The next few years could be a make-or-break period for some banks. They will join the digital financial ecosystem movement—or be consumed by it.

These platform-based ecosystems offer products and services that are created and distributed in partnership with others. And they confer powerful advantages, allowing organizations to enter new markets, create new services, and acquire new customers faster and more affordably than with traditional product development and go-to-market models. By 2030, digital ecosystems could account for a significant share of the banking revenue pool.

Despite their massive potential, research by Boston Consulting Group’s Henderson Institute found that less than one-third of the world’s largest banks are investing in ecosystems in a meaningful way. Nearly one-quarter aren’t investing in them at all, beyond the occasional pilot. Challengers from outside the traditional banking arena, however, are taking action. Bigtechs, such as Google and Amazon, are using their deep technical prowess to integrate payments and financial services capabilities into a variety of ecosystem offerings. And financial technology companies are chipping away at value chains that banks once dominated, attracting customers with niche services tailored to their specific segment needs.

So what’s holding banks back from more full-throated engagement in ecosystems? The answer for many is uncertainty . Given the risks of moving away from existing business models, the fear of cannibalization, and the intricacies of partner-based initiatives, not even the largest and best-resourced institutions are certain which approaches can deliver the greatest risk-adjusted returns. Indeed, banks have historically explored many consortia-based responses to market needs and challenges, including the establishment of SWIFT in the early 1970s. However, many initiatives never scaled and subsequently failed; this may be driving executives to approach ecosystems with caution.

This article seeks to help banks address this uncertainty by walking through the ecosystem opportunity, detailing specific engagement archetypes, and laying out the capabilities needed for success.

Value Is Shifting Toward Business Ecosystems

Ecosystems are the inexorable next step in digital disruption for the financial services sector. The hyperconnectivity that digital tools and channels enable has blurred traditional boundaries between brick-and-mortar and web environments and between the four walls of an enterprise and the wider value chain. (See A Short Primer on Digital Financial Ecosystems.)

A Short Primer on Digital Financial Ecosystems

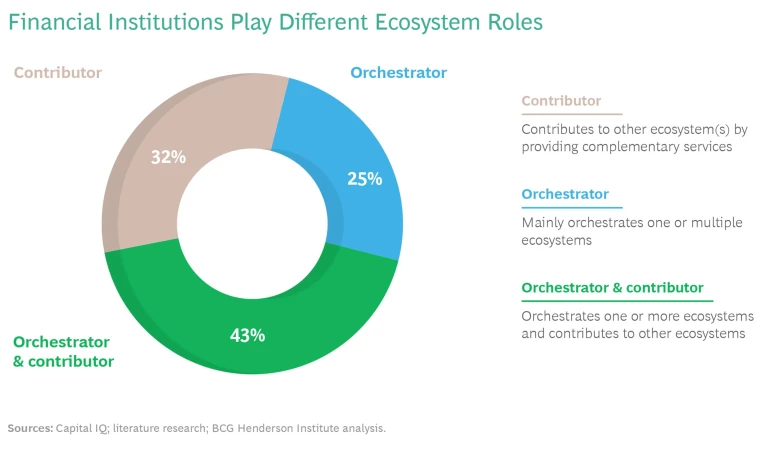

Financial institutions can participate in ecosystems in two non-mutually exclusive ways:

The first is as an orchestrator. An orchestrator designs the ecosystem, sets its focus, selects the network of participants, and assumes overall responsibility for its management and success. This role can give banks greater control and provides more profit potential, but it also involves more investment and risk.

The other way banks can participate in an ecosystem is as a contributor—providing products and features that can be included in the ecosystems that others manage. Acting as a contributor can be a faster and more affordable way to both test the waters of the ecosystem landscape and reach scale. However, this comes with less strategic decision-making power and could end up commoditizing some bank products if the rollout is not managed carefully.

Among the 79 ecosystem-active banks in our research, 25% have focused on orchestrator roles, 32% of top banks restricted themselves to a contributor role, and 43% pursued a combination of both.

Tech leaders have popularized the ecosystem concept, delighting consumers and business customers with “one-stop shopping” experiences and integrated journeys that fold partner-developed financial solutions into their online platforms, apps, and services. Today, with a swipe on a phone or the click of a few buttons, customers can complete many financial activities without any direct engagement with a bank.

Examples include:

- Industry-specific platforms that allow companies to run their business and manage transactions from a single portal. These have proven popular with retailers, restaurants, medical facilities, and small and midsize enterprises (SMEs).

- Integrated software solutions such as procure-to-pay offerings that connect buyers with suppliers and combine ordering, invoicing, payment, and reconciliation together into a streamlined end-to-end process.

- Integrated platforms that support entire consumer journeys in real estate, healthcare, and other sectors—such as guiding people through the home-buying process or making it easier for individuals to manage medical appointments.

- Buy-now-pay-later platforms such as those offered by Klarna, Affirm, and Afterpay. Leveraging customer preference information from transaction data, these platforms have created rich, two-sided ecosystems that enable consumers to access and pay for merchant offers using open invoices, interest-free installment plans, and other flexible arrangements—all directly from the merchant channel or a simple application. Merchants benefit from affiliated marketing, repeated purchases, and larger volumes.

This ecosystem innovation is giving bigtech and fintech creators more market power. In China, for instance, Alipay has largely replaced traditional short-term deposit, payment, and credit card services. And in Singapore, DBS’s PayLah ecosystem allows customers to make cashless payments at thousands of locations, interact with vendors to get exclusive promotions, and integrate with other digital wallets such as Google Pay.

Ecosystems are the next step in digital disruption for the financial services sector.

Recognizing the threat these challenges pose, a number of established banks and financial institutions are beginning to mobilize. As the general manager of China Merchants Bank (CMB) put it, “The focus of banks is shifting from internal platforms to external ecosystems. Many leading banks are accelerating efforts to partner with different industries and build their own ecosystems. This will be the new growth curve for banks.”

However, only a few of the world’s largest and best-resourced banks are backing ecosystem development in a concerted fashion—a discovery that should set off alarm bells for the industry at large. Over the last six months, BCG analyzed the activities of the largest 100 financial institutions as defined by market capitalization at the end of 2021. Using public information on business activities and partnerships, we assessed the extent to which they were engaged with business ecosystems, whether by creating and orchestrating their own or by contributing to those created by others. From this analysis, we examined the correlation between a bank’s ecosystem engagement and its financial performance and capital market valuation—and extracted a set of strategic plays.

Here are some key findings from our research.

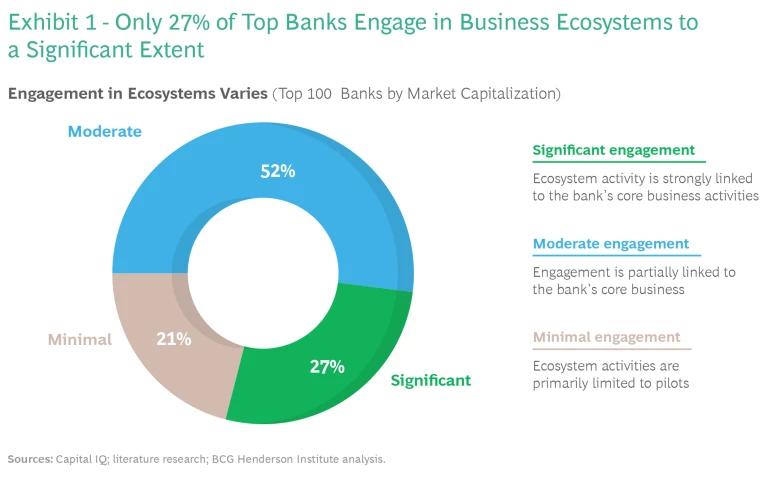

Most banks are still in test-drive mode. Our analysis shows that only 27% of top banks have engaged in ecosystems to a significant extent—defined as having substantial ecosystem activities with a strong link to their core business, not just peripheral experiments. (See Exhibit 1.) More than half (52%) are in the experimental phase; they’re active in ecosystem initiatives, but not to the level of significance of core business activities. And 21% have yet to sponsor anything beyond small projects or pilots. This failure to leap into the ecosystem movement in a targeted way is leaving massive value creation at stake—and giving a significant leg up to peers that have embraced this shift.

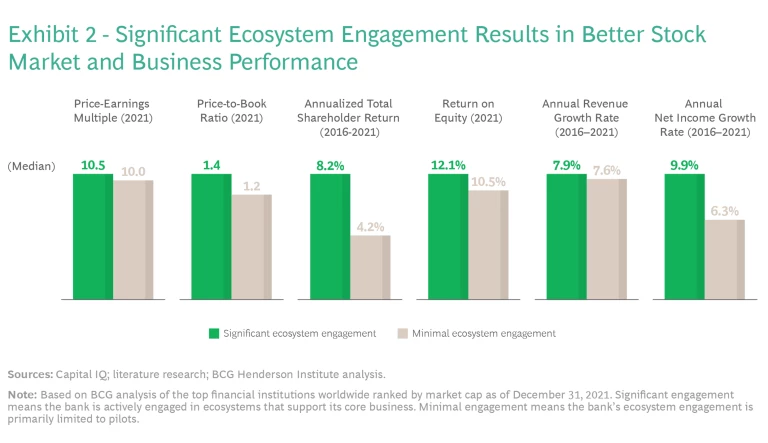

Winners could achieve superior market performance. The 27% of banks with significant ecosystem engagement have higher multiples (10.5 versus 10.0) and a higher price-to-book ratio (1.4 versus 1.2) than the 21% that had little to no engagement. And their annualized total shareholder returns grew two times faster than ecosystem abstainers over the past five years—8.2% versus 4.2%.

This stronger capital market performance is not just driven by expectations of future earnings but also by stronger fundamentals. Banks that viewed ecosystems as part of their core business enjoyed a return on equity of 12.1%, compared to 10.5% for those with minimal engagement. In addition, their five-year annualized net income growth rates were sharply higher—9.9% versus 6.3%. (See Exhibit 2.) Of course, correlation is not necessarily causation, but the findings nevertheless show that ecosystem investments and business model shifts can go hand in hand with strong value for institutions.

Competition for value is likely to intensify. Over the next decade, we expect ecosystems could drive a massive shift in value. However, bigtechs and fintechs are likely to pursue that value for themselves. Horizontal players, vertical specialists, and niche solution providers from within and outside the traditional financial services sector are attacking the banking value chain from all angles. Many are well-funded. And bigtechs that today focus mainly on the point of sale could use their resources and sizeable market share to acquire dominance in other parts of the financial services industry.

This momentum will have sweeping repercussions for incumbent players. The US banking revenue pool is worth over $900 billion. As of 2020, traditional banks claimed 80% of that amount. But that share is likely to drop precipitously. BCG projects that fintechs, non-traditional banks, and non-bank players will command more than 40% of total banking-related revenues in the US by 2027. And while the speed of the transition may vary, we expect to see a similar trend in other markets globally.

To ride the ecosystem growth wave and avoid being sidelined, banks must develop a clear strategy and fund it with the right resources and capabilities.

Understand the Strategic Plays Best Suited to Incumbents

Whether ecosystems are an exponential growth driver or an existential threat comes down to the strategic choices a bank makes. But therein lies the challenge.

Incumbent banks and financial services institutions have different needs, ambitions, and starting points than the typical fintech or bigtech. Yet they face a tougher conundrum: how to compete in business ecosystems without cannibalizing their core business and devaluing capabilities that they have been building for decades.

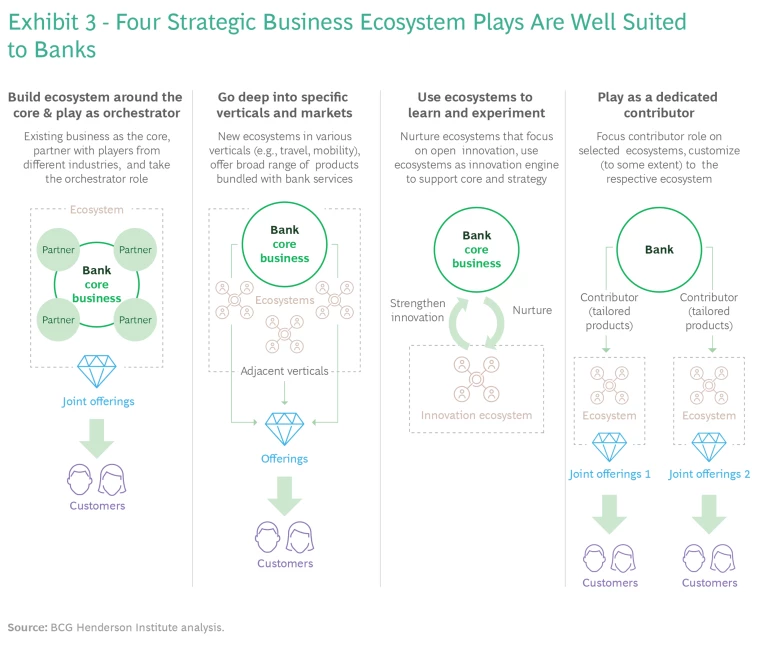

To address this challenge, we have identified four ecosystem plays that our client work and research suggest can give incumbent organizations strong marketplace advantage. (See Exhibit 3.) Three are orchestrator strategies and the fourth describes how banks can win as contributors.

1. Build an ecosystem around the core and play as an orchestrator. Under this model, organizations serve as the primary orchestrator, building an ecosystem that is closely tied to their traditional core business. They partner with businesses in different domains to build the ecosystem, then bundle their financial products with complementary offerings.

This archetype is suitable for banks that command strong share in a specific market, or that wish to transform into an ecosystem player outright. HSBC, for instance, launched an ecosystem called BusinessGo to extend its core banking services and deepen relationships in the SME market in Hong Kong. Through the ecosystem, business customers can find specialist providers in areas such as marketing, tax, legal, accounting, logistics, or warehousing; get answers from the site’s knowledge hub; and access workflow automation tools and other services. While likely beneficial in terms of attracting and retaining SME customers, direct monetization often takes time to build with this model.

This archetype can also be used to help banks defend against challengers. For example, a Spanish bank consortium created the innovative payment platform Bizum to provide customers with simple-to-use, peer-to-peer payment functionalities on mobile phones and give merchants and consumers a tool to accept and initiate e-commerce payments. These capabilities have enabled Bizum to become an alternative to international payment platforms such as PayPal.

2. Go deep into specific verticals and markets. With this strategy, financial institutions build ecosystems in specific industry sectors where they have strong existing penetration and growth prospects, offering their core products and services to these segments and tailoring or introducing others to provide additional value. Often, in this model a bank would partner with one or more large players in a given industry to help reach scale quickly, enabling all participants to benefit.

This approach allows banks to build a differentiated client base and use their expertise to gain dominance in niches that competitors would have a hard time challenging. Particularly as sustainability becomes a larger agenda item for banks, a vertical- or market-specific play can also enable banks to use their capabilities and convening power to accelerate sustainable practices and decarbonization across sectors. For example, a digital ecosystem that connects buyers and suppliers across a supply chain (through a supply chain finance program can help provide more granular and validated data on emissions and offer industry-specific solutions to abate them.

DBS is an example of a bank that has pursued vertical ecosystem plays. They established the DBS Marketplace, consisting of seven ecosystems each focused on a specific sector such as real estate, travel, and health. Its “green solutions” ecosystem, for example, includes home renovation loans that enable customers to secure funding for energy-efficiency improvements and other climate-friendly options, while its “health” ecosystem provides customers with teleconsultation and medical test services.

3. Use ecosystems to learn and experiment. With this strategy, banks and financial services institutions use digital ecosystems as a learning lab to enable experimentation, diversification, and piloting to deal with external opportunities and threats. Institutions can use these incubators to explore new products and business models, access new technologies, and gauge which concepts have the potential for substantial commercial upside. Critically, such experimentation can reveal where products need to be simplified to work effectively on digital channels and where compliance procedures need to be streamlined—improvements that are cheaper and easier to address while still in prototype than after a concept has been launched.

This archetype can be a safe and effective way for banks to experiment before committing the core business. For example, ANZ, BNP Paribas, Citi, Deutsche Bank, HSBC, and Standard Chartered founded Trade Information Network in 2018 as a data registry to support the digitization of global trade through enabling the exchange of original trade information between the buyers, suppliers, and financiers around the world. This collaboration aims to accelerate the development of fully digitized paperless trade, provides access to alternative lending sources, and improves liquidity for vendors in the supply chain, but applies a consortium model away from each founding bank’s core. While effective in terms of advancing learning through collaboration, a common pitfall of such consortia is that they are not necessarily sufficiently commercially-focused to “win” in the long term and leapfrog competition.

In another example, ING crafted a sales partnership with Scalable Capital, Germany’s largest robo-advisor, after field testing revealed that embedding digital advisory services into a brokerage ecosystem would be a hit with customers.

4. Play as a contributor. There are several ways in which banks can capture value on platforms managed by others. One is to be a generic contributor and embed white-labeled products and services such as payments or loans in non-proprietary ecosystems as additional avenues to drive growth. For example, Goldman Sachs provides embedded financing through its ecosystem relationships with Apple (such as Apple Card) and Amazon (Small Business Loans) as part of its newly formed Platform Solutions division. The contributor role can help banks like Goldman Sachs rapidly grow volumes in parts of the market where they have limited share, experience, or established distribution channels.

Another approach is to focus on particular segment-based ecosystems and tailor offerings to those platforms and customers. For example, IWOCA and NatWest provide financing in the UK on a business management and accounting platform tailored to the SME market. With a subscriber base that is growing over 20% a year, the platform gives the banks access to an attractive high-growth market. Similar examples include the integration of payment capabilities into B2B procurement ecosystems that connect buyers and suppliers. For example, Citi, Bank of America, American Express, and HSBC offer and integrate payment capabilities into Coupa’s procurement, sourcing, and invoicing platform.

A third approach is to act as an exclusive contributor in a niche ecosystem. This can be a strong choice when a bank possesses distinctive advantages relevant to that segment. HSBC is going deeper into healthcare through its integration with the Heals platform in Hong Kong, offering financing to help doctors gain better pricing on drug procurement and receive speedier transaction processing so they can obtain insurance claim payments faster.

The contributor archetype allows banks to de-risk their entry into ecosystems by partnering with those that have already mastered the concept. This approach requires less upfront investment and offers increased strategic flexibility. In addition, contributors with in-demand capabilities can command strong pricing power with the partners that run the platforms and secure a substantial share of profits from the solutions they bundle.

The most successful banks build, test, and refine two or three ecosystem archetypes in parallel.

Excel at Execution

Delivering a successful ecosystem strategy is not just about good ideas, but good ideas delivered well . There are several steps to help banks do this.

The first is to be deliberative and take the time upfront to determine what strategy archetypes best align with the bank’s capabilities and market ambition. Given the pressures to create an ecosystem play, it can be easy to rush through the planning stages, but failure to think through the details and business case can result in sub-scale investments and diminished returns. (This companion article offers a deeper dive into how to build an effective business ecosystem strategy.)

Subscribe to our Financial Institutions E-Alert.

Second, we encourage banks to pursue multiple bets. The most successful large banks we have studied adopt two or three ecosystem archetypes and build, test, and refine them in parallel. They recognize that some ideas will not pan out, but understand that the knowledge gained from these efforts will help refine their overall ecosystem strategy.

Third, having aligned on a course of action, banks then need to determine the most effective way to execute. Don’t immediately assume the answer is to “build your own ecosystem.” As described above, banks may find that contributing to an existing ecosystem can be a much faster route to scale and a smart way to gain needed learning before investing in a proprietary ecosystem. Banks that serve as an ecosystem contributor need to define clear competitive and financial objectives to avoid margin erosion and cannibalization.

Discipline is key. Leaders recognize that to be commercially viable, the ecosystems they engage in must offer digitally native products that can be sold on platforms and marketplaces. Bank offerings must have easy onboarding features that enable them to acquire customers at scale, as well as automated credit decisioning capabilities that allow them to make loan offers in real time. In support of this, banks have to invest not only in product development but also in the underlying ecosystem “engine”—and build integration layers, authentication layers, APIs, standardized data models, and AI algorithms that can support multiple ecosystem plays. Top-performing institutions will also create asset libraries stocked with reusable components and features.

Banks that win the ecosystem game from a cost and market leadership perspective make a point of reusing core capabilities to launch multiple bets sequentially and iteratively. This approach helps them gain speed and efficiency advantages and stay ahead of the market.

Business ecosystems can be a game-changer for banks, giving them the means to leapfrog into new markets, acquire new customers, and enrich their portfolio of offerings. Success, however, requires that financial institutions devise a cohesive ecosystem strategy that is tightly aligned to the business’s customer and commercial ambitions, while crafting a roadmap that considers the required capabilities and investments. Those that approach the ecosystem opportunity in an assertive and purposeful way can de-risk complexity and returns—and gain a jump on slower and less disciplined competitors.

The authors thank Mingjin Guo and Hermin He for their contributions to this research.