Once out of fashion, industrial policy is seeing a revival. The US, the European Union (EU), Japan, and China, among others, are starting to take a more active approach to innovation policy. They are offering tax breaks, loans, and direct subsidies to develop new technologies, commercialize new products and services, and establish new markets.

In the US, for example, the recently passed CHIPS and Science Act of 2022 and the Inflation Reduction Act of 2022 together authorize up to $1.4 trillion of public funding to attract private investment and to be augmented with additional state-level funding. Meanwhile, the European Green Deal is allocating at least €500 billion to similar efforts. These amounts come on top of the sizable existing grant and tax-credit programs that across the OECD countries amounted to about 1.4% of their combined GDP in 2021. These industrial policy efforts are mirrored in other countries’ ambitious national growth and innovation strategies , including Vision 2030 in the Kingdom of Saudi Arabia (KSA), Egypt Vision 2030, and Singapore Green Plan 2030.

How countries plan to spend all this money and the regulatory frameworks governing their efforts vary widely. France, for example, has allocated roughly 30% of its spending to job creation, while Israel is spending just 1% of its innovation funds on new jobs, preferring to use the rest to promote long-term R&D and innovation.

To ensure that all this funding doesn’t go to waste, many governments, business leaders, and other stakeholders are working together to create innovation and technology hubs. Whether at the municipal, regional, or national level, these hubs are designed to develop and commercialize new technologies, products, and services. That’s no easy task, given the high failure rate of all too many such efforts. But by bringing together the right mix of companies, agencies, talent, technology, funding, and market access, united in a clear common cause and governed under the principles of innovation ecosystems, innovation hubs stand the best chance of succeeding in their goals.

The Innovation Ecosystem Paradigm

The key to successfully catalyzing innovation hubs is, first and foremost, collaboration across a wide variety of private, public, and institutional stakeholders. The now-dominant organizing principle for ensuring effective collaboration at scale is the innovation ecosystem —a consortium of companies and other economic stakeholders that can provide the essential expertise, capabilities, supplies, financing, and policy support to the task of bringing specific technologies to market.

Ecosystems enable the coordination of stakeholders along multiple value chains in parallel, facilitating the stimulation of demand from end users and ensuring mutually beneficial investments that could not be made in insolation. Case in point: the Aviation Climate Taskforce, a consortium of aviation industry leaders and technology partners committed to funding and preordering direct air capture and synthetic aviation fuel technologies. By bringing together manufacturing and service firms, educational and research institutes, and potential customers, such ecosystems can help overcome the chicken-or-egg problem: Which comes first, the product or the customer demand?

Effective collaboration is not only a means to ensuring successful innovation ecosystems, it is often an end, especially for public stakeholders. Recipients of funding from the CHIPS and Science Act of 2022, for example, must demonstrate regularly that their organization and governance allow for communities to be heard and actively involved in the decision-making process. Continued government funding will only be granted to those regions credibly committing to open, unbiased, and fair decision-making procedures that enable true community involvement.

Successful innovation ecosystems require a credible ecosystem orchestrator—an organization with a major stake in the financial investment necessary as well as the benefits to be captured. The key job of the orchestrator is to set up a governance model for the entire ecosystem; in this role, the orchestrator should maintain a central position in the ecosystem blueprint, with a significant stake in the ecosystem’s success and a reputation as a fair and neutral player. Effective ecosystems also require multiple “complementors”—partners that collaborate with the orchestrator and among themselves, bringing specific technologies and capabilities to the table.

Why Ecosystem Governance Matters

Unfortunately, traditional ecosystems orchestrated by large private-sector firms and limited to members of a specific business value chain often struggle to set up a governance model well. According to BCG’s research, more than 85% of business ecosystems fail , and governance issues are the number one reason. More than 50% of ecosystem failures are due to core governance issues, including the configuration of players, their roles, and their decision-making rights.

More than 50% of ecosystem failures are due to core governance issues.

In the private sector, the potential for failure is a necessary condition of doing business, as it is a byproduct of socially beneficial risk taking, and hence, even desirable under certain circumstances. But failures of public-private innovation ecosystems tend to be harder to unwind and often leave behind stranded physical assets, people unable to find new jobs in the region, traumatized communities, and the potential for long-term political damage. In Germany before 2010, for example, generous feed-in tariffs for producing renewable energy led to a massive but short-lived photovoltaic cell production boom that outpaced domestic demand. Lasting just a few years, it resulted in several multimillion-euro bankruptcies and thousands of lost jobs when most production moved to China.

Failure often manifests in conflicts among ecosystem partners, typically due to concerns about sharing the value to be gained. But the reasons for such failures often lie deeper. A common reason is treating key decisions as technical challenges to be solved, without taking into account other factors, such as demand and policy issues and the effects on the surrounding community. Instead, ecosystems must embrace adaptive leadership , viewing leadership as an activity that all the players can and should engage in, and not just the orchestrator. This means being willing to raise hard issues, to learn from the reactions of other players, and to manage the inevitable tensions by maintaining productive momentum.

This type of leadership requires people experienced in managing long-term political processes, engaging stakeholders, and moderating dynamic processes and tension without holding formal authority or hierarchical power. They must be willing to step into the arena, take on personal responsibility, and explore the underlying assumptions and values of all the stakeholders, with the intention of fostering agreement on a shared purpose, goals, and the rules of engagement. Leaders can only operate effectively if they operate in a well-designed governance system.

Good Governance

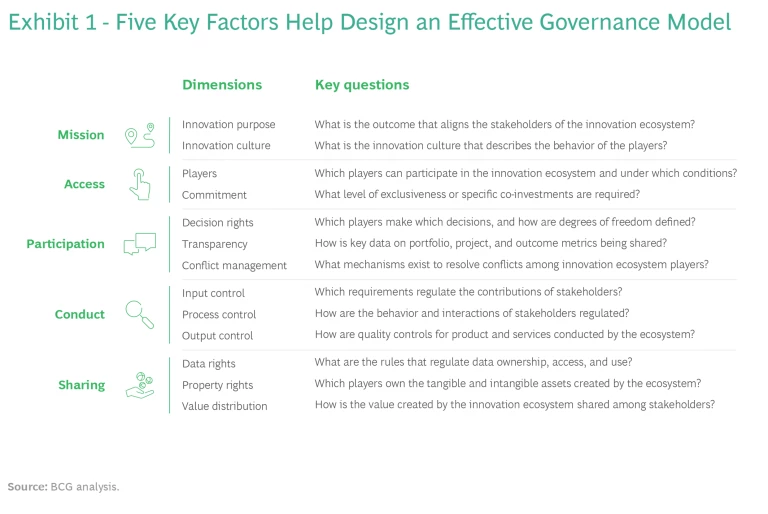

Unlike governance within a single corporation, concerned primarily with decision making in typically hierarchical structures, the choices and decisions involved in ecosystem governance are more complex . Effective governance in innovation ecosystems requires careful consideration of five critical factors: mission, access, participation, conduct, and sharing. (See Exhibit 1.)

- Mission. Conflicts among firms, communities, and other ecosystem participants often boil over because of small operational details, but the friction is ultimately driven by mismatches in values that have remained unarticulated for too long. Successful innovation ecosystems are held together through a common long-term mission and a shared set of values. Culture can be codified in values or remain tacit but still influential.

- Access. Access determines which players can participate and under what conditions, and controlling it is essential. Some ecosystems require ecosystem-specific co-investments from partners to enhance commitment and avoid free riding that can derail projects. For players not making financial contributions, the access rules can be based on people or intangibles, such as intellectual property, brand, or tacit knowledge.

- Participation. Rules that define decision-making rights and conflict resolution processes are at the heart of ecosystem governance. Decision making can be joint, centralized, or decentralized, depending on the relative size and commitment of ecosystem partners. Transparency rules vary, with some ecosystems being open to nonmembers, while others limit transparency to members only. Conflict resolution processes can be governed by an in-ecosystem conflict resolution mechanism or by outside stakeholders. In countries with weaker overall regulatory environments, it may be necessary to set up a dedicated regulator for the ecosystem.

- Conduct. Most ecosystems are not guided solely by a strong mission and rules covering access and participation; there are also checks on the behavior of partners and stakeholders. Process controls regulate partner behavior during interactions, requiring dedicated community involvement formats when stakeholders make significant changes to plans, for example. Output controls involve checks on the quality of products and services delivered, such as adherence to timelines in the setup of manufacturing plants or external market testing of innovative new products and services.

- Sharing. The assigning of property and shared ownership rights must be clarified from the beginning, and any conflicts must be resolved within the ecosystem itself. Property rights over intangible assets (such as software, brands, and intellectual property) are typically owned and used by creators but can be licensed to other participants. Value distribution can follow market-based approaches, coordinated pricing, or centralized pricing and value sharing.

As a rule of thumb, the innovation hub must be designed and managed so that ecosystem members benefit proportionately to their investment of time, money, and expertise. And hubs must maintain the support and trust of their surrounding communities to be viable in the long term.

Three Case Studies

While the principles of effective innovation hub governance are consistent across industries and regions, the specific solutions vary. The following three examples, from the US, KSA, and Germany—all with various scopes, ambitions, and goals, and under very different regulatory and institutional environments—highlight specific aspects of ecosystem governance and what works and what doesn’t.

Southern California. The US’s Southern California region, while rich in diversity and the critical elements needed to drive innovation, is challenged by its sheer size—a sprawling landscape covering 40,000 square miles, from Santa Barbara down to San Diego, that results in the isolation of many resources across a fragmented region. In this context, the Alliance for SoCal Innovation (or the Alliance) was founded in 2017 as a nonprofit initiated by innovation leaders in Northern California looking to diversify the innovation economy beyond the Bay Area. The goal: to create a cross-stakeholder consortium of interested Southern California leaders to support the ambition of stimulating innovation and increasing the success of startups in the region.

Shortly after forming, the Alliance created a map of existing stakeholders across the region—including large corporations, small startups, academic institutions, investors, service providers, and community and government organizations—to better understand the region’s existing players and available resources. Amid a complex array of mature and disparate stakeholders, there is no natural government partner that is invested specifically in driving growth across Southern California. In this context, the Alliance serves as a neutral super connecter, committed to understanding the critical needs of each group, the persistent gaps in resources that they face, and the opportunities to provide value by facilitating important linkages among them. Specifically, the Alliance focuses on building networks, orchestrating collaborations, and sharing information to facilitate interactions. These activities serve to strengthen six key ingredients for a leading ecosystem by nurturing stakeholder connectivity across the region.

The Alliance for SoCal Innovation serves as a neutral super connecter that is committed to providing value by facilitating important linkages.

To ensure the appropriate distribution of value across participating stakeholders, the Alliance has been deliberate in hearing everyone’s voice and defining and validating tailored value propositions that resonate for each stakeholder group. The diversity of stakeholders makes governance challenging, so having balanced representation on the Alliance’s board of directors and conducting regular meetings among its more than five leadership committees have helped to inform priorities. These groups collectively total more than 100 leaders and further strengthen connections across communities that would otherwise not exist. Altogether, the Alliance engaged more than 1,200 innovation leaders across more than 120 institutions in 2022.

Among the most critical stakeholders, large corporations often look to gain market intelligence and access to matchmaking with relevant startups through their external innovation activities. With this in mind, the Alliance organizes deliberate programming to provide insight to corporations and investors and valuable introductions for startups and academics that could benefit from access to potential customers. For example, the Alliance’s First Look SoCal Innovation Showcase 2023 featured a curated cohort of 24 startups that pitched to an audience of as many as 230 industry and investor representatives.

Expanding its regional value even further, in March 2021, the Alliance launched the SoCal Venture Pipeline to help venture-ready startups seeking access to seed or Series A investments. In 2022 alone, the program engaged more than 1,800 startup founders, leading to 15 companies raising a total of $63 million, with an average investment of $4.2 million. Because plenty of physical facilities are available to house existing stakeholders, the Alliance has focused on building social networks. In 2022, the Alliance fostered approximately 60 meetings and more than 2,200 individual introductions and connections.

Currently, the Alliance serves as an invaluable coordinator of stakeholders across an otherwise fragmented region, providing forums for leaders to convene, learn from one another, and identify new connections to address individual needs. In a landscape where there is no singular public partner leading the way, the Alliance offers an example of how private sector leaders can catalyze meaningful impact through a neutral vehicle that drives shared benefits across stakeholder groups.

The Kingdom of Saudi Arabia. Like most countries, KSA maintains numerous government agencies with very different scopes and mandates on wide-ranging issues, including information and communications technologies, cybersecurity, innovation goals, and support for small and medium enterprises. This can make ecosystem coordination and governance in the Kingdom very complex, especially considering the scope of the country’s Vision 2030 ambitions and the tight timelines under which it is operating.

Moreover, the sheer scale of operations needed to make meaningful progress toward Vision 2030 further complicates the design of the country’s innovation hubs. These projects are typically planned as new greenfield, city-scale projects and, thus, require a planning and construction roadmap spanning two or three decades and a substantial initial capital outlay. In addition, they require infrastructure (such as power-hungry data centers, district cooling, and other fit-for-purpose options) specifically tailored to the hub’s purpose.

Under these circumstances, designing, building, and operating multiple large-scale innovation hubs from the ground up cannot be managed through traditional brownfield mechanisms. It requires an holistic approach that accounts for three key factors:

- Ecosystem Design. Critical to the design of innovation districts and special zones in KSA is the creation of self-sufficient ecosystems that include a variety of market actors and that have opportunities to connect and scale. Think of academic institutions and research centers that are connected to the industry and that can create and nurture relevant intellectual property and business ventures. Such ventures must be able to find a home for their unique requirements (for example, living labs and testing fields) and be able to scale to the point where they can work with multinational companies that also reside in the hub. So-called demand anchors—companies that can create markets for the services and products of emerging players—are also essential.

- Government Coordination. Any successful innovation ecosystem must be multidisciplinary and include a wide variety of actors. Thus, it will have a wide range of needs and requirements and offer various incentives. A whole-of-government approach is needed to ensure orchestration across multiple levels. This approach includes special zone authorities to manage the ecosystem’s portfolio of offerings and to ensure no internal competition, the KSA’s Ministry of Investment to manage tax incentives, local government at the city and regional levels to help with planning requirements, an authority governing small and medium enterprises to harmonize the necessary support systems, and additional relevant ministries and authorities to provide guidance from both industry-specific and cross-industry perspectives.

- City Planning. Greenfield, city-scale developments embedded in broader cities create the need for new layers of regional and city planning coordination, including coordination with utilities, mobility options, schools, and green parks.

An entire portfolio of new economic zones was announced in 2023: King Abdullah Economic City, Ras Al-Khair, Jazan, and Cloud Computing, a virtual economic zone that is part of King Abdulaziz City for Science and Technology in Riyadh. All of these are long-term projects that will continue to be developed over the next few years.

Germany. Germany’s innovation ecosystems, while robust with a strong foundational research base, face critical challenges that could jeopardize the country’s long-term prosperity. Chief among them: the inclination among core industries to innovate incrementally, the limited transfer of knowledge between academia and industry, and a lack of private sector growth capital.

To support breakthrough technology projects with the potential for major societal impact and to accelerate their commercialization, in 2019, the German government founded SPRIND, an agency under both the Federal Ministry of Education and Research and the Federal Ministry for Economic Affairs and Climate Action. Its stated ambition: to create the German equivalent of US government R&D agencies, such as the Defense Advanced Research Projects Agency and Advanced Research Projects Agency–Energy.

Since its founding, SPRIND has used its annual budget—€170 million in 2023—to make initial investments in various fields, including biotech, nanorobotics, optics, photonics, and renewable energy. Despite its early traction, however, the agency’s governance setup was constrained by the EU’s state aid laws and Germany’s budgetary laws, which proved unsuitable to the need to make fast decisions. Two factors proved to be particularly challenging:

- Rigid Governance, Finance, and Investment Structures. SPRIND was confined to a system where it had to adhere strictly to annual budget cycles. This meant it couldn’t carry over funds from one year to the next or invest them in long-term projects that may not align with a specific fiscal year, unlike private sector funds that are able to deploy capital more flexibly. Nor was SPRIND allowed to acquire or sell minority stakes in companies, limiting its potential for strategic investments as a co-investor alongside professional private investors.

- Uncompetitive Salaries. It was challenging for SPRIND to pay competitive salaries for key positions owing to the requirement to pay all its employees in line with public sector pay scales. This limitation required extra justification for every exception in order to attract and retain the best technical experts and innovation managers.

Addressing these factors required devising novel solutions and exceptions from budgetary laws, as well as a major culture change at key ministries, some of which had originally had reservations about granting a government agency such an unprecedented degree of freedom.

These challenges are now being addressed through a new piece of legislation—the so-called SPRIND Freedom Act—that is still working its way through the parliament. It is designed to grant the agency greater flexibility in its operations, both in terms of its direct interactions with the federal government and its ability to invest and disburse loans. The measure includes:

- Greater Budget Flexibility. SPRIND would be able to carry forward 30% of its annual budget to the next year.

- Increased Investment Flexibility. SPRIND would be able to hold minority stakes, make joint investments with external funds, and issue debt. These funding mechanisms are crucial to meeting the expectations of leading investors and would align the agency’s financial strategies with those of the private sector. This flexibility would position it much better in building specific thematic innovation ecosystems on topics such as biotechnology or advanced computing.

- Higher Degrees of Autonomy. SPRIND would be able to acquire and sell stakes of up to 25% in other companies or worth up to €10 million without securing federal approval. If the stake is greater than 25% but does not exceed €10 million, it would be considered approved unless the Federal Ministry of Finance objects.

- Self-Funding. Income generated from loan repayments or the sale of subsidiary companies could be reinvested, with half of the proceeds flowing back to the government and the other half retained in SPRIND’s own budget. “We have the long-term ambition to build our own fund, but this will take time,” says Rafael Laguna de la Vera, SPRIND’s founding director.

The act also includes provisions allowing SPRIND to pay competitive salaries to select hires, although the treatment of employee stock options is still up for debate.

SPRIND’s journey exemplifies the challenges involved in driving innovation in ecosystems with public and private stakeholders—and the progress that’s possible when those stakeholders work side by side toward a common goal, in the spirit of collaboration and trust.

Getting Started

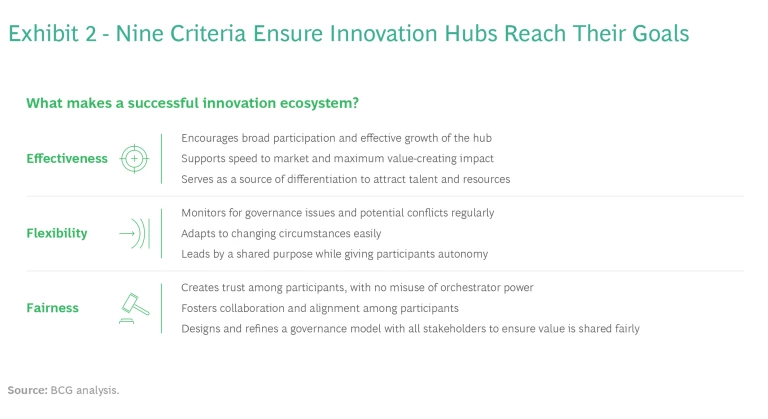

Prospective leaders who are looking to launch and coordinate an ecosystem effort should use nine guidelines to ensure that their governance design is effective, flexible, and fair—qualities that all innovation hubs need if they are to reach their goals. (See Exhibit 2.)

More generally, leaders would be wise to keep in mind three overall success factors:

- Many innovation hubs fail, but failure is not an option for public sector hubs. Even more than in the private sector, success requires diligent leadership, explicit discussions about mission and values, and the consistent setup of ecosystem governance mechanisms.

- That being said, as the above three cases demonstrate, contexts vary. Design choices must always be customized. The active participation of local communities and its institutions is key, especially for brownfield endeavors such as those in Southern California and Germany.

- Strong governance is crucial but not everything. The success of the three cases above has been made possible by a few exceptional leaders who were able to build broad coalitions and forge a way forward despite multiple conflicting goals and interests. The right mix of talent is key and often requires tapping into the global pool of expertise beyond the regional scope of the ecosystem.

It Takes an Ecosystem

Many cities, regions, and countries have made noble efforts to seed and develop innovation and technology hubs. The results so far, however, have been decidedly mixed—the result of conflicts regarding decision-making rights, sharing of the value to be gained, inflexible leadership, and other factors.

The key to success is to take an ecosystem approach to the governance of innovation hubs. A common mission and values, clear decision-making rules, active stakeholder participation, and adaptive leadership—all are critical to developing new products and services and bringing them to market.

Most important of all is the willingness on the part of all stakeholders—business leaders, startup founders, community leaders, and university and government officials—to contribute their fair share of funding, knowledge, expertise, and political capital to the cause and to work together, in good faith, toward their common goal.