Loyalty programs are more popular with consumers than ever, having improved significantly in recent years with enhanced personalization, digital offerings, “gamification” (elements of game play or challenges), and paywalls. A new BCG survey shows that, among US consumers, those that participate in loyalty programs belong to an average of 14 free and paid programs—primarily in the grocery, mass retail, travel, and media industries. (See “Our Survey Methodology.”)

Our Survey Methodology

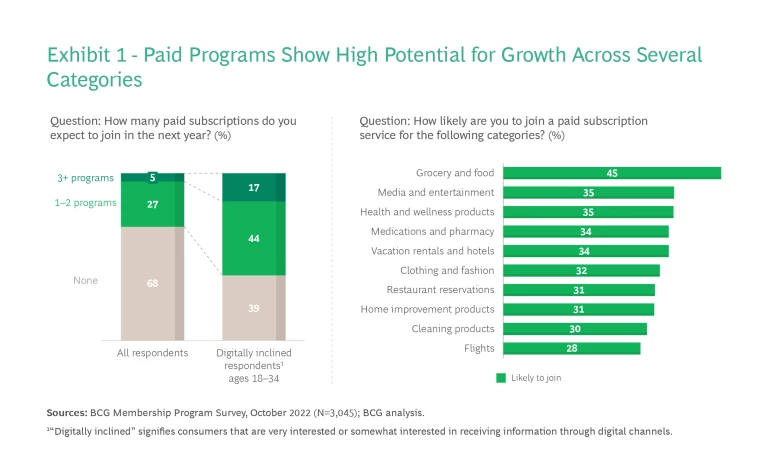

Paid, or membership, programs in particular are gaining traction. They grew rapidly during the pandemic as consumers increasingly turned to online channels for shopping and engagement. And there is still room for growth. Over 60% of consumers under 35 who are digitally inclined say they expect to join at least one new paid program in the coming year—and 17% expect to join three or more.

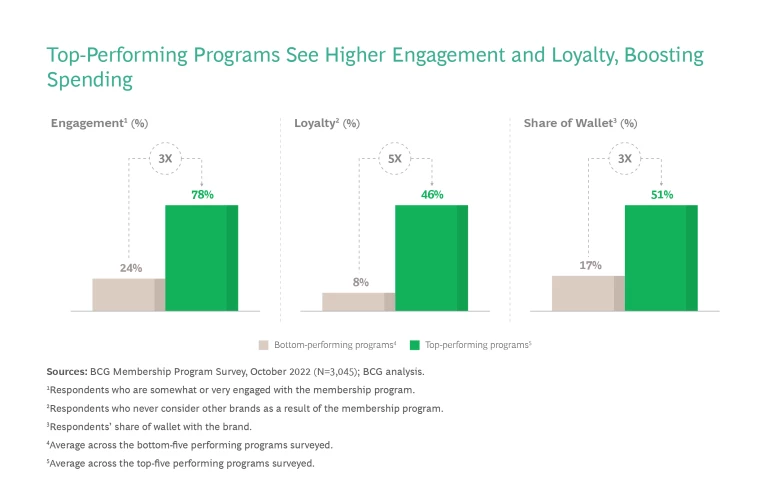

Companies have good reason to get these loyalty programs right. Our survey finds that programs receiving the highest rating for engagement and loyalty can have up to three times the percentage of customers who feel highly engaged with the business vis-à-vis less-successful programs—and as much as five times the percentage who feel loyal to the company. These programs also see an average 35 percentage points greater share of their customers’ wallets.

Achieving such performance requires thoughtful program design, contextualized to a company’s customer base and environment. It’s not enough for companies to simply “copy and paste” the programs of others. Instead, they must develop distinctive programs that fit specific, focused objectives and take into account factors such as the business’s market position, product context, and customer needs. While most loyalty programs are easy to launch and will typically get some level of traction, only those that are genuinely grounded in specific consumer preferences and expectations will deliver high loyalty and engagement and low attrition rates over time.

The Value of Successful Loyalty Programs

Whether promoting coffee sales, ride-hailing services, or credit card usage, loyalty programs are not simply a sidebar for consumer-facing businesses: they are a way for companies to engage with every single customer in their ecosystem. In sectors with high-frequency customer interactions, such as the restaurant, credit card, and beauty industries, the accumulated customer data alone can often justify investment in a loyalty program—particularly as these programs don’t just help businesses collect and store valuable data; they offer an avenue to monetize it through highly personalized engagement with members.

In addition, loyalty programs can increase customer stickiness and boost spending, with top-performing programs in this metric seeing over 50% of their members spend more with the brand. They can help introduce new revenue streams and trial new offerings, extending the brand. And they can even help businesses acquire new customers, often through strategic partnerships.

Emerging Trends

Loyalty programs have evolved over the years, becoming more experiential and customized. Partnerships play a bigger role today and are likely to continue expanding. And many programs are designed not only to hit financial targets but also to capture customer data. At the same time, as consumers’ expectations evolve, they are increasingly willing to pay for a more rewarding experience.

Paying for Rewards. Membership programs continue to increase in scale and impact, enabled by businesses’ growing data and analytical capabilities. Ample opportunities still exist for companies to launch new paid membership programs or introduce paid options to their current programs, especially in industries where customers have expressed an interest. (See Exhibit 1.) Even beyond those industries, however, we expect to see more programs generating meaningful results in terms of loyalty and engagement that boost top-line growth. Such programs are even being offered today in industries not traditionally known for membership programs, such as restaurants and automotive brands .

Greater Customer Engagement. Several consumer-facing brands have been experimenting with new program models and engagement tactics in recent years. In particular, we find a growing trend in programs that work to build deeper customer connections through partnerships and communities. These programs can create value for customers that is not tied to the cost of a company’s product offerings. More important, they allow businesses to use first-party customer data in increasingly sophisticated ways.

Walmart, for example, has strategically partnered with Paramount Global to offer Walmart Plus members free access to the Paramount Plus media streaming program. This makes Walmart Plus competitive with the likes of Amazon Prime, while also introducing new members to Paramount’s streaming service.

Disney, in turn, is exploring opportunities to build seamless connections across its physical and digital offerings, such as extending special discounts on Disney World resort hotels to members of its Disney+ streaming service. In late 2022, the company also launched a test run of a new shopping opportunity that allows Disney+ subscribers to purchase exclusive Disney merchandise online.

Taking a different tack, Sephora and Lululemon are using their membership programs to build communities with their customers through in-store workshops and wellness and beauty events. Such communities can strengthen customers’ emotional connection with a brand and promote brand loyalty organically. The 17 million customers who are registered for Sephora’s Beauty Insider Community, for instance, can engage with each other by asking questions, joining challenges, swapping tips, and sharing photos of their “new looks.” Meanwhile, Lululemon offers access to live events, such as community runs and pop-up yoga classes, to both its free Essentials membership program and paid Studio program, along with the program’s more traditional benefits.

Diverging Program Effectiveness

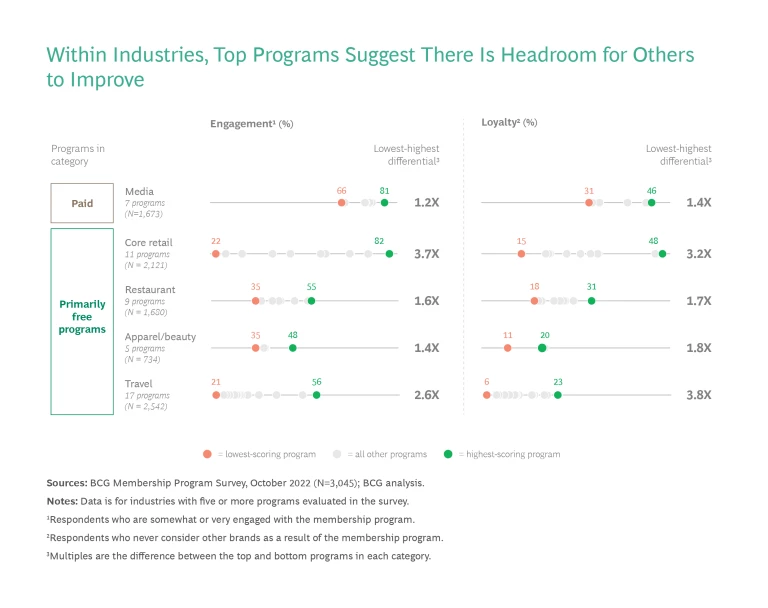

Given the ongoing growth and popularity of loyalty programs, many companies are looking to launch or renew. However, designing a successful program is not a simple task. Our survey finds that program performance—as measured by customer loyalty and engagement—varies widely across businesses and program types and even across the same industry. For example, the amount of members who consider themselves to be very or extremely engaged ranges from 22% to 82% of our respondents in grocery and mass retail, with similarly wide ranges of members saying they are loyal to the brand.

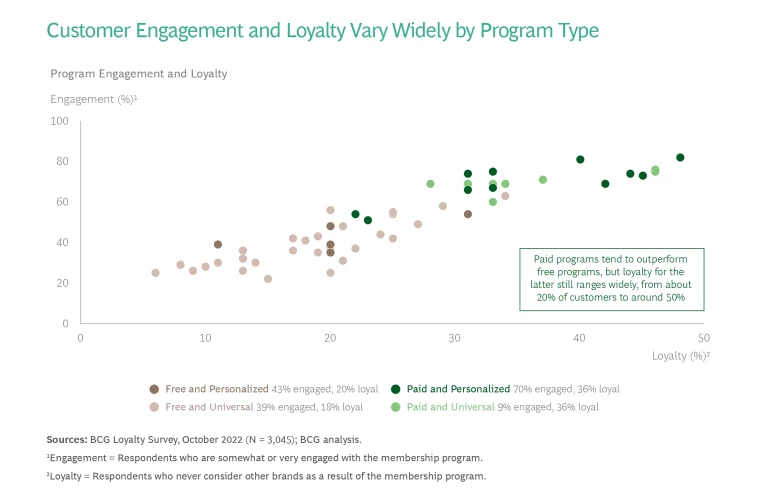

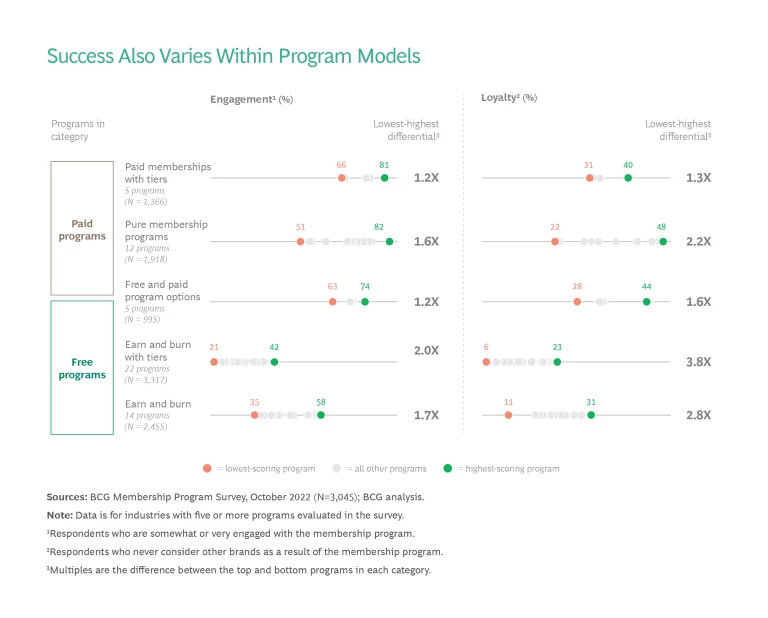

When looking to generate higher engagement and loyalty among free membership programs, we find that personalization is the leading tool for success. However, free programs do not perform as well across engagement and loyalty metrics as paid personalized programs, on average. In fact, top-performing paid programs score 24 percentage points higher in loyalty and 33 points higher in engagement than the average program overall. (See the Slideshow.) One reason is that paid programs help customers feel invested in the program through the fees they pay. Another is that paid members self-select the programs with which they are most likely to engage.

Nonetheless, we find a range of performance results even within paid programs. While fees may be a successful way to engage customers, they also come with a high bar for satisfaction. For a paid program to reach scale and generate meaningful customer engagement, the program has to deliver the benefits it promises and provide perceived value to the customer. If it does not, high attrition rates are the likely outcome.

Value Goes Beyond Money

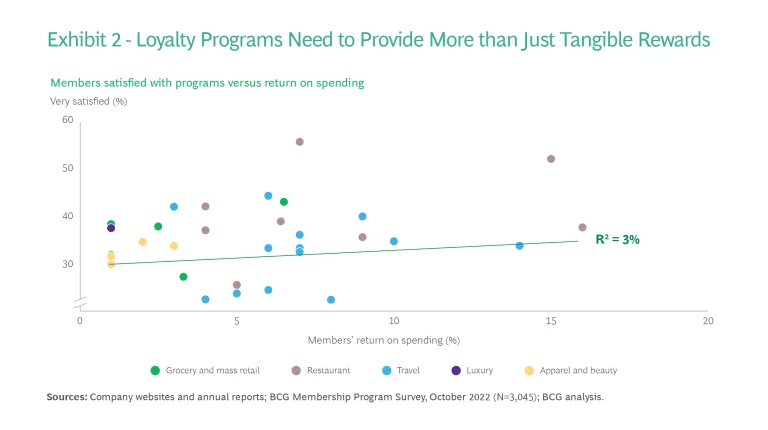

Perhaps surprisingly, the perceived value of a loyalty program is not necessarily monetary. Whether a program is fee-based or free, customers want more than financial rewards. In fact, our survey finds a low correlation between members’ return on spending and their satisfaction with the program. (See Exhibit 2.)

The implication is that monetary rewards alone—such as discounts, coupons, and freebies—are not enough to change customer behavior in today’s environment. Customers expect a higher level of personalization, and they want community-based benefits. In addition, the primary reasons customers say that they cancel programs (beyond the cost) include a lack of rewards that are relevant to them and a lack of digital presence and community.

Companies should therefore consider a broad spectrum of potential benefits and rewards when designing a program. Many potential benefits are cost-free (or very low-cost), yet offer convenience to customers, motivate users to download the brand’s mobile app, and create deeper engagement and loyalty.

Getting It Right Through Thoughtful Design

Loyalty programs are a major tool for businesses to communicate their brand and value proposition. They play an important role in enhancing the customer experience . And they are a critical mechanism for understanding customers in order to better serve them.

Programs therefore need to be designed with very specific, focused objectives in line with the brand’s overall strategy. Is the main objective to increase customer engagement and loyalty? To add new revenue streams or increase share of the customer wallet? Is it to increase purchasing frequency or average basket size, or both? There are many different ways that brands can use their loyalty program to produce results for the business—and many different tools for reaching those objectives.

To be successful, a loyalty program must offer simplicity, personalization, and a frictionless customer experience—while keeping program economics sustainable.

Note that a mobile-first and frictionless cross-channel experience—where membership is automatically recognized on a device, in-store, and online—will allow customers to shop seamlessly. Gamification, in turn, will boost engagement with the brand and motivate desired behaviors, while a sense of community will encourage consumers to interact with the brand—and sometimes one another—more frequently. Partnership reciprocity, such as buying from one company and getting a coupon from a partner company, will help keep the brand top-of-mind for consumers even while they are experiencing another brand’s products and services. Finally, program ecosystems that encompass member communities and partnerships will help boost loyalty and reduce the likelihood of a consumer considering a competing brand.

Subscribe to our Marketing and Sales E-Alert.

As businesses begin to sketch out a new loyalty program or consider upgrading an existing one, they should keep in mind that any successful program needs to achieve simplicity, personalization , and a frictionless customer experience—while keeping program economics sustainable. And even the best-designed program must be supported by high-quality products and delivery if it is to succeed.

Companies should begin by asking themselves some key questions:

- How should our market position and long-term strategy shape the vision and objectives for the program?

- Which customers are we designing for? Existing? Potential? Particular income levels or age groups? And what will truly affect their behavior?

- How can we use the program to differentiate ourselves?

- How does our perceived product value shape the benefits we should offer, such as discounts, recognition, and exclusivity?

- Is the design going to be durable over time as customer behavior changes?

- What tangible benefits can we give customers that provides the highest value at the lowest relative cost?

Consumer spending has proven unpredictable for many sectors in recent years, and many loyalty programs may be designed in a way that no longer reflects reality. We therefore expect to see continued evolution and innovation in these programs. In the process, businesses should always remember that loyalty from customers is hard to earn—and easily lost. Those that invest in getting both design and execution right have a tremendous opportunity ahead.