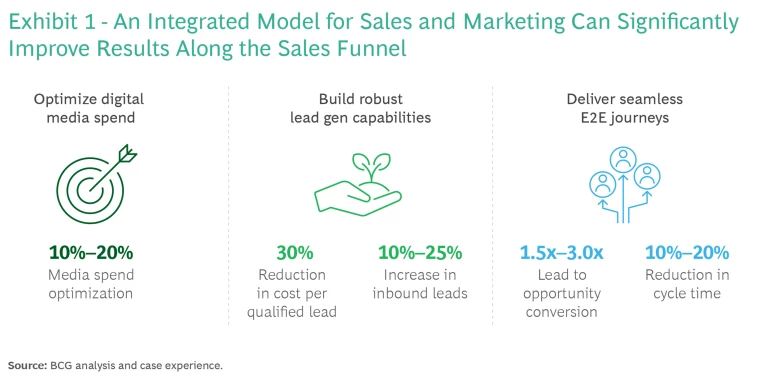

A growing number of B2B companies are exploring ways to use marketing technology (martech) to bolster their go-to-market activities. Our recent project experience shows that companies that implement demand centers and then successfully integrate their marketing, sales, and service functions are generating better leads more efficiently, improving their conversion rates, and achieving higher returns on marketing investment.

These initiatives are ensuring that their highly targeted, personalized messaging consistently reaches the right person at the right time. (See Exhibit 1.) By automating the generation of qualified leads, a demand center frees-up time for sales representatives to focus on value-adding activities such as sales conversations and conversions.

Yet for many B2B companies, demand centers and the integration of their sales and marketing functions remain abstract concepts rather than a cornerstone of their revenue generation. Despite martech’s proven value, particularly in challenging economic conditions, leaders have not been motivated to allocate the time and resources to pursuing the necessary transformation. Hesitant to change the status quo, they remain confident in their company’s ability to ride out periods of uncertainty until the next upswing arrives.

In other words, their leaders have only seen a smoldering platform for change, not a burning one. Instead of organizing marketing and sales as one continuous process, leaders see the performance achieved by digital marketing and lead generation as separate and distinct from sales execution. This perspective relegates B2B marketing to the role of awareness generator, whether via digital campaigns or analog channels such as trade fairs and brochures. In these companies, the function hasn’t made the transition to automated digital lead generation, nurturing, and scoring.

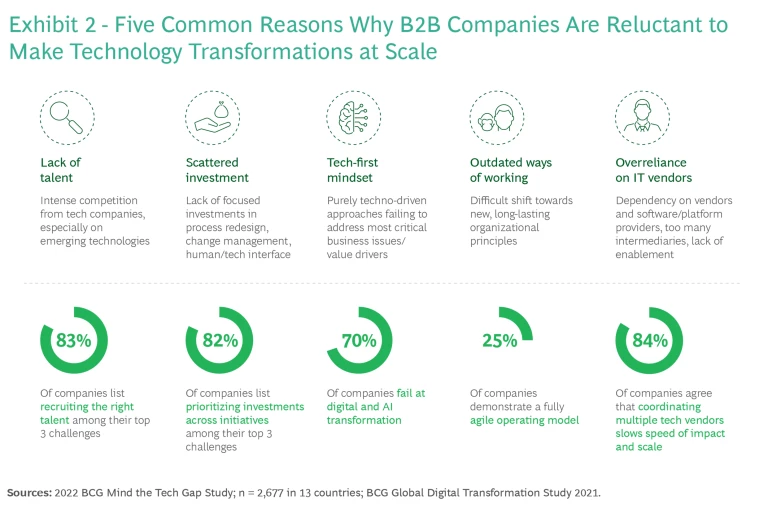

A study conducted by BCG revealed several reasons why companies have been reluctant to implement a technological platform such as a demand center—even when they are aware of the upside opportunities of the platform and the downside risks of waiting. These reasons include a lack of talent, a tech-first mindset, and outdated ways of working.

Sub-optimal marketing and sales processes make it more costly to identify, qualify, and convert leads. They also make it less profitable for companies to serve certain customer segments, especially potentially underserved segments such as small-volume, small-business customers. Fragmented tool and data landscapes compound this problem, because they leave salespeople without comprehensive visibility into upselling and cross-selling opportunities, or into increased churn risks in their customer base.

But leaders’ hesitance to establish a demand center that is accompanied by functional integration will soon have more far-reaching consequences. Maintaining traditional sales approaches and the siloed relationships between marketing and sales will inhibit a B2B company’s ability to respond quickly and proactively to profound market shifts.

Three Shifts that Warrant a New Role for B2B Marketing

Our recent experience shows that a burning platform does exist. Consumerization of the B2B purchasing process, the growing importance of parts and services, and the potential efficiencies from generative artificial intelligence (GenAI) are opening up opportunities for the next wave of fast adopters to gain market share, deepen their relationships with customers, and profit from greater efficiencies in lead generation, qualification, and conversion.

The “consumerization” of B2B purchasing

Advances in martech and the growing role of Millennials and Gen Z in corporate decision-making continue to make the purchasing journey for B2B customers converge toward one that consumers are familiar with: omnichannel presence, intuitive user interfaces, and a positive user experience. A 2023 report by Forrester said that these generational cohorts constitute 64% of business buyers and that their “digital savviness” leads them to seek self-service transaction channels as well as information from a range of third parties rather than the seller. The extent and impact of these changes have become so pervasive that B2B companies should accept them as givens, not as emerging or momentary trends.

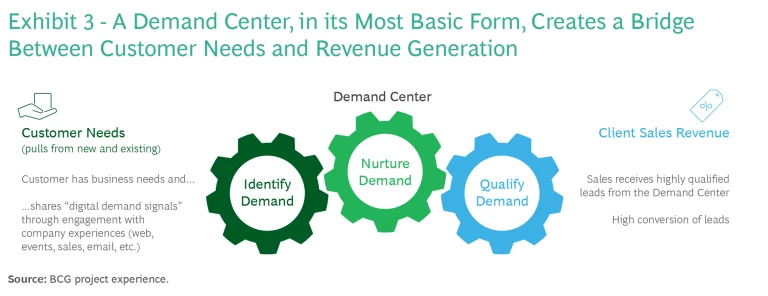

The consumerization of B2B marketing and sales requires upgrading the marketing function from mere awareness-generation to a role as co-owner and key enabler of the entire sales conversion funnel. This will require a new marketing and sales operating model, covering the entire funnel with a demand center as a new capability for lead generation, qualification, and nurturing. (See Exhibit 3.)

The fluid nature of sales relationships with customers

Economic uncertainty and higher quality products are making customers more likely than ever to postpone big-ticket purchases in favor of extending the life cycle of their existing equipment. This trend, combined with widespread consumerization, means that sales interactions in many industries are evolving from a series of discrete transactions to a continuous, fluid stream of opportunities as needs emerge. After-sales parts and service, as well as upselling and cross-selling opportunities, now play a much greater role in revenue generation and in meeting the needs of customers. Because the value of each individual transaction tends to be smaller, companies should focus on more efficient and cost-effective identification, qualification, and conversion of leads.

The tools to generate ideas and communications efficiently

Applying martech and GenAI to lead generation and enrichment can improve marketing efficiency and account engagement by creating highly personalized marketing content, including visuals. In B2C applications, some companies have reduced their lead times for the generation of new marketing content and campaigns from more than six weeks to less than six hours. For B2B companies, GenAI creates many opportunities, such as drawing inspiration and insights from the extensive but disparate data they are already collecting about their installed base of customers. It can help sales and marketing teams understand what a compelling offer should look like—and can also make recommendations on better business cases and stories that can help the team reframe an individual buyer’s decision-making. This can prove especially helpful for newer salespeople.

In light of these three pronounced shifts, B2B companies can no longer afford to forgo the opportunities created by an empowered marketing function that is integrated with the sales function and a demand center.

Three Steps for Empowering the Marketing Function

Taking advantage of this changing environment requires a company to align roles and responsibilities across marketing and sales to deliver a seamless customer journey, including well-defined collaboration and handover points with tight integration between the two functions.

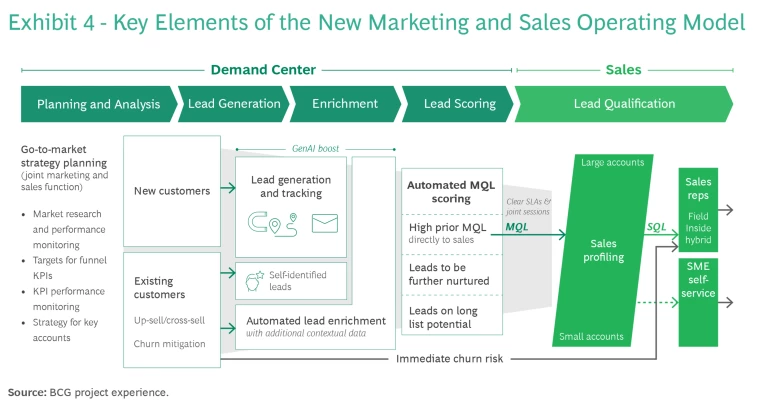

In our experience, companies that have made this transformation—and achieved the benefits highlighted in Exhibit 1—have built such connections, implemented new martech and tools to generate more insights from existing data, and optimized their processes across the funnel shown in Exhibit 4. They have also made the complex transformation less intimidating by breaking it down into smaller integrated initiatives.

The demand center’s key outputs are marketing-qualified leads (MQLs). Each one should include mandatory and optional qualitative elements that enable the sales team to convert these leads efficiently into sales-qualified leads, or SQLs. The automated demand center in the funnel in Exhibit 4 uses available data to evaluate leads from potential new business and from existing business (up- and cross-selling opportunities and churn risk) and score them. The leads with the highest priority go to sales for further qualification and ultimately conversion, while other leads receive lower priority and are either routed back into the nurturing process or deprioritized. A GenAI module within the demand center can draw in a wide range of contextual data to augment and personalize the lead generation and enrichment while also accelerating the process.

To harness the full potential of a demand center, a B2B company should focus on three steps.

Build connections between marketing and sales.

Devoting resources to enhance marketing or sales in isolation is like having state-of-the-art wheels on a car, but no axles or transmission. The power and traction come from full integration, and that means not only breaking down the organizational siloes, but the thinking behind them.

Feedback loops between marketing and sales trigger a flow of data and information—such as buyer archetypes and behaviors and the impact on conversion rates—that enable marketing to improve the quality of lead generation. An integrated dashboard, linked to the CRM platform, provides a coherent and systematic way for the company to track KPIs between marketing and sales. The interconnection also enables marketing and sales to develop unified account prioritization and acquisition strategies. A regular meeting cadence covers market monitoring, target setting, ideal customer profile planning, and strategy setting for account-based marketing.

Perhaps more importantly for the internal working relationships, these interconnections shift the perception of marketing from a qualitative and nice-to-have function to a true co-owner and critical enabling function of the sales conversion funnel. The existence of MQLs creates a quantifiable link between incoming leads and revenue generation, which turns marketing from a message generator into a targeted machine for hunting specific leads that can generate higher-quality revenue. This makes marketing’s activities measurable and accountable.

The interconnections also place greater importance on the end-to-end customer journey. Integrated go-to-market strategy planning between marketing and sales ensures guidance and monitoring along all funnel activities that parallel this customer journey.

Create more data leverage.

Marketing needs to tap into the large amount of data and state-of-the-art martech to personalize the customer journey and drive conversion rates. This greater data leverage allows marketing to generate leads with higher deal value, higher propensity to buy, and supporting information that helps sales qualify the leads. Having all lead data bundled in one place ensures a holistic overview and standardized lead qualification. It lays the basis for scalable lead generation and also ensures structured lead enrichment and nurturing for the handover of high-priority leads to sales.

The MQLs derived from this richer set of data improve resource allocation, because sales no longer needs to spend time on non-sales activities such as lead generation and initial qualification. They also open up sales to pursue leads in underpenetrated segments which they have normally ignored, because working with existing customers is generally a safer and less expensive bet.

Optimize processes.

The marketing team is responsible for content creation for lead generation, lead nurturing and enrichment, and the scoring of marketing-qualified leads. Optimizing this process is necessary because having too many or too few leads can disrupt sales activities.

Managing two parameters—the number of MQLs per week or month and the related estimated SQL volume potential—is critical to optimizing sales teams’ activities. A weak flow of MQLs risks underutilizing the sales team and jeopardizing sales targets. An overflow of MQLs risks wasting leads or letting them age out if the sales team does not have sufficient capacity to contact all leads within a defined time.

Generating SQLs is the first critical activity of the sales team to process the MQLs. The generation, nurturing, and scoring of MQLs is usually highly automated within the demand center, but the conversion to SQLs often requires initial, in-depth, one-on-one interactions with the potential customer.

Finally, the company must have specific, well-defined service level agreements between marketing and sales. These include the underlying KPIs and targets along the entire funnel or process. Clear service level agreements between the demand center and sales ensure consistent qualification of SQLs and a division of responsibilities. This typically requires investment in the marketing and sales tech stack, such as CRM and marketing automation systems. But more important is the definition of deliverables and process elements.

Despite the advancements in technology and fundamental changes in how customers buy products and services, many B2B companies still view technological change as a smoldering platform rather than a burning platform.

The combined intensity of these fundamental changes—the consumerization of B2B purchasing, the fluid nature of customer relationships, and the emergence of new tools—is leaving B2B companies at an inflection point. The ones who invest in platforms such as demand centers and integrate their marketing and sales functions are better positioned to optimize their marketing investments, convert leads more efficiently, and deepen customer relationships.