Part fashion, part status symbol, part mechanical art, luxury watches over the years have won admirers for their craftsmanship and style. Today, the secondhand watch market is commanding more recognition than ever as a result of growing buyer interest and a shortage of the best models. Interestingly, the recent boom has less to do with style than with money.

Luxury watches are in demand as alternative investments. Buyers are paying high premiums for preowned models from top brands such as Rolex, Patek Philippe, and Audemars Piguet, as well as from leading independents such as F.P.Journe and De Bethune, with the expectation that the value of these watches will continue to rise.

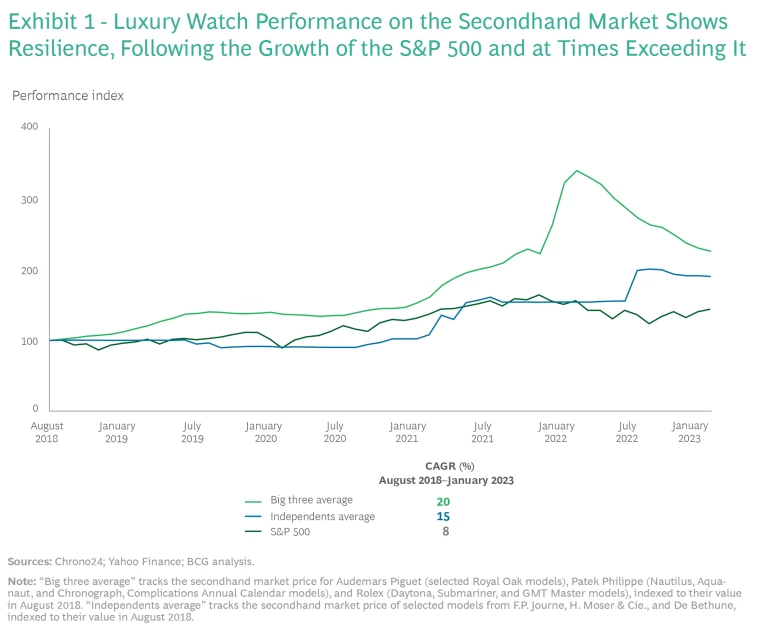

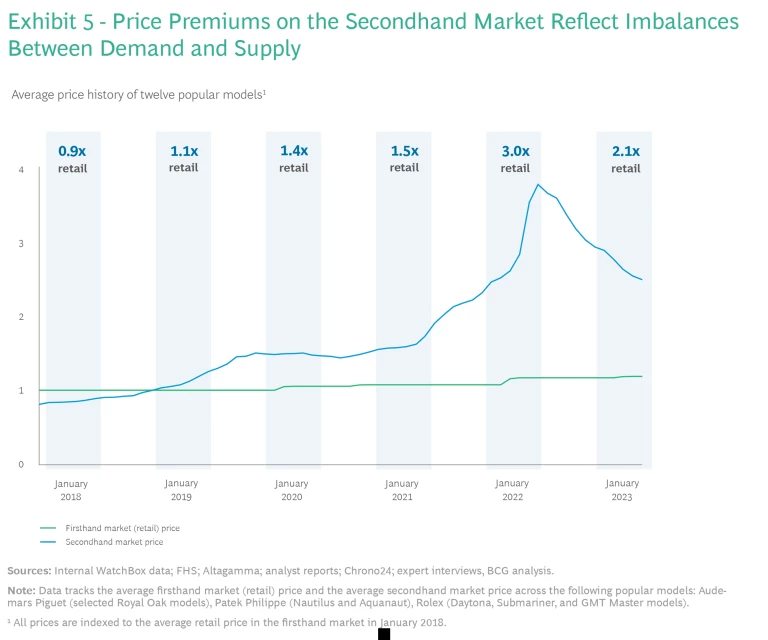

They have reason to believe. Luxury watches have performed well, especially over the long term, in comparison with traditional investment categories. From August 2018 to January 2023, average prices in the secondhand market for top models from the three largest luxury brands—Rolex, Patek Philippe, and Audemars Piguet—rose at an annual rate of 20%, despite broader market downturns during the pandemic, compared with an annual rate of 8% for the S&P 500 index. Although prices declined during 2022, echoing declining stock market and cryptocurrency exchanges, watches have performed well relative to stocks. Luxury watch prices also outperformed the S&P during the 2007–2009 recession and took less than two years to recover from the 2008 market crash, while many traditional financial categories and consumer products categories took longer. (See Exhibit 1.)

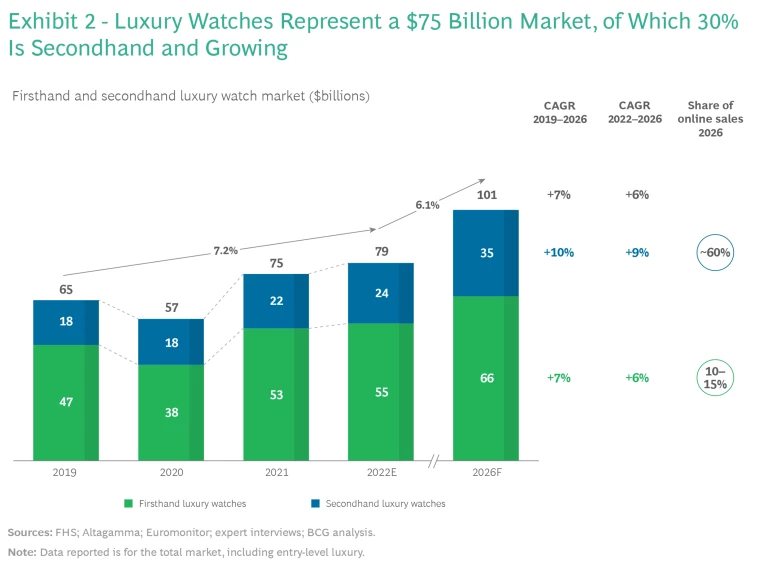

The positive financial performance has attracted new buyers, fueling market growth. Preowned watch sales reached $22 billion in 2021, accounting for nearly one-third of the overall $75 billion luxury watch market. The segment is growing faster than the firsthand market, and that trend is likely to continue. (See Exhibit 2).

The Investment Market for Watches Is Growing

The secondhand watch market once evoked images of back alley deals and discounts, with dubious authenticity and a high risk of fakes and fraud. Today’s market is transparent, fueled by online information sharing, supported by authentication services, and composed of knowledgeable buyers and established sellers. The secondhand market is essential for collectors who seek rare and special watches, given that nearly 95% of watches are no longer in production.

Younger customers are entering the market, inspired by the craftsmanship and mechanics of luxury watches, and lured by their investment performance. In a recent BCG survey of US consumers, watches performed well in comparison with traditional investments on a variety of measures, including price, level of risk, portability, and price transparency and

Third-party online platforms such as WatchBox, Chrono24, and Watchfinder have promoted the market’s growth, especially among Generation Z and millennial buyers who are comfortable buying online, by helping educate buyers, encouraging price transparency, and bringing buyers and sellers together. Online sales already exceed auction and store sales, and they are on a trajectory to account for close to 60% of the secondhand luxury watch market by 2026, according to our study.

Wealthy investors increasingly seek alternative investments to diversify their portfolios and to hedge against inflation. For these and other investors, luxury watches stand out as a class of alternative assets because of the strong demand for them and because they have generally delivered strong price performance in the market over the past five to ten years.

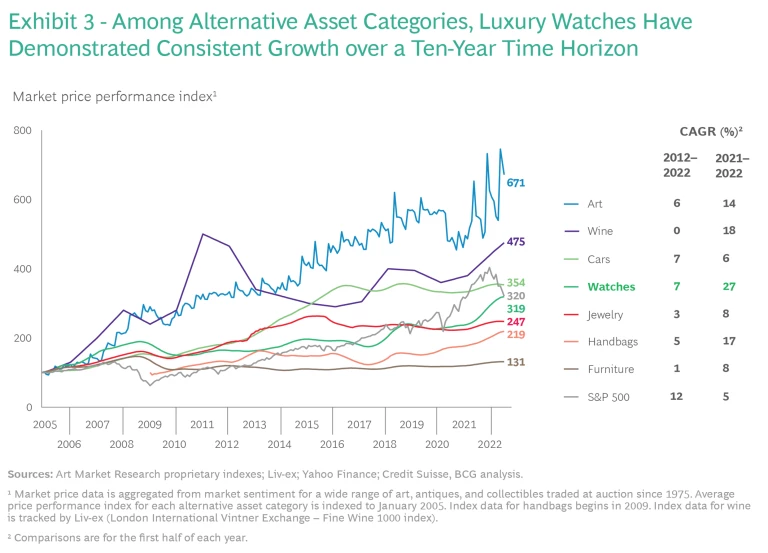

Investors also invest in watches to diversify their portfolios. Watch prices have tended to hold up well over the long term and during market downturns, compared with traditional financial investments, like stocks, and with other alternatives or collectibles. Buyers regard the category as a stable investment built on reputable brands and supported by a consumer base of high-net-worth individuals. In the ten-year period from 2013 to 2022, watches outperformed collectible assets such as jewelry, handbags, wine, art, and furniture, growing in value at an average annual rate of 7%—and by 27% from 2020 to 2022—according to indices that track these categories. (See Exhibit 3.)

New Watch Scarcity Increases the Value of Preowned Watches

The secondhand market used to be the place to go for bargains. That is still the case for certain watch models, but as some types of new watches have become nearly impossible to acquire through traditional retail channels—owing to higher demand and reduced capacity coming out of the COVID-19 pandemic—buyers have a better chance of getting them through the secondhand market, albeit at a hefty premium. Whereas most items drop in price as soon as they leave the shop, luxury watches tend to do the opposite, with resale value typically increasing for hard-to-find models from desirable brands.

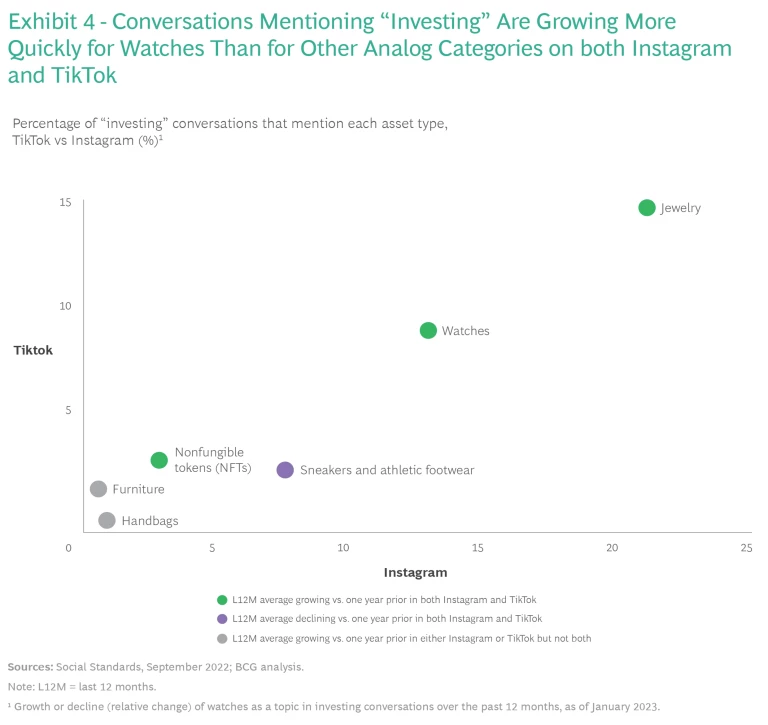

Investor attention has concentrated on a handful of models—Patek Philippe Nautilus, Audemars Piguet Royal Oak, and Rolex Daytona and GMT-Master II—following strong growth in online consumer conversations. (See Exhibit 4.) On the secondhand market, these models typically fetch up to 200% of firsthand market prices . Individual Rolex Cosmograph Daytona watches, with a retail price of $14,800, were selling recently on preowned watch exchanges for $24,250 to $38,500.

The pandemic and related product scarcity have contributed to the surge in unmet demand. In 2020, as sales in firsthand watch markets declined by 17% during the pandemic, sales of preowned watches rose by 3%, according to our market analysis. Preowned luxury watches traded at 1.5 to 2 times their retail prices during the pandemic. (See Exhibit 5.) In our survey, 29% of collectors reported paying more than the retail price for their most recent preowned watch, with top reasons citing new or minimal-wear condition (41%) and avoidance of long waiting lists in the firsthand market (40%).

Independent Brands Are Becoming Mainstream Collectibles

Several independent brands and models—especially those seen as high value, unique, or hard to find—are performing strongly, too, including F.P.Journe, De Bethune, and H. Moser & Cie. Sales are highest in the US and Europe, but the secondhand market is also active in Asia, where it has significant potential for continued growth.

The market for independent watches benefits from the industry’s limited production capacity, which enhances scarcity and collectability. For buyers, elements of the appeal include the high level of craftsmanship and the artisanal nature of manufacturers’ operations—which also make it difficult for the companies to increase production. Market perceptions of independent brands vary widely, but buyers tend to associate them with traits such as engineering and design excellence, timelessness, complexity, and exclusivity, according to our survey.

Who Buys Luxury Watches?

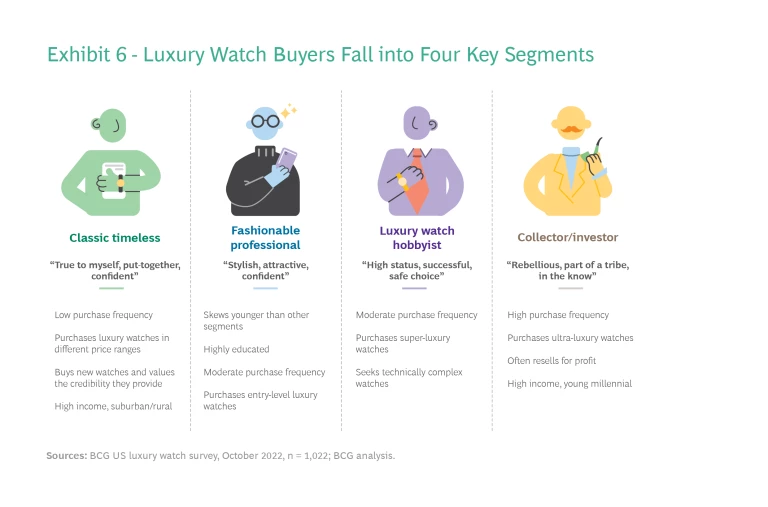

The typical luxury watch buyer is a high-income millennial or Generation X male, according to our survey. Individual buyers can be categorized in four general buyer types (see Exhibit 6):

- Classic Timeless. Classic buyers typically invest in traditional financial assets and appreciate durable, credible products. They purchase across price ranges and seek classic or timeless watches with a strong brand heritage or a distinctive design. They tend to be comparatively low-frequency buyers, however, and are the least likely to engage with the secondary market.

- Fashionable Professional. Buyers in this category are highly educated, stylish, confident, and, on average, younger than other buyer types. They are likely to purchase entry-level luxury watches. Professional buyers favor watches that are stylish and trendy, high quality, or have an exclusive image. Such buyers purchase with moderate frequency, but are comparatively likely to buy a watch within the next 24 months. Sustainability concerns are often the reason for purchasing a preowned watch. This segment is the second-most engaged with the secondary market; more than 50% of fashionable professional consumers have bought a secondhand luxury watch in the past 24 months.

- Luxury Watch Hobbyist. Hobbyist buyers prefer technically complex watches, with a strong brand heritage in the super-luxury category, where watch value is generally expected to increase over time. Moderately frequent buyers, hobbyists (77% of whom are male) tend to be status-conscious and successful. Much of the pleasure they find in purchasing a secondhand watch is in the hunt for a special item.

- Collector/Investor. Members of this buyer segment are the most active buyer group, on average, favoring ultra-luxury watches at a higher price point than other segments prefer. They represent 44% of watch buyers and claim a 58% share of the market by value. This segment is highly engaged with the secondary market, with nearly three-quarters having bought a secondhand piece in the past 24 months.

Subscribe to receive the latest insights on Consumer Products Industry.

Why Are They Buying?

One major reason that the secondary market has grown is clearly that consumers seeking investment opportunities are gravitating to it. In our survey, 54% of Gen Z and younger millennial buyers said that they had increased their spending on luxury watches during the previous 24 months, citing increased ease of buying and selling and more investment opportunities as their top reasons. Two-thirds, 66%, said that the anticipated retained value or value growth of the watch influenced their decision to buy. Half of the watch buyers we surveyed said that they expect to spend more on luxury watches in the next 24 months in response to new models and confidence in rising market prices, an indication of continuing positive momentum in the category and comparative price resilience despite the likely impending onset of a recession.

How Can Brands Engage with the Secondhand Watch Market?

It may be time for companies to consider adopting an integrated strategy that builds on the secondhand market’s ability to drive sales and strengthen the firsthand market’s reputation. The right approach can complement sales of new products, reinforce the brand’s value, and help the brand connect with future customers.

Given that many secondhand buyers are younger, this market is also an area that companies can investigate with the ultimate goal of building brand loyalty in this rising demographic. Understanding true demand should be a priority for companies seeking to manage the supply chain and their brand in an important forum.

Several large brands that initially regarded the secondhand watch business as a competitor and kept their distance from it have more recently recognized the potential of the secondhand market as a source of market insights and have begun to adopt an integrated strategy. For example, in 2018, Swiss luxury goods corporation Richemont SA, parent company of Cartier, purchased Watchfinder, Ltd., a preowned watch seller with a strong online presence. Audemars Piguet has launched a preowned watch business, and some established retailers are now selling preowned watches. At the end of 2022, Rolex announced its own preowned watch authentication program, which it operates cooperatively with authorized jewelers. Rolex’s official stamp of approval recalls the way the Gemological Institute of America certifies diamonds. This arrangement helps increase the value of preowned watches by certifying Rolex brand authenticity and whether any repairs were made with authorized parts.

These investments are among the strategies for dealing with the secondhand market that companies can adopt to extend their brand presence and customer engagement.

Monitor and participate in the market. Luxury watch companies can actively monitor the secondhand market and manage relationships with auction houses and marketplaces to protect their brand image. Efforts could include investing in authentication services, blockchain technology (for provenance verification), appraisal pricing, and customer service—all activities that could enable engagement with customers who might become lifelong fans of the brand.

Engage with new buyers. The secondary market is a place where new buying patterns surface, and it presents opportunities to understand the appetites and expectations of Gen Z, young millennials, and investors. Brands can increase their market presence and activity to further educate consumers about quality and value. They can use feedback to inform their product design and brand messaging, and they can leverage user-generated content to strengthen messaging around the story of the brand’s products or to encourage the association of watches with investing.

Enhance planning for increased demand resulting from secondhand growth. Brands can use different approaches within secondhand channels to understand true demand—for example, by cross-checking customer waiting lists or by tracking secondary market price trends. They can then use the information to enhance supply-and-demand tools, especially in the sales and operations planning process to pressure test for scenarios that may lead to oversupply or stockouts.

Invest in content, inspiration, and community building. Companies can develop a community strategy, including building online communities for watch enthusiasts, where like-minded consumers can share knowledge. This might include investing in inspirational content across social media and other digital platforms. Companies can digitize the brand experience via online avatars, NFTs, and other digital products to drive playful engagement and brand affinity.

Encourage private investors to continue to view watches as an alternative to traditional asset classes. The secondhand market has shown long-term growth and is likely to continue to grow. Individuals and other private investors can use watches to diversify their investment portfolios, hedge against inflation, and reduce overexposure in traditional asset classes. In addition to value retention and growth potential, the luxury watch market provides investors with sustainability benefits, longevity, portability, and personal enjoyment.

Luxury watches are drawing new interest from buyers, not only as stylish accessories for the status-conscious, but as alternative assets for savvy investors. Watches have compared favorably with stocks as well as with alternative or collectible asset classes—and buyers, especially newer watch fans in the millennial and Generation X demographics, are taking notice. Thanks to high demand and short supply of the best watch models, prices are strong, waiting lists are long, and the secondhand market is burgeoning and becoming increasingly sophisticated. Forward-looking watch brands with their eye on long-term brand management are examining the benefits of integrating their firsthand and secondhand market strategies.