Environmental, social, and governance (ESG) factors have become increasingly important in the banking sector. Regulators are implementing more requirements, investors are demanding concrete returns, and both corporate and retail customers are seeking diverse offerings. As a result, ESG is no longer just a risk and compliance matter; it now influences nearly every aspect of banking operations.

While financial data, customer data, and other, more traditional types of information are usually managed by specific departments, ESG data is scattered across the bank, stored separately and classified inconsistently without a clear owner. These inefficiencies lead to increased costs and risks and to missed opportunities.

It’s time for banks to professionalize how they manage ESG data. The good news is that doing so doesn’t need to involve change-the-bank level investment. By adapting their approach and creating an integrated data platform, banks can turn ESG data from a headache to an opportunity. This article explains how.

Banks Have an ESG Data Problem

Bank clients we’ve spoken to share a similar story: ESG data is more important than ever but is harder than ever to manage. One reason is the sheer volume of information involved. Banks need metrics on every dimension of ESG, from energy consumption and emissions to workplace health and safety to diversity, equity, and inclusion. That data must cover banks’ own operations and its value chain, both upstream across supplier and partner activities and downstream to the broader client portfolio.

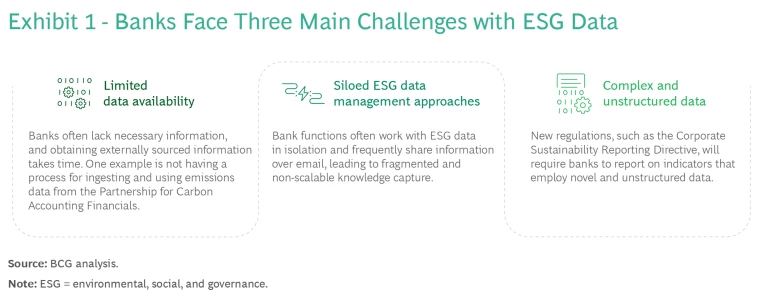

This is more data from more sources than banks have historically needed to collect, and it comes in more unstructured forms than many banks are used to, including PDF files, imagery, and web scraping. While many banks have analytics engines that can process structured and unstructured data, few have invested in mechanisms that can do so specifically for ESG data. As a result, while more users across banks need ESG data, they can’t get it in a timely way. Limited data availability, siloed data management approaches, and an inability to process complex and unstructured data are key challenges. (See Exhibit 1.) Metrics and calculations also vary widely, complicating modeling efforts and making it hard for business teams to provide clear and consistent reporting. With pressure on banks to step up leadership on ESG issues—and a burgeoning list of regulatory pronouncements—most know they need a different approach.

But the still-evolving nature of many ESG frameworks, solutions, and standards has made it difficult for banks to figure out the best way to start. Fortunately, there is a solution.

A Better Way to Orchestrate ESG Data

Through our work with institutions globally, we’ve derived a method that can help banks harness the value of ESG data while building foundations that can flex and grow as the field of ESG matures. This approach ensures that time and investment spent today will pay continual returns. Here’s what we’ve seen work well.

Create a dedicated ESG data strategy. While many banks have crafted an ESG strategy for the institution as a whole, few have developed a holistic plan for ESG data specifically. That’s a mistake. This can happen when there isn’t a clear owner of ESG data within the bank. All C-level executives should be interested in ESG data because each of their functions are impacted by it. But in particular, it can make sense for the chief data officer, chief information officer, and chief sustainability officer to take the lead in developing the overall strategy, given the nature of their roles. Their oversight can ensure that all users across the bank leverage ESG data appropriately. For example, these leaders could help set up systems and processes that would allow chief risk officers to manage and monitor environmental threats and chief commercial officers to adapt pricing based on a client’s ESG ratings.

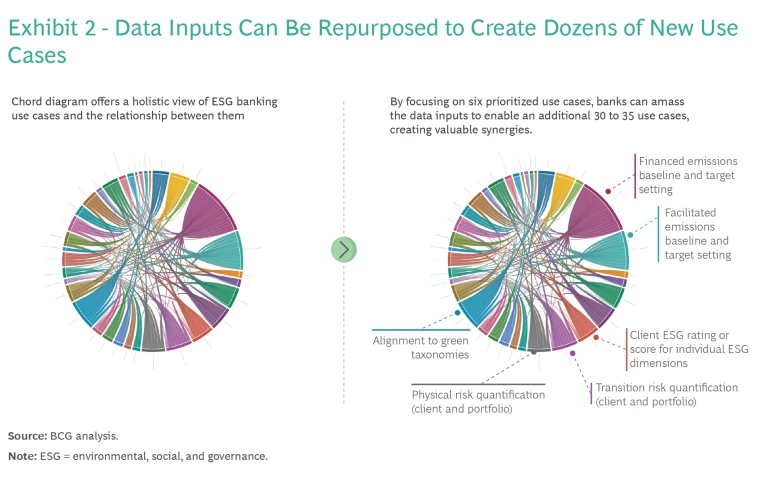

Design the data platform around a core set of use cases. Banks need ESG information to meet their risk management and compliance obligations. But much of that underlying data can be harnessed to support other ESG activities such as reporting and disclosures and sustainability finance. By anchoring the ESG data strategy on a core set of foundational applications, banks can gain powerful synergies. For example, BCG research found that amassing inputs for five or six cross-cutting ESG applications can supply 70% of the data and analytics required for 30 or 35 additional use cases, since many of these activities draw from similar data sets. (See Exhibit 2.) A use case-led approach to platform design also eases orchestration, enabling greater standardization and reuse, reducing rework, and cutting IT costs.

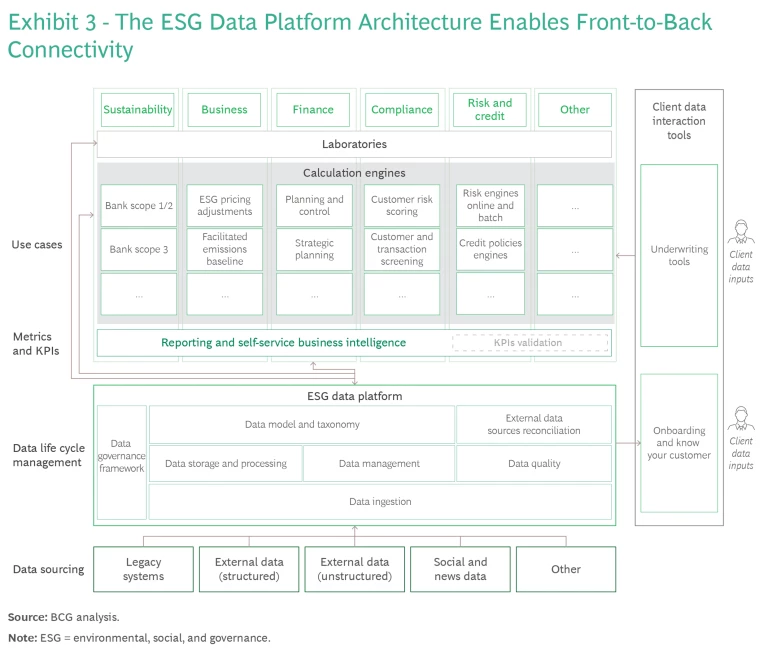

Build the platform with the future in mind. Banks need an ESG data platform that can grow with them. A data architecture that is holistic, integrated, and modular can give banks that flexibility. Generally speaking, this architecture has four main layers. (See Exhibit 3.) The data sourcing layer helps banks ingest, store, process, and reconcile metrics and other data from internal and external sources, housing it centrally and refreshing it continually. The data life cycle management layer then organizes information within the platform around specific business topics and marries it with appropriate controls. That domain-based structure democratizes access to data within a consistent governance framework. Metrics and KPIs are captured and codified in a similarly centralized manner. The top layer, use cases, incorporates the functionality that day-to-day users need, such as calculation and distribution processes and self-service business intelligence (BI) capabilities.

Building a platform in this way helps banks achieve significant performance benefits—in particular, cutting use case development time and allowing data democratization. Moreover, by creating a “single source of truth” for ESG data, quality is better assured. Business users can access the information they need when they need it and in formats they can readily apply, saving time, reducing error, and accelerating results. And because the entire platform is designed with flexibility in mind, it can scale with the bank’s capabilities and needs. For example, banks could migrate over time from metrics that are calculated on a monthly basis, leveraging batch processes to source data, to metrics that are fully embedded in day-to-day activities and computed in real time to enable such activities as ESG product pricing.

Enhance the data governance framework to manage new types of data. Most banks have some form of data governance system in place. But most frameworks will need to be updated to account for the newer data types that ESG platforms use, such as unstructured data and information from external providers. The most effective frameworks define data management processes at the strategic, tactical, and operational levels, supported by tools that help with version control and automate key quality indicators. Getting this foundation in place can help teams innovate faster, without having to jump through unplanned process hoops or, worse, having to roll back work due to data quality oversights. In Europe, the new Corporate Sustainability Reporting Directive will require banks to give their assurance that reported information is correct, making data quality even more important.

Start Now and Grow Incrementally

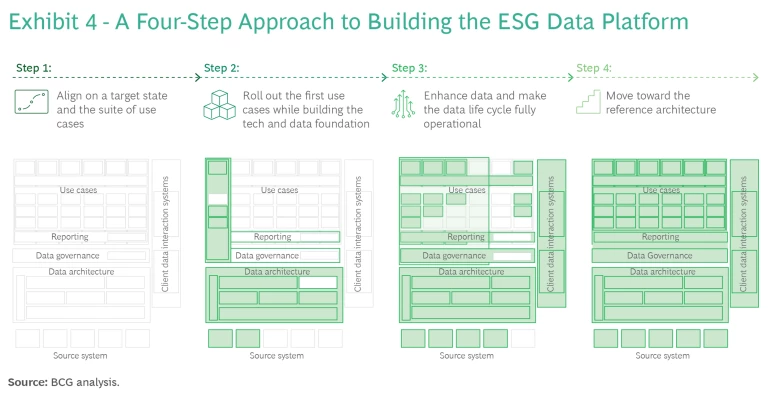

Banks can no longer afford to push ESG data issues to the side of the desk. The needs for this information are simply too great, and the risks associated with inadequate reporting and analytics are growing. But implementing an ESG strategy doesn’t have to be an overwhelming task. We’ve found that focusing on four “must-do” requirements and “can do now” capabilities can allow banks to build an ESG data platform that is successful from the start. Here are the steps we recommend. (See Exhibit 4.)

- Step 1: Align on a target state and the suite of use cases that the platform will support. This prioritization should be driven by the overall ESG data strategy, the bank’s strategic needs, regulatory expectations, and existing data and tech infrastructure, balancing impact with feasibility.

- Step 2: Roll out the first use cases while building the tech and data foundation. It’s helpful to approach the platform build one use case at a time. This approach allows banks to focus their attention on getting the data architecture right by laying out the supporting processes, metrics, and governance that will enable industrialized output for first and future use cases. This planning involves charting the various technologies and data needed to support the use cases, carefully noting any dependencies among them. Banks can then map these requirements against their existing systems and capabilities and flag critical gaps. Defining KPIs to guide this process can help maintain momentum.

- Step 3: Enhance data and make the data life cycle fully operational. With the core architecture in place, banks can begin to refine the mechanics to ensure that the data life cycle works fluidly and effectively from end to end. They can continue to deploy priority use cases while also enabling more-advanced features such as self-service BI for flexible reporting.

- Step 4: Move toward the reference architecture. Having established the foundational layers, banks can build on them in a modular way, use case by use case, continually adding new functionality to accommodate evolving ESG opportunities and requirements.

This is the time for banks to unleash the power of their ESG data and stand out as industry leaders.

With the right focus, banks can move through these steps fairly quickly. We’ve seen institutions assemble their ESG data platform and begin operationalizing their first use cases within three to six months and move toward a reference architecture within 12 to 18 months.

This is the time for banks to unleash the power of their ESG data and stand out as industry leaders. By creating a dedicated data strategy, focusing on a select set of core use cases, and building a platform that can flex and grow with the evolving landscape, these institutions can harness the value of ESG data today and ensure lasting returns in the future.

The authors would like to thank Eriola Beetz, Anne Kleppe, Alessio Menichelli, Mariana Linhares, Eugenia Fortis, Eduardo Silva, Davide Martelli, Giulia Lubrini, Rodrigo Cezaro, Danilo Lavieri, Enrico Ricci, and Davinder Dhillon for their significant contributions to the development of this article.