The gaming sector is unique. Originally viewed as a children’s diversion, attracting limited attention compared to TV, movies, or music, gaming is now by far the fastest growing sector of the media industry. With the average player age recently exceeding 30 years old, gaming is now the second largest media sector that is about to reach $200 billion.

Key Insights

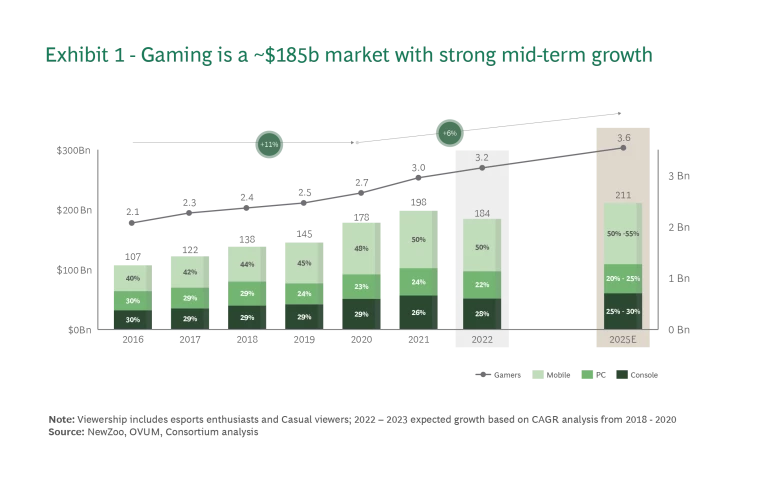

- Gaming is the #2 media sector after TV: $184.4 billion in 2022 with a path to reach >$210 billion in the next 3 years.

- Mobile is the #1 gaming segment (>50% in revenues): driven by casual gamers with easy entry (smartphone) and free-to-play model, enjoying mostly “time-killer” games. e.g., smartphone penetration in Indonesia drove significant Mobile Legends: Bang Bang (ML:BB) adoption

- PC/Console are still strong: major platforms for core gamers that demand full immersion and advanced gameplay. Live game streaming sustains interest from a wider audience. e.g., Elden Ring was #1 in streaming after its release and sold 12M copies in 2 weeks

- Mobile and PC/Console have started to converge: main trend is in IP as many PC/Console games are adapted to Mobile (League of Legends (LoL) – LoL Wild Rift, Diablo – Diablo Immortal) or even go Mobile-first PlayerUnknown's Battlegrounds (PUBG). Cross-play is a 5+ year trend due to vast differences in gameplay.

- Game publishers adopt a “less is more” strategy: main focus is on games based on proven IP, often free-to-play, that can be sustained and evolved for 10-20 years. e.g., Activision-Blizzard builds around core IP for 25+ years (Warcraft, Diablo, Call of Duty)

- Microsoft is the closest to building a “future of gaming” offering: hardware (Xbox, HoloLens), content (publisher – Activision-Blizzard; user-generated – Minecraft) and infrastructure (Azure cloud) that can be bundled into a single subscription (Xbox Game Pass).

- Highest gaming penetration: >60% of the population are game enthusiasts, resulting in the highest share of gaming mobile app downloads (50% vs 40% globally of total app downloads are gaming apps).

- Long-term commitment to the sector: Saudi Arabia recently announced its gaming and esports strategy, and UAE has created two gaming centers to attract global companies.

- Unprecedented government investments: Saudi Arabia's Public Investment Fund (PIF) allocated $38 billion to Savvy Games Group to invest in gaming and esports across the full value chain (and potentially more funds for other levers to develop the gaming ecosystem) with multiple acquisitions in gaming (Embracer Group, Scopely) and esports (ESL, FACEIT, VSPO) have been already executed; Abu Dhabi Gaming created a dedicated gaming and esports hub with strong incentives.

- Leader in game streaming growth: while China will be the largest market for streaming, reaching a ~265 million audience in 2025, Middle East & Northern Africa will grow 3 times faster (24.5% vs 7.6% CAGR) to reach ~200 million people in 2025.

2 2 Newzoo “Gaming’s Live Streaming Audience Will Hit 1.4 Billion by 2025”

- Direct investment is a straight-forward path followed by many VCs like Bitkraft and Hiro Capital.

- Media can build content on gaming IP: e.g., Netflix creates content around gaming IP (Arcane, Cyberpunk 2077, Dota to name a few) and games on own IP (e.g., Stranger Things).

- IP owners can build flywheels: e.g., Tencent promotes IP through media content (gaming, video, books) and beyond (e-commerce, travel, F&B).

- Technology companies can utilize multiple synergies: e.g., Apple created one-stop-shop for games, video, music, fitness, and cloud storage (Apple One); Meta experimented with live gaming streaming integrated in its social network (Facebook) and will likely leverage gaming technology for its Metaverse play.

- Telecom operators (telcos) can leverage gaming to strengthen brand for its audience: some telcos integrate gaming into their offering (e.g., KPN offers its customers access to in-game items; Deutsche Telekom and LG Uplus offer cloud gaming services to their customers), while others follow audience’s attention (e.g., SK Telekom and Ooredoo invested in esports clubs).

Middle East Expert Perspective: Interview Paul Dawalibi

Paul, you recently moved from US to the Middle East. What excites you about the gaming sector in this region?

Paul Dawalibi: For years now, I’ve been saying that the world is sleeping on a massive gaming opportunity in the Middle East. Everyone talks about Asia, but the real gaming powerhouse will be the GCC region due to several factors. There’s a confluence of factors that gets me excited about gaming in the Middle East.

First, the Middle Eastern populations, especially Saudi Arabia, are young and digital savvy. Seventy percent of Saudi Arabia’s population is below the age of 30. Average disposable income is higher. The hot weather means people spend more time inside, which makes gaming an obvious choice of activity and recreation.

The second factor that gets me excited is the significant government commitment. Saudi Arabia has committed to investing $38 billion in gaming companies. Abu Dhabi provides strong incentives and benefits to gaming companies that set up shop in the emirate.

The third factor is tourism. The UAE is obviously a tourism hotspot already, so there is a significant opportunity to provide visitors with gaming and esports related experiences. Saudi Arabia is also making a big tourism push, so gaming and esports would provide something unique to market to the world.

Finally, gaming is a global industry, and the Middle East is truly at the crossroads between East and West. This gives gaming companies operating in the Middle East a distinct advantage in being able to serve North American, European, and Asian customers with equal ease.

Paul, focusing on the gaming and esports efforts in the Middle East: what’s your view, and how do other major sector centers see them?

Paul Dawalibi: A lot of the conversation around gaming in the Middle East has been dominated by Saudi Arabia, which isn’t surprising given its large-scale financial commitments to boost the sector. Most of the western world is not aware at all of what’s going on in the Middle East when it comes to gaming, beyond a few – not always favorable – press releases. While the path forward for Saudi Arabia is bright, it still needs to address several challenges to realize its ambition. It especially needs to attract experienced human capital with deep industry knowledge, and redouble marketing efforts to the West and East to draw both partners and talent.

But Dubai and Abu Dhabi have a major opportunity to compete with Saudi Arabia. The UAE has great infrastructure and easy access to talent from around the world. What the UAE lacks is a cohesive emirates-wide gaming vision and strategy backed by sufficient funding. As interests might diverge in Abu Dhabi, Dubai, and other free zones, it could be more challenging to reach the required scale.

Over the past decade there has been a lot of buzz around the gaming opportunity in China, and Asia in general. But this region faces a number of challenges and hurdles. While the population sizes are large, disposable income and average spend per player in this region are actually quite low. China has also spent the last couple of years restricting gaming, and approving only few new games for distribution in the country. In fact, we’ve seen Asian gaming companies like Tencent and Netease building their presence in the Middle East because they realize that the opportunity in the region is greater.

Paul, we see more and more industries getting interested in gaming. Gaming IPs are leveraged for Hollywood blockbusters. Technology companies and VCs make major investments. Just hype, or the beginning of a longer journey?

Paul Dawalibi: Gaming and gaming principles (gamification) will inevitably either intersect or completely disrupt every industry on the planet. So we are just at the beginning of a very long journey for the sector as a whole.

Content and IP will be important pillars of this multi-trillion-dollar sector. Technology and infrastructure will also be key growth areas. Brands and traditional entertainment embrace gaming because of the still massively untapped value of the gaming audience. It’s also inevitable that we will see an increase in investment and venture capital to match. If the next few years bring recession, gaming will once again demonstrate that it’s one of the most recession-proof industries on the planet.

In fact, all of the hype and talk around the metaverse is fundamentally just gaming. The metaverse is just a fancier word for gaming (especially if we define gaming as the creation of virtual worlds). The word “metaverse” feels more “adult” than gaming, which is often perceived as a hobby just for kids. The result is that billions have been poured into companies that are fundamentally gaming businesses (but calling themselves metaverse). The metaverse concept also makes it far more palatable to bring gaming into the workplace, or into education or government - all areas where metaverse has seen tremendous penetration but is still just gaming or gamification.

AI also has deep connections to gaming. The same underlying technologies that enable virtual worlds (e.g., GPUs built by Nvidia) also power the biggest AI models. The breakthroughs in parallel computing that enable AI wouldn’t have been possible without gamers spending money to make their games look more realistic. AI will give back in equal amounts to the gaming industry, as virtual worlds get populated with NPCs (non-player characters) that are so realistic they become indistinguishable from human players.

Paul, any closing remarks?

Paul Dawalibi: The one consistent trend over human history is that as technology progresses, our leisure time increases. As machines and AI do more work for us than ever before, we will have more free time to spend on recreation. This is how gaming becomes the biggest industry on the planet. And the Middle East is best positioned to capture trillions of dollars of new value that will be created by gaming and metaverse over the next decade.

The Drivers of Global Gaming Growth

The COVID-19 pandemic spurred growth in various media and technology sectors in 2020. Within media, gaming outpaced other segments with an 8% growth rate to reach $198 billion (versus TV's 1% decline to $408 billion

However, the industry is expected to resolve these challenges and recover in mid-term, as games become more embedded in everyday life (Exhibit 1). Games have consistently held a 40% share of global mobile app downloads over the past 5 years. The number is even higher in the Middle East, reaching 45-50% in 2020.

The Middle East is a unique market for gaming. Governments in the GCC region have invested heavily in the industry and recognized its potential, implementing strategies to attract gaming companies. In Saudi Arabia, a National Gaming and Esports Strategy plans to create 40,000 jobs and develop 30 games by 2030, while in the UAE, AD Gaming and DMCC Gaming Center aim to attract global businesses and support local talent.

Gamers on PC/Console vs. Mobile

The gaming sector is expanding and changing, which makes the definition of a “gamer” more nuanced. While mobile dominates the gaming market, the split of revenue across different platforms does not always match the preferences of the core global gaming community. According to a BCG survey of 10,000 participants from 10 countries, most core gamers primarily play on PC and console. This is because only PC/console games enable high-engagement AAA titles, demanding more player’s focus and dedication.

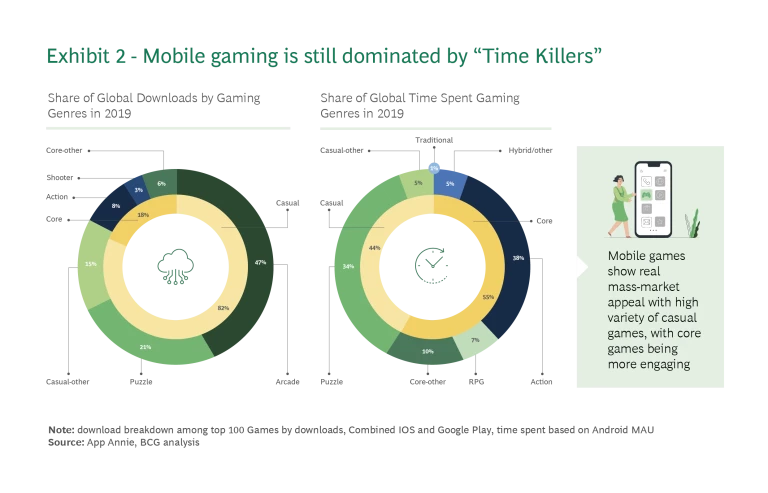

However mobile games absorb twice as many hours per week as PC/console games, and the mobile gaming market is more diverse (Exhibit 2). It attracts casual players who enjoy “time killer” games like Candy Crush but may not identify themselves as "gamers." Nevertheless, these casual players contribute substantially to the growth of the mobile gaming market.

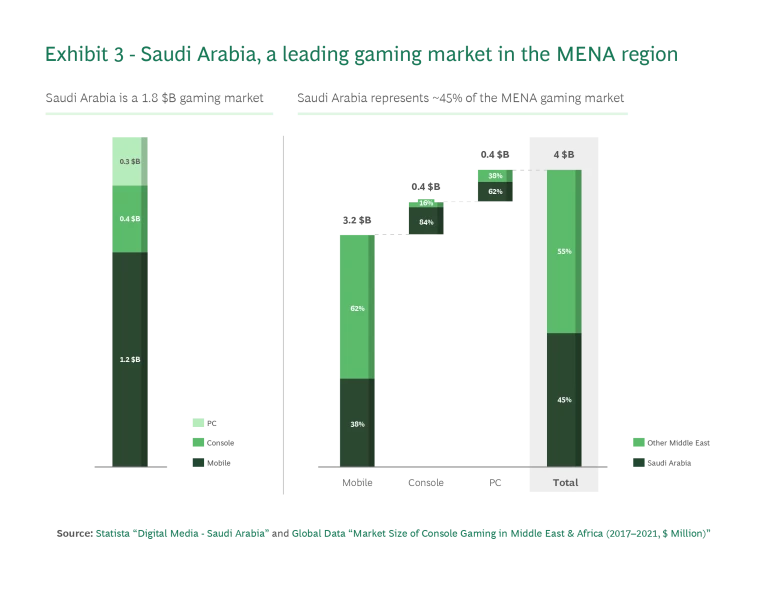

The Middle East is a significant market for both core and casual gamers. Saudi Arabia leads, with a market of ~$1.8 billion (Exhibit 3). It is a skewed towards mobile gaming which accounts for >65% revenues, though this is partially explained by a stronger presence of non-casual mobile games like PUBG Mobile, Free Fire and FIFA in the top-10 downloads (versus only Free Fire in the top-10 globally).

Changing Gamer Preferences

While PC/console and mobile experiences are different, they have started slowly converging. Mobile devices can now offer very high-quality graphics and gaming experiences, while smartphone evolution increasingly reflects and enables the sophisticated gameplay that was previously available on PC/console only. Also, as smartphones are tailored to communication, mobile games can integrate social gaming features better than PC/console.

This has led to more popular PC/console (though mostly PC) titles being adapted to mobile, including leading games like League of Legends (LoL – mobile version is LoL Wild Rift), Call of Duty (CoD Mobile), Diablo (Diablo Immortal). Some leading games are even going with mobile first (e.g., PUBG). And many titles initially released on PC or consoles, such as Minecraft, FIFA, Genshin Impact, and even Fortnite are experiencing resounding success on mobile. Another example is Square Enix, which acquired Eidos and reimagined popular games like Hitman, Tomb Raider, and Deus Ex by releasing IP-driven mobile puzzle games.

However, true convergence resulting in cross-play is still far from being fully implemented. While it can be easily realized in some game genres (e.g., the collectible card video game (CCG) Hearthstone), it is difficult to ensure the same experience for shooters or RPGs whose gameplay is heavily optimized for PC. An additional challenge for cross-platform development is the need to optimize a game for an increasing number of devices.

Growth Drivers in Mobile

The mobile gaming industry has experienced significant growth in recent years, with the widespread adoption of smartphones and the increasing power of mobile computing. And PC/console game publishers are actively investing in this trend. Factors contributing to this growth include:

- Accessibility

- Mobile gaming has outpaced other platforms over the last two decades, particularly after the launch of smartphones, which enabled mobile gaming growth.

- One example of this is the mobile multiplayer online battle arena (MOBA) game called ML:BB - Mobile Legends: Bang Bang, which dominates in Indonesia with 69.7% smartphone penetration and 192.15 million users. Its release coincided with the smartphone boom in the country.

- Convergence

- Platforms serve different purposes. For example, mobile gaming may be used during commutes, while console gaming is the preferred platform for AAA games with high-quality visuals and engaging storylines.

- Platforms already converge by leveraging the same gaming IP, which will accelerate with cloud computing in the mid- to long-term.

- Business Model

- The rise of casual games, which are designed to be played in short periods of time, has driven innovation in the monetization of mobile games, making them affordable for a wider audience.

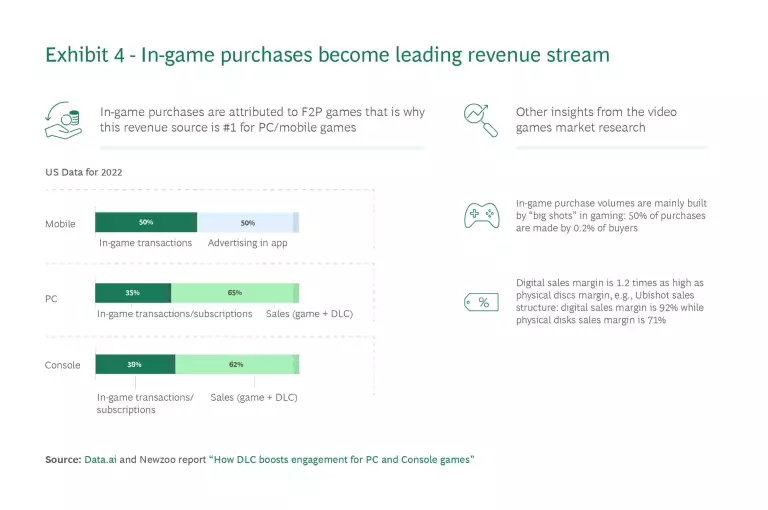

- Mobile gaming is mostly monetized through advertising, which is technically free for a player, while PC/console games are yet to realize the potential of this model (Exhibit 4).

Unique market conditions are accelerating mobile segment growth in the Middle East. With half its population under 25 years old and tech-savvy, these countries require localized content. For example, Chinese publisher Tencent deployed an Arabic version of the Battle Royale game (PUBG Mobile) in the region. It is now one of the most popular games in the Middle East

What About the PC/Console Market?

Despite mobile being the top-line driver of the gaming market, it does not mean that the PC/console is in decline. Core gamers still prefer playing on PC/console as games are more immersive and complex.

Constantly improving visual and game content and leveraging popular IP (e.g., the recent Hogwarts Legacy) have traditionally formed the heart of gaming’s strong appeal to a young audience. Today there is an additional growth factor for PC/console market – the rise of game streaming as separate content, run by both professional players and casual gamers.

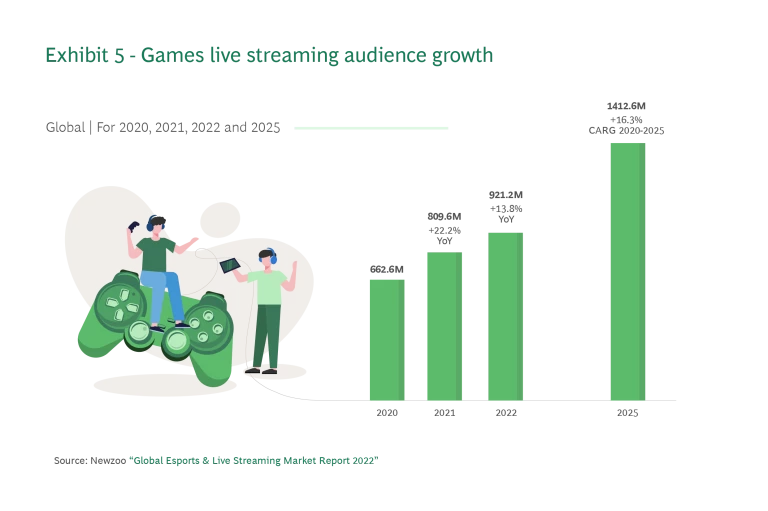

The growth of gaming streams is a global phenomenon, which increased markedly during the pandemic. Streaming’s audience will exceed one billion people in 2023, increasing with a CAGR of +16.3% from 2020 to reach 1.4 billion in 2025

While streaming growth has slowed, viewership is still up 6% from its COVID-19 pandemic peak in 2020, and 164% higher than 2018. Live streaming slightly decreased in 2022, but Twitch was the least affected, dropping only 6% YoY and keeping its strong leadership position. Facebook Gaming was hit the hardest in 2022, dropping 56% YoY from 2021. While YouTube Gaming has also seen a decrease in hours watched, it has since pulled away from Facebook as the definitive second most-utilized live streaming platform in the West.

Game streaming is why popular titles like LoL or Fortnite stay relevant for the community as it allows interaction with top streamers. Game publishers also reward those who watch streams with “drops” – giveaways of unique digital items to people who watch a stream for a certain time. Both elements incentivize people to watch their favorite streams and strengthens their commitment to the game.

Streaming platforms also play a significant role in discovering and promoting new games. Since Epic Games’ success with Fortnite, when it cemented its leadership position by paying top streamers to play, more games follow same approach (often even without direct payments to streamers). Some newer titles strongly benefit from streaming at the time of release, like Elden Ring which became a leader in streaming right after its launch. This resulted in 12 million units sold in first 2 weeks and significant time spent within game.

The importance of these platforms is hard to overemphasize as viewers tend to stay on platform rather than follow top streamers. For example, a popular streamer Ninja left Twitch for Mixer for an estimated $25 million dollars; however, most viewers stayed on Twitch, which was one of the reasons for Mixer's closure.

China is expected to remain the largest market for live streaming audiences (forecast CAGR of 7.6% from 2020 to 267.5 million people by 2025

Publishers Adapt to New Trends

With such dynamic changes in the industry, game publishers and developers are adjusting their strategies.

New Business Models

Innovation in the mobile market incentivized publishers to explore new monetization methods, in particular "free-to-play" with in-game monetization instead of upfront purchase. Electronic Arts released its flagship shooter franchise Battlefield with a free-to-play version called 2042.

The potential to extend the life cycle of their titles through new content and in-game purchases makes this shift attractive compared to developing completely new games every few years. However, publishers must carefully design monetization to ensure it supports the game and its community, not harm it with:

- "Pay to win" mechanics that impact gamer experience and become similar to gambling.

- "Play to earn", which has potential, but success depends on the ecosystem and can be risky. Earning crypto currency through blockchain based gaming has attracted companies like Gala games, which will be releasing multiple titles in the near future. Axie Infinity is game that had players earning crypto currency and saw a spectacular rise, particularly in the Philippines, but has also suffered a significant drop in fortunes during the recent technology recession. Like any new technology, it needs to be tested over time to know what will work.

Growth in Gaming Budgets

Extension of a game’s life cycle as well as the demand for more immersive and high-quality experiences drive publishers to invest more time and resources in developing their games. AAA games require tens or even hundreds of millions of dollars in investment. For example, Rockstar Games' GTA V had a budget of $260 million and CD Projekt's Cyberpunk 2077 had a budget of over $300 million.

Considering the variety demanded by core players, it is not realistic for publishers to shift to few games with longer life cycles in near future. Instead, hundreds of high-profile AAA games are released each year, though only a handful of those have budgets at the level of GTA V or Cyberpunk 2077.

While this model expands opportunities to generate a return on investment over a longer shelf life, major games still require large upfront investment and long development periods, which can delay cash inflows for several years.

Competition for Popular IP

Focus on proven IP is a strong media industry trend, extending well beyond gaming. Considering the significant investments required to create blockbusters and high audience expectations, recognized IP reduces commercial risks. In film and video, franchises like Fast & Furious and Marvel have gained substantial investments and extensions. Gaming follows the same path, with publishers such as Activision-Blizzard, Naughty Dog, and Tencent aggressively building on their existing IP. For example, Activision-Blizzard has focused on its Call of Duty, Diablo, Warcraft and StarCraft IP for many years.

Over last decades major IP franchises have created active, loyal communities. As with comics two decades ago, the movie industry noticed this trend and has turned to gaming IP as a source for new content (Exhibit 6). In return, this provides an opportunity for game publishers to extend the community for their games and attract new audiences. Beyond movies, publishers are also leveraging gaming IP in other segments like amusement parks, toys, and retail. These further strengthen the connection with IP fans and benefit the games.

Future of the Gaming Market

How will the gaming sector change moving forward? There are multiple technological, demographic, and media industry trends, many mentioned above, that will continue to play major roles. Among those, four will likely have the largest impact:

- Audience growth and demographic shifts

- Innovation from players

- M&A activity

- New use cases

Audience growth and demographic shifts

On one hand, gaming industry growth continues with wider demographic appeal. Mobile gaming is now attracting all ages, particularly in Western markets. In the US, games appealing to Gen X and Baby Boomers (45+), make up nearly 25% of top grossing games in 2021, a 6% increase from 2019.

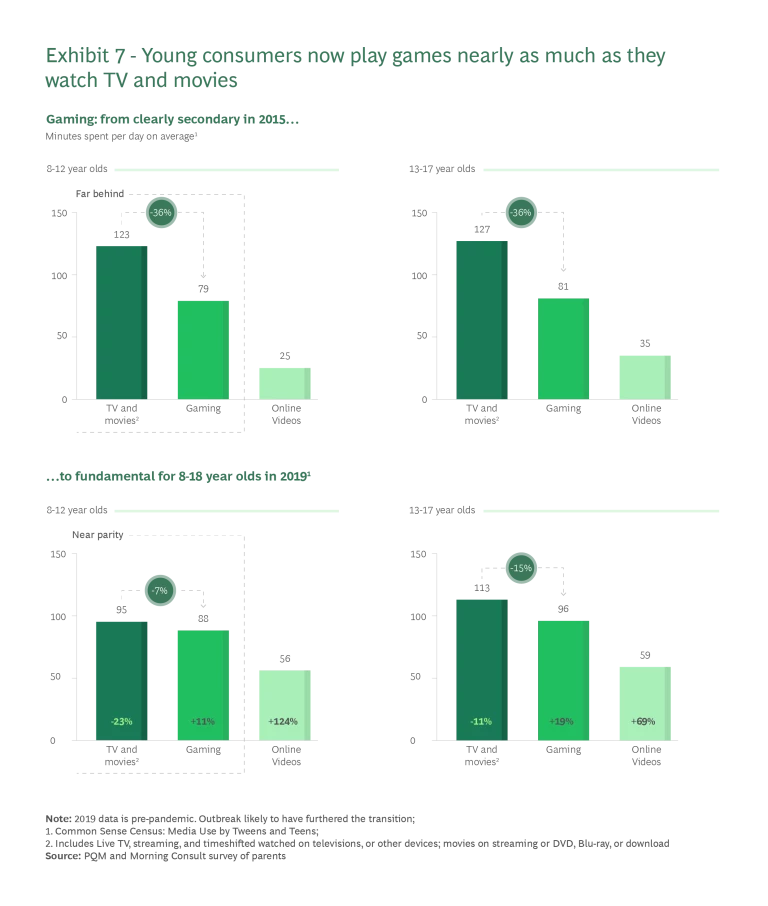

On the other hand, children and youth still account for most of the sector’s audience growth. Gen Z is the first demographic cohort that spends as much time gaming as watching video content (Exhibit 7). As each child adds to the gaming market, the audience will continue to grow.

Innovation from players

Innovation in the gaming market is very different from other media segments, with a much stronger contribution from consumer communities:

- Consumers have historically been the key innovators. One distinctive characteristic of the gaming sector and community is that innovation is often driven by consumers, rather than major developers. This has been a trend throughout the sector’s history. For instance, in the 2000s, the MOBA genre (#1 today with games like League of Legends and Dota 2) emerged as players’ modifications to Warcraft 3. Similarly, in the late 90s, Valve's highly successful Counter-Strike franchise originated as a user modification of their Half-life game.

- Platforms today are making innovation easier. User-generated content in games is set to grow with platforms like Roblox and Minecraft actively promoting it. Examples include Squid Game’s success leading to a similar game on Roblox, and advancements in game engine technology by Epic (Unreal) and Unity making game creation easier for players.

- Publishers are on the front foot adopting innovative ideas from users. Game publishers are often quick to adopt and commercialize innovations from players. The MOBA genre is a prime example, as players created it first, but then publishers led incorporation of unique features from MOBA into first person shooter (FPS) games like Activision-Blizzard's Overwatch which included multiple heroes with unique skills.

It is expected that this trend will continue, especially with platforms like Roblox and Minecraft that ease game development and innovation for gamers.

M&A activity

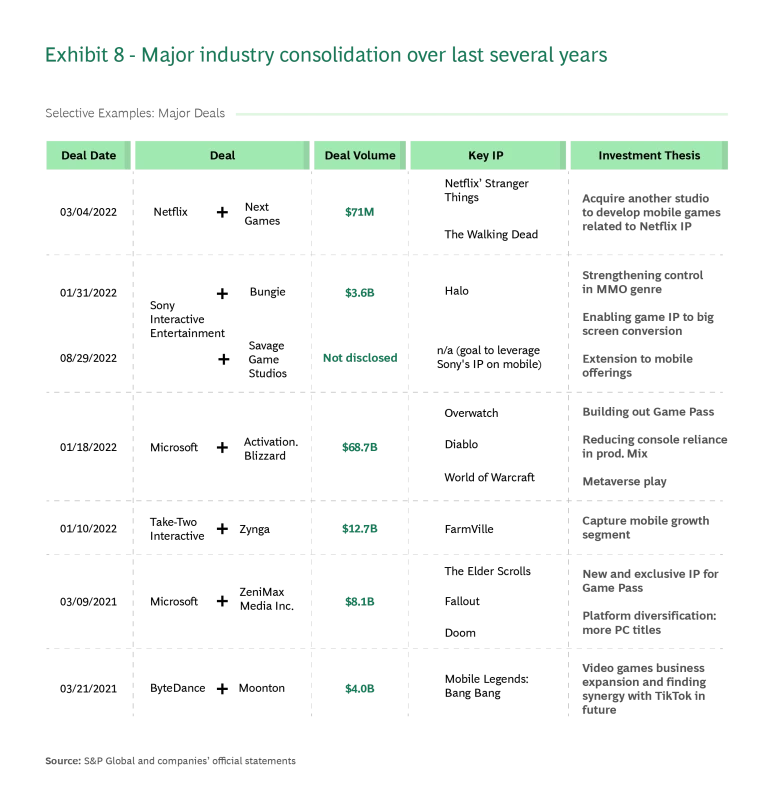

The gaming industry is already highly consolidated. Further consolidation is expected to continue in the medium-term as major publishers, media companies, and technology firms acquire studios and other gaming-related assets on a global scale (Exhibit 8). More than 650 gaming M&A or investment deals were announced or closed in the first six months of 2022, and gaming companies such as Epic Games raised billions on the strength of the market.

Today top-10 players already control more than 70% of the market. The top 3 players (Tencent, Sony and Microsoft)

Game publishers follow two main paths in their M&A strategies:

1. Consolidation of game development

Gaming companies are consolidating to achieve economies of scale and support the increasing costs of game development. Such scale also facilitates experimentation with new intellectual properties to ensure success in the medium- and long-term. Both Microsoft and Sony are building gaming ecosystems:

- Microsoft's move to acquire Activision-Blizzard is a direct play to strengthen its gaming portfolio, which already includes cloud services and the Xbox console, and to provide a seamless gaming experience across mobile devices.

- Sony is focusing on acquiring studios such as Bungie, and mobile developers like Savage Game Studios, to expand its offerings and enhance its console business with a single pass experience.

- Other players in the industry are also acquiring promising studios, sometimes as a means of entering the mobile market. For example, Take-Two and Zynga have both acquired studios, and EA has acquired Glu Mobile.

2. Extension of internal capabilities

As games become more complicated, game publishers also seek to extend their reach along the value chain, especially parts related to technologies embedded in the games.

One good example is in-game advertising. As games become even more immersive, lengthen their life cycles, and encourage players to spend more time, it highlights the opportunity to leverage space in PC/console games for advertising. Currently games either do not have ads (mostly AAA PC/console games) or feature pre-agreed product placement. However, new technology can allow personalized advertising in real time, and thus boost games’ advertising revenues (e.g., a billboard in a game can contain actual ad that is personalized to a player). Game engine Unity and app economy developer AppLovin's attempts to merge with IronSource illustrate this trend.

Another example is motion tracking and facial animation technologies. As PC/console games rely on these technologies to build an immersive experience, access to advanced and unique solutions is a critical success factor. That is one of the reasons behind game publisher Take-Two Interactive’s acquisition of Dynamixyz, a company focused on cutting-edge facial recognition technology.

New use cases

Gaming is not just affected by technologies, but also drives innovation and experiments with new offerings. This is especially true in areas like cloud solutions, the Metaverse, and blockchain:

- Cloud-gaming. Enterprises employ cloud solutions to lower IT costs, but consumer use is limited. Popular MOBA, FPS, and BR games requiring low latency may drive increased consumer cloud adoption as it eases end-user device requirements and allows top game play even with inexpensive hardware. This trend is long-term, requiring significant infrastructure investments like 5G networks and edge data centers. Gaming company growth and market growth may accelerate consumer adoption of cloud technology once such infrastructure is in place.

The Metaverse. The concept is a virtual world with its own economy, built upon Virtual Reality, Augmented Reality, and Non-Fungible Tokens (NFT). Gaming has a significant influence on the Metaverse, having first created the concept decades ago. Games like Second Life and World of Warcraft established compelling places for players to spend time and multiple digital items to acquire, which the Metaverse seeks to re-establish with more advanced technology.

Today there are many potential Metaverse use cases, though games remain central to driving early adoption and attracting a wider audience. Recent examples of the intersection between gaming and the Metaverse:- Since 2020, the music industry has taken new notice of platforms like Fortnite, Roblox, and Minecraft. Epic Games’ Fortnite has held virtual performances for Travis Scott, Ariana Grande and Charlie Puth – with players convening in-game to attend a concert.

- Part game platform, part game creator, Roblox (which allows users to create their own “worlds” and games for people to interact with) has nurtured a community of 164 million consumer-creators with over 58 million DAU,

22 22 Statista developing and sharing content with one another.

In addition, the gaming sector is instrumental in making the Metaverse a reality. The Metaverse faces several challenges, such as enabling multiple people to interact in virtual reality simultaneously. Gaming technology is crucial in overcoming these challenges. For example, game engines like Unity or Unreal Engine are essential for real-time 3D rendering, while rendering and tracking technologies like OptiTrack or Vicon are vital for proper functioning of VR cameras.

- Play-to-Earn Gaming (NFTs/Blockchain). In 2017, CryptoKitties introduced a new model for gaming with NFTs. Dapper Labs raised $725M in 2022 for the game . Web3 games, like CryptoKitties and NFL Rivals, use blockchain and a decentralized approach but face challenges with speed and usability. The play-to-earn gaming ecosystem saw a drop in user activity in 2022, but companies are still working to create games that reward players with tokens. The play-to-earn crypto games' success is worth observing closely.

How do these play together?

Many factors and different dynamics move the gaming market. Microsoft is a one example to look at as we try to imagine the gaming offering of the future. The company is currently building on all the key trends, with the result that:

- Xbox is one of the leading consoles, with multiple games offered.

- Activision-Blizzard can enhance the games offered.

- Minecraft is the source for user-generated content in games and innovation.

- Microsoft Cloud Azure provides infrastructure to boost the cloud gaming offering.

- HoloLens allows experimentation with the Metaverse, building on gaming use cases and technologies.

Its portfolio of assets allows Microsoft to create a single convenient subscription to access all of its offerings at a better value price for the consumer. It also gives Microsoft a "flywheel" with multiple data and income streams increasing the value of its overall offering.

Entering the Playing Field

Companies from many different industries are expressing strong interest in entering the gaming sector. Their rationale ranges from opportunistic investments to participate in the growth opportunities, to strategic investments to drive synergies with core businesses through IP and technology, brand positioning, or additional monetization.

Investors can consider gaming companies to diversify their portfolio and participate in the promising sector growth.

- A strong catalyst to growth was not only the increase in demand for gaming during the pandemic, but also the U.S. money supply increase which led to a 2020 spending rally. Investment in gaming went from $1.6 billion in 2019 to $4.7 billion in 2020

23 23 Maddyness “Pitchbook Data” . - Gaming focused VC funds are growing around the world. U.S. based VC Bitkraft raised $165 million against a $125 million goal in 2020. Luxembourg based Hiro Capital and an Indian based fund called Lumikai similarly exceeded their targets. Venture capital firm Griffin Gaming Partners has launched a mammoth and oversubscribed $750 million fund focused on the gaming business and adjacent sectors such as tools and platforms, including the fast-emerging blockchain-based segment

24 24 Forbes .

- A strong catalyst to growth was not only the increase in demand for gaming during the pandemic, but also the U.S. money supply increase which led to a 2020 spending rally. Investment in gaming went from $1.6 billion in 2019 to $4.7 billion in 2020

Media companies can benefit from incorporating gaming IP and broader gaming concepts into their offerings. Netflix serves as a prime example of this strategy, having:

- Created multiple videos based on popular game IPs (e.g., Witcher, Arcane, Cyberpunk 2077) to attract new audiences and keep them engaged.

- Included exclusive games in its subscription video on demand offering, like Minecraft: Story Mode and Stranger Things 3: The Game. It also boosted its gaming division with the Next Games acquisition, already offering 48 games on mobile.

- While the success of this strategy is yet to be determined, it shows a potential opportunity for media companies to explore.

IP owners can benefit from acquiring gaming companies and using their IP to create a strong, diversified revenue stream across various channels. For example:

- Tencent grew the popular game League of Legends in China, and created an ecosystem where the same IP is leveraged across different media channels and licensed to both internal and external parties for e-commerce and other purposes.

- Disney actively leverages its IP across media platforms, including its amusement parks and Disney+ subscription bundle.

- IP owners can also follow this trend and build on it, as seen with the example of The Witcher, which started as a book, became a game, and then a successful TV show.

Technology companies can find synergies between their own assets and the gaming industry by creating a compelling ecosystem value proposition. For example:

- Amazon has leveraged its acquisition of Twitch, a popular live streaming platform for gamers, by incorporating it into its Amazon Prime offering. This not only provides benefits for gamers, but also increases spend and boosts retention among its members.

- Apple has bundled its various services, including music, video, magazines, gaming, fitness, and cloud storage, into one subscription in order to boost retention. They have also invested heavily in a mixed reality headset, with gaming being a key use case.

- Facebook-owned Meta has infused game streaming into its social network as a type of content that users can browse for and see in their thread. It also has the most advanced VR headset and actively promotes Metaverse topics, where gaming is a critical use case.

- ByteDance, the company behind TikTok, is planning a strong push into gaming,

25 25 Reuters exploring the opportunity to drive more gaming content on its platform through dedicated challenges with game-related themes. It has already acquired Moontoon, which developed a very popular game called ML:BB (Mobile Legends Bang Bang).

Telecom operators (telcos) have various options to enter the gaming field, though selection largely depends on their specific circumstances. For example:

- Partnership with leading gaming companies to provide customers with access to exclusive game releases, in-game advertisements of the operator's own products, direct carrier billing (DCB) for popular games, or making unique access to some games a part of their tariffs (e.g., KPN in the Netherlands offers tariffs with access to in-game items).

- Cloud gaming offering by partnering with international providers, leveraging existing network infrastructure (e.g., LG U+ partnered with NVIDIA, Deutsche Telekom offers a cloud gaming service offering with over 100 gaming titles).

- Own gaming business, though there are limited successful examples among telcos (e.g., Telkomsel launched Shellfire, a popular mass online battle arena and FPS game).

- Investments in esports to promote the brand to a younger audience (e.g., SK Telecom built their own esports team that has won multiple global tournaments; Ooredoo followed the same path in the Middle East)

Irrespective of the sector, one important factor to consider is the geographical market for such investments. While China and Western markets seem to be obvious candidates, the Middle East has growth potential driven by two fundamental factors. Firstly, its demographics trend toward a young digital savvy audience that actively consumes gaming content. Out of 35M people in Saudi Arabia, 23.5M (67%) identify themselves as game enthusiasts. This creates a sizeable market not only for gaming, but also for many brands that target this audience.

Secondly, we see substantial governmental efforts to establish a thriving gaming industry. For instance:

Saudi Arabia’s Public Investment Fund (PIF) invested over $3 billion in 2022 to develop the sector, which is part of a significantly bigger $38 billion commitment by PIF to be deployed by its company Savvy Games Group (SGG) for M&A only.

26 26 Alarabiya Savvy already started utilizing those funds with acquisition of game developers (8.1% stake in Embracer Group27 27 Owner of 120 game studios and IP rights for Lord of the Rings for $1 billion, Scopely28 28 Develops and publishers free-to-play games such as Marvel Strike Force for $4.9 billion), leading esports events operators globally (ESL and FACEIT for $1.5 billion)29 29 Operates major esports events in multiple games such as CS:GO, Dota2 and multiple mobile games and China (became the largest equity holder in VSPO30 30 Operates major esports leagues in Asia (King Pro League, Honor of King) and has long-term partnerships with all key Chinese game publishers (Tencent, Garena and Krafton) for $265 million), and technology companies (Vindex).31 31 Offers content production for events and analytics in gaming, streaming and esports In addition, SGG has multiple other initiatives that will be delivered through five of their subsidiaries:32 32 Venturebeat - Nine66, a professional services provider for game developers

- VOV, an architectural firm specializing gaming and esports venues

- An upcoming studio that will publish mid/core games

- ESL FACEIT Group (EFG), the esports tournament conglomerate formed from the merger between ESL Group (ESL and DreamHack) and FACEIT

- Savvy Games Fund – Savvy’s investment arm that will focus on establishing developers in Saudi Arabia.

- Abu Dhabi Gaming aims to make Abu Dhabi a leading hub for gaming and esports. They collaborate with regulators on dedicated legislation and provide infrastructure for companies. AD Gaming partners with industry players like Ubisoft and Unity, offers in-house support, and organizes events like Yas Gaming Month to build the community.

33 33 Abu Dhabi Gaming

Looking Forward

Satya Nadella, CEO of Microsoft said: “Gaming is the most dynamic and exciting category in entertainment across all platforms. We’re investing deeply in world-class content, community, and the cloud to usher in a new era of gaming that puts players and creators first.”

Gaming has been on the rise and is destined to outperform other sectors in the media industry in the next decade. And while gaming is itself evolving quickly, it will also shape other media and technology sectors due to its:

- Access to a wide audience (especially Gen Z) and new ways of interacting with them

- Valuable IP

- Immersive content and storytelling

- Advanced technology stack that can enable a variety of Metaverse and other use cases.

As part of BCG’s series of gaming reports, our next report will focus on Esports, an important part of the sector that is revolutionizing the way consumers engage with video games.