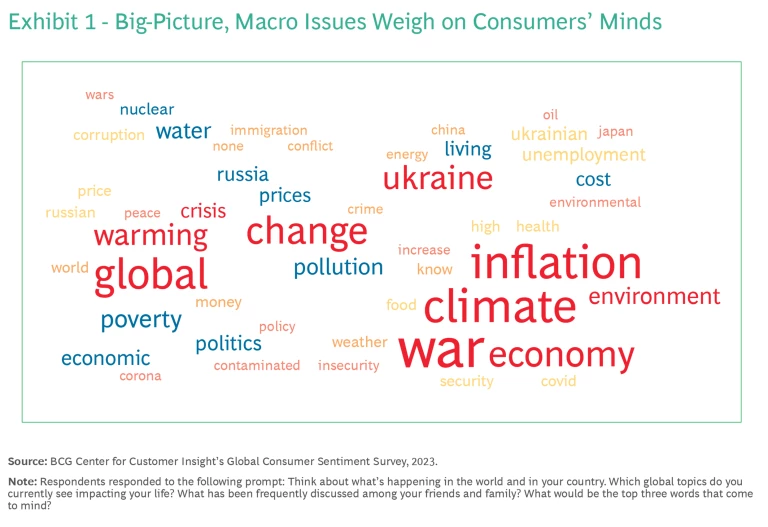

Headlines trumpet “macro” concerns—big-picture global issues, such as geopolitical disruptions, economic challenges, and technological changes, that have entered the mainstream narrative and are echoed by consumers. (See Exhibit 1.) Among the potential consequences of those issues: spending cuts, inflationary pressures on wallets, and recession. Amid much noise and little consensus, all of this suggests that consumer spending and saving could be sharply curtailed. Broadly, all of this augurs a potential end to consumer-led economic growth.

But when you go straight to the silent stakeholders—the consumers—you learn that this is not so. We ventured beyond the noise to listen more closely and more directly to what matters to consumers.

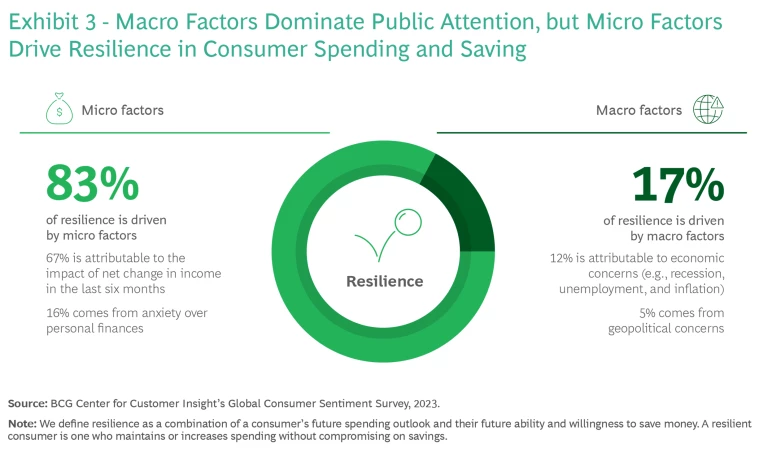

Recent BCG research reveals that although macro concerns dominate the news and the noise, they are not the primary drivers of consumers’ spending or their ability and willingness to save. Rather, “micro” concerns—the more personal, close-to-home sentiments regarding individuals’ jobs, household income, and finances—guide consumers’ optimism or pessimism. In simple terms, consumers may worry about economic and geopolitical matters, but they act and behave according to their personal situation. And those situations vary widely—by demographic, by country, and by category. There is no one narrative around consumer sentiment. (See “About Our Research.”)

About Our Research

- Argentina

- Australia

- Brazil

- China

- France

- Germany

- India

- Indonesia

- Japan

- Mexico

- Morocco

- Philippines

- Saudi Arabia

- South Africa

- South Korea

- Sweden

- Thailand

- Turkey

- UK

- United Arab Emirates

- US

- Foods (fresh, baby, packaged, and pet foods) and food delivery

- Sustainable products

- Travel and tourism (flights/air travel, business travel, vacations, and theme parks)

- Automotives and automotive spare parts

- Fitness equipment

- Luxury brands

- Insurance

- Apparel (clothing, shoes/footwear, and fashion accessories)

- Home construction/improvement

- Over-the-counter medicines and supplements

- Household care products

- Video streaming and movie cinemas

- Cosmetics

- Mobile phones

- Spas, concerts

- Personal care

- Eating at restaurants

- Large electronics

- Alcohol and packaged beverages

- Toys and games

- Tobacco and smoking supplies

- Kitchen appliances

Growth is not gone. You just need to know where to look for it—where to find “resilient” consumers—and then act accordingly.

What Makes a Consumer Resilient?

We measured economic buoyancy in terms of consumer resilience. That is, we considered how much (or how little) consumers are spending and how much they are willing and able to

And we considered how macro and micro considerations, individually and together, influence resilience.

For starters, it’s clear that there is no single answer regarding how consumers around the world are feeling. Concerns about both macro and micro issues are high, and both show wide ranges, from less than 50% of Indian and Chinese consumers worried about personal finances and income to more than 80% worried in Japan, Argentina, and France. Consumer sentiment in the US rests roughly in the middle. (See Exhibit 2.)

Overall, 83% of consumer resilience is driven by micro factors—concerns closer to consumers’ personal situations and finances. (See Exhibit 3.)

Where Do Growth Opportunities Await?

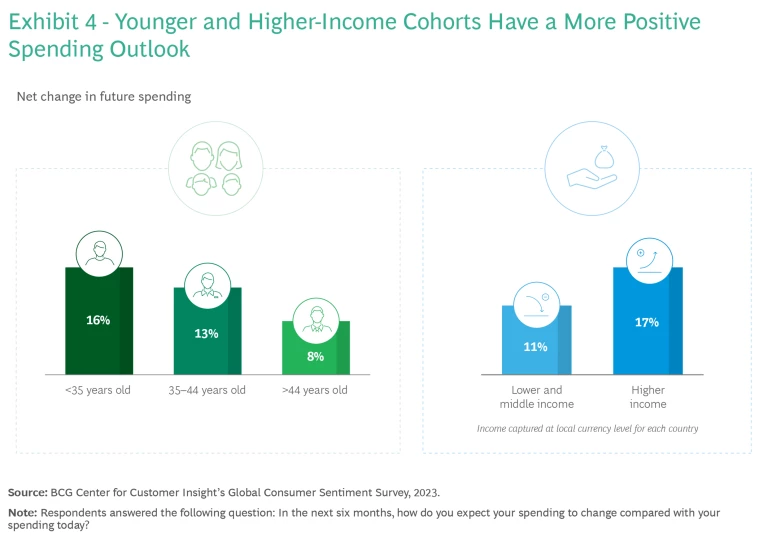

The spending outlook is relatively positive among young working adults—those who are 18 to 34 years old. (See Exhibit 4.) Further, affluent and higher-income households continue to want to spend. Although these spenders are not super-affluent or high-net-worth individuals, they earn enough to position them as, at least, upper-middle-income consumers in the countries in which they reside.

Further, certain countries continue to see positive sentiment and a good spending outlook—particularly India, China, the United Arab Emirates, and Saudi Arabia. These nations will continue to be growth markets over the next one to two years.

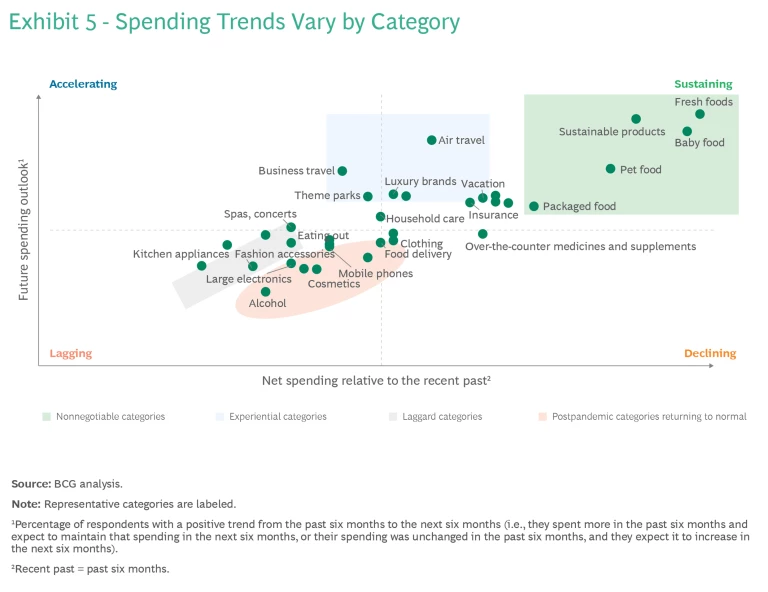

Finally, consumers continue to prioritize spending on certain categories even when they have to cut back on others. (See Exhibit 5.)

Nonnegotiable categories, such as baby food, fresh food, and packaged food, have demonstrated strong recent spending and are expected to see even higher spending in the future. Consumers refuse to compromise on quality in these important categories and are willing to trade up if necessary, even in the face of inflation.

It’s encouraging to see that sustainable products have also become a priority for consumers as climate change and global warming enter the mainstream psyche.

Additionally, consumers are still prioritizing experiential items such as air travel, vacations, and luxury brands; investing in good experiences is seen as worthwhile, often to relieve pressure in their daily lives and to reclaim time lost during COVID. Interestingly, spending on insurance is also on the uptick—perhaps another legacy of the pandemic era.

On the other hand, spending is decreasing in categories that have been declining for a few years now, such as large electronics, which consumers see as one-time, big-ticket, functional purchases. Also, categories such as food delivery and alcohol, whose sales were inflated during the pandemic, are seeing decreased demand as a consequence of the post-COVID cooldown.

If we reflect on lessons for consumer companies, the following come to mind:

- Pursue growth in markets where consumer behavior still trends toward spending, especially large, increasingly resilient emerging markets.

- Identify and support resilient consumers in your market. For instance, an affluent consumer base may afford premiumization opportunities in your portfolio.

- Even in countries with poorer sentiment, growth can be found among some resilient, high-growth categories, such as younger consumers.

Don’t give up on growth. Staying on top of consumer sentiment will guide you to fertile sources of consumer spending and saving around the world.