It’s no secret that biopharma manufacturing costs are rising. Various factors—external events such as inflation, regulatory shifts, and the Inflation Reduction Act of 2022, as well as internal company decisions regarding technologies and supply chains—have been pushing up the cost of goods sold (COGS) considerably across various therapeutic modalities over the past few years.

The end does not appear to be in sight. Currently, about 40% of companies are expecting COGS as a percentage of revenue to increase over the next three to five years. However, we anticipate that companies will review their projections, as roughly 50% of leading biopharma companies have missed their earnings guidance this year.

Biopharma companies cannot do much to change the external events that have driven COGS up. Leaders can, however, reconsider their internal business decisions and deploy solutions that are best suited for their company. Choosing the right solutions will require weighing the company’s capabilities against the scale of the ambition and the time it takes for the solution to make an impact.

Key Internal Factors Impacting COGS

Novel technologies and the need for more-resilient supply chains have had an outsized impact on biopharma companies’ per unit costs.

THE ASCENT OF NEW MODALITIES

After decades of development, new treatment modalities have become a central focus of biopharma portfolios. Currently, companies are using 18 promising new modalities to develop a wide array of innovative drugs.

Although many small-molecule drugs and other products that use traditional modalities are still in development, the number of approvals and launches declined from 65% in 2017 to 55% in 2022. Meanwhile, the number of drugs in development that are based on new modalities—including DNA and RNA-based therapeutics, cell and gene therapies, antibody drug conjugates, oncolytic virus therapy, and viral vectors—is growing quickly.

Revenue performance mirrors this shift. The first time that new modalities drove more than half of biopharma revenues was in 2021. While the mRNA vaccines for COVID-19 were a key driver, new modalities served as the platform for other top-selling biopharma products as well. This trend is likely to continue as more drugs that use new modalities become blockbusters. These innovative products have a very different cost profile from more-traditional medicines because of smaller addressable patient populations and more-personalized supply chains.

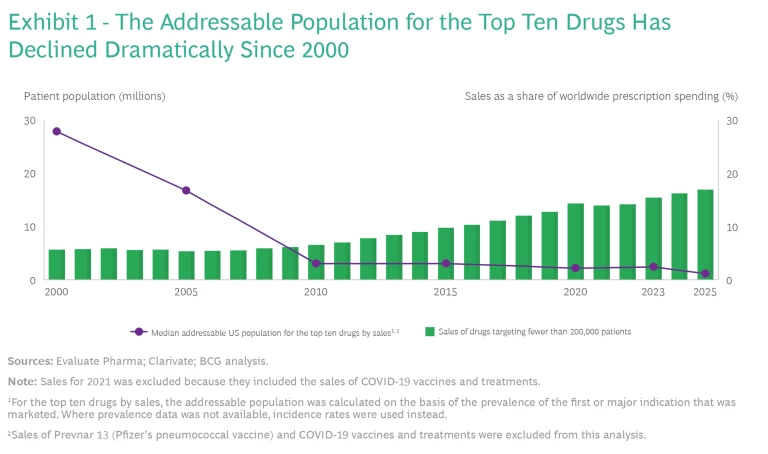

Smaller Addressable Patient Populations. With the exception of the mRNA COVID-19 vaccines, most biopharma products that are based on new modalities are being developed to treat cancers and rare diseases when unmet medical needs are extremely high and the patient populations are low. In 2000, when the top ten biopharma products were based on conventional modalities, the median addressable population was 28 million. Currently, eight of the top ten biopharma products are based on new modalities, and the median addressable population is 2 million. (See Exhibit 1.)

The smaller addressable populations and the resulting smaller product volumes have a major impact on manufacturing unit costs because scale is the primary driver of COGS . As our benchmarks have demonstrated, each time a biopharma product’s volume doubles, unit costs fall by approximately 30%. To put it another way, each time a product’s volume is cut in half, unit costs increase by 40%. This pattern holds true for unit costs across different modalities as well. For example, small-molecule drugs, which, on average, are produced at ten times the volume of vaccines, have a unit price that is one-fifth. Currently, many of the treatments for rare diseases have higher prices, but that may not be the case in the future.

Personalized Supply Chains. The personalization of medicines has created an unprecedented level of manufacturing and delivery complexity. Consider, for example, the autologous CAR T-cell treatment . After a patient undergoes apheresis at a designated clinical site, the patient’s cells are transported, using cold chain logistics, to a manufacturing facility, where the therapy is created in an individual batch. It is then shipped back to the clinical site, where it is administered to the patient.

Individual batches are costly because they have limited economies of scale—scaling out does not provide the same savings as scaling up. No less important, they require reliable, real-time, end-to-end data tracking to ensure that the right patient receives the right therapy. This can be achieved only through robust systems integration involving all the key interface points, such as patient services, manufacturing, quality control, distribution, and logistics.

THE NEED FOR GREATER SUPPLY CHAIN RESILIENCE

For the past few decades, companies have prioritized supply chain efficiency over redundancy. They have often relied on global centers of excellence for drug substance production as well as primary and secondary packaging—centers that are at specialized manufacturing sites across different countries. This approach provided significant economies of scale because it allowed companies to transport drugs and their components relatively cost-efficiently and reliably across the world.

This strategy worked well until recently, when the pandemic, geopolitical events, and trade barriers exposed the fragility of global supply chains. Biopharma companies have been especially hard-hit: BCG’s analysis reveals that nearly all of the top biopharma companies have been significantly affected by disruptions over the past five years.

Regionalization. To improve supply chain resilience , some biopharma companies are regionalizing some of their production facilities. Selective use of redundancy and nearshoring allows companies to reduce their dependence on complex global logistics, while vertical integration makes it possible to bring manufacturing for critical components (including those that are related to IT) in-house.

For example, Amgen began constructing a $365 million advanced assembly and packaging facility in Columbus, Ohio, in 2021 to bring back manufacturing capabilities to the US. Sanofi is building a vaccine manufacturing facility in Singapore to serve the Asian markets and another in France.

Regionalizing production strengthens supply chain resilience, but it also can reduce manufacturing scale and raise costs.

While regionalizing production strengthens supply chain resilience, it also can reduce manufacturing scale and raise costs. Biopharma companies that decide to pursue regionalization need to be aware of the tradeoffs and formulate effective strategies to mitigate them. For example, if a company determines that meeting market demand is more important than the cost savings that come from scale, it needs to determine the best ways to make up for the higher costs.

Procurement and Manufacturing Redundancies. To avoid relying on a single supplier for critical raw materials or components, some companies deploy a dual-sourcing strategy. But using more than one supplier may lead to purchasing lower volumes from each and higher costs.

Manufacturing redundancies have a similar tradeoff. Some companies add more plants and distribution facilities to mitigate the risk of disruption, while other companies qualify certain production processes in multiple existing facilities to avoid high capital expenditures. Both will likely result in higher fixed costs, reduced benefits from scale, and diminished economies from experience.

Inventory Buffers. Our analysis of 10-K filings of the top 20 biopharma companies found that for more than half, the value of their inventory as a percentage of revenue is much greater than it was five years ago. While inventory buffers can protect companies against disruptions that span from a few days to a few weeks, they require more working capital or longer lead times and can result in higher scrap costs.

FUTURE UNKNOWNS

Some other factors are likely to contribute to higher COGS, but it’s still unclear what their impact will be.

Reshoring. During the pandemic, many countries enacted protectionist policies, some of which are still in place today. A 2022 BCG survey of biopharma companies found that there are more companies planning to onshore manufacturing than there are arranging to move it abroad. Since the lead time to set up a new manufacturing facility is five to ten years, it is hard to know how many companies are actually moving plants onshore. But it does suggest that future offshoring will be impacted.

ESG Pressures. Facing pressure from patients, peers, investors, regulators, and employees, biopharma companies are acting on their environmental, social, and governance commitments, with a special focus on improving patient access to medicines and higher sustainability standards. Companies are making drugs more affordable for lower-income populations around the world. At the same time, they are reducing their carbon emissions and increasing their usage of renewable energy.

Coming to Terms with COGS

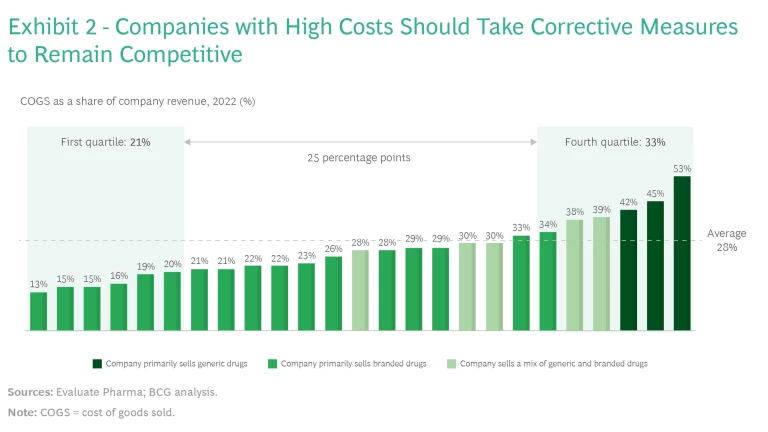

COGS as a percentage of revenue, which depends heavily on the portfolio and technology mix, varies significantly from company to company. Comparing the quartile of companies that have the lowest COGS as a percentage of revenue with the quartile that have the highest COGS as a percentage of revenue shows a difference of 25 percentage points, on average. (See Exhibit 2.)

Companies that have a higher COGS, compared with peers that have a similar technology portfolio, should start working on reducing these costs at once. The initiative can be a small effort focused on just one or two areas or a full-blown, holistic cost transformation program. We have identified six actions that companies can take to lower their COGS.

Optimize internal and external manufacturing networks. Biopharma companies need to ensure that their internal and external manufacturing networks are optimized to support the demand and capacity profile of each modality over the long term. Specifically, companies should focus their internal resources on supporting their ambition and long-term portfolio strategy.

It’s also important for organizations to make sure that their network configuration is aligned with their overarching principles for investment tradeoffs across various dimensions, including financial impact, agility, reliability, and efficiency. No less important, the network strategy should be able to provide flexibility during periods of uncertainty.

While the right network configuration will depend on the company, we’ve found that large biopharma companies have, on average, 15 to 20 internal commercial manufacturing sites, with revenue averaging approximately $2 billion per site. Companies need to reevaluate their manufacturing network strategy every five years to ensure that it is still optimized.

Make manufacturing capabilities flexible. Building modular manufacturing plants (ones that have adjustable shop floor designs, for example, or that can produce on demand) provides valuable flexibility: companies can scale up production only for products that have received regulatory approval, instead of building capacity before it is warranted. Sanofi, for example, is building modular plants that are designed to produce multiple vaccines and biologics platforms.

According to our analysis, companies that invest in manufacturing flexibility can stagger their investment decisions and make site and equipment purchases as much as two to four years later than if they used a traditional manufacturing setup.

Promote operational excellence. Biopharma companies can use lean production systems (LPS) to improve onsite productivity. LPS should eliminate key sources of waste and inefficiency across the manufacturing network, address bottlenecks, and foster a culture of continuous improvement and ownership.

It is paramount to invest in next-generation data and analytics across the value chain to enable the transparency and collaboration essential for making sound COGS decisions. Companies should deploy digital tools holistically across operations and link them robustly to value creation. An integrated digital LPS has the potential to improve year-over-year productivity by 6% to 7%.

An integrated digital lean-production system can improve year-over-year productivity by 6% to 7%.

Streamline the organization. Biopharma companies should redesign their operating and organizational models so that decision making is more efficient and effective. This includes managing the span of control to ensure the optimal number of managers, eliminating overlapping positions, reducing the number of reporting layers, and lowering the ratio of work to teams to remove work that adds little value. This effort should address all COGS or product-supply-related functions (including not only direct operations but also quality, engineering, and maintenance) that are centralized as well as those at each site.

Optimize procurement spending. To make an immediate impact on COGS, companies should tackle indirect spending and use the savings to fund the rest of the initiative. To realize savings in the medium to long term, organizations should address direct spending, investing in capabilities along the value chain from development to delivery. Companies often pass over direct spending because it can take a long time to see results, but it can drive significant benefits.

Proactively manage portfolio complexity. According to BCG’s benchmarks, portfolio complexity is the top factor driving COGS after scale. While portfolio decisions are commercial, it’s essential for companies to establish a clear governance process so that the right actors make them. The operations team can ensure that the tradeoff between the cost of additional complexity and the revenue benefit is weighed appropriately, thereby making more informed and effective investment and exit decisions.

To remain competitive over the long term, biopharma companies will need to manage COGS across their legacy portfolios and innovative pipelines, balancing the tradeoffs among product innovation, supply chain resilience, and production costs. This is not an easy task. But as biopharma companies continue to develop therapies with the potential to significantly improve patient outcomes, making the drugs more affordable will be more than worth the effort.