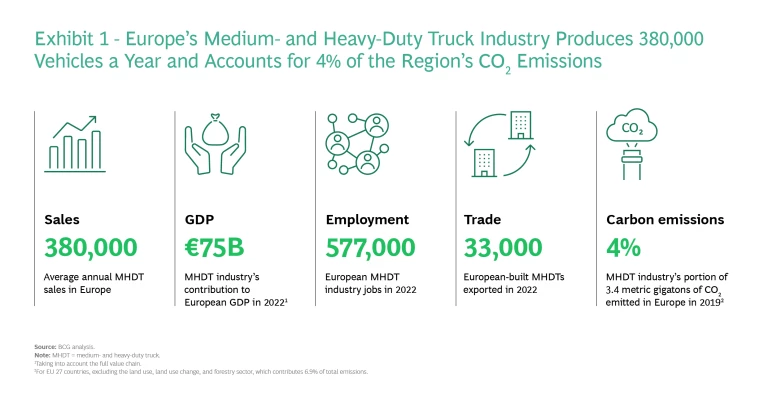

The medium- and heavy-duty truck (MHDT) industry is a central part of Europe’s economy, contributing €75 billion in GDP and 577,000 jobs in 2022, but it also contributes approximately 4% of Europe’s CO2 emissions. (See Exhibit 1.) Zero-emission vehicle (ZEV) technology promises to transform the MHDT industry, helping achieve the sector’s climate ambitions while retaining its economic contribution. We recently analyzed the potential impact of this development on GDP and employment in Europe—a project commissioned by Transport & Environment (T&E), a European NGO that advocates in favor of stricter emissions regulations.

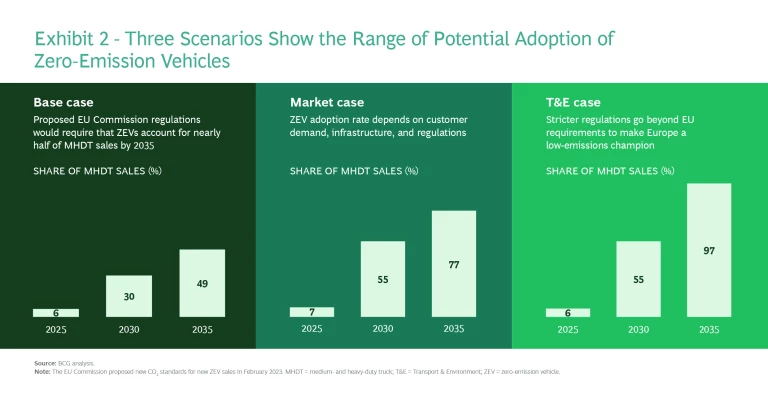

Several factors will spur adoption of ZEVs, including regulation, a reduction in the total cost of ownership, a buildup of infrastructure, and a broader range of offerings. BCG research estimates that these market factors will push ZEVs to 77% of the MHDT market by 2035. In the area of regulation alone, new rules will establish a baseline for the shift from trucks with internal combustion engines (ICEs) to ZEVs, according to two other scenarios. (See Exhibit 2.)

One scenario, proposed by the European Commission, would lead to ZEVs making up 49% of the market by 2035. We call this the base case. A second scenario, based on a stricter rule, would require 97% of new-vehicle fleet to be ZEVs. We worked with (T&E) to analyze the implications of this stricter scenario, which we call the T&E case.

To meet the elevated T&E case in 2035, the industry would need to manufacture up to 400,000 ZEV trucks, along with battery cells possessing a combined 230 gigawatt-hours of capacity to power them. Infrastructure and utility companies would need to provide tens of thousands of ZEV chargers and 160 terawatts of electricity to keep these vehicles on the road.

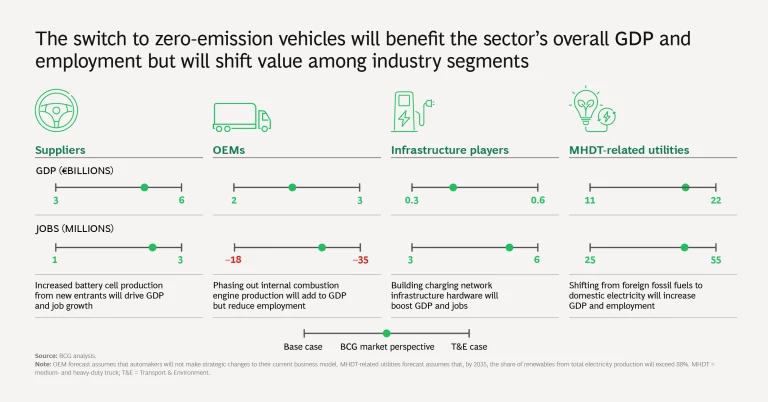

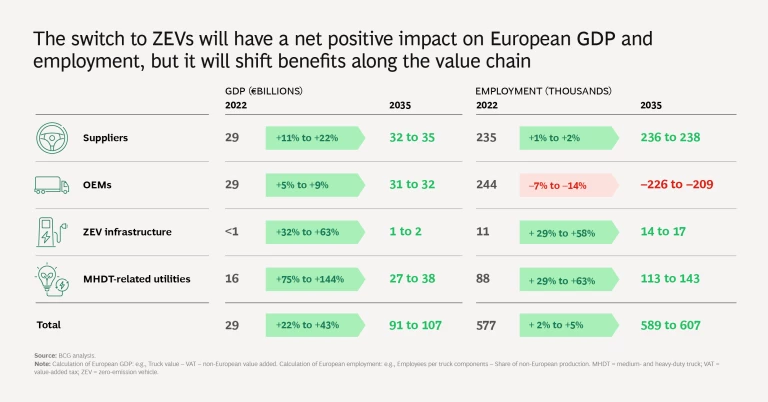

Under this scenario (assuming constant production at 2019 levels), we estimate that the MHDT industry would add up to €32 billion in GDP and 30,000 jobs in Europe. However, the shift to ZEVs would also have highly variable implications for incumbent suppliers and OEMs:

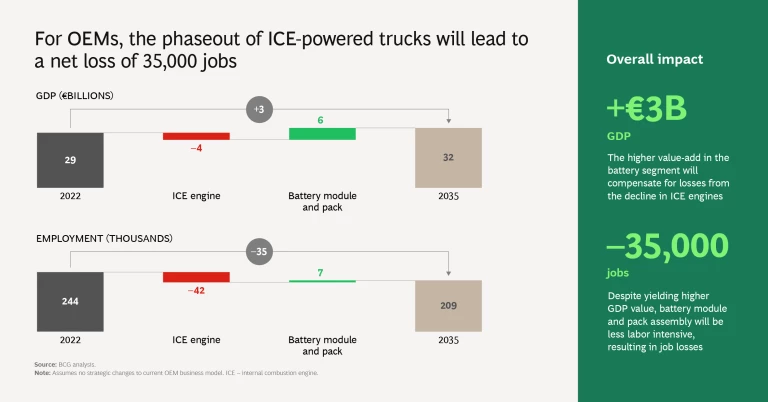

- OEMs may lose 42,000 jobs related to making ICE vehicles, although about one-sixth of those losses will be offset by new battery-related jobs, resulting in a net loss of 35,000 positions. That figure is equivalent to the job losses that would occur if an average-size European truck OEM disappeared altogether. The overall GDP contribution from OEMs will increase by €3 billion, however, due to a higher value-add from battery-related components.

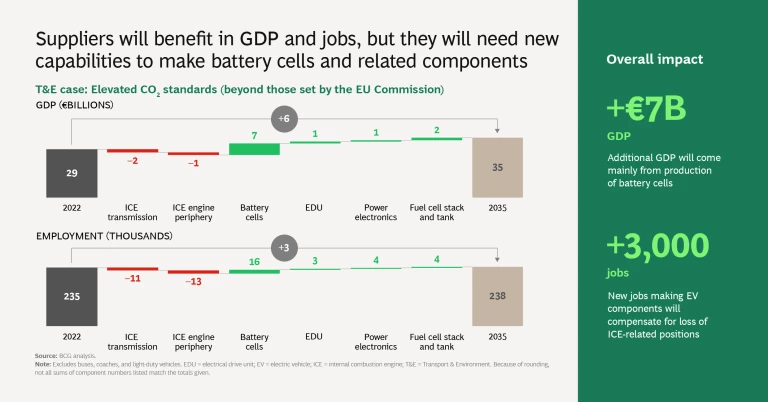

- MHDT suppliers may lose up to 24,000 jobs, but those losses will be more than offset by new employment opportunities in the production of battery cells, electric drive units, and power electronics. The net gain in jobs could increase further if Europe expands its production of battery cells and related components. The supplier contribution to GDP will increase by €3 billion. But pivoting to battery-electric vehicle (BEV) components won’t be seamless for all suppliers. Some will probably not transform their business, creating opportunities for new players with BEV technology expertise to enter the market.

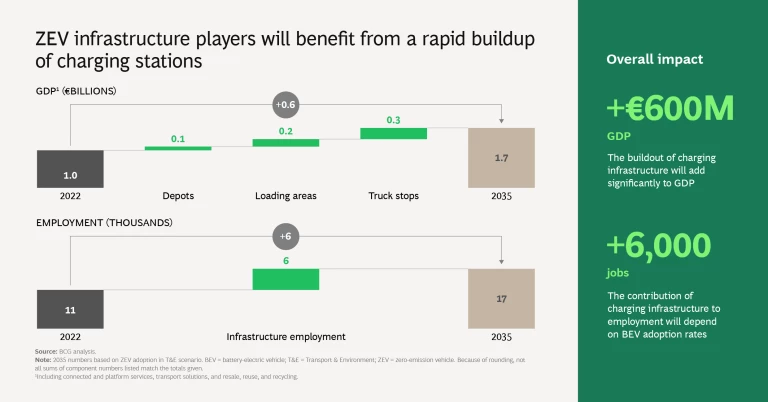

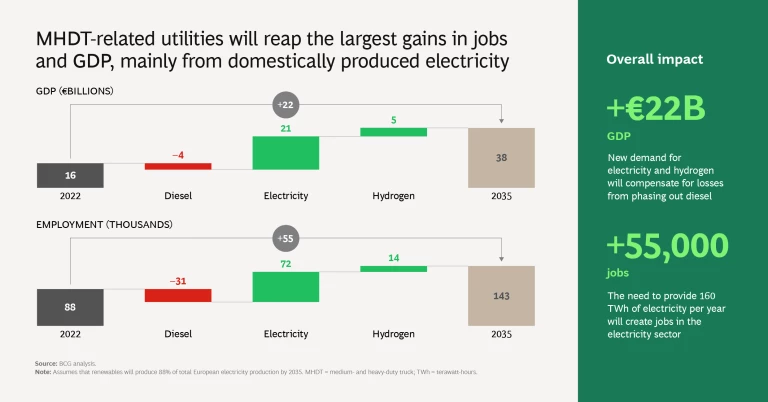

- Infrastructure companies and MHDT-related utilities will more than counterbalance the job losses among OEMs and suppliers. ZEV infrastructure companies will add 6,000 new positions and €600 million in GDP contribution. The impact is far greater for MHDT-related utilities, which will deliver up to 55,000 new jobs and €22 billion in GDP, mainly in electricity generation, which must increase from 1 terawatt-hour (TWh) to 160 TWh to feed the estimated 1.8 million ZEV trucks expected by 2035 in the high-adoption case. That amount of additional electricity is equivalent to the output of 27,000 on-shore wind turbines capable of producing up to 3 megawatts each.

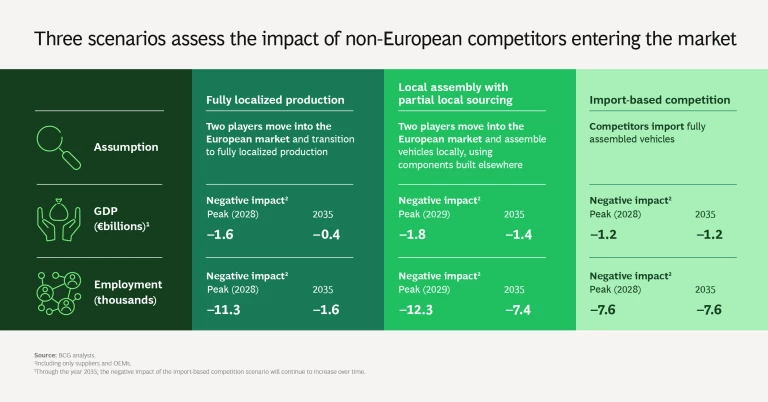

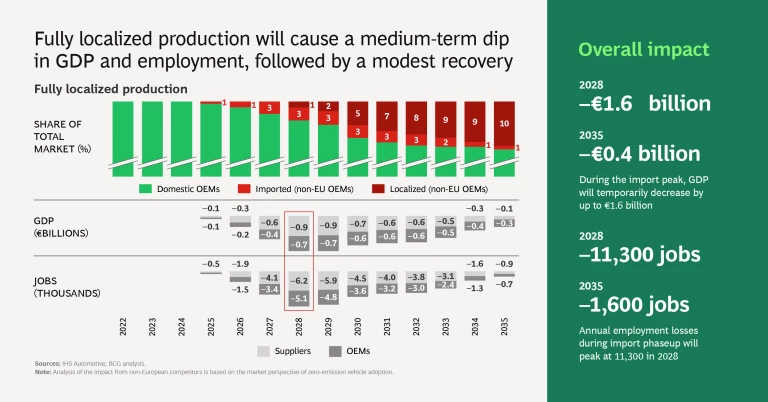

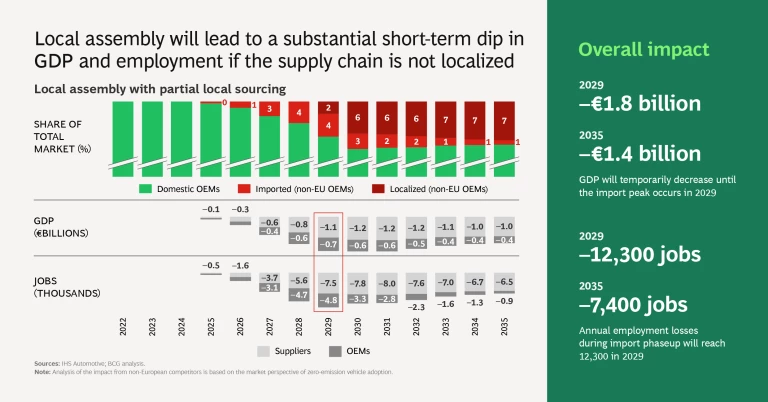

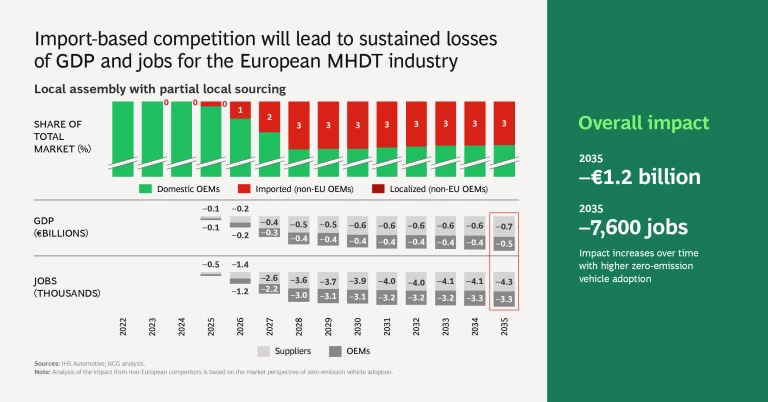

- The pressure on European truck makers could be compounded by the entrance of non-European players into the market, with the potential to reduce GDP by up to €1.4 billion and employment by up to 7,600 jobs (assuming that outside OEMs achieve a market share of 11% in the European market).

In the slideshow below, we analyze the economic impact of the two regulatory scenarios on GDP and employment development in Europe and reveal more about the effects of future ZEV adoption scenarios on individual segments of the MHDT value chain.

How the MHDT Industry Can Prepare

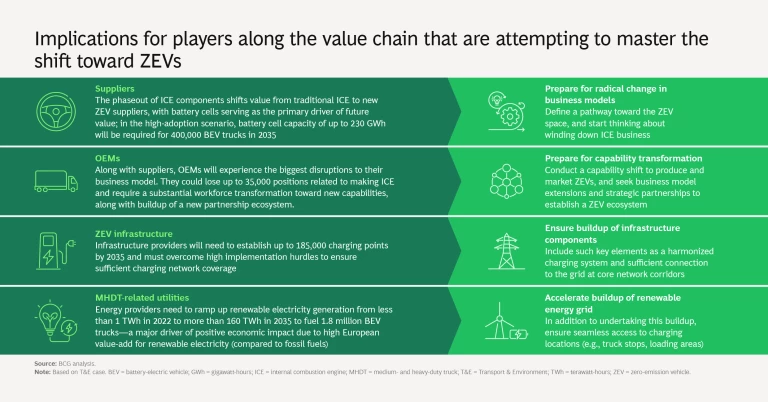

The anticipated disruptions are significant enough that European trucking industry players should start preparing now. Suppliers and OEMs should update their business models and redesign their workforces to build the capabilities needed for zero-emission trucks. Infrastructure players should begin building and scaling a harmonized truck-charging system, and utilities should prepare to construct a renewable-energy-powered grid to support it.

Regardless of the pace of change, some MHDT industry players will need to make large-scale changes to their product portfolios and operations. Others will have to scale up the physical infrastructure and electrical power network they need to support clean-energy vehicles.

Suppliers must radically change their business models. The switch from making ICE components and related parts to making battery cells, electric drives, power electronics, and related parts will require distinct new capabilities. Not all existing suppliers will manage the transition, creating opportunities for new competitors. Suppliers must define their pathway toward the ZEV space and start thinking about how to wind down their ICE business.

OEMs will bear the brunt of the disruptive shift to ZEVs. Along with suppliers, OEMs will experience the biggest disruptions to their business model. As a result, they must make similar radical changes. OEMs may also have to contend with new competition from foreign ZEV truck makers. To reorient themselves, OEMs must create a ZEV ecosystem that reaches beyond their existing relationships. They need to cultivate strategic partnerships with partners such as technology providers, charging station infrastructure operators, and utility companies, as well as other OEMs.

The changes that OEMs must make require a massive workforce transformation to provide workers with the skills they need to produce and sell ZEVs and support other new offerings. Training alone won’t fully meet demand. Companies must update their recruiting practices and talent pipeline to identify, recruit, and retain people with relevant capabilities and experience.

Infrastructure players must build and scale a charging network. If the T&E scenario plays out, Europe will need 185,000 charging stations for MHDTs by 2035. Infrastructure players must start rolling out a harmonized system of public and private charging stations that is linked to major European transportation routes. Ensuring that truckers can plug in to recharge wherever and whenever they need to will involve overcoming a number of hurdles to implementation, including lack of access to the existing electrical grid and to other infrastructure.

Utilities must speed up the development of renewable power capacity. Electricity is to charging stations what diesel is to traditional truck stops. Utilities must build up their generative capacity with enough renewable electricity to power future ZEV fleets. The estimated 1.8 million ZEV trucks expected to be on the road in 2035 under our high-adoption scenario will require 160 TWh of electricity—a massive increase from the 1 TWh of electricity that the commercial trucking industry used in 2022. MHDT-related utilities must work quickly to expand the existing power grid, using electricity produced primarily through wind or other renewable energy, and distribute it to charging stations at truck stops and elsewhere.

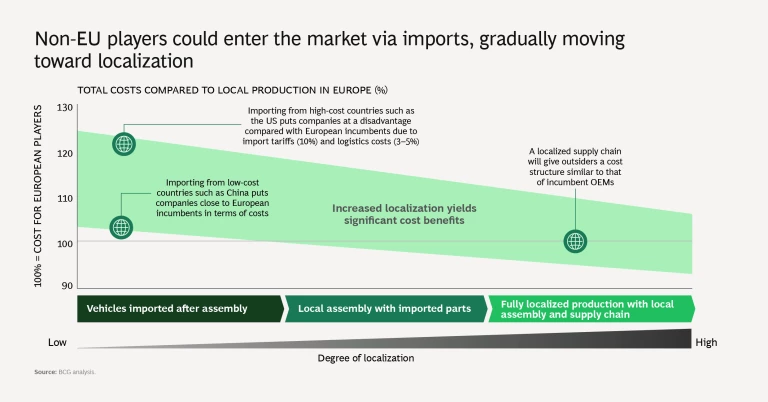

Non-European players entering the market will negatively affect European OEMs and suppliers. Although the ZEV transition will increase the number of jobs and the GDP for the European MHDT industry overall, the entry of non-European competitors into the market will reduce that impact. The loss of local jobs and GDP will be particularly acute if foreign competitors manufacture the vehicles or major components elsewhere and import them to Europe. Conversely, a model of full localization will be most advantageous for the region. Policymakers can influence the impact of non-European competitors by introducing protective measures such as import tariffs or local content requirements, offering subsidies for local production, and setting regulations to ensure that supply keeps pace with demand.

The transition to ZEVs is fast approaching. Getting enough ZEV trucks on the road in time to meet regulatory requirements calls for work across the value chain—from securing raw materials for batteries that will power electric trucks to generating enough electricity to keep them moving. All industry players have a vested interest in making the transition as smooth as possible. They can contribute to that effort by forging closer connections with existing partners and working with new providers. The shifts will create uncertainty, but they will also make the industry more robust and self-reliant, and ultimately create more value.