The malaise and anticipation around the economy linger, persisting like a bad cold or a cloudy vacation day. We surveyed over 2,700 buyers and influencers of product and service purchases at small and medium-size businesses (SMBs) across four countries—France, Germany, the UK, and the US—to see how business decision makers felt about the economy and what they expected of the next 12 months.

A Ray of Sunshine

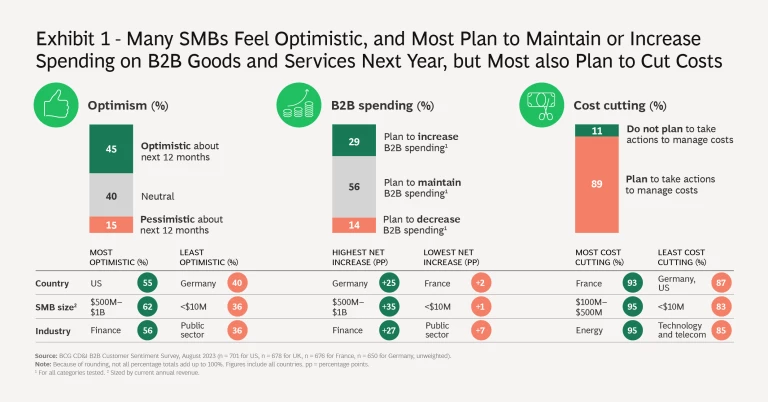

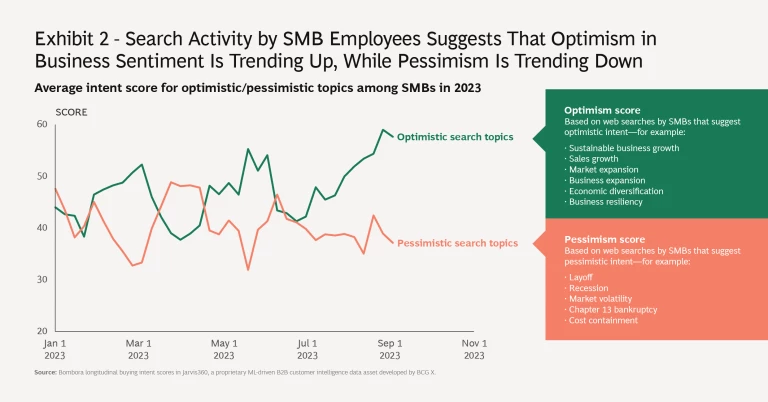

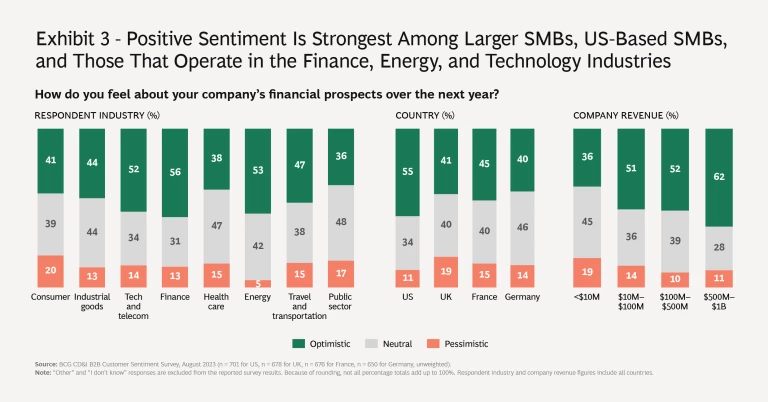

Despite continued talk of a recession and global economic challenges, key stakeholders at SMBs say that they are optimistic about the next 12 months. (See Exhibit 1.) Online web search activity by SMB employees supports this growing optimism. (See Exhibit 2.) Larger SMBs, US-based SMBs, and SMBs in the finance, energy, and technology industries express the greatest optimism, while those in the consumer, health care, and public sectors are most pessimistic. (See Exhibit 3.)

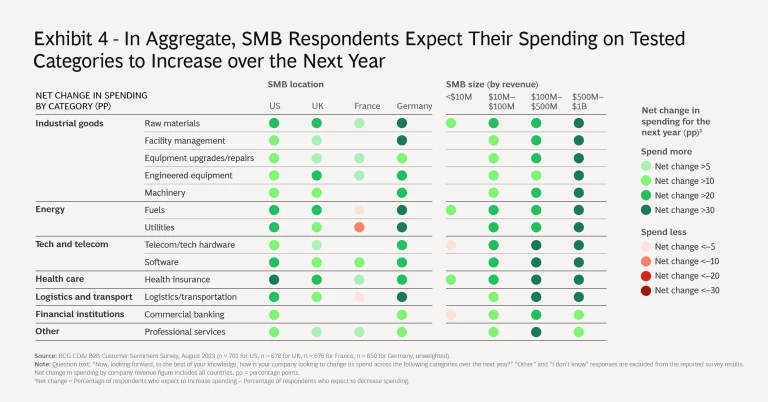

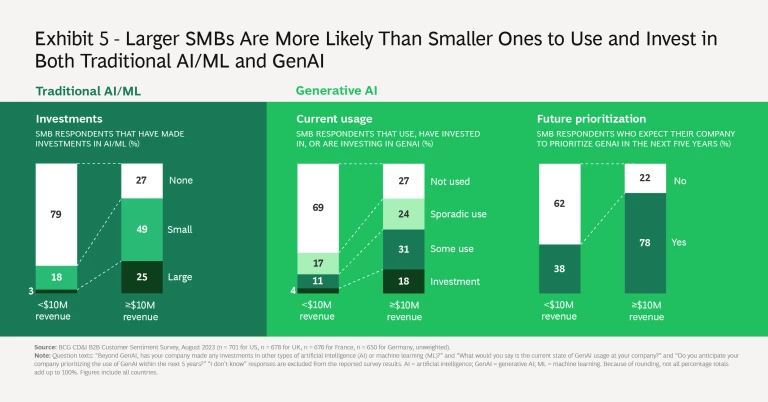

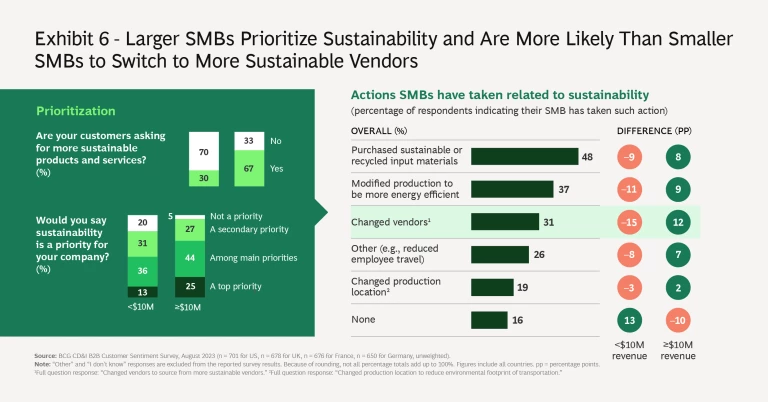

In fact, respondents at most SMBs say that their companies intend to increase or maintain their current level of spending, with larger SMBs across all four countries surveyed and SMBs in Germany overall showing the highest net increase in planned spending overall and across spending categories. (See Exhibit 4.) In contrast, smaller SMBs across the four countries and French SMBs overall show the lowest net increase in planned spending. With regard to hot topics like AI , generative AI (GenAI), and sustainability , which have garnered a lot of press and discussion in the past year, larger SMBs are much more likely than smaller ones to be making proactive investments. (See Exhibits 5 and 6.) This tendency aligns with their more positive outlook on the next 12 months, as well as with their likely deeper pockets.

Preparing for a Rainy Day

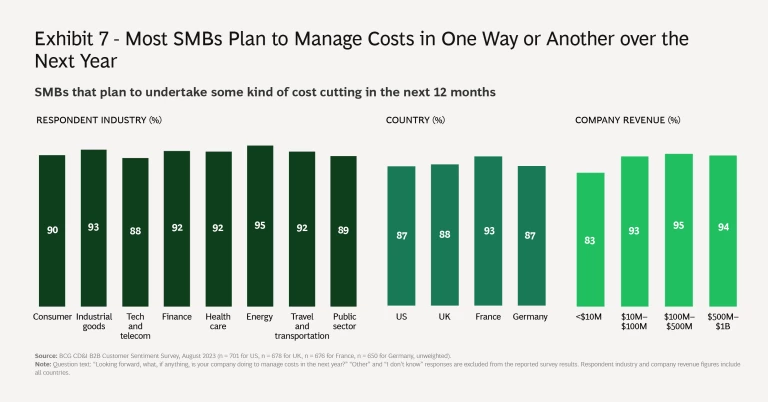

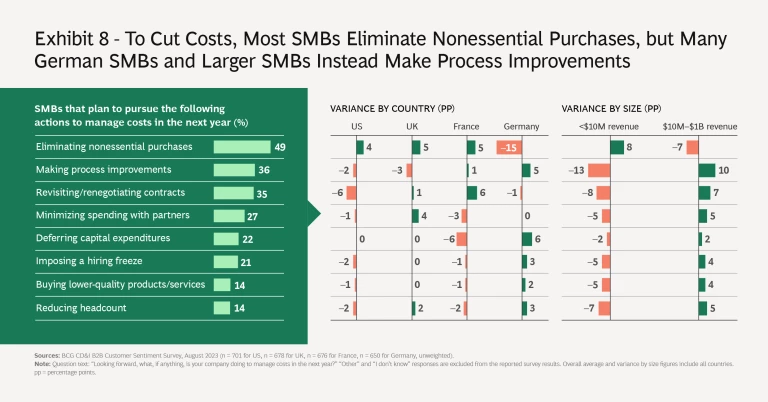

But the optimism seems tenuous. Uncertainty has plagued the global economy for some time, and SMBs appear to be preparing for the possibility that economic conditions may shift course and soften. In our survey , respondents at 89% of all SMBs said that their organizations plan to cut costs over the next 12 months, with the steepest cost cutting anticipated in France (93%), the energy sector (95%), and companies with revenues of $10 million or more across all four countries (93% to 95%). (See Exhibit 7.) Where will companies pull back? Many will focus on eliminating nonessential purchases. (See Exhibit 8.) Medium-size businesses, however, are more likely to emphasize process improvements. Many SMBs also plan to revisit and renegotiate contracts and minimize spending with partners, putting pressure on partner/vendor businesses going forward.

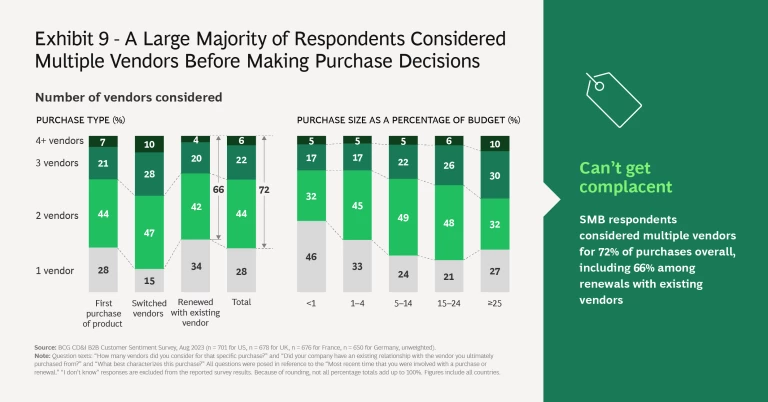

When we asked about recent purchases, most SMBs reported that they considered multiple vendors, regardless of whether the transaction in question was a first purchase, whether it involved a switch to a new vendor, or whether it ended up with renewal with an existing vendor. (See Exhibit 9.) We also found that the number of vendors that a business considered before arriving at a choice increased as the purchase size grew as a percentage of the company’s total budget. In tandem with that, sole sourcing generally decreased as the size of the purchase increased. But interestingly, for the largest purchases, we saw a slight uptick in sole sourcing. It seems that for the largest and most important purchases, SMBs either strive to identify the broadest set of vendors to consider in order to ensure that they have left no stone unturned or they rely on proven vendors that they know and trust for such a large purchase.

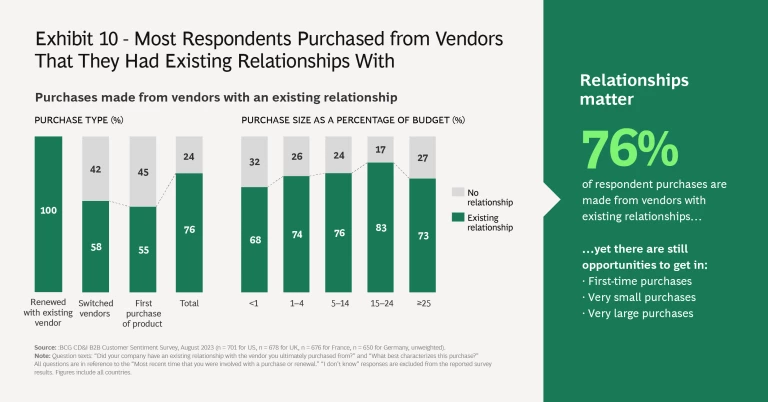

Although SMBs shop multiple vendors for most purchases, 76% limited their shopping to vendors with whom they had existing relationships. (See Exhibit 10.) That said, we see opportunities for companies to break in as first-time vendors either in cases involving very small purchases, where the buy serves as a trial for a potentially expanded relationship down the road, or in cases involving a very large purchase, where an SMB may open up its vendor list to a larger playing field in order to avoid missing out on what may be the optimal choice.

Staying at Home

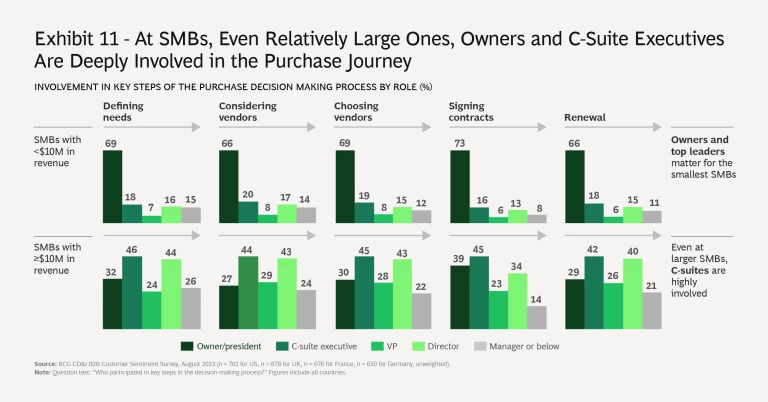

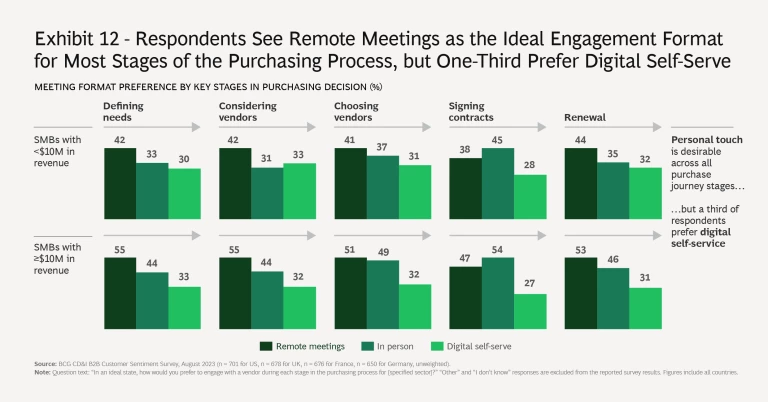

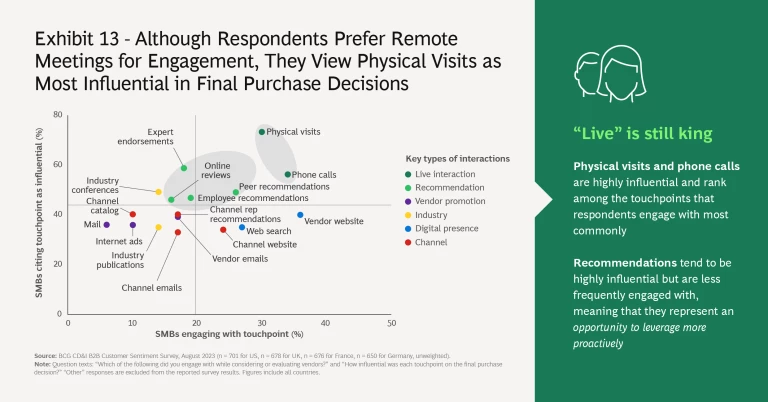

Today, owners and C-suite executives participate in decision making even at larger SMBs. (See Exhibit 11.) Respondents told us that although they prefer remote meetings throughout the purchase process, the physical visit remains the most influential sales and marketing touchpoint in purchase decisions. (See Exhibits 12 and 13.) This highlights the importance to vendors of making the in-person trip and pushing for live interactions despite the shift away from live interactions during the era of COVID-19. Recommendations also play an influential role in decision making—and given that they occur less frequently, they present an opportunity for vendors to step up their game. Finally, over one-third of respondents cited digital self-serve as a preferred form of an engagement, reinforcing the importance of delivering an intuitive and seamless digital experience to SMBs.

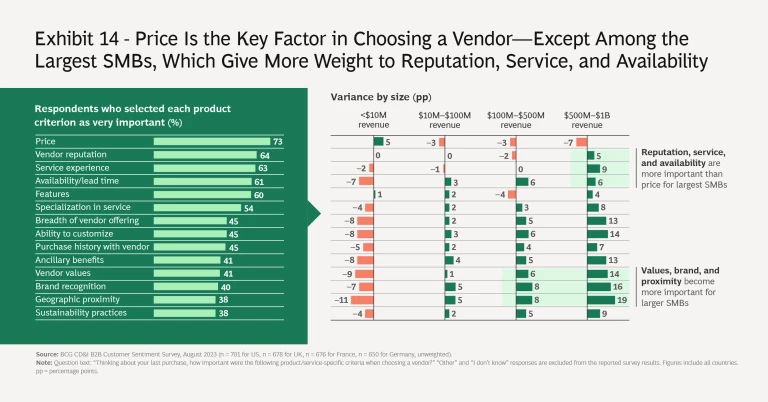

Unsurprisingly, price is the key factor in choosing a vendor—except in the case of larger SMBs, which instead prioritize reputation, service, and availability over price. (See Exhibit 14.) Larger SMBs also see vendor values, brand recognition, and geographic proximity as more important than smaller SMBs do.

Watching the Weather Forecast

As the debate continues over whether the global economy will see a recession or a soft landing, SMBs are optimistic and looking to spend more, but they are also cutting costs—a tactical approach to an uncertain future that should position them to deal effectively with whatever conditions come their way.

About the Research

This document provides both an overview and specific industry deep dives based on research fielded for France, Germany, the UK, and the US from August 7 to August 18, 2023.

Acknowledgments

- Team: Ken Hilton, Nicole Reynolds, Alice Rau, and Alex Cinquegrana

- Practice leadership: Jean-Manuel Izaret, Carsten Schaetzberger, Vaishali Rastogi, Saurabh Tripathi, Pattabi Seshadri, and Suresh Subudhi

- Additional contributors: Keith Gillespie, Carl Lonnberg, and Lauren Taylor

About the Authors/Research Study Leaders

Claudia Ojeda is a managing director and partner in the firm’s Miami office, focusing on growth strategy and consumer insights across a range of industries. She has deep expertise in the travel and tourism sector. You may contact her by email at ojeda.claudia@bcg.com.

Nick Zwemer is a principal in BCG’s Miami office. He is a member of the Marketing & Sales practice, with a focus on customer-centric growth. You may contact him by email at zwemer.nick@bcg.com.

Greg McRoskey is a partner and associate director in the firm’s Los Angeles office and part of the senior leadership team for BCG’s Center for Customer Insight, where he focuses on customer-centric strategy across a wide range of industries. You may contact him by email at mcroskey.greg@bcg.com.

About BCG’s Center for Customer Insight (CCI)

About BCG

To succeed, organizations must blend digital and human capabilities. Our diverse, global teams bring deep industry and functional expertise and a range of perspectives to spark change. BCG delivers solutions through leading-edge management consulting along with technology and design, corporate and digital ventures—and business purpose. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, generating results that allow our clients to thrive.