Radical weather is fast becoming an existential crisis for property owners and their insurers.

The world has suffered more than $1 trillion in damages from more than 1,000 extreme-weather events in recent years. In 2022, the global insurance industry saw claims for natural catastrophes soar by 54% compared with the most recent 10-year average and by 115% compared with the most recent 30-year average. For a combination of reasons, coverage in some locations is becoming hard—even impossible—to obtain. Multiple major insurers have stopped writing new homeowners’ policies in two of the most populous US states, California and Florida.

Conditions are only expected to get worse. By 2040, according to Swiss Re, losses from weather-related events are likely to spike by 35% to 120% in Australia, Canada, France, Germany, Japan, the UK, and the US, driven by big surges in floods, hurricanes and cyclones, and wildfires. Premiums for primary insurance coverage are rising quickly, with climate change fueling projected increases of 30% to 60% by 2040 (excluding inflation). The share of catastrophe risk in property premiums is projected to rise from 20% to around 30% over this period.

The insurance industry faces a dual dilemma: a looming crisis in profitability for insurers and in affordability for customers. As we observed in our 2023 Value Creators Report on the US property and casualty industry, there are multiple pressures on profitability. They include the inability to raise rates in the face of rising claims, which stems from a combination of gaps in underwriting capabilities, regulatory constraints, and competitive pressures. The scarcity of reinsurance capacity is putting additional pressure on primary insurers.

Affordability presents its own series of issues. As rates keep rising in high-risk areas, many customers will simply be unable to pay. Countries face the potential for economic and social disruption as traditional vehicles for spreading and managing risk stagger under growing financial pressure. Adjustments to existing insurance business models, especially with respect to high-risk areas, and new measures to spread awareness of risk are both needed. Insurers must lead the way, for their own benefit as well as that of their customers.

A New Framework for Climate-Based Risk Management

The need is urgent. Big changes take time, and the emerging problem will only become more severe. Individual insurers are taking their own steps, but we believe that the sheer scale of the issue requires an industry-wide and multisector game plan.

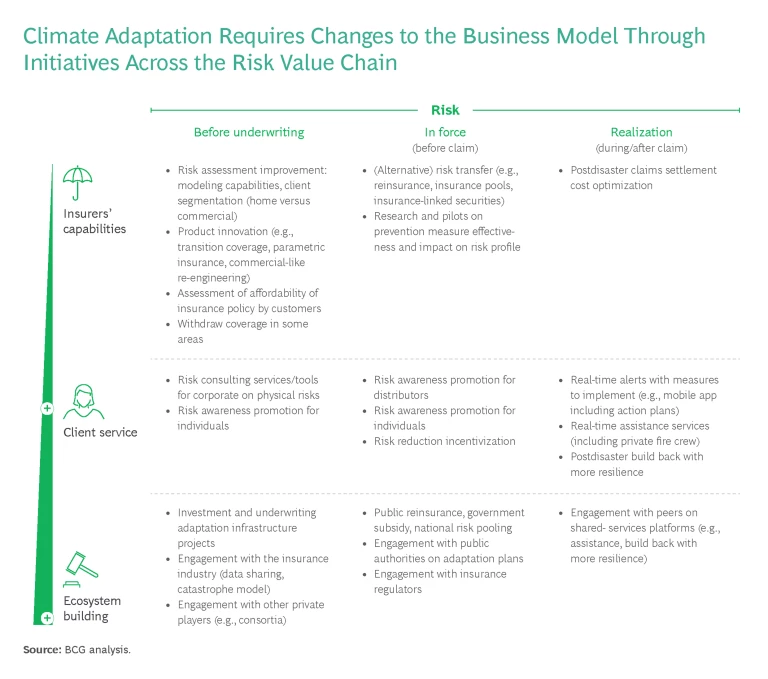

Based on our work around the world with property and casualty and multiline insurers, BCG has devised an integrated framework to align risk management with both the major steps in the risk value chain (risk assessment, policy in force, and during and after the claim) and individual companies’ state of climate readiness. (See the exhibit.)

At each stage of the value chain, companies can implement those initiatives that address where three principal sets of stakeholders need to adapt to new climate realities:

- Insurers’ Capabilities: Improving Risk Management. Implement internal measures to better assess and price risk while limiting exposure (including risk transfer and, where necessary, coverage withdrawal). Specific initiatives include improved risk assessment (with stochastic forward-looking models, for example), product innovation, risk transfer, and postdisaster claims settlement optimization.

- Client Service: Creating Risk Awareness and Mitigation Plans. Engage with clients to raise risk awareness and actively promote adoption of the most effective mitigation measures at both the individual and community levels. Specific initiatives include risk consulting, risk awareness promotion, and postdisaster services to build back with more resilience.

- Ecosystem Building: Fostering Collaboration for Resilience. Engage with policy makers and regulators to advocate for standards and regulatory changes that adapt ecosystem rules to current (and future) climate realities. Engage with peers on joint initiatives that can help maintain coverage and reduce costs (such as data sharing and shared-services platforms). Specific initiatives include working with public-sector players on climate adaptation strategies and plans and underwriting climate adaptation infrastructure projects.

Basic to our framework is the understanding that we are all in this together and that more collaboration and information sharing are needed if the industry is to adapt to the new environment. We have discussed our framework and recommended initiatives with senior executives from more than 15 large insurance companies as well as other industry experts. All are in broad agreement with our approach and have suggested specific ways to strengthen the effort that should receive immediate attention. Here are some steps that the industry can help each set of stakeholders take.

Insurers’ Capabilities: Improving Risk Management

In today's insurance landscape, strong predictive modeling for risk-based pricing is essential. Yet many insurers find themselves faced with gaps in scenario and forecasting capabilities, limited asset-vulnerability-based risk assessment, and changing correlation patterns across both assets and liabilities. Calls for innovation in catastrophe models requiring next-level industry collaborations and wider local climate management initiatives are on-target, but the ability to execute lies well beyond current modeling capabilities. As one senior executive said, “We have consistently underestimated the risks in our models.” Insurers need to up their game, starting immediately. Key solutions include:

- Developing Enhanced Forecasting Capabilities. Insurers need to integrate next-generation scenario prediction at all levels to better capture catastrophe potential and inform strategic decision making beyond the current four to five years. For example, Canadian tech company Riskthinking.AI has developed two platforms that marry sophisticated risk assessment with data on physical assets worldwide to help companies achieve a more thorough understanding of the impact of climate risks.

- Establishing Internal Climate Centers. Companies can set up internal climate change assessment centers to better weigh the impacts of climate change. Portugal’s Fidelidade launched its Center for Climate Change in 2023, together with a number of universities and research centers, to develop innovative tools on physical risk assessment and pursue climate change-related research.

- Augmenting Spatial Imaging with AI. Artificial intelligence can augment insights from spatial imaging. Insurers can partner with AI providers to assess asset vulnerabilities more accurately. Suncorp in Australia, through its partnership with Arturo, a provider of AI-powered property insights and predictive analytics, is enhancing risk assessment based on aerial imagery of houses. As a senior executive at one global property and casualty insurer and reinsurer said, “Enhancing our risk assessment capabilities, including leveraging AI, would benefit both ourselves and our clients through more accurate pricing.”

- Investing in Open-Source Models. Companies can invest further in open-source catastrophe models to improve industry-wide modeling capabilities. Many leading global insurers, reinsurers, and brokers are investing in one such platform, Oasis, to enhance their understanding of data assumptions and loss drivers and to harness crowd sourcing for model upgrades and validation.

- Leveraging Smart Cities. Using readily available technologies, cities around the world are building digital twins to develop data-driven insights. This opens new forms of engagement for financial institutions and insurers that can unlock climate and sustainability solutions for urban areas. Smart cities can help identify future insurance trends in such important areas as mobility, real estate exposure, cybersecurity, health, and regional climate adaptation. Not only will insurers have access to more data but they may be able to better connect trends to policy initiatives. They can shape regional responses to climate adaptation, develop incentives, and assess their effectiveness.

Client Service: Creating Risk Awareness and Mitigation Plans

Loss prevention goes well beyond the basic upgrading of building standards and is a pivotal lever for curbing potential risks and damages. A 2023 study by JBA Risk Management, which specializes in flood risk, on 28 million insured properties in Great Britain found that a 5% enhancement in home prevention measures (such as elevated foundations and reinforced floors) reduces losses by 40%. Several barriers impede progress, however. These include limited R&D on prevention effectiveness, difficulty ensuring successful client implementation, and a deficit of technical and building expertise within the insurance distribution network. In addition, the lack of standardization in practices across insurers limits the development of risk mitigation incentives. As one senior company executive told us, “Prevention at both the individual and corporate levels is crucial for risk mitigation. Nevertheless, we face challenges in identifying the most effective resilience measures and establishing a sustainable incentivization model.”

Key solutions include:

- Funding More Research on Prevention Effectiveness. Insurers can support collaborative research initiatives to gain insights into the effectiveness of prevention measures. For example, France Assureurs, reinsurer CCR, and Mission Risques Naturels launched an initiative to study the effects of drought on building foundations and to assess prevention and protective measures as well as repair methods. In Canada, Intact Financial established the Centre on Climate Adaptation to evaluate home flood risk and offer guidance to homeowners on practical approaches to mitigate it. The findings have contributed to the training of home inspectors and insurance brokers on flood risk. In the US, Liberty Mutual partnered with the Insurance Institute for Business & Home Safety (IBHS) to conduct research on storm damage prevention. The results allowed the company to launch WeatherReady, a new resource that assists customers in making their homes more resilient according to their location.

- Using AI-Enhanced Underwriting Processes. Companies can leverage digital and AI-enhanced software to confirm the use of prevention measures by automatically reviewing photos submitted by clients during underwriting. Honeycomb Insurance (which insures more than $4 billion in residential housing in the US and is backed by Phoenix Insurance) uses a mobile solution that leverages AI and computer vision to assess risks remotely.

- Establishing Contractor Alliances. Insurers can forge alliances with contractors that follow stringent building codes, guaranteeing the quality and effectiveness of preventive measures, such as storm-resistant construction and roofing practices. Fortified, launched by IBHS, is one such network of contractors in the US.

- Pursuing Standardized Practices. Insurers and regulators can collaborate to explore the market benefits of establishing more mandatory standardized ratings that acknowledge customers’ use of approved prevention measures so they can offset premiums with credibly tested proof-of-prevention measures. Alabama passed legislation in 2009 requiring insurers to provide discounts for homes with IBHS’s Fortified designation. Louisiana and North Carolina have since adopted the IBHS standards. In 2022, California introduced a regulation mandating insurers to offer discounts to customers that follow a standardizing framework in their prevention measures against wildfires.

Ecosystem Building: Fostering Collaboration for Resilience

An executive at an Asia-Pacific insurer put it this way: “While insurer-centric and client-centric initiatives are crucial for addressing short-term adaptation, the long-term solution lies in increased public investments and more effective policies for resilient infrastructure.”

The insurance industry possesses unique capacity, insight, and potential to further understanding of climate adaptation strategies and their broader societal and economic impacts. Policy makers and regulators can gain lessons and insights from the industry into the effects of severe weather and incorporate them into legislation and regulation as well as planning and investment decisions. Public agencies and institutions can embed adaptation strategies in regulations and standards.

Key solutions include:

- Advocating for Climate-Related Government Training. Insurers can encourage governments to provide training on climate-related issues, drawing from examples such as a 2022 training initiative of the French government under which 35 scientists provided short training courses on environmental issues, with a strong focus on climate change, to newly installed members of parliament. France has set a target of training 25,000 state officials in climate, biodiversity, and natural resources by 2025.

- Collaborating with Peers Through Industry Associations. Insurers can work hand in hand with peer companies via industry associations to promote deeper engagement with government bodies. For example, Climate Proof Canada, a coalition of insurance companies, municipal governments, indigenous organizations, NGOs, and research organizations, advocates for stronger government climate adaptation policies and initiatives. In the US, the American Property Casualty Insurance Association and the Reinsurance Association of America presented testimony in November 2023 before the House Committee on Financial Services on the challenges facing the US property market.

- Equipping Governments with Data and Risk Assessment Tools. Insurers are in a unique position to leverage claims data and risk models to facilitate policy changes (such as through the development of climate adaptation business cases) and further the development of national and local adaptation plans. Insurer Aviva and sustainability agency Good Business conceived the Climate-Ready Index to promote the UK’s climate readiness. The Zurich Flood Resilience Alliance brings together organizations from various sectors to help communities in developed and developing countries address flood risks. In the US, the Department of the Treasury (through the Federal Insurance Office) is working with insurers to assess how climate risks are impacting insurance markets across the country— paving the way for data-driven policies that address gaps in coverage and affordability.

Consumers, businesses, and governments need a strong insurance market that can absorb risk and use its expertise to develop strategies to combat the effects of climate change. The loss trends of the last few years have elevated the priority of addressing the effects of extreme weather and made clear that all stakeholders need to participate in developing solutions. We believe that a coordinated framework, like the one presented above, can direct this effort. The insurance industry has the capacity and motivation to lead, but it needs to move now to adapt quickly to new climate realities and secure the collaboration of others to forge a more secure and resilient future.

The authors are grateful to Maryam Golnaraghi of the Geneva Association and to their BCG colleague Nicolas Bachan for their valuable contributions to this article.