and charging for calibration of sensors on vehicles with advanced driver assistance systems (ADAS).

There is also good momentum for mobility offerings that leverage dealership assets. A third of dealers see potential in leasing vehicles to drivers for the leading ride-hailing businesses, an offering that Hertz and Uber have piloted and scaled successfully. Even more dealers are optimistic that they could offer vehicle rental and subscription as an ancillary business: service loaner fleets could be monetized without the major depreciation hit that has accompanied many OEMs’ experiments with subscription offerings built around new cars. Dealerware is one of the players offering the technology for dealers to pursue subscription and rental offerings, an example being the Audi on demand business model that evolved out of Silvercar’s original car rental business. “Subscriptions will be huge,” one dealer told us. “They also create a longer captive revenue stream for maintenance.”

EV charging as a revenue opportunity also resonated with 47% of dealers, although questions remain: Can charging at the dealership be monetized? Or will charging become an amenity provided free of charge? In many smaller towns and rural areas, dealerships are currently the only public source of fast (50 kWh) or high-speed (greater than 150 kWh) charging for miles.

Consumers Want Omnichannel Experiences

Our study included an assessment of consumer sentiment; we reviewed 47,000 individual customer reviews across 220 dealers. We found that approximately 65% of people said that ease and convenience are the most important factors in deciding which car to buy and where to buy it; that was more important to them than financing, sales support, or service. Increasingly, they expect digital channels to facilitate an easy and convenient buying process—even if the ultimate step still takes place in person at a traditional dealership.

More than 90% of US consumers now do research online before they visit a dealership, and the average number of dealerships visited before making a purchase decision has continuously been trending downward. Customers expect to go to a website to select models that interest them, verify prices, and schedule appointments to see and test-drive cars. Once they have selected a car, they increasingly expect to be able to secure financing and complete the paperwork online.

Dealers have embraced digital, and 90% offer digital solutions for most stages of the transaction. However, when it comes to delivering a seamless experience across online and offline elements of the purchase journey, the gap between customer expectations and actual dealer performance remains large. Though their experiences vary from dealer to dealer, customers don’t always find that digital transactions make car buying easier; rather, they sometimes create redundant processes. One customer described the experience of “repeating three hours of paperwork I already did” on arrival at the dealership.

Auto dealers tell us that they recognize the shortcomings. Information available digitally might not match information that dealer reps have at their fingertips. Systems are not always fully connected and synced with the OEM’s digital offerings, so dealer staff and sales reps interacting with consumers don’t always have access to their prior activity in digital channels.

Throughout the buying process for a vehicle, customers on average interact with five different dealership staff members and go through process steps (such as vehicle configuration, inventory browsing, and lease estimation) that are supported by digital solutions from nine different vendors—creating a lot of handovers and potential disconnects. As one franchise dealer put it: “We are at a moment where everybody thinks digital is easy, but many don’t have a grounding on how the transactions actually play out for customers in the real world.”

To build an end-to-end experience that can rival, if not exceed, what customers can currently experience at DTC OEMs and at some digital dealers (like Carvana), dealers and OEMs will need to resolve customer pain points along the journey.

Key Success Factors

Established OEMs and their franchise dealer partners need to collaborate to build a compelling omnichannel retail offering that removes customer pain points and online-to-offline handover frictions. This requires seamless connectivity across digital tools, process redesign, and employee incentive and pay plans that reward the desired behaviors.

OEMs and franchise dealers might seem to have conflicting goals as they adapt to a new retail landscape, but we see great opportunity for the two groups to jointly reshape their agreements and partnership structure to yield a win-win. This would pave the way to a more efficient distribution model, with higher BTO, lower inventory levels, and reduced intra-brand dealer competition in the same markets (for example, through more centrally managed dynamic pricing and incentive steering).

OEMs and dealers also need to collaborate on getting the infrastructure and sales processes ready for the impending uptick in EVs’ share of new-car sales. Providing a convenient omnichannel buying experience is part of it, as is a clear offering for ancillary concerns beyond the vehicle itself, such as access to public charging networks, installing charging infrastructure at the buyer’s place of residence, and guidance on future service needs.

Used-car dealers will see EVs’ share of the mix rise, albeit at a delayed pace of a few years of relative to new cars, yet still need to prepare for a broader vehicle portfolio. A key question will be EVs’ residual value, which is heavily influenced by the status of the propulsion battery. Getting an actual read on battery health through advanced diagnostics will help dealers set appropriate used-car prices and give buyers of used EVs confidence. Because the used-car supply will be constrained for of the next two to three years (owing to lower new-car sales), it will be important to invest in sourcing channels, such as partnering with rental-car companies or commercial fleets.

Staff preparedness and an omnichannel buying experience are important success factors for used-car dealers as well, particularly given the strong digital offerings of players like Carvana and Carmax.

All dealers should explore new revenue and profit pools, such as providing vehicle subscriptions or rentals out of the dealer inventory. The right answer will vary based on the size, geographic reach, and brand coverage of the dealership group.

Digital providers in the automotive retail space need to be very explicit and clear in how they address existing pain points and integrate into the broader retail ecosystem. Further proliferation of standalone, single-scope providers is not how we expect the industry to evolve; instead, we see significant potential for greater consolidation and integration across the functional spectrum. Established players like dealer management system providers should continue to look for partnerships and acquisitions to round out their offerings and reduce the number of handover points along the customer journey , building toward an end-to-end experience.

As last year’s supply chain disruptions and inventory fade in the rear-view mirror, players in US auto retail must look ahead to a very different set of challenges. The transition to EVs is on, and consumers are increasingly kicking the tires and even starting the purchasing process virtually before actually purchasing. Established OEMs are actively looking to evolve their franchise models to stay competitive with DTC EV brands. Throughout this transition, it will be key to find win-win propositions for OEMs and dealers, enabled by a more integrated digital ecosystem that reduces frictions in the customer journey.