Creating value from environmental, social, and governance (ESG) considerations has gained importance in M&A . Companies are examining how they can leverage a target’s ESG strengths to promote revenues, profits, and balance sheet efficiencies for the combined business. Such synergies often feature prominently in the equity story presented to investors and can play a major role in boosting total shareholder returns.

Acquirers face numerous challenges, however. Although the quality of ESG reporting has improved among large companies over the past five years, the use of multiple standards and frameworks complicates efforts to understand and compare their ESG performance. Additionally, relatively few middle-market companies fully report their ESG performance. This makes it difficult to pinpoint ideal targets for bolt-on acquisitions, both from an immediate standpoint and with regard to long-term ESG-related value drivers, such as talent retention and brand visibility.

To overcome the challenges of unlocking ESG synergies, acquirers need to integrate ESG considerations throughout the M&A process, from pre-deal due diligence to post-merger integration . The optimal approach is similar to that used for traditional synergies but addresses the unique challenges of identifying and evaluating ESG-related benefits.

ESG Synergies Are Often Significant

Traditionally, acquirers have mainly addressed ESG during the risk assessment in their due diligence efforts, in order to mitigate the risks and preserve the target's value. ESG risk mitigation continues to be a fundamental aspect of the pre-deal assessment. An acquirer needs to integrate targets into its ESG compliance and reporting standards and avoid potential downgrades of the combined entity's ESG score. It also must assess the impact on integration costs if the target does not comply with its ESG objectives.

ESG synergies go beyond risk mitigation. They encompass the ways in which an acquirer can generate value for the combined entity by utilizing its own ESG practices and those of the target, as well as by implementing new operating models and generating scale effects. This value can be quantifiable or nonquantifiable.

Quantifiable value is created by ESG synergies that directly affect the income statement. These include, for example:

- Driving recurring cost savings through measures such as enhancing operational efficiency in conjunction with decarbonization and implementing more sustainable procurement and supply chains

- Increasing revenue, such as by overcoming regulatory barriers to access new markets, increasing customer engagement, or raising prices

- Improving the cost of capital, such as by mitigating risks, gaining access to alternative funding, or optimizing capital expenditures, investments, and assets

Nonquantifiable value arises from the impact of ESG synergies on the acquirer's equity story and TSR. A BCG study found that deals emphasizing ESG considerations tend to outperform other deals in terms of cumulative abnormal returns upon announcement and two-year relative TSR.

ESG synergies go beyond risk mitigation.

For example, enhanced ESG scores and ratings may lead to higher valuations by reducing the cost of capital and facilitating better access to capital markets. Moreover, if an acquirer materially improves its ESG performance by integrating a target, it may attract new types of investors and broaden the investor base, leading to further capital-raising opportunities and long-term growth.

A prime example of the contribution of ESG synergies to TSR is Holcim’s acceleration of its green growth through a bolt-on acquisition strategy since 2020. (See “Holcim’s Green Growth Strategy in Building Materials”) Acquirers can capture the value of ESG synergies by reducing carbon emissions, fostering social inclusion, or raising governance standards. (See “A Food Company Uses Synergies to Reduce Emissions Faster.”)

Holcim’s Green Growth Strategy in Building Materials

From 2020 through 2022, the solutions and products division’s contribution to Holcim’s net sales surged from 8% to 19%. The company has set a target of 30% by 2025. At the same time, Holcim’s CO2 emissions per net sales ratio declined from 5.1 to 3.7. Moody’s ESG scorecard indicates that this strategic approach substantially improved Holcim’s ESG performance compared with the sector average. Its performance was one factor that contributed to Holcim’s annualized TSR of 10% since January 2021, which significantly outpaced the 2% TSR of its industry peers.

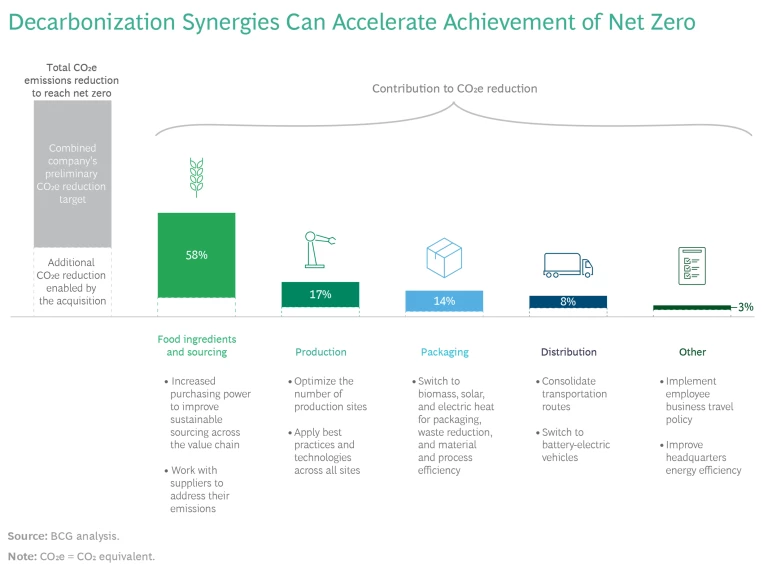

A Food Company Uses Synergies to Reduce Emissions Faster

- Food Ingredients and Sourcing. The company can leverage increased purchasing power to enhance sustainable sourcing throughout the value chain. It can also collaborate with suppliers to address and reduce their carbon emissions.

- Production. The company can optimize the number of production sites in the combined manufacturing network to reduce its emissions. It can then implement best practices and cutting-edge technologies across all facilities to maximize efficiency and sustainability.

- Packaging. Transitioning to renewable-energy sources such as biomass, solar, and electric heat promotes the sustainability of packaging processes. The company can also reduce waste and enhance material and process efficiency to minimize its environmental footprint.

- Distribution. By consolidating transportation routes and switching to battery-electric vehicles, the company can make distribution more sustainable and efficient.

- Additional Levers. Other initiatives, such as implementing an employee business travel policy across the combined organization and improving energy efficiency at headquarters, also accelerate the achievement of net zero emissions.

Addressing ESG Synergies in Three Phases

Acquirers can extract maximum value from their ESG investments by utilizing a traditional approach to synergies. This includes synthesizing and prioritizing synergy targets, identifying and validating risks and opportunities, substantiating synergies, and preparing for implementation. The following steps serve as a guide for unlocking ESG synergies.

1. Conduct ESG Due Diligence Before Signing the Deal

Before the due diligence phase or the initial stages of public takeovers, it is vital to pinpoint the most significant ESG factors for both the target company and the potential combined entity. Utilize publicly accessible data to perform an outside-in assessment of material ESG-related risks and opportunities. Gain a clear understanding of the most important sustainability issues in the industry, along with the trends and technologies that should be prioritized and accelerated. If ESG presents substantial risks or is central to value creation, leverage data from the target during the due diligence process to evaluate risk exposure, identify mitigation opportunities, and formulate preliminary synergy hypotheses.

2. Validate ESG Risks and Opportunities Between Signing and Closing

After signing the deal, use the additional information available to validate the assessment of ESG-related risks and opportunities, describe the synergies in detail, and develop an implementation plan. Support from a “clean team” composed of third-party personnel is valuable during this stage. Although antitrust laws prohibit merging companies from sharing sensitive information before the closing, the clean team can analyze data from both companies and share sanitized, interim results with both integration teams.

It is vital to pinpoint the most significant ESG factors for both the target company and the potential combined entity.

The validation process includes collecting data, harmonizing ESG metrics and taxonomies, consolidating ESG baselines, and synthesizing hypotheses. The output is a prioritization of material ESG factors along with initial estimates of savings potential. Substantiate synergies by having the clean team conduct initial analyses and refine top-down synergy targets derived during due diligence. This phase also includes prioritizing ESG initiatives by materiality, assigning and communicating targets, and refining integration costs.

Finally, plan the execution of ESG synergies. Start by validating bottom-up synergy targets with functional teams from, for example, finance, procurement, sales, marketing, and HR. This provides the basis for prioritizing longer-term opportunities and aligning on new or renewed ESG priorities and ambitions to include in detailed implementation plans.

3. Implement ESG Synergies from Day 1

After the deal closes, start implementing ESG synergies right away. To obtain comprehensive data about the acquired company, engage in open-book discussions, town hall meetings, or small group sessions. Use this detailed information to validate targets and plans developed in earlier phases, execute risk management and savings initiatives, and, if necessary, reprioritize longer-term opportunities. The execution phase is also the time to fine-tune the new or renewed ESG priorities and ambitions for the combined entity, as well as to define a roadmap for capturing the value. Finally, create a culture of collaboration among teams from acquirer and acquiree so that they can pursue shared goals aimed at enhancing the combined entity’s ESG performance and unlocking further value.

As ESG topics gain importance as motivations for M&A, acquirers must look beyond defensive moves to mitigate risk and comply with regulations. Instead, they should determine the forward-looking actions that the combined entity can take to generate value through ESG synergies. This makes it essential to identify and accurately estimate these synergies throughout the M&A process. Acquirers that succeed will promote sustainability goals and ensure that the combined entity’s performance is more than the sum of its parts.