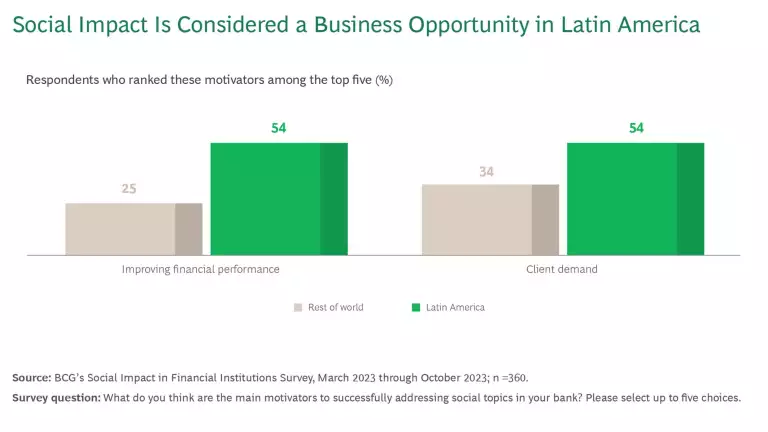

Banks have a major opportunity when it comes to social impact. They can not only address critical issues—such as financial inclusion, human rights, and the advancement of a just climate transition—but also expand their business.

Consider that globally, about one-quarter of the population, some 1.5 billion people, do not have a bank account. Meanwhile, an even greater number—2.8 billion—are underbanked, meaning they have limited access to financial services. In addition, BCG has found a link between institutions’ financial performance and their performance on environmental, social, and governance (ESG) metrics; institutions that perform strongly on each pillar also generate higher total shareholder return and lower cost of capital. Among these pillars, the link was strongest for social metrics .

These data points raise several questions: Are banks moving to seize this opportunity? How does the social imperative compare with—and how is it tied to—banks’ push to net zero? What is motivating and blocking banks’ actions on social topics? And how does the approach to the social opportunity differ by region?

To find answers, we conducted a global survey of 360 senior executives from 40 banks headquartered in 33 countries, and we interviewed dozens of respondents. We then supplemented our analysis with insights gleaned from our extensive work with clients. The slideshow presented here provides some key findings from our research.

A sound social strategy can deliver real value for banks. As financial institutions seek to define and sharpen that strategy, they should keep in mind some important likely developments:

- There will be mounting scrutiny and regulatory requirements related to a bank’s record on social topics. As a result, banks will need to begin to put greater focus on the actions of their clients and on their clients’ value chains.

- The degree to which inequity poses a systemic risk to the financial system will become more apparent. Financial institutions will need to not only take this into account in overall risk management but also address any ingrained biases in their business processes.

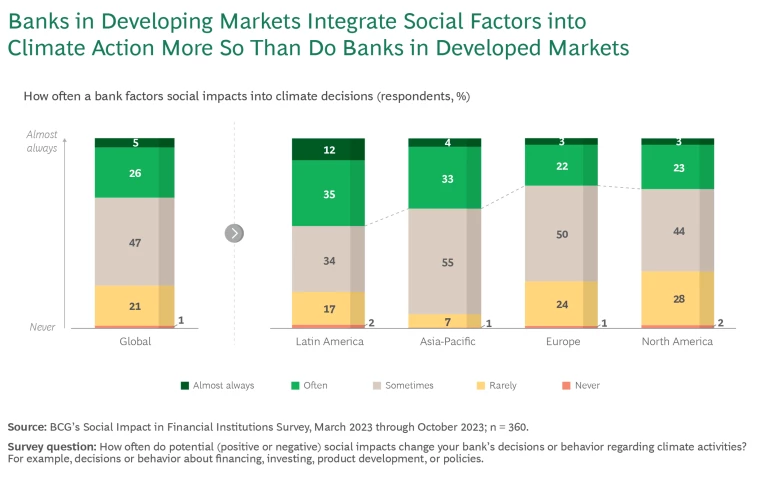

- As the just transition becomes increasingly critical, efforts to address climate change and deliver social impact will become increasingly intertwined. Banks will need to break down silos within their organization to integrate climate and social strategies and capabilities.

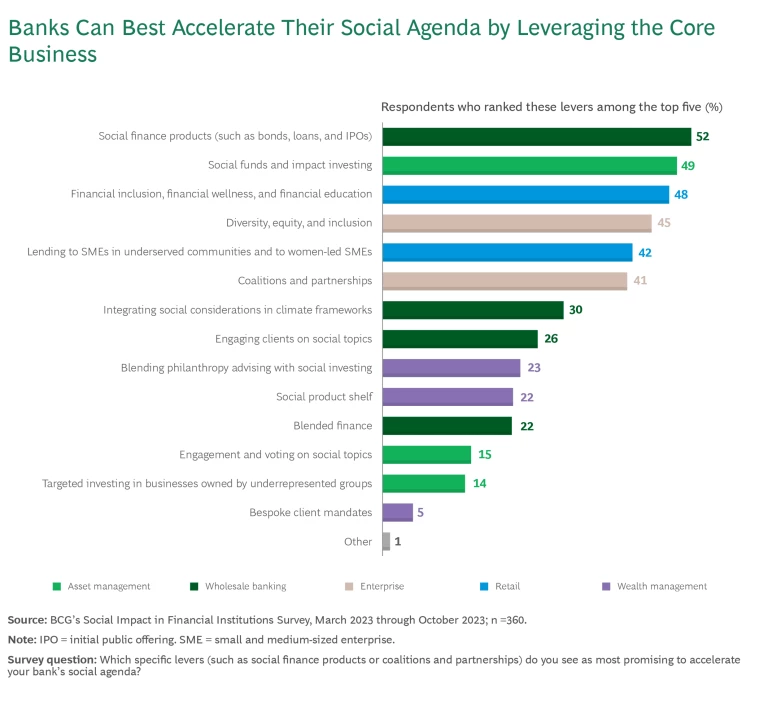

- The demand for socially oriented products—investment funds aligned with social goals, for example—will continue to grow. Leading banks should embed their social efforts more directly within the core business and ramp up product innovation.

So how does a bank up its game and make a bigger difference on social topics? There are some clear steps: create a broad social strategy, assess bank performance in key social topics, identify where the bank can have the most impact, and track and report KPIs. Some banks have taken some of these steps, usually as part of a wider ESG push. But these efforts are often limited in scope and are not built around leveraging the core business to have social impact.

To truly lead on social impact, banks need to think creatively. We see a number of actions—many not yet widely adopted—that can move the needle. They include:

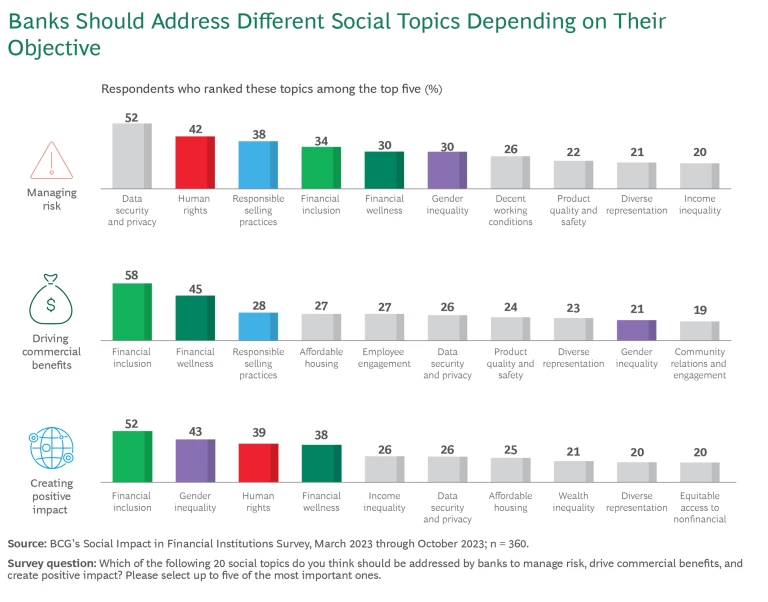

- Pick social topics with your head—not your heart. There are numerous social topics that banks can tackle to create impact, but they cannot do everything. They should zero in on topics for which they can make a business case for action and have a significant impact. The right answer can depend in part on the bank’s business model, region, and client base.

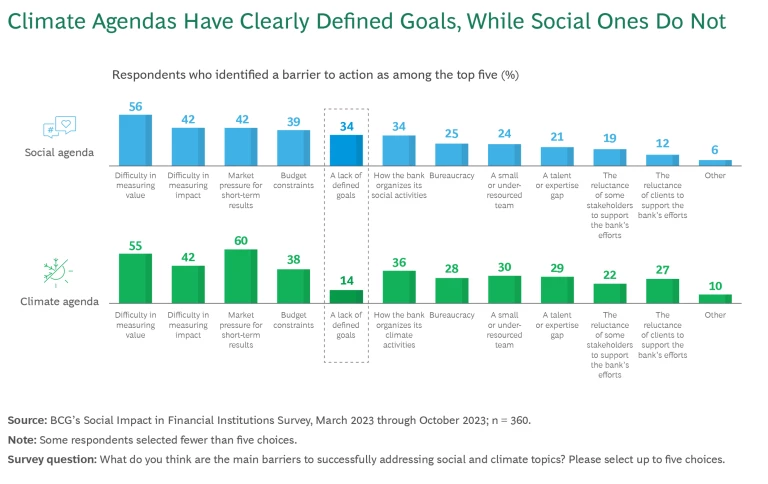

- Create a role overseeing the bank’s social agenda. Nearly every bank now has a climate chief who oversees the entire net zero push across the bank. But in most banks, social efforts tend to be fragmented, with disparate programs—social finance; diversity, equity, and inclusion ( DEI ); and financial wellness to name a few—run separately with little coordination. Bank leadership should identify someone with strong expertise on social topics who also has outstanding relationship-building skills and the proven ability to manage complexity. Creating such a role can be a catalyst for better coordination and magnified impact.

- Hire the right social experts. Banks need to have people with the right skills and experience on social issues. For many topics (such as human rights), banks may need to reach outside the financial industry to bring in the right talent. At the same time, banks need to connect those experts to others across the business—including client managers, product developers, and risk experts.

- Think horizontally. Certain social topics may at first seem to fit with certain business units. But numerous topics can be addressed through more than one business unit. For example, many think of financial inclusion as a goal to be advanced by the retail business. In fact, the wholesale unit can finance an intermediary, such as a community development finance institution in the US or a bank in Africa, both of which can, in turn, advance financial inclusion on the ground with their retail and small and medium-sized enterprise clients.

- Break down silos between social and climate efforts. Banks must identify where climate and social goals and efforts may conflict with—or complement—each other. For example, the Taskforce on Climate-related Financial Disclosures requires banks’ lending practices to consider climate risk, but banks need to be careful that implementing this requirement doesn’t lead to unintended redlining. Banks that bring both the climate and social lenses to their regulatory and business activities can maximize impact in both areas.

- Think outside the bank walls on DEI. An increasingly critical driver of business value for companies, including banks, is DEI. But many still think of it as largely a workforce topic. Forward-looking banks are integrating DEI principles into core activities, including lending.

- Don’t go it alone. Banks need to collaborate to maximize their social impact even more so than they do to achieve their climate goals. They can partner with nongovernmental organizations on financial wellness efforts. At the same time, there are many institutions that have more flexibility on their required rate of return than banks do and that are looking for private capital partnerships to scale their own social programs. Banks can partner with these organizations to create blended finance structures.

In our discussions and work with banks across the industry, we hear a common message: while climate issues have been and will remain a major priority for financial institutions, the social agenda will become more and more important in the years ahead. Banks that move proactively today can position themselves to seize the opportunity.