Consumer brands are scouring the planet for markets that offer steady growth and new opportunities in today’s challenging environment. Yet many of them are overlooking a multi-trillion-dollar market right under their noses: the 1 billion consumers around the world between the ages of 50 and 70.

Why do many brands neglect mature consumers? First, they don’t understand them as well as they do younger consumers, and second, they harbor a number of deep-seated misconceptions about this demographic.

Global research conducted by BCG’s Center for Customer Insight on mature consumers clears up many of these myths. It also reveals that the return on investment (ROI) for marketing to mature consumers is far better than often assumed. Mature consumers have immense buying power, spend more than members of other age groups do on individual purchases, exhibit strong brand loyalty, are resilient through economic ups and downs, and wield surprising influence over younger consumers.

Mature consumers represent a massive opportunity that brands should no longer ignore. And as societies age, the demographic will continue to grow in size and importance for decades. Yet our research also found that these consumers are difficult to reach and persuade through conventional marketing techniques.

How can brands successfully engage mature consumers? One strategy is to target what we call “vibrant mature consumers”—the top 20% of spenders among 50- to 70-year-olds in each product category, who account for more than half of that age group’s purchasing. Brands must also approach mature consumers differently than they do younger consumers. In particular, they should design dedicated omnichannel customer journeys, communicate directly and personally, and focus on persuasion based on honesty and transparency. Brands should also rethink how they measure ROI, in order to gauge the full long-term value of mature consumers more accurately.

The Increasing Importance of Mature Consumers

Mature consumers control a substantial share of global consumer spending. In the 12 markets we studied—Brazil, China, France, Germany, India, Italy, Japan, Spain, Sweden, Thailand, the UK, and the US—870 million people from 50 to 70 years old are responsible for 27% of spending, around $7 trillion each year in the nine product categories we researched. In India, consumers in this demographic currently account for 15% of spending, a percentage that is rapidly growing. In China and the US, they account for 30%; and in nations such as Japan, UK, Germany, and Spain, 40%. (For details on how we conducted the research, see the sidebar, “Methodology.”)

Methodology

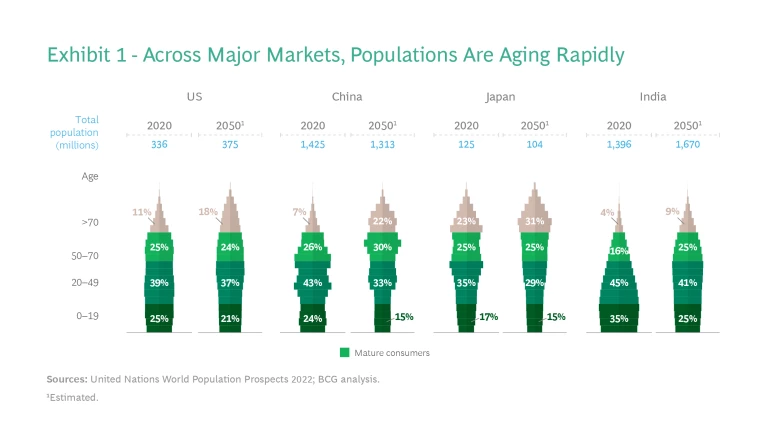

Aging will transform the demographic structure of every major market, even those with relatively young populations today. In China, for example, the percentage of the population 50 to 70 years old will grow from 26% in 2020 to 30% in 2050. In India, it will increase from 16% in 2020 to 25% over the same period. (See Exhibit 1.) The size of this opportunity will continue to grow, too: the population of 50- to 70-year-olds in the 12 nations we examined will approach 1.1 billion in 2050.

Our research also found that mature consumers are quite resilient and tend to have a different mindset from younger consumers. (See Exhibit 2.) One result of these differences is that mature consumers’ spending doesn’t vary as much in response to economic ups and downs. Only about a quarter of mature consumers regularly worry about their financial situation, for example, compared to nearly half of younger consumers. And almost nine out of ten mature consumers—compared with three out of four younger consumers—indicate that they have enough money to lead the lifestyle they want and that they don’t need financial support from their families.

Mature consumers expressed these sentiments most strongly in the US, the UK, and Germany. In markets such as India, Brazil, Italy, and Thailand, they still worry less about money than younger consumers, but the difference is smaller.

Mature consumers also indicate that they have more time on their hands and have a higher desire to travel than younger consumers do. In addition, they are interested in trying new things and desire to experience an adventure. These sentiments are true not only in the US and Germany, where mature consumers feel more financially secure, but also in India. Because they tend to be financially secure and resilient spenders, mature consumers are a highly valuable consumer segment—especially in times of economic uncertainty.

Myths That Cause Brands to Overlook Mature Consumers

Our research debunked several misconceptions that have caused many brands to pay insufficient attention to mature consumers. Prominent among them are myths that mature consumers spend less, don’t engage on social media, and have little influence—or even a negative influence—on younger consumers. Many marketers also wrongly assume they can effectively reach mature consumers with the same messages that work with younger consumers.

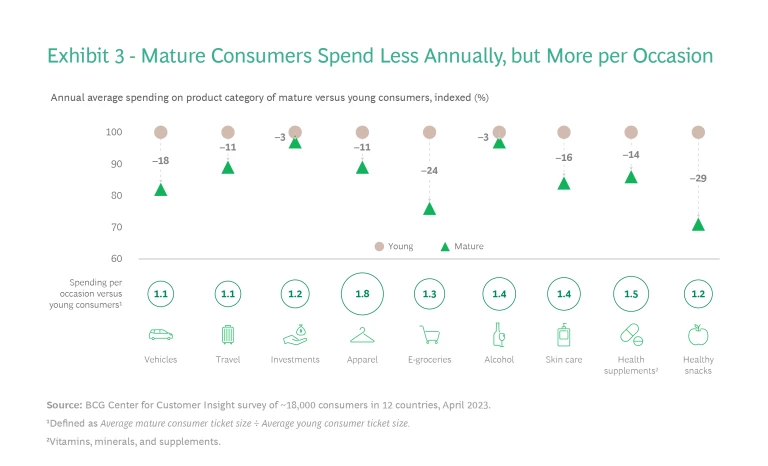

Let’s start with consumption. Although mature consumers do spend less overall each year in every product category, they spend significantly more on individual purchases in all of the categories we researched. (See Exhibit 3.) That’s because they tend to value quality more highly and therefore purchase higher-priced and more premium products. This is particularly true for big-ticket items such as vehicles, travel, and investments, but it is also pronounced in categories such as alcohol and apparel . This data suggests that mature consumers are a critical market for premium goods and services .

Mature consumers are also quite active on social media. Around 90% of them use social media platforms at least once a day. Consequently, brands can engage with mature consumers online, although how they structure that engagement may need to differ. Mature consumers tend to be more risk averse, and they especially value information that they regard as trustworthy. Messages that come directly from their personal networks or from accredited or recognizable brands help build trust.

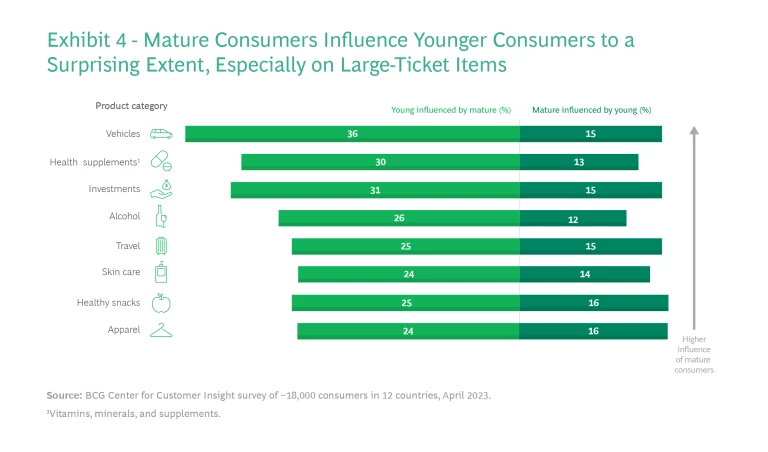

Brands also vastly underestimate the influence that mature consumers have on other groups of consumers. In fact, mature consumers are significantly more likely to influence younger consumers than the other way around. (See Exhibit 4.) In all of the categories that we researched, mature consumers project a “halo effect” on brands they choose—especially with respect to big-ticket purchases, such as investment products, vehicles, and leisure travel . In these product categories, many young consumers seek to tap the experience of their elders to reduce risks or receive validation for their choices.

Another misconception is that advertisements that work for younger consumers will work for mature consumers without alteration. Our study shows that brands may struggle to engage mature consumers through conventional marketing techniques. Appealing to this demographic segment requires a far more nuanced approach than simply adjusting the age of the actors and models used in advertising. We tested several different types of advertisements—some with older actors and others with younger actors. Neither approach works well with mature consumers unless the message itself is tailored to their interests and inclinations. Because mature consumers have a stronger preference for facts, brands should determine what those consumers truly value and relay targeted messages backed up with hard facts to engage them more effectively.

How to Engage with Mature Consumers

On the basis of our extensive research, we recommend five key strategies for successfully engaging with mature consumers. (See Exhibit 5.)

Identify and engage the vibrant mature consumer. One way to double down on mature consumers, our research found, is to target “vibrant mature consumers”—people whose purchasing patterns put them in the top 20% of mature consumer spenders. We call them vibrant because they generally tend to be happier, enjoy a more active lifestyle, and worry less about money than other mature consumers do.

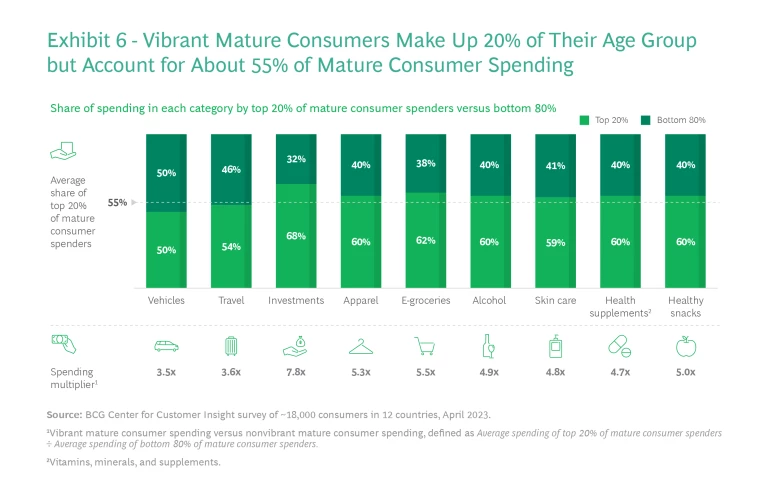

The commercial value of vibrant mature consumers is substantial: although they make up only 20% of all mature consumers, they account for a disproportionately large share of spending among their age group in every category we studied—ranging from 50% of spending on vehicles to 68% of spending on investment products. (See Exhibit 6.)

These findings suggest that brands can achieve a high ROI by focusing on this relatively concentrated community of active older consumers.

Design dedicated omnichannel customer journeys. Because mature consumers were relatively slow to adopt online marketing channels, many brands assume that they still prefer brick-and-mortar stores. Our research indicates that mature consumers do appreciate the ability to speak with real people: they are nearly twice as likely as younger consumers, for example, to prefer engaging live with a sales agent. But this inclination doesn’t apply all the time and at each stage of the shopping journey.

We found that mature consumers deeply value the accessibility, convenience, and ease of using online channels. Indeed, in some markets, mature consumers are more likely than consumers in the age group from 18 to 49 to use online channels. In the US, for example, 46% of mature consumers purchase apparel online, compared with only 36% of younger consumers. The use of online channels differs considerably by market, however. In China and Brazil, for example, only 30% and 39% of mature consumers purchase apparel online, compared to 45% and 55% of their 18- to 49-year-old counterparts.

Nonetheless, across a wide range of categories and contexts, online channels are an important means of reaching mature consumers. Brands must therefore consider how to engage with them differently online and how to design suitable dedicated omnichannel journeys for them.

Be direct and personal to guide purchasing decisions. Mature consumers are more risk averse than younger buyers, and they want to ensure that they have trustworthy information when making a choice. Direct, personalized interactions are extremely important to build trust and get sales over the line. One Chinese apparel consumer in the 50-to-70 demographic explained that quality is very important for her. She identified her trust in a store’s staff as the biggest factor in navigating the options to reach a purchase decision.

Most mature consumers prefer speaking to brands directly. Nearly half of mature consumers told us that they buy in a brand-controlled store, as opposed to a discount or multibrand store. By contrast, only one-third of young consumers prefer brand-controlled stores.

The good news for marketers is that creating human-like touch points to engage mature consumers is getting easier. Generative AI can help brands do this efficiently, removing roadblocks to accessing mature consumers.

Be honest and transparent in efforts to persuade mature consumers to trade up. Mature consumers have deep and resilient pockets and are willing to spend. But because they also have more experience exploring a category and making purchases, they are more discerning and more difficult to convince. When purchasing an alcoholic product, for example, one US consumer told us that he tends to disregard marketing, claiming that he “sees right through it.” Instead, he prefers to go to a store, receive honest information from a salesperson, and sample drinks before making a purchase.

While influencing mature consumers may seem difficult, brands have everything they need at their disposal. They should communicate the values that are important to the mature consumer in an honest and fact-based manner.

Rethink marketing KPIs to account for the value of mature consumers. Marketers often substantially underestimate the value that mature consumers bring to a brand. Such consumers can be harder to win over because in many cases they already have a trusted brand repertoire and are less likely than younger consumers to seek out new options. But this same quality makes them very valuable customers for the long term: once they decide on a brand, they tend to be more loyal than members of other age groups. And as noted earlier, their preferences influence the younger generation.

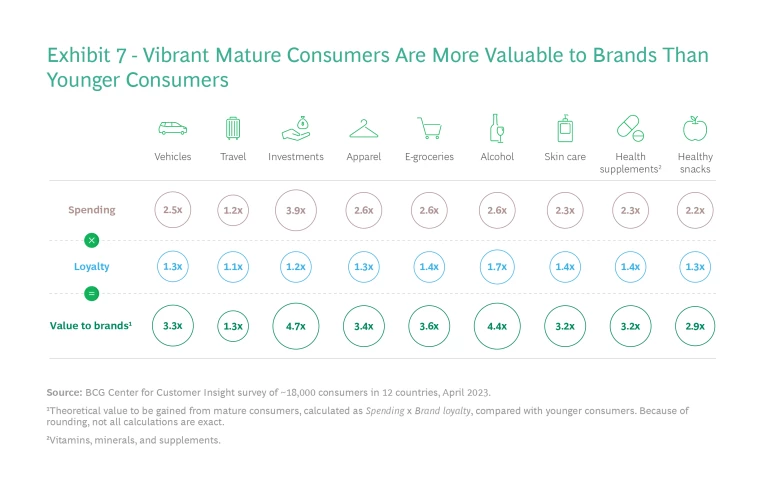

The value of vibrant mature consumers is especially great, thanks to their combination of high spending and high loyalty. We estimate that the average vibrant mature consumer is roughly three times as valuable to apparel, healthy snacks, health supplements, and skin care brands as the average young consumer, and more than four times as valuable to alcohol beverage and investment brands. (See Exhibit 7.)

Brands should therefore adapt their KPIs or develop new ones to ensure that they don’t underestimate the long-term ROI of mature consumers and to optimize allocation of their marketing budgets.

Mature consumers already constitute a crucial market across the world, and their importance will continue to grow. To engage them successfully, brands don’t need to create a separate sub-brand or new products. Instead, they should take strategic steps to appeal to this valuable pool of mature consumers. Brands that unlock the secrets to successful engagement have an enormous opportunity to win the long-term loyalty of one of the most lucrative—and currently overlooked—markets for decades to come.