This article is the third in a series developed by BCG in collaboration with the International Air Transport Association (IATA) on the airline industry’s transition to retailing, which is based on Offer and Order management (see the first article here , and the second article here ).

Triggered by new technologies, airline “retailing” is an industry-wide functional transformation initiated by IATA. It enables airlines to better serve their customers throughout their journeys by making more relevant and personalized offers to them, driving airline revenue. Airlines should also benefit from lower costs, thanks to changes in technology and new distribution models.

Recently airlines focused primarily on internal development to work toward their retailing goals. Now it is time to work with key partners and stakeholders to accelerate the transformation. These players—such as travel agents, hotel chains and car rental companies—are deeply interconnected with the airlines and they have the same customers. To ensure high-quality customer experience end to end—and bring value to airlines and partners—it’s critical for all to align on a common path.

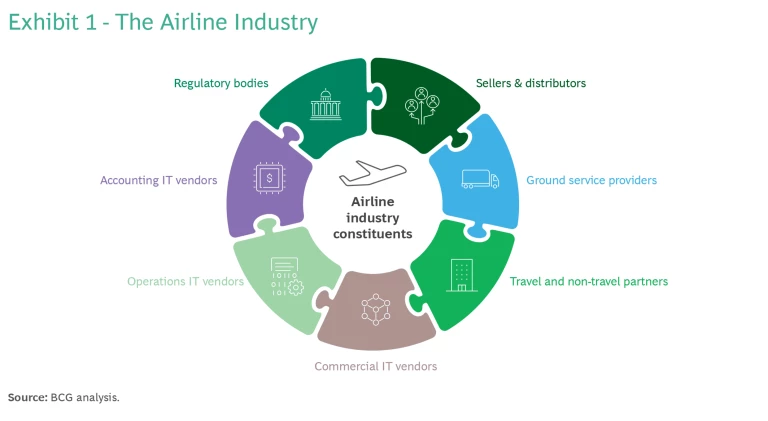

To understand the opportunities and challenges for partners and stakeholders, we interviewed more than 20 executives and senior leaders from companies within the broader travel ecosystem (see Exhibit 1), and surveyed more than 25 leaders from the IATA Airline Retailing Consortium. We also studied how three other industries have managed similar transformations— telecommunications , financial institutions , and automotive —and the lessons these might hold for airlines and others in the broader travel business.

Airline leaders expect this transformation may lift revenue by 3%-5% annually—which can amount to hundreds of millions of dollars for each medium-sized and large airline—and drive 25%-50% in distribution cost savings, or tens of millions of dollars. At the end of this discussion, we identify five key actions to accelerate the transition.

Offers and Orders Will Transform Airline Retailing

To power next-generation Offers (everything related to product and pricing offerings for customers), airlines are adopting IATA’s New Distribution Capabilities (NDC) standard. NDC is a more flexible data exchange format connecting airlines, sellers, distributors, and other partners to make dynamic and personalized offers and bundles available to the trade.

Meanwhile, to power the use of Orders (everything related to managing the customer purchase internally such as performing changes and cancellations, accounting and fulfilment), airlines are adopting IATA’s ONE Order standard, created to streamline processes, lower transaction costs, and simplify money collection by combining multiple records (PNRs, e-tickets, and EMDs) into a single retail order.

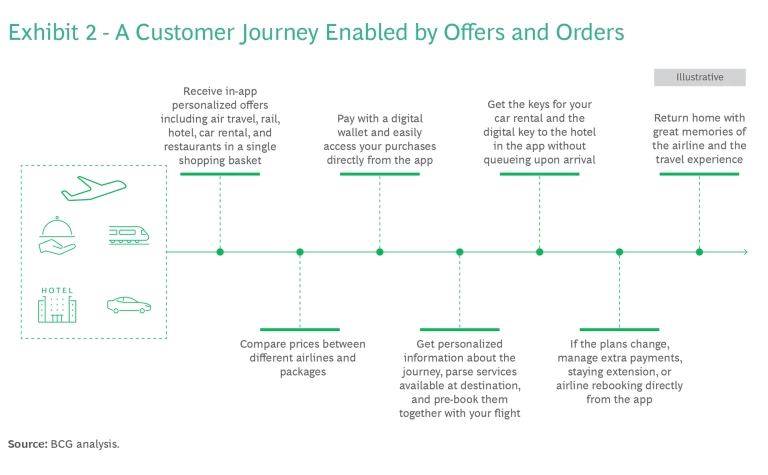

Offers and Orders will allow airlines to implement use cases to improve the customer experience (see Exhibit 2) that are very difficult to implement with current technology (particularly in indirect channels). A few examples include:

- Partner with railway operators and car rentals for multi-modal transportation

- Connect to ground service providers to sell ancillaries at check-in, at boarding, and increase penetration of on-board sales

- Share rich media content such as videos of the on-board experience with meta searches and online travel agents

- Develop bundles tailored for corporates together with travel management companies, including sought-after attributes such as flexibility, CO2 compensation, lounge access, extra legroom seating, and priority check-in and boarding

- Compute the profit and loss (P&L) of a flight immediately after take off

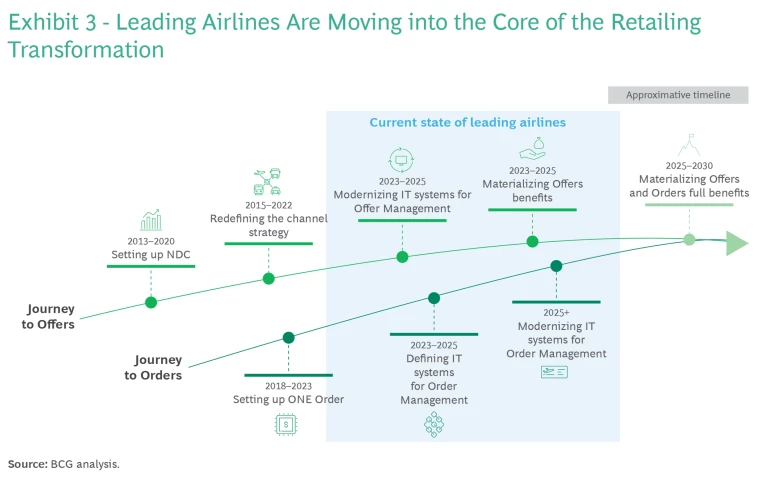

Many airlines have already made real progress with the NDC setup—building the technological pipelines and reviewing their distribution strategy. Now is the time to focus on new product offerings that leverage Offers and Orders’ full potential, such as green fares, new ancillaries and bundles, continuous pricing, and personalized offers—without costly and complex workarounds. This will require overhauling the commercial IT infrastructure and rethinking the passenger service systems (PSS) entirely. According to our research, a medium-sized airline expects to spend from $50 million to $100 million on its full transformation to 100% Offers and Orders (see Exhibit 3).

The Status of Retailing

Getting the most from such an investment requires the participation of partners and stakeholders. Travelers interact directly and indirectly with multiple retail actors throughout their journeys, so airlines must ensure that all their partners understand the retailing concept and are committed to it.

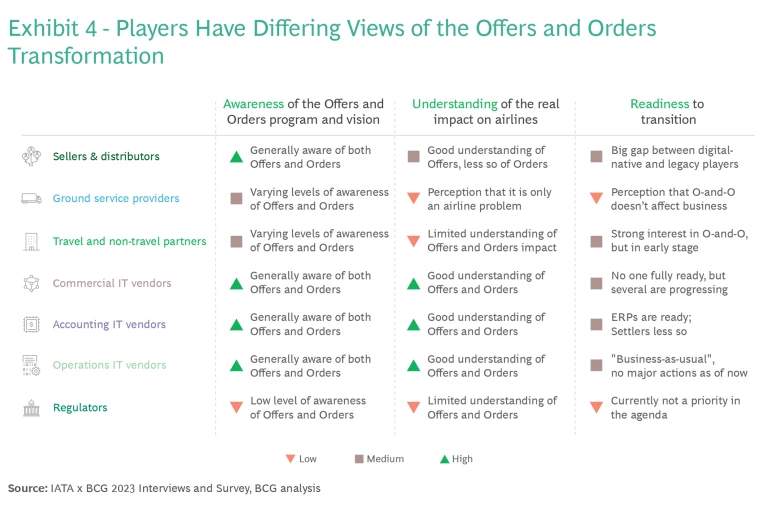

As part of our research, we gauged the awareness, understanding, and readiness of the airline ecosystem for the transition to retailing (see Exhibit 4). We also investigated the business case for airline partners in terms of their own expected benefits and costs, and we evaluated which adoption mechanisms might help accelerate the transition.

While we find that the industry is generally aware of retailing—particularly of NDC, thanks to recent airline announcements and news coverage—there is still more work to be done. Awareness is higher among sellers, distributors, and IT vendors, who confer with airlines on commercial and IT topics. But ground-service providers, as well as some travel and non-travel partners (such as trains, car rentals, and hotels), have more limited knowledge of the transformation. One sales director at a car rental agency candidly said: “The concept of airline retailing is completely new to me.”

Yet, even the most aware players need more information to fully understand the transformation’s size, impact, complexity, and technical implications. Some think their processes won’t change much because they already use APIs and other modern technologies, or because they already integrate with low-cost carriers leveraging their ticketless technology. But intricate airline commercial processes are deeply rooted in legacy practices. Switching to retailing is unlikely to be “plug-and-play” for any player.

Travelers interact directly and indirectly with multiple retail actors throughout their journeys, so airlines must ensure that all their partners understand the retailing concept and are committed to it.

Given these findings, it’s not surprising that, with some exceptions, the level of readiness among partners and stakeholders is low. At the same time, many are eager to enhance collaboration with airlines on retailing. Sellers and distributors would like to improve access to the best airline products and prices. Travel and non-travel partners would like to exchange more data with airlines and provide seamless end-to-end travel experience to customers. IT vendors would like to offer future-proof solutions and keep serving their long-standing clients and add new ones. And ground handlers and service providers would like to tap into new ancillary sales. As one IT vendor said: “With Offers and Orders we have a once-in-a-generation opportunity to redefine the airline commercial technology.” In fact, the momentum is building significantly, and we expect to see increased engagement across the ecosystem in the near future.

Potential challenges for airline retailing include that the business case, particularly revenue potential, is still a work-in-progress for several players in the value-chain. Few airlines have implemented retailing initiatives that increase revenues meaningfully for partners.

Skepticism notably held back partners using legacy technology. As one tour operator said: “Maybe in the future we will switch to NDC. But we wonder when there will be a business case to validate it." An executive at a travel management company added: “So far, NDC has not brought efficiencies in the way we service our corporate customers.” Digitally native players, on the other hand, were more enthusiastic. One executive at a travel startup company said: "From day one we built our solution to support Offers and Orders. Today, 90% of our NDC business can be self-serviced thanks to its automation capabilities.”

Mechanisms to Accelerate the Transition

Opinions differ across the industry on the need for acceleration mechanisms. Some believe that there is an opportunity to shorten the transition timing and ensure technological consistency across airlines. Others believe that market dynamics should drive the transformation. Some industry veterans have in mind the transition from paper to electronic ticket in the early 2000s, which required strong steering at industry level.

Use of a mechanism to accelerate a technological transition is an issue that other industries have wrestled with. Among financial institutions, regulatory mandates are a definite catalyst. The open banking directives in the EU and the UK allow the integration and sharing of data between banking and non-banking entities, resulting in new digital services and improved customer experiences.

But mandates or regulations are not the only mechanisms to accelerate change. In mobile telecommunications, the industry trade association GSM Association (GSMA), sets the standards and the technological roadmap. This allows the industry to update its systems periodically so telco players can offer customers the most advanced technology (5G, for example).

Regulatory or industry-driven mandates could be detrimental if key stakeholders are not fully onboard. In the case of open banking, for example, large banks were not "all-in" and the costs of implementation were very high. The results so far are below expectations. The takeaway is that a mandate will only work if a sufficient number of stakeholders is aligned, share the same goals, and the industry has reached enough technical maturity.

The Path Forward

The transition to airline retailing is coming, with or without an acceleration mechanism. Unknown yet are what form the transition will take and who will be the retailing market leaders.

A “big-bang” immediate technological transformation is not likely. To gradually migrate customers, both telcos and banks launched new, digitally native platforms either under their own brand name or a separately owned digital brand. Digital transformations inevitably include a “hybrid” period where old and new platforms run in parallel. This lowers the risk of technological bugs interrupting operations, but requires that the company sustain the running costs of old technology, potentially for a long time. Airlines should be prepared for a long transition. Until full migration is possible, they will need to mirror transactions and customer records from modern retailing platforms to the PSS, and vice versa.

The transition to airline retailing is coming, with or without an acceleration mechanism. Unknown yet are what form the transition will take and who will be the retailing market leaders.

Front-runner innovators could gain significant competitive advantages in certain markets and contexts. What would that take? Tesla’s innovation in the EV market offers some clues. First, for a long time legacy automakers did not participate in the EV market, giving Tesla an opportunity to hone capabilities and expertise ahead of competitors. Airlines that lag will lose out to innovative players who grow and capture market share.

Second, by envisioning a car manufacturer as a tech company and putting a strong focus on great customer experience, Tesla changed customers’ perception of EVs, making them attractive and desirable. New technology alone is not enough to drive and maintain advantage. Airlines need to combine it with tangible customer benefits in the form of relevant products and seamless experience throughout the journey.

The complexity of the transformation makes it unlikely that airlines will succeed on their own. Airlines and partners need to team up. Partners need to embrace the retail transformation: reach out to airlines, suggest ideas, get involved, and thus share in the value creation opportunities. Airlines, for their part, need to open up to partners, communicate clearly about the transformation, and be truly collaborative. The most likely scenario is that a front-runner airline (or group of airlines) collaborates with a few like-minded partners (such as IT vendors and sellers and distributors) and creates a base that the rest of the industry can build on.

One avenue of collaboration for airlines could be jointly to build their business cases with their partners by identifying common customer-centric goals and prioritizing high potential use cases. These might be packaging end-to-end travel experiences with hotels and car rentals and creating tailored bundles and ancillaries for corporates and travel management companies. To ensure that airlines and partners are aligned on targets and incentives they should agree on joint retailing KPIs (conversion ratios, NPS, and ancillaries penetration, for example). Currently, airlines tend to have such KPIs only to their owned channels.

In addition to finding a common path with the broader travel industry, airlines should focus on five critical actions.

Actions for Airlines Transformation

In addition to finding a common path with the broader travel industry, as we discussed at length above, airlines should focus on five critical actions.

- Move on from obsolete processes: Airlines need to rethink business processes early on and decide how much IT to build in-house and how much to outsource. They should explore different collaboration models, minimize the risk of vendor lock-in, and shift the focus from add-ons, plug-ins, and complex workarounds to open, modular, and flexible systems. Above all, an airline should be certain new systems fit its commercial strategy, not the other way around. Otherwise, it risks building a new legacy infrastructure and being in the same situation in ten years.

- Adopt practices from other consumer-facing industries: Some airlines are focused on matching the success low-cost airlines have had with ancillary sales. But legacy airlines need to think bigger to drive revenue beyond slightly increasing ancillary sales. That means empowering teams to create and implement new bundles and more dynamic pricing. Airlines should look to industries with advanced e-commerce practices for inspiration, such as shopping carts, proactive product recommendations, and cross-sales.

- Drive internal change: Despite progress, retailing is still not top of mind for many airline CEOs. But their engagement and sponsorship is needed to weigh priorities and drive internal change. For example, the commercial organization usually wants to innovate and get out in front of the competition, while IT tends to be cautious. An involved CEO can make sure they align priorities, agree on KPIs, and balance their differing views. CEOs can also drive change by looking to hire senior leaders with retailing or modern technology backgrounds from outside the industry to help steer the transition. While there have been some high-profile outside hires, the industry still tends to promote from within.

- Consider mechanisms to accelerate the transition: Given the potentially long and costly transition, the question of whether a mandate is necessary is worth consideration. What form could the mandate take? If some mandate is needed, who would set requirements and deadlines and how would they be set? Who are the stakeholders, and what is the best way to involve all of them? We expect airlines and the broader ecosystem to initiate discussions on the topic from now on.

- Innovate to keep strong customer relationships: If airlines are not proactive, more agile, digitally savvy players are likely to seize the retail opportunities and gain market share. This disintermediation could limit airlines’ ability to understand customer needs and provide the best customer experience.

At the current stage in the transition, it is important that airlines assess where partners and stakeholders are in this journey and what is needed to properly engage and prepare them. At the same time, partners in the industry must fully embrace the change to retailing. By adopting the actions and attitudes covered above, the industry can make the retailing transformation a success.

We would like to thank the industry leaders who participated in our interviews and responded to our survey for sharing their insights, which were critical to the creation of this article.