Retailers, take a deep breath.

The holiday shopping season is no longer months, weeks, or even days away. It’s already here. Analysis informed by the very latest data from BCG’s mid-October 2023 Holiday Spend Survey offers timely insights essential to retailers gearing up for their most important season of the year.

A soft landing sets the stage for healthy spending

The specter of a post-pandemic recession has dominated headlines over the past two years. This gloomy expectation has been heightened with the confluence of rapid interest rate hikes from central banks, geopolitical escalations, and other exogenous shocks. However, these factors have so far not materialized into the ‘hard landing’ in the United States that many have predicted.

Instead, BCG’s prevailing expectations call for a ‘soft landing,’ including inflation rates declining and labor markets easing with potentially moderate increases in the unemployment rate. And while consumer balance sheets are less strong than they were last year—when they were bolstered by stimulus checks and student loan relief—they do remain healthy relative to historical levels.

Despite these better-than-expected economic indicators, consumers are still feeling the strains of two years of inflation and still recovering from uncertainty. Consumers are reporting cutting back on activities such as food delivery and dining out.

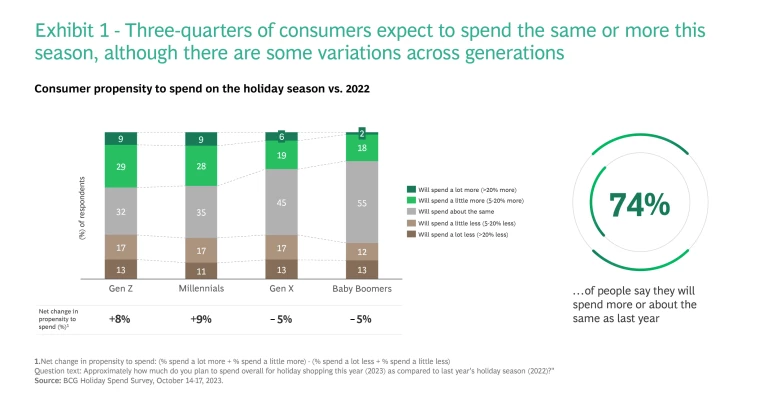

These factors should contribute to a favorable holiday season outlook in 2023 compared to 2022. Based on BCG Lighthouse data, September has been a strong month for retail, with spend at mass market retailers up 8%, department stores and off-price up 5%, and dollar/ value formats up 10%+. The Holiday Spend Survey indicates optimism from consumers and a higher willingness to spend across categories compared to last year. In fact, 74% of consumers expect to spend the same or more this holiday season.

Another favorable contrast: Retailers were plagued with overbuilt inventories last season that resulted in significant discounts and markdowns to clear through excess goods and products. Looking at this year’s season, based on recent retailer earnings, supply chain bottlenecks and inventories have normalized (though it’s worth noting that geopolitical tensions could still present a risk). This should not only benefit sales but also margin realization. This year, many retailers are taking the approach of buying deeper in value and trade-down, as well as their tried-and true conversion drivers; likewise buying down in higher tickets for middle and lower-upper income segments. It’s true, however, that consumers are signaling fatigue with austerity. Now the question remains: are consumers’ plans for energetic holiday spending merely wishful thinking, or will they play out? It remains to be seen from Halloween and November results.

A spirited younger demographic

While healthy spending is expected across generations, Gen Z and Millennials (Gen Y) could be the driving force for sales growth this holiday season relative to their Gen X and Baby Boomer counterparts, who are less optimistic. 38% and 36% of Gen Z and Millennials, respectively, expect to spend more this year on holiday shopping, compared to just 20% of Boomers.

Notably, younger consumers’ intention to spend more on holiday shopping runs counterintuitively to their broader financial sentiments. So what explains this general spending restraint and the intention to spend more on the holidays? Two contributing factors are likely. First, tighter labor markets have pulled people at the “margins” (e.g., teenagers and younger adults) into the labor force, which has led to younger generations having significant wage gains recently outpacing inflation by a notable margin.

Of course, it’s important to understand that spending plans vary by income level, in addition to age demographics. From the consumer research, BCG analysis indicates that higher-income households plan to increase spend. Meanwhile, lower-income households are planning to maintain spending at last year’s levels with a share shift into essentials and trading down/ shopping more deals.

Defining the bounds of the holiday season is getting harder every year, with progressively earlier retail promotions and earlier consumer engagement. Significant activity continues to happen earlier in the cycle, such as campaigns like Amazon’s Prime Day. As such, consumers are getting an earlier start to their research, inspiration, and shopping for the holidays. Survey participants indicated that they would be done with 60% of their holiday shopping by Black Friday and Cyber Monday weekend.

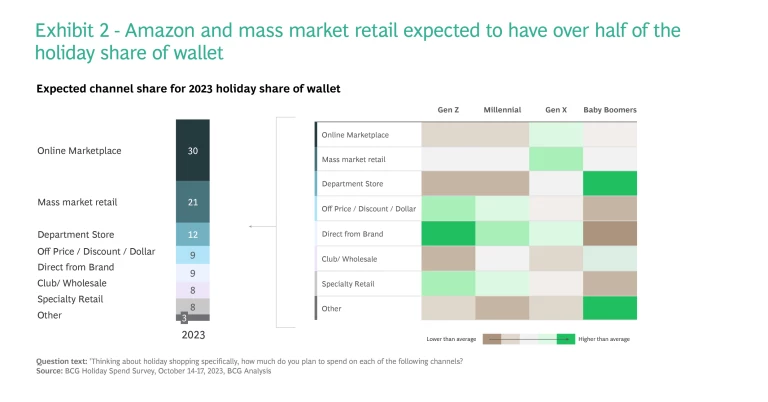

When it comes to channel, Amazon and mass market retailers are expected to drive 50% of the consumers wallet-share. Gen Z and Millennials are more likely to buy directly from brands, specialty retail and discount/ value formats, while Boomers prefer department stores. We see these trends extend beyond just holiday shopping.

What’s driving the holiday wish list

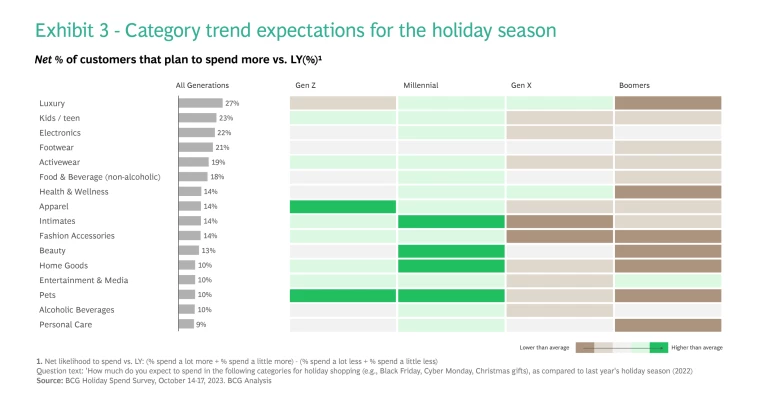

Consumers expect to spend more this year across all categories, particularly with inflation expectations embedded in pricing. Consumers expect to spend more on Luxury, Kids/ Teen, Electronics, and Footwear. However, underlying trends vary by generation, with Gen X and Boomers expecting to cut back spend across many discretionary categories relative to last year, especially categories that saw a demand pull forward during the pandemic.

Gen Z is expected to spend more across all categories, particularly on apparel and pets; likewise, Millennials also plan to spend more on kids, beauty, intimates and home goods. In contrast, Gen X spend is expected to increase less this year than that of younger generations, with two exceptions: luxury and health & wellness. Boomers expect to spend less across most categories as they buy fewer products and hunt for additional deals.

What’s drawing consumers’ attention

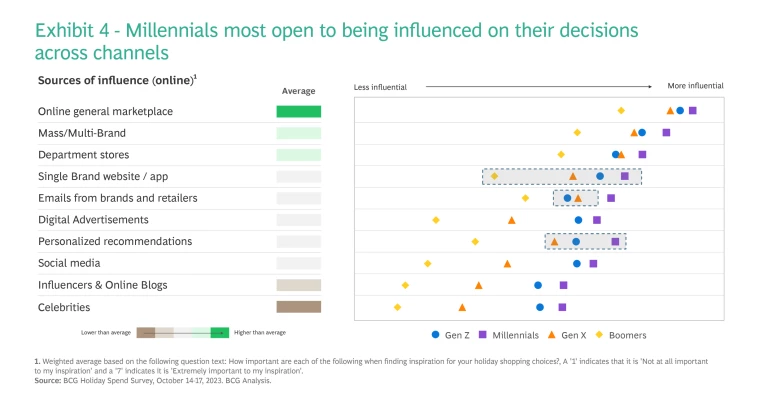

As companies compete for consumer attention, a look at the key sources of influence this season is important. It appears that Baby Boomers have generally decided what they want to buy and may be less open to online/digital influence, with Millennials most open to suggestions. Generally, direct brand platforms have the widest variations (where Millennials/ Gen Z expect to engage, but Boomers less so). One of the drivers of this trend could be Baby Boomers preferring inspiration in physical formats, whereas younger generations looking for top picks, recommendations, gift guides, deals, and discounts digitally.

Personalization continues to be a critical vehicle, especially for Millennials and Gen Z. Interestingly, Gen Z considers emails among the lowest forms of influence as they engage more over text and social, which has implications on how retailers and brands should plan to reach them and cut through the clutter this season.

Ways to win in the holiday shopping market

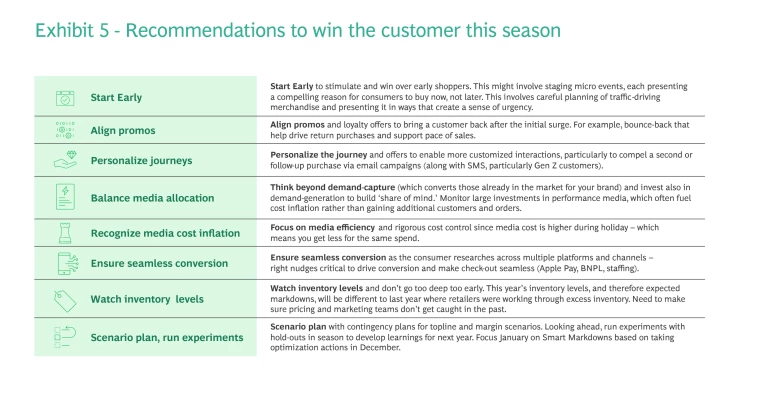

The holiday shopping season is on. With buys and assortments already for the most part locked-in, the focus for retailers now should be on how to achieve competitive advantage through outreach tailored to different customer cohorts. Here are key moves for retailers to win with holiday shoppers:

‘Tis the (shorter) season for success

One could make the case that the holiday shopping season is effectively getting longer each year as it begins ever earlier—a fair point. However, the critical period for retailers remains tight as ever, with more than half of customers aiming to complete their shopping by Black Friday and Cyber Monday. That means retailers have a narrow window to get it right for 2023. Understanding consumer trends is the foundation for the competitive edge and a festive holiday sales season.

The authors would like to extend special thanks to Jose Berruecos, Max Gordon, the BCG Lighthouse team, and BCG Center for Customer Insight for their contributions to the article.