In geology there is a term for a period of heightened seismic activity, a series of earthquakes clustered in the same location over days or weeks. It’s called a swarm. While each individual quake is generally mild, collectively things feel unstable as the foundation underfoot shifts repeatedly.

For corporate leaders focused on sustainability and social impact, the past several years have felt like an earthquake swarm. We have seen unparalleled growth in attention to environmental, social, and governance (ESG) topics—followed by unexpected backlash in some pockets and an uncertain path forward. The ground is shifting, and the footing can feel unsure.

As leaders weigh what to do amid a complex and nuanced global landscape, our perspective is that inaction on environmental and societal topics is not an option. Nor is running through a pro forma to-do list on these issues. What’s required is authentic action. Action rooted in your company purpose, true to your strengths, and core to your business.

We have argued before that authentic impact is the gold standard for companies, taking them beyond a compliance or altruistic mindset and toward an understanding of environmental and societal action as part of their competitive advantage and essential to their purpose.

In this article, we dig deeper into the notion of authenticity in corporate impact and share a new model for shaping impact strategy that goes beyond materiality to include three critical considerations: capability, conviction, and opportunity.

Why Authenticity Matters in Today’s Business World

The landscape of corporate environmental and societal impact has experienced seismic shifts over the past five years. This period has mostly been defined by a significant rise in corporate attention and commitment to these concerns, following strong demand from stakeholders of all types and a compelling business case for action.

But recently, the picture has become more intricate. We still see strong and rising demand, as well as regulatory requirements, for corporate action on environmental and societal topics in some regions, particularly Europe. While in other regions—namely the US—we see a splintering of demands as the polarization of society reaches into the boardroom and challenges both the role that companies play in addressing social issues and the prerogative of investors to factor ESG performance into their portfolio choices.

We can’t just hit pause while the dust settles on this one. The window is rapidly closing for bold action to forestall the worst effects of climate change , and there is a pressing need to step-change the pace toward the UN’s Sustainable Development Goals to alleviate poverty, inequality, and illness worldwide. Half of the 15-year timeframe to achieve the SDG goals has passed and, collectively, we’re behind schedule.

Inaction is not only untenable from a societal perspective; it’s unwise from a business standpoint. With rapid change coming to nearly all industries as the world transitions to a low-carbon economy, it is simply good business for a company to find its authentic, strategic role in a more sustainable and inclusive future.

Faced with this confluence of factors, corporate CEOs find themselves on uncertain ground. The imperative to act for many remains strong, but the pitfalls are more plentiful. How, then, should they proceed?

In the current context, authenticity in corporate impact is more important than ever. Applying the lens of authenticity ensures that companies focus their efforts where the issues are financially material and beneficial, their voice is credible, their organization has deep expertise, and their purpose is clear.

It is simply good business for a company to find its authentic, strategic role in a more sustainable and inclusive future.

Companies that come up short on authenticity—approaching impact topics with a check-the-box mindset and a generic, un-strategic agenda—see middling or even negative returns on their efforts. But companies that find the overlap between their inherent strengths and an environmental or social need—creating business and societal value simultaneously and moving with focus and conviction—see myriad benefits. These include access to talent and capital, retention of talent, license to operate, consumer preference, and competitive advantage in new markets, to name just a few.

A Working Definition of Corporate Authenticity

Humans have an intuitive barometer for authenticity and sincerity. And for good evolutionary reason: since our earliest days as a species, the question of whether we can trust those we are interacting with has been key to our well-being and our survival. We evaluate companies and brands through a similar lens, with our senses attuned for signs of trustworthiness or its converse.

What are the inner workings of this barometer? How can we concretely define the ingredients for corporate authenticity beyond “You’ll know it when you see it?”

From the perspective of philosophy, something is considered authentic because “it is what it professes to

- True to action – What the company says is aligned to what it does.

- True to origin – What the company does is aligned to who it is.

True to Action: Do What You Say

Authenticity, for people and corporations, means high alignment between what you say about yourself and what you do. There are, of course, two ingredients to create this alignment—action and communication. Authenticity requires not just genuine intention but observable action. And it requires transparent communication about that action. For a business, this means that noble commitments alone don’t cut it; they need to be accompanied by clear action plans and honest updates on progress.

Transparent, accountable communication is more important for companies today than ever before. That’s because the rise in nonfinancial disclosure standards has given stakeholders a magnifying glass, while the growth of social media has given stakeholders a megaphone. The combined effect is to increase what stakeholders can see—and share—when it comes to the actions of corporations they work for, buy from, and invest in.

Given these dynamics, it’s not surprising that what we see out in the world is reputational benefit going to companies that are deliberate and transparent about their corporate impact. A trusted reputation is not just a nice-to-have; BCG’s research finds that the 100 most trusted companies in our Trust Index generated 2.5 times as much value as their peers and enjoyed 47% higher P/E multiples.

When it comes to building trust, greenwashing is a common pitfall for corporations. In some cases, greenwashing is blatant misinformation. But more often it manifests as a subtle distortion or obfuscation of reality. An example would be loudly celebrating a green product that is in fact a small portion of a company’s portfolio. In other cases, greenwashing emerges from a lack of internal clarity and alignment—when commitments are marketed externally but not fully integrated into the internal decision-making muscles across many functions and business units and their respective goals and incentives. Beyond incurring potentially significant financial and regulatory costs, greenwashing can erode customer and public trust, a critical asset for companies in this era.

Achieving fidelity between action and communication is a challenge for any organization. But it highlights the importance of mobilizing around the company’s purpose and impact ambitions. If the impact strategy is composed at the top and published in a report—but isn’t brought to life across the organization—there is almost no chance that employees will consistently act in line with the company’s stated goals.

True to Origin: Be Who You Are

The second dimension of authenticity—true to origin—is a less obvious but critical consideration for corporate leaders. Being authentic means being true to your purpose, for your actions to spring from what resides at the heart of your organization, rather than imitating what’s going on all around it.

For companies, this means their social impact agenda is rooted in who the company is and focused where the company is credible and concerned. Commitments are made with clear-eyed focus and a deep understanding of how the company will deliver, not simply by looking at the market to match competitor commitments.

Companies that resist the impulse to imitate and instead develop an agenda that is unmistakably rooted in their purpose, values, capacity, and brand are much more likely to reap the benefits of their efforts—and to avoid repercussions from those critical of generic corporate action (or inaction) on these topics.

Note that being true to your origins doesn’t mean each company must devise unique, one-of-a-kind impact initiatives. For example, we need many companies in the food system to innovate in regenerative agriculture, many aviation companies to advance sustainable fuels, and many fashion companies to advance ethical labor practices in their supply chains. It is helpful to look at the overall impact agenda with an understanding of where you share a calling with other ecosystem players and how you can distinctively contribute and tell your story.

A Framework for Finding Your Authentic Lane

While the case for authentic impact may be clear in the abstract, how can corporate leaders put it into practice?

A good place to begin is by taking a critical look at where the organization is investing its effort. Most companies set their social and environmental agendas by conducting a materiality analysis, which effectively asks, What matters to the market when it comes to these topics? Even better is considering dynamic materiality: How is what matters to the market changing over time, and what will matter tomorrow?

The question of materiality is certainly a critical one, but it’s insufficient. Most players in a given industry will have the same set of material topics to address, so materiality alone doesn’t indicate where a company can carve out business advantage through leadership. To get more clear perspective, more lenses are required.

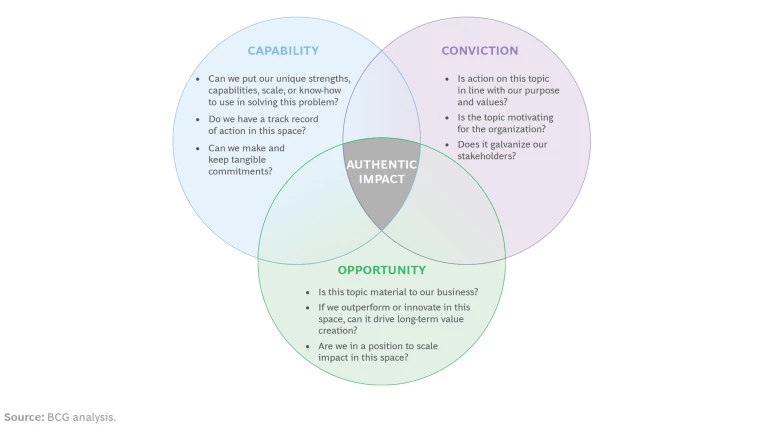

Beyond materiality, the critical question to explore is Where can we authentically lead? To tackle this somewhat more subjective consideration, we established a set of filters for evaluating where best to focus, looking for topics and flagship efforts that sit at the intersection of capability, conviction, and opportunity. (See exhibit.)

- Capability permits you to play. Lean in where you can leverage your strengths credibly and forcefully. For example, Kroger’s focus on solving the dual crises of food waste and food scarcity through their Zero Hunger Zero Waste commitment makes sense for America’s largest grocer—an entity with the scale and community presence to make a meaningful dent in the problems of food waste in their business and hunger in their communities.

- Conviction powers you forward. Leadership on environmental and social topics takes courage and innovation over the long-term. That’s always been true, but it’s especially so in today’s complex global landscape. Go where your organization has a wellspring of conviction to feed that courage. Your impact strategy should be borne of your purpose and informed by a comprehensive view of what matters to your employees, customers, and other stakeholders. The B-Corp Seventh Generation draws its name from the Iroquois philosophy that we should be acting in the interest of those who will live seven generations after us. The company is animated by a commitment to environmental sustainability in their products, their supply chains, and, more broadly, through activism for climate justice.

- Opportunity fuels impact. Bolt-on social responsibility efforts are doomed to remain small and have limited impact. To achieve sustainable scale, environmental and social innovations should be tied to the value drivers of the business. Companies that pursue authentic impact don’t shy away from profit; they find the overlap between economic and social impact. The areas of greatest opportunity vary by business; it might be in the supply chain for a manufacturer, in reaching new markets for those in health care or finance, or in labor practices for companies with large workforces. For example, a retailer with over 250,000 frontline employees developed an industry-leading approach to personalized inclusivity in the workplace. This effort creates social impact through inclusion for diverse groups and helps the company to attract and retain the best talent in an industry currently experiencing high turnover and persistent labor shortages. It’s a win-win for business and social impact.

This is not an easy moment to be at the helm of an organization. As global uncertainties continue to unfold and expectations around the role of corporations change quickly, it may feel like the ground is rumbling and shifting for some time to come.

It’s worth bearing in mind then the words of Danish philosopher Søren Kierkegaard, who said, “To dare is to lose one’s footing momentarily. Not to dare is to lose oneself.”

Where materiality, capability, conviction, and opportunity overlap, be bold. It’s a place where you can find sure footing—once you dare to take that first step—in an uncertain and changing landscape. A place where your organization has unique advantage to capture value in the market and an authentic role to play in creating a more sustainable and equitable future.