To steer their companies through today’s volatility and uncertainty, it is imperative that finance functions turbocharge their role as forward-looking, strategic advisors. Two related steering capabilities—dynamic planning and advanced business intelligence—are critical enablers of this enhanced role . Dynamic financial planning provides a driver-based, comprehensive view of potential future performance, accelerating a company’s ability to sense and respond to a changing business landscape. Advanced business intelligence capabilities enable real-time analyses of both historical and future performance.

To steer their companies through today’s volatility and uncertainty, it is imperative that finance functions turbocharge their role as forward-looking, strategic advisors.

With greater visibility and better scenario planning, companies can improve their monitoring of operations, markets, and customers and can enable faster and more informed decision making. Companies of any size or industry can quickly deploy proof-of-concept tests of new solutions and capture material value in the near term while building capabilities for the long term.

Several building blocks are required to accomplish this step change in finance function excellence . Companies must create a driver-based business logic that connects strategic, financial, and operational metrics and implement digital tools and visualization engines. Success also requires having shorter planning cycles, a central data platform, and a new talent strategy. Given the scope, it is critical to effectively coordinate a multidisciplinary effort across finance, business, and technology.

Today’s Environment Demands New Steering Capabilities

Companies need more accurate and agile planning and more actionable business intelligence to weather the challenges of today’s economic environment. They face an unprecedented combination of intense supply chain pressure, high inflation, low unemployment, rising interest rates, and global political conflicts. To guide decision making amid the uncertainty, companies must understand how different scenarios will affect operational and financial performance.

An advanced approach to planning and business intelligence also helps to attract and retain top talent. Finance professionals will feel empowered if they spend more time on value-added analyses and decision support instead of data extraction and manipulation. In addition, more precise and accurate data allows CFOs to be true strategic advisors to the business and be better prepared for investor meetings.

To capture these benefits, finance functions need two types of enhanced capabilities:

- Dynamic financial planning and forecasting involve creating a comprehensive view of future outcomes more rapidly, using driver-based logic and scenario analyses. This is enabled through modern planning tools that automate the process and improve accuracy. The tools are connected to a centralized data platform that serves as a single source of truth.

- Advanced business intelligence enables real-time analyses of historical and future performance to understand patterns, link financial and operational metrics, and determine root causes. Companies replace static Excel reports with dynamic dashboards that users across the organization can access via self-service.

Enhanced Capabilities Provide Significant Benefits

These enhanced capabilities make steering better, faster, and more efficient.

Better

The advanced approach allows the finance function to focus on drivers that influence the metrics that matter most to the business, such as growth, margins, and shareholder returns. This improves both the quality and the efficiency of decision making and strengthens the strategic partnership with business leaders.

A major US department store chain implemented dynamic planning and advanced business intelligence to respond to the challenges of the COVID-19 pandemic. The company was able to improve inventory turnover compared with prepandemic levels by 15%, set location-level prices, and rethink how stores measure productivity. It achieved these impacts by:

- Giving finance and business partners the ability to drill down into historical performance on a driver basis, which provided information for discounting and purchasing decisions

- Presenting consolidated dashboards with cross-functional metrics—such as for sales, inventory, margin, credit card spending, and demand—that visualize KPIs and trends for decision making

- Integrating algorithmic models of sales, demand, and other metrics into the financial-forecasting process to improve predictive power

- Empowering the finance team to pressure-test how business partners run their operations—for example, using scenario-based analysis to test the implications of changing specific operational factors

Faster

Producing and updating plans, budgets, and forecasts requires significantly less time and enables agile decision making. The department store company shortened the lead time for producing forecasts to one week from the customary three to four weeks. It now updates performance dashboards in real time and produces full management reports in a few hours, versus two to four weeks in the past.

More Efficient

Finance functions that modernize their planning and business intelligence can often become 15% to 20% more efficient by reducing the amount of time spent extracting, manipulating, and reconciling data. The department store’s finance function decreased the share of its time spent on these low-value tasks from 60% to 80% in the past to less than 20%. This freed up finance professionals to spend more time on business advisory activities.

Subscribe to Our Corporate Finance and Strategy E-Alert.

Five Building Blocks

Implementation of the new capabilities requires establishing five building blocks: driver-based business logic, digital tools, simplified processes, data platforms, and redesigned talent and operating models.

Driver-based Business Logic

Each company needs a solid understanding of its business logic—that is, the drivers of performance and a structure for analyzing the results. Two capabilities are essential:

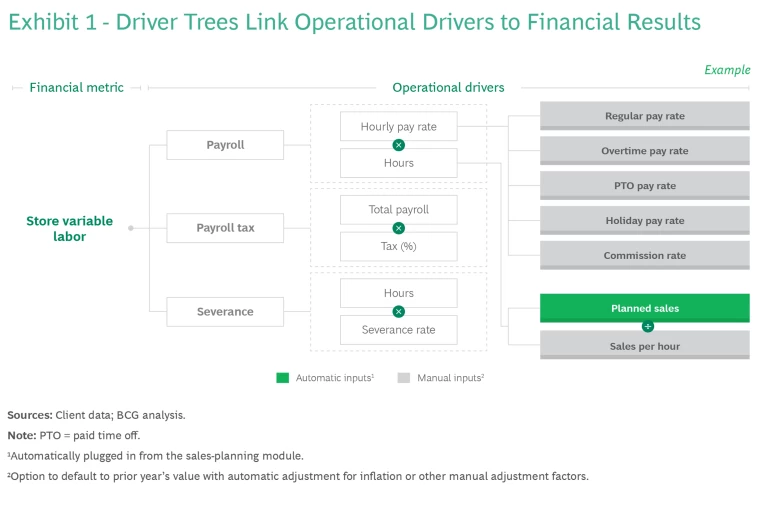

- A driver-tree logic that links financial KPIs (for example, total revenue, the cost of goods sold, and net income) with operational KPIs (such as the hourly labor rate, capacity utilization, and number of truck routes needed). Companies can use artificial intelligence (AI) and machine learning (ML) models (advanced demand models, for instance) as inputs for the drivers. The finance function uses driver trees to explain the results, establish the causality, identify the root causes, and plan the next steps.

- The ability to slice and dice views of KPIs along the dimensions that are most helpful to the business. Each business unit may need varying levels of granularity for each KPI, and some business units might want to see different data cuts for each plan and forecast.

A US luxury department store developed driver trees for all key line items in the P&L statement, including sales, merchandise costs, supply chain costs, and SG&A expenses. Exhibit 1 illustrates the driver tree for variable labor in stores and how a company can leverage automatic and manual inputs.

Digital Tools and Visualization Engines

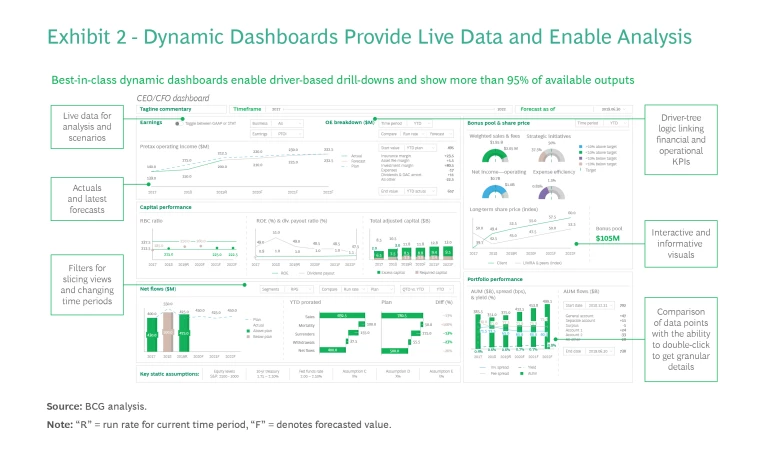

After establishing the business logic, finance functions need to configure digital-planning tools and visualization engines that allow teams to examine what-if scenarios, interpret the results, develop actionable insights, and define plans. Financial-planning tools (such as Anaplan and OneStream) and visualization engines (including Tableau and Power BI) are examples of modern cloud-based tools that are transforming traditional finance processes. Exhibit 2 shows a sample dynamic dashboard that visualizes real-time data and enables analyses by stakeholders across the organization.

Digital tools should provide the following capabilities:

- Live Data. Connect tools directly to the single source of truth and automatically update data feeds as changes occur.

- Drill-Down and Roll-Up Ability. Enable users to drill down to operational drivers and roll up results to various dimensions of the business (for example, aggregate costs by store type or product line).

- A Comparisons of Results. Provide the ability to compare a selected period of plans and forecasts with the actual results in real time.

- Self-Service. Give business stakeholders self-service access to all the data they might need and enable them to easily configure planning views.

- Scenario Analysis. Allow users to plan for potential scenarios (for example, a recession, high inflation, or supply chain disruptions) and accelerate responses by simulating what would happen if certain market conditions change.

- AI/ML Modeling. Incorporate AI/ML models (such as for customer demand and sales) to improve the accuracy of planning and forecasting and estimate the operational and financial impacts of potential decisions.

A US retailer created an ML engine to improve its ability to sense demand and respond rapidly to customer needs. The model integrated multiple external data sources to better predict customer buying patterns and to get “smarter” at sensing demand over time. The company integrated the model into regular operational and financial-planning processes, to ensure that its insights inform daily decision making and resource allocation decisions.

Simplified Processes

To effectively run the digital tools using the new business logic, finance functions need to rethink their processes. They can apply automation to shorten planning, budgeting, and forecasting processes. In addition, frequent forecasting with occasional detailed planning and budgeting allows companies to maximize visibility into, and control over, operations while minimizing the amount of time spent on the annual planning process. Companies can also boost efficiency by improving alignment touch points with senior leadership and breaking down organizational silos to better coordinate financial and operational planning.

To effectively run the digital tools using the new business logic, finance functions need to rethink their processes.

To enable the adoption of AI-driven algorithmic forecasts, an automotive manufacturer’s leasing business unit needed to replace its traditional bottom-up forecasting process. The new process included alignment touch points that allowed leaders to adjust the algorithmic forecasts manually by applying their expertise, followed by strategy sessions to simulate the impact of making changes to strategic levers (such as debt ratios). Full adoption of algorithmic forecasting enabled the company to shift from retrospective analysis of past results to proactive identification of actions and their likely bottom-line impact.

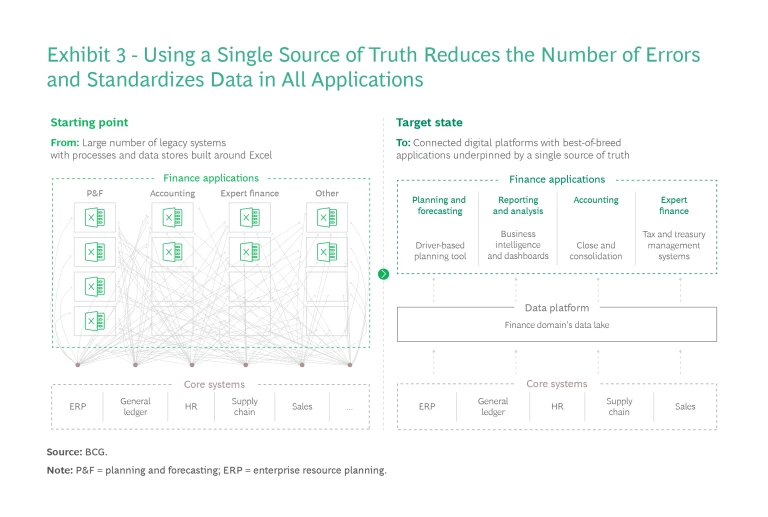

A Central Finance Data Platform

To feed digital tools and calculation engines, companies should establish a data repository (for example, a data warehouse and data lake) as the single source of truth. (See Exhibit 3.) To make effective use of the data repository, companies must take the following actions:

- Develop a business glossary or data dictionary to standardize the metric definitions used by teams. For example, stores and supply chain groups should use the same definition of “returned items.”

- Designate the business events (such as store sales, online sales, and returns) that trigger the flow of data from source systems into the data platform in a standardized format. Establish procedures to ensure that consistent and high-quality data flows into the platform—for example, by conducting unit tests to check for outliers.

- Create a centralized data management function responsible for ensuring that the data flowing out of the platform is complete, accurate, and consistent so that it can be used for analyses that support decision making.

- Establish integration mechanisms (for example, application programming interfaces and data pipelines) to connect the data repository with best-of-breed planning and visualization applications, such as Anaplan and Power BI.

- Implement workflows (such as data reconciliation) that leverage automated data feeds and minimize manual work.

Enhanced Talent

Companies need to identify the new competencies required to manage dynamic planning and advanced business intelligence. They must upskill the current workforce (to use new tools and conduct scenario analyses, for example) as well as hire people for new roles (such as data scientists and configuration specialists for finance tools). A center of excellence should oversee any future changes to the new digital tools and ensure that they are being used to their full potential.

Leading organizations are addressing this imperative aggressively; many see it as especially urgent given the intense competition for digitally savvy talent. A global health care company transformed its talent strategy to support changes to its digital tools and operating model. This included upskilling people within the finance organization through formal training in key skills, updating the skills (such as coding and scenario modeling) required for each role, and expanding career paths to prioritize diverse, skill-based experiences. This upgraded approach is driving a greatly enhanced employee value proposition, which helps the company attract and retain the best talent.

Key Success Factors

Although the concepts behind dynamic planning and advanced business intelligence are not overly complex, many companies struggle to implement them successfully. For organizations to achieve full value, it is crucial that they set appropriately bold ambitions for progressing through the journey and think holistically about the required changes concerning people, processes, and technologies. Companies can use a diagnostic to understand their starting point. For example, BCG’s CFO Excellence Index benchmarks a finance function’s performance along dimensions such as finance IT and systems, planning and forecasting, and business intelligence.

Five success factors are crucial for implementation:

- Cross-Functional Collaboration. Although finance teams own the overall transformation, successful execution requires the participation of business and technology teams as well. The teams need clear accountabilities across design, data, build, configuration, testing, and rollout.

- Change and Project Management. Establish dedicated teams that can drive implementation by helping to remove any roadblocks during execution and promote the adoption of the new solutions across the finance organization.

- Two-Speed Implementation. Demonstrate rapid value delivery (such as by building dashboards in sprints) while developing foundational capabilities (a data platform, for example) in the background.

- Senior Sponsorship. For a transformation to gain the most traction, it should be led by the CFO and senior business executives and treated as a key strategic initiative.

- Quick Process Changes. Shut down legacy processes, such as Excel-based planning, as soon as possible to encourage full adoption of the new tools.

Dynamic financial planning and advanced business intelligence promise to be transformative. Finance functions can generate forecasts in days instead of weeks and prepare plans and budgets in weeks instead of months. Finance teams can avoid spending more than 70% of their time on manual processes. Business stakeholders can have access to all necessary information at their fingertips. Ultimately, finance functions will have more cost-efficient processes that enable better and faster decisions, allowing them to steer the business with greater confidence and foresight. To meet the challenges of the current business environment, companies must act now to make the future of financial steering a reality.