When discussing decarbonization, most people talk about the emissions released during a product’s use. Yet this focus overlooks a significant source of environmental impact: the production phase. To address production-phase emissions, all companies along a product’s value chain—including raw material suppliers and manufacturers, suppliers across all tiers, and OEMs—must understand consumers’ willingness to pay for decarbonization.

BCG recently surveyed consumers of automobiles and white goods (large home appliances such as washing machines) to gauge their openness to pay a “green premium”—a markup for products manufactured with net zero emissions. Our global survey identified three consumer segments that say they are, to a varying extent, willing to pay this premium. (See “About Our Study.”) The survey was conducted in Q3 2023 amid ongoing inflation, a recessionary climate, and diminished consumer confidence—factors potentially leading to a reduced reported willingness to pay.

About Our Study

- Raw material suppliers and material manufacturers

- Suppliers across all tiers

- OEMs of autos and white goods, respectively

- Consumers, defined as individuals who purchase products for their personal use

The study included a consumer survey and executive interviews.

Consumer Survey. In October 2023, BCG surveyed consumers of the automotive and white goods industries to evaluate their willingness to pay for net zero production. Net zero production, as we use the term, maximizes the decarbonization of all product materials with current technologies, while offsetting any remaining, unavoidable emissions.

A total of 2,524 respondents participated: 1,750 for automotive and 774 for white goods. Automotive participants were from the US, the UK, Germany, France, Poland, Japan, and China. White goods participants were from the US, Germany, and China.

There are caveats regarding the survey population: In online research within developing countries, urban regions may be overrepresented owing to internet accessibility variations, potentially skewing perspectives. In our study specifically, the online format meant that rural participants were more challenging to reach, particularly in China and Poland. Moreover, generalizing findings should be approached cautiously to account for a comprehensive understanding of the broader socioeconomic and geographical landscape.

We introduced respondents to the concept of net zero production in detail and asked them explicitly about their willingness to pay for products manufactured via net zero production. We asked respondents to specify the price, model, and brand of their recently purchased car or washing machine (within the past 12 or 24 months, respectively); then, relative to this price bracket, we tested their willingness to pay with successively higher green premium values. We used the Gabor-Granger technique to construct a demand curve to understand the relationship between the product’s green premium price and the proportion of consumers who are willing to pay that amount.

In studying sustainability preferences, it is critical to grasp the concept of the “say-do gap.” This gap denotes the difference between individuals articulating their intentions, values, or preferences and their actual behavior. Several factors influence this phenomenon. An important factor is the lack of barriers to expressing a willingness to pay in a survey, irrespective of actual behavior. Also, fostering the understanding of net zero production in a controlled environment results in total awareness and attention, which is challenging to replicate in the market.

To reduce bias in the survey results and minimize the potential for a “say-do” gap, we established multiple safeguards and corrected conceptual misunderstandings. Even so, the reported figures should be viewed as a ceiling effect, representing the maximum achievable values.

Executive Interviews. We interviewed 22 industry executives to examine the business-to-business implications of green premiums. The interviewees spanned the value chain, including raw and processed materials producers, component suppliers, and OEMs. Their roles encompassed procurement, sales, strategy, and sustainability. We asked interviewees about their experience with or perception of consumer willingness to pay, the challenges they face when procuring or selling green materials or components, and the systemic changes needed for the entire value chain to benefit from premiums from net zero production.

But understanding consumers’ willingness to pay is only the starting point. Companies, especially OEMs, must also solve the challenge of how to distribute resulting premiums across their complex manufacturing value chains. This implies equitably sharing the costs, responsibilities, and gained value of reducing emissions along a product’s value chain, ultimately leading to more sustainable production.

Three Critical Questions

Production-related emissions—from the mining of raw materials until the finished product is ready for sale—can be a substantial share of a product’s total lifecycle emissions. For instance, raw materials and production can account for up to 25% of the emissions for an internal combustion engine (ICE) passenger vehicle. This figure soars to at least 50% for battery electric vehicles (BEVs).

Automotive and white goods OEMs, their suppliers across all tiers, and processed materials manufacturers need green premiums to help balance the higher costs of production practices that partially or fully reduce emissions of CO2 or CO2 equivalents (“net zero production”). The green premium is especially important if every value chain player aims to maintain its margins. To operationalize net zero production and understand its economic viability, all value chain participants need to consider three critical questions.

- How can we increase the likelihood that consumers who say they are willing to pay a green premium actually pay one at the time of purchase?

- Is the green premium arising from consumers’ stated willingness to pay sufficient to cover decarbonization costs, plus margins?

- How can participants at all stages of the value chain benefit from the green premium paid by consumers at the end of the value chain?

We explore these questions and recommend some key actions to take.

Convincing Consumers to Pay the Green Premium

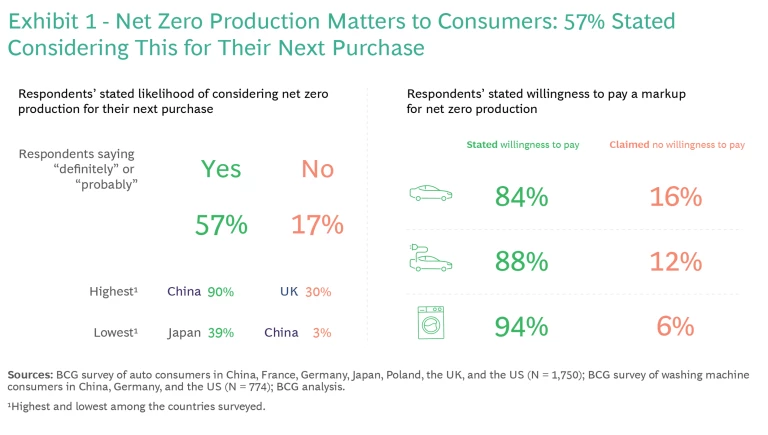

Question #1: How can we increase the likelihood that consumers who say they are willing to pay a green premium actually pay one at the time of purchase? In our global survey, 57% of respondents said that they would “definitely” or “probably” consider net zero production when purchasing their next new passenger vehicle or home appliance. Some 88% of respondents stated they are willing to pay at least a 0.4% green premium for net zero production of passenger vehicles and appliances (we used a washing machine as an example). (See Exhibit 1.)

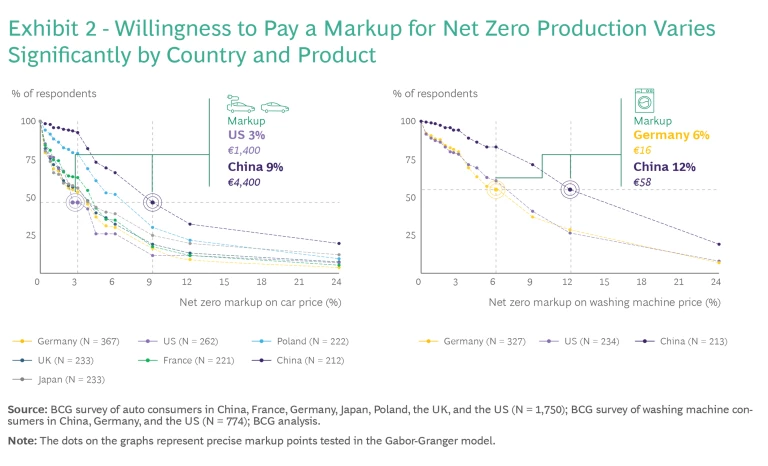

Across the product categories, respondents’ willingness to pay trends were similar in the US and Western Europe, but much higher in China, Japan, and Poland for cars and in China for washing machines. Country- and product-specific differences emerged: Roughly 47% of car consumers tend to cap their willingness to pay at 3% in the US (lowest) and 9% in China (highest). Approximately 55% of washing machine consumers report a willingness to pay a 6% increase in Germany (lowest) while Chinese respondents report 12% (highest). (See Exhibit 2.)

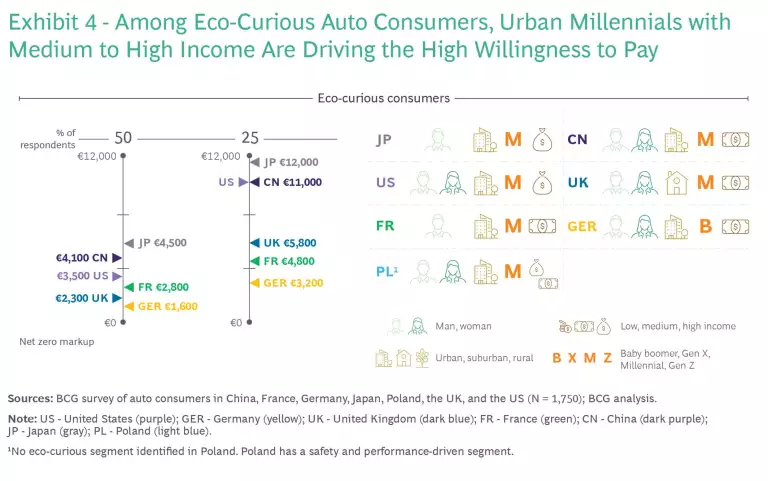

Needs-based segmentation of consumers in each country provides a more accurate view of consumers’ willingness to pay, by de-averaging them and revealing the highest value segments to focus on. We delve deeper into segmentation for automotive and washing machines below. First, we examine the demographic factors influencing willingness to pay.

To further understand these country differences, we examined respondents’ characteristics, including urbanity, generation, income, and gender. In all countries, there was a divide based on generation and urbanity: Younger respondents such as Millennials (aged 25 to 34) and Gen Zers (aged 18 to 24) and urban dwellers consistently exhibited higher willingness to pay than their older and suburban and rural counterparts. Respondents in the US, Western Europe, and Japan had similar demographic profiles. However, the respondents’ demographics from Poland and China diverged. They were predominantly Millennials (52% in both countries) who lived in cities (77% in Poland; 95% in China). These demographics mirror the typical car buyer profile in these countries, as well as our survey’s higher reach among urban and suburban consumers. In our survey, Chinese respondents stated the highest willingness to pay, a finding that aligns with other BCG research wherein Chinese consumers were the most concerned about sustainability.

Actions to Capitalize on Current Consumer Willingness to Pay. Companies, especially OEMs, need a nuanced understanding of the drivers of consumer choice with a comprehensive view of segments’ attitudes, demographics, country-level variation, and their broader sociopolitical context. We see three types of action that OEMs and suppliers can take to harness existing consumer appetite for sustainability and drive positive developments in the market. OEMs and suppliers must pinpoint key consumer segments by de-averaging them on the basis of willingness to pay; assess and address the barriers and enablers that affect these consumers’ willingness to pay; and adapt pricing strategies to support a decarbonized production value chain.

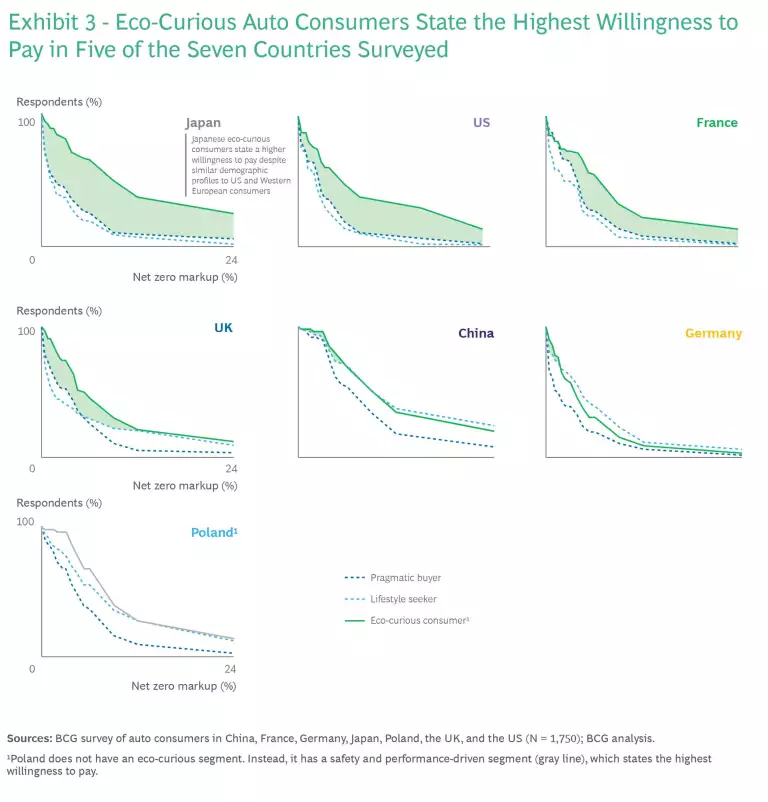

De-average consumers. For autos globally, three broad consumer segments emerge based on needs: eco-curious consumers, pragmatic buyers, and lifestyle and comfort

Significant differences exist between segments’ stated willingness to pay, with eco-curious consumers consistently showing the highest indicated willingness to pay in nearly all countries. (See Exhibit 3.) However, in Germany, lifestyle seekers have reported slightly higher willingness to pay than eco-curious consumers.

Despite sharing the tendency of stating a high willingness to pay for net zero production, the eco-curious segment displays variations across countries. In Germany, over half of eco-curious consumers are willing to pay slightly more than 3% (€1,600)—the lowest among the countries. Conversely, in China and Japan, 50% of eco-curious consumers are willing to pay 9% (€4,100 and €4,500 respectively), representing the highest willingness-to-pay rates. (See Exhibit 4.)

The eco-curious segment propels the transition toward BEVs and hybrid electric vehicles (HEVs), while in the other segments, consumers mainly opt for ICE cars. Only in China the share of purchased BEVs and HEVs is roughly the same across all segments. Brand preferences strongly vary by country and segment, influenced in part by car visibility and branding.

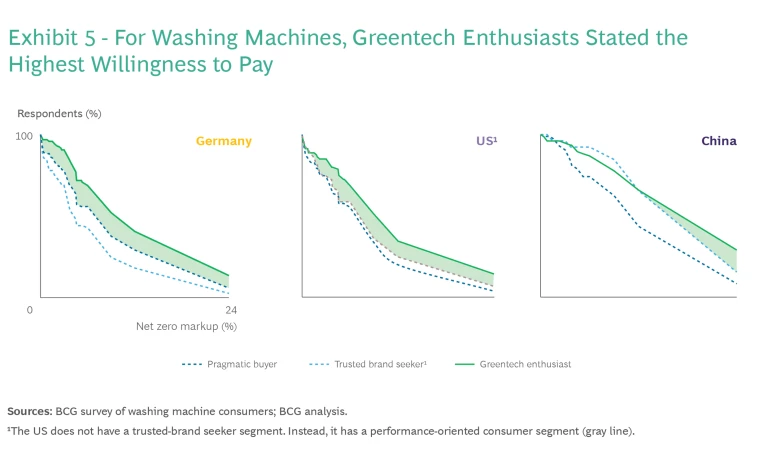

Buyers of washing machines are also split into three segments: pragmatic buyers, trusted brand seekers, and greentech

Segments of washing machine consumers exhibit similar needs across regions. US consumers are an exception, emphasizing performance features over brand. Across all surveyed countries, greentech enthusiasts consistently reported the highest willingness to pay. (See Exhibit 5.)

Brand preferences differ by country but remain relatively consistent within segments.

The absence of strong brand preferences within segments, in contrast to the auto survey results, mostly results from the lesser visibility of washing machines for consumers compared with autos or even kitchen appliances. Indeed, OEMs often employ different marketing strategies for home appliances that are prominently visible versus those that are typically hidden in bathrooms or cellars.

Promote willingness to pay by addressing barriers and enablers. Across all countries, we identified three common barriers that limit consumer willingness to pay for vehicles and white goods: concerns that the additional charge is too expensive for their budget; doubts regarding the authenticity of net zero production and suspicions about false claims (“greenwashing”); and concerns about performance. Prior BCG research confirmed these consumer concerns and the executives we interviewed emphasized the need to communicate that sustainability does not compromise product performance.

We identified two enablers that lower barriers for consumers to pay a green premium for net zero production. First, across all consumer segments and countries, most consumers want to see an explanation of CO2 equivalent savings (60% to 70% of respondents); in China, this amount reached approximately 90%. Second, external certification of net zero production from a recognized authority. This would increase credibility and willingness to pay for 50% to 60% of respondents.

Recent BCG research finds a trend that consumers are purchasing more sustainable products and are increasingly willing to pay a higher price for their perceived higher quality. Addressing consumer concerns through data transparency and certification can increase trust and allow businesses to tap into these existing segments and benefit from a higher willingness to pay.

Adapt the pricing strategy. Looking at consumers’ stated willingness to pay, companies, especially OEMs, are faced with a challenge: Should they choose a higher net zero markup yielding fewer potential buyers, or should they opt for a lower markup targeting a broader buyer base?

As for many innovations, starting with a higher initial premium to target the early adopters (that is, eco-curious consumers and greentech enthusiasts) seems to be a promising strategy for autos and white goods OEMs to kickstart their green transformation and incentivize the value chain with a compelling business case. This is an application of the pricing strategy known as “skimming,” which uses a high premium to focus on a small group of high-value

Our recommendation of the skimming strategy is based on a consideration of key value-chain dimensions, including: the number of steps and players, decarbonization ramp-up speed and upfront costs, secondary material supply constraints, and the margin for upstream value chain players. This approach proves economical in advancing decarbonization efforts, particularly as green supply chains develop for economies of scale.

Covering Decarbonization Costs

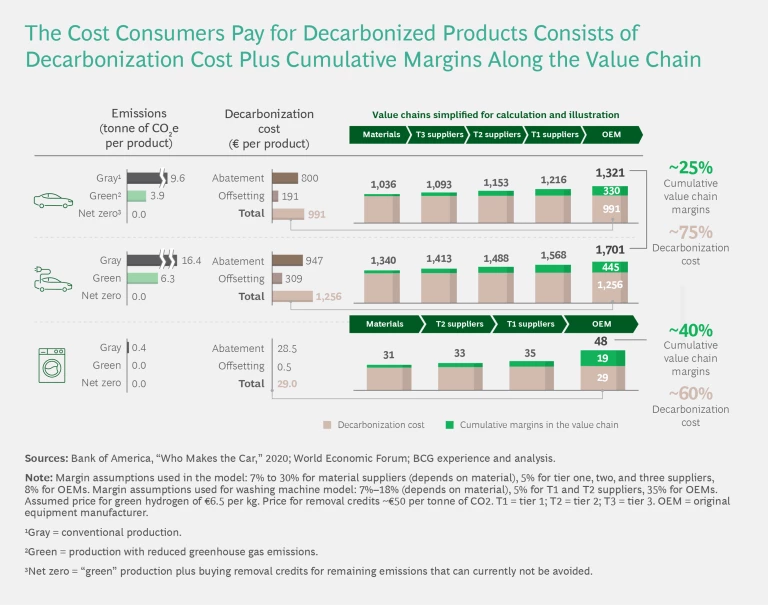

Question #2: Is the green premium arising from consumers’ stated willingness to pay sufficient to cover decarbonization costs, plus margins? If the willingness to pay a green premium is at least equivalent to a product’s decarbonization cost, then OEMs could cover this amount at the level of an individual car or washing machine. (See “Calculating the Decarbonization Cost.”)

CALCULATING THE DECARBONIZATION COST

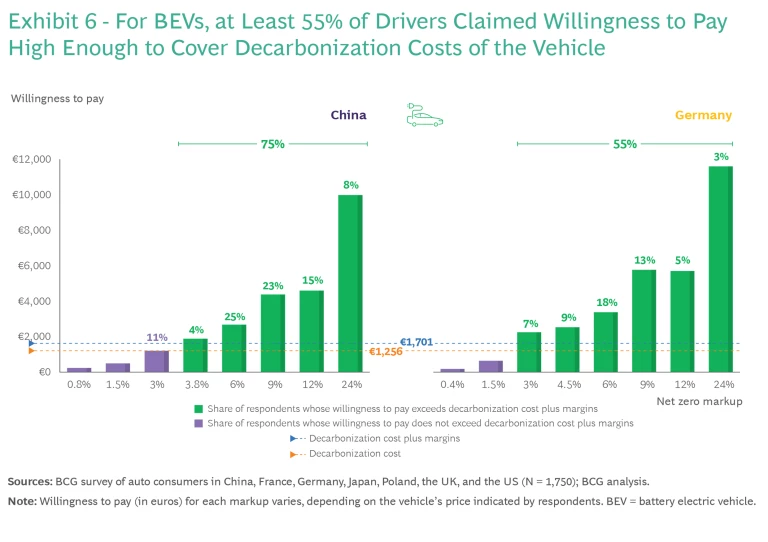

For BEVs, most of the drivers in our survey said they are willing to pay a markup that, based on our calculation, would be sufficient to cover the decarbonization costs of the vehicle. Moreover, 75% of Chinese BEV drivers and 55% of German BEV drivers state a willingness to pay that would be enough to also cover decarbonization costs, plus margins for all the value chain

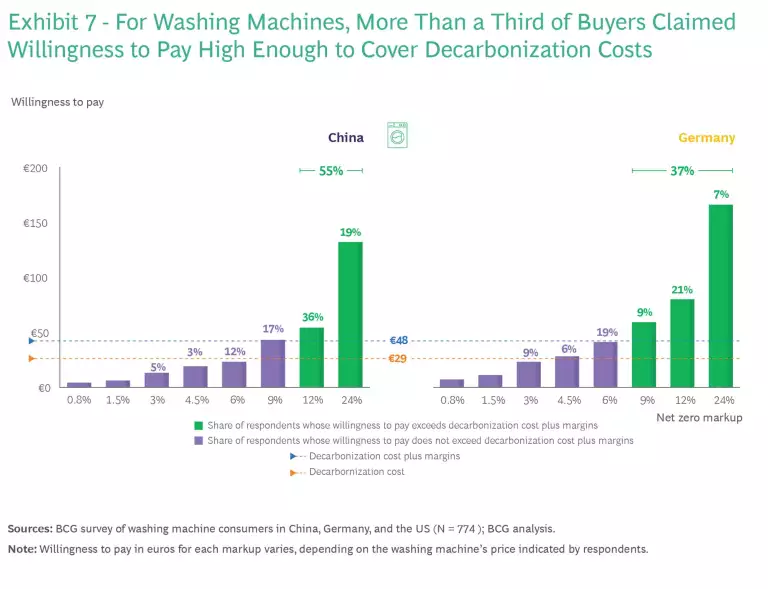

For washing machines, more than one-third of respondents expressed a willingness to pay a markup that would cover the decarbonization costs while allowing for a profit margin. This sentiment was particularly strong among respondents in China (55%) and also notable among those in Germany (37%). (See Exhibit 7.)

Actions to Cover Decarbonization Costs. Leveraging stated consumer willingness to pay is one element in an array of strategies companies will likely need to cover decarbonization production costs. As companies advance on their net zero journeys, they need to strategize for decarbonized production now to accommodate product planning cycles. Even if companies cannot fully cover costs, they can consider the following actions to gain green premiums:

- Identify and address key segments. Auto and white goods OEMs should start now to learn how to target the growing and evolving segment that is willing to pay for green production. It will likely take multiple attempts to refine how to cater to these segments’ needs.

- Operationalize net zero production. All value chain participants from raw and processed materials manufacturers to OEMs need a game plan for key choices in upgrading their production to decarbonized materials. This includes how they will adjust their design criteria, manufacturing processes, and facilities; how to source and secure green material supply; and if production will be net zero or have varying grades of reduced-carbon products, even if this incurs a complexity cost.

- Consider partially green production. Although our survey asked specifically about net zero production, some OEMs and suppliers may be interested in deploying partially decarbonized production. However, partial decarbonized production may not be relevant for all industries. Our interviewees’ responses suggest that this approach is more relevant in automotive than white goods. OEMs should examine consumer appetite for partially green products and engage them appropriately through marketing, education, and communication.

- Price strategically. Companies should evaluate the impact of changes to decarbonization costs and consumers’ evolving willingness to pay. Suppliers and OEMs should ensure that pricing aligns with critical consumer segments. Companies can also anticipate future reductions in decarbonization expenses (via scaled production, increased green material supply, and supporting government action) and increased willingness to pay (due to growing awareness and consumer expectations).

Spreading the Benefits Along the Value Chain

Question #3: How can participants at all stages of the value chain benefit from the green premium paid by consumers at the end of the value chain? Even if the stated markup does not break even with decarbonization costs, it has the potential to be more equitably distributed along the value chain. An ecosystem approach is needed to interconnect value chain players so that green premiums, often collected by OEMs, can flow upstream to suppliers and producers.

Expert interviews confirm the ongoing challenge for value chain players to recoup their decarbonization expenses. Although material manufacturers affirm the feasibility of decarbonization, they identified financing as the primary obstacle. We find that tier one suppliers and OEMs are willing to pay a premium to subsidize net zero production, but often not enough to cover the cost of full decarbonization, let alone provide a margin. Furthermore, suppliers revealed that a mutual commitment to Science Based Targets initiative (SBTi) goals has resulted in some OEMs being reluctant to incur additional expenses to support suppliers’ decarbonization efforts. Among interviewees, even OEMs that are willing to pay a premium for green materials and components are limited in how much they can spend because their consumers cannot see a visible difference with the decarbonized product (for example, green steel used in a car).

Our analysis found that upstream players, such as manufacturers of raw and processed materials, bear the brunt of decarbonization expenses in both the automotive and white goods industries. As a result, to support the development of the entire value chain, a key challenge is how to allocate value in a way that benefits upstream players, rather than predominantly rewarding players further down the value chain.

Actions to Benefit Participants at All Stages of the Value Chain. To improve their positions and secure a larger share of growing green value, companies must recognize that there is no one-size-fits-all solution, as revealed by our interviews. Rather, they need to tailor their strategies for value generation—this is especially important for material and component manufacturers and suppliers to gain more influence. Furthermore, any changes need to be integrated into a coherent decarbonization plan with alignment throughout the company.

Based on our research, we recommend that all value chain players should prioritize the following three approaches to enhance the visibility of their contributions, both within the value chain and to consumers.

Increase transparency. This includes sharing detailed product carbon footprint data, emphasizing CO2 equivalent emissions. Transparency fosters credibility and trust, increases willingness to pay, and allows for better value comparisons throughout the supply chain. Transparency also involves addressing concerns about potential tradeoffs between performance and sustainability. When any company discloses emissions of their decarbonized products, it also casts a spotlight on their yet-to-be-decarbonized products, necessitating preparedness for this scrutiny. To enhance communication, various OEMs in our interviews voiced a need for authorities to establish clear KPIs and standardized reporting that would streamline communication and foster a shared understanding.

Educate. To create understanding and awareness of production emissions and incurred additional costs of decarbonization efforts, all value chain companies can educate not only their own workforce and direct customers but also target a broader audience of peers, other value-chain partners, and even end consumers. There are various avenues for education and engagement, including internal training sessions, collaboration with industry associations, publishing educational materials, and transparency in reporting. In particular, companies at the beginning of the value chain must ensure that their direct customers as well as distant consumers understand their contributions to decarbonized production.

Communicate. Making the typically invisible net zero production visible to consumers can be achieved through strategic marketing, branding, and design. Examples include branding green materials and products, incorporating recycled components into visual design, adding elements that signal green production (such as color choices), using certifications, applying labels, and exploring co-branding opportunities. These approaches can help even suppliers of green materials increase their visibility by directly reaching consumers.

Furthermore, companies should adopt a long-term perspective by developing an ecosystem that fosters the growth of decarbonized value chains. Given the scarcity of certain green materials, OEMs can help secure their own consistent supply by supporting upstream players. This can be done by forming collaborative relationships and investing in vital infrastructure for their value chain (such as facilities for recycled plastics). By reinvesting in their value chain, OEMs and suppliers can leverage partnerships and cooperative dynamics for mutual growth.

The findings of our global survey are a call to action for every company along a product’s value chain to strategize on how to adapt their pricing, communication, education, and transparency to capitalize on consumers’ stated openness to pay a green premium today and in the future. Respondents revealed a significant willingness to pay for decarbonized production, surpassing expectations in specific segments and regions. From raw material suppliers all the way to OEMs, companies can no longer cite a lack of stated consumer willingness to pay as an excuse to avoid transforming production. Although consumer willingness to pay does not fully cover the costs of decarbonizing production, it is a critical component of a comprehensive approach to financing these efforts. Companies must proactively consider the implications and analyze and cater to key consumer segments to capture the growing opportunity.

The authors would like to thank BCG colleagues Fabian Uhrich, Mario Farsky, Karen Lellouche Tordjman, Lauren Taylor, Martin Luers, Andreas Dinger, Migaku Takizawa, and Davide Di Domenico for sharing their insights. We also thank our working team, including Mara Kronauer, Diana Sukailo, Deepa Rao, Yiran Lin, Paul Hofeditz, and Ingo Mergelkamp, for their contributions to this article.