Knockoffs. Perhaps, you’ve seen them on Canal Street in New York City, or a friend has leaned over to you at a dinner party after your gushing compliment and whispered, “Oh, it’s not real.” It looks authentic at first glance, but the longer you look at it the more clearly you see that it's just not a Gucci, a Prada, a Louis Vuitton. Still a high-quality knockoff does have certain similarities that give you the flavor of the real thing.

A Good Imitation

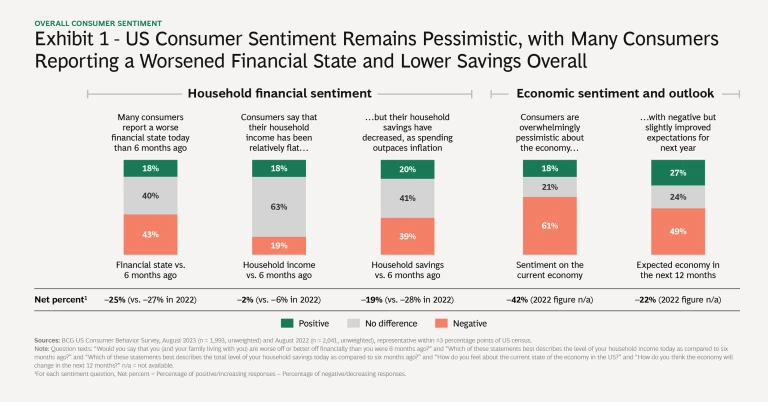

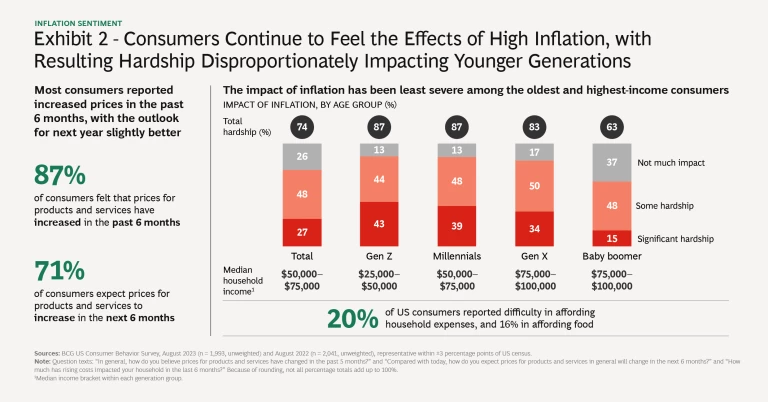

That's what we are seeing in the US economy. Although it has continued to elude falling into actual recession, many consumers feel that the economic situation is grim. In our most recent survey of US consumer sentiment, conducted in August 2023, 61% of consumers expressed pessimism about the economy today, and 49% remain pessimistic as they look ahead to the economic situation 12 months from now. (See Exhibit 1.) When asked about their personal financial position, 43% report that they are in a worse financial state now than six months ago. And the current inflationary environment has an even more far-reaching impact, as 74% of consumers say that they are experiencing some hardship or significant hardship due to inflation. That number is even higher for Gen Z and Millennials (87% each) and for Gen X (83%). (See Exhibit 2.)

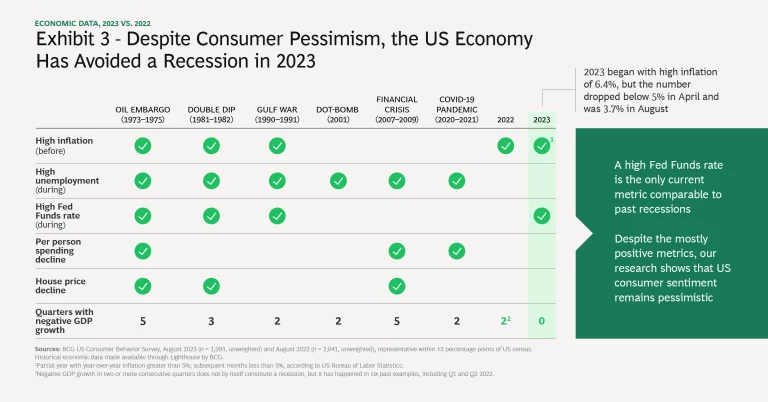

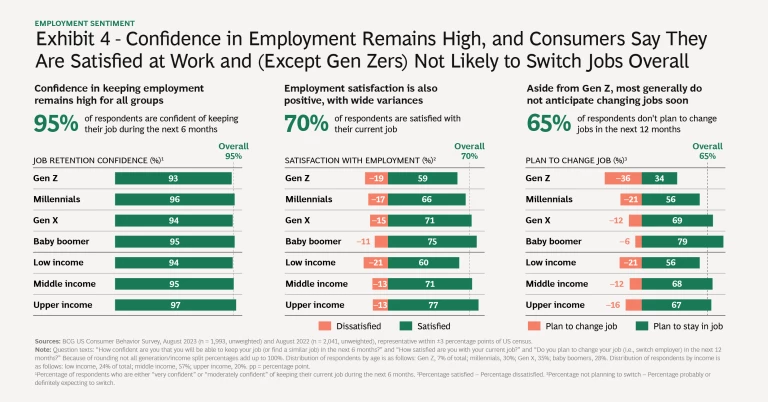

On the other hand, if you look at the typical indicators of a recession, only one of those common indicators—a higher Federal Funds rate— is clearly still in evidence today. (See Exhibit 3.) The US’s high rate of inflation in 2022 (8% on average) has cooled in 2023 from 6.4% in January to 4.9% in April to 3.7% in September. Moreover, the country has not experienced negative quarterly GDP growth, and unemployment continues to be low (3.8% in August). In fact, consumer confidence in employment is exceptionally high, with 95% of consumers confident that they will be able to keep their job or find a new one in the next six months. (See Exhibit 4.) Employment satisfaction is also strong, at 70% overall.

But It Feels Real

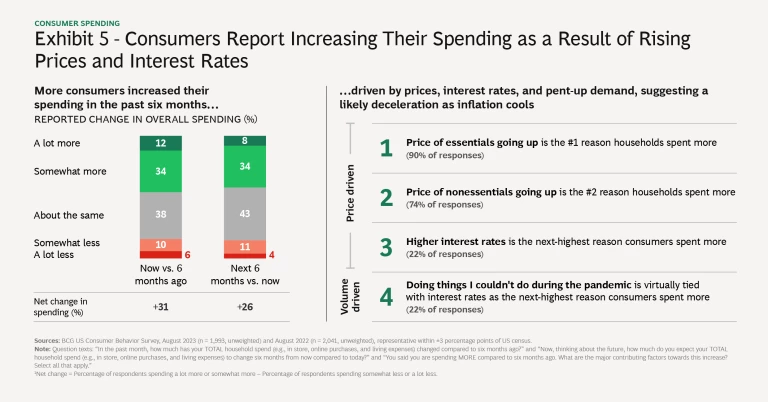

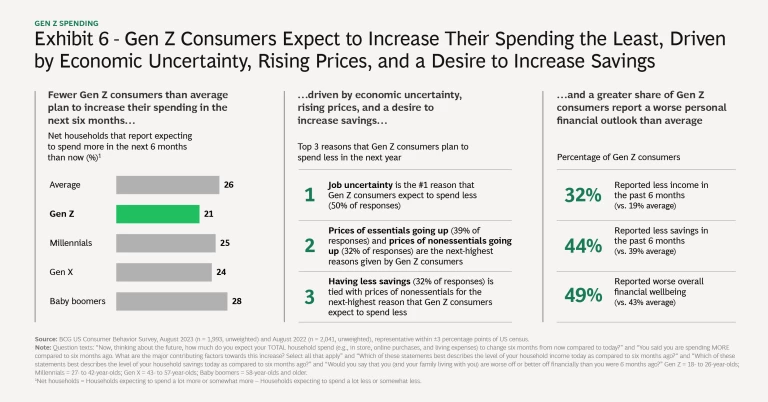

So, why are consumers feeling financially squeezed? In our survey, 46% of consumers said that they increased their overall spending during the previous six months, primarily in response to rising prices due to inflation. (See Exhibit 5.) Further, 90% of consumers noted that this was due to price increases of essential purchases, while 74% claim that it was due to price increases on nonessentials. A smaller percentage of survey respondents (22%) also blamed rising interest rates for driving up spending. Unsurprisingly, the youngest generation surveyed—Gen Z—reported facing a worse financial outlook than other generations did. They also said that they expect to increase their spending the least, driven by economic uncertainty, rising prices, and a desire to increase savings. (See Exhibit 6.)

A Lot Like the Original

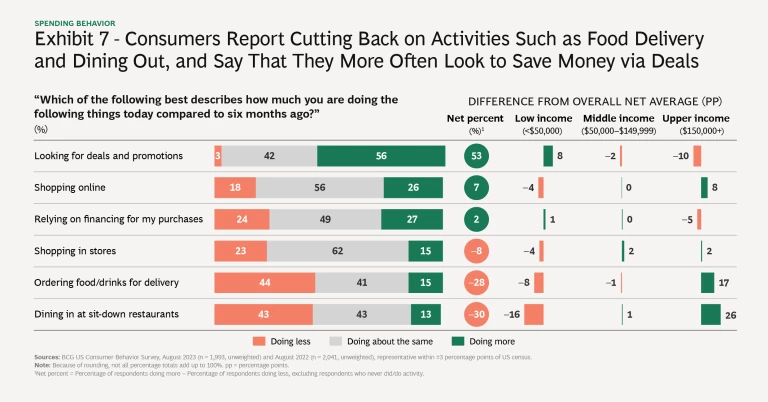

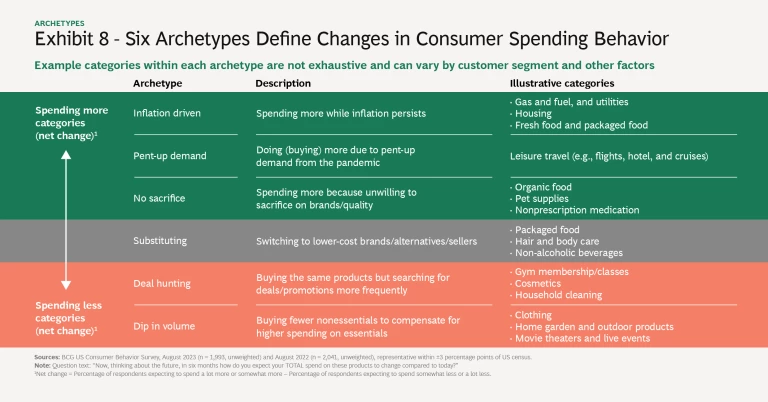

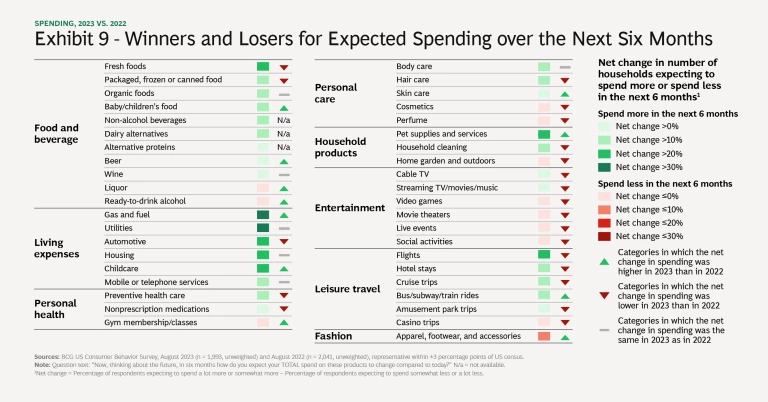

Like a good imitation, most consumer behaviors match what we would see in an actual recession, continuing the trends that we saw in our August 2022 survey. Consumers are spending less in such categories as clothing, food delivery, dining in restaurants, and out-of-home entertainment (for example, movies and live events). (See Exhibits 7, 8, and 9.)

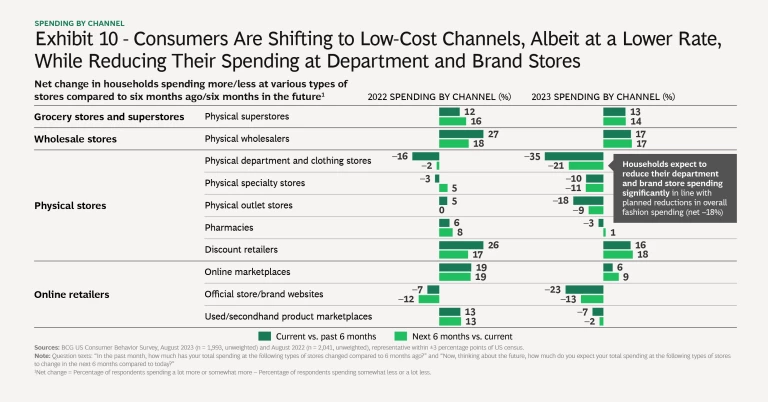

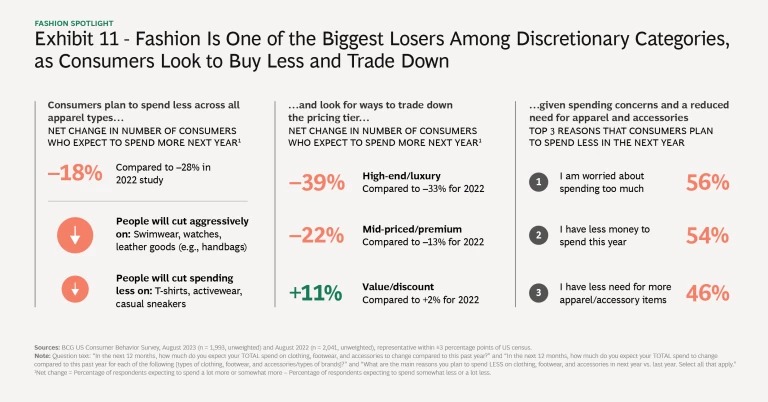

We also see more evidence of deal hunting, with consumers saying that they plan to decrease their spending at department stores and branded stores, instead shifting to low-cost channels such as discount retailers, online marketplaces, and wholesalers. (See Exhibit 10.) One of the hardest hit categories is fashion, where we see consumers looking to spend less and to trade down in light of spending concerns, a belief they will have less money this year, and a reduced need for apparel. (See Exhibit 11.)

The areas where spending is increasing are also those we would expect to observe in an actual recession. Consumers are increasing spending on essentials such as gas, food, and utilities, and they cite inflation as the primary driver. Consumers also continue to isolate a small set of “no sacrifice” categories in which they will not decrease spending despite harder economic times; these include organic food, nonprescription medication, pet supplies and services, and health food (for example, dairy and protein substitutes).

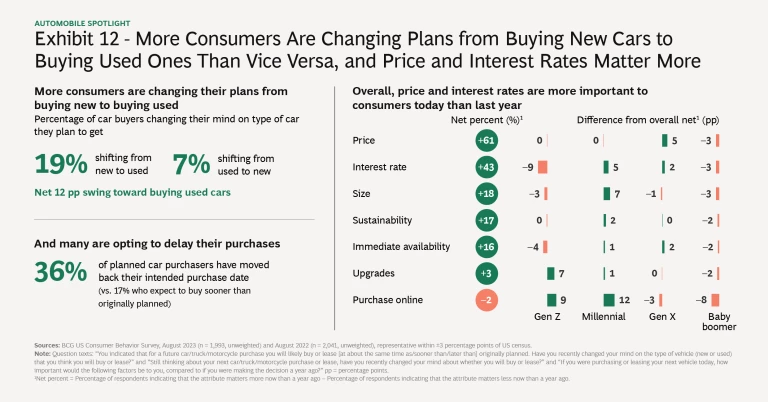

In automotive, more consumers are switching plans from buying a new car to buying a used one than vice versa. (See Exhibit 12.) We also see more consumers planning to delay their intended automotive purchase date (36%) than planning to move it forward (17%). And when asked what factors are most important in purchasing or leasing a car today compared to a year ago, more consumers note price (61%) and interest rate (43%) than any other attribute. Size is the third-most mentioned attribute, although just 18% of consumers cite it.

On the other hand, leisure travel is a discretionary category that usually faces declines when the economy softens—and yet in today’s economic environment we see a net increase in consumers who plan to spend more on travel in the next 12 months. (See Exhibit 13.) We observed this pent-up demand in our August 2022 survey, and we continue to see it today. In fact, in the travel subcategories of flights, hotels, cruises, amusement parks, and business/trains/subways, more consumers in our survey said that they will spend more in the next 12 months than said that they will spend less. Consumers cite rising prices due to inflation as one reason why they are spending more on travel (36%), but they also note that they are continuing to make up for lost time (33%), spending on things they couldn’t do during the COVID-19 pandemic.

At a Lower Price?

If you ask consumers today about the knockoff recession we’re having, they will tell you that it’s a very good fake. In fact, 49% of the consumers we surveyed believe that we are currently in a recession, and 66% are worried that the world will struggle with a long-term economic recession. Aside from feeling pessimistic, many consumers are behaving as if we are in the midst of a genuine recession—cutting back on spending in key categories, shifting spending to lower-cost channels, deal hunting, and spending more in essential categories as a way of coping with inflation. But because the economy is hanging on and employment numbers continue to be strong, this knockoff has so far cost consumers, and the US economy as a whole, a lot less than the real thing—just as any good imitation should. The big question is, will that state of affairs last?

About the Research

Legal Context

About BCG’s Center for Consumer Insight (CCI)

We would like to thank our key contributors for this article:

- Global consumer recessionary behavior team: Ryan Chung, Matt Simons, Anna Todd, Saurabh Chaddha, Ashish Chadha, Harshit Agarwal, Prabhakaran Santhana, and Aryan Rana

- Practice leadership: Jean-Manuel Izaret and Niki Lang

- Knowledge team: Kelly Kutas

We also thank BCG’s Center for Customer Insight (CCI) team globally.