The delicate balance of nature—the earth’s plants, animals, and ecosystems—has profound implications for the global economy. More than half the world’s economic production, valued at $44 trillion, is moderately or highly dependent on nature, according to the World Economic Forum. The loss of any of these critical requirements can pose a severe threat to financial stability, supply chain integrity, and overall business resilience.

Some companies have begun to recognize the importance of comprehensive reporting about their impact on nature. The imminent introduction of regulations mandating disclosures adds urgency to the need to understand the appropriate scope of reporting and best practices.

To support these efforts, BCG explored the current state of nature reporting. We reviewed sustainability disclosures by more than 80 companies in the Dow Jones and EuroStoxx indices and surveyed 200 sustainability experts in Europe, the US, and Asia. Our research, reinforced by our client work and a study of emerging regulatory standards, found that only a handful of companies excel in nature reporting and highlights the steps that companies can take to ramp up their reporting efforts.

Impacts on Nature Are Pervasive and Hard to Address

Negative impacts on nature—such as resource exploitation, climate change , pollution, changes in land and water quality, and the introduction of invasive species—affect the nine planetary boundaries within which human operations must be restricted in order to maintain a stable environment and decrease the risk of irreversible environmental change.

One manifestation of these negative impacts is the loss of biodiversity. Our planet experienced a decrease of approximately 69% in monitored wildlife populations between 1970 and 2018, according to the World Wildlife Fund. To forestall further harm, the Kunming-Montréal Global Biodiversity Framework, adopted in 2022 during COP15, seeks to achieve zero net nature loss by 2030 and net gains beginning in 2030. The framework also sets long-term goals to achieve the vision of “living in harmony with nature” by 2050. The framework's adoption has elevated the topic of nature impacts and intensified efforts to address them.

Although closely linked to climate change, negative nature impacts differ in three respects, making them even harder for companies to address than carbon emissions:

- Multifaceted. There is no single metric, such as greenhouse gas emissions, to gauge a business’s impact on nature. For instance, water consumption is measured in liters, while air pollution is assessed by particle count.

- Localized Impact. The repercussions of harm to nature are nonlinear at the local, regional, and global levels, necessitating tailored protection and restoration efforts.

- Nonfungible. Because ecosystems are complex and face myriad pressures, offsetting damages in one area by making improvements in another is difficult. As a result, restoring or compensating for current damages may not be feasible in the future.

Mandatory Reporting Is Coming Soon

Global efforts to report on nature impacts aim to increase transparency and motivate companies to understand their operations, set goals, and plan strategies. A strong baseline can also aid in benchmarking by investors and customers, providing an additional incentive to improve reporting.

Global efforts to report on nature impacts aim to increase transparency and motivate companies to understand their operations, set goals, and plan strategies.

We anticipate that nature reporting will follow a trajectory similar to reporting on climate-related topics. That has already begun with scientific consensus on what needs to be reported on and some companies already reporting voluntarily on their impacts. Eventually, there will be agreement on standards and mandatory disclosures, resembling those currently set forth by the Task Force on Climate-Related Financial Disclosures. Today, nature disclosure is voluntary. Standards are being developed through various initiatives such as Science-Based Targets for Nature, the Task Force on Nature-related Financial Disclosures (TNFD), and the revised Global Reporting Initiative framework.

Beginning in 2025, the Corporate Sustainability Reporting Directive (CSRD) will mandate nature and biodiversity disclosures by companies with a significant presence in the EU or with securities listed in an EU-regulated market. The disclosure standards, developed by the European Financial Reporting Advisory Group, require companies to outline their strategies to ensure alignment with the Kunming-Montréal Global Biodiversity Framework and the EU Biodiversity Strategy for 2030. Furthermore, companies must provide details on significant impacts, risks, and opportunities and on how these intersect with their business models and strategies. EFRAG has signaled its intention to strongly consider the TNFD’s recommendations. Additionally, the International Sustainability Standards Board is likely to issue standards for biodiversity and nature disclosures, having released its first two standards on sustainability and climate-related disclosures.

Comprehensive Reporting Addresses Five Imperatives

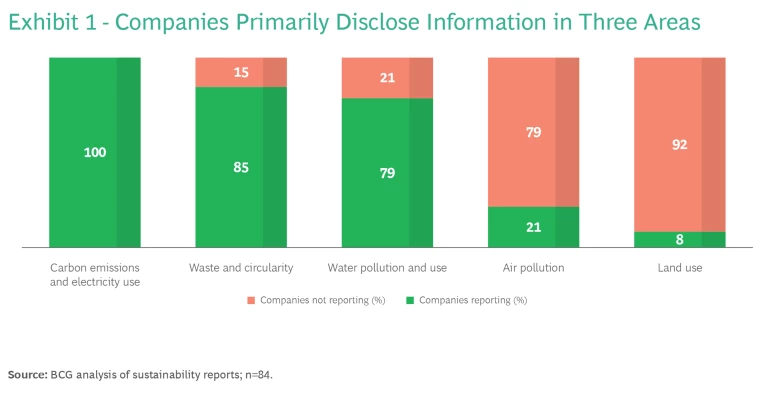

BCG’s study focused on current practices for reporting on nature impact and targets in five categories: carbon emissions and electricity use, waste and circularity, water pollution and use, air pollution, and land use. For any given company, these are considered “material topics” if they are relevant to its financial value or its impact on nature. We found that although businesses plan to broaden their scope of reporting on these factors, many companies still have a significant journey ahead. Among leading companies, we found five emerging best practices.

Disclose impacts across material topics. Today, all companies must report on their carbon emissions, so every company we studied discloses this data. The number of companies that provide voluntary disclosures on the four other potentially material topics varies. Most report on waste and circularity (85%) and water pollution and use (79%), while relatively few report on air pollution (21%) and land use (8%). (See Exhibit 1.) (For more on the reporting by leading companies on each of these topics, see “How Top Companies Are Disclosing Impacts.”)

How Top Companies Are Disclosing Impacts

Waste and Circularity. Kering reports a percentage breakdown of the traceable materials used in its garments, categorized into plant fibers, animal fibers, leather, and cellulose-based fibers. The company also details the percentage of sustainable materials—those that are recycled, organic, or sustainably sourced—used in its collections, classified by fabric type (such as silk and cashmere). In addition, it publishes an environmental profit-and-loss statement that quantifies its total environmental impact, including the effects of raw-materials extraction, processing, and end-of-life waste.

Water Pollution and Use. Stellantis’s sustainability report specifies the water intake, consumption, and discharge at each of the company’s automotive manufacturing plants. The report also discloses the heavy-metal content of the discharged water and the level of water stress of the surrounding area (that is, the gap between supply and demand). In addition, the report provides the total and normalized amount of water withdrawn per vehicle.

PepsiCo discloses water use efficiency (encompassing the complete agricultural supply chain), absolute water usage, and water replenishment, categorized by product segment and region. It also reports on the adoption rate of water stewardship goals in facilities located in areas of high water stress. The company includes third-party manufacturing sites in its reported figures.

Air Pollution. Stellantis reports specific air pollution reduction targets, covering both its production activities and its finished products. The company’s disclosures include air pollution from its production processes and the share of zero-emission vehicles in its portfolio.

Land Use. Nestlé emphasizes land use and the sustainable sourcing of ingredients. It has disclosed that its current environmental footprint includes nearly 10 million metric tons of CO₂ attributed to land use changes driven by deforestation. Its sustainability report details its efforts to become “forest positive” through reforestation projects, including the planting of 37 million trees through 2022 (with a target of 200 million by 2030) and offsetting approximately 1.4 million metric tons of CO₂.

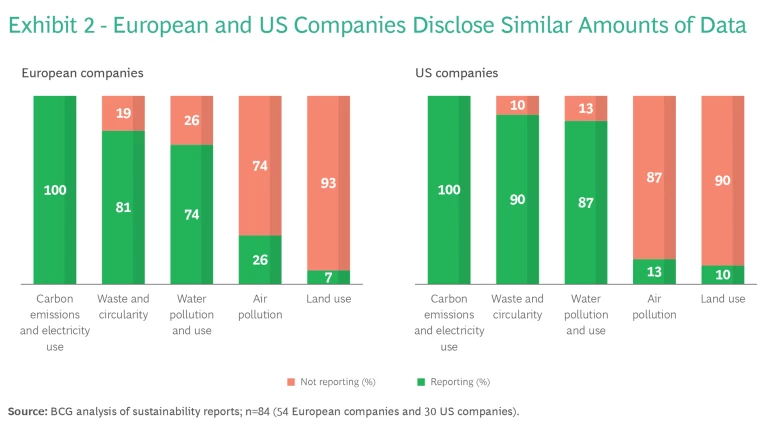

Companies in Europe and the US disclose similar amounts of data across topics. (See Exhibit 2.)

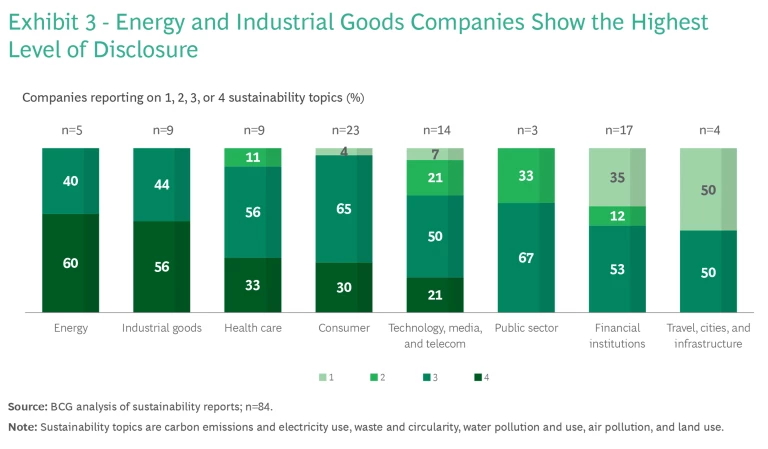

In both regions, however, disclosure varies notably among industries. (See Exhibit 3.) The energy and industrial goods sectors stand out for their extensive disclosure of impacts. We found that approximately 60% of energy companies and 50% of industrial goods companies report on at least four material topics (including carbon emissions). In contrast, financial institutions and the public sector perform the least comprehensive reporting (probably in part because of the nature of their operations).

Describe effects on nature across the value chain. Comprehensive nature reporting encompasses the operations of a company’s suppliers and customers across the entire value chain, not just the company's own practices. Leading companies, including AstraZeneca, BASF, and PepsiCo, disclose the percentage of suppliers adhering to standards or the percentage of raw materials sustainably sourced. PepsiCo also discloses the acreage that suppliers utilize to produce raw materials, as well as the share of acreage on which they employ regenerative farming practices. However, it is rare to see disclosures about cooperation with suppliers and customers on sustainability issues or the direct environmental impacts associated with these parties. Limited data availability, especially relating to customers, is a significant obstacle to improving disclosures. Current data collection efforts rely heavily on partnerships and mutual agreements rather than standardized frameworks and requirements.

Provide location-specific details, particularly in high-risk areas. On impacts besides carbon emissions, companies will be required to report on specific locations, focusing on high-risk areas. According to a nature benchmarking conducted by the World Benchmarking Alliance, 50% of companies currently disclose the location of their operational sites. However, only 14% clearly indicate whether these sites are in or near areas of high ecological value. This lack of clarity makes it challenging to hold companies accountable for their impacts in these critical regions.

Some companies, such as Holcim, Heineken, and Enel, have adopted a localized reporting approach. They provide breakdowns of selected sustainability KPIs at specific sites or offer overviews of operations and environmental impacts by region, emphasizing high-impact areas. Localized reporting is more common among companies with production operations, allowing individual impacts to be measured and allocated appropriately. In addition, companies frequently include site-specific flagship initiatives in their reports. Another common practice, by companies with operations in high-impact regions such as rainforests (those involved in palm oil-intensive food production, for example), is to report on partnerships with local nongovernmental organizations.

Highlight impacts on biodiversity and ecosystems. Companies will be required to disclose their broader effects on biodiversity and ecosystems. For example, they will need to specify not only the use of paper from nonsustainable sources in their packaging but also the implications with respect to deforestation and biodiversity.

The nature benchmarking conducted by the World Benchmarking Alliance showed that, so far, only 5% of companies have carried out science-based assessments to understand how their operations and business models affect nature and biodiversity. This is supported by our study, which found very few reports commenting on a company's current impact on ecosystems and biodiversity as a whole, and even fewer offering quantitative metrics.

Only 5% of companies have carried out science-based assessments to understand how their operations and business models affect nature and biodiversity.

Recognizing the challenge of measuring biodiversity, Holcim has developed a dedicated methodology in partnership with the International Union for Conservation of Nature. The company now reports the percentage of quarries assessed using this methodology and the percentage of quarries that have active biodiversity management plans.

Rio Tinto reports on the species affected by its mining operations, classified by critically endangered, endangered, vulnerable, near threatened, and species of least concern. The company provides these reports according to country, product group, and specific mine, as well as information on protected areas or areas of high biodiversity impacted by its operations.

Articulate the company’s dependence on nature, not only its impacts. Companies will need to report on both their environmental impact and their dependence on nature, a concept known as "double materiality." Our discussions with clients indicate that very few companies understand the extent to which their activities rely on nature. It is premature to identify best-practice examples in this area, and more guidance is anticipated from the CSRD and the TNFD. As a result, the adoption of double-materiality reporting is expected to grow.

How to Get Started

To fulfill these reporting requirements, companies should take steps to gain a deep understanding of their value chain’s impact on nature, as well as the impact of nature on their business.

Assess. Identify your value chain’s greatest impacts on nature, considering all supplier tiers and locations. The new Science-Based Targets for Nature guidelines suggest analyzing impacts on freshwater, land, biodiversity, oceans, and climate. Armed with a solid baseline, set targets in accordance with the new guidelines. In addition, identify and quantify nature’s impact on the company and the company’s dependence on nature.

Plan. Prioritize areas where intervention can have the greatest overall effect. Consider the company’s operations, the entire value chain, and the areas surrounding the company’s facilities and those of value chain participants. Such an assessment will also help in defining areas where the company may wish to differentiate itself through reporting, targets, and actions. For priority topics, draft initiatives to avoid or reduce impact and restore and regenerate nature. In addition, pinpoint quick wins and identify interdependencies with existing climate programs. Finally, roll out initiatives across the organization.

Measure and report impact. A robust baseline provides a solid foundation for monitoring progress and reporting. Conduct regular progress updates to gain insights into where strategies need to be adjusted in order to reach the desired targets. Use the emerging guidance from the TNFD to describe the impact of nature on the company. This includes, for example, resource dependence and the consequences of flooding and pollution.

The adoption of the Kunming-Montréal Global Biodiversity Framework and the TNFD standards are clear signals that government leaders are prepared to take bolder steps toward nature conservation. This puts business leaders on notice that they should start preparing their companies for a nature-positive future. The best practices we have identified enable an integrated approach that addresses the unique characteristics of nature loss and aligns with the goals of global frameworks. Business leaders who embrace the imperative of nature reporting will gain a competitive edge and become change agents in protecting and restoring our environment.

The authors thank their colleagues in the BCG Center for Climate & Sustainability Policy & Regulation for their contributions to this article.