This report was produced with the cooperation and consent of SHEIN, which allowed BCG access into its sourcing and supply chain operations. The remaining research was conducted through publicly available sources. SHEIN is not a client of BCG.

Balancing supply and demand in the fashion industry is not easy—but it is necessary, given the direct impact of inventory turnover on profitability. As recent as the third and fourth quarters of 2022, many leading global fashion players reported excess inventory levels, some up as much as 40% over the previous year, resulting in steep discounts and impact on the bottom line. It’s no surprise, then, that accomplishing this feat has become a top priority for companies looking to ensure sustainable, long-term business expansion.

Product complexity, long supply chains, and constantly evolving consumer needs are the key factors that make balancing supply and demand such a high-wire act. First, SKUs in the fashion industry are extremely complex. Products vary by style, category, color, pattern, and size—all of which need to be considered in store-level merchandising, adding to difficulties in inventory management. Second, the fashion industry has long supply chains that span planning, design, sourcing, production, logistics, and retail, making end-to-end supply chain management challenging. Finally, it is not uncommon to see companies struggle with high inventory levels, because the design-to-shelf lead time often takes at least six months, by which time consumer tastes may have moved on.

To help fashion players overcome these challenges and address supply issues directly, we’re sharing critical insights from our work with leading fashion companies. Our experience suggests that by building an agile supply chain—a customer-oriented, end-to-end mechanism for responding to fluctuating demand—retailers can gain a powerful competitive advantage.

Changing Demand, E-Commerce, and Covid-19

Consumers’ fashion needs are becoming more diverse. The fashion industry in recent years has become increasingly inclusive by catering to all individuals—regardless of their culture, skin color, size, and more. As a result, fashion brands must address a long tail of fragmented demands by providing more nonstandard SKUs more often, which puts pressure on forecasting and inventory management. Further complicating matters is that, in the face of growing e-commerce activity, consumers are now expecting larger product collections, faster product launches, and cheaper prices.

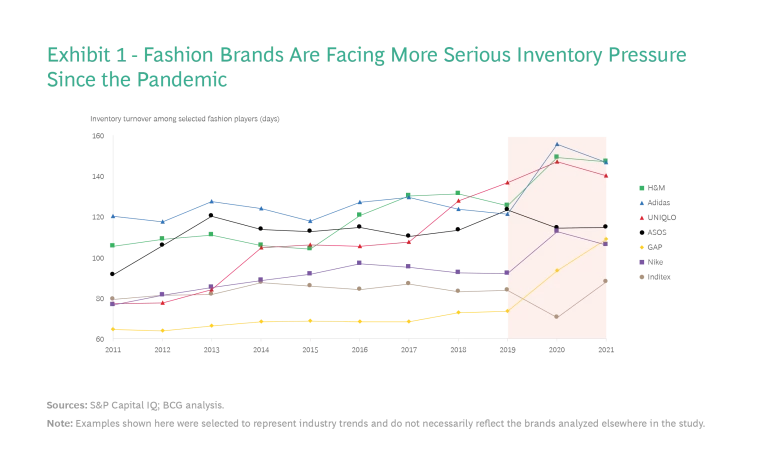

Because of the COVID-19 pandemic, the fashion industry has seen a lower rate of inventory turnover. On the demand side, consumers’ income and confidence have experienced sharp declines. According to an OECD survey, in July 2022, the Consumer Confidence Index dropped from 87.4 to 55.4 in the US and from –3.6 to –27.0 in the European Union. The rise of remote work has reshaped consumer behaviors, causing much less willingness to pay for apparel, footwear, and other nonessentials. On the supply side, anti-COVID measures, such as quarantines, have caused frequent disruptions in logistics and manufacturing, impeding sales growth—especially in offline channels. It is estimated that the loss of global fashion sales was as high as 20% in 2020, slowing down inventory turnover times and driving up inventory costs. For example, the average inventory turnover of the world’s leading fashion brands soared from 108 to 121 days between 2019 and 2021. (See Exhibit 1.)

The Promises and Pitfalls of an Agile Supply Chain

What makes a supply chain agile?

Generally, fashion companies demonstrate supply chain agility if they can move products from the design phase to retailer shelves in two to eight months (or less), replenish inventory in season based on demand, and keep end-of-season overage to a minimum.

In other words, companies with supply chain agility are able to respond quickly to short-term changes in demand by building a customer-oriented, end-to-end product-supply mechanism. This requires close collaboration and the quick coordination of merchandizing, design, production, and channel needs.

Companies with supply chain agility are able to respond quickly to short-term changes in demand.

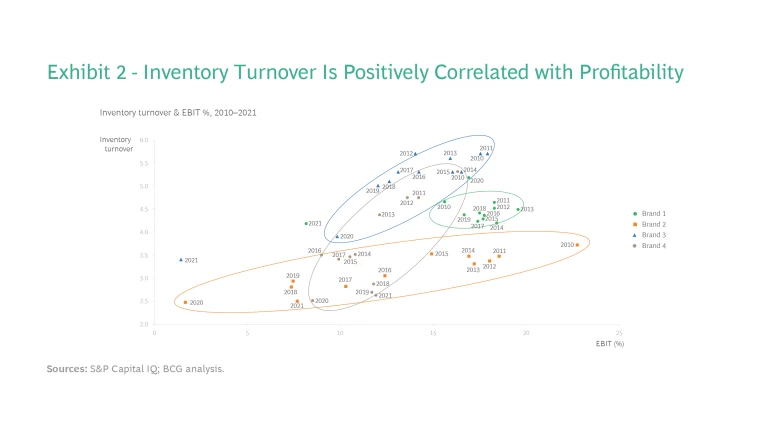

Supply chain agility enables fashion brands to balance supply and demand, thereby reducing inventory costs, improving capital efficiencies, and potentially generating more revenues or sharing the gains with customers through reduced pricing. For fashion players, inventory turnover has a positive correlation with profitability, as seen in a ten-year analysis of four global fashion brands. (See Exhibit 2.) Good inventory management brings three benefits to fashion companies:

- Greater Potential Revenue. Fashion players will have more shelf space available for in-season products, which could help them generate more sales.

- Higher Capital Utilization. Companies that earn a quicker, greater return on working capital can more effectively reinvest in product design, R&D, and talent acquisition.

- Lower Inventory Costs, Fewer Markdowns, or More Competitive Pricing. Lower costs incurred in inventory management suggest a lesser need for discount sales or the ability to offer competitive pricing in the first place.

The Four Key Components of an Agile Supply Chain

An agile supply chain is composed of four key elements: merchandising agility, production agility, channel agility, and organization agility.

Merchandising Agility: Demand-Oriented Merchandising and Product Development. When it comes to merchandising and product design, brands need to develop products better tailored to consumer needs and fashion trends, which requires a deeper understanding of consumer preferences. By leveraging surveys and voice-of-the-customer methodologies, for example, brands can identify pain points and gather the critical input needed for product design and potential upgrades. Moreover, by forecasting demand more accurately and at the SKU level, brands can maintain a better inventory-sales balance. This requires more advanced analytics, driven by artificial intelligence and big- data algorithmic capabilities, which make it possible to support in-season replenishment of top-selling items.

Production Agility: Precise Fabric Sourcing and Responsive Manufacturing. Fashion brands strive to build agile production capabilities using several approaches. First, they can achieve greater accuracy and efficiency in fabric sourcing by harnessing intelligent forecasting and reporting systems. Second, they can provide information access and procurement advisories to their supply networks and thus optimize local scale and productivity with the big picture in mind.

Channel Agility: Dynamic, Data-Driven Inventory Management. By building a database that accounts for all channels, brands can gain access to their inventory status in real time, allowing for more informed decisions on inventory management and order replenishment. They can take such follow-up actions as cross-store inventory transfers and discount sales to immediately accelerate inventory turnover times.

Organization Agility: Building Agile Teams with Strong Synergies. To better respond to ever-changing fashion trends, brands can improve organizational responsiveness and encourage cross-functional collaboration by adopting a flat structure with fewer layers of management and decision delegation.

Three Key Challenges

The agile supply chain offers fashion brands a big opportunity, but they must also be mindful of the following considerations:

- Cost Management. Some companies resort to a small-order model (producing batches made up of hundreds of units rather than thousands) to achieve agility. This approach is inherently associated with a lower economy of scale. There is a steeper learning curve for each product on the factory floor and more changeover time between products.

- End-to-End Collaboration. Building an agile supply chain requires seamless cross-functional collaboration and quick responses across the value chain, from merchandizing, design, sourcing, and manufacturing. Compared with the traditional supply chain model—in which different functions often work in silos—it is important to ensure end-to-end collaboration and cross-functional synergy in an agile supply chain.

- Quality Control. It is not surprising for companies to overlook quality issues in an agile supply chain model, as greater emphasis is put on speed and efficiency. Besides, an increasing number of orders may require greater coordination among multiple small and midsize suppliers, adding to difficulties in aligning and implementing quality standards.

To help fashion brands and retailers overcome these obstacles, we’ve analyzed the various best practices that leading brands take to optimize their supply chain operations. Among the companies we’ve studied, SHEIN has been of particular interest to the broader industry when it comes to agile supply chains.

The Fashion Supply Chain Archetypes

Companies have their own approaches to achieving supply chain agility. We identified three broad-stroke archetypes.

Intelligent Push

This archetype, a modern twist on the more traditional fashion model, seeks to shape demand through the traditional merchandising approach. The added twist is, with the empowerment of digital capabilities, companies can more accurately predict demand based on initial sell-through and fast track / virtualize certain supply chain steps to achieve agility and efficiency.

Fast-Fashion Pull

This archetype, brought about by fast-fashion players, rapidly adapts high-fashion trends for everyday designs. After initial launch, it tracks demand closely by mobilizing its store, logistics, and production networks in fast replenishment cycles. It often selectively deploys digital systems to increase demand-forecast accuracy and makes resolute decisions for rapid markdowns and end-of-season inventory clearance.

On-Demand Digital Direct to Consumer (DTC)

This archetype, championed by SHEIN, uses digital prowess to enable a highly demand-responsive, small-order / fast-replenishment supply chain solution. From merchandising, production, and channel needs to supply chain organization, digitalization permeates every part of the chain. Digital ecosystems and tools help the company make fast and intelligent decisions to match supply with consumer demand in near lockstep, therefore achieving better full-price sell-through or high-price competitiveness. To offset the lack of scale due to small orders, the company seeks out synergies in materials and opportunities to reduce waste in other parts of the supply chain.

On-demand digital DTC enables a highly demand-responsive supply chain solution.

A word to the wise: running a continuously responsive model requires extra caution on the part of the demand-facing party, here the DTC brand itself, to avoid putting unnecessary strain elsewhere in the supply chain.

Archetypes Tackling Agile Supply Chain Challenges

The supply chain archetypes can help address the three key challenges mentioned earlier: cost management, end-to-end collaboration, and quality control.

Cost Management

As noted, an agile supply chain may lead to an increase in costs in the absence of an economy of scale. However, brands can realize better economics by reducing inventory costs and increasing their sell-through rate at full prices. They can also use several tactics to mitigate rising costs in sourcing, sampling, and production.

Intelligent-Push Tactics. These include:

- Deploying AI for Accurate Demand Forecasting. One “intelligent push” company deploys AI to achieve more accurate order placement and to minimize the risk of slow-moving inventory. The brand has identified the key influencing factors for store sales (such as previous sales, inventory level, product features, promotion plans, and even weather) and more than 500 granular parameters that can be used as key inputs for its AI-powered sales-forecasting model. By leveraging AI, the company has improved the accuracy of its store-level sales forecasts by 5% and continues to derive key inputs for accurate order planning.

- Lowering Costs with Virtual Sampling. The traditional sampling process consumes a lot of time and effort, typically involving dozens of suppliers. Companies can overcome these obstacles with digitization. One “intelligent push” company has built a digital design platform to transform two-dimensional drawings into three-dimensional virtual product samples. Leveraging algorithms and big-data technologies, the platform replicates key attributes—such as material texture, color scheme, and cut pieces—into virtual samples, allowing designers to make critical decisions without having to produce actual, physical samples. This could bring significant benefits: shorter lead time, lower costs, and higher efficiency.

- Identifying Operational Bottlenecks with Process Visualization. One “intelligent push” brand uses a digital supply chain management platform to identify key bottlenecks at each production stage and develop tailored solutions to improve efficiency. For example, when it comes to packaging, the traditional approach entails factories manually checking whether product mixes meet order requirements, which is tedious and results in a high error rate. To solve this problem, the company bases product mixes on store attributes and applies RFID, or radio-frequency identification technology, tags on each garment, making it easier for factories to determine whether the product mix meets stores’ requirements.

Fast-Fashion Pull Tactics. These include:

Supporting Frequent Replenishment with Data and a Strong Logistics Network. One “fast-fashion pull” company we studied adopts a small-batch, responsive production model to avoid the risks of overproduction and unsold inventory. This entails placing a small order three months prior to the season—equivalent to 30% to 35% of the sales forecast—and then making frequent in-season order replenishments based on actual sales. Store managers collect and transfer sell-through data in real time, allowing marketers to analyze the performance of a given SKU and adjust quantities and product mix accordingly.

The company has built a strong logistics and warehouse network to support its responsive production model. It has set up central warehouses in major regions across one European country, making it possible to replenish stock at the store level at least twice a week. In other key markets, the company has set up small warehouses near store locations. This allows the retailer to replenish stock in more important markets within 48 hours, or within 24 hours in Europe’s most critical markets, and achieve a balance between sales and inventory without overstocking for fear of product unavailability.

A small-batch, responsive production model can avoid the risks of overproduction and unsold inventory.

Unlocking Economies of Scale and Nearshoring to Lower Logistics Costs. One “fast-fashion pull” company purchases unprocessed raw fabrics in advance of need and encourages multiple uses of the same fabric across different products to achieve economies of scale. For example, around half of the company’s fabrics are purchased six months before the season unbleached and undyed so they can easily be blended with different patterns and colors to keep up with fast-changing fashion trends. Each type of fabric can be used in the design and production of ten or more SKUs, on average.

The company is committed to nearshoring to improve responsiveness and reduce logistics costs. It purchases 65% of printed fabrics from neighboring countries, and half of its suppliers are based in nearshore locations, a figure that is much higher than the competition’s.

On-Demand Digital DTC Tactics. These include:

Minimizing Markdowns and Inventory Costs with Small-Order-Responsive Production. As an e-commerce pure player and champion of on-demand digital DTC, SHEIN produces small minimum order quantities of 100 to 200 pieces to test the market and replenish its orders on demand while securing minimum safety stock levels. SHEIN takes a holistic approach to merchandising and places bets on various products to test market demands, determine the depth of ordering and production, and optimize the overall economics.

Specifically, its merchandising team focuses less on an open-to-buy strategy or the potential of a particular SKU. Instead, the company has built a customer-facing website to offer personalized product recommendations and has developed algorithms to replenish SKUs quickly based on tracked user data (product favorites, clicks, conversions, and deals). Moreover, SHEIN can lower the cost of testing products by tracking customer feedback immediately after the launch of pictures on its site. With this on-demand production model, SHEIN reduces the cost of inventory, with approximately 40 days of inventory turnover, an unsold inventory rate of less than 2%, fewer markdowns, and less waste.

Consolidating Fabric Sources to Optimize Procurement and Increase Efficiency. SHEIN proactively manages its supplier base and design process by setting master fabrics at the product-design stage. Requiring designers to choose fabrics from this pool simplifies sourcing and maximizes economies of scale in procurement.

Instead of purchasing fabrics from the market, SHEIN has built an online platform that allows manufacturers to source fabrics from designated suppliers for better quality control, to make payments, and to apply for after-sales needs directly. The company has consolidated 70% of its fabrics this way. SHEIN also regularly monitors the price of fabrics in the database, leveraging big-data tools and renegotiating prices to ensure cost advantages.

Empowering the Supplier Ecosystem with Digital Tools. SHEIN has built a strong ecosystem comprising small and midsize suppliers that specialize in small-order production. It’s gradually bringing on board large suppliers as well. The company offers competitive payment terms—weekly, biweekly, and 30 days, facilitated by its DTC model, instead of a more typical 90 days for the industry—to help its suppliers improve their liquidity and profitability throughout the year.

The retailer uses digital tools to lower the cost of production. SHEIN’s suppliers are required to connect with the company’s digital manufacturing system. By asking suppliers to share real-time capacity, and tagging each supplier based on its corresponding category strength and weakness, SHEIN can allocate orders automatically. However, the ability to see through capacity could mean that suppliers become more utilized than those in an otherwise less transparent ecosystem, where each party optimizes capacity utilization on its own. This model places greater responsibility for the managing and well-being of the suppliers in the hands of the retailer.

SHEIN empowers its suppliers with on-site training and dedicated projects. For example, the company invests in suppliers to build factories, promotes the use of digital systems, and dispatches operation specialists to help optimize operations, such as by deploying hanging assembly lines that improve efficiency.

Cross-functional collaboration and a flatter organizational structure can empower employees– and more.

End-to-End Collaboration

Brands can enhance their responsiveness and build greater synergies by streamlining their operations—and encouraging others in the supply chain to do the same—with digitization and reimagined organization design.

Intelligent-Push Tactic: Managing Suppliers for Greater Transparency. One “intelligent push” company integrates its manufacturing, warehousing, and logistics service providers on its own digital supply chain platform to create end-to-end transparency—by aggregating key information, such as capacity reservations, orders, and production progress, and by breaking down silos that hinder effective communication. Applying RFID technology throughout the manufacturing process, for example, allows the company’s production department to more effectively track progress and identify risks.

Fast-Fashion Pull Tactic: Empowering Employees in a Flatter Organization. One “fast-fashion pull” player encourages cross-functional collaboration by co-locating design, merchandising, and procurement teams, which work together as a whole instead of in silos. The design team is responsible for identifying fashion trends and popular elements and quickly translating them into drawings. The merchandising team collects and analyzes sell-through data, communicating with store managers to obtain firsthand insights and feedback, which it then shares with the design team. The procurement team reacts to the information provided by design and merchandising, determining whether to buy raw materials, for example, or outsource production to ensure support for mass production.The same company has adopted a relatively flat organizational structure—with fewer middle managers—to minimize the distance between management and frontline employees. In addition, stores are recognized as one of the most powerful channels for understanding what is going on in the market. Store managers are responsible for synthesizing data on sales, restocking, and inventory. This data is shared with the merchandising team, providing input for product development. For example, when a new product arrives, a store manager has the right to decide whether to sell it immediately, put it away in the storeroom, or store it in the warehouse for a later launch date.

On-Demand Digital DTC Tactic: Enhancing Collaboration along the Value Chain. SHEIN’s digital production center supports its business units with the help of nearly 2,000 employees and almost 1,000 digitized tools. The center uses an end-to-end digital system to connect different functions—spanning merchandizing, design, supply, and marketing—along the entire value chain. For example, it can forecast demand and decide replenishment based on sales within the first three to seven days of a product’s launch. That decision feeds back into the system to generate orders automatically. These are assigned to the best-suited manufacturer, with sourcing and quality-control details included in each order. The digital production center also provides connectivity with external systems. Nearly all of SHEIN’s suppliers (98%)— including fabrics, manufacturing, and logistics players—use the digital production center, which provides greater visibility into capacity, inventory levels, and other key information.

Subscribe to receive the latest insights on Consumer Products Industry.

Quality Control

In an agile supply chain, quality control begins at the product-design stage. At the other end of the spectrum, it’s necessary to have a robust voice-of-the-customer (VoC) methodology in place to gather and respond to feedback promptly.

Intelligent-Push Tactic: Upgrading Products Based on a Deep Analysis of Consumer Feedback. To improve quality control, one “intelligent push” player gathers and analyzes feedback across various touchpoints—including consumer reviews, call centers, social media, and employee insights—with the latest tech. The brand deploys AI technologies, such as automatic speech recognition and natural-language processing, to distill keywords that will help product upgrades. For example, the company determined that it could improve the “color” and “tightness” of one type of jeans based on its analysis of keywords in consumer feedback. It found that these issues were caused by inconsistent production processes across different fabric suppliers, so the supply chain team guided its suppliers on how to resolve these issues.

On-Demand Digital DTC Tactics. These include:

- Leveraging a Quality Management Control (QMC) System. SHEIN’s QMC system addresses quality issues at the product-design stage. Quality management is essential to the retailer because tedious return and exchange processes erode the customer experience and result in extra logistics and warehousing costs. SHEIN has therefore established a quality-control team to ensure unified quality standards across the whole design-to-production process. SHEIN conducts quality controls with an automated system, mapping design elements onto quality risks and leveraging automated quality alerts. For example, when designers choose contrasting colors, the system recommends colorfast fabric options (to ensure fade resistance), and it analyzes whether colors will run in the wash during the sampling and mass-production phases. In the late-stage quality-control phase, the QMC system will help generate standard operating procedures on a product-by-product basis, accounting for fabric, size, color, model, and more.

- Achieving Excellence with an Omnichannel VoC System. After customers give reviews and feedback on SHEIN’s products, the customer-service team quickly uploads that information into a VoC system. The quality-control team then conducts an analysis to group issues, such as mispacked products, poor sizing, and fabric quality issues. The quality-control team would then initiate a product-optimization process with the product-development team for active SKUs that require more substantial improvement.

The agile supply chain is the future of fashion, but it requires more than a mere transformation in the supply chain itself. It calls for a revolution in a company’s full operating model and fundamental changes in management’s mindset.