BCG’s latest survey of physicians and their preferences for patient and pharma company interactions finds a hybrid model of in-person and virtual engagement taking shape.

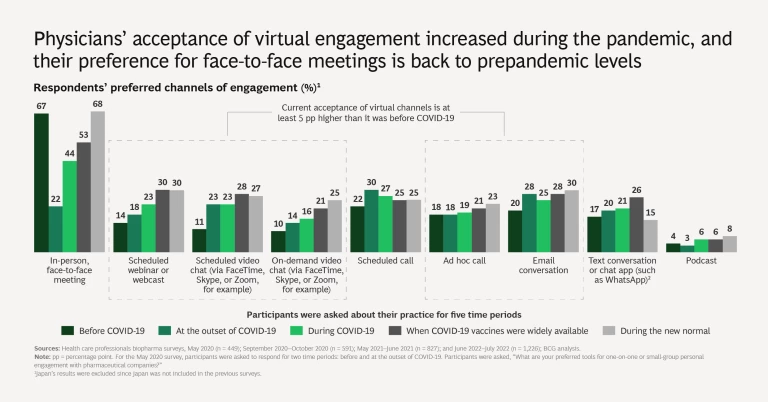

For health care professionals (HCPs), the new normal is hybrid. Virtual engagement channels are clearly here to stay: webinars, video calls, and telemedicine, in particular, are now firmly established as core channels for engagement. At the same time, face-to-face interactions between physicians and patients, as well as between physicians and pharma company representatives, have returned to prepandemic levels.

However, not all pharma companies have been able to adapt to the new hybrid model. Almost half of the 24 companies that BCG surveyed in late 2022 scored below average in digital delivery of content to HCPs over the past 12 months. Many companies have not put the necessary success factors in place. Considering that most HCPs have become comfortable adapting the channel of interaction to the medical or business need, pharma companies should accelerate their efforts.

In the third quarter of 2022, BCG surveyed more than 1,200 physicians in four major markets (China, Germany, Japan, and the US) about their interactions with patients and pharma companies. This is our fifth such survey; the previous four span the period from before COVID-19 until vaccines were widely available in 2021. (See “More About Physicians’ Evolving Views.”) The findings from the current survey can be found in the slideshow below. There are two main headlines.

More About Physicians’ Evolving Views

Physicians Want Hybrid Interaction with Pharma Companies

Face to face is back, and the acceptance of virtual channels remains high. Preference for in-person meetings with pharma reps has risen significantly from pandemic lows, and physicians also are much more open to virtual engagement than they used to be. In fact, physicians are now asking for hybrid forms of interaction.

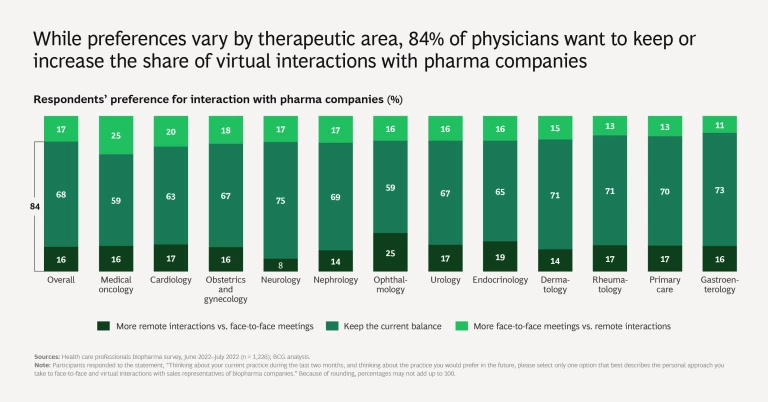

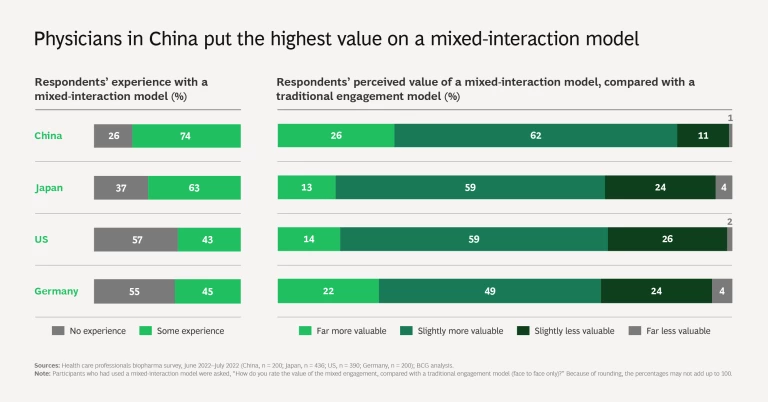

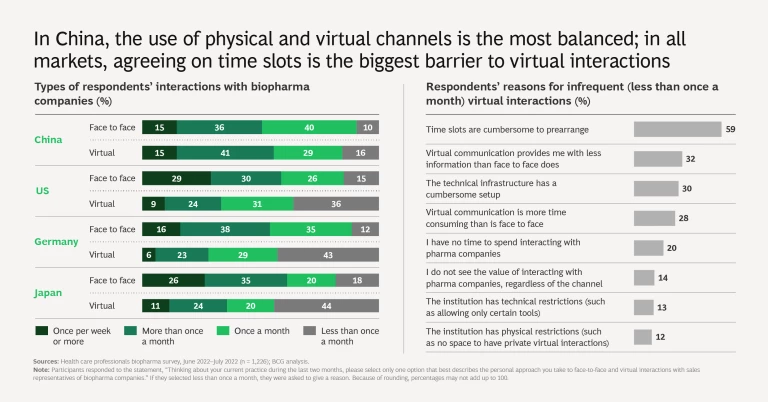

While we found some differences by therapeutic area, 84% of physicians overall prefer to maintain or increase the share of virtual interactions with pharma companies. Large percentages of physicians in all markets see more value in a mixed-interaction model, compared with traditional forms of engagement only. The US and Japan have the highest shares of once-a-week face-to-face meetings, while China has the most-even balance between physical and virtual channels. The biggest barrier to more use of virtual channels appears to be administrative: the difficulty of arranging a time slot for the call or meeting.

Overall, 84% of physicians prefer to maintain or increase the share of virtual interactions with pharma companies.

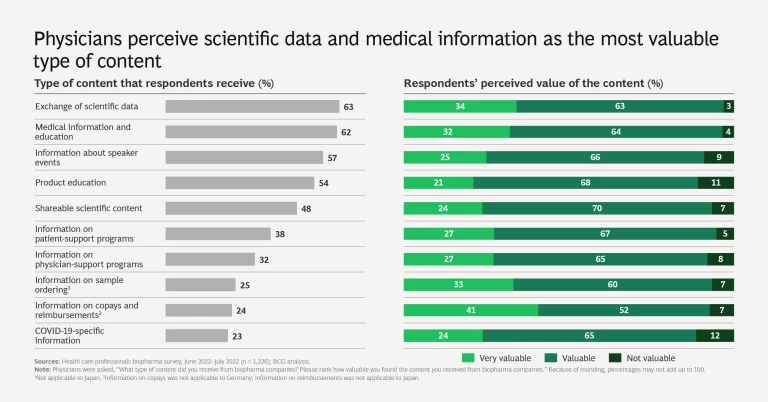

For their part, pharma companies have increasingly adopted a hybrid approach to communication and interaction with physicians, with face-to-face meetings remaining the anchor channel. But the right timing and content of digital communications is important. Physicians continue to cite too many emails and insufficient time to read them as their primary complaints about digital communication. Their biggest interest is in more scientific data and medical information.

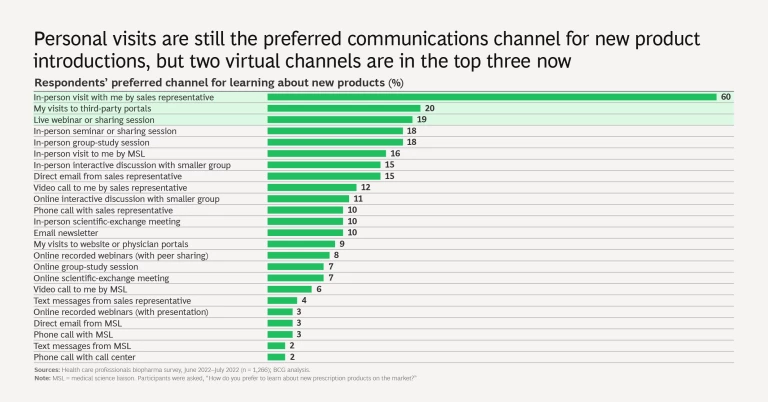

For new product launches, face-to-face visits remain key, followed by two virtual channels—third-party portals and live webinars. But for this purpose, physicians prefer personal visits by a wide margin.

Overall, pharma companies that interact more through digital channels tend to generate higher satisfaction—except among physicians with more professional experience (whom we can also presume to be older). They are a little less satisfied with digital communications than personal meetings.

The Pandemic Put Telemedicine on the Map

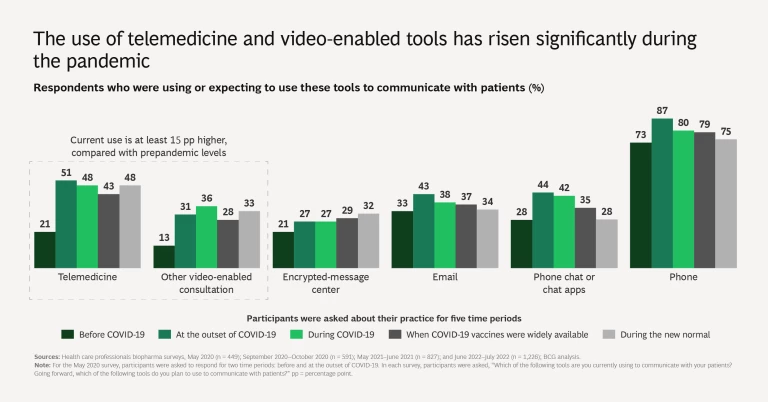

The use of digital channels between physicians and patients, especially telemedicine and those enabled by video, is significantly higher than before COVID-19, although it appears to have peaked. The share of virtual patient visits is now about 15 percentage points higher than pre-COVID-19 levels.

Markets differ in the balance of in-person and virtual care. Japan has the highest level of decision making during in-person visits, and China has the highest use of virtual channels.

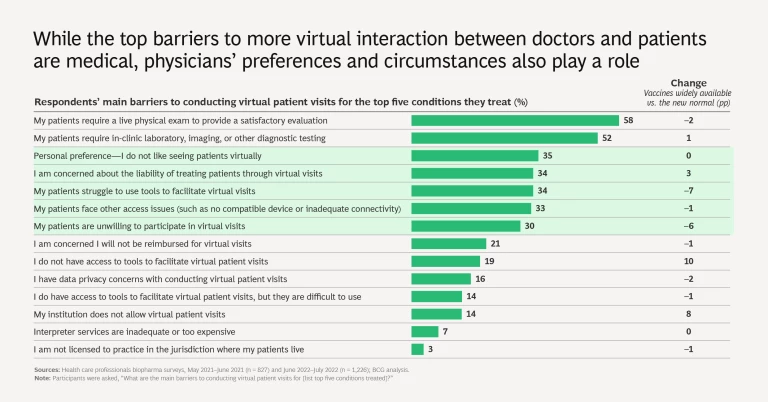

The two top barriers to more virtual patient visits are medical: the need for live physical examinations and in-clinic services. These show little change from 2021. The five next-most-common barriers (which also have not changed much) have to do with physicians’ and patients’ preferences. Physicians often prefer providing in-person treatment, and some are concerned about liability when treating patients virtually. Patients can struggle with accessing and using virtual tools, and many dislike virtual visits.

Here are the details.

Implications for Pharma Companies

It appears that physicians have settled comfortably into the new normal of a hybrid model. This has substantial implications for pharma’s engagement model of the future. The newest data underscores the following:

- Offering a variety of different channels, including those for both face-to-face and virtual engagement, is more effective than providing ones for face-to-face-only or virtual-only contact.

- Virtual models can drive increased efficiency—particularly for specific therapeutic areas, markets, or life stages of a product—making consideration of these factors important when setting the overall engagement mix.

- Companies should personalize the mix of engagement channels for HCPs. The use and timing of each channel should be based on consideration of physician preferences, behavioral patterns, and schedules, as well as practice-specific and regional factors.

- Companies should continue to collect engagement data, so they need to stay agile in adapting personalized outreach over time.

Subscribe to our Health Care Industry E-Alert.

Digital channels will continue to mature, and the hybrid model of engagement will evolve. Companies that have not shown success with the new model, or that have yet to realize the full value of omnichannel and

personalization

strategies at scale, need to redouble their efforts. Others should continue to adapt to changing circumstances to maintain the optimum balance between in-person and virtual models. Delivering the right content will continue to be key, but digital

infrastructure

and executional agility will also be essential as hybrid engagement continues to develop.