As the health care sector emerges from the pandemic, providers and their medtech suppliers face a much-changed economic, commercial, and competitive landscape. Providers are struggling with both new and structural financial issues that for many pose an existential threat. Medtech companies are directly affected and want to help, but they are wrestling with their own business challenges, including inflation, changing investor expectations, pricing pressures, supply chain and labor shortages, geopolitical risks, and technological headaches.

Medtech management teams, which have grown used to more stable markets and growth trajectories, are looking for answers to an unfamiliar set of questions. They need to continue delivering solutions to health care providers while addressing immediate financial challenges and investing for the future. The players that can successfully navigate the new and often challenging terrain will be the winners of the 2020s.

Providers’ Struggles Cast a Shadow

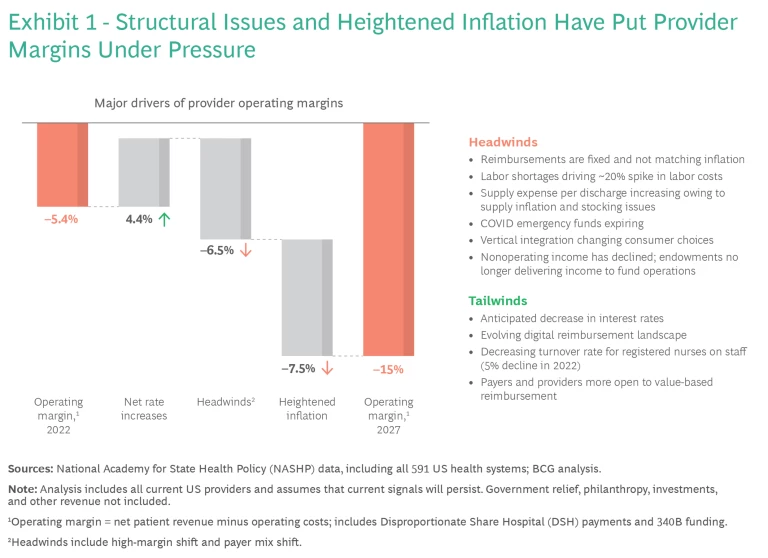

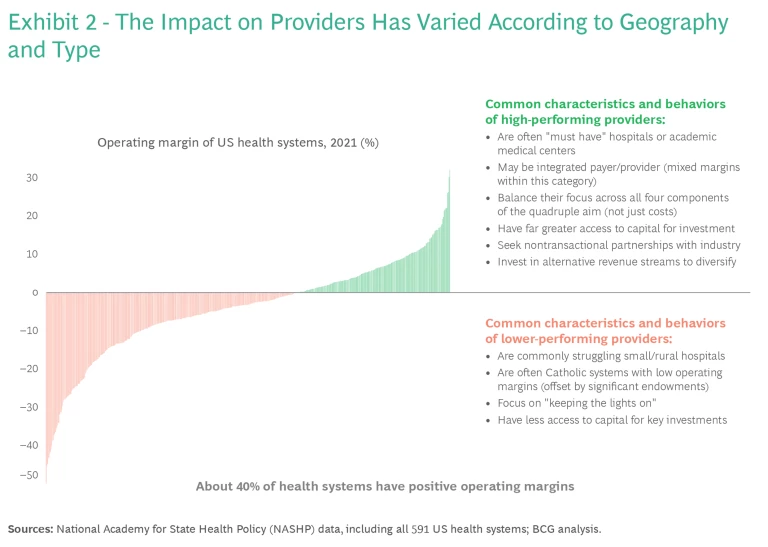

The challenges start with providers, which are facing unprecedented pressure on operating margins. (See Exhibit 1.) Earlier this year, we estimated that the l00 largest US health systems are looking at an aggregate annual financial shortfall of more than $200 million by 2027. Our current analysis, of nearly 600 health systems and the headwinds they face, projects a risk of average operating margins falling from –5.4% in 2022 to –15% in 2027, although the outlook for individual providers varies. Right now, some 40% of health systems are operating profitably. (See Exhibit 2.) The most profitable tend to be academic medical centers or centers of excellence within a given therapeutic area or service line. Struggling institutions are typically smaller rural hospitals or health systems (although some of these have endowments that help offset operating losses).

Inflationary pressures and labor shortages are current problems for providers, but the bigger and more persistent challenges are systemic. These include the shift in care from hospitals to lower-acuity settings—including at-home care—and the pressing need to digitize operations, which is accentuated by the rapid uptake of AI. In addition, rising patient empowerment is changing the dynamic between providers and patients. Many, if not most, providers are struggling to fund the investments they must make to be competitive in the future—investments in virtual and at-home care (such as telehealth and at-home diagnostics), digitization (including digital “front doors,” electronic medical records, and digitized clinical workflows), and, of course, medtech equipment.

In today’s environment, providers tell us that they seek three things from medtech companies:

- Stability in supply and predictability in pricing

- Partnerships that advance such priorities as operational efficiency, standardized clinical practice, more efficient clinical workflows, better outcomes, and optimized procedures

- Digitization support, especially user-friendly technology that integrates with electronic medical records

Medtech’s Challenges

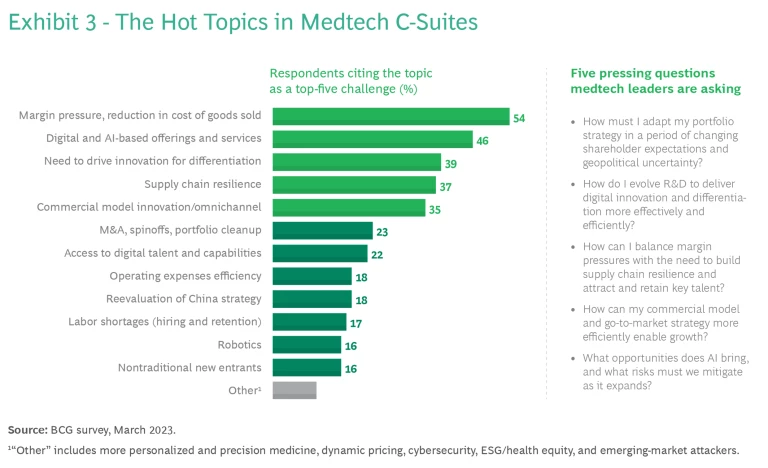

For their part, medtech management teams recognize providers’ challenges, but they are wrestling with their own difficulties. BCG recently surveyed executives at leading medtech companies about their top challenges and those of their provider customers. We learned that the biggest issues in medtech C-suites include margin pressure and costs, digital and AI-based offerings and services, product and service innovation, supply chain resilience, and commercial model innovation. (See Exhibit 3.) Executives also see providers buffeted by macroeconomic trends (inflation, high and rising interest rates, the threat of recession) and developments in the health care sector (patient empowerment and the shift to more outpatient and integrated care).

When asked about their own priorities, medtech leaders of course cited the need to continue to innovate—for competitive advantage and differentiation and to stay ahead of product commoditization. But they also pointed to a long list of challenges, many beyond their control, that affect their ability to invest in innovation, operate efficiently, serve customers effectively, and deliver value to shareholders. These include changing investor expectations; diminishing access to low-cost capital; persistent labor shortages; cost, pricing, and margin pressures; geopolitical uncertainty (particularly regarding China); shifting patterns in the delivery of care; and digital disruption occurring at an unprecedented pace.

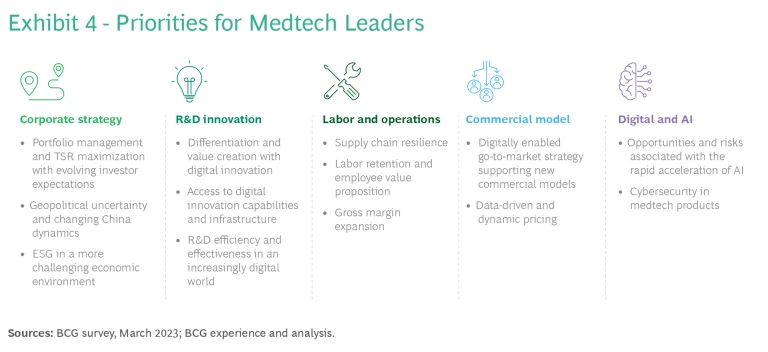

Against this daunting backdrop, medtech’s leaders are formulating their responses. We are seeing decisive moves in five areas, from longer-term corporate and financial strategy to companies’ individual go-to-market commercial models. (See Exhibit 4.)

Corporate Strategy

Medtech leaders are focused on three areas: portfolio management, China, and ESG (environmental, social, and governance) initiatives.

Portfolio Management. Investors’ expectations are evolving. They are looking beyond revenue increases to evidence of profitable growth as a key indicator of the ability to generate value. This is causing companies to take a hard look at their product portfolios in order to determine where to double down (through investment in either organic growth or M&A) and where to cut back or divest. We expect to see more carveouts and spinoffs going forward, as diversified medtech players seek to rebalance and focus their portfolios.

China Strategy. Despite increased geopolitical tensions and slowing GDP growth, China remains an attractive market for many medtech organizations. But market realities are forcing companies to reconsider how they operate. These include the emergence of volume-based procurement, which puts extraordinary pressure on pricing; regulatory shifts toward local manufacturing, which disadvantages multinationals; and the drive toward local R&D innovation, an additional bias in favor of local companies and their R&D.

Building a volume-based procurement strategy is a heavy and complex lift, but it’s likely a necessary one for companies that want to continue to sell medical devices in an enormous and growing market. Companies looking to remain in China are also determining how to embrace local manufacturing and R&D. More and more medtech players will probably take stronger stances, either by increasing their investment in localized manufacturing R&D, supply chains, sales, and marketing or by scaling back in China.

ESG. Health care accounts for 5% of total global carbon emissions, and medical devices and technology are responsible for a large portion. As inventive as medtech companies have been in patient diagnostics and treatments, they are latecomers to sustainability issues . Spurred by environmental concerns raised by providers, patients, regulators, and investors, frontrunners are making up for lost time with innovative solutions—and they are benefiting in unexpected ways. For example, cutting emissions by 20% to 30% can, when done right, generate a net cost saving, and cutting emissions by up to 80% can be cost neutral.

Environmental concerns are only one third of the ESG equation, however. The pandemic highlighted other issues, including health inequities and the need for high-quality care for all segments of the population; both are now sources of increasing pressure from patients, investors, and regulators. Medtech companies, along with providers and other health care players, face rising expectations for ambitious ESG targets and viable strategies for meeting them.

For example, there is an increasing (and overdue) focus on the needs of women outside of those related to their physical differences from men. In the US, women account for 80% of health care decisions (regarding both themselves and family members), and they spend almost 30% more per capita on health care than men. Yet only a third of medical students report feeling prepared to address gender differences in health care.

Medtech companies, along with providers and other health care players, face rising expectations for ambitious ESG targets and viable strategies for meeting them.

The funding landscape is beginning to change, with almost $2.7 billion in venture funding devoted to women’s-health-related products and services in 2021, up from less than $100 million in 2011. Medtech players have an opportunity to differentiate in this underserved market as part of their ESG strategy.

R&D Innovation

Medtech companies struggle with the commoditization of maturing products, making innovation increasingly important as a means to improve both care and differentiation. The explosion of digital and AI-based offerings (see below) ups the urgency for companies to determine how best to prioritize hardware and software development—and how to do so in a capital-constrained environment.

Leading companies are responding with

new technology-driven offerings

, business models, and R&D operating models. While slower movers are still thinking in terms of discrete products, each with its own starting point and finish line, more advanced players are focused on developing platforms according to a more iterative cadence (think Apple’s iPhone and iOS platforms). Four priorities can help medtech companies make the transition:

- Shift from individual products to evergreen platforms.

- Innovate more closely with end users.

- Redesign innovation processes for speed.

- Develop the talent base.

These principles, which have been successfully applied in other industries, can help medtech companies get new products to market faster and more efficiently.

Labor and Operations

Health care has experienced an employee exodus. At the same time, despite layoffs in the technology sector, finding tech talent, in particular, remains difficult. Medtech companies need clear employee value propositions to help them find and retain the kind of employees who can drive innovation. They can also target their recruiting efforts more precisely if they think in terms of skills rather than roles . What skills does the company have in-house? What skills are being tapped in existing roles? What skills are needed to complement current employees’ skills and strengthen the business?

Supply chains have become another source of concern. Medtech organizations know that by addressing the risks they face all along the supply chain, they can get their products to providers with greater predictability. We are seeing leaders create supply chains that are more agile, adaptive, and sustainable. They are looking to build resilience and partnerships at each stage so they can respond quickly to even small changes in demand and deal with disruptions wherever they occur.

Commercial Model

Since the COVID pandemic, the hybrid model of both in-person and virtual communication between providers and medtech salespeople has become more prevalent. Meanwhile, providers’ margin erosion is triggering further scrutiny of suppliers and prices—and restricting sales rep access. Health care providers also are demanding more customized treatment from their suppliers.

Leaders are looking to next-generation commercial models that will enable them to be more purposeful with their resources and more effective and tailored in their outreach to providers.

Leaders are looking to next-generation commercial models that will enable them to be more purposeful with their resources and more effective and tailored in their outreach to providers. Early medtech pioneers have been making the transition to a go-to-market model that capitalizes on digital and omnichannel interaction. This approach can lead to a two- or threefold increase in the productivity of sales representatives (as measured in revenue per rep). But to get there, companies will have to design a new customer journey rather than simply optimizing existing processes. They must put marketing in the best possible position to generate, nurture, and qualify leads; build a sales force armed with advanced technologies; and expand their focus beyond selling to actually making customers successful.

At the same time, escalating inflation, coupled with rising supplier and input costs, is imposing pricing pressures on medtech companies and their customers. Medtech suppliers need real-time visibility into input costs and the ability to quickly react to inflation increases. One solution is

dynamic pricing

, which combines data, AI, and automation to enable companies to adjust prices rapidly and manage volatility. Suppliers that generate savings from better insight into pricing, based on an accurate assessment of their own costs, can pass along some of the benefit in the form of more competitive pricing, helping providers to ease their margin pressures—and perhaps giving priority to rural or other institutions that are in particular financial difficulty.

Digital and AI

Generative AI is projected to grow faster in health care than in any other sector. In medtech, the technology can lead to more efficient processes, personalized customer interactions, greater innovation, and increased value. BCG has identified more than 60 use cases for GenAI in medtech, spanning the entire value chain. To capitalize, companies should identify and pilot priority use cases, incorporate GenAI into the broader enterprise strategy, and put the right policies and people in place.

Our cross-industry research shows, however, that many of the companies that have invested in AI broadly have failed to unlock its full potential. Only 11% of companies have released significant value, and the majority have failed to scale AI beyond pilots. One important reason is that they often lack a

mature digital foundation

. Leaders in

scaling and generating value from AI

do three things better than other companies:

- They prioritize the highest-impact use cases and scale them quickly to maximize value.

- They make data and technology accessible across the organization, avoiding siloed and incompatible tech stacks and standalone databases that impede scaling.

- They recognize the importance of aligned leadership and of employees who build and leverage AI, and they support staff who promote collaboration and end-to-end agile product delivery.

Digital offerings and smart devices expose medtech to cybersecurity risks. Companies that get cybersecurity right treat it not as an add-on but as something shaped by—and aligned with—business strategy. For these firms, cybersecurity and IT risk management are not technology projects. They are business projects with strong tech components. Companies that understand this don’t pursue wide-ranging—and often impossible to implement—cyber roadmaps. They focus on the relevant IT risks and capabilities.

The array of challenges facing providers and medtech companies is such that the remainder of this decade may well separate medtech winners from losers, with the latter encountering mounting difficulties and forced to investigate strategic alternatives. The key to staying on the right side of this equation is getting out in front of the issues now and working with customers to develop a mutually beneficial path forward. Winning medtech suppliers will help keep the health care sector focused on providing top-quality care.