Many companies in the global oil and gas (O&G) industry are moving forward in their efforts to decarbonize. Yet the gap between the leaders and the laggards is growing: The evidence shows that huge differences remain in both the speed and the cost of decarbonization between companies and even among similar assets at the same company. Closing this gap will be critical: to reach net zero by 2050, the average energy intensity of the global supply of oil and gas in 2030 will need to be more than 50% lower than it was in 2022.

Companies that lead on decarbonization have proven that they can gain not just a smaller carbon footprint but also a material bottom-line impact, potentially higher revenues, and real competitive advantage. They do so by pulling every abatement lever applicable to their portfolio—including greater energy efficiency, reductions in escaping gases, and switching to low-carbon sources of power and heat—in the most effective way possible.

Companies that lead on decarbonization have proven that they can gain material bottom-line impact and real competitive advantage.

We analyze how these leaders have gotten past the decarbonization commitment stage and are now reaping the benefits of developing superior decarbonization capabilities. Finally, we lay out how other companies can follow in their lower-carbon footprints.

Good News and Bad News

We looked at 40 O&G companies, which together contribute more than 25% of the sector’s GHG emissions. The good news is that our analysis shows that 20% of them reduced either their emissions or their emissions intensity by more than 20% between 2017 and 2022.

To get there, these companies have pulled on one or more decarbonization levers, including:

- A shift to lower-emitting products (from oil to gas, for example)

- Operational and energy efficiencies

- Flaring reductions

- Methane emissions reductions

- Renewable energy

- Carbon capture, utilization, and storage (CCUS)

- Switching to bio-based fuels for power and heat generation

Many of the companies that are making progress on decarbonization are actively using revenue opportunities to help fund their further decarbonization efforts. Some are installing solar panels to replace the electricity generated by their gas power plants, for example, and at least one plans to sell the surplus energy to generate cash. And one petrochemicals company was able to capture enough CO2 through CCUS technology to use it to increase its methanol production.

The bad news, however, is that the gap between what the industry has accomplished so far and what needs to be done is still huge. Producers of around 40% of global oil and gas production have not yet announced any commitment to a net zero target, and at least half of that is concentrated at the top ten companies. In fact, at least 40% of companies in our analysis actually increased their emissions or emissions intensity between 2017 and 2022. Moreover, there is frequently a large variance in emissions intensity among a company’s assets in the same asset class. Despite similar levels of complexity and maturity, and even when they are within the same jurisdiction and under the same operator, some assets are as much as seven times more emissions intensive than others.

The Promise

Yet those O&G companies that are developing superior decarbonization capabilities have already begun to capture competitive advantage through both bottom-line improvement and strategic gains.

Consider, for example, an offshore O&G platform in a mature basin. Many of the multiple gas turbines, compressors, pumps, and boilers it runs are redundant, serving primarily as back-up, and are operating with less-than-optimal energy efficiency. Leading companies are removing such unnecessary equipment and run the rest as efficiently as possible. Less equipment directly cuts operations and maintenance activities, and thus costs. By reducing its equipment needs, one North Sea platform operator lowered emissions by 30% and operating costs by 20%.

In addition, according to reports, 23% of global GHG emissions across industries are subject to an emissions trading system or carbon tax of some kind, and another 13% to various carbon reduction incentives such as carbon credits. In these jurisdictions, less emissions directly results in either savings or new sources of income. In the UK, for example, where carbon prices on the Emissions Trading System hit close to £100 per ton of CO2e in 2022, removing a single gas turbine could reduce emissions permanently by 20 kilotons of CO2e and could lead to up to £2 million in savings per year.

According to our analysis, a carbon price of $100 per ton would add between $2 and $4 per barrel to oil refineries’ operating costs. That’s a lot, given that refineries operate at low margins, so the additional cost could risk the refinery’s competitive advantage. A further risk is that a company’s performance on environmental, social, and governance (ESG) metrics, including its emissions performance, is beginning to influence its borrowing costs, with sustainability leaders securing a significantly lower cost of capital —an average of around 266 basis points less than O&G sector laggards, according to our analysis.

O&G companies that can decarbonize quickly will also gain a real strategic advantage. In jurisdictions with decarbonization targets, for example, the advantage will go to producers of oil and gas with the lowest carbon footprint. The result: a greater likelihood that they will retain their regulatory and social licenses to operate and earn the right to redevelop their current assets and to gain access to new acreage. And they can use their advantage as leverage to pursue M&A deals in these jurisdictions.

Moreover, the technologies required to decarbonize current assets can also

give companies a head start

in entering and scaling up new, higher-value energy and low-carbon businesses. For example, building an electrolyzer to decarbonize the supply of refinery hydrogen could open up future opportunities in the nascent low-carbon hydrogen market.

Four Imperatives for the New Paradigm

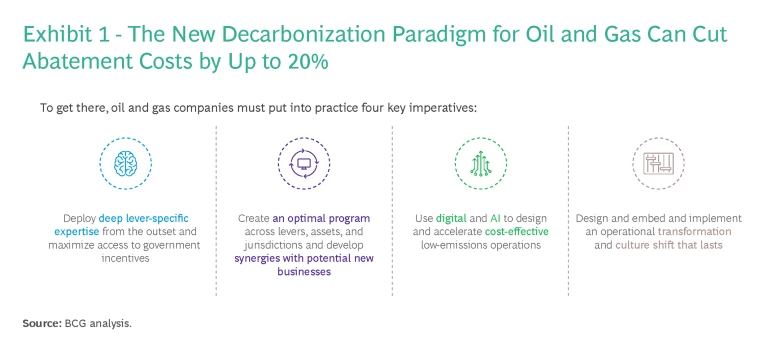

In our experience, taking the right approach to decarbonization can cut the typical O&G company’s abatement costs by up to 20% and increase revenues, boosting the return on their investment in some decarbonization projects by as much as 25%. To achieve these gains, companies must put into practice four key imperatives. (See Exhibit 1.)

Deploy deep lever-specific expertise. Companies need to go beyond generic marginal abatement cost curves and decarbonization roadmaps and focus instead on the decarbonization potential of each individual asset, pulling hard on every decarbonization lever applicable to each asset.

When deploying solutions for energy efficiency improvements, for example, our experience shows that low-cost investments and changes to operations and maintenance procedures for some assets can abate 5% to 25% of total GHGs. This will depend, of course, on the age of the asset, its location, and the cost of power, among other factors. Many improvements represent win-win opportunities across costs and emissions. For example, improving the logistics of offshore production activity could result in up to 50% fewer vessels, reducing trips, costs, and emissions. Plenty of mature technologies have considerable abatement potential and fast payback but are vastly underutilized. For example, variable-speed drives for electric motors can generate up to 25% energy savings and payback within months. Yet less than 25% of electric motors use this technology.

Efforts to abate methane emissions can be significantly improved by taking a top-down approach that links technology choices with specific goals. These could include building a complete a digital methane monitoring system and emissions control room, defining and implementing proper workflows, and creating a culture that focuses on delivering sustainable zero methane designs and operations. (See “Abating Methane.”)

Abating Methane

All too often, however, companies have no concrete plans for how to move from estimates of methane emissions to detecting and measuring them and then embedding a solution for sustainable zero methane operations. Typical pitfalls include taking a technology-first approach to the problem, installing more sensors, and gathering more data than is needed without linking the findings to adequate decision-making efforts, and failing to establish the context and culture needed to drive zero methane emissions across all layers of the company, from executive teams to field crews. The result: methane abatement is likely to be ineffective.

In our experience, those who have succeeded in lowering their methane emissions follow five key steps:

- They approach the problem with specific end goals in mind. This could be a more effective leak detection and repair (LDAR) program, improved equipment reliability, and better regulatory compliance, gas certification, and reporting.

- Only then do they build the technology strategy for emissions detection, measurement, and source identification. This involves creating the right mix of technologies for an optimal balance across data granularity and cost, from satellites and drones to handheld devices.

- They build a methane digital solution to unveil insights from complex emissions and operational data via a scalable and robust interface. This interface ingests, integrates, reconciles, and transforms data into information that feeds operational and structural choices and accurate reporting.

- They make the emissions control room a center of excellence for methane abatement via a structural link to the methane digital solution.

- Finally, they adapt the whole company to deliver zero methane emissions operations, from accountabilities and talent to workflows and culture.

Regional decarbonization incentive programs can greatly impact a program’s economic viability. In the US, the Inflation Reduction Act, for example, provides tax credits of up to $85 per ton of CO2 captured and sequestered from CCUS. In the UK, the Energy Profits Levy gives back £109.25 for every £100 a company spends on upstream decarbonization capex. And decarbonization efforts can significantly reduce the impact on O&G companies of the cost of emissions in jurisdictions with emissions trading schemes.

Key to maximizing the benefit of this approach lies in putting together teams with deep expertise and practical experience in each lever in the context of each asset and jurisdiction.

Fully leverage synergies and trade-offs. Decarbonization leaders must make sure to seek out and take advantage of synergies and trade-offs across levers, assets, and jurisdictions. For example, a fully optimized decarbonization program involving carbon capture and storage could abate more than 50% of emissions in a refinery and more than 30% of emissions in a gas processing plant. Achieving this may require comparing the business cases of two potential carbon capture and storage (CCS) projects, one in Texas, for example, and one in the UK with the goal of making optimal capital and resource allocation decisions. This task requires deep CCS expertise but also the ability to compare drastically different policies, risks, customers, supply and demand balance, and business and technical partners across the CCS value chain in each location.

Similarly, in reducing the carbon emitted when generating power and heat, which contributes up to 70% of Scope 1 emissions in most O&G assets, companies should take into account multiple factors. One factor is the “technology complex”—the optimal mix of renewable power sources and options for variability, such as the ability to cut back on energy consumption, as well as energy storage systems that could help manage the intermittency of renewable power.

Another factor is the optimal business model. What role could the company play in complex new value chains, including what to produce on-site versus what to buy? Which customers should be targeted for potential renewable energy sales, for example? And with which other players, such as renewable energy developers and technology companies, could companies partner? Our experience demonstrates that analysis of the business case can yield projects with up to 25% higher return on investment than technology-specific studies alone.

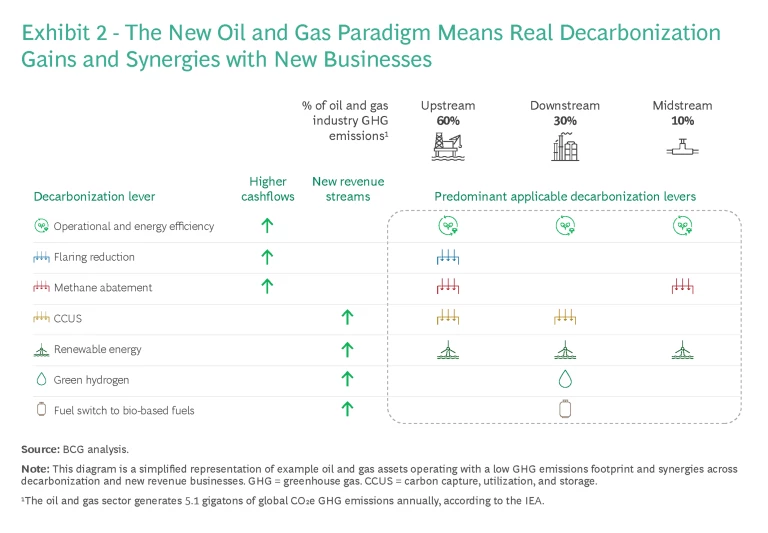

For the typical O&G asset, improving operational and energy efficiency could be the least costly means of emissions reduction. These improvements could both save costs and generate incremental revenues from the sale of fuel that would otherwise be used. For upstream and midstream assets, flaring reduction and methane abatement could yield similar or even greater benefits, including lower emissions, cost savings and potentially incremental revenues from the sale of methane that would otherwise be burnt or lost. Some of the technologies required for deep decarbonization, such as renewables, CCUS, green hydrogen and bio-based fuels, once scaled up, could also generate revenues from new businesses . Exhibit 2 shows the potential synergies across decarbonization projects and revenues from new businesses.

Invest in digital and AI solutions. The ability to make optimal use of digital technologies, including AI and machine learning , to accelerate the decarbonization process is one of the main differentiators between O&G decarbonization leaders and laggards.

Decarbonization leaders in the O&G industry typically use these technologies to build a reliable emissions baseline, identify the most effective abatement actions, support decision making, and execute their decarbonization program. This can accelerate the deployment at scale of mature technologies, solutions and practices that could abate more than 50% of O&G emissions in some assets, by maximizing energy use and generation efficiency and abating flaring and methane emissions in the most cost-efficient way.

In our experience, these technology initiatives can pay back within months. The methane workflow can contribute as much as 40% of Scope 1 emissions. Building a digital platform into the workflow, linked to the control room, for example, can greatly accelerate methane emissions abatement, as well as the monetization of gas otherwise lost.

Digital solutions can inform both practical and strategic decisions and aid in the design of various abatement technologies. Examples include proven technologies such as PV solar as well as less mature technologies such as the use of hydrogen or ammonia to generate heat and CCS systems. One such digital tool is the CCS Hub , which can help implement CCS at scale by identifying those CO2 emitters that would offer the most cost-effective locations for CO2 storage facilities.

Embed the transformation companywide. The key to a successful decarbonization effort lies in running the program until it is engrained in the company’s DNA and becomes business as usual. As such, O&G companies must go beyond the technical and operational viability of decarbonization solutions to carry out profound changes in their priorities . In our experience, companies succeed by taking four key steps:

Accountability. Make clear from the outset who is accountable for decarbonization and keep ownership of the decarbonization of each asset with the asset teams while maintaining targeted support from leadership.

Talent. Use strategic workforce planning to access and plan for critical capabilities required now and, in the future, via a combination of upskilling, reskilling, and sourcing needed expertise from outside. Establishing a center of excellence with experts with a clear vision of the end goals for each decarbonization lever can be effective in transferring know-how across assets and geographies.

Workflows. Establish early on a solid, evergreen process for closing the gap in each asset’s decarbonization potential. Embed decarbonization into each asset team’s budgeting cycle business planning, reporting, and performance management. Finally, launch a structured effort to adapt each team’s workflows, including operations and maintenance, in light of their decarbonization roadmap.

Culture. Radical cultural change is key to every successful decarbonization program. Downplaying the impact of GHG emissions and the need to decarbonize all assets on day-to-day actions and strategic choices must no longer be tolerated. Instead, companies must make the need to decarbonize part of how the entire workforce goes about its business. This shift in culture must also extend to interactions with all partners up and down the value chain, including equipment providers, energy technology companies, end customers, equity partners and policymakers.

To catch up, laggards need to make radical choices in the ways they operate their assets—and be willing to pull every available abatement lever.

Most of all, it requires bold leaders at all levels, from executive teams to frontline crews. O&G leadership must visibly demonstrate their commitment toward emissions reduction, even, at times, at the expense of production or cost, and they must prepare to accept lower returns for some emissions reduction initiatives and projects. In short, they must be willing to design and deploy nothing less than the most cost-effective decarbonization programs possible.

As the decarbonization leaders in the O&G industry have shown, others looking to lower their carbon footprint must invest in several key capabilities. These include deep lever-specific expertise; synergies across assets, jurisdictions, and new revenue streams; digital solutions; and full accountability for the desired outcome. To catch up, laggards need to make radical choices in the ways they operate their assets—and be willing to pull every available abatement lever.

Companies that succeed will benefit in several ways: a considerable financial return on their decarbonization investment, the social license to keep operating, and a real competitive advantage over their slower and less competitive rivals.