The transition to low-carbon energy has the potential to create massive economic opportunities and benefit individuals and communities across the globe. It could create 30 million jobs in clean tech sectors, eliminating millions of premature deaths each year caused by air pollution and delivering energy to nearly 800 million people who live without electricity. But if not managed properly, the energy transition could also bring high costs and inequities, often for the world’s most vulnerable populations.

We are in the grip of a complex energy trilemma —the need for a secure and reliable energy supply at an affordable cost with minimal environmental and socioeconomic repercussions—and it requires leaders to make difficult tradeoffs. The transition to a green economy will impact the livelihoods of at-risk communities and millions of people working in carbon-intensive industries. It is imperative that we adopt a human-centered approach so that no one is left behind.

If not managed properly, the transition to low-carbon energy could bring high costs and inequities for the world’s most vulnerable populations.

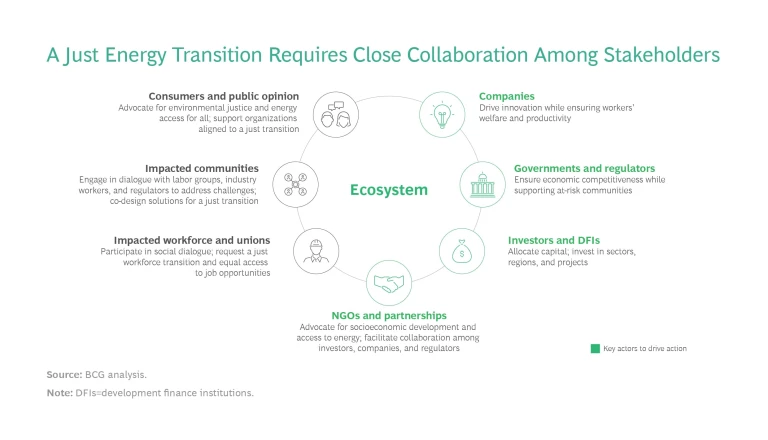

No single actor can achieve a just energy transition. All stakeholders must cooperate to secure the future of workers and at-risk communities. In this article, we’ll highlight the challenges of achieving a just energy transition and offer several no-regret moves that companies, governments and regulators, investors and development finance institutions (DFIs), and NGOs and partnerships can make to protect those affected, maximize positive socioeconomic outcomes, and ensure that the costs and benefits are fairly distributed.

Challenges of a Just Energy Transition

When leaders embark on a just energy transition, they are forced to reconcile a complex array of issues, including job losses, rising energy costs, availability of financing, and equal access to green energy. Here are some of the key obstacles that must be addressed:

- Driving Equitable Employment. The energy transition will disrupt entire industries, such as coal and oil and gas, destabilizing regional economies that depend upon jobs in these fields. While the path to net zero has the potential to create 30 million clean-energy-related jobs by 2030, it may also cause the loss of more than 5 million jobs in fossil fuel industries. Newly created clean energy positions will require new skill sets and specializations, and those roles may not be available in the towns and cities where factories, plants, and mines shut down. Measures and policies will be needed to minimize the impact to workers’ livelihoods.

- Supporting At-Risk Communities and Nations. Climate change is pushing more than 26 million people under the international extreme poverty line each year—and the poorest 40% of the global population are most likely to lose income. The Global South is suffering disproportionately. Africa has contributed the least to cumulative global CO2 emissions but will be hugely affected by floods, storms, and droughts brought on by climate change. If the effects of the energy transition are not managed intentionally, rising energy costs and job losses will further disadvantage the world’s most vulnerable populations.

- Addressing Inequities in Financing. Current spending on climate action is inadequate to achieve the Paris Climate Agreement goal of limiting global warming to 1.5 degrees Celsius. In fact, BCG analysis shows that nations have deployed only 16% of the $3.8 trillion that experts say is required annually for mitigation and adaptation. And only 30% of climate funding has gone to emerging and developing markets, though they are most exposed to the physical consequences of climate change. Governments and companies must boost funding and direct investments to change that.

- Securing the Supply of Clean Energy. Most of the roughly 800 million people without access to electricity are located in Africa and Asia. With higher energy prices and global supply chain challenges, that number could grow. Businesses and policymakers transitioning to a greener economy must take an active role in making sure these populations don’t get left behind.

- Ensuring Responsible Decarbonization. To achieve net zero, we must phase out fossil fuels in a responsible way, ensuring that emissions are reduced, not just shifted to new actors or asset owners. Furthermore, we must deliver exponential growth in renewables, including tripling solar and wind capacity by 2030. Meeting these commitments will require increased funding and international cooperation to accelerate the deployment of proven solutions and usher in the next generation of climate technologies.

Despite these challenges, leaders have an opportunity to build a sustainable, low-carbon, job-rich path to net zero without leaving anyone behind. Advancing just energy transition goals requires close collaboration across a complex ecosystem of actors. (See the exhibit.)

Here are some no-regret actions stakeholders can take to accelerate a fair and just energy transition.

Companies

Organizations have a crucial role to play in protecting the workforce, responsibly retiring carbon assets, catalyzing climate finance, and taking a leadership role in driving a just energy transition. Some important things they can do include the following:

- Focus on people. Companies should plan for a just transition that includes pathways for retaining, retraining, and redeploying workers. When firms decommission power plants, for example, they can forge partnerships with educational institutions to support upskilling and reskilling opportunities for their employees. For instance, utilities in Italy and South Africa have repurposed energy facilities for renewable generation and developed training facilities to support reskilling as part of their just energy transition strategy.

- Support socioeconomic development in affected communities. Companies can create a plan to responsibly convert, retire, or sell carbon-intensive assets while supporting sustainable local development and protecting impacted communities. Rather than merely shifting emissions responsibility from one company to the next, leaders should consider the net societal and environmental impact of their portfolio decisions and strive for positive results. When decommissioning fossil-fueled power plants, companies should partner with local governments, nonprofits, and communities to identify alternative economic development opportunities that benefit the area. This step, combined with seeking opportunities to repurpose decommissioned facilities and land for renewable energy, would ensure the best outcomes for local communities. ACEN, an energy company based throughout Southeast Asia, collaborated with the Asian Development Bank to retire its South Luzon coal plant 15 years early and reinvest proceeds into renewable generation.

- Address global climate financing barriers. Companies should collaborate with investors and DFIs to encourage the creation of innovative financial products. They can also build partnerships and coalitions to improve risk-return profiles, address scale challenges, and improve visibility into the pipeline of bankable projects. Tata Power, India’s largest integrated power company, collaborated with the Rockefeller Foundation to launch microgrid developer and operator TP Renewable Microgrid, which is set to build more than 10,000 microgrids that will provide affordable, reliable, and clean electricity to more than 5 million homes in rural India.

- Communicate frequently and transparently. Leading companies are sharing plans for an equitable transition and publicly announcing progress toward meeting those goals. They are also sharing best practices with industry peers and other organizations. In 2021, SSE, a UK energy supplier, published a just transition strategy that outlined its own 20 commitments, in addition to sharing 10 recommendations for industry and governments to support workers as they transition from high-carbon careers to low-carbon ones.

Governments and Regulators

Governments and regulators have an important role to play in a just transition. Actions they can take include the following:

- Support affected communities and workers. Governments should collaborate with companies and social groups to identify local and regional employment alternatives for affected communities and design compelling transition plans focused on employment, sustainable economic development opportunities, and protecting livelihoods. Direct investments and subsidies can provide short-term security for displaced workers and mitigate unemployment. For instance, Australia pledged more than AUD$300 million to support workers and economic development after the closure of the coal-fired Hazelwood Power Station in 2017, dedicating funds to support retraining, offer job-seeking assistance, and incentivize employers to hire displaced workers.

- Leverage investments, policies, and incentives to support and accelerate a just energy transition. Governments should invest in modern transmission and distribution infrastructure, along with planning and permitting improvements, while promoting energy security and access. At the same time, they can enact policies and financial mechanisms that incentivize climate investments. They can do this by issuing sovereign green bonds linked to equitable transition principles, for example, or by setting up a just energy transition fund. The EU has set up the €17.5 billion Just Transition Fund to be deployed through 2027 in the form of direct grants to EU regions that are most affected by the transition. Additionally, the Loss and Damage Fund, established by the UN in the wake of COP 27, mobilizes financial assistance for developing countries to compensate for loss and damage caused by heat waves, flooding, desertification, acidification of seas, rising sea levels, and other climate-related challenges. While this is a positive step forward, more progress is needed.

Subscribe to our Climate Change and Sustainability E-Alert.

Investors and DFIs

Investors can embed just transition principles into investment criteria and lead the way to scale up climate financing, while national and international DFIs—including multilateral development banks—can help address inequities in global climate finance. More specifically, these players can do the following:

- Leverage metrics. Investors should focus on building tools that assess companies through a just transition lens—and incorporate findings into investing and capital allocation decisions. The investor-led initiative Climate Action 100+ developed a Net Zero Company Benchmark assessment tool that measures company disclosures on climate change-related issues and evaluates actions that companies are taking to reduce emissions. In 2022, they integrated a just transition indicator into their benchmark disclosure framework.

- Scale up global financing and address funding gaps in developing economies. Investors can also support efforts to integrate climate-related factors into risk models, quantify the cost of inaction, and collaborate with companies, policymakers, and NGOs to overcome barriers to deploying private capital. To make an even bigger impact, DFIs should shift away from large scale, conservative investments with well-forecasted returns and embrace smaller, proof-of-concept investments backed by blended finance. To address funding gaps for developing economies, DFIs and philanthropies can increase grant funding or enable debt financing without requiring government guarantees. For example, to scale climate funding in Asia, the Asian Infrastructure Investment Bank and the Global Energy Alliance for People and Planet recently entered into a $1 billion strategic investment partnership that identifies opportunities to co-finance green energy transition projects and mobilizes private capital in emerging economies in the region.

NGOs and Partnerships

NGOs, development organizations, research institutes, and coalitions can do a lot to foster just transitions. Some examples include the following:

- Focus on metrics and reporting. These groups can drive the development of just transition standards and advocate to improve the rigor and transparency of related metrics, tracking, and reporting. The World Benchmarking Alliance, for example, assesses 450 companies in high-emitting sectors on their contribution to a just transition by tracking what they are doing to support workers, communities, and the most vulnerable while making efforts toward low-carbon goals.

- Address barriers to scaling climate financing. Partnerships can support collaborations between investors, regulators, and private actors to scale up climate financing. Coalitions can also build visibility into green project pipelines, facilitate funding for smaller projects, and improve risk-return profiles. To unlock new investment opportunities, the UN’s High-Level Climate Finance Champions Team identified more than 100 adaptation and mitigation projects across five regions and connected them to potential investors, demonstrating the viability of small-scale bankable projects.

- Raise awareness and advocate for an equitable and fair energy transition. These groups have a unique opportunity to promote social dialogue, draw attention to equitable-transition considerations, and advocate for policies that protect at-risk workers and communities. For instance, the Grantham Research Institute on Climate Change and the Environment proposed a new category of bond—called the just transition sovereign bond—that governments can issue to support green recovery and social renewal during the energy transition.

To deliver effective, inclusive, and fair solutions, we need participation from all stakeholders—public and private, large and small, developed and developing.

Just energy transition cannot be achieved through individual action alone. To deliver effective, inclusive, and fair solutions, we need participation from all stakeholders—public and private, large and small, developed and developing. Companies, governments and regulators, investors and DFIs, and NGOs and partnerships must collaborate to promote social dialogue, partner across sectors to scale new ventures, and create sustainable employment and development opportunities for at-risk workers and their communities.