COP27 highlighted the many complexities of mobilizing the trillions of dollars needed for climate adaptation and mitigation in developing countries, which have contributed the least to global warming but are suffering the most from it. Meeting this need will require innovative mechanisms and multiple types of capital, some of it public but most of it private.

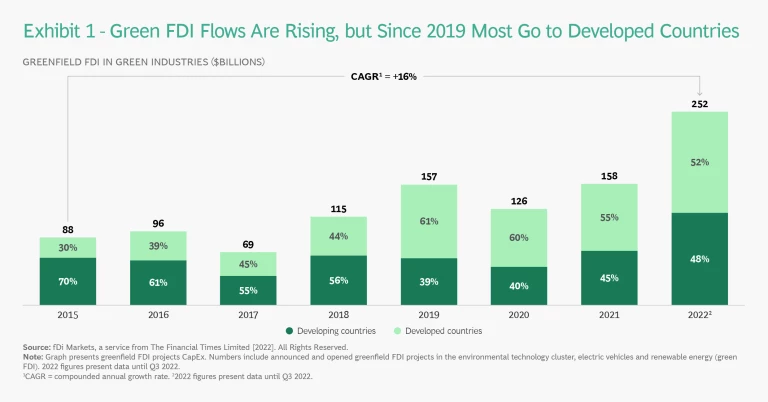

Foreign direct investment across the many sectors impacting (or impacted by) climate change —“green FDI” for short—is the most important segment of these much-needed private capital flows. With sectors ranging from agriculture and forestry to energy and infrastructure, it is difficult to track green FDI investment flows comprehensively. However, using a simplified definition focused on renewable energy , transportation , and environmental technology and services, data from fDi Markets shows that green FDI has tripled in the last ten years and is now the largest FDI category. (See Exhibit 1.)

In developed countries, strong flows of green FDI have supplemented large pools of domestic capital in financing the transition, a dynamic that green incentives in the US Inflation Reduction Act of 2022 and the coming European Green Deal Industrial Plan are accelerating. But few developing countries have gotten a significant share. Indeed, underperformance in channeling green FDI is a key reason why developed countries have fallen short in mobilizing the $100 billion in annual flows they pledged in 2009 to support climate action in the developing world.

Greener Growth Needed

Changing this picture is an urgent task. Emerging market and developing economies (EMDEs) face the transition with limited financial resources and, in many cases, high postpandemic debt levels and regulatory barriers to investment. With some notable exceptions, they have made less progress than developed countries in greening their economies, although the cost of cutting emissions in EMDEs is on average half that of advanced

For now, most EMDEs make only a small per capita contribution to global emissions. But a significant share of future growth in energy use will be driven by EMDEs as they improve living standards for their populations and drive urban growth. If they cannot decouple economic growth from greenhouse gas emissions, the climate challenge becomes even more daunting.

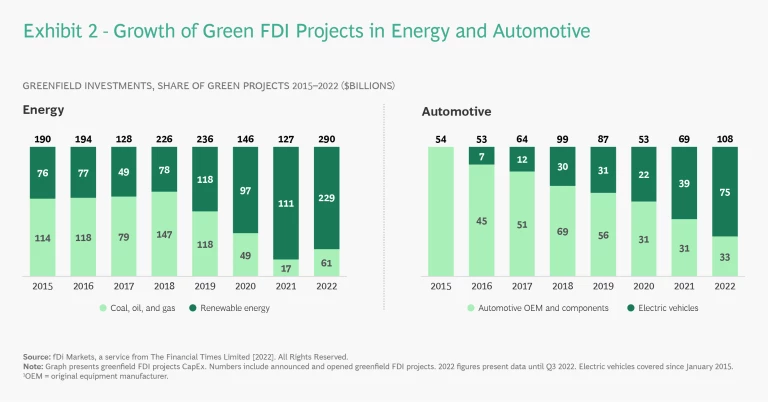

With sufficient investment, EMDEs can jumpstart or accelerate their greening. The logic of falling costs for clean energy sources and steady improvements in related technologies holds true everywhere those sources are found. Unlike fossil resources, which are concentrated in relatively few countries, renewable resources are more evenly distributed. Some early movers in the developing world are already attracting significant FDI flows, especially in the energy and automotive sectors. (See Exhibit 2.) For the world as a whole, investments like these can help avoid the most-dire climate scenarios, saving lives and lessening a potential hit to global GDP of as much as 14% in 2050 from unmitigated climate

The urgent question is how to scale such flows. Development finance institutions (DFIs) and multilateral development banks (MDBs) are helping to facilitate projects, often by sharing risks in blended finance structures, where public capital is used to catalyze private flows. But much more support will be required from these institutions, and proposals to revamp their operating models and balance-sheet practices to dramatically increase their capacity for blended finance deals and other types of funding now have significant momentum. Developed countries also need to step up their efforts, working through the DFIs and MDBs as well as bilaterally. An important objective for all parties is agreement on a common definition of green FDI to facilitate collaboration and tracking of flows and combat potential greenwashing.

With global integration already disrupted by geopolitical and technological forces, decarbonization can be either a source of further strains or an opportunity to put globalization on a sounder and more equitable foundation. In October 2023, the European Union will start to phase in its Carbon Border Adjustment Mechanism (CBAM), which over time will impose a carbon tax on imports from countries that don’t price carbon domestically. Multinational enterprises (MNEs), influenced by shareholders and consumers as well as the regulatory outlook, are increasingly focused on the carbon footprint of their supply chains. In the future, countries with carbon-intensive infrastructures and value chains will be increasingly disadvantaged. By contrast, countries that meet the decarbonization challenge will see their global competitiveness rise and their populations benefiting from more and better jobs, cleaner air, and other environmental improvements.

For their part, EMDEs face the interconnected challenges of updating their development strategies and upgrading their FDI attractiveness. They are a highly varied group, so there is no single set of levers for them to pull. But there are some important lessons to be learned from early movers—starting with the power of setting ambitious climate goals and supporting them with FDI-facilitation measures.

Lessons from Early Movers

To identify EMDEs whose green FDI records may hold lessons for others, we looked for countries that met two criteria: a high ranking from the Economist Intelligence Unit’s ESG Rating Service and success attracting FDI flows in the subset of green FDI sectors for which reliable data is available.

For purposes of our analysis, green FDI means greenfield investments—those that create new assets from scratch in the host country—in renewable energy and related industries; the electric vehicle (EV) value chain; environment-related business services; and recycling. Data limitations prevented inclusion of important sectors such as food and agriculture; mitigation categories such as carbon capture; and projects focused on adaptation and resilience. Still, we believe we have been able to track a majority of the flows that would reasonably be called green FDI. To capture the latest trends, we included announced agreements as well as those where capital has been deployed, using data as of September 30, 2022.

Even our narrow definition of green FDI covers investments of widely varying types. Wind and solar energy are now proven, economically attractive power sources, with levelized costs of electricity generally less than coal’s. The EV value chain is also well advanced, and as global automakers go electric, they are driving green FDI into developing country automotive hubs, such as those in Thailand, Indonesia, and Morocco. By contrast, the development of a low-carbon hydrogen industry is at a much earlier stage. Hydrogen is nevertheless one of the most active sectors for green FDI. We use the term “low-carbon hydrogen” to cover both green hydrogen, manufactured using renewable power, and blue hydrogen, derived from natural gas with the carbon captured. (See “Low-Carbon Hydrogen Is Fueling Green FDI.”)

Low-Carbon Hydrogen Is Fueling Green FDI

Chile, Egypt, Indonesia, and Morocco all have major aspirations in low-carbon hydrogen. Chile’s main focus is green hydrogen (manufactured using renewable energy) while the others are active in both green and blue hydrogen, which is derived from natural gas, with the carbon captured. Since 2016, greenfield FDI-funded hydrogen projects valued at $150 billion have been announced around the world. Disruptions in oil and gas markets following Russia’s invasion of Ukraine have added urgency to the push for low-carbon hydrogen. In May 2022, the European Union set a goal of importing at least 10 million tonnes annually by 2030, with another 10 million tonnes to be produced within the bloc.

For EMDEs, hydrogen development can be a highly attractive opportunity, but they must be careful that the huge expansion needed in dedicated renewable energy capacity doesn’t impede their ability to supply more and greener electricity to their own populations. Many are also taking steps to avoid simply becoming exporters of a new commodity, planning instead to use their future hydrogen capabilities to climb the value chain, boost low-carbon domestic industry, and add quality jobs at home.

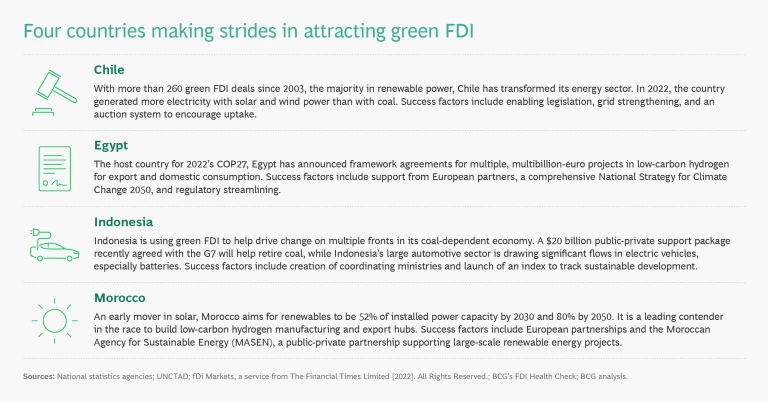

Chile, Egypt, Indonesia, and Morocco are four developing countries making strides in green FDI. They are quite different—Chile, for example, has only about 20 million people, compared to Indonesia’s 276 million—but each has attracted significant investment, both to keep their economies in sync with global trends and to target new growth opportunities. Their success is partly attributable to FDI best practices, such as streamlined regulations, with investment promotion authorities coordinating reviews and helping to acquaint regulatory staff with new technologies. A focus on developing human capital and deepening local knowledge is also common. At the same time, local specifics make each of their paths distinct. (See the slideshow.)

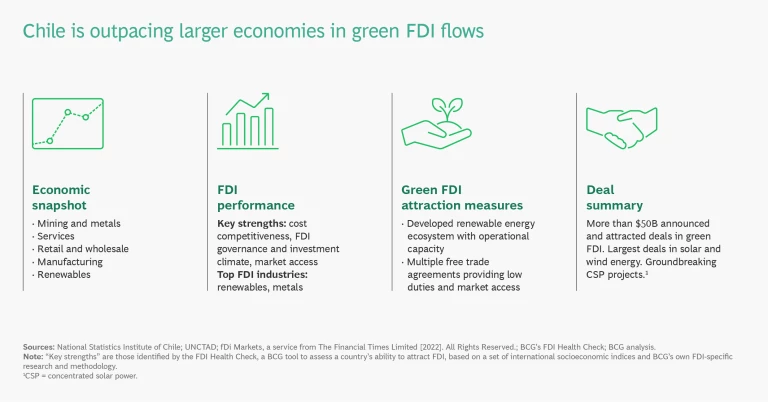

Chile: A Timely Pivot Now Paying Dividends

Chile ranks high on most of our green FDI measures. With inflows of $17.4 billion over the past five years, it is fourth on the list of developing countries for inflows over that period, ahead of much larger economies such as Indonesia and India. These inflows have helped drive a transformation of Chile’s energy sector: In 2022, more electricity was generated with solar and wind power (29%) than with coal (27%) for the first time in its

Chile planted the seeds for these changes in the 2000s. The economy was heavily dependent on imported energy, and most electricity came from coal. When Argentina moved in 2004 to restrict natural gas exports amid domestic shortages, it helped push energy prices to the highest level in Latin America. The energy-intensive mining industry, a key sector of the Chilean economy, looked especially vulnerable. Abundant renewable resources (solar in the northern desert, wind along the lengthy coastline) offered a different path, and a 2008 law got development under way. A renewable quota mandate supported uptake, as did a complementary auction system added in 2013. Also important was the strengthening and unification of the Chilean grid, previously divided along north-south lines and unready for the variable and often decentralized electricity flows that solar and wind produce. The efforts produced a market where renewables could fully compete with conventional energy, and a long buildout of wind and solar capacity—funded mainly by the private sector—resulted. Chile has been the host country to more than 260 green FDI deals since 2003, the majority in renewable power, according to figures from fDi Markets.

In the past few years, attention has turned to downstream industries that could benefit from an abundant and competitive source of low-carbon power, such as green hydrogen. Producing this energy carrier through clean electrolysis of water requires lots of dedicated renewable electric capacity, which Chile could build. Local customers in mining, industry, and transportation would provide early support for growing a major export business. A national strategy was put in place late in 2020, and at COP27, Chile announced an agreement with the World Bank and Inter-American Development Bank to develop production, backed by a potential $750 million in loans over time.

Chile is also seeking to expand its R&D efforts. Plans for a clean-tech research institute have yet to bear fruit, but CORFO, the economic development agency, is backing several small research consortia and is working with universities to develop copper smelting technologies using green hydrogen. The idea is not to compete with bigger R&D efforts around the globe, but to connect and collaborate with them, and make progress in niches such as copper refining, where there is local expertise.

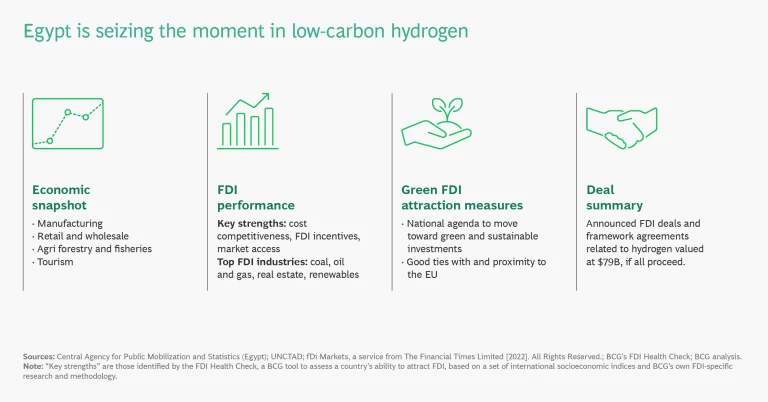

Egypt: Rapid Emergence as a Likely Low-Carbon Hydrogen Hub

As the host country for COP27, Egypt took center stage amid growing enthusiasm for low-carbon hydrogen as an important part of the world’s energy future. The country used the spotlight to show how the right combination of policies, partners, and resources can mobilize major green FDI commitments at such a time. Building on earlier work, Egypt and its partners announced framework agreements for no fewer than eight multibillion-euro, low-carbon hydrogen projects in the Suez Canal Economic Zone. Developers included companies from India, Norway, Saudi Arabia, and the UK, with the European Bank for Reconstruction and Development (EBRD) advising and also lending in some projects. Not all such projects move ahead as anticipated, but if the majority do, 2022 will have been a banner green FDI year for Egypt.

Egypt holds great promise as a low-carbon hydrogen hub. Its wind and solar resources are abundant, its location is favorable and its partnership with the EU—a major backer of hydrogen development as well as Egypt’s largest trading partner—is strong. Egypt’s position as a natural gas exporter strengthens its hand in striking FDI deals, and its role as a large producer of “gray” hydrogen (made from natural gas and used mainly to make ammonia for fertilizer) provides relevant experience and infrastructure.

Yet the challenges are significant. The country is water stressed, and much of the water to make hydrogen will need to come from desalination, itself an energy-intensive process. Electricity still comes mainly from natural gas, and while renewable power sources are growing fast (they are targeted to be 42% of installed capacity by 2035) the buildout must accommodate retirement of gas-fired capacity as well as the huge expansion needed for the hydrogen projects. In addition to all this new generation capacity, significant expansion and adaptation of the power grid is required.

The government is using multiple levers to move development forward, both for green hydrogen and sustainable projects more broadly. The “golden license” (created in 2017 to facilitate investment in key sectors) has been issued to several projects, enabling developers to bypass some procedures as they acquire real estate, build, and operate projects. Additional incentives are expected when the government finalizes its $40 billion national hydrogen plan and could include special custom points for import/export, reimbursement of 50% of land allocation costs, and other inducements.

Egypt used the year of its COP presidency to fast-forward green development on multiple fronts. Announcement in May 2022 of the comprehensive National Strategy for Climate Change 2050 was followed in July with the launch of the Nexus on Water, Food, and Energy (NWFE) program. The EBRD is helping to finance several NWFE initiatives and plans to commit up to $1 billion to private renewable projects as well as $300 million in sovereign loans to support grid improvements, supply chain development, and reskilling of workers.

The most advanced hydrogen project is Egypt Green (where the partners include Norway’s Scatec, the UAE’s Fertiglobe and the Sovereign Wealth Fund of Egypt) and the EBRD is participating with a $30 million loan. The facility will produce green hydrogen for use as a feedstock in the production of green ammonia, which in turn will be used in green fertilizers. With this and other projects, Egypt is seeking to balance a commodity-level export orientation with efforts to climb the value chain domestically, creating jobs and fostering domestic development in growth sectors such as green fertilizer (needed at home as well as for export) and green steel.

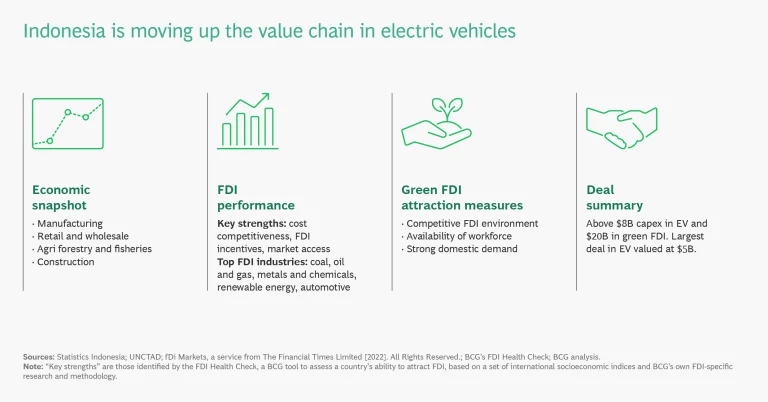

Indonesia: A Greener Path for Southeast Asia’s Largest Economy

Indonesia’s large, multifaceted economy is expected to triple in size over the next 30 years. The country faces the complex challenge of putting this development on a greener path, both in terms of energy (coal is the biggest source of electricity, as well as a major export) and also Indonesia’s position in evolving global value chains. The government has taken multiple steps in recent years to accomplish this, with attraction of green FDI playing an important role. Among developing countries, Indonesia ranks fifth for total green FDI inflows over the last five years, having attracted $17.3 billion in the period.

Government efforts include the 2019 creation of coordinating ministries to improve collaboration on complex efforts like the green transition, and the 2022 launch of the National Development Planning Agency’s Green Economy Index, a metric for tracking sustainable development. Plans for the new city of Nusantara—now under construction on the island of Borneo and set to replace Jakarta as Indonesia’s capital—include ample green spaces and ambitious water conservation and renewable energy objectives.

Indonesia is pushing hard to develop its significant renewable resources, including hydro and thermal, now targeted to be 23% of the energy mix by 2025, up from 12% today. The $20 billion support package recently announced as part of the G7’s new Partnership for Global Infrastructure and Investment (PGII) will speed development and hasten the retirement of coal. Dubbed the Indonesia Just Energy Transition Partnership (JETP), the agreement combines equal measures of public and private finance and commits Indonesia to more ambitious climate targets, including a pledge for emissions to peak by 2030, seven years earlier than the prior target.

Meanwhile, Indonesia’s automotive sector is finding new opportunities as the global industry goes electric. Thanks to the local presence of Toyota, Honda, and other global players, it has already seen an influx of EV FDI, making it a leader among developing countries in the category.

Batteries for EVs look particularly promising, and Indonesia’s world-leading production of nickel gives it an opportunity to be more than a supplier of raw materials. The government has restricted exports of unrefined nickel (a key ingredient in lithium batteries) to encourage investments in processing and manufacturing. A consortium led by LG Energy Solution is set to invest $9 billion as part of an agreement with local mining company ANTAM and Indonesia Battery Corporation (IBC). In another deal, China-based Contemporary Amperex Technology is investing $5.1 billion to build a battery manufacturing plant.

The nickel sector poses its own set of environmental challenges for Indonesia, including a current reliance on mostly coal-fired electricity in refining. Still, Indonesia believes that strength in batteries, plus a large domestic market for vehicles, can also help it compete with India and others in manufacturing EVs, including two-wheelers. PT Hyundai Indonesia Motors produced its first EVs in 2022.

Development in low-carbon hydrogen is at an earlier stage. Like Egypt, Indonesia has a natural gas-based, gray hydrogen industry. In March 2022, two state-owned enterprises—the fertilizer company Pupuk and the energy company Pertamina—signed an MOU with Japan’s Mitsubishi Corp. regarding future production and transportation of hydrogen and ammonia. More recently, Pertamina agreed with global oil major Chevron to study the development of a sizable hydrogen production facility in Sumatra powered by geothermal energy. Pertamina aims to invest some $11 billion in hydrogen and other clean energy projects in the next five years. Between 2030 and 2060, the government projects a need for up to $25 billion to build hydrogen capacity for both domestic use and export.

Morocco: Facilitating Flows and Leveraging EU Connections

Like Chile, Morocco made an early commitment to renewable energy, starting in the mid-2000s and accelerating in 2009 with an ambitious plan for 42% of its installed electrical capacity to be renewables by 2020. The country fell slightly short of that target but succeeded in driving a huge buildout in wind and solar and attracting nearly $20 billion in green FDI between 2004 and 2022. Morocco still relies on imported coal to generate the largest share of its electricity, but in 2021 it pledged additional cuts in future emissions and now aims for renewables to be 52% of installed power capacity by 2030 and 80% by 2050.

The Moroccan Agency for Sustainable Energy (MASEN) has played a central role in the renewables buildout. Launched in 2010 as the Moroccan Agency for Solar Development, it was given expanded responsibilities and renamed in 2016. A public-private partnership, MASEN integrates development, funding, and management of all large-scale renewable energy projects, including the showcase Noor Solar Plant in Ouarzazate, the world’s largest concentrated solar power plant. Development of renewables has also received important support from international partners such as the UN’s Green Climate Fund, the African Development Bank, and the EBRD.

Some of Morocco’s green power is slated for export to European countries. Nearby Spain is already a customer, and the UK could become one via the Xlinks project, which aims to build and connect new Moroccan solar and wind capacity to the UK through an undersea cable. Foreign investors tend to be most comfortable with export projects, and Xlinks has attracted significant FDI. But given Morocco’s fast-growing demand for energy, the country also needs ongoing domestic-oriented development to meet its emission goals. Increased efficiency will help as well. SIE, a state-owned energy services company, is working across key sectors to help achieve the government’s ambitious efficiency targets.

Government support (dating back to an FDI-friendly simplification of the tax code in 1995) has also helped build Morocco into the African continent’s biggest auto manufacturing hub. Smaller than Indonesia’s auto hub, it hasn’t yet experienced major EV inflows. But with Renault and Stellantis as its biggest manufacturers and the EU as its biggest market, Morocco’s auto sector could see an increase in future FDI flows from the industry’s shift to electric vehicles.

With its proximity to Europe and abundant renewable power potential, Morocco is a leading contender in the race to build low-carbon hydrogen manufacturing and export hubs. The country has formed a number of partnerships (including one with the International Renewable Energy Agency) and bilateral deals, such as a 2020 agreement with Germany that included pledges of €300 million to support green hydrogen development. In a milestone deal earlier this year, France’s Total Eren agreed to invest $10 billion in a hydrogen and green ammonia project, with construction to start in 2025 and production planned in 2027. Like other countries, Morocco is looking beyond just exporting the raw molecules and considering how it might use hydrogen to move up the value chain into products such as green steel.

Unlocking More Investment

In developed countries, national support measures have played an essential role in attracting investment, including FDI, to renewable energy and other green sectors. Tax subsidies and other inducements have thereby helped build scale and drive down costs in wind and solar power.

National support measures are also typically needed for green initiatives in emerging market countries. However, unlocking green FDI flows on the scale of those seen in the developed world will require much broader collaboration. Developed and developing countries alike will need to work with multilateral development banks and development finance institutions to address long-standing impediments to foreign investment in emerging markets. These barriers (which include currency risk and sovereign credit ratings lower than those in developed countries) are especially formidable when there’s a large upfront investment pegged to a lengthy payoff over time, as in renewable power development and other infrastructure projects. The bespoke nature of these complex projects and a lack of familiarity with local conditions can further complicate things for investors.

Subscribe to receive BCG insights on the most pressing issues facing international business.

The MDBs and DFIs have made a start on mobilizing the private capital needed. Initiatives such as the G20’s Partnership for Global Infrastructure and Investment (PGII) rely on these institutions as well as bilateral commitments. The Indonesia JETP announced at the 2022 OECD summit in Bali was the second of three JETPs to date. (South Africa’s came first, in 2021, and Vietnam’s most recently, in December of 2022.) The Bali meeting also saw the unveiling of deals for sourcing renewables-related materials in Brazil and developing solar power in Honduras, with backing from the Export-Import Bank of the United States, among many others.

The nine MDBs (which include the World Bank Group plus regional institutions such as the African, Asian, and Inter-American Development Banks) pledged in 2017 to align their financial flows with the objectives of the Paris agreement, but the process is far from complete. They have, however, upped their commitments to climate finance. Most ambitious is the European Investment Bank, which plans to raise the share of financing allocated to climate and environmental sustainability above 50% by 2025.

Global leaders are now seeking more fundamental changes in these institutions, with a dramatic increase in climate finance—including better mobilization of private capital—as the top priority. Following a call from US Treasury Secretary Janet Yellen, the World Bank Group has formally begun adapting its mission and evolving its operating and financial models, and a pending leadership change is expected to bring a new focus on climate issues. Boosting climate finance was a key objective for a 2022 report on reforming the capital adequacy frameworks of the MDBs, commissioned by the

There’s no shortage of ideas. A 2022 IMF paper, for example, discusses the creation of green asset-backed securities that would bundle bonds from a variety of projects to boost liquidity and diversification for

Suggestions for host countries, meanwhile, include strengthening the legal groundwork that supports predictable revenues from projects. In renewable power development, where local utilities are usually the partners signing long-term contracts to buy the power produced, strengthening the financial profiles of the utilities to make them stronger counterparties is among the recommendations in a 2021 International Energy Agency

There is much work ahead and much still to be agreed upon. Mitigation projects like renewable power development are much better at producing revenues, and hence attracting FDI, than adaptation projects like building seawalls, combating deforestation, or improving the resilience of the agricultural sector, yet the needs in EMDEs are significant on the adaptation side. Encouragingly, innovations such as the African Carbon Markets Initiative, launched at COP27, are showing a way forward on problems such as deforestation.

The so-called north-south divide on climate reflects deeply felt differences, but there’s little doubt that these differences can and must be bridged for the well-being of people in developing and developed countries alike. Stronger flows of green FDI into EMDEs will help bridge them.