The Inflation Reduction Act (IRA) of 2022 constitutes a major legislative effort to address drug pricing and Medicare expenditure. By now, most industry executives and investors have familiarized themselves with the law’s provisions regarding direct negotiation, the Part D redesign, and the inflation price cap. But as we’ve seen from our discussions with many industry executives, the broader strategic implications are not as well known.

A closer look at the provisions can provide a better sense of what the law means for

biopharma

and biotech companies and the broader health care ecosystem. Given that some of the most important provisions have just started taking effect, leaders need to get a better handle on this challenge now.

A Quick Recap of the IRA

Signed into law in August 2022, the IRA allocates federal spending to reduce carbon emissions, lower health care costs, provide funding for the IRS, and strengthen taxpayer compliance. Biopharma and biotech companies are naturally most focused on the three provisions concerning prescription drug prices for Medicare patients.

Direct Negotiation. This provision grants Medicare the authority to negotiate drug prices directly with biopharma and biotech companies. To be eligible for negotiation, drugs must be among the top of the list in terms of Medicare expenditure; lack any generic or biosimilar equivalents; and have already been on the market for a set number of years (7 for small molecules and 11 for biologics).

In late August, the US government announced the first ten drugs to be subject to negotiation. The new prices will go into effect in January 2026. A cumulative total of 60 drugs will have been selected for negotiation by 2030.

Direct negotiation will disproportionately affect two types of drugs: (a) those that cost Medicare the most and (b) small-molecule drugs. Additionally, while the direct negotiation provision applies solely to the Medicare population, the resetting of prices in certain cases could inadvertently extend to other populations as well. For instance, it could cause commercial payers to push for lower prices or even reset the “best price” given to Medicaid and 340B entities. Because of the large number of drugs that will be eligible for negotiation and the powerful impact price resetting will have on drug companies’ revenues, direct negotiation has the broadest ramifications of the three provisions.

Part D Redesign. This policy caps out-of-pocket (OOP) drug costs for Medicare patients at $2,000 per year (and $35/month for insulin). To fund this redesign, the law shifts most of the financial liability from Medicare to industry players. Most significantly, in the “catastrophic phase” of Part D coverage, drug manufacturers will be will have to provide a 20% discount, while payer responsibility will increase fourfold—from 15% to 60%.

While more attention has focused on direct negotiation, the Part D redesign will have a significant impact on biopharma, predominantly in three ways:

- The direct impact of increasing catastrophic phase responsibility to 20%, which will essentially serve as a 20% gross-to-net hit for high-priced Part D products

- The indirect impact from payers attempting to mitigate their own increased liability by more actively managing drug costs, even in new therapeutic areas where cost pressure has historically been lower

- The potential spillover of Medicare’s cost management to commercial populations

Taken together, the Part D redesign and direct negotiation strongly shift incentives in favor of biologics/Part B drugs. Part B drugs are by definition exempt from the Part D redesign, and biologics (which are often also covered by Part B) are allowed more years on market before they become eligible for negotiation.

Inflation Price Caps. This provision limits the rate of drug price increases in Medicare to the CPI-u, a measure of inflation. While this policy is likely the most straightforward of the three IRA provisions, its potential implications for launch price strategy and pricing decisions more broadly are not to be ignored.

Preparing for the IRA’s Impacts

To be ready for the IRA’s implementation, biopharma and biotech leaders need to understand the short- and long-term implications of the law.

Navigating Direct Negotiation

After the IRA was passed, many biopharma and biotech leaders naturally wondered if their drugs would be subject to direct negotiation and, if so, when. But it’s important to see that negotiation is a market event that affects all competitive players, not only the drug in question. That’s because reducing the price of an expensive prescription drug will have a ripple effect. The access and pricing of competitive branded drugs will be affected in a similar manner as when a generic drug hits the market, though probably not as much. While the size of the effect will vary from market to market, companies can expect that as new, lower-priced options become available, drugs in the same therapeutic area will see greater cost management efforts.

Companies can conduct scenario-planning exercises to understand the responses across the value chain that can occur after a price is negotiated.

It will be important for biopharma and biotech players to monitor how commercial payers leverage the newly negotiated prices to determine patient access for competitive products. We’ve seen companies conduct scenario-planning exercises simulating moves and countermoves to understand the responses across the value chain that can occur after a price is negotiated.

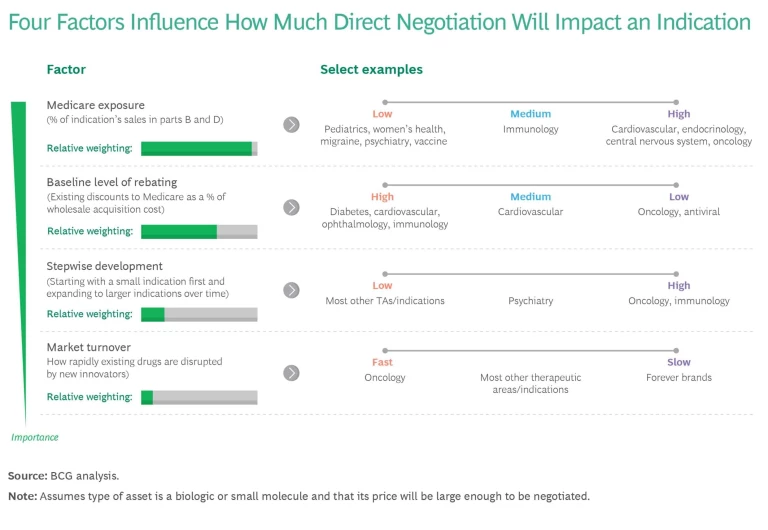

As leaders think about R&D and their therapeutic focus areas over the long term, they must also consider which indications will be most exposed to direct negotiation. There are four key factors. (See the exhibit.)

- Medicare Exposure. Indications with a greater proportion of Medicare patients are inherently more likely to be exposed to direct negotiation (as well as to the other IRA provisions). The greater the share of revenues from Medicare, the larger the potential impact of direct negotiations. Thus pediatric indications and vaccines would have low exposure, while oncology and Alzheimer’s would have high exposure.

- Baseline Rebating. When assets in an indication tend to be deeply rebated (discounted), the incremental impact of negotiation is smaller. Consequently, indications that are already heavily rebated are less exposed to direct negotiation. Diabetes has a high baseline level of rebating, whereas oncology and rare disease baselines tend to be significantly lower. In late August, the US government announced the first ten drugs to be subject to negotiation. The new prices are to go into effect in January 2026. Companies need to watch how much the final negotiated price deviates from the CMS’s published ceiling prices, as well as the influence of the existing net Medicare pricing of the negotiated product and its therapeutic alternative.

- Stepwise Development. Indications and disease areas with assets that require the company to launch with an indication with a small addressable market before launching larger indications are more exposed because they lose years of peak revenue. Oncology and immunology indications are far more exposed than most other therapeutic areas.

- Market Turnover. Indications with short innovation half-lives (where the standard of care is rapidly improving because new innovators disrupt the space) are less vulnerable to negotiation. The reason: the new competition will likely cause revenue to erode before the indication is subject to negotiation. On the flip side, drug classes for which it is very difficult to develop a generic or biosimilar entry are more vulnerable because a negotiated price can remain in effect for a long time.

Adapting R&D Strategy

Companies will need to evolve their R&D strategies and capabilities in four core areas.

Portfolio Prioritization. While the IRA will reduce the return on R&D overall, the impact is likely to be uneven across different disease areas. Biopharma and biotech companies will need to adapt their R&D strategies accordingly.

The limit on the number of years a drug can be on the market pre-negotiation will have a major impact on the lifetime revenue of those drugs likely to be negotiated. According to our analysis, the average small molecule’s lifetime revenue will drop by 5% to 6% and that of biologics by 3% to 4%. Given that the cost base will not change, the impact on net present value (NPV) is likely to be twice as much.

Certain therapeutic areas, such as oncology and metabolic disorders, have proportionately more older patients and are thus going to be more affected than others. Pharma leaders and investors will need to reevaluate their disease area priorities and decide if the IRA provisions warrant a course correction.

Drugmakers should conduct a full portfolio review, updating their approach to business development and determining whether they need to adjust long-term resource allocations.

In light of these considerations, drugmakers should conduct a full portfolio review that includes reevaluating pipeline assets and M&A targets, updating their approach to business development, and determining whether they need to adjust long-term resource allocations. Some companies have already shelved certain programs after deciding the ROI would be insufficient to justify investment.

Of course, it is important to keep in mind that the IRA is just one consideration among many when evaluating R&D decisions. Out-innovating and bringing to market medicines that are highly efficacious and differentiated will still be the ticket to success. Additionally, despite the further incentive shift toward biologics, small molecules often do have a greater ability to be used by underserved populations. And, for certain types of diseases, they remain the critical modality from an access and equity perspective.

Out-innovating and bringing to market medicines that are highly efficacious and differentiated will still be the ticket to success.

Clinical Development. Since the IRA truncates a product’s time in market at full price, biopharmas and biotechs must launch products faster and reevaluate the sequencing of indication expansions. The clinical development of oral oncolytics, immunomodulators, and endocrine drugs are likely to be most impacted because they often go through stepwise development. Several companies have already abandoned clinical trials or assets, and many more have said that the IRA influences their clinical development decisions.

To compensate for margin compression, biopharmas and biotechs need to out-innovate themselves. They can work with regulators to try to accelerate the timelines for indication expansions and explore launching in larger indications first. Companies can also slim their cost base or optimize trial design and time to market.

Financial Considerations. In addition, companies should consider changing how they finance development so they can accelerate their pipelines with minimal impact on earnings, R&D budget, or equity dilution. Partnering with life-science-focused investment companies is one way to do that.

Sharing R&D risk for core franchise assets with an investment firm can help maximize asset NPV with reduced P&L impact for pharma partners and reduced equity dilution for biotech partners. For assets that are of less strategic value, do not meet internal peak sales thresholds, or are too costly from a budgetary perspective, investment firm partners can help build new companies with excellent management teams, where the partner can retain significant value without additional expenses as well as, in some cases, to agree on reacquisition rights. Such partners can also share upfront acquisition or licensing costs.

Real-World Evidence (RWE) Generation. To determine the appropriate negotiated price, CMS will ask companies to submit various kinds of evidence, including cost-effectiveness, R&D costs, unit costs, and more. This presents companies with an opportunity to marshal additional evidence to justify their targeted price, including scientific quality, diversity and inclusion, health outcomes, and financial impacts.

Since negotiation will not take place until a product has been in the market for at least 7 or 11 years, companies may need to do late-stage adaptations to their RWE strategy. They may, for example, decide that certain types of evidence are needed after seeing the evidence packages of products that were more recently launched in that indication.

Companies may also want to consider whether they need to build capabilities in a few areas, including new business intelligence to know what evidence matters most; new RWE data generation to have more-robust data on hand; and more agile evidence generation to be more responsive given the short negotiation timeline. In addition, players may want to develop a detailed plan with roles, responsibilities, and deliverables to be prepared for when a negotiation is triggered.

The IRA’s Impact on the Broader Health Care Ecosystem

The IRA will also have an impact on key constituents of the health care value chain—payers, patients, and providers—and therefore must scrutinize these knock-on effects as well.

Payers. The Part D redesign quadruples insurers’ cost burden in the catastrophic phase. They are therefore likely to face significant financial pressure as the IRA limits the degree to which this cost can be offset through increases in patient premiums. As a result, we are likely to see payers putting more rigid controls in place to limit patient access in categories where expenditures have typically been high, such as multiple sclerosis treatments and oral oncolytics.

Interestingly, Medicare Advantage (MA) plans have more levers to pull to manage this increased Part D liability, and, consequently, the Part D redesign may further accelerate the shift to MA plans. These plans, however, will likely achieve cost control by offering patients less choice in providers, especially in oncology, where many specialized cancer centers may be out-of-network.

Patients. At the same time, the Part D redesign creates opportunities for pharma, particularly in patient support. Capping patients’ annual OOP costs at $2,000 (and allowing that cost burden to be evenly distributed across the year to $167 monthly beginning in 2025) is the IRA’s clearest and most direct benefit for patients. It will make high-priced therapies more affordable, thereby providing opportunities to improve patient persistency and outcomes.

Before the IRA, many patients who were prescribed high-priced therapies eventually stopped filling their prescriptions—or never filled them at all—because of the high cost. While the $2,000 cap won’t remove all cost considerations, it will greatly reduce them. For certain disease areas with significant patient drop-off, we estimate that volumes could increase 15% to 30%.

In anticipation of this change, biopharmas and biotechs should consider investing in educating both patients and providers about the Part D redesign. Companies should also evaluate whether changes are warranted in their patient-support offerings. This could include initiatives to better track patient persistence and address non-cost barriers contributing to patient drop-off. Revamped patient services not only make sense from a direct financial lens but, more importantly, in ensuring patient outcomes, which is even more critical with the heightened evidence burden during negotiation.

Providers. Price controls may have unintended consequences for providers as well. In the case of “buy-and-bill” drugs, a negotiated price will change the way physician payments are calculated, reducing the amount that a physician is reimbursed for administering the drug.

While the IRA introduces greater uncertainty and complexity into an already opaque drug-pricing landscape, it is important to realize that many of the high-level structures and incentives that existed before the IRA will be fundamentally unchanged. The IRA does not govern the price of a drug at launch, nor does it change the pervasive dynamics of rebating. Additionally, companies are already accustomed to operating with patent cliffs (drop in price when a drug goes off patent and generics are available). Now they will have to operate with negotiation cliffs as well. And biologics were already receiving favorable treatment over small molecules before the IRA; with the IRA, that treatment will be even more favorable. In other words, the IRA is just another step in the evolution of an already complex landscape. Nevertheless, companies will need to navigate it carefully.

Although the full ramifications of the IRA won’t be known for quite a while, companies need to start planning now. The perspectives we’ve presented here may help companies as they consider what the IRA may mean for them.