Low-carbon hydrogen must play a vital role in driving global decarbonization, particularly in hard-to-abate sectors such as heavy transport and chemicals. Given the mismatch between where production and demand will be located, global trade of low-carbon hydrogen will be vital to achieving targeted emissions reductions in many parts of the world. Right now, ambitious scenarios show global trade in low-carbon hydrogen starting to scale by 2030, with total export volumes in that year hitting 16 Mtpa according to International Energy Agency (IEA) tracking of announced projects.

A significant shortfall in supply of low-carbon hydrogen for trade will exist through 2030.

But the reality is likely to fall far short of such projections. Our study of the market, along with our extensive client work in the sector, reveals that a significant shortfall in supply of low-carbon hydrogen for trade will exist through 2030. Volumes are currently held back by a lack of long-term offtake agreements among buyers and sellers, increasing equipment and energy prices, and the absence of supportive government policies. The good news: while infrastructure such as pipelines is not coming online quickly enough, transport via marine shipping will be sufficient to handle demand through 2030.

To gain deeper insight on the state of play, we took a close look at the market for trade in low-carbon hydrogen in Europe.

The looming supply shortfall in the hydrogen market has major global implications. In order to stay on track to limit global temperature increase to even 2°C compared to preindustrial levels, global emissions must be slashed dramatically by 2030. Slow development of hydrogen trade could be one of the contributing factors that pushes that goal out of reach. Government and business leaders gathering at COP28 must confront this hard fact head-on.

The Hydrogen Supply Shortfall

Large-scale, low-carbon hydrogen projects are extremely complex—in some cases combining chemical production and renewable power into one project. To get such projects off the ground, a host of factors must align including permitting offtake agreements between producers and buyers, manufacturing of items with long lead times (such as electrolyzers), finance, and export infrastructure.

In the early stage, project developers focus on the overall technical concepts, the business case, and the commercial foundations. The advanced-stage development and execution, which includes detailed engineering, procurement, construction, commissioning, takes another six to eight years. Given this timeline, projects that have not currently moved to the advanced development stage are unlikely to bring low-carbon hydrogen to the market by 2030.

Unfortunately, the ramp-up of supply is being dampened by three factors.

- There are a limited number of offtake agreements being signed. Our analysis indicates that announced deals between buyers and sellers, including memorandums of understanding, letters of intention and joint ventures, cover total volumes of 11 Mtpa globally in 2030. However, when it comes to formal offtake agreements—arrangements under which buyers have committed to set volumes—the market signals are weaker. The information that is available shows less than 2 Mtpa covered under firm, signed offtake agreements.

- Energy costs, which are a primary cost driver for hydrogen production, remain high. Meanwhile, over the last year, prices for critical equipment in the renewable energy market have failed to decline, or even surged, due in large part to inflation and disruption in supply chains. For example, electrolyzer prices were expected to fall due to economies of scales and learning rates. However, costs have held steady at around $2,000/kW and are expected to remain at that level at least through 2025.

- Although supportive policies for the market have been passed in some regions—the Carbon Border Adjustment Mechanism in the EU and the Inflation Reduction Act in the US, for example—the full impact of such policies will not be felt for five to ten years.

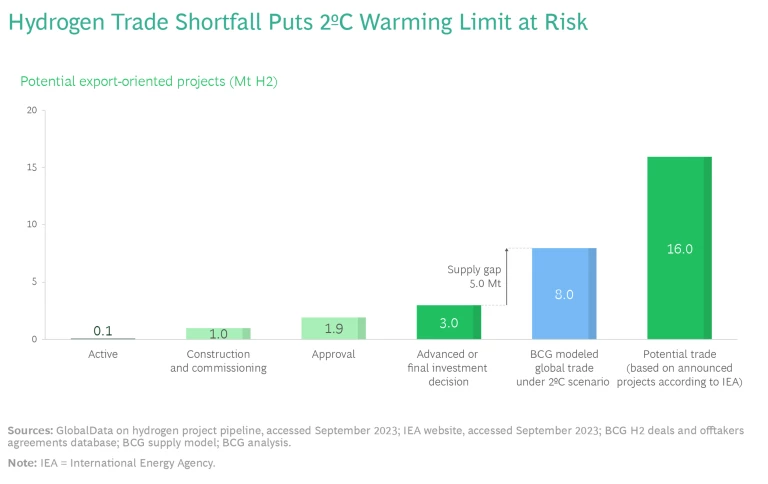

Our analysis reveals that export-oriented projects with volumes of just 3 Mtpa have moved to advanced stage or reached (final investment decision) FID globally, well below the 8 Mtpa in trade volumes required to keep the world on track to limit global temperature increase to 2°C. The gap is even wider when we compare these advanced and FID project totals with trade volumes estimates (based on announced projects) from the International Energy Agency (IEA). (See the exhibit.) Meanwhile, industry groups have presented still more ambitious projections that are double those of the IEA. That has significant implications for Europe. It will be impossible to hit the 10 Mtpa import target and exceedingly difficult to even reach 5 Mtpa.

Infrastructure Challenges

The most efficient means of transporting hydrogen up to 5,000 km is through pipelines. However, a limited number of hydrogen pipelines are in operation globally today.

Consider the EU. Gas infrastructure operators are in the planning stages for large-scale hydrogen transmission pipelines across the EU to connect expected production centers in the south with concentrated demand in the north. Currently, approximately 1,300 km of hydrogen pipelines are in service in EU connecting the Netherlands, Belgium, France, and Germany. Transmission systems operators, a mix of public and private entities, have announced that more than 30,000 km of hydrogen pipeline will be operational in the EU by 2030. However, pipeline construction typically takes about seven years from the start of advanced stage design to operation. Today, just 4,000 km of the planned hydrogen pipelines are in advanced stages.

In some cases, existing natural gas pipelines can be converted to hydrogen service, with these conversions taking roughly one to three years on average. Still, even when we factor in both the addition of new hydrogen pipelines that are on track to be operational by 2030 and the conversion of some natural gas infrastructure, transportation capacity will be insufficient for the volumes expected to flow from the south of Europe and other global production centers.

There is, however, capacity for longer range transportation of low-carbon hydrogen. Typically, transport of hydrogen over distances greater than 5,000 km will be done by marine transport, with the hydrogen molecules being synthesized into a derivative, most commonly ammonia, for more efficient transport. Today 18–20 Mtpa of ammonia is shipped globally every year and capacity is expected to expand 30% between now and 2026. This growth will be sufficient to handle global ammonia shipping volumes. Meanwhile, a number of ammonia-import terminals with additional capacity of 14 Mtpa are expected to come online by 2027.

Although the 2030 gap cannot be completely closed, there are critical actions that can help materially narrow it.

Between now and 2030 the primary use of this ammonia will be as a chemical feedstock or as a fuel in shipping as well as in power generation. A secondary use could be to convert the ammonia back to hydrogen through cracking. However, technology for cracking ammonia is immature and expensive today, making it economically unattractive to deliver hydrogen via this route before 2030. Beyond 2030, as the low-carbon hydrogen market develops, we will need both robust pipeline infrastructure and lower-cost, large-scale cracking capabilities to transport the growing volumes.

Hydrogen will play a vital role in combating climate change. But we can no longer ignore the fact that global trade in hydrogen will not reach the levels required over the next seven years.

Although the 2030 gap cannot be completely closed, there are critical actions that can help materially narrow it. Governments can take steps that strengthen the business case for low-carbon hydrogen, including establishing mandates to create demand certainty and spark investment in infrastructure. Governments can also eliminate obstacles including through streamlining of the permitting process and support the development of robust supply chains via trade policies and agreements. And companies can collaborate, the First Movers Coalition being a prime example, to speed up the development of complex and capital-intensive hydrogen projects and to create platforms that match supply and demand.

The steps required to accelerate the development of hydrogen trade are not a mystery. What is lacking is the commitment and energy to actually put them into action. Hopefully, a hard dose of reality about where things stand today can be the catalyst we need to ensure hydrogen lives up to its potential.