Unlike many fast-growing consumer industries , medical aesthetics has proved highly resilient to economic downturns. The industry has been growing fast for the past ten years, and although that growth may decelerate in the short term, long-term prospects remain strong, with expectations of close to double-digit growth rates through 2027.

That said, manufacturers and investors can’t simply sit back in the current environment. The industry is changing, with evolving consumer and provider behaviors that players and investors need to understand in order to succeed.

A Foundation of Strong Growth—and More to Come

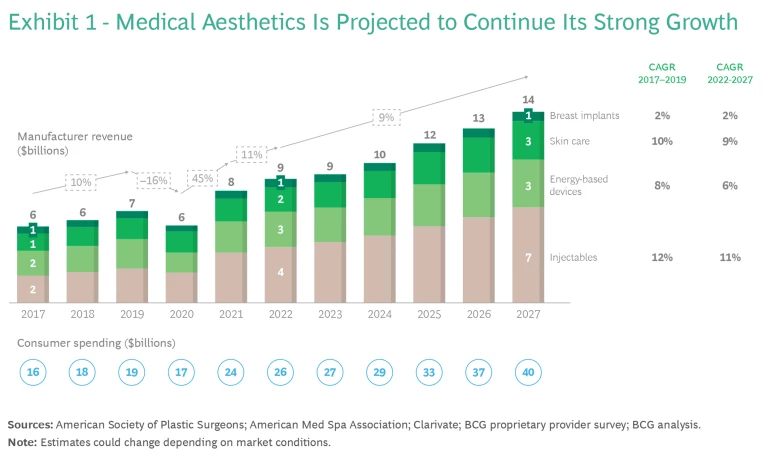

Revenue for US medical aesthetics manufacturers totaled about $9 billion in 2022 and has grown roughly 10% a year since 2017. (See Exhibit 1.)

Spending among consumers is nearly three times that amount—approximately $25 billion—as products and procedures get marked up to retail prices. In segments popular among younger consumers, such as facial injectables, growth rates can be as high as 12%. (For a breakdown of the industry, see “The Main Categories of Medical Aesthetics.”)

The Main Categories of Medical Aesthetics

- Injectables include neurotoxins and dermal fillers—both hyaluronic acid and biostimulators. Typically, neurotoxins are used to help minimize the appearance of facial lines and wrinkles (such as crow’s feet around the eyes), while dermal fillers are used to restore facial volume in areas like the cheeks and lips. New categories are emerging in the injectables space, such as fat injectables and platelet-rich plasma injectables.

- Energy-based devices have applications across three areas:

- Skin resurfacing, rejuvenation, or tightening: the devices can improve skin quality, smooth out imperfections, stimulate muscles, and spur the production of collagen or elastin, gradually improving skin tone and texture.

- Laser hair removal destroys hair follicles with highly concentrated beams of light.

- Body contouring breaks down fat cells to reduce cellulite and the size of subcutaneous fat pockets.

- Medical-grade skin care includes acne treatment, anti-aging products, facial cleansing and hydrating products, and chemical peels. These products are typically sold through medical channels such as dermatologists, since the products have been clinically tested.

- Breast implants for aesthetic purposes include silicone gel-filled or saline-filled sacs placed under the chest muscle.

There are three main reasons why medical aesthetics is poised to grow despite economic uncertainty: huge untapped market potential, significant investment from both private equity funds and manufacturers, and a track record of fast recovery from economic dips.

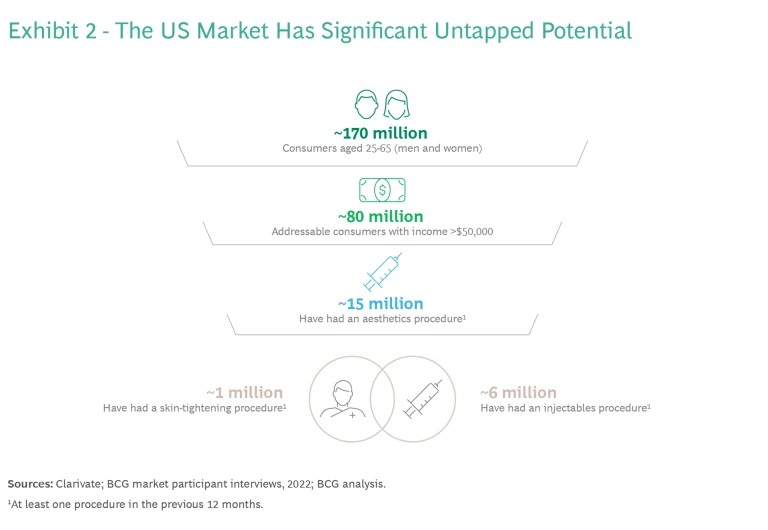

Untapped Market Potential. Only about 15 million Americans have had an aesthetics procedure, but the pool of potential consumers is nearly six times that amount—roughly 80 million people, according to a BCG Consumer Sentiment survey. (See Exhibit 2.)

Adoption will increase as manufacturers develop innovative products and services that can generate better results with less discomfort. New ultrasound technologies in skin tightening, for example, incorporate cooling systems that reduce pain and recovery time. Upcoming laser technologies are effective across multiple skin types and can treat disorders such as melasma more efficiently. These developments will likely draw new consumers and entice current customers to get more frequent treatments.

More affordable treatments will expand the market as well. In neurotoxins—a common entry point for medical aesthetics—new entrants have implemented aggressive commercial strategies with the goal of attracting younger consumers. Similarly, Ideal Image, a large chain of medical spas (“medspas”) in the US, set a base price in 2018 that was significantly lower than that of its competitors, generating higher sales volumes that more than offset the price cut. Lower prices at both the manufacturer and provider level are making medical aesthetics far more accessible.

Beyond price discounts, manufacturers are creating innovative go-to-market and consumer engagement strategies that will drive more traffic to providers. Skin care players, for example, are opening sophisticated storefronts near provider locations. Other players offer providers cooperative marketing and consulting support to improve financial outcomes. (For a breakdown of providers, “The Main Providers of Medical Aesthetics Services.)

The Main Providers of Medical Aesthetics Services

Medical aesthetics-focused plastic surgeons and dermatologists cater to consumers looking for a wide range of treatments; they are older (aged 35 to 55), primarily female (roughly 95%), and higher-income than other consumers.

Medspas (including physician-owned medspas, independent practices, and chains) cater to a wider cross-section of the population. Their consumer base is younger (aged 20 to 55), lower income, and includes more men (approximately 15%).

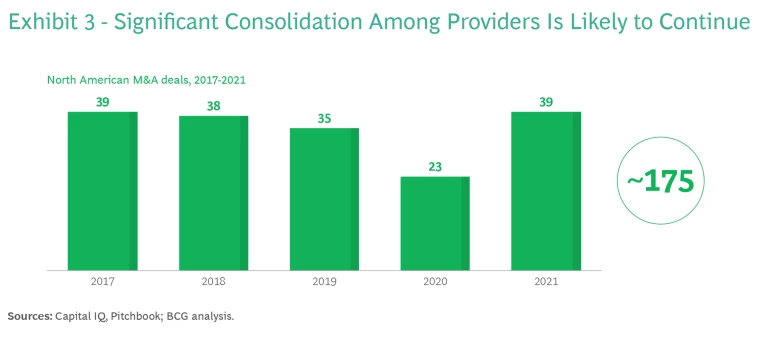

Increased Investment Activity. The second factor spurring growth is investments by both private equity firms and manufacturers. We estimate that over the past five years, approximately 175 M&A deals have closed, mostly involving PE buyers seeking to consolidate plastic surgery practices, dermatology clinics, and medspas. (See Exhibit 3.) By tapping into private equity capital and expertise, providers can market themselves more efficiently (including through digital channels), increase scale, improve margins, expand product offerings, and roll out new technologies such as virtual consultations.

US firm L Catterton, for example, acquired Ideal Image in 2015. Since then, the medspa chain has transformed its brand, broadened its service offerings, lowered prices, and opened new locations. Washington, DC-based Potomac Equity Partners has likewise bought up several aesthetics players (Laser MD Medspa, Sculpt MD, and Laser Gentle Medical Spa) with the goal of creating a cross-brand medical aesthetics platform, opening new medspa locations, and investing in operations , marketing , and technology .

In addition, manufacturers are deploying capital to expand their portfolio of products and services. This allows them to meet growing demand from providers seeking discounts and bolster cross-selling and up-selling opportunities. Galderma, the second-largest injectables player worldwide, acquired Alastin Skincare in 2021 to complement its Dysport and Restylane products. Similarly, in 2022, L’Oréal broadened its skin care portfolio by acquiring Skinbetter Science. This consolidation trend will have an impact on companies’ strategies moving forward, with single-asset players—such as Evolus, Prollenium, and others—potentially garnering higher valuations as attractive targets for manufacturers seeking diversification.

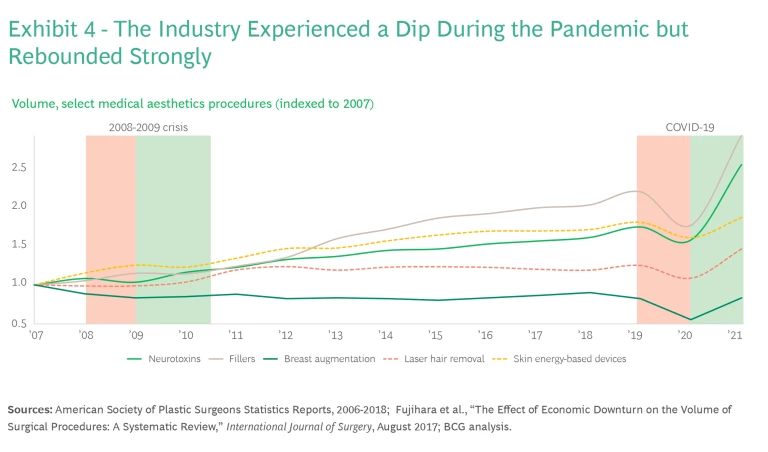

Strong Resiliency Following Economic Downturns. Medical aesthetics has a track record of resilience. During the 2008 recession, the overall number of procedures plateaued for a few years but by 2011—and even sooner for some companies and market segments—had resumed their growth trajectory.

In 2020, the industry took a major hit as most provider locations closed during the pandemic. But growth rates recovered within a year and have since surpassed their prepandemic performance. As Exhibit 4 shows, the industry grew significantly in 2021, a strong rebound that was driven in part by an unanticipated consequence of remote work: the “Zoom effect.” Seeing themselves on their computer screens during video calls, many people became dissatisfied with their appearance, generating new demand for aesthetics treatments.

To be clear, the current economic uncertainty will have some effect on medical aesthetics. Growth rates will slow in the short term, down from the 10% expected in early 2022, but we estimate a full recovery in 12 to 18 months as inflation eases and consumer confidence returns. Among treatment categories, energy-based devices and breast implants will likely experience the biggest impact, given their high price. Among providers, medspas will see the biggest decline because of their younger and lower-income consumer base.

Shifting Behaviors Among Consumers and Providers

Preferences are changing for both consumers and providers. Consumers have become far more educated and brand aware, and providers increasingly want manufacturers to help them grow their business—not just to discount prices. Manufacturers and investors need to understand these changes and adapt if they want to win in an evolving market.

Consumer Engagement. As the market expands, consumers are becoming more empowered and educated. Five years ago, only about 20% of consumers asked for a specific brand when deciding to undergo a filler procedure; today, that number has grown to 30%. In response, manufacturers need to shift part of their marketing focus from providers (which remain the primary audience) to consumers.

Consumers have become far more educated and brand aware, and providers increasingly want manufacturers to help them grow their business—not just to discount prices.

The urgent need to build—or buy—consumer marketing capabilities could push manufacturers to hire talent from sources such as the fashion or beauty industry. Manufacturers can also take a fresh approach, offering more seamless integration with providers’ systems, better-tailored loyalty programs, or support from providers’ business development and financing. Internally, manufacturers can track consumer data to assess their marketing efforts, analyzing metrics such as conversion rates, repeat purchases, and net promoter scores

Provider Engagement. Providers increasingly want help growing their businesses. They are also getting more sophisticated thanks to the ongoing consolidation trend, which further raises the bar for manufacturers. This is where compelling marketing services and loyalty programs can make a difference.

Evolus offered social media and digital marketing services to its providers when it launched, boosting adoption. Other industries (with fewer regulatory constraints) are already ahead of medical aesthetics in offering these kinds of services and brand partnerships. To follow suit, medical aesthetics manufacturers could analyze what has worked in those industries and apply the most relevant lessons, while maintaining compliance with stringent industry regulations.

Subscribe to our Health Care Industry E-Alert.

For example, like financial services companies, they could create an invite-only, not-widely-advertised membership tier for top providers, offering proactive, personalized, and exclusive services. Or they could emulate the travel industry and develop a partnership with a high-status brand in another industry, creating a positive association that benefits both companies.

Five Imperatives

We see five imperatives for manufacturers and investors hoping to win in the medical aesthetics market:

- Play where you have the right to win. Align your targeting strategy with the key characteristics of your portfolio of products and services.

- Align loyalty programs with your go-to-market strategy. Price is important, but it’s not everything. Nonmonetary services can have a big impact on adoption.

- Invest in consumer marketing. Providers see a manufacturer’s ability to generate consumer demand as a differentiator.

- Focus on training to build confidence. For example, familiarize nonphysician staff with the products across different demographic groups.

- Support providers’ business growth. Consult with practices and medspas to help them optimize operations and digitize their infrastructure, develop cooperative marketing campaigns, and hold special events.

The current economic slowdown in the US will have an impact on medical aesthetics manufacturers and providers, but the industry’s growth prospects remain strong. An expanding consumer base, strong innovation, and continued investment will all drive growth. However, the successful models of the future will be different from what has worked in the past. Manufacturers and investors need to understand the changes currently underway among both consumers and providers and position themselves for the coming growth wave.