The German real estate industry’s ongoing market uncertainty driven by higher interest rates, recession fears, and inflation will likely continue to weigh on property values and financing costs, according to Boston Consulting Group’s latest analysis. Transaction volumes are declining and it has become more difficult to refinance or redeem existing financing, with regularly maturing liabilities forming a “maturity wall.” This will continue to present real estate companies with financial challenges they have not had to face in recent years.

To address these issues, real estate companies and their stakeholders must consider operational, financial, and structural measures early, and integrate them consistently and comprehensively into holistic concepts. In this article, we delve further into the root causes and driving factors behind the German real estate market’s current difficulties, and the actions that stakeholders in the market can take to ride out the headwinds they face.

An About-Face in the Real Estate Market

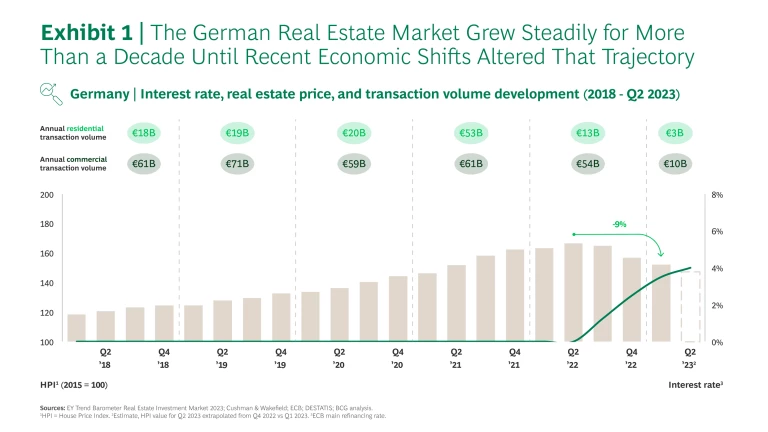

The low interest rates and high transaction volumes that fueled real estate prices and became the norm for international property markets was fundamentally altered by economic conditions in the last year. In response to rising inflation, the European Central Bank (ECB) changed its interest policy and raised rates significantly. The ECB’s main refinancing rate, for example, increased from 0% in June 2022 to 4.5% in September 2023. The result, however, threw the German real estate market into profound uncertainty. For example, the House Price Index (HPI)—a key market indicator that previously had climbed steadily for years—recorded a decline of around 9% from the second quarter of 2022 to the first quarter of 2023. (See Exhibit 1.)

The uncertainty is further compounded by short-term interest rate developments that repeatedly exceed previous forecast levels, and current interest rate forecasts for the next two years that have increased considerably. Expectations for 2025 differ by more than two percentage points, from 2.25% to 4.5%, for example. This volatility has increased markedly, resulting in unpredictability that has a deep impact on the traditionally highly leveraged real estate sector. Market participants are finding it increasingly difficult to put together financing for existing or new projects.

As a result, transaction volumes have declined significantly since mid-2022 in both the residential and commercial real estate sectors. The decrease in market liquidity, combined with higher interest rates, is negatively affecting real estate valuation and achievable purchase prices. Companies with their own construction and development activities have been hit hard on the operating level, with increased labor and material costs resulting from higher inflation and raw materials shortages.

The pressure to initiate stop-gap measures or even to fundamentally restructure will depend on the individual companies’ exposure to these conditions, as will the amount of support they will require from equity and debt investors. In addition to an integrated approach, a clearly structured communication and participation plan should be established and closely managed to ensure success. Alternative in-court solutions should also be prepared, within the legal frameworks of the respective countries involved.

Real Estate Companies Hit ‘Maturity Wall’

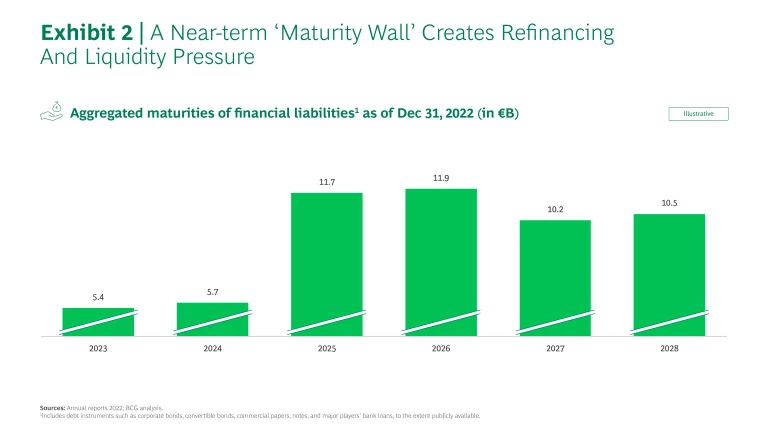

The financial markets’ about-face places an unrelenting burden on the debt sustainability of real estate companies in terms of both their balance sheets and their liquidity. Financing costs for new volumes and those to be refinanced are rising significantly, putting pressure on companies’ profitability and liquidity. Simultaneously, property valuations have been adjusted downward, causing loan-to-value (LTV) ratios to rise, which in turn results in absolute debt capacity being squeezed as companies struggle to raise additional debt capital while servicing their existing debt.

Previously, when interest rates were low, refinancing was generally possible even with high debt ratios, but this is increasingly difficult in the current conditions. Reduced transaction volumes and pressure on real estate prices means that partial sales of projects or entire portfolios for the redemption of maturing financing are hardly possible. This makes the refinancing of existing liabilities even more difficult. Parameters that receded a little into the background in (re)financing processes in recent years will again assume a more important and ultimately decisive role in the future— these include the (remaining) maturities of existing financing instruments, companies’ cash reserves, and the free availability of (additional) collateral.

The combination of rising interest rates and reduced asset values jeopardizes the timely servicing of liabilities. Until a few months ago, it was possible to either refinance regularly maturing debt or redeem it by selling assets, but today these factors combine to form a “maturity” wall. (See Exhibit 2.) This may threaten the continued existence of indebted real estate companies in a persistently tight market environment.

The central question for all stakeholders here is how fast and hard the rate hikes affect their companies or investment. While a strong portfolio with good locations and high demand provided a good basis in the past, the crucial question today is when and to what extent refinancing is required, and at what cost? The logic of recent years—in which profits boosted with value gains rather than rents were used as the basis for even higher leverage—no longer works in the new interest rate environment.

Solutions Depend on Stage of Crisis

This complex situation presents stakeholders with critical questions that need to be addressed in the short term. Real estate company leaders face the dual challenges of creating a sustainable business model while remaining attractive to equity and debt investors in both the short and medium term. Equity investors face increasing value erosion and must constantly reassess the value of existing investments while also forming a view on what a sustainable business model looks like in the current situation. Lenders, especially to highly indebted companies, must analyze the potential risk with regard to the recoverability of their exposure and the timely servicing of both principal and interest, and also reassess collateral. In the event of an acute crisis, lenders also face the challenge of finding a restructuring solution that preserves as much value as possible.

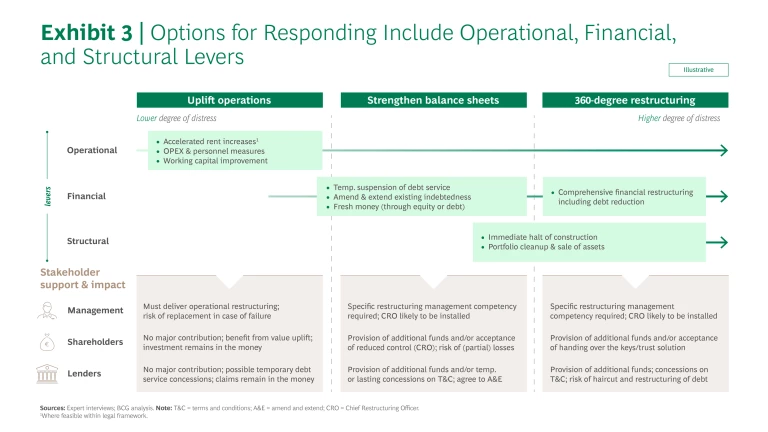

The range of options available to real estate companies for meeting these challenges spans operational, financial, and structural levers, depending on a company’s specific context and the support of stakeholders. The restructuring option will take different forms and paths; for illustration purposes we differentiate between three main archetypes: uplift operations, strengthen balance sheets, and 360-degree restructuring. (See Exhibit 3.)

Uplift Operations. Situations in the uplift operations archetype represent a comparatively mild form of crisis and are characterized by operationally driven causes. Pressure on earnings and cash flow is not from the financing structure, and there are few significant short-term maturities. Debt servicing is assured, with a sufficient interest coverage ratio (ICR) of for example more than 1.5, and adequate debt sustainability, for example with an LTV ratio of 30% to 50%. In this case, operational levers are usually sufficient to secure earnings and liquidity. The focus here is the reduction of personnel and non-personnel cost, which is supported by optimized rent increases where possible, and working capital measures. Additional temporary financial measures such as interest and principal deferrals can also be helpful for restructuring.

Strengthen the Balance Sheet. Situations in this archetype are characterized by increasingly serious symptoms of crisis. Profitability is highly strained and may be negative, with a looming liquidity crisis driven by debt service obligations and refinancing needs. As a result, the balance sheet structure is impaired, debt servicing is only just given (often with an ICR of approximately 1), and debt sustainability is at the limit (for example with an LTV ratio of 50% to 60%). More complex financing structures may also be expected, in which groupwide capital market financing is supplemented by the usual bank financing at the level of property-holding companies. Operational measures form the basis of restructuring, but must be supplemented by targeted financial instruments and structural levers where appropriate.

The focus is on the amendment and extension of existing debt’s terms, which can potentially be complemented with fresh, additional debt and equity capital. Sub-portfolios and individual development projects may be sold opportunistically to free up liquidity, but only if acceptable prices can be achieved and resulting depreciation effects are sustainable from a balance sheet perspective. When structuring financial levers, it’s important to ensure amendments and extensions are sustainable in the long-term and covenants based on LTV ratio and ICR have adequate headroom to allow sufficient leeway in a volatile market. Unlike in a purely operationally driven restructuring, the likelihood that a consensual agreement cannot be reached is higher, which would then leave only the option of an in-court solution.

360-Degree Restructuring. An acute liquidity bottleneck driven by short-term liabilities in combination with an unsustainable balance sheet structure forces companies to act immediately. Companies in a “360-degree restructuring situation” often show a high complexity in their financial structure (for example capital-market financing that is distributed internally via multilevel inter-company loans, international creditors, and various mixes of financing instruments) and a high leverage (LTV greater than 60%, for example) as a result of which the current debt service cannot be provided (with, for example, ICR lower than 1.)

In this case, in addition to operational and financial measures, significant structural actions need to be considered. Disposal of individual projects or portfolios may be necessary over time due to current market conditions, along with immediate construction stops on development projects, and, if necessary, a sale of unfinished developments may need to be considered, as well as site closures (for large-scale projects) and sustainable adjustments to the organizational structure. The focus here is in freeing up cash, mostly regardless of its adverse effects on balance sheets. Due to the high need for refinancing, temporary financial levers are not sufficient, requiring debt and equity investors to make additional contributions, for example in the form of accepting “haircuts” or other means of financial restructuring on the debt side, and capital increases on the shareholders’ side. In the case of 360-degree restructuring, in-court solutions are becoming more and more likely, so appropriate preparation for in-court restructuring solutions should be part of the toolkit when developing the restructuring concept.

A Structured Process as the Basis for Successful Restructuring

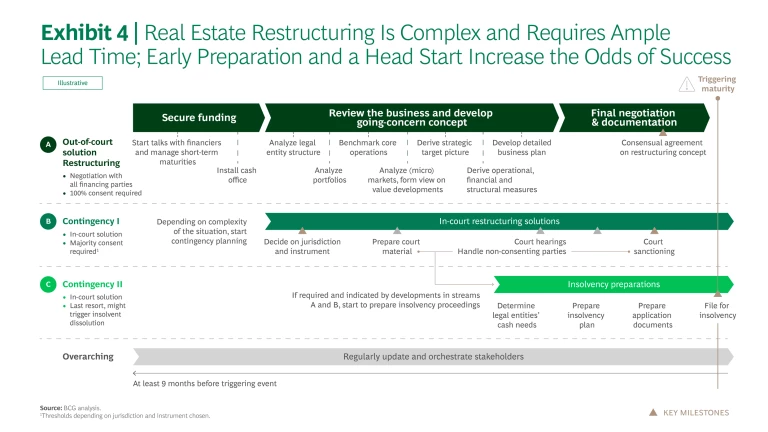

Especially in critical situations, the various measures available should be carefully coordinated and combined in a comprehensive approach, resulting in an integrated restructuring concept. To increase the chances of success, a clearly defined communication and cooperation process must be established and managed. Due to the complexity involved, the process should be started with sufficient lead time before a triggering event such as the maturity of a debt instrument. In our experience, nine months lead time should be considered, as a range of analytical steps must build upon one another to arrive at a consensual solution together with financiers and any other involved stakeholders. However, in the event that a consensual solution cannot be reached, in-court solutions for implementing restructuring concepts should also be considered and readied. (See Exhibit 4.)

Short-term financing should be secured first in every situation, and management must seek negotiations with equity and debt capital providers. Stabilizing measures such as deferrals of scheduled debt service and waivers for covenant breaches must be agreed in the short term, if required. It is advisable to set up a cash office situated close to top management and give it responsibility for planning and managing groupwide liquidity. Starting from a stabilized liquidity situation, an integrated restructuring plan needs to be devised, including all necessary levers to address the crisis. To form an analytical basis for real estate portfolio performance, it is important to understand local property markets and their expected development.

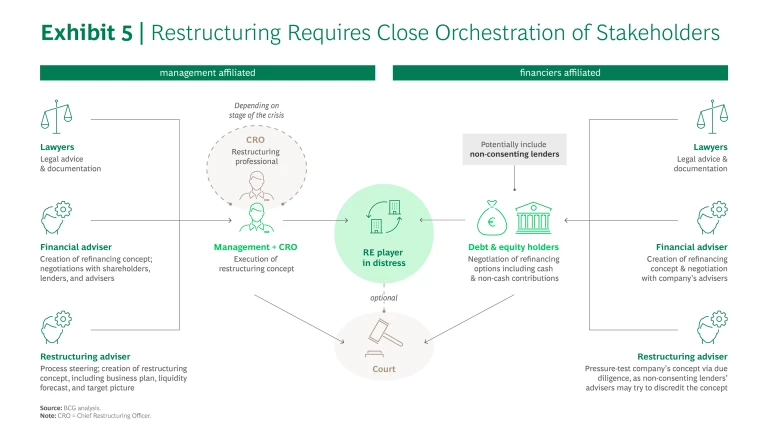

As with any major transaction or transformation, process is key. The full concept for the restructuring should be mapped in a robust, integrated business plan tailored to different scenarios. This will serve as the central basis for negotiating with the various stakeholders typically involved in such situations and assessing the success of restructuring. It is essential to coordinate all stakeholders and enable efficient communication. (See Exhibit 5.)

While striving for consensus, companies should also prepare for an in-court solution as a contingency plan, which may result in either a court-supervised restructuring, or insolvency proceedings. While a consensual solution is always preferable because of the lower complexity and reduced costs compared to in-court solutions, the preparation and structuring of a backup plan is recommended. German companies can choose pre-insolvency proceedings under German law, but may also want to consider proceedings in foreign jurisdictions, especially English procedures. In the event that a pre-insolvency solution fails, the next step for companies is to file for insolvency.

Germany has StaRUG, a stabilization and restructuring framework for companies, as well as the commonly used Schutzschirm “protective shield” and standard “Regelinsolvenzverfahren” insolvency proceedings. While StaRUG is a court-supervised restructuring in self-administration, the latter two procedures focus on insolvency and consequently are associated with a higher degree of complexity and risk. This is also reflected in the length of the proceedings. While StaRUG is expected to last between three and four months, protective shield proceedings usually take six to 12 months, and several years for standard insolvency proceedings. Companies that need a legal solution in the UK, or meet the requirements to opt for one, generally resort to either a restructuring plan or a scheme of arrangement. Both procedures are similar to StaRUG, but usually take only two to three months. Both British procedures generally have two advantages over StaRUG: greater transaction certainty and familiarity with the process on the part of Anglo-American investors. On the other hand, those solutions usually imply higher costs as additional resources are required for the process abroad.

Two Recent Examples Illustrate Possible Solutions

While the real estate market has not yet undergone a major wave of restructuring, the industry does have two practical examples that can serve as examples.

The first case involved a German real estate operator and developer with more than 25,000 residential units located mainly in Germany. Short-term restructuring became necessary due to bond financing maturities that couldn’t be refinanced or redeemed by portfolio sales because of higher interest rates and a market-driven decline in property values. An integrated restructuring plan was drafted to avert insolvency. Key financial components provided bridge financing until 2025 and the amendment of bond terms on outstanding instruments. In addition, extensive structural measures such as site closures and significant portfolio disposal are under consideration. Due to conflicts of interest among numerous creditor groups, it was not possible to reach a consensual agreement, so the concept was implemented by means of an English restructuring plan despite opposition from creditor groups.

The second case was driven by short-term maturities and involved a real estate manager and co-investor with also more than 25,000 residential units. As part of the restructuring, management defined extensive cost-cutting measures that included staff reductions. The consensual solution comprised significant financial contributions also by capital providers in the form of bridge financing, the restructuring of existing bonds with a reduction in the nominal amount and debt-to-equity swaps, and maturity extension on further outstanding bonds.

A Path Forward

Though the current conditions may at times feel insurmountable, well-planned paths through the prevailing headwinds are possible. Whether consensual or in-court restructuring solutions are appropriate, an integrated approach based on an objective assessment of facts and context around them along with close process and stakeholder management will go far toward developing a sustainable solution.