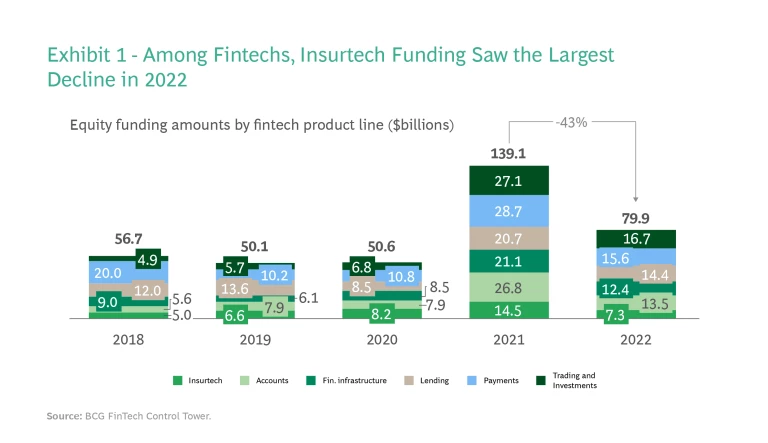

The global technology sector experienced a sharp reset in 2022 due to a combination of high inflation, rising interest rates, weak economic growth, and geopolitical tension. The NASDAQ 100 Index ended the year 33% lower; globally, venture capital investments in private technology companies fell by the same percentage.

Insurtech was no exception. Investments in the fintech sector decreased by 43% year over year, with insurtech registering the largest drop at 50%. After hitting a peak of $4.9 billion in the second quarter of 2021, insurtech funding began its descent. By the fourth quarter of 2022, funding had reached its lowest level of the past 20 quarters, with only $800 million invested. That marked a decrease of 64% from the previous quarter and 78% from the fourth quarter of 2021.

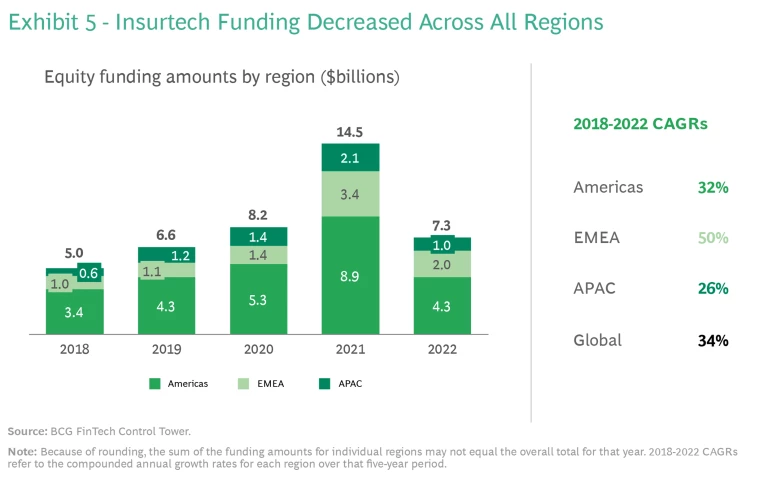

To a certain degree, insurtech is still reaping the benefits of record growth in previous years; global insurtech investment registered a compound annual growth rate (CAGR) of 34% between 2018 and 2022. But the pace of growth has slowed significantly, and the market shows no signs of a rebound. (See Exhibit 1.)

The 2022 decline signals a turning point in the industry. Some product lines—notably personal property and casualty (P&C) and health insurance—have reached a stage of relative maturity and now have lower expectations of private investment growth. But even when private capital was at an all-time high in 2021, underperforming insurtech equities in the public markets were a clear indication of impending turmoil.

Amid the current downturn, investors have become more cautious in deploying capital and are performing more in-depth due diligence. After seeing what happened to the valuations of public companies, investors in private insurtechs are demanding more efficiency, sustainability, and solid operating and financial performance.

This investor caution has forced insurtechs to pivot from growth mode to cash conservation mode. Privately held insurtechs, especially the most established and cash-flow-positive ones, are now more inclined to extend their runways by cutting costs, decreasing headcount, or looking at different sources of capital such as venture debt.

Investment Slowed Across All Product Lines

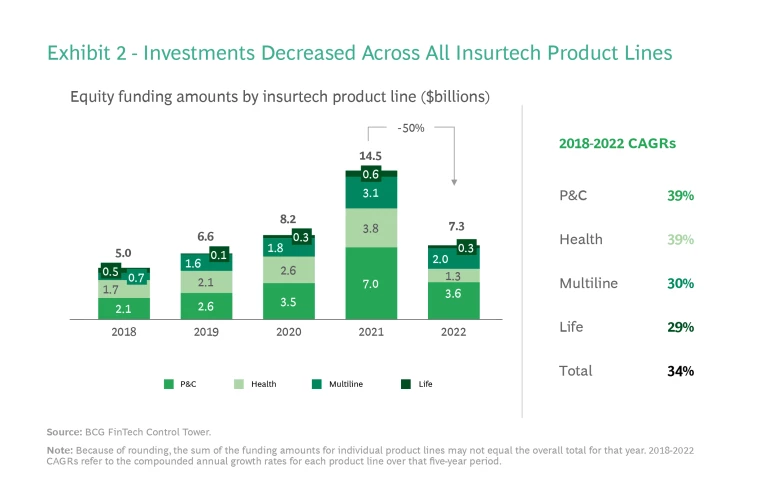

Insurtech investments slowed across all product lines and operating models. The sector as a whole raised $7.3 billion in equity funding globally in 2022, a steep decline of 50% compared to 2021.

The strong annual growth rate of previous years was driven largely by megarounds of investment in digital carriers of P&C and life

In 2022 P&C and multiline insurance continued to receive the lion’s share of funding; of all capital raised for the year, 78% went into P&C ($3.6 billion) and multiline ($2 billion). However, investments fell across all product lines, with health, life and P&C insurance registering the largest year-over-year declines, at 65%, 49%, and 48%, respectively. Multiline insurance funding had a milder downturn of 35% year over year and accounted for about one-third of the total capital invested in 2022.

Our report notes the following sector trends.

P&C Insurance. After a record year in 2021, investments in P&C returned to more modest levels in

Personal P&C saw the largest drop, at 55%, with motor vehicle P&C experiencing the greatest decline, at 70%, with $207 million raised. The personal motor vehicle category is the birthplace of insurtech, and as such it has reached a more mature stage.

Commercial P&C dropped by 45%, with commercial automobile and cyber security insurance registering the largest declines, at 81% and 55%, respectively. Funding for the personal and commercial P&C subsegment showed a smaller decline of only 25%.

P&C insurance still showed a relatively strong five-year growth pattern, with a CAGR of 39% from 2018 to 2022. Personal P&C, which showed a CAGR of 50% over that period, was the main engine. Significant investment over the past five years has gone into digital intermediaries in personal P&C that offer pet insurance—for example, ManyPets in the U.K. and Santevet in France. General P&C insurtechs such as Branch in the US and Friday in Germany were also major recipients of investment capital.

Investment in personal and commercial P&C also grew at a strong pace from 2018 to 2022, with a five-year CAGR of 48%. A major share of the capital went into risk-assessment technology platforms offering general P&C products—for example, Cytora in the UK and Bold Penguin in the US—as well as motor and commercial auto P&C products, including the US-based companies Cambridge Mobile Telematics and Nexar.

Commercial P&C on its own had a five-year CAGR of 30% through 2022. Digital intermediaries that provide cyber security insurance were a main driver, especially after the COVID-19 pandemic brought a worldwide shift to virtual workplaces. Major recipients of funding included Coalition, At-Bay, Corvus, and Cowbell Cyber, all based in the US.

Investors will be demanding when they assess insurtech value propositions and business models.

Health Insurance. This is a fairly advanced product line, and as such equity funding fell by 65% in 2022, reaching its lowest point in the last five

From a five-year perspective, health insurance has been the slowest growing insurtech cluster, with investment increasing at a CAGR of 29% between 2018 and 2022. Among health insurance subclusters, benefits and network design was the second largest in terms of funding, with investments rising at a CAGR of 37%. Funding was driven mostly by digital insurers offering employee health benefits—for example, Alan in France, Sana Benefits in the US, and Ottonova in Germany.

Investments in patient-engagement insurtechs—another subcluster of health insurance—also saw sustained growth over the past five years, at a CAGR of 33%. The main funding targets were a small cohort of US-based technology platforms designed to reduce administrative and billing problems and improve the patient experience; for example, Cedar, GOQii, and Zipari.

Multiline Insurance. Although investment in multiline insurance fell by 35% year over year in 2022, funding nevertheless reached the second highest level over the past five years, at about $2

Investment in multiline insurance grew at a CAGR of 30% between 2018 and 2022. The top driver was life and health insurance funding, which grew at a CAGR of 46%. In particular, investors gravitated to intermediaries and technology platforms, including Betterfly, the Chinese mutual insurance broker Waterdrop, and the Swiss risk-assessment platform Dacadoo.

Funding for P&C and life insurtechs also saw sustained growth over those five years, with a CAGR of 30%. The growth was fueled by megarounds of capital that went to digital insurers and intermediaries, including US-based Lemonade and the price-comparison websites Zebra and Insurify.

Life Insurance. Equity investment for this product line decreased by 49% in

As a whole, life insurance has been a high-growth cluster, with a five-year CAGR of 39% through the end of 2022. The growth was driven largely by investment in the still fledgling subcluster of income protection, which showed a CAGR of 83%. The primary capital targets were a small group of players that provide incomes and paycheck coverage, including Breeze and Asteya in the US and Coverhero in Australia.

The medium-sized subcluster of group life also registered above-average investment growth at a CAGR of 43%. The major recipients were intermediaries offering corporate employee life insurance, such as UK-based YuLife and technology platforms such as US-based Bswift.

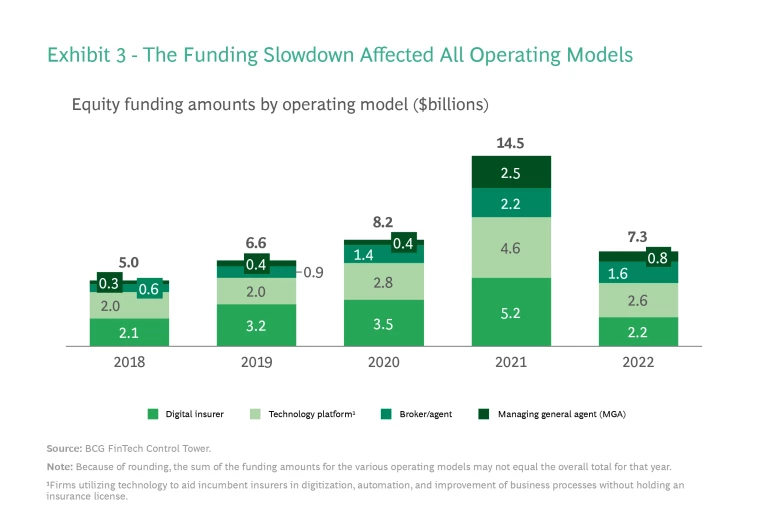

The Slowdown Affected All Operating Models

Digital insurers made up only 8% of the total number of insurtechs but received about 42% of the global investment funding over the past 20 years. In 2022, however, there was a significant decrease in equity funding for all of the operational models, with managing general agents and digital insurers registering the largest declines year over year, at 67% and 57%, respectively.

However, the funding levels for most categories were similar to those of 2020, or in some cases higher. The exception was digital insurers, which saw a 37% decrease from 2020. (See Exhibit 3.)

The share of funding for digital insurers decreased by about 20 percentage points from 2019, when it reached 49%, to 2022, when it dropped to 30%. The first wave of digital insurers has reached scale and doesn’t need massive fundraising rounds anymore, and investors have also set their sights elsewhere. As digital transformation accelerated during the pandemic, investors turned their attention to emerging categories of players such as technology platforms.

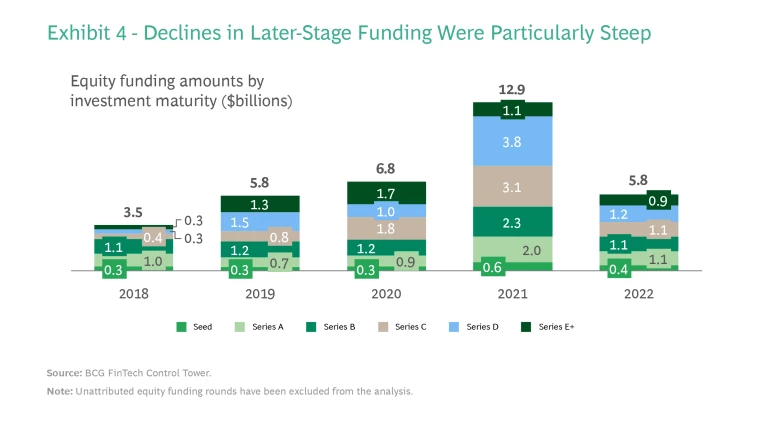

A Steep Decline in Late-Stage Venture Capital and Megarounds

Funding decreased at all growth stages, but the biggest decrease was in later-stage funding through Series C deals and beyond. Investments in this category totaled $3.2 billion in 2022, a 60% decline from the year before, as many insurtech companies elected to cut costs in an effort to extend their survival period with the cash they already have rather than settle for deals with flat or only modest valuation increases.

However, early-stage venture capital also tapered

Megarounds had been a key growth driver for equity funding in 2020 and 2021, accounting for 54% of the total amount invested each year. In 2022, however, the share going into megarounds plummeted to a five-year low, accounting for 42% of the total. The actual number of such deals declined by 63% compared to 2021. There were only two megarounds of early-stage venture capital in 2022, down from seven in 2021. Megarounds for late-stage venture capital decreased by 61%, with Series D registering the largest drop, at 77%.

The three largest rounds of funding included two Series D round and one Series E+ round. Of these deals, the largest was a Series D investment of $400 million in the German general P&C digital insurer Wefox. US-based Pie Insurance, a digital insurer of workers’ compensation for small businesses, raised $315 million in a Series D round. The third largest investment was a Series E+ round that raised $250 million for cyber digital insurer Coalition, also in the US.

A Few Bright Spots in Latin America and Europe

Investments decreased in all parts of the world in 2022, the first global decline in five years. The Americas and Asia-Pacific (APAC) registered the largest drops, at approximately 53% each, with total investments of $4.2 billion and $1 billion, respectively. (See Exhibit 5.)

In the Americas, although overall investment declined, Latin America registered an 18% increase in funding year over year, with $219 million invested in 2022. Historically, the US has been the main driver of funding in the region as well as worldwide, but the insurtech ecosystem in Latin America is gradually picking up steam. Most of the region’s investment is going into firms headquartered in Brazil, Mexico, and Chile. The Americas’ five-year CAGR from 2018 to 2022 was 32%.

In APAC, investments decreased across all of the subregions. The largest decline was in East Asia, where investment fell by 75%, followed by Southeast Asia, which saw a 55% drop. From a five-year perspective, APAC was the slowest growing region, with a CAGR of only 26% from 2018 to 2022.

Investments in Europe, the Middle East, and Africa (EMEA) decreased by approximately 43% year over year. The decline was less severe in the EMEA region thanks largely to five megarounds, with notable targets including Wefox, which raised $400 million in Series D funding; Alan, which received $193 million in Series E+ funding; and Descartes Underwriting in France, which raised $120 million in Series B funding.

Investments decreased across the entire region with the exception of the subregion known as the “rest of Europe,” which saw an increase of 9% year over

EMEA was the fastest-growing region over the past five years with a CAGR of 50%, driven by insurtechs in Western and Northern Europe that account for approximately 86% of the total capital deployed to date.

Market Turmoil Has Held Up Exit Plans

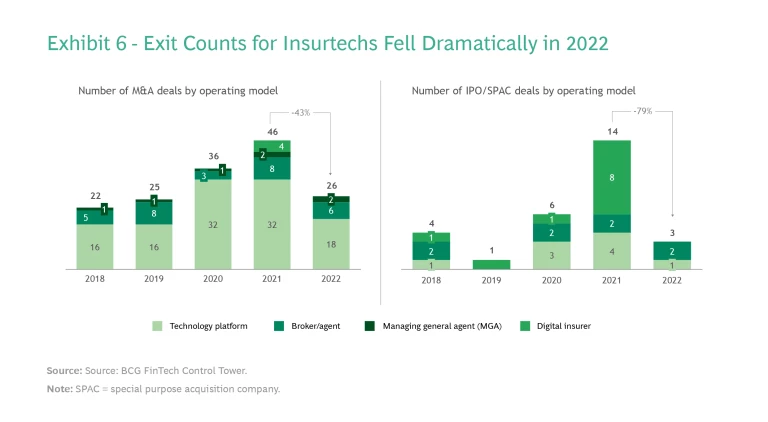

Exits dried up in 2022 as macroeconomic conditions and potential exit valuations worsened, resulting in fewer initial public offerings ( IPOs ) as well as fewer private exits through M&A . (See Exhibit 6.)

M&A: In 2022, the number of M&A deals dropped by 43% from 2021. Basically, M&A returned to the levels seen before the favorable macroeconomic conditions of 2020 to 2021—low interest rates, low inflation rates, and high demand for technology solutions during the pandemic—led to a boom in the number of exits through M&As and IPOs. Technology platforms have been the most targeted assets, accounting for about three quarters of the total number of M&A deals since 2018. Acquiring firms have found them attractive because they serve a strategic function in digitizing specific insurance value chain segments, in addition to a tendency to be balance-sheet light and inexpensive compared to digital insurers and insurtech managing general agents (MGAs).

IPOs: While 2020 and 2021 were characterized by a frenzied race to go public, in 2022 the combination of global macroeconomic turmoil and rising interest rates brought the activity to a grinding halt. Around the world, public exits of insurtechs have slowed to almost nonexistent levels, dropping by 79% since 2021. That translates to only three IPOs in 2022: Italian general P&C insurance broker Yolo, Chinese health insurance intermediary Medbanks, and UK claim-prevention platform Ondo.

Kin Insurance, TypTap, and Policygenius in the US, along with FWD Group in Hong Kong, were among the insurtechs that put their IPOs on hold until market conditions become more favorable.

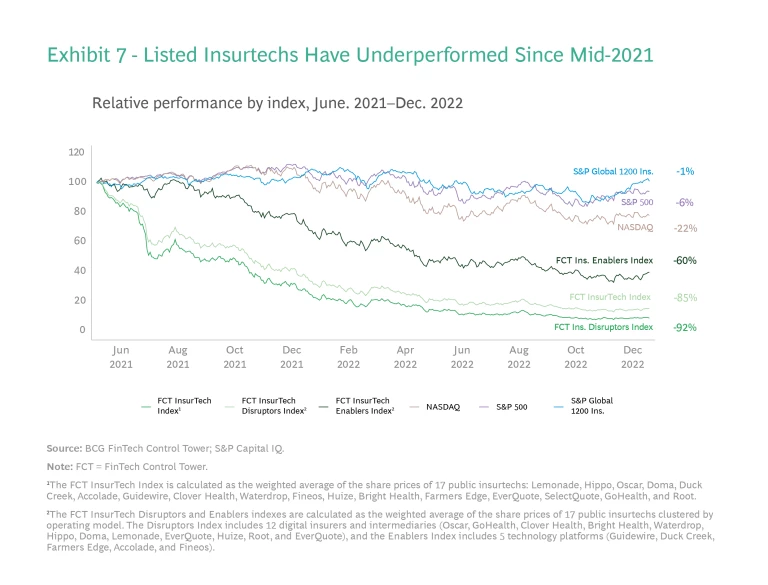

Our analysis of listed insurtechs finds that since mid-2021 the sector has underperformed not only in comparison to the broader stock market but also to publicly traded traditional insurance firms and technology companies. Between June 2021 and December 2022, the FinTech Control Tower (FCT) InsurTech Index of publicly traded companies dropped by 85%, whereas the NASDAQ declined by just 22%, the S&P 500 index by 6%, and the S&P Global 1200 Insurance index by 1%. (See Exhibit 7.)

Within the sector, insurtech enablers outperformed disruptors, owing to fundamental differences in their operational models, which investors partially took into account. The FCT InsurTech Disruptors Index dropped 92% from June 1, 2021, to December 31, 2022, while the FCT InsurTech Enabler Index was down 60% over the same period.

Disruptors, which maintain a balance sheet, underwrite policies, and manage capital, have found themselves confronted with a number of challenges in their efforts to develop the underwriting capabilities they need. Consequently, they’ve had trouble finding a path to profitability. Their loss ratios are significantly higher than the industry average.

Enablers have also had their share of setbacks. On the one hand, they’ve been able to adopt SaaS business models and operate with light infrastructures and little or no balance sheets. Much of this advantage has been offset by the global tech downturn, however, and the dismal performance of disruptors has had an indirect impact.

Valuations of public insurtech disruptors have dropped from the billions to the millions. Root Insurance, Bright Health, and Doma almost halved their valuations. The decline can be traced to the increased skepticism among investors and market participants over the long-term viability of disruptors. Investors are now questioning whether companies in this segment can actually deliver on their promises and whether they will be able to generate enough revenue to justify their valuations.

The recent downturn in insurtech raises a number of questions about where the industry is headed. It is likely that in 2023 equity funding amounts will remain in line with 2022, and valuations of private companies will start to drop as well, mirroring the valuations in the public markets. M&A activity might rise for privately held insurtechs, especially since those at risk of running out of cash might be willing to sell to strategic buyers at a discount rather than risk going out of business. The next M&A wave might also result in some publicly traded companies becoming privatized—as happened when Lemonade acquired Metromile in 2022 and Vista Equity Partners acquired Duck Creek Technologies in 2023.

Rising interest rates and uncertain markets are benefiting many insurance carriers, in contrast to the previous decade when insurers struggled to earn their cost of capital amidst low interest rates and premium growth that often fell below GDP growth. Incumbent insurers are now in an advantageous position, with opportunities to acquire digital and analytical talent and buy insurtech market access and capabilities.

There is still a lot of dry powder in the market available to successful players, but investors will be demanding when they assess insurtech value propositions and business models. For digital carriers and MGAs, it is crucial to achieve accurate underwriting and align operational performance with industry standards. Technology platforms will need to identify customer concerns and design innovative solutions that address these issues while adopting a scalable and efficient operational model that generates long-term profitability.

It is very likely that insurtechs are facing a period of slower growth and reduced valuations. Transitioning from a growth-oriented mindset to one focused on conserving cash and achieving profitability may not seem ideal, but it is the best way to ensure that today’s players are able to survive the downturn and reach the next phase of growth.

About This Report

About This Report

About FinTech Control Tower by BCG

The FCT also offers a digital platform that helps users perform fintech and insurtech market monitoring, intelligence, and scouting. The platform is built and specialized for financial services, leveraging third-party sources for funding and investment data as well as proprietary data assets such as partnerships and news sentiment.

For more information, contact us at